Precious metal prices have had a nice run lately. Gold topped out at just shy of $2,050/oz., but has pulled back to $1,990/oz. as I write this sentence. Importantly, the factors that launched it above US$2,000/oz. remain firmly in place.

Yesterday the banking crisis reared its head once again. First Republic Bank, a top-15 financial instituion in the U.S., was down ~50%. Many financials are trading within 10-15% of multi-yr. lows.

Gold’s attraction as a safe haven extends well beyond banks. The world is splitting into two geopolitical/economic blocks — West vs. East. Interestingly, central banks sense the elevated geopolitical risks around the world and have stepped up purchases of gold.

Away from the financial turmoil, S. America is in the news as Chile’s President proposed to effectively nationalize the country’s lithium sector, sending SQM & Albemarle Corp. much lower. Argentina is suffering from 100% inflation rates, Peru is rocked by political unrest leading to blockades of copper mines.

Canada is the place to be, especially with high-grade gold

Investors are seeing the vital importance of jurisdiction, which is why I remain so bullish on Canada and one of my favorite gold juniors — Scottie Resources, (TSX-V: SCOT) / (OTC: SCTSF) led by CEO Brad Rourke.

Readers are reminded that Scottie has 60,000+ hectares in the heart of the Golden Triangle (“GT“) (the southern part) in B.C. near key infrastructure including; power, roads, airport, deep-water port, labor & services.

