It has been a lousy run for silver/gold juniors for quite some time. This, despite the gold price being above $2,000/oz. To add insult to injury, silver-heavy producers are lagging behind gold-heavy names as the gold-silver ratio has inched back up to 89:1 from the low-80s.

Over the past 30 years, this ratio has been more like 65:1. Readers are reminded that the inflation-adjusted Ag price for the entire year of 1980 was ~$79/oz, vs. today’s $22.84/oz. meaning the current level is 71% below that inflation-adj. high.

In a bull market for silver (“Ag“), which I think could happen this year, the Au-Ag ratio could easily revert to 75:1, which would mean a silver price of $27/oz. I’m not a Ag or a gold (“Au“) bug. I just noticed that at the current Ag price, producers like Guanajuato Silver (TSX-v: GSVR) / (OTCQX: GSVRF) are barely squeaking by.

G-Silver’s stock has been hit by selling from Cantor Fitzgerald. Cantor did a bought deal for the Company five months ago, I guess they were unable to find buyers in this depressed market. Selling at Cantor won’t last forever. G-Silver at $0.195 per share offers a tonne of silver bang for the buck.

Even much larger players like Fresnillo, Hecla Mining & First Majestic are down 40%-45% from 52-wk. highs. However, in the midst of this doom & gloom, a ray of sunshine in central Mexico. This morning, G-Silver announced that it has picked up new toll-milling business.

CEO James Anderson, commented,

“We are excited to have reached this agreement which will utilize a considerable amount of the excess capacity that exists at our El Cubo mill. We believe both parties will mutually benefit from this agreement, as we collectively look to expand silver production in the Guanajuato area through the processing of low-cost and readily available material.”

The unnamed toll-milling customer is said to be big enough to tie up a “considerable amount” of El Cubo’s excess capacity. I imagine that the party will be identified in the days/weeks ahead. Here’s the thing with toll-milling third-party ore….

It can’t be transported more than say 50 km due to the (round-trip) trucking costs of fuel, labor, truck maintenance & logistics. There are only two groups of meaningful size within 50 km of G-Silver’s production facilities, Fresnillo plc & Endeavour Silver.

In the map above, I wondered what it might be like for G-Silver to one day be refining ALL of the ore in the district. We could be a step closer to that, but to be clear, G-Silver will need to split the profits (not necessarily 50/50) from toll-milling with whomever the deal is with.

I think an important takeaway is that G-Silver chose to announce this even with the Ag price below $23/oz., meaning that the business opportunity is attractive at these levels.

In a prior press release mentioned receiving 4,000 tonnes/month for 6-10 months from the, “past-producing” El Horcon mine. Today’s press release does not us the phrase past-producing. So, if it’s a currently producing company, that again points to Fresnillo or Endeavour.

That would be a potentially big development, one that could boost profits for years, not just quarters. The greater the throughput at the Company’s three production facilities, the greater the economies of scale, synergies & operational flexibility, which translates to stronger margins.

Is today’s news a game-changer? Probably not at $23/oz. Ag, but add 10-15% to the price, and things get really interesting again. Given the poor performance of precious metal producers, (Barrick’s stock was down 9.5% yesterday on a weak 4th qtr.), it’s reasonable to ask how likely a material move higher in Ag is.

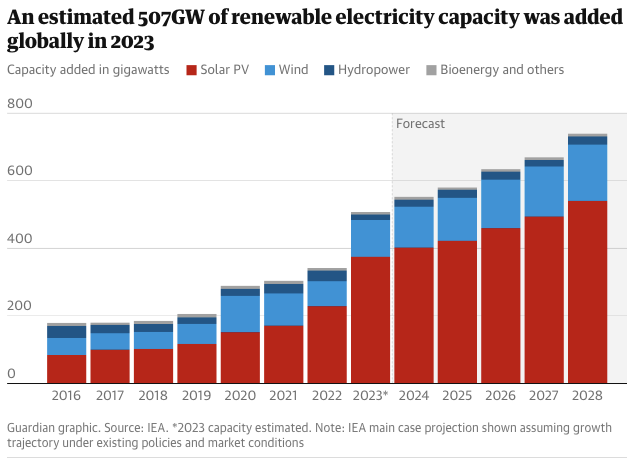

In the chart below, the IEA estimates that renewable energy grew +50% last year. Of that +50% gain, three quarters came from solar.

This is important b/c actual silver (not paper contracts) is used to produce solar cells. China’s growth in solar is truly staggering. Already the world’s largest, capacity could double to 1,000 gigawatts by 2026.

