I’m tracking 235 junior miners with at least one lithium (“Li“)-prospective property in Canada. The vast majority are early-stage Canadian & Australian-listed companies in Quebec and/or Ontario.

Quebec’s Patriot Battery Metals [“PMET”] & Winsome Resources have world-class Li projects in northern Quebec. Several meaningful projects including Arcadium Lithium’s James Bay, Sayona Mining’s Moblan & NAL, Critical Element’s Rose, and Nemaska’s Whabouchi are also in Quebec.

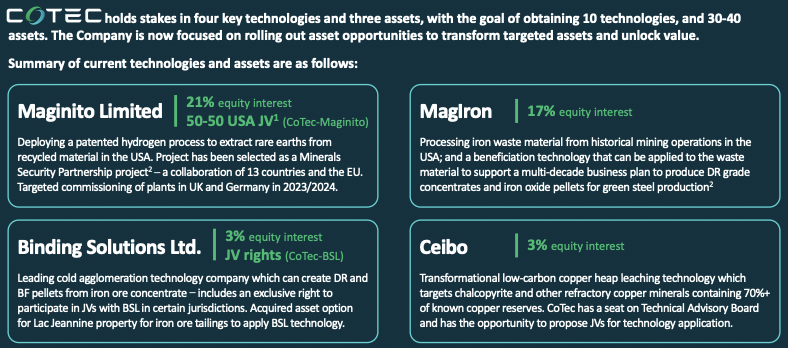

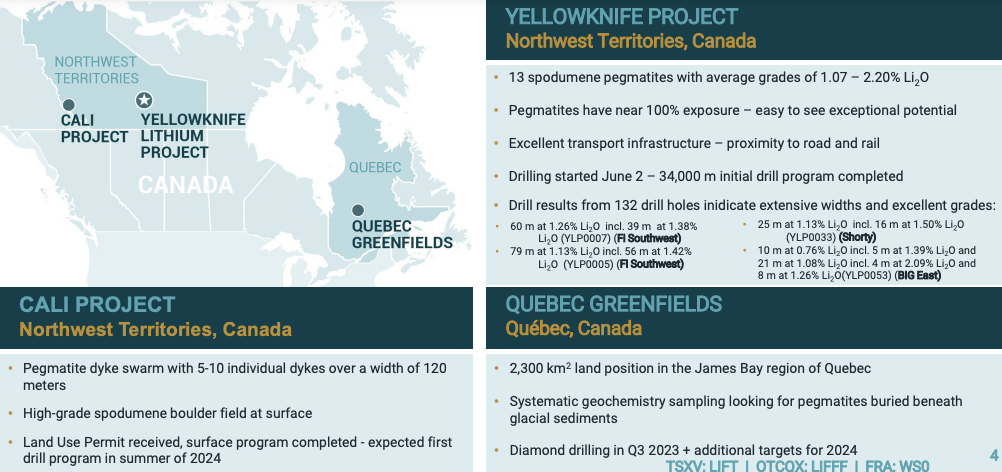

Ontario hosts just one globally-significant project, Frontier Lithium’s PAK. SE Manitoba is considered the 3rd most interesting Li hotspot in Canada, but a giant project owned by Li-FT Power (TSX-v: LIFT) / (OTCQX: LIFFF) in the Northwest Territories (“NWT“) is giving Manitoba a run for their money. See new Corporate presentation.

Li-FT’s Yellowknife project a Top-3 N. American hard rock Li project…

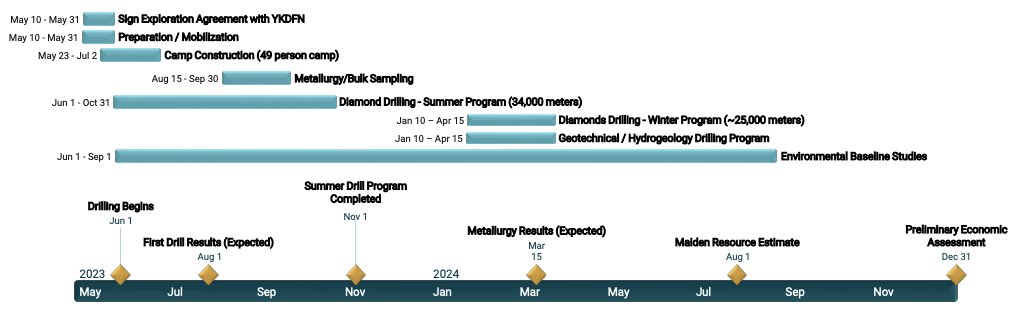

A maiden resource estimate (“MRE“) at the 100%-owned Yellowknife project is expected in September, followed by a PEA several months later. Management believes it has 95 to 125 million tonnes [midpoint = 110M] of mineralization from 8 of 13 pegmatite systems. Seven of the eight are easily road-accessible.