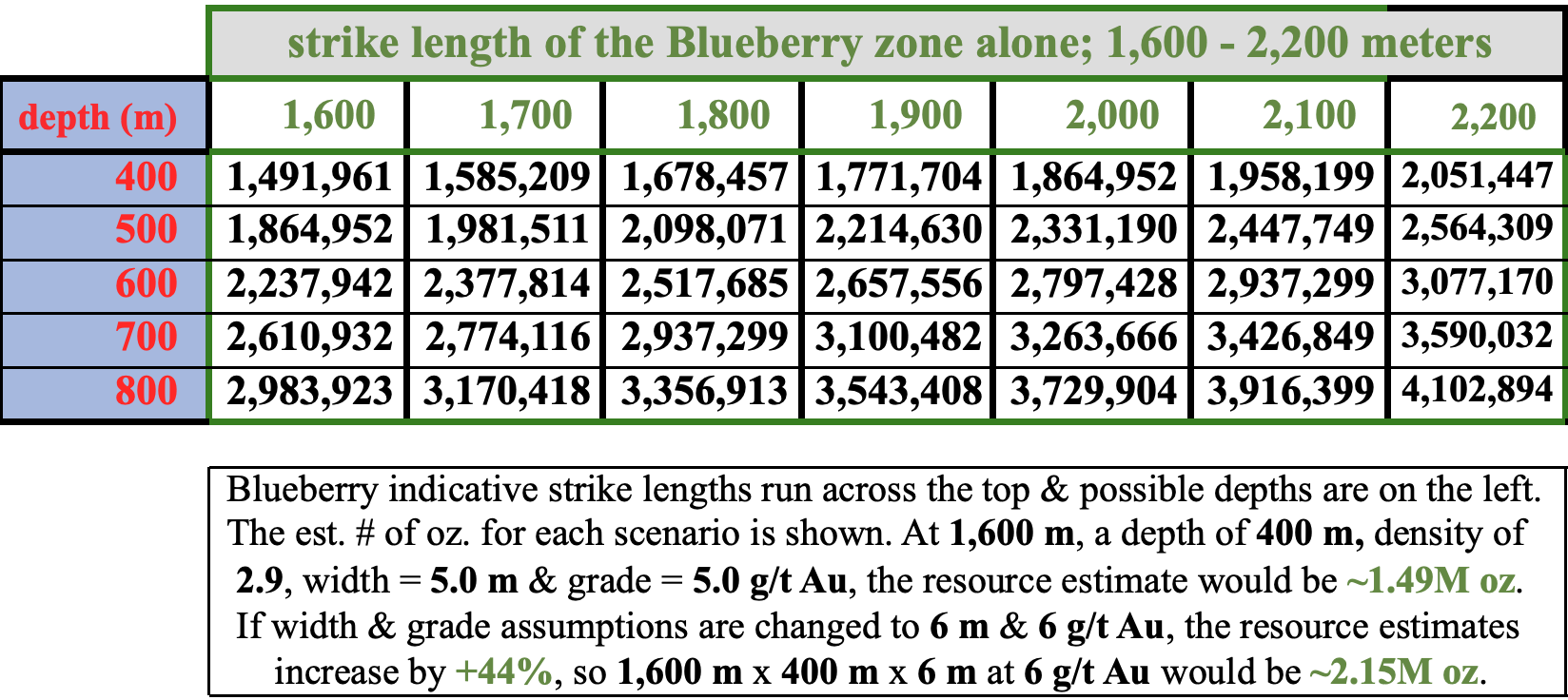

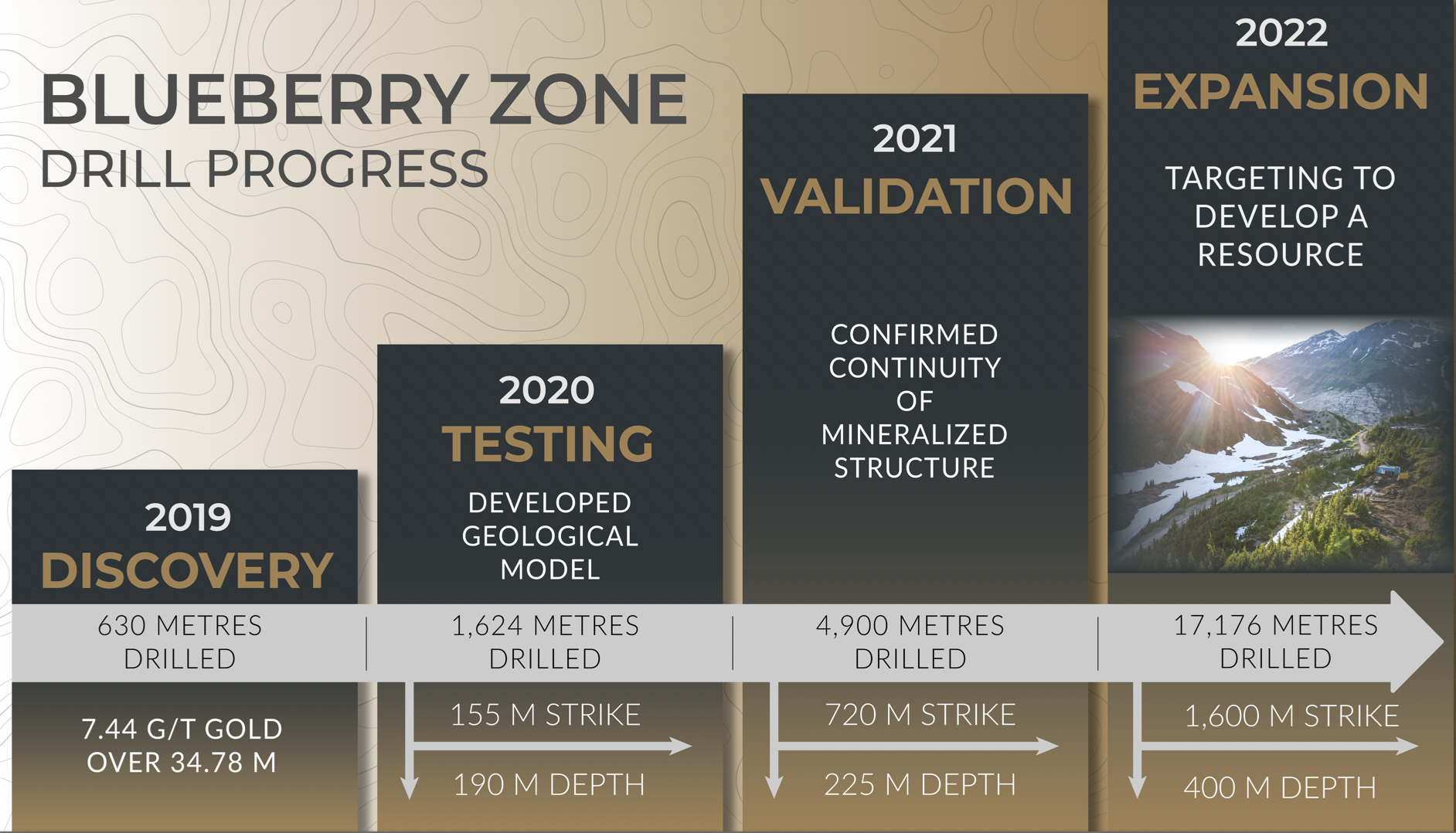

The Company has line of sight to what I believe is 2.0M high-grade ounces on just its 100%-owned Blueberry Contact Zone (“BCZ“). Importantly, there are no royalties on Scottie’s properties. Blueberry is two km N-NE of the 100%-owned past-producing Scottie Gold Mine (“SGM“), ~35 km north of Stewart.

Notice the past-performing SGM on the map above is ~2 km east of the prospective Domino target, and ~2 km southwest of the BCZ. Imagine the potential if some degree of continuity can be established between Blueberry & the SMG, or even across all three zones.

In the chart below notice that instead of 2M ounces, the figure could end up being higher, depending on the ultimate depth, grade & mineralized strike length. While Blueberry is known to be mineralized to ~1,600 m, a potential extension ends at 2,200 m. How much deeper than 400 m could it run?

Newcrest’s Brucejack & Red Chris mines are mineralized to depths of 1,900+ m & 1,800+ m, respectively. Please note, that doesn’t mean Scottie’s prospects will be nearly as deep, but look in the chart at what 700-800 m of depth might mean for the indicative # of ounces.

Blueberry zone could be a monster deposit…

The BCZ is increasingly being recognized as a significant gold discovery in Canada. At last month’s PDAC investor conference, drill core from Blueberry was showcased in the conference’s [invite only] core shack exhibit (cores chosen by a technical committee).

Moreover, the SGM project that hosts Blueberry has an active permit allowing for the mining of up to 75,000 tonnes/yr., ~200 tonnes/day. This is interesting given that Newcrest & Ascot each have mills within ~25 km of the BCZ.

