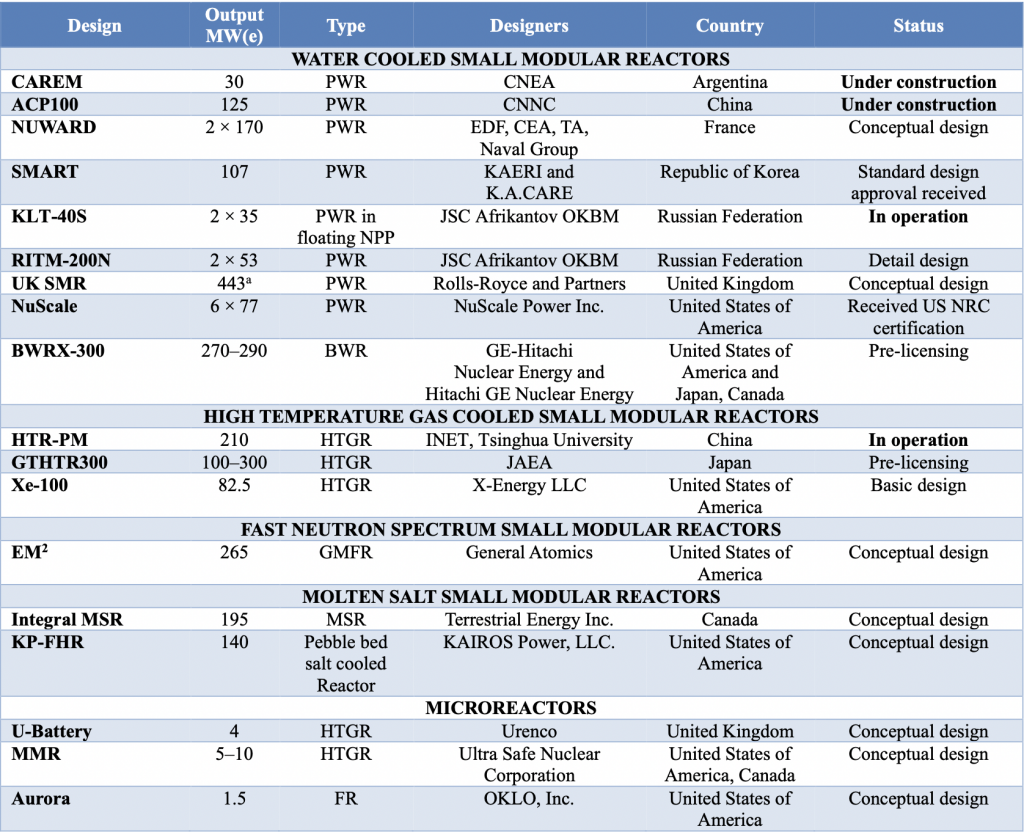

Small Modular Reactors (“SMRs“), what are they and why should we care? They’re small-to-very small nuclear reactors, including “micro-reactors,” with output up to 300 megawatts (MW) — one MW powers ~500 homes. SMRs are way smaller than the world’s 438 reactors, averaging ~900 MW, and up to ~1,365 MW.

SMRs rated at ~50 to ~190 MW propel a few hundred submarines in navies around the world. Readers should care because SMRs are the future of nuclear power, strongly reinforcing the demand for uranium.