By including the remaining five systems (a few of which are smaller), a total resource at Yellowknife could reach the midpoint of 110M + ~50M = ~160M tonnes.

A historical (non NI 43-101 compliant) resource estimated 49M tonnes at 1.4% Li2O. Substantial historical surface work and > 34,000 meters of recent drilling suggest a resource grade of 1.1% – 1.3% Li20.

The five untested pegmatite clusters need a 70-80 km access road. Management believes a winter road would cost < $5M. Options, including the possibility of government assistance to build a permanent road, are being reviewed.

Given that the seven road-accessible clusters + the Echo target, are thought to contain 95-125M tonnes of 1.1%+ Li20, the others are icing on the spodumene cake.

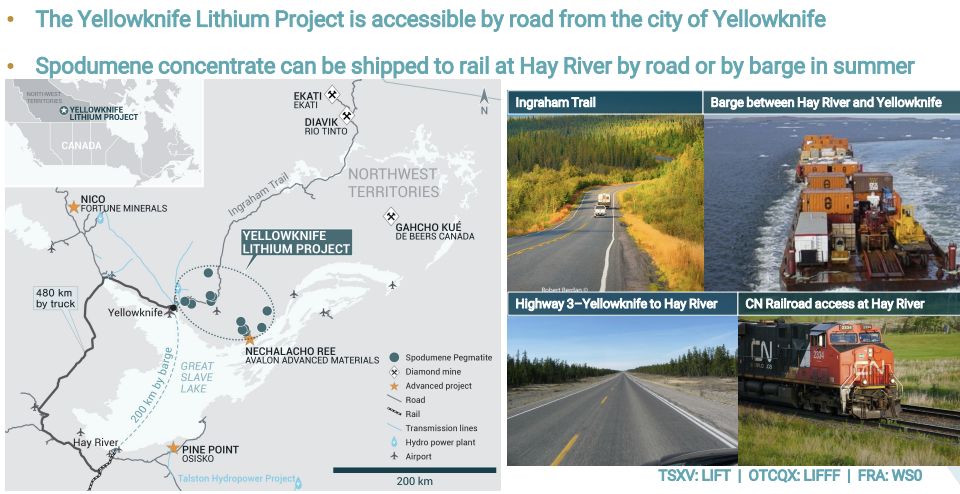

Regional infrastructure & product transport routes de-risk Yellowknife project

Yellowknife is possibly best positioned of the globally significant Canadian hard rock projects in terms of regional infrastructure & product transportation routes.

A paved highway from Yellowknife comes within a few km of seven meaningful deposits. Trucking around and/or barging across Great Slave Lake (in the summer months) to a rail line at Hay River is straightforward.

Barging for 3-4 months/yr. is expected to be very low cost. From Hay River, concentrate can be railed to a port at Prince Rupert or further south to the U.S.

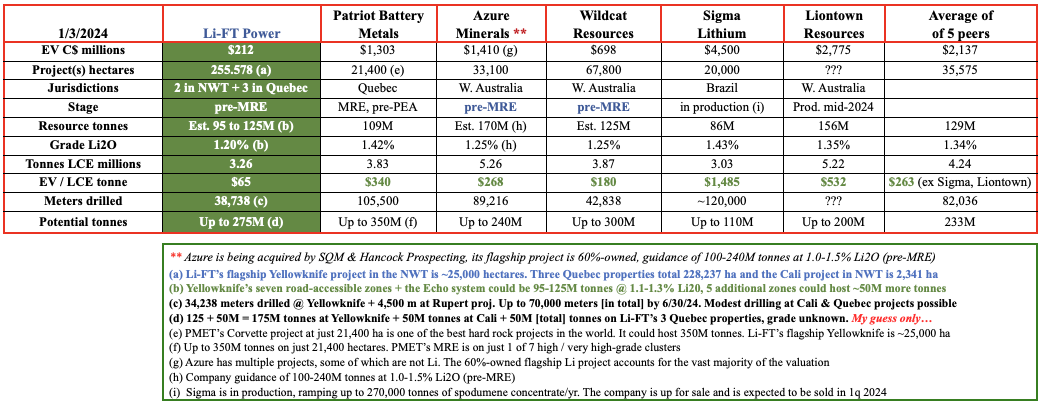

The following chart shows five globally-significant hard rock Li peers. Li-FT, Wildcat Resources & Azure Minerals are at earlier stages, but notice that pre-MRE junior Azure is being acquired for ~$1.4B by SQM & Hancock Prospecting.

