Peter Epstein of Epstein Research [ER] has no prior or existing relationship with any person or company mentioned in this interview. Mr. Epstein owns shares in Colonial Coal

Rarely is there such a disconnect between what shareholders believe a Company’s assets are worth and its market value!

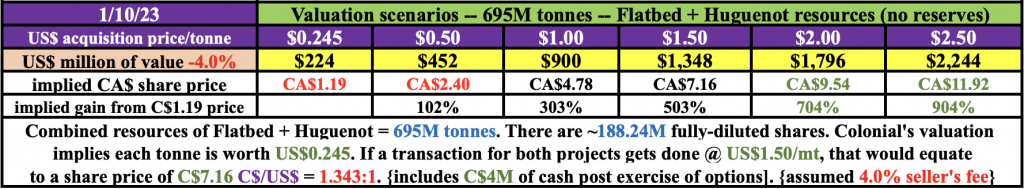

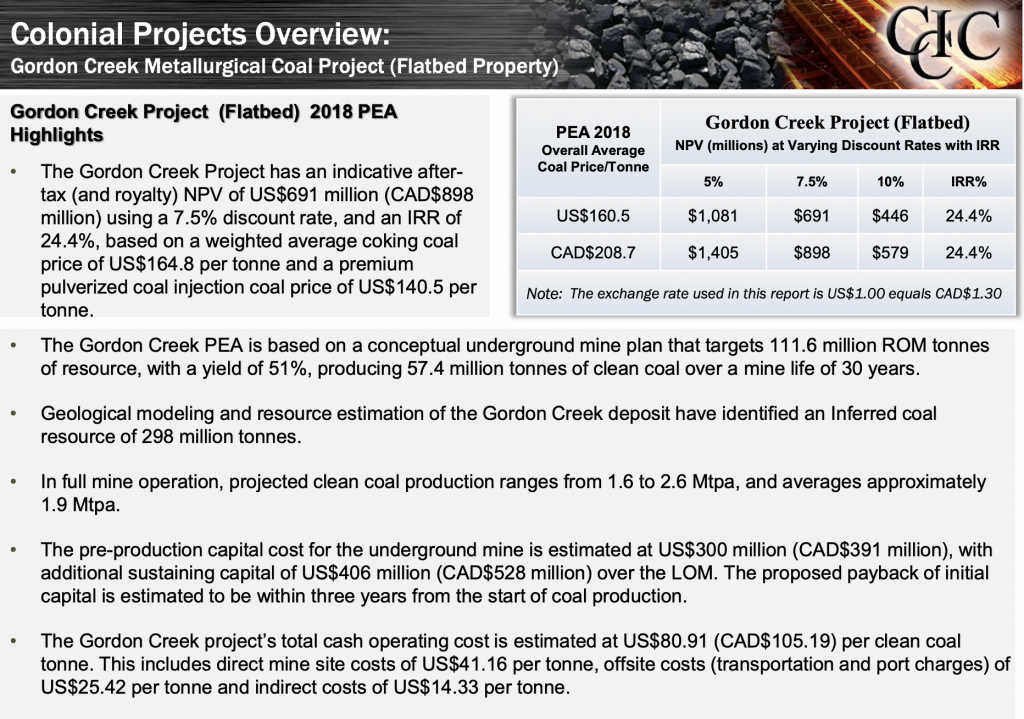

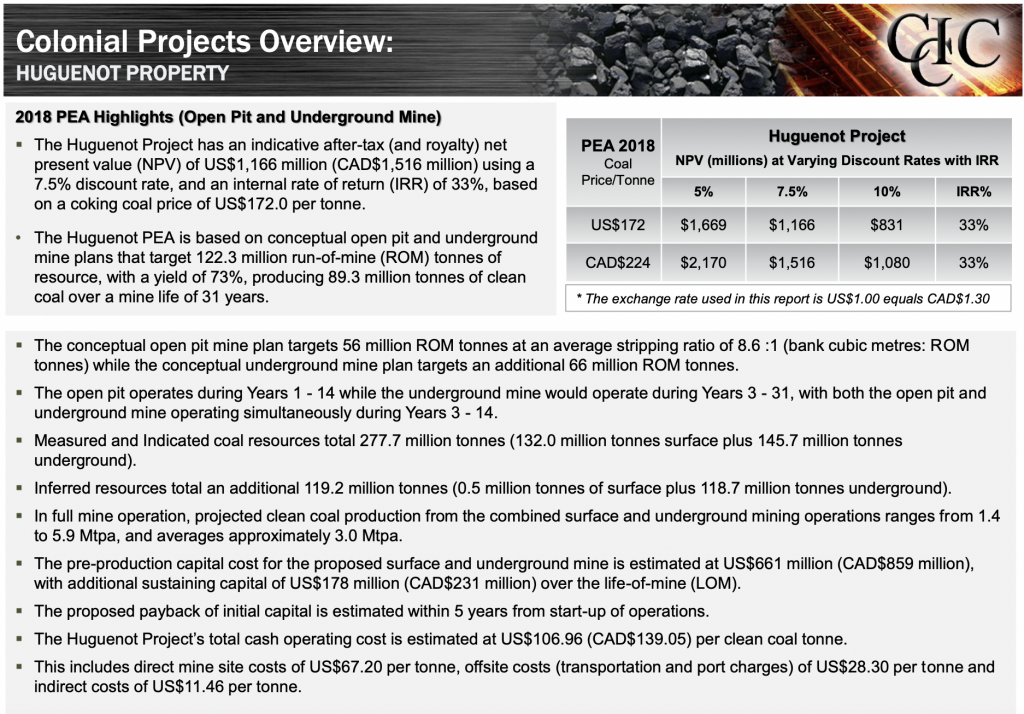

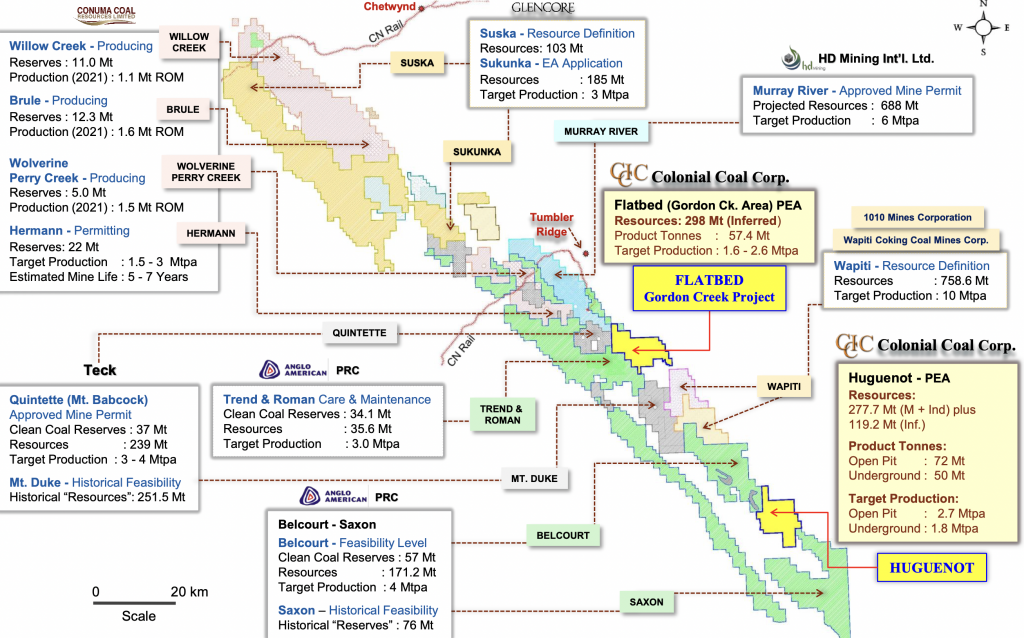

Holders of Colonial Coal (TSX-v: CAD) / (OTCQX: CCARF) think its two PEA-stage coking coal projects in B.C., Canada, surrounded by valuable operations owned by Teck Resources, and projects owned by Anglo American are worth US$2-$3.00/resource tonne in the ground, but the market is valuing them at US$0.245/t.

Please review my last article for more detail on the Company and the ongoing sale process. The investment-bank led process began around the same time as COVID-19. Detractors consider it a red flag that it’s been nearly four years and still no bids.