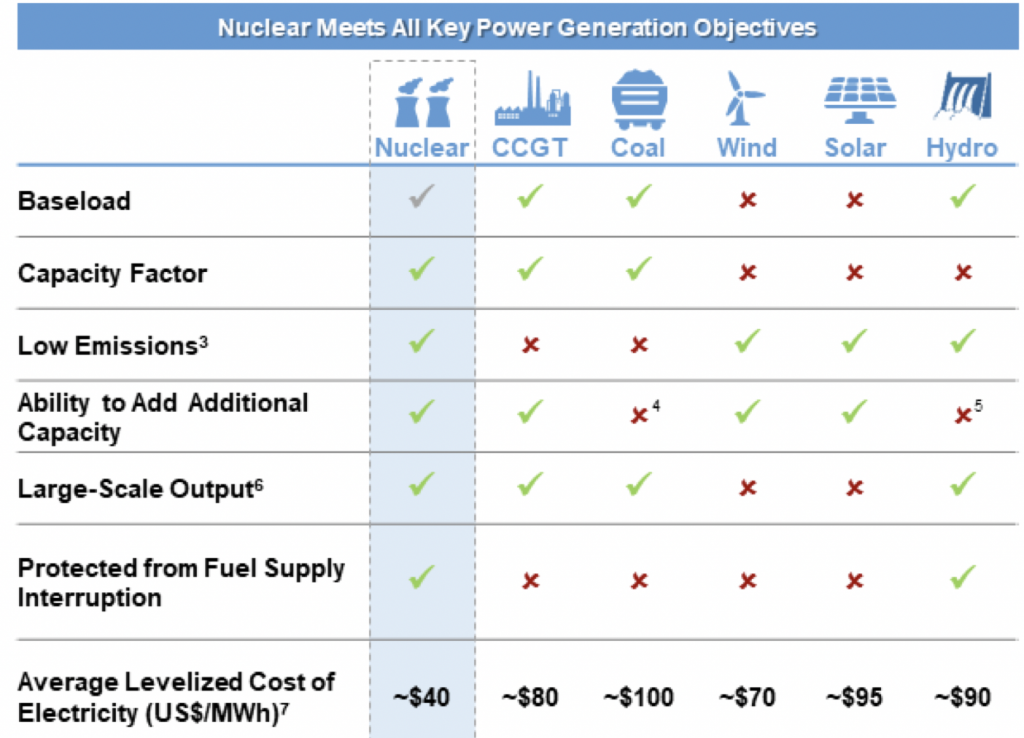

Nuclear is the only realistic answer to the question, “what if solar & wind can’t scale-up fast enough to replace retiring fossil fuel plants?”

Even as logistical & land usage issues are resolved, the supply of critical materials going into solar & wind farms is a concern, most notably silver in solar panels & REEs in windmills. Nuclear reactors require mostly concrete, steel, copper & URANIUM.

SMRs will be mass-produced in modules at giant purpose-built facilities, slashing labor & materials costs via economies of scale, materials handling efficiencies & automation. Instead of 10-15 years & billions of dollars, a SMR could be up & running in a year or two at a small fraction of the cost.

Over time, logistics, site prep, insurance, safety, maintenance, etc. will become well established, making SMRs the best choice for a much larger universe of users.

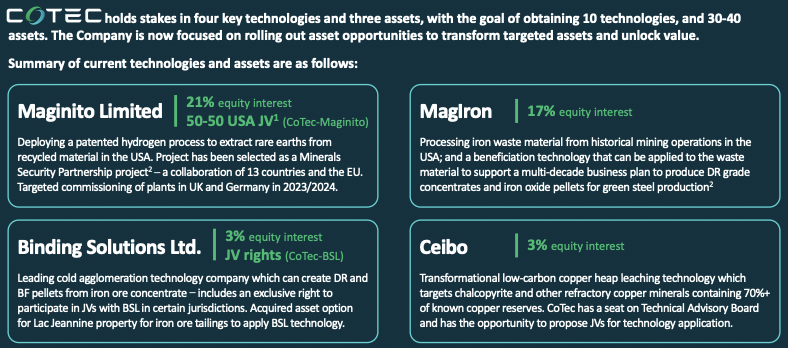

Powerful companies like Rolls-Royce, Ge-Hitachi, Westinghouse Electric, General Atomics, NuScale, TerraPower & France’s EDF are partnering with electric utility companies to prosper in this massive new market.

Government agencies around the globe assume fossil fuels will remain very significant contributors through 2050. While fossil fuels use is unavoidable for the next 15-20 years, if SMRs are successful the public will demand those plants be retired sooner.