I’ve noted in prior articles that wind power had a very difficult year. At the margin, wind’s decline is bullish for solar & therefore bullish for Ag. Since it’s China that needs by far the most Ag, and China doesn’t mine a lot of it, we could see that country stockpiling Ag like it does with other critical materials… like uranium.

At this point, it would be both fun & easy to compare the prospects for Ag with what’s happening in the uranium market. Is the analogy apt? I think it is!

The uranium price has doubled in the past eight months. Clearly, uranium is critically important for decarbonization, and there’s been a notable rehabilitation of its reputation. At the UN COP28 climate summit, 22 countries pledged to triple nuclear power by 2050. Meanwhile, the world’s two largest producers of uranium are sold out.

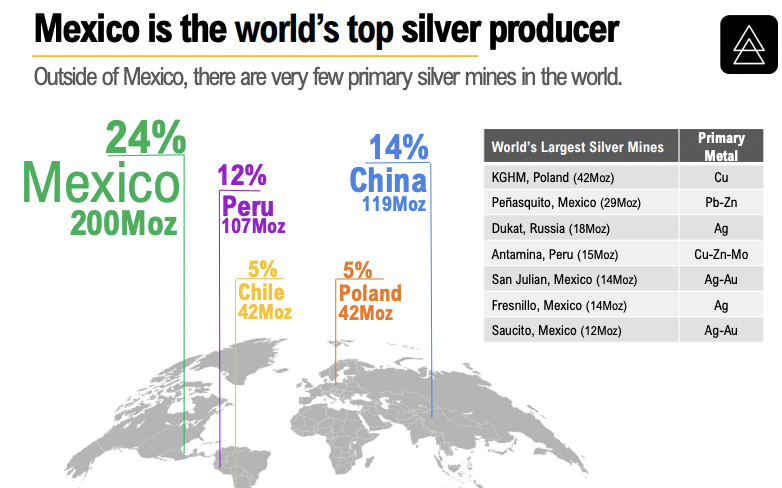

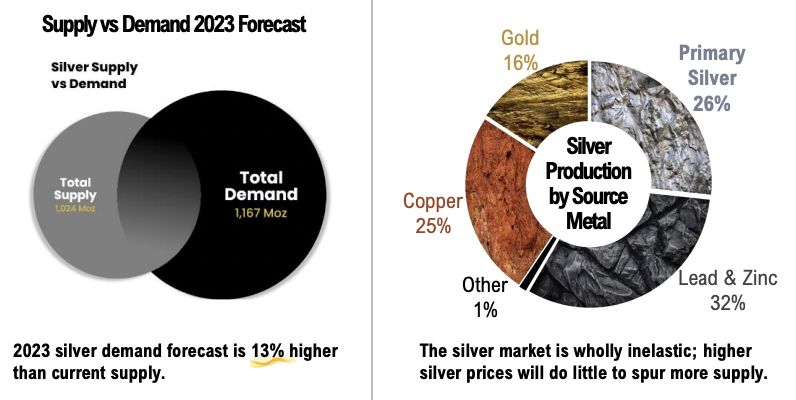

Silver supply is highly inelastic…

Ag is critically important in solar panels, but also in EVs, electronics, aerospace & defense. Ag cannot be substituted out of key end uses requiring the highest levels of electrical & thermal conductivity + superior resistance to corrosion. Like in uranium, there’s no switch to turn on ample new supply of Ag. Supply is highly inelastic.

As an aside — but an important one — in EVs, battery chemistries are always shifting. Some worry that lithium will eventually be replaced by sodium & other alternatives.

However, no matter the mix of lithium, nickel, cobalt, manganese, etc. — every battery in an electric vehicle, truck, boat or airplane will continue to require the same amount of Ag for wiring & connectors as that segment of the battery won’t change.

If fuel cell vehicles gain traction (promising for long-haul trucking + other heavy-duty applications), Ag is critically important there as well as a replacement to much more costly PGMs.

Guanajuato Silver (TSX-v: GSVR) / (OTCQX: GSVRF) is as well positioned for a bull market in Ag as most any other producer. Even though things are tight right now, today’s news could be an important factor down the road in turning the story around.

With most Ag producers suffering, and mining costs running hot, a higher Ag price seems likely. Will the Ag price double like uranium did? Who knows. I believe there’s a 5%-10% chance of a doubling. Hopefully the odds are even higher.

Still, at $0.195, shares of G-Silver offer a high-risk, but compelling risk/reward proposition for those who are bullish on Ag.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)