In other news, Newmont is still trying to acquire Newcrest, in part to own Brucejack in the GT, one of Canada’s highest grade mines. Teck Resources is the subject of takeover interest by Glencore, and reportedly Freeport McMoran, Vale & Anglo American.

There are good reasons for Newmont to continue expanding in the GT to capture synergies & economies of scale. It already has major assets in Ontario & Quebec, the GT is the next logical step.

Teck is best known for its prodigious coking coal (being spun out into a new vehicle) & copper segments, but it also has a 50/50 JV with Newmont on Galore Creek and a 75% interest in Schaft Creek, one of the largest undeveloped porphyry Cu-Au-Moly-Ag deposits in N. America.

I often compare Scottie to Ascot Resources and I hereby reiterate the compelling thesis of a (hypothetical) combined Ascot/Scottie being very tempting to a company like Teck, Newmont, Newcrest & Glencore.

In March, Freeport McMoRan invested in tiny Golden Triangle junior Arcwest Exploration, in Nov., BHP acquired a 19.9% stake in Brixton Metals. Freeport & Boliden have investments in Amarc Resources.

Scottie is like a prime takeout candidate, but not yet…

How integral is Scottie to an Ascot/Scottie combination? Look at the map! — Scottie’s land package at 60,000+ ha is more than twice that of Ascot’s 25,258 ha, and the BCZ is closer to Ascot’s mill than its own Red Mountain project. Ascot expects first production in 1H 2024.

In prior articles I’ve discussed the likely outcome of Scottie being acquired (perhaps after the 2024 drill season). To be clear, I don’t believe Scottie has any interest in selling unless at a very attractive valuation. There’s so much more drilling to be done.

This season’s drill program at 20,000 m will be impactful — nearly as much as 2021 & 2022 combined. Readers are reminded that Blueberry is right off the road, so costs are relatively low and logistics are easy.

