In early May gold rallied $290/oz. (+15.3%) from a late February level of $1,805/oz. to an all-time (nominal, intra-day) high of US$2,081/oz. (investing.com). However, since May 3rd the price has fallen to $1,960/oz. Gold is down 6%, but many companies are down 2x-4x as much.

This makes little sense, especially as gold juniors did not rally to new highs (not even close) as the precious metal shot above $2,050/oz. Readers are reminded that adjusted for inflation, the all-time high was ~$3,200/oz. (in today’s dollars) in 1Q 1980. What was it about 1980 that’s quite similar to the current economic backdrop?

Inflation averaged 14.4% in the U.S. in the first half of 1980. What readers might not realize is that it took 3.5 years to put the inflation genie back in the bottle. During the second half of 1983 inflation averaged 3.0%.

I’m not predicting the gold price, but with continued high inflation, unstable financial/bank stocks and a global debt bubble, not to mention growing tensions between China/Russia & the West, I think the chance of gold rising 10-25% is higher than it falling 10-25%.

Central banks agree, they have been buying up gold at the fastest rate in decades.

Assuming that gold juniors return to favor, which jurisdictions could become hot? The Golden Triangle in northwestern B.C., is a prime candidate. However, led by New Found Gold (“NFG“), two years ago Newfoundland & Labrador was one of the hottest plays in N. America.

I believe that Newfoundland’s juniors are poised for another run. If so, Gander Gold (CSE: GAND) / (OTCQB: GANDF) offers tremendous discovery potential at a cheap valuation.

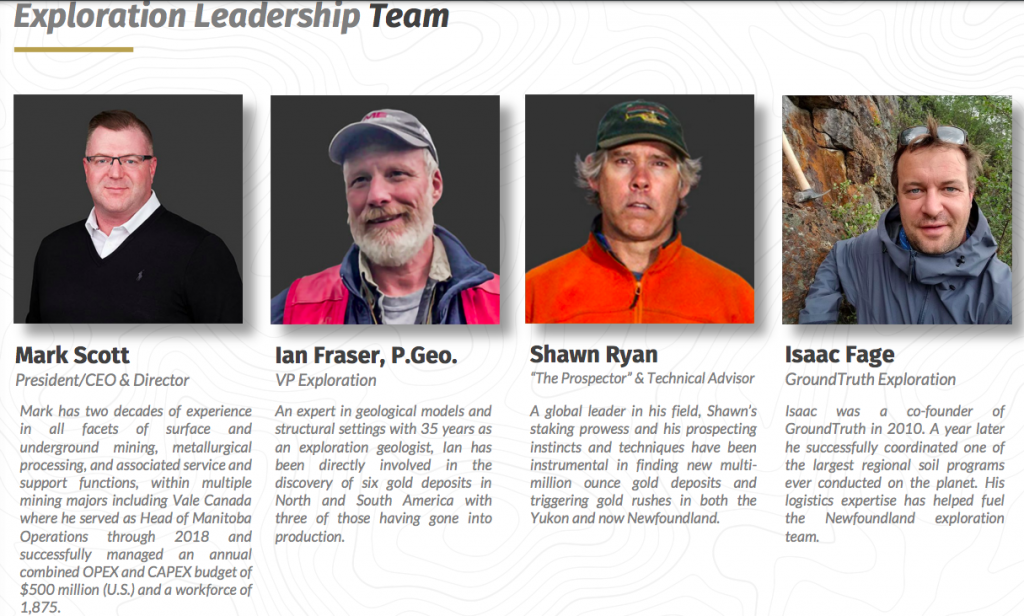

Gander has a strong team & advisors. Please see brief bios of CEO Mark Scott, VP Exploration Ian Fraser P.Geo, prospectors Mike Middleton & well known advisor Shawn Ryan & Isaac Fage of GroundTruth Exploration in images below.

This team prudently secured a large land package before the Newfoundland gold rush of 2021.