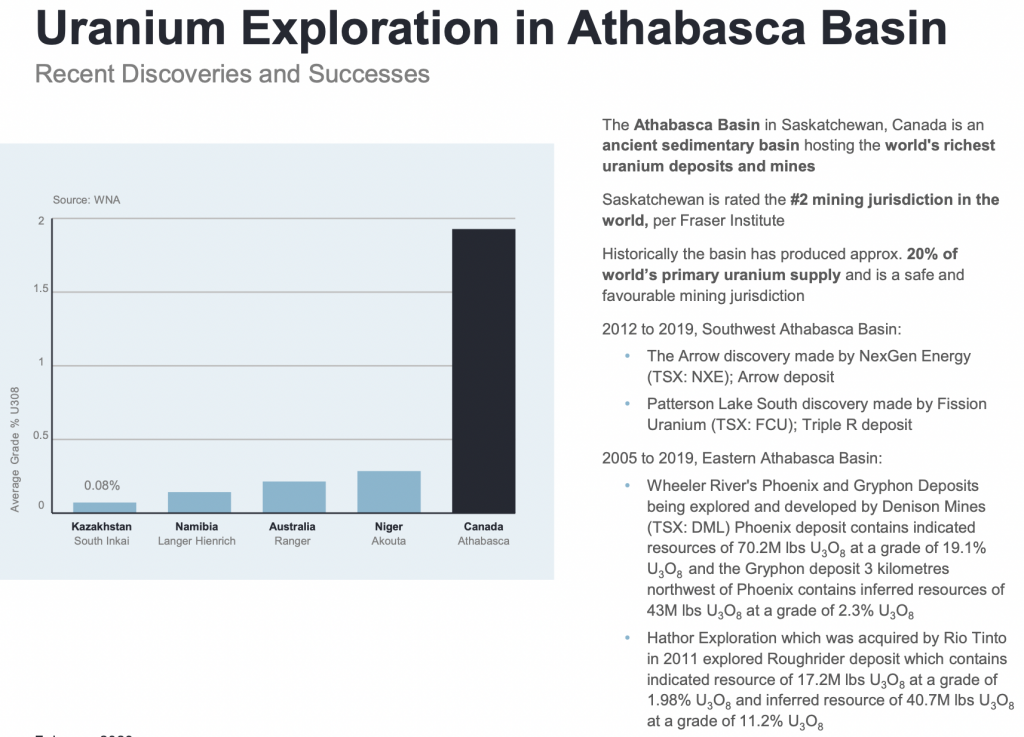

Demand for uranium is soaring, but where does it come from? Among the top-8 uranium producing countries, six; Russia, China, Kazakhstan, Uzbekistan, Namibia & Niger produced 60% of global output in 2021.

That’s a huge problem for the U.S. By far the #1 consumer of uranium, it produced < 1% of what it used every year from 2019-2022.

New U.S. mines are coming, but most will be In-Situ Recovery (ISR) operations capable of only 1 or 2M tonnes/yr. Can the U.S. continue to rely heavily on Kazakhstan, Russia & China? No!

Canada is the closest source and home to the planet’s highest uranium grades. These two factors make investments in uranium juniors with projects in Canada’s Athabasca basin quite appealing.

Make no mistake, uranium juniors are highly speculative, but ultra high-grade partially offsets other risk factors. Given my view on SMRs, I believe the uranium price, currently ~$51/lb. is headed higher.