The program at the SGM project, utilizing three diamond drill rigs, is expected to start in late June. Approximately 17,000 m will focus on expansion of the BCZ and the other holes across the remainder of the area.

Twenty thousand meters is a large program, Tudor Gold & Benchmark Metals are also embarking on 20,000-meter campaigns this year.

Please see Scottie’s latest corporate presentation

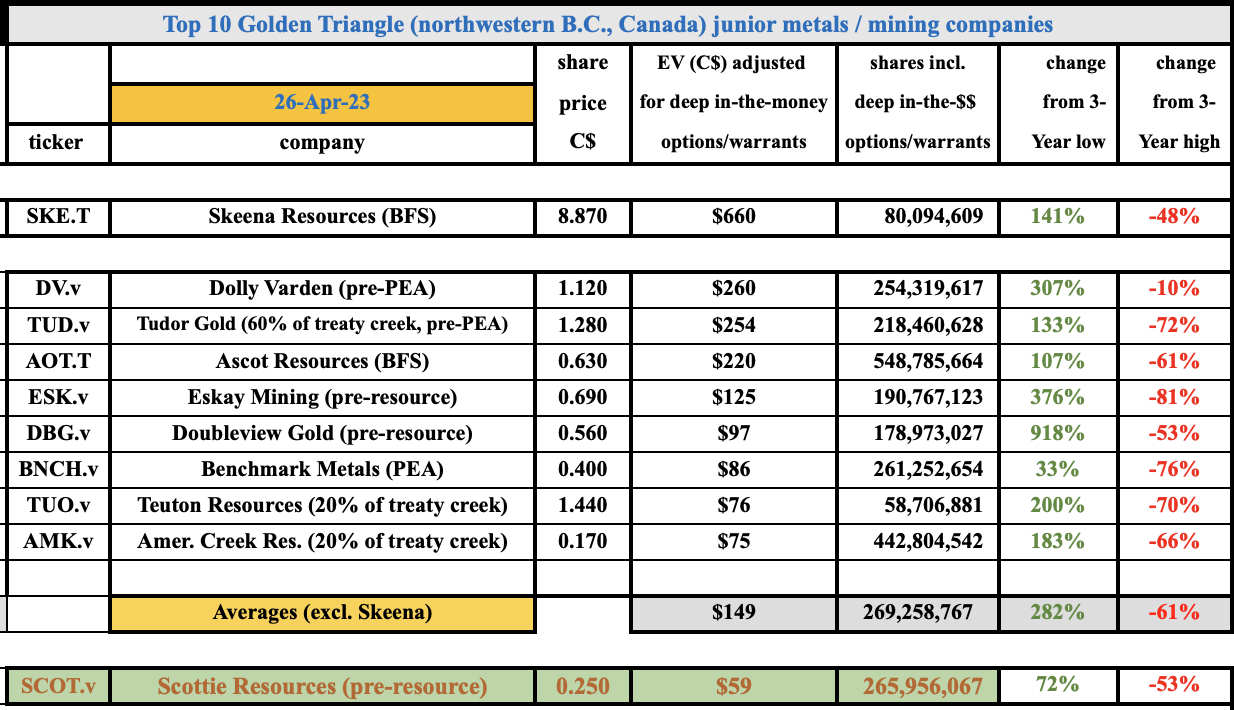

In the chart below, notice that Scottie is the 10th largest pre-consturction GT company. Readers should consider comparing Scottie to pre-resource GT players Eskay Mining & Doubleview Gold and pre-PEA Dolly Varden Silver.

Each hosts attractive properties that could be takeout targets, but neither Eskay nor Doubleview have blockbuster high-grade gold intercepts or are within 25 km of two gold mills.

The three have an average property package & enterprise value {market cap + debt – cash} of 23,900 hectares & $160M vs. Scottie at 60,000+ ha and a $59M valuation (~$30/prospective BCZ oz.).

Dolly Varden is a silver/gold story with a maiden mineral resource of ~138M Ag Eq. oz., (equal to ~1.84M Au Eq. oz. @ 5.2 g/t). Its valuation tripled after hitting blockbuster gold intervals.