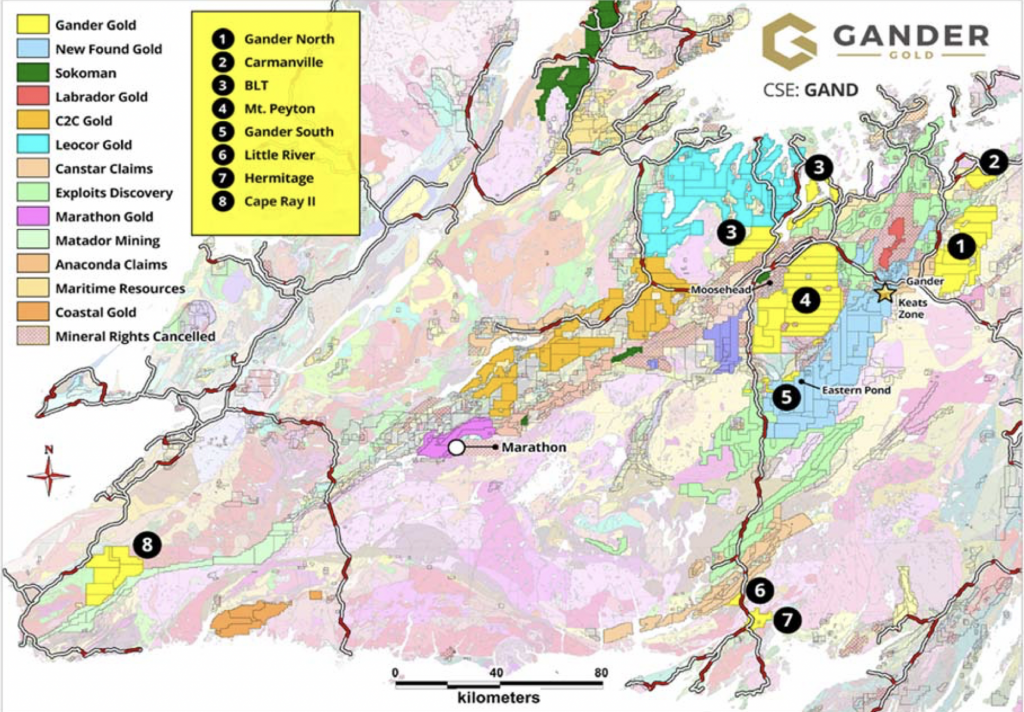

Gander owns/controls 225,900 hectares spanning eight project areas, five of which are in the heart of the Central Newfoundland Gold Belt (“CNGB“). That’s a giant land package, but let’s be honest — size is typically less important than location & geological setting.

How well situated is Gander Gold? Eighty-two percent of its 225,900 ha is in the CNGB, which is great, but still not necessarily prime real estate. Please look at the above map. The yellow areas numbered 1, 3 & 4 are three large claims blocks (Gander North, Mt. Peyton & BLT) within 10-30 km of NFG.

Last year management identified a “potentially major” new gold trend at GN starting ~12 km east of the GRUB Line & ~25 km east of the Appleton trend that host NFG’s & Labrador Gold’s high-grade projects.

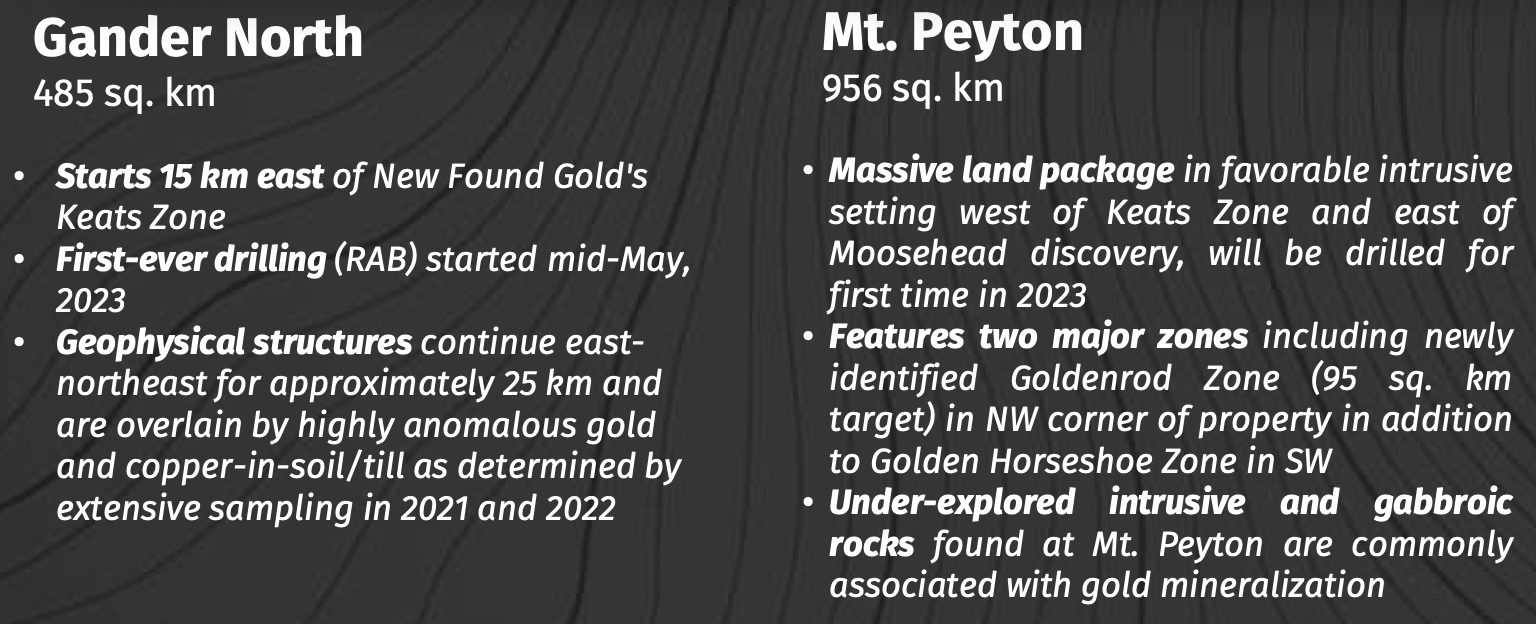

Gander recently started a 70-hole rotary air blast (“RAB“) drill program across four of its eight prospects. It began at the 485 sq. km Gander North (“GN“) project, ~15 km east of NFG’s blockbuster Keats zone.