The average peer valuation is 10x Li-FT’s, yet Li-FT holds its own in all key respects. It’s just earlier stage with a flagship project outside better known Li hubs in Quebec & Ontario. If any of the Company’s three properties in Quebec are well mineralized, all bets are off!

Assuming Azure has 170M tonnes, it’s valued at $268/tonne LCE. Based on its MRE, PMET is valued at $340/t, but an upcoming resource estimate could put it above 150M tonnes.

At 110M tonnes & 1.20% Li2O, Li-FT is valued at $65/t, less than half of Wildcat, a quarter of Azure & a fifth of PMET. Sigma is in production, so not an apples to apples comparison, but it’s valued at nearly $1,500/t, or 23x that of Li-FT.

Notice that Wildcat & Azure, both Australian-listed, enjoy very strong valuations. Perhaps Li-FT will follow PMET’s lead and co-list in Australia?

Yellowknife is a world-class, globally-significant hard rock Li project

Assuming in two years that Li-FT has delineated > 180M tonnes (combined) at Yellowknife, Cali + one or more of the Quebec properties, and has a PFS on Yellowknife, the Company could be worth a multiple of today’s enterprise value {market cap + debt – cash} of $212M. (C$5.57/shr.).

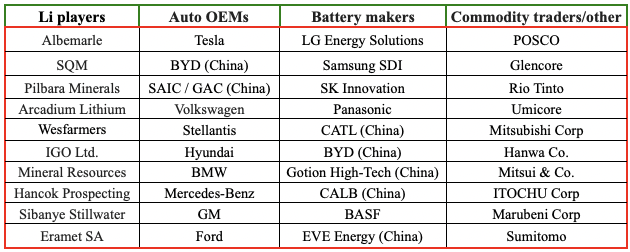

Heated M&A in Australia will likely spread to Canada. In the chart above are 41 companies actively looking to enter the Li space or expand their portfolios.

Only six juniors (one in NWT, four in Quebec, one in Ontario) have world-class hard rock Li projects that can reach meaningful production this decade. That’s right, 41 companies, most large enough to acquire multiple assets, and six projects — do the math.

While those 41 groups are presumably also shopping in Brazil & Australia, there are no Tier-1 Li projects in Brazil besides those held by Sigma Lithium & Latin Resources, and Sigma is expected to be acquired soon.

There could be a bidding war for Li-FT, especially if/when PMET is acquired, leaving dozens of groups looking for the next world-class project.

Meanwhile, western Australia is becoming crowded & expensive. Competition for critical resources like labor, rail/port access, mining services & power is driving up costs. Canada is thousands of kms closer to a major EV market than Australia & Brazil are.

In addition to the strong team members in the above image is Iain Scarr. Mr. Scarr brought three Li projects in Argentina to Feasibility-stage before they were sold. Iain has > 30 years’ experience at Rio Tinto, most recently as Commercial Director & VP Exploration.

A tsunami of Li M&A is coming to Canada…

Rio is important to watch as it’s earning into two Li projects in Quebec, and has diamond operations in the NWT. According to a consultant report from 2017, “Mining represents nearly 25% of the NWT’s GDP and ~50% of its international & inter-provincial exports.”

Importantly, the large prospective resource size of Yellowknife and the considerable value of its regional infrastructure & transportation routes is boosted by four additional early-stage projects, one in the NWT and three in Quebec.

The 100%-owned Cali project has a spodumene-bearing pegmatite dyke system up to 1,200 x 60 x 300 m deep. It has the potential to be over 50M tonnes, but there’s been no drilling on it. Last year (2023), sampling & mapping was done to establish a rough estimate of grade & tonnage.

In November, the Company obtained a Land Use Permit enabling it to establish an exploration camp, drill and construct & maintain winter access roads. A modest drill program is planned for the summer.

