Shares of Winsome Resources (ASX: WR1) / (OTC: WRSLF) have been a big winner, but have come under pressure along with every other Lithium (“Li”) company. The price in Australia is down 47% from its high, but that’s actually better than many peers. Will Winsome rebound, or is the rose off the Li bloom?

Lithium is still a thing, an important thing in fact. Sentiment has soured due to a plunge (down 56.4% from 597,500 yuan/tonne to 260,500 yuan/t since mid-November) in the spot price of battery-quality Li carbonate in China. In US$ terms, the latest price is ~$37.8k/t.

Possible reasons for the decline include; 1) prices had soared too high, 2) slower year-to-date EV sales growth in China & Europe, 3) inventory destocking, and 4) Chinese players “talking down” the price.

For a less volatile look at the market one can watch contract pricing at major producers like SQM, who reported an average Li carbonate price of $59k/t in 4th qtr. 2022, up 5.4% from the prior qtr.

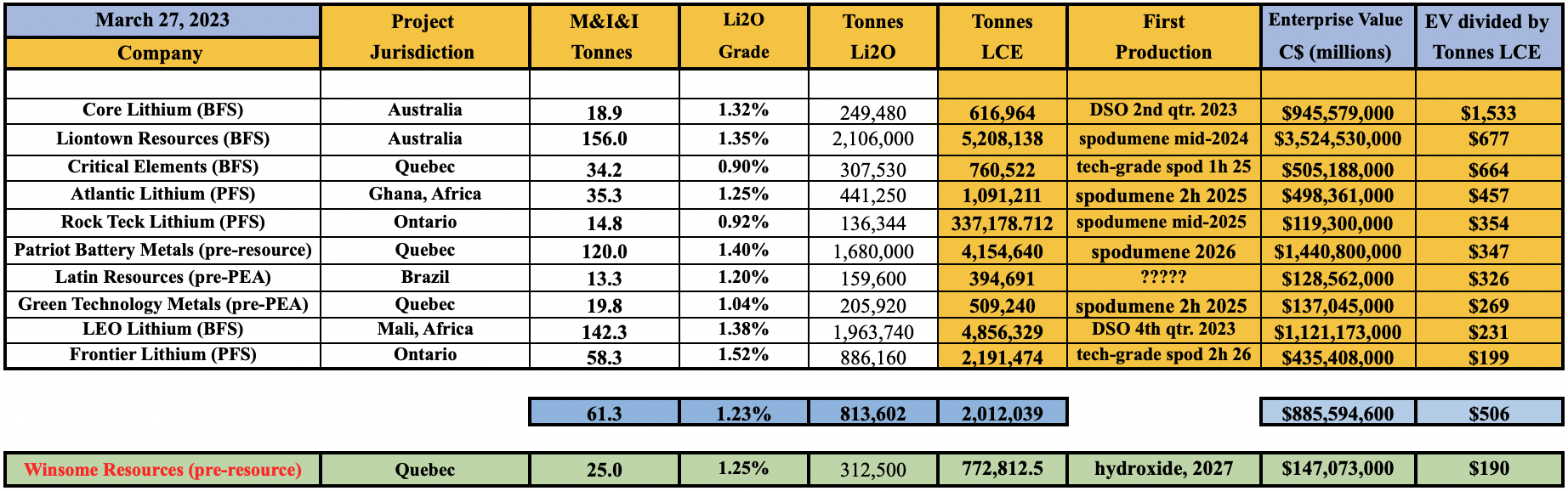

In the chart below are top pre-production hard rock juniors. Although the selloff in Li companies around the world has been painful, the best names will bounce back.

Why do I feel confident about high-quality Li players? The world needs dozens of hard rock mines to have any chance of meeting surging Li demand. Each 30M tonne project @ 1.00% Li2O = 741,900 tonnes of Li Carbonate Equiv. (“LCE“).

Assuming a 15-yr mine life, that’s ~50,000 tonnes LCE/yr., {at 100% recoveries} a large mine by today’s standards. The problem is that Li demand estimates keep rising. Albemarle Corp. now forecasts a need for 3.7M tonnes LCE/yr. in 2030, roughly 4x current production.

After existing producer expansions and new brine/DLE projects, if an incremental 1.0M tonnes LCE/yr. from hard rock sources is required, that would be 20 new 50k tonne/yr. mines up & running at nameplate capacity.

Yet, I count ~30 companies listed in Australia, Canada, the U.S. & London with projects that have reached (at least) the maiden resource stage, and fewer than 60 hard rock explorers have announced a single Li drill result.

I’m not tracking Asian companies, except majors like Ganfeng & Tianqi, or private companies, except giants like POSCO, but I believe I’m catching the lion’s share of the global pipeline of new projects & exploration companies.

