In a prior article I wrote on New Age Metals (TSX-v: NAM) / (OTCQB: NMTLF) [enterprise value {market cap + debt – cash} = $6M]. I said the following,

“Most analysts, consultants & pundits agree that lithium will remain in short supply, or be under-supplied, for much of the next decade. There’s a sweet spot for Li prices, perhaps in the US$25k-$40k/tonne range, where producers & endusers thrive and there’s less incentive to pursue alternative battery chemistries.”

I now think the long-term Li price might be more like $20k-$30k/t. Morningstar’s Seth Goldstein is calling for an average $30k/t through 2030. In this more reasonable range, new end uses for Li-ion batteries will continue to emerge.

From $20k-$30k, use in stationary energy storage systems will grow faster, and the urgency to commercialize competing battery chemistries such as sodium-ion will diminish.

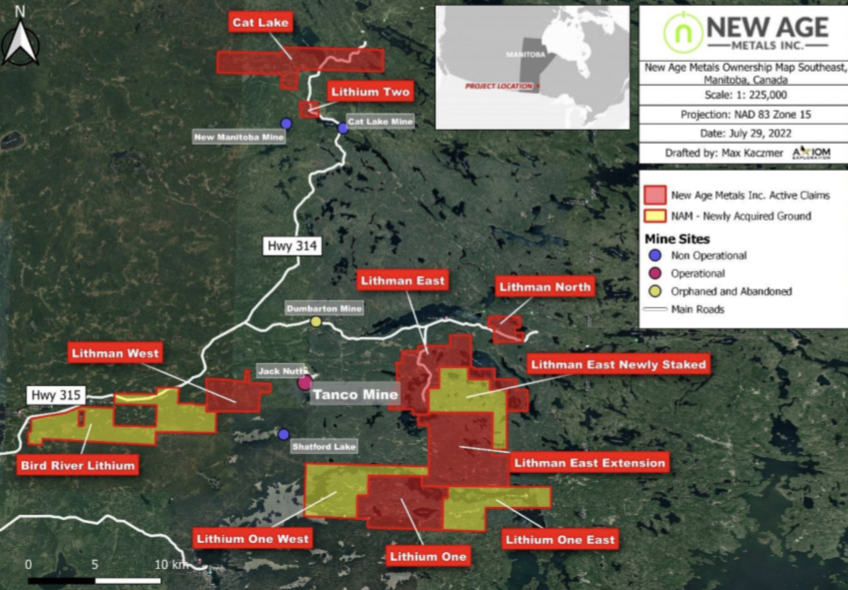

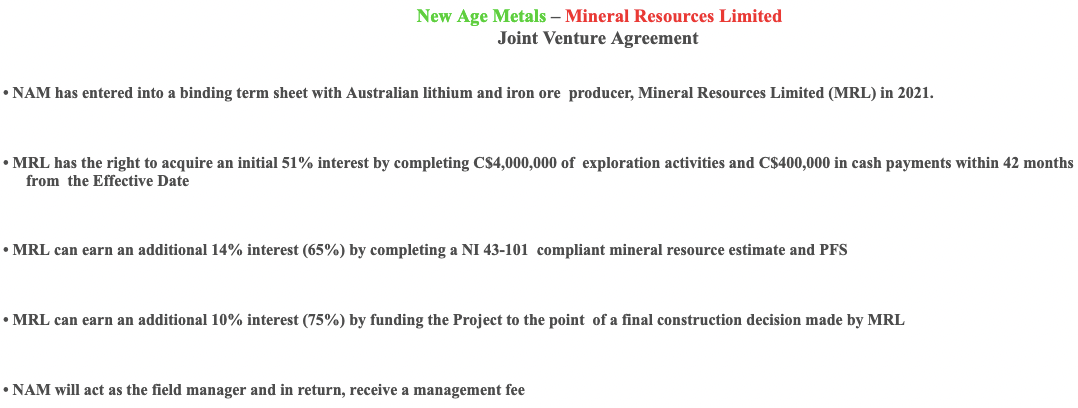

New Age has promising Li prospects in SE Manitoba just north of the high-grade Tanco Li/cesium mine and in Northern Manitoba. Importantly, management has an ace-in-the-hole in the form of a 75% farm-out arrangement with Australian Li Major Mineral Resources [“MinRes”].