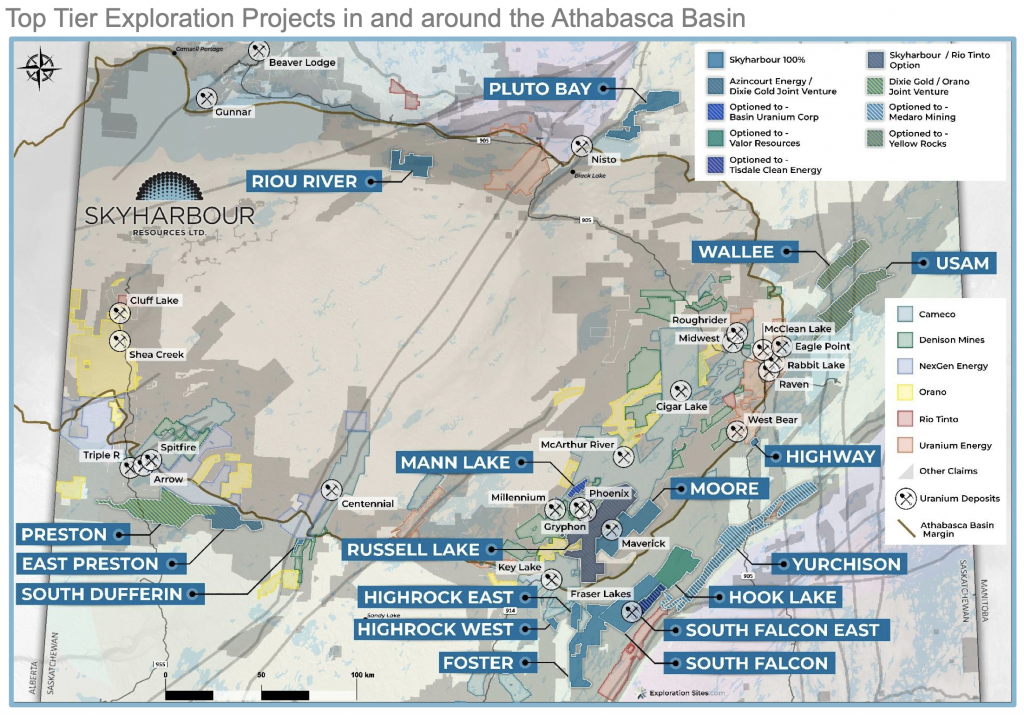

How to play the uranium theme? I like companies with multiple ways to win through interests in many projects. I remain bullish on Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF), a uranium exploration / early-stage development company with 18 properties/projects covering 1.2M acres of mineral tenure in the Athabasca Basin.

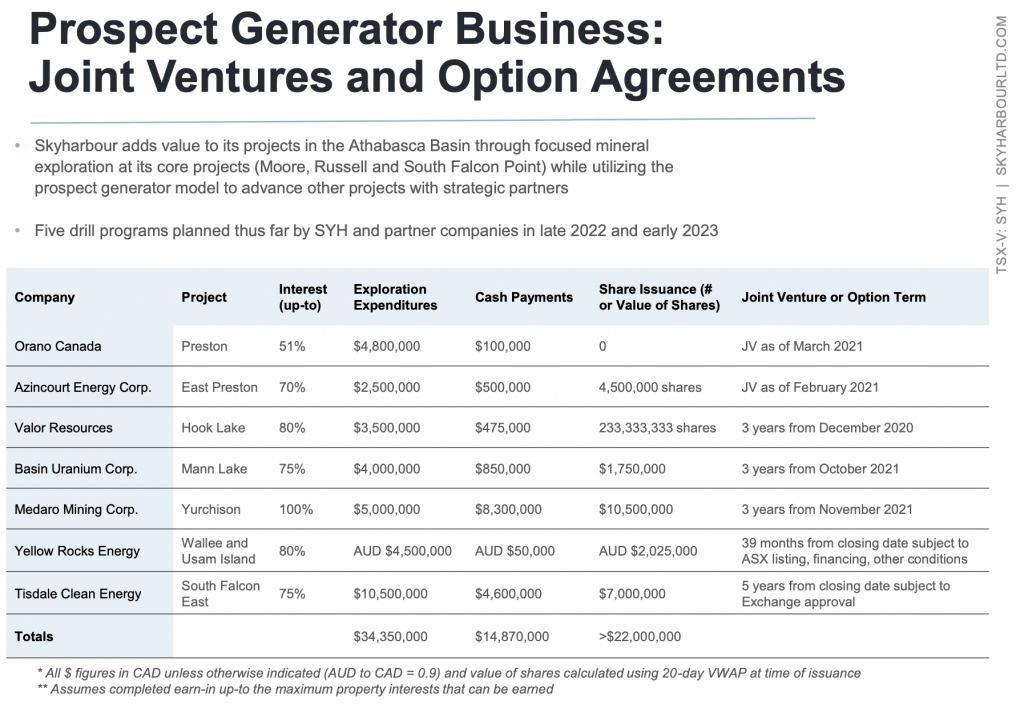

That 1.2M controlled acres makes it the largest landholder in the region. Skyharbour has a hybrid business model with a focus on advancing two flagship assets, Russell Lake & Moore Lake through drilling, and also employing a prospect generator model.

Skyharbour has two JV & five earn in option partners participating in its prospect generator portfolio by drilling & exploring at no cost to the Company.