It’s possible that groupthink has set in and stakeholder expectations are too high… And, it’s possible that management is largely on track, (albeit the process is moving quite slowly) and investor fatigue has taken over. I lean firmly towards the second scenario.

Management says that COVID was a major constraint on dealmaking. Each time the Company’s or a bidder’s advisor, banker, lawyer, consultant, executive or board member was sidelined, the process slowed to a crawl.

Entire countries were off limits for extended periods, most notably Canada, China & India, not necessarily at the same times. Without key suitors from those countries, calling for bids to kickstart a transaction might have resulted in a muted response.

I spent the past week asking Chairman & CEO David Austin why his team remains excited about the prospects to sell Colonial’s projects at a favorable valuation.

He pointed out that his board’s fiduciary responsibility is to maximize the value received, not merely to liquidate the assets. If that means waiting longer than some investors like to get an extra US$0.25/t, (~C$1.20/shr.) the board remains willing to do that.

Coking coal futures price of 2,517.5 Chinese yuan per tonne = US$372/tonne…

David, thank you for your time. Why is it taking so long to monetize Colonial’s two assets. How big a factor has COVID-19 been?

COVID-19 has been a huge factor. Dozens of international companies, lawyers, executives, consultants, financial advisers, bankers, consultants — and state-owned / affiliated parties — are involved in this unwieldy process.

Each time the process was bogged down, it took time to reschedule travel & meetings and regain focus. The good news is that COVID seems mostly behind us. Canada lifted all remaining restrictions back in October and China is reopening, notice the copper price — it’s up +28% in the past three months.

Aside from COVID, please remember, we’re working on a complex deal in which suitors do a lot of due diligence. Giant steel & coal companies, especially state-owned/controlled entities, don’t move fast in the best of times.

How many potential bidders are at the table? Can you characterize the bidders by country of origin, and/or type of operation?

We have over a dozen active NDAs in place. Prospective buyers are mostly from Canada, China, India, the U.S. & Australia. Japanese & Korean groups are on the sidelines, but they know our coal. We think they might still jump in.

Asian steelmakers have most of their existing & planned blast furnaces near ocean ports, making them highly reliant on the seaborne market. Transporting massive quantities of coking coal thousands of km by rail is an economic, environmental & logistical nightmare.

Regarding interested parties; mostly steelmakers & coal companies. One or perhaps a few commodity traders, no investment funds. We’re talking with major companies that can easily afford to acquire our projects.

Should shareholders be concerned about the blocking of Glencore’s Sukunka coking coal project located nearby Colonial’s projects?

Good question. Investors are concerned, in fact probably more concerned than our prospective bidders, who know a lot about Sukunka and the other projects / mines / companies in the Peace River Coalfield.

Prospective suitors do considerable due diligence, including speaking with provincial & federal gov’t agencies about permitting steps & environmental requirements.

Gov’t commentary accompanying the Sukunka decision clearly stated that it was a project-specific action, completely unrelated to other proposed mining projects in the province. It’s worth noting that the project that Conuma acquired is closer to Sukunka than our projects are.

Make no mistake, the issues in the Sukunka decision have been openly discussed for years with potential suitors, there’s information on those topics in our digital data room. We have many interested parties.

Giant steel & coal companies do business all over the world and face challenges wherever they look. Western Canada is not as risky as pursuing coking coal resources in Mozambique, Mongolia or Russia.

Just days before the Glencore news, Teck sold a non-core asset to privately-held Conuma Resources, showing that coking coal deals in B.C. can and do happen.