Dolly is now trading with an enterprise value {market cap + debt – cash} of $260M, or ~$142/Au Eq. oz. All else equal, iIf Scottie were to trade at that valuation on my estimate of 2.0M ounces (BCZ alone), the share price would be above $1.00 vs. today’s $0.25.

One more thing I’ve noticed — Scottie’s share price has yet to have an explosive move higher the way that Eskay, Doubleview & Dolly Varden have (up an average of 528% from 3-yr. lows vs. Scottie up 72%).

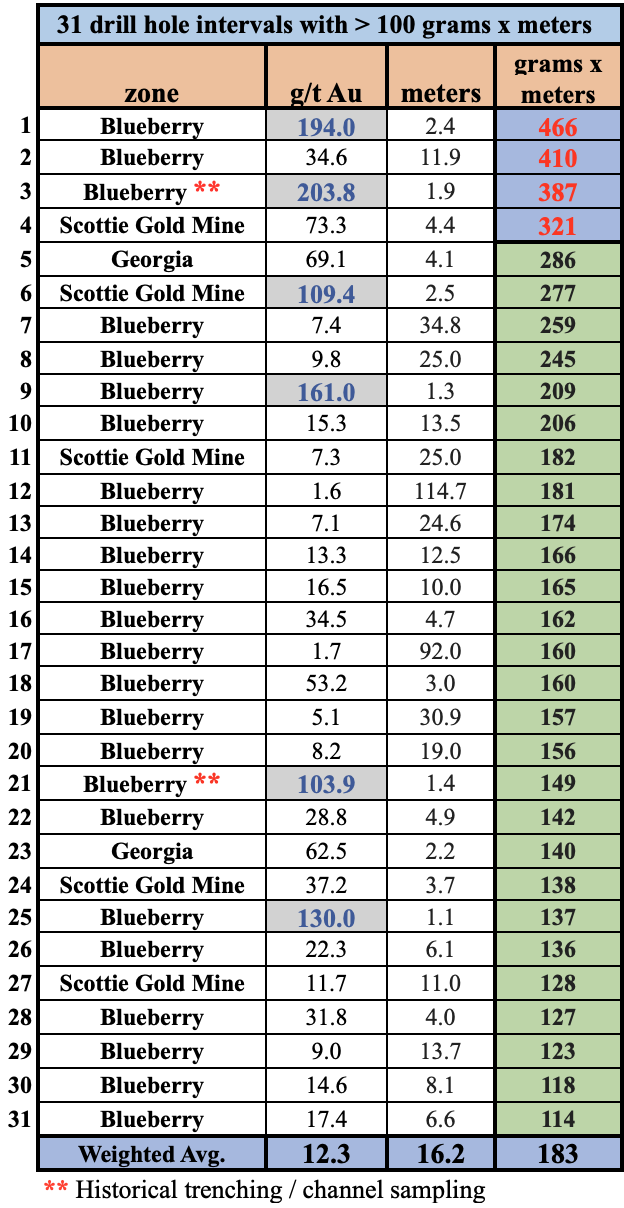

Scottie has some of the best gold drill intervals in all of Canada

Below are the best intervals at the BCZ, SGM & Georgia zones to date. Many companies boast about 100+ gram-meter results, but often they only have a handful, with low single digit meter widths.

By contrast, Scottie has delivered thirty-one 100+ gram-meter intercepts (incl. two historical trenching / channel samples) with lengths averaging 16.2 m at a (weighted-avg.) grade of 12.3 g/t gold. These are the best of the best, so not representative of the entire property package.

Note: {gram-meter figures are for illustrative purposes only. These strong gram-meter hits do not necessarily mean the indicated zones will become parts of an attractive NI 43-101 compliant mineral resource}.

A strategic partner or acquirer could facilitate a doubling or tripling of drilling to book ounces faster. Readers should consider taking a closer look at Scottie Resources (TSX-v: SCOT) / (OTC: SCTSF) as it’s fully-funded for a robust 20k -meter drill program that should be quite insightful. Please see Scottie’s latest corporate presentation

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Scottie Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Scottie Resources was an advertiser on [ER] and Peter Epstein owned shares in the company

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)