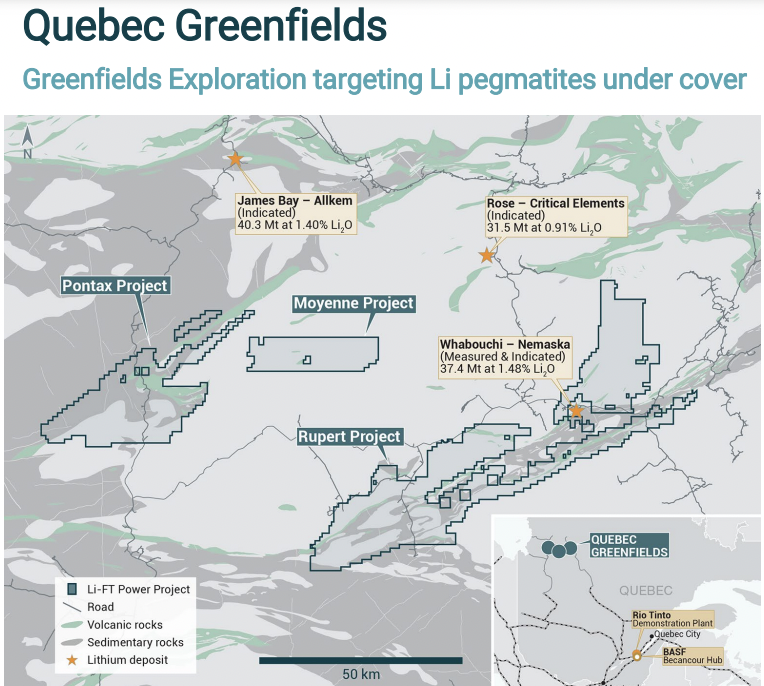

In Quebec, the 100%-owned [Rupert, Moyenne & Pontax] properties span a total of 228,237 hectares. Rupert (141,572 ha) surrounds Nemaska’s advanced-stage Whabouchi project {see map below}. To say that $10B+ Arcadium [formed in merger of Livent & Allkem] should care about Rupert is an understatement.

Although early-stage, 228,237 hectares in Quebec could be huge

Moyenne is 25,145 ha, about the same size as the Yellowknife project and larger than PMET’s 21,400 ha Corvette project. It’s within 50-60 km of both the James Bay & Rose projects.

Pontax is 61,520 ha and has the most extensive Li anomaly of the Quebec properties. It has highway access and is < 50 km south of the James Bay project. Any of the three Quebec prospects could be a company-maker if farmed out.

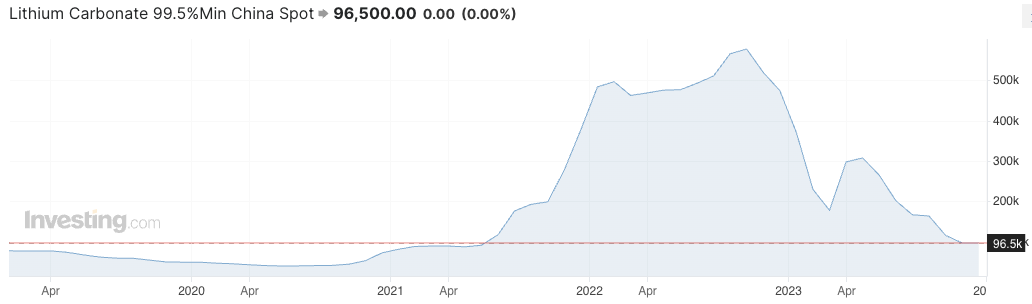

This bullish article on Li-FT assumes that Li prices will rebound. A widely-followed Li carbonate spot price in China has been pinned around US$13.5k/tonne since December 6th, suggesting it might have bottomed.

More representative of the Li market, the trailing 3 / 4 & 5-yr. average quarterly contract prices reported at SQM are $25.2k / $22.4k & $21.4k/t, respectively.

Has the spot price in China bottomed?

As 2024 unfolds, investors in the 235 Li hopefuls will come to realize the tremendous value in the world’s top early-stage projects, especially Li-FT Power’s (TSX-v: LIFT) / (OTCQX: LIFFF) Yellowknife in clean-green Canada.

There will be a tsunami of Li M&A across Canada. By the end of 2025, Li-FT will likely have been acquired by one of the 41 companies listed above, or others, at a valuation well above today’s levels.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Li-FT Power, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Li-FT Power are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Li-FT Power was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)