With the spot uranium price inching higher to ~US$56/lb., near the highest in over a year, I revisit Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) as it’s in the sweet spot of robust share gain price potential with less risk than most early-stage uranium juniors.

Why less risk? In addition to owning/controlling two promising flagship projects, it operates as a prospect generator. That means management is less reliant on capital markets to raise exploration funds. Please see latest corporate presentation for excellent maps of the Athabasca Basin.

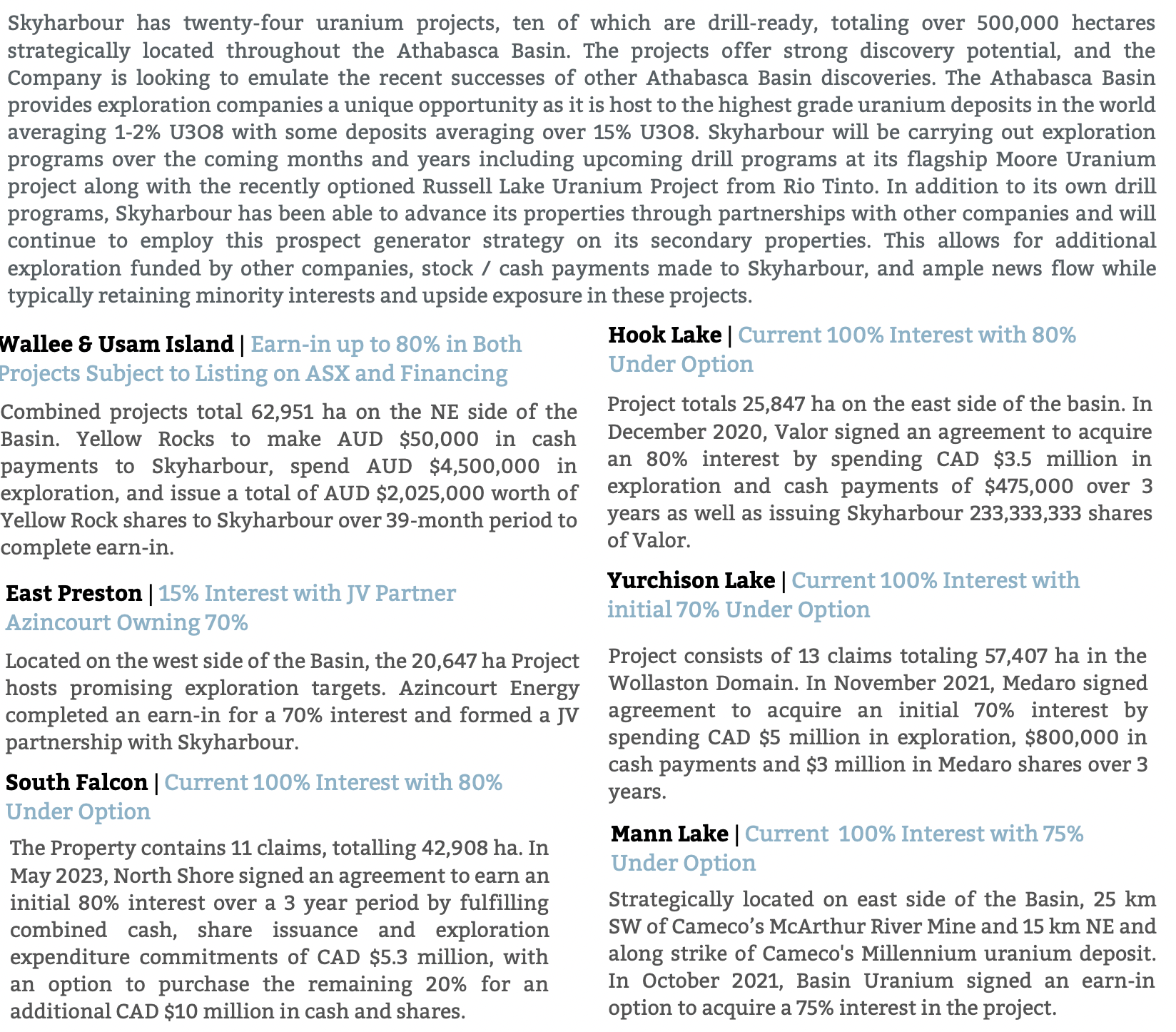

Skyharbour is an explorer / early-stage development play with properties/projects in & around the world-famous Athabasca Basin in Saskatchewan, Canada. Including its two flagships, it has 24 prospects covering 504k hectares in the heart of the [east side] of the Basin.