The odds of 20 hard rock projects (averaging 50k tonnes LCE/yr.) being explored, permitted, funded, constructed, commissioned & ramped up to nameplate capacity by 2030 seems extremely low.

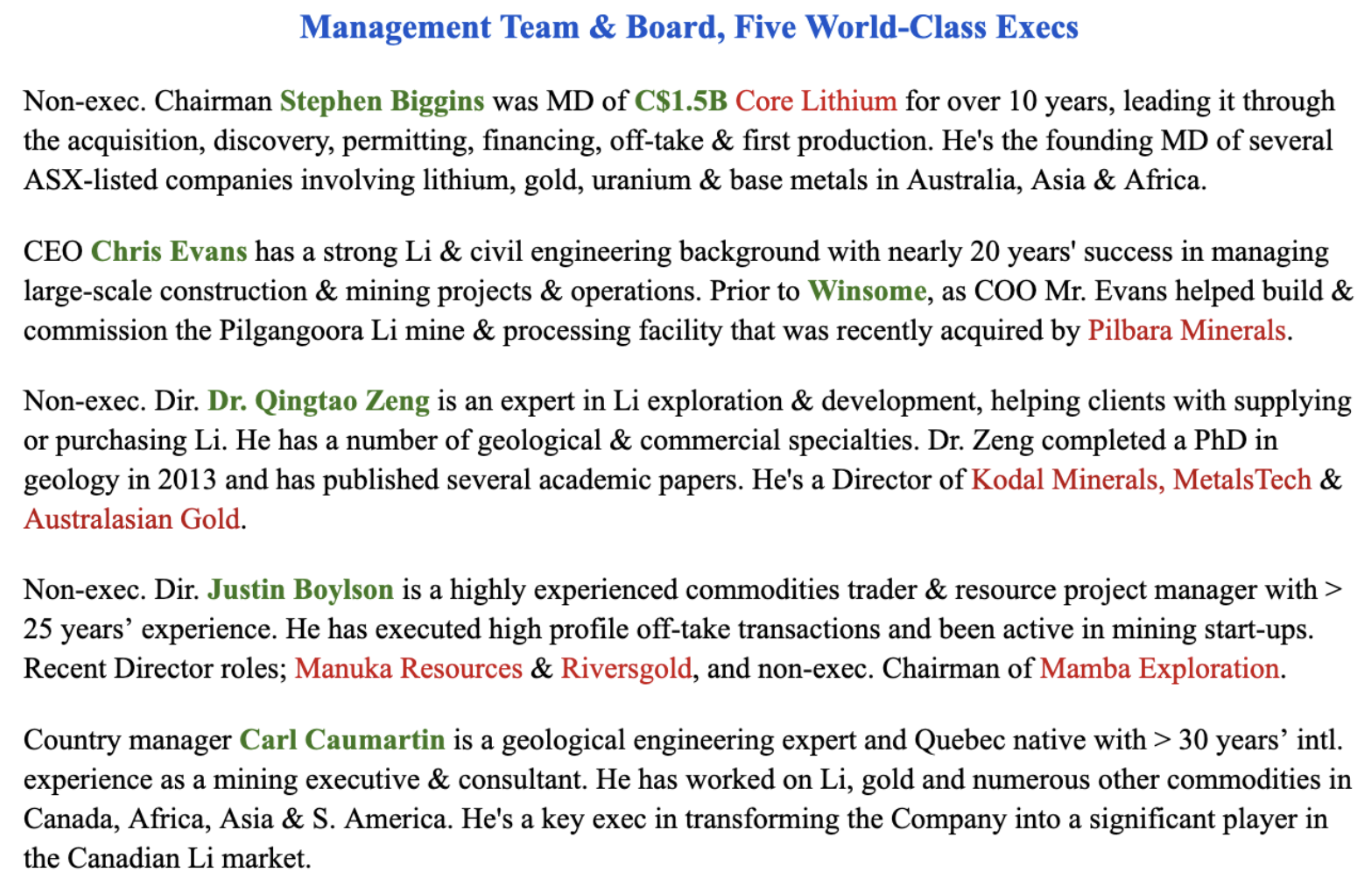

Winsome’s management team is preparing a maiden resource estimate at Adina for mid-year, but might not release it if continued drilling successes warrant holding off to incorporate more drill holes.

In my view, Winsome could reach initial production at its Cancet project by 2026 and at the Adina project in 2027. CEO Chris Evans calls the Cancet project a “sleeping giant.” It’s sizable at over 20k hectares, has seen > 7,000 meters of drilling and is just 30 km west of Patriot’s game-changing Corvette project.