Since initiating work at GN two years ago, management has done an extensive exploration program consisting of airborne geophysical surveys, 12,342 soil samples, geochemical follow-up surveys, structural interpretation, prospecting & geological mapping.

Multiple high-priority drill targets have been identified across a 25-km series of structures considered highly prospective for high-grade discoveries.

As prospective as GN is, management also reported high gold-in-soil results (1,583 & 1,014 ppb gold) from the Company’s 956 sq. km Mt. Peyton project. The samples were found at the newly-identified Goldenrod zone covering a large area in the northwest corner of the Project.

Goldenrod is ~12 km east of Sokoman Minerals’ Moosehead project, which features five open-ended zones of high-grade gold. Gander has taken ~4,000 soil samples at Goldenrod (2021 & 2022), showing anomalous to extremely anomalous values across a 95 sq. km target area.

The Golden Horseshoe Zone in southwest part of Mt. Peyton shows anomalous-to-extremely anomalous gold-in-soil values across ~150 sq. km. In my view, both GN & Mt. Peyton could be company-makers.

GN & Mt. Peyton are fully-permitted for preliminary RAB, and follow-up diamond drilling. In total across eight Central Newfoundland Gold Belt properties, more than 100 linear km of potential strike has been outlined along which gold-in-soil geochemistry anomalies are overlain on geophysical anomalies.

Many Newfoundland companies reference NFG on their maps to show where their flagship properties are. No company has nearly as large a position, 172,800 hectares (GN + Mt. Peyton + BLT) near NFG as Gander.

BLT hosts the best soil sample on all eight prospects to date at 5,940 ppb gold (5.94 g/t). BLT is smaller than GN & Mt. Peyton and further from NFG, but at 28,700 hectares is as large or larger than the entire land packages of many Newfoundland peers. For example, Marathon Gold’s advanced Valentine project is 24,000 ha.

Nearly 4,500 soil samples, geophysics surveys & detailed structural interpretation at Gander’s Cape Ray II project outlined three large zones of interest. One zone is within 3-5 km of Matador Gold’s two main deposits, and has returned promising gold-in-soils over seven km.

In my view, the GN project alone could be worth the Company’s entire enterprise value {market cap + debt – cash} of ~$12M. Compare GN’s 48,500 ha to Sokoman Minerals’ 2,450 ha Moosehead or Labrador’s 7,700 ha Kingsway projects. Small land parcels can carry large per hectare valuations.

If one looks at Gander’s land package, the Company is trading at ~$80/ha on only the GN + Mt. Peyton + BLT projects. Compare that to Labrador’s & Sokoman’s more advanced, but pre-maiden mineral resource flagship projects valued in the $1,000’s/ha.

NFG’s growing high-grade deposits (pre-maiden resource) will almost certainly become a mining complex. That means surrounding prospects (if not developed into mines) will be highly sought after as satellite deposits to operations springing to life later this decade.

Companies like Gander with large land packages have multiple ways to win. In addition to some properties ending up as satellites, think one step further… NFG is likely to be acquired by a much larger company.

An example would be Kinross taking out Great Bear Resources. Any acquirer of NFG would be crazy not to also take out Gander, not to mention Labrador & Sokoman.

Readers are reminded that bonanza drill results from any CNGB project is good news for all. NFG is in the midst of a 500,000 meter drill program. Labrador is drilling 100,000 meters.

A great thing about controlling > 9,000 claims is the ability to sell, JV, or farm-out all, or portions of, owned/controlled properties, thereby diminishing cash burn.

To the extent that management can strike deals to receive a mix of cash, shares + production royalties, that would be an attractive long-term call option on the price of gold.

Gander Gold (CSE: GAND) / (OTCQB: GANDF) is an early-stage play, but if one believes in the Company’s technical team, precious metals investor Eric Sprott, Canadian prospector Shawn Ryan and Newfoundland as a world-class, vastly under-explored jurisdiction — then there’s substantial bang for the exploration buck here.

Next door neighbor NFG’s valuation is nearly a billion dollars and it’s worth every penny. At ~$12M, Gander’s valuation has room to grow a lot larger upon exciting new drill hole discoveries as soon as this year.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about GANDER GOLD, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of GANDER GOLD are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of GANDER GOLD and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)