Last week, large Skyharbour shareholder Denison Mines released strong results of a Definitive Feasibility Study on its Phoenix project, part of the overall Wheeler River project, highlighted by an after-tax NPV(8%) of US$1.6 billion, and an IRR of 90%.

Importantly, the upfront cap-ex came in at just US$420M. Compare that 90% IRR with Nexgen Energy’s world-class Rook project’s IRR of 52.4%. These enhanced economics are a huge vote of confidence in the viability of In-Situ Recovery (“ISR”) mining in the Athabasca basin.

I believe Denison could be a prime takeover target for $16B Cameco. If Cameco were to acquire Denison, it would be crazy not to also take out Skyharbour.

I typically don’t do a deep on the fundamentals of uranium, but this video link of industry pundit Mike Alkin, CIO of Sachem Cove Partners, is compelling.

Alkin’s team believes the bullish uranium data & trends are incontrovertible. Some of his team’s findings — underfeeding in the uranium enrichment process released 20-25M lbs./yr. into the spot market, suppressing prices, for nearly a decade through 2021.

That process is reversing to overfeeding, which will pull 20-25M lbs./yr. out of the market for years to come. So, a 40-50M lb./yr. swing on consultant UxC’s 200M lbs./yr. estimate of consumption from 2023 to 2030. Primary mine supply is currently ~140M lbs./yr.

Atkin states that last year roughly 60% of demand was contracted for. In past upward pricing cycles, contracting rose to 110%-140% of annual demand when utilities were forced to the table.

Alkin sees 2023-25 as strong years for contracting and believes the market is one supply shortfall away from a potentially large price spike. The Russian war on Ukraine could be that supply incident. U.S. sanctions on Russian uranium are in the works.

Among the top-5 uranium producing countries, Kazakhstan, Russia & China produced > 50% of output in 2021. This is a recipe for disaster. And, replacing those sources with African supply makes little sense for the U.S. market.

Uranium prices can move significantly in a matter of months. Since 2020 there have been three spot price rallies of 42% to 112%. By contrast, the current 3.5-month move to $56/lb. is just 14% above its mid-March low.

If the current rally is destined to run to +77%, (average gain of past three bull markets), uranium would hit $88/lb. A year ago when uranium topped at $64.5/lb., Skyharbour’s share price touched $0.84.

Since then, inflation has remained high and the Company has made meaningful advances on existing and new opportunities — without much equity dilution — yet the share price is now $0.355.

Readers are reminded that in today’s dollars the all-time high price from mid-2007 was ~$200/lb. That level was short-lived, but the contract price was pinned at $95/lb. (~$135-$140/lb. adj. for inflation) for nine months in a row!

Switching back to Skyharbour, management is excited about the potential of ISR mining following successful testing by Denison & Orano who are actively pursuing ISR.

Skyharbour could be a prime beneficiary of the 5+ years & $10s of millions invested in testing ISR on properties near Russell Lake & Moore Lake. Importantly, not all of the Company’s properties will be amenable to ISR techniques, but even if a few are it would be impactful.

Another technology, borehole mining, is also being studied and could be amenable to select Skyharbour properties. ISR & borehole mining offer possible paths to fast-track production if/when applicable.

Even if management can’t deliver 10s of millions of pounds, smaller deposits could be viable with ISR and borehole mining. Or, conventional resources could become satellite deposits for nearby existing & upcoming processing facilities (Cameco, Orano, Denison, Nexgen, Fission).

