I wrote an in-depth article on Wealth Minerals (TSX-v: WML) / (OTCQB: WMLLF) in November. Since then, things are going better for President Boric and the world wants more lithium from Chile. Note: all figures C$ unless indicated otherwise… See new corp. presentation.

The spot lithium (“Li“) carbonate price in China had been falling for months, but may have hit bottom at ~US$13,500/tonne, down from the low-US$80,000‘s/t a year ago. Since Dec. 6th, the price has been at 98,500 –> 97,500 and now 96,500 yuan/t. (Jan. 4th).

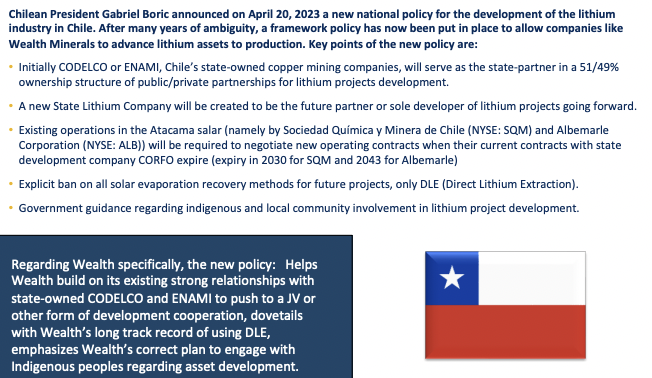

The SQM/Codelco update is a win for Chile, allowing SQM to operate in the Atacama salar through 2060 in exchange for contributing 50% of its Chilean operations to a newly formed JV in 2031. Chilean politicians appear motivated to make critical changes in policy in a more timely manner.

Regarding news specifically related to Wealth, it was reported Dec. 7-8th on various websites that the Company is collaborating with Germany’s giant chemical company BASF SE.

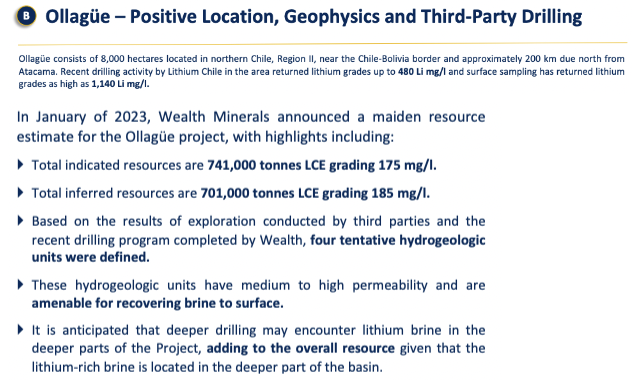

In other BIG news, a summary of a Preliminary Economic Assessment (“PEA“) on the Ollagüe project is out, and the results are good. Note: The name of the project has been changed to Kuska. The after-tax NPV(10%) came in at $1.54 billion, with an IRR of 28%.

Notice that Wealth used a more conservative 10% discount factor in its economics vs. peers using an 8% discount factor. I estimate that at 8%, Wealth’s NPV would be ~15% higher. The after-tax NPV/cap-ex ratio would be an attractive 1.8x.

The proposed mine plan does NOT require the use of solar evaporation ponds. The mine life is 20 years with initial production ramping up to 10,000 tonnes/yr. of battery-quality Li carbonate, then to 20,000 tonnes two years later. My guess for first production is in 2027 or 2028.

A well-known Direct Lithium Extraction (“DLE“) player, currently delivering commercial-scale solutions in multiple countries, should have considerable experience under its belt when installing Wealth’s DLE component 4-5 years from now.

The fact that project economics are strong after three years of elevated cost inflation is impressive. Comparing this PEA to any study that’s over a year old is apples to oranges. Op-ex & cap-ex figures for mining projects have been rising 8-12%/yr.

Comparing this PEA to studies that propose the use solar evaporation ponds is unwise. Local communities will fight against any company (besides SQM & Albemarle “ALB”) planning to use evaporation ponds.

Note: SQM & ALB are not allowed to increase brine pump rates in the Atacama salar. In fact, SQM has pledged to reduce pumping in half by 2030. Importantly, pump rate constraints will not impact Wealth as its use of DLE includes re-injection of brine back into the salar (minus the Li).

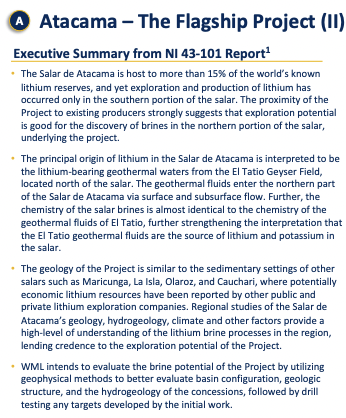

Readers are reminded that Wealth holds mining properties spanning 54,200 hectares, 46,200 of which are in an area with the highest potential in the world for finding large, high-grade Li deposits. Unlike SQM & ALB, who lease from Chilean entity CORFO, Wealth owns its licenses outright.