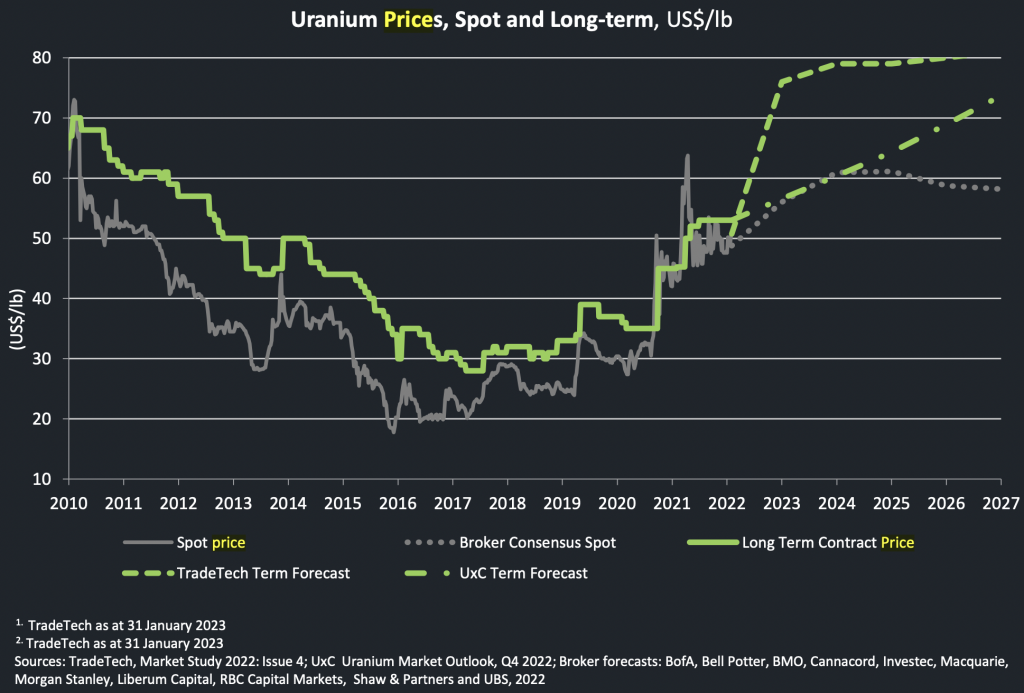

TradeTech forecasting #uranium futures contract price hitting ~$80/lb. in 2024

Circling back to the uranium price, I’m not alone in thinking it will go higher. The real questions are how much and how soon? If one turns to uranium bulls on social media (Twitter is home to several, one is bombarded with predictions of $75-$100+/lb. uranium THIS YEAR!

Skyharbour doesn’t need a doubling in the uranium price for its shares to perform. New discoveries by its team at Russell & Moore, and/or partner companies could do the trick. Eleven months ago uranium was ~25% higher and the stock was trading between $0.65-$0.80.

Nothing has gone wrong in the past year, only disappointment that the uranium move stalled at $64.5/lb. In fact, there have been positive developments that I highlight below. But first, one more thing on the uranium price.

Inflation means that $100/lb., whether it comes this year or later, will NOT be a problem for end users who paid north of that (adjusted for inflation) in the past. Uranium spiked to ~$140/lb. in June 2007, but that was short-lived.

More relatable is the May 2007 – Feb. 2008 period when the contract price was pinned at $95/lb. {see Skyharbour Ltd.’s latest presentation}

In today’s dollars, $95/lb. = ~$136/lb. If one believes that 2007’s $95/lb. contract price was an aberration, consider the inflation-adj. level of ~$97/lb. in 1Q 2011, a price only taken down by Japan’s Mar-2011 Fukushima accident.