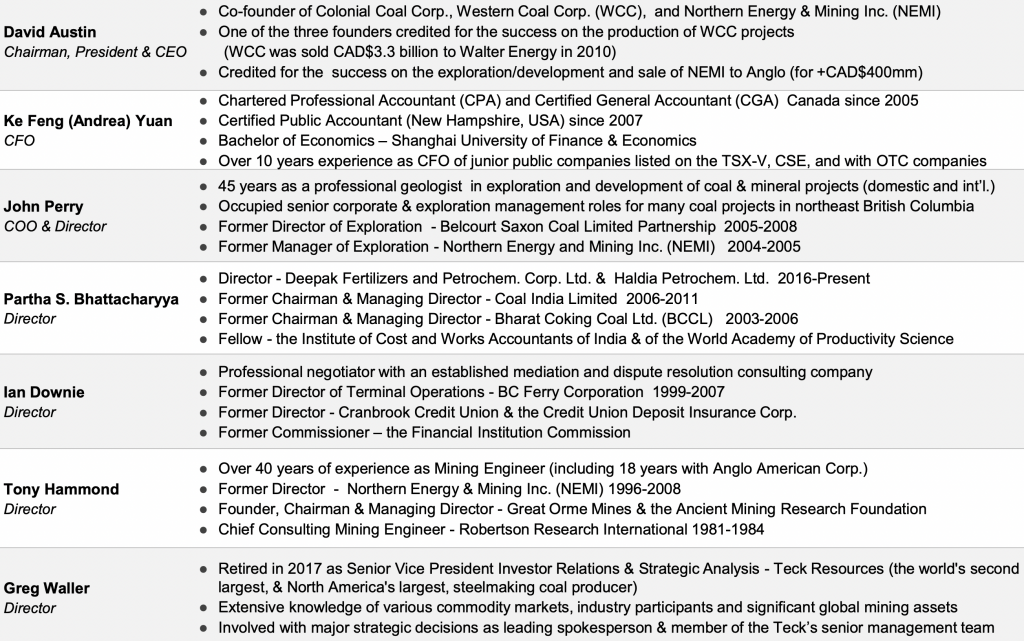

To the extent that shareholders have contact with Colonial, it’s generally through you. Please tell us about other key team members.

Colonial has a strong team and we remain confident in our investment bankers. Most investors only have access to me, but that’s by design. We simply can’t talk that much about the sale process and don’t want to risk sending mixed messages.

Note, Mr. Austin spent considerable time talking about the strength of his team, but in the interest of brevity, please see their bios in the image below.

As mentioned, Teck sold its past-producing Quintette coking coal project to Conuma. Is there a read-through valuation on this transaction?

Yes, C$120M/US$90M was paid upfront for 274M tonnes of Measured, Indicated & Inferred resources. Conuma is assuming perhaps a couple hundred million dollars in mine reclamation (and other) obligations, as the mine operated for 18 years. Assuming that figure is US$100M, that bumps the price paid to US$0.69/t.

Conuma agreed to pay Teck a 25% Net Profit Interest (“NPI”) royalty. Assuming a long-term coking coal price of US$220/t, 25% of the net present value of that royalty is worth well into the hundreds of millions.

Therefore, we believe the total price paid for Quintette’s resources, obligations and ongoing NPI is at least US$3/t.

Note: 25% of the NPV(7%) of a 12-yr. mine, ramping up to 4M tonnes/yr., would be ~US650M (on US$220/t coking coal, US$85/t profit & US$30M in start-up costs]). Adding US$650M to the assumed obligations + upfront payment suggests Conuma is paying ~US$3.06/t.

We believe our coking coal would sell at Australia premium-hard coking coal index Peak Downs (minus US$5-$10/t). In other worlds, truly world-class assets. According to Argus, premium-hard coking coal has rallied +68% to $315/t fob Australia on Jan. 6th from $187/t on Aug. 1st.

Your team obviously has a high opinion of B.C.’s Peace River Coalfield, but what makes it special? Can’t steelmakers go elsewhere?

No, there simply are not that many places that can deliver tens of millions of tonnes, year after year, of premium quality coking coal. The list is short, Australia, Canada & the U.S. Mongolia? Landlocked, Mozambique? Quality & logistical issues. Indonesia? Low-grade.

Australia is by far the largest exporter of top-quality coking coal, but is facing more frequent flooding, labor shortages, shrinking cap-ex (due to ESG concerns) & rail bottlenecks.

Thanks again David for your valuable insights. Any final thoughts?

Thank you Peter. My team remains optimistic that we can sell one or both (preferably both at the same time) of our premium coking coal projects at an attractive level. We continue to see an uptick in activity from prospective bidders.

We recognize that the process is taking a long time, but we note that seaborne coking coal fundamentals for top-tier products are as strong as ever and securing long-term coking coal from safe, prolific jurisdictions is getting more difficult. Western Canada is one of the two best places in the world.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)