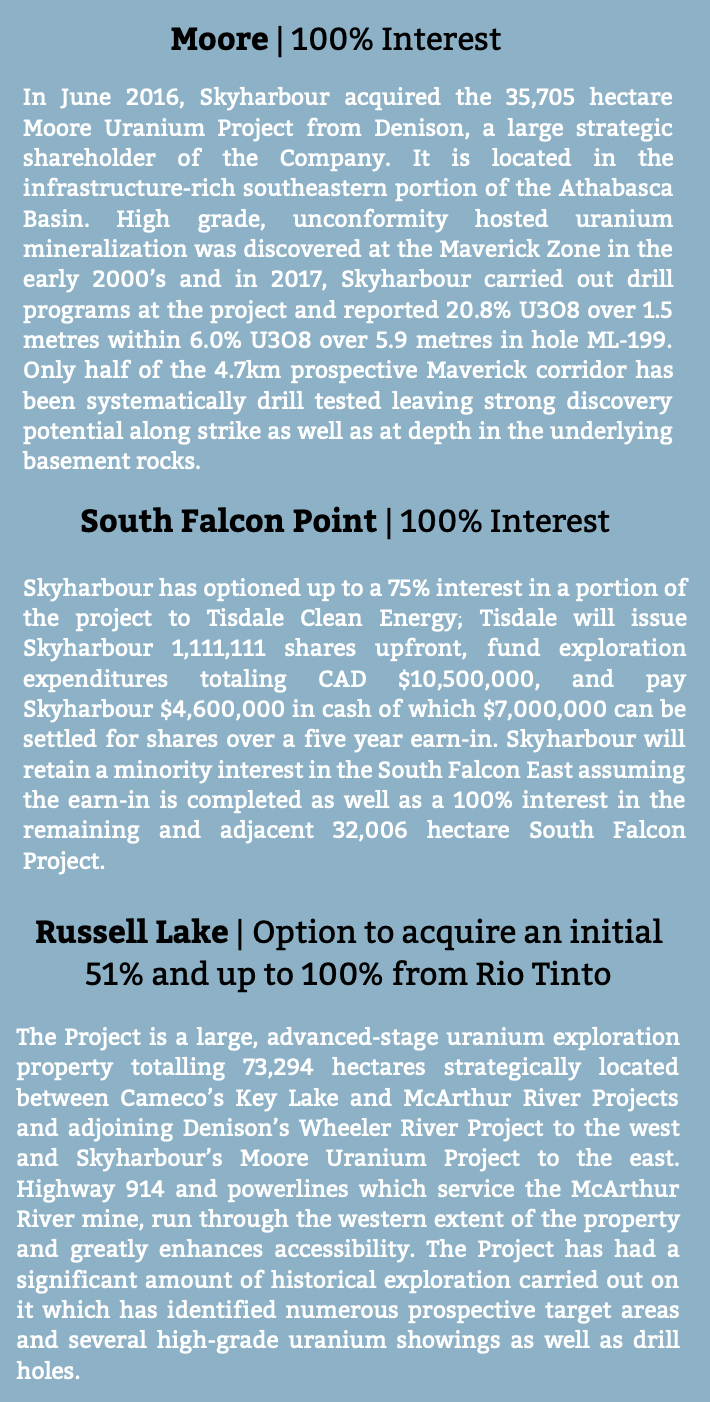

The most advanced project, (and 100%-owned), is Moore Lake (“ML”). The best intercepts; 4.0% U3O8 over 10.0 m, (incl. 20.0% / 1.4 m), 0.72% U3O8 / 17.5 m, 2.5% / 6.0 m, (incl. 6.8% / 2.0 m), 5.1% / 6.2 m, 4.0% / 4.7 m, 20.8% / 1.5 m (within 6.0% / 5.9 m), 9.1% / 1.4 m and 4.2% / 4.5 m.

Anything above 1% is high-grade in this neck of the woods, and would be considered a blockbuster result anywhere else.

Complimenting & expanding ML is an earn-in to initially acquire 51% of Rio Tinto’s 73,294 ha Russell Lake (“RL”) project. Like ML, RL has seen significant exploration, incl. > 95,000 meters of drilling.

Recent commentary by CEO Jordan Trimble is that visual inspections of drill core from this year’s 10,000 meter program at RL looks, “very good.”