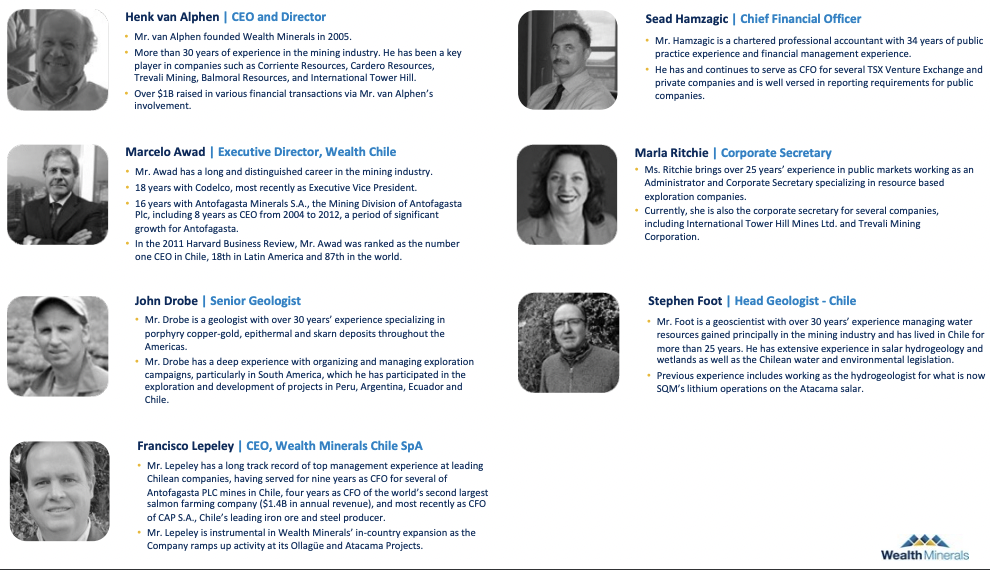

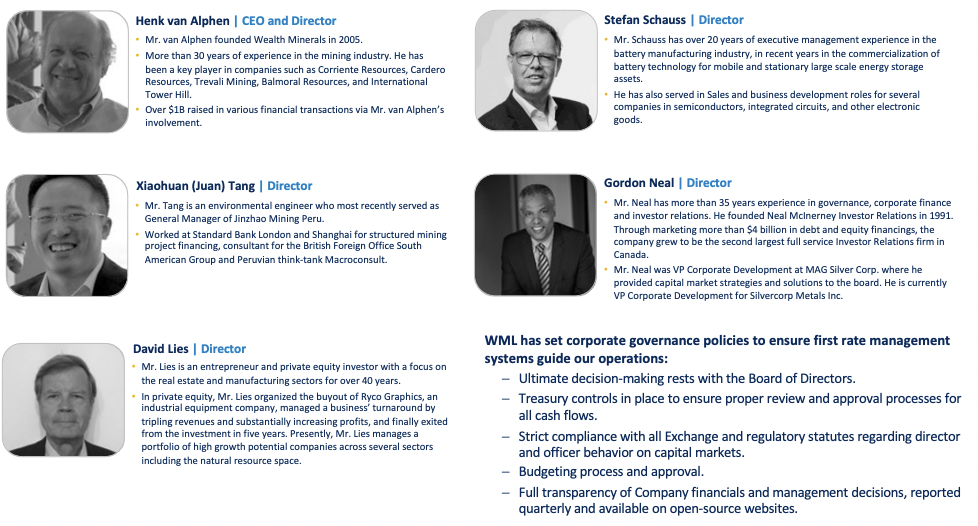

The Company has a strong mgmt. team, board & slate of advisors set to be unleashed as more clarity emerges on Chile’s Li policies. CEO Henk van Alphen has very extensive relationships in Europe, Scandinavia & Chile, in both investment & industry circles.

Exec. Dir. of Wealth Minerals Chile Marcelo Awad is literally a mining legend in S. America. His background and prestige will be extremely valuable in ongoing dealings with major foreign companies & Chilean groups Codelco & ENAMI.