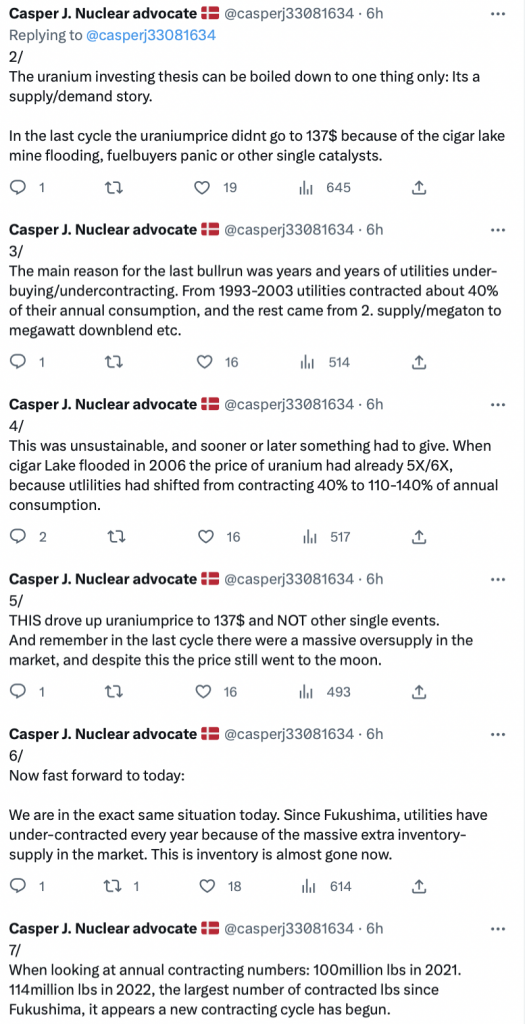

The above Twitter thread is important in explaining why today’s uranium fundamentals are as good or better than at any time in the past 25 years.

I’m no better at predicting timing than some of the Twitter accounts I follow, so let’s turn to Skyharbour’s assets. For seven years management has been working hard on the 100%-owned, 35,705 hectare Moore Lake (“ML“) project in the eastern part of the Athabasca Basin.

ML has had ~$50M invested in it over the last 25 years, incl. ~140,000 meters of drilling. It has delivered high-grade hits extending into the basement rocks. The best results; 6% U3O8 over 6 m, incl. 20.8% U3O8 over 1.5 m, 9.1% U3O8 over 1.4 m and 5.3% U3O8 over 2.5 m.

More recently The Company has been drilling into the under-explored basement rocks in the Maverick corridor area, intersecting the 6.8% U3O8 over 2m in this relatively new geological setting.

Complimenting & expanding ML is an earn-in agreement to initially acquire 51% of Rio Tinto’s 73,294 ha Russell Lake (“RL“) project. Like ML, RL has seen significant exploration, incl. > 95,000 meters of drilling.

Adjusted for inflation, as much as C$100M has been spent on the ML & RL projects over the last 30 years. It would take years to replicate that work. Skyharbour isn’t searching for high-grade uranium, it’s already found it, it just needs to find more.

ML & RL could host satellite deposits for nearby mills, or be combined into a standalone operation upon exploration success. Satellite deposits avoid very substantial costs & years of permitting, development & construction.

An acquirer could take out both ML & RL, leaving shareholders with 16 prospects. Readers are reminded that two of the most successful juniors in Canada, IsoEnergy & Fission 3.0 are spinouts.

The combined footprint of ML & RL is ~8x Denison Mines’ world-class Wheeler River project (~12,000 ha). Wheeler has booked a world-class 135M Indicated + Inferred pounds (so far) on its 12,000 ha. That’s 11,250 pounds/ha. If ML/RL could deliver 5-10% of that per/ha figure, it would amount to 54-108M pounds.

Skyharbour owns/controls 16 other assets in its prospect generator portfolio, some moderately advanced. In the image below, notice that seven juniors need to invest $70M (over several years) in exploration, cash payments + share issuances.

Compare that $70M, plus roughly $100M (in today’s dollars) invested into ML/RL to Skyharbour’s $59M valuation.

Imagine what those 16 prospects might be worth once uranium hits $100/lb. In a bull market, the Company and its partners will be able to fund, explore & develop faster, leading to potentially more discoveries and higher share prices all around.

At a recent investor conference, Denison’s CEO (who’s sits on Skyharbour’s board) gave a compelling update on his company and the uranium market.

While not mentioning Skyharbour, in which Denison owns a position, CEO Cates discussed in significant detail how amenable ISR is for some, not all, deposits in Athabasca. Could ISR be viable on ML & RL?

Skyharbour shares touched $0.84 on 3/9/22, (up 91% from 1/24/22), as uranium was close to topping out at $64.5/lb. in April. Readers are reminded that back then management hadn’t executed the transformative earn-in deal with Rio Tinto yet.

The next time uranium breaks out, timing unknown, Skyharbour shares will enjoy another large rally, the only questions are, how much and how soon?

{Skyharbour Ltd.’s latest presentation}

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)