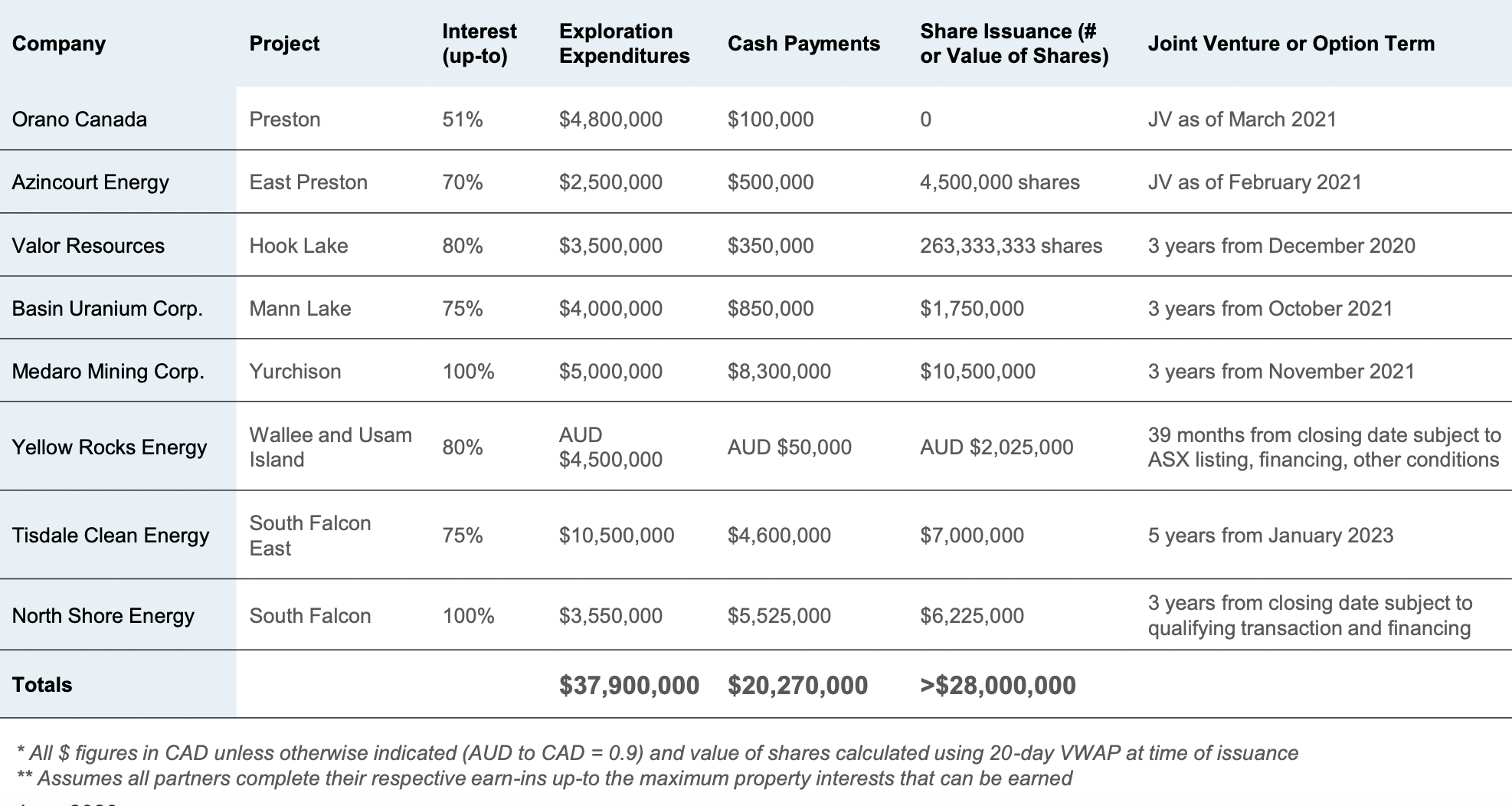

Management has secured two JVs & six earn-in partners, all drilling & exploring at no cost to the Company. Additional option/JV transactions are being negotiated..

Adjusted for inflation, as much as C$100M has been spent on the ML & RL projects alone. It would take years to replicate all that work.

The combined footprint of ML & RL is ~8x that of Wheeler River (~12,000 ha). Wheeler has booked 135M Indicated + Inferred pounds (so far), ~11,250 lbs./ha. If ML/RL could deliver just 5% of that pounds/ha figure, it would amount to ~54M pounds.

Satellite deposits avoid substantial costs & shave years off of permitting, development & construction activities.

As mentioned, Skyharbour owns/controls 22 other properties in its prospect generator portfolio. In the image above, notice that eight companies plan to invest $86M in total consideration, (some already incurred), via exploration + cash payments + share issuances.

Skyharbour is trading at an enterprise value of just $51M, half of what has been spent over the years at ML & RL. How much might the other 22 prospects be worth? I believe $10s of millions… but whatever they’re worth, double it as uranium surpasses $70/lb., and double it again if we see $100+/lb.!

To sum up how cheap Skyharbour Resources is, consider that today’s uranium price of $56/t is down 13% from last year’s peak of $64.5/t, yet Skyharbour‘s shares have fallen 58% from $0.84 to $0.355.

A mere 25% gain in uranium would breach the $70/lb. level. I see no reason why Skyharbour couldn’t more than double in that scenario. Does a 25% gain seem like a lot? If Russian sanctions are enacted, U.S. utilities might be forced to pay a premium for friendly pounds.

The U.S. currently produces less than 1M of the 50M pounds of U308 it consumes. Production is on the rise, but U.S. supply growth will come almost entirely from ISR mines that typically are good for 1-2M lbs./yr.

How many pounds might the U.S. be producing by 2030? My guess is 10-15M/yr., with 45-50M/yr. additional pounds sourced mostly from countries that are not China, Russia, Kazakhstan or in Africa. That’s why Cameco would greatly benefit from acquiring Denison & Skyharbour.

Please check out Skyharbour’s new corporate presentation.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)