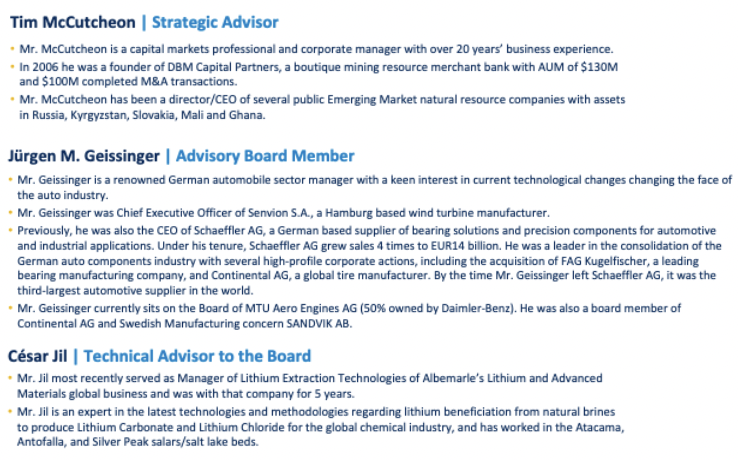

Long-time strategic advisor Tim McCutcheon is Henk’s right hand man in finding & vetting prospective partners, formulating off-take agreements & negotiating complex deals.

In the past year, Tianqi Lithium, LG Energy Solution, BYD, Tesla, GM & Rio Tinto have announced interest in Chile. In November, Rio & Codelco recently formalized a JV called Nuevo Cobre to explore & develop resources. LG Energy is said to be looking at a cathode processing project with SQM.

Tesla Chile was registered on Sept. 28 for the, “the import, export, manufacturing, marketing, distribution & sale of vehicles” Chile is Tesla’s beachhead for S. America. BYD plans to build “the Continent’s first cathode plant” in Chile.

Major Chinese producer Tianqi owns ~22% of SQM, it knows the Chilean Li market. China’s Tsingshan is building a LFP battery plant. Another Major player, Ganfeng Lithium, is invested in five brine projects in Argentina. Might it be interested in Chile?

Chile’s economy urgently needs investments from giant multinational firms. If/when Wealth secures a strong partner, it should be viewed favorably by government entities & officials, which could lead to faster permitting.

The new PEA comes on the heels of Codelco acquiring Lithium Power Intl. [LPI] to consolidate the promising Maricunga salar and French mining conglomerate Eramet announcing a $144M Li property acquisition.

Eramet has DLE technology it wants to deploy in Chile after rolling it out in Argentina. Earlier last week, Australian-listed Pan Asia Metals announced option agreements to earn into various Li properties in northern Chile, resulting in a +72% gain in its share price in three days.

Continued good news in Chile and Wealth could allow management to break the Albemarle/SQM duopoly. As mentioned, partnerships will be formed between juniors & State-sponsored companies like ENAMI & Codelco. The third leg of the stool will involve major automakers, battery makers, etc.

As discussed in my last article, investors today get the world-class Atacama project for free because the Company’s Kuska project alone is worth more than Wealth’s entire enterprise value.

If/when companies valued in the billions of dollars get involved in one or both of Wealth’s projects, management will be able to move forward with greater confidence as a partner would meaningfully de-risk the story.

Readers may want to compare Wealth’s valuation to companies with projects in neighboring Argentina. For example, Lithium Americas (Argentina)’s flagship Caucharí-Olaroz JV project with Ganfeng (~590 ppm Li) is valued at ~C$2 billion. (on a 100% basis). It’s ramping up to a run rate of 40k tonnes LCE/yr. in 2024.

With respect to Kuska’s valuation, LPI was recently acquired by Codelco for ~$340M. That company’s Maricunga project has an after-tax NPV of $1.8B. LPI’s project is years ahead, so to make the comparison more palatable, I discount the $340M figure back three years at 8%/yr. to get $270M.

Then I divide by 2 to account for equity dilution that would be required to get Kuska to the same stage as LPI — bringing the read-through valuation to $135M.

Another company that was acquired is PEA-stage Alpha Lithium, taken out for ~$300M by Tecpetro. Alpha’s project in Argentina has a NPV of $2.4B. The takeout valuation was ~14% of NPV. Multiplying Kuska’s NPV of $1.54 billion x 14% = $216M.

Wealth’s entire valuation (including the Atacama project) is just $80M.

As discussed in my prior article, even though the Company won’t own 100% of the Atacama project, it will control the lion’s share of the economics.

If one agrees that Kuska is worth more than $80M, then the exact value of Atacama hardly matters as investors are getting it for free. Readers are encouraged to look out a year or two as Chile expands its Li profile. Admittedly, shareholders have heard this before…

If a company like Volkswagen or CATL (both rumored to be acquiring Brazil’s Sigma Lithium) or Glencore / POSCO team up with ENAMI or Codelco + Wealth, that would be a powerful combination to navigate Chilean economic & political developments.

Chile and the world require a lot more Li production, but the staggering amounts needed are not going to come from Albemarle’s & SQM’s evaporation ponds. Those operations are the backbone of Chile’s output, but they can’t be relied upon to deliver robust long-term growth.

Will 2024 be the year that Chile finally opens up its Li sector to new companies? If so, Wealth Minerals (TSX-v: WML) / (OTCQB: WMLLF) should be among the very first to benefit. See new corp. presentation.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)