Before finding Adina, Cancet was the main focus with excellent drill intervals including; 21.5 m of 2.24% Li2O, 26.0 m of 1.55%, 18.0 m at 3.14%, and 17.0 m at 2.06%. Initial metallurgical work at Cancet showed that high-quality spodumene concentrate can be produced using simple, low-cost DMS gravity separation.

Stage 1 baseline environmental studies have been completed at Cancet and are well underway at Adina. Pro forma for announced capital raises the Company will have ~$55M in cash to drill, drill, drill.

Adina & Cancet are straightforward projects with access to key infrastructure, and led by an expert team with extensive Li & hard rock mining experience. Management believes it has line-of-sight to > 20M tonnes at Adina alone, at (my estimate) ~1.25% Li2O.

Winsome is surprisingly de-risked in several key respects. It’s located in a part of Quebec that will certainly have Li processing facilities built (and roads, power, water & gov’t support). The Company has five noteworthy execs {see bios below}.

This is a team that can take on new projects. They have a 10% stake in Ontario-based Power Metals that includes a board seat & 100% of off-take rights for Li, tantalum & cesium. Power Metals plans a maiden mineral resource estimate this year. It has drilled over 13,000 meters, including an interval of 19.0 m at 1.86% Li2O.

With a lot of eyes on nearby Patriot Battery Metals, I believe investors under-appreciate Winsome’s highly attractive relative value. Patriot has what appears to be the largest & highest grade hard rock Li deposit in N. America. Majors including Pilbara Minerals & Mineral Resources are rumored to be looking to acquire Patriot.

In my opinion, over $2.5 billion would need to be paid for Patriot vs. today’s valuation of $1.4 billion. While Winsome’s current footprint does not have the scale of Patriot’s, even at a third the size at Adina alone it would be a very significant Canadian resource.

A third of $1.4B = $467M, but Winsome’s enterprise value {market cap + debt – cash} is $154M. Its solid cash balance should fund aggressive drilling for the remainder of the year.

Readers should note in the map above that Patriot’s Corvette is close to Winsome’s Adina & Cancet projects. An acquirer of Patriot would be crazy not to also want to grab Winsome.

In addition to MinRes & Pilbara other prospective suitors of Patriot are thought to include; Rio Tinto, Wesfarmers, SQM, & IGO ltd.

Other companies that should care about Patriot are; Albemarle & POSCO, commodity traders like Mitsui & Co and Glencore, and Japanese, European, U.S. & Korean battery makers & OEMs who see tremendous opportunities in N. America as China is increasingly shut out.

Smaller players that could swing an acquisition of Winsome include; Sibanye Stillwater, Allkem ltd., Sigma Lithium, Livent, AMG Advanced Metallurgical Group, Imerys S.A., Liontown Resources, Core Lithium, Lithium Americas & Sayona Mining.

I list a lot of companies to demonstrate that bidding wars could erupt over top Canadian Li prospects. Only one company can buy Patriot, leaving the rest to fight over the next best projects. Is Winsome really that great? YES.

In the above chart, the strongest hard rock drill hole intervals are listed. Notice that Winsome is in the Top-5. Besides Green Technology Metals at #8, no other Canadian junior comes close to Winsome’s 107.6 m at 1.34% (from 2.3 meters), placing it in the top decile of intercepts from 51 projects (30 shown).

Last week management announced 47.4 m at 1.64%, 55.5 m at 1.35% and 59.4 m at 1.26% across three holes, among several others. These are results most Li hopefuls can only dream of – one interval returned 2.1 m at a blockbuster 4.78% Li2O, another, 5.0 m of 4.12%.

Winsome has five properties in total. It controls Decelles & Mazerac, optioned in 1h 2022, totaling 53,400 hectares near Sayona’s two projects. Sayona is partnered with Piedmont Lithium on the NAL mine that’s starting up next quarter.

Might cash flow from NAL encourage Sayona and/or Piedmont to go after Decelles & Mazerac? Livent & Allkem also have Li investments in that immediate area.

All roads lead to Quebec becoming a world-class, globally-significant Li mining hub with many mines + satellite deposits, combined with several large Li processing facilities. Quebec alone could have 3 or 4 hydroxide plants by early next decade.

Several of Winsome Resources‘ (ASX: WR1) / OTC: WRSLF) prospects will be mined. Even as satellite deposits, the valuations per LCE tonne in the ground will be strong, especially if multiple mills are bidding for nearby ores.

Readers are encouraged to take a closer look at this exciting Li story. Here’s the latest corp. presentation. And here’s one of several recent YouTube videos of CEO Evans.

Disclaimer/disclosures: Peter Epstein of Epstein Research [ER} has no prior or existing business relationship with any person or company mentioned in the above article. Mr. Epstein owns shares of Winsome Resources.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)