The chart above shows the China battery-qual. Li carbonate spot price in yuan/tonne. 95.5k = ~US$13.3k/t. Since Dec. 6th, the price has been pinned at 98.5k, 97.5k, and now 95.5k yuan/t, suggesting it might be near a bottom.

The far less volatile quarterly contract price at Li Major SQM has a trailing 3 / 4 & 5-yr. avg. of $25.2k / $22.4k & $21.4k/t. For those believing that SQM’s contract price will fall below $15k/t from 2024-26… Li stocks may not be for you.

An extended period of sub-$15k/t is of course possible, but I think a long-term average of $20k+ is more likely. Above $20k/t, I estimate each tonne of Li carbonate equiv. (“LCE“) in a feasibility study could be worth $200 – $300.

If true, a prospective 20M tonne resource with a feasibility study on it — (5M tonnes net to New Age) — at 1.15% Li20 could be worth $28.5 to $43.0M vs. the current valuation of $6M. Between now and a potential $28.5-$43.0M valuation, there should be little or no equity issuance.

Why do I use a 1.15% Li20 value? Just a guess based on one of New Age’s properties that hosts a small [historic] (non 43-101 compliant) resource that graded 1.40% Li20. That fact, combined with the Company’s close proximity to the high-grade Tanco mine, points to attractive grade potential in SE Manitoba.

A potential five million tonnes net to New Age is not much compared to Patriot Battery Metals [PMET] at 109M tonnes. PMET has 22x more tonnage, but is valued 210x higher!

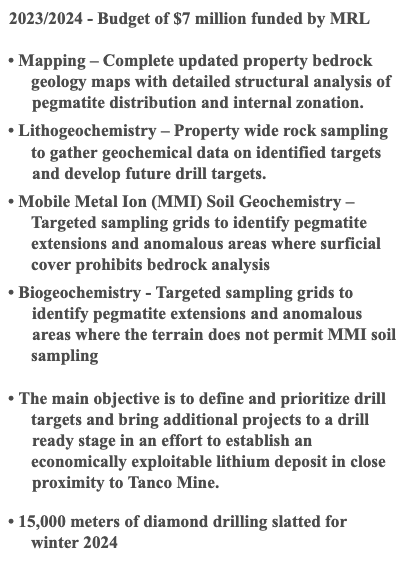

New Age is free-carried for the next several years as MinRes invests serious cash (compared to New Age’s enterprise value of $6M). In the 12 months ending 6/30/24, MinRes has committed to spending $7M, enough for a robust 15,000 meter drill program starting this month.

The New Age/MinRes properties are near the high-grade Tanco mine, the only active Li/cesium operation in Canada. In fact, Tanco is the world’s largest producing cesium mine.

From Wikipedia, “Globally, there are three major occurrences for cesium that have been commercially mined — the Tanco mine in Manitoba, Bikita in Zimbabwe & Sinclair in Australia. The Tanco underground mine has been in operation since the late 1960’s.”

Of the 235 Canadian & Australian-listed juniors I’m tracking with at least one Li prospect in Canada, how many will see 15,000 (or more) meters next year? As far as I know, besides PMET, Frontier Lithium, Winsome Resources, Li-FT Power, Brunswick Exploration, Sayona Mining & Power Metals, none have as much drilling planned.

Are readers aware of another junior with a third-party, 100%-funded exploration budget that’s larger than the company’s entire valuation!?! Talk about a free option. New Age also has a call option on the price of palladium via its PEA-stage River Valley project, which it gets zero credit for, but is worth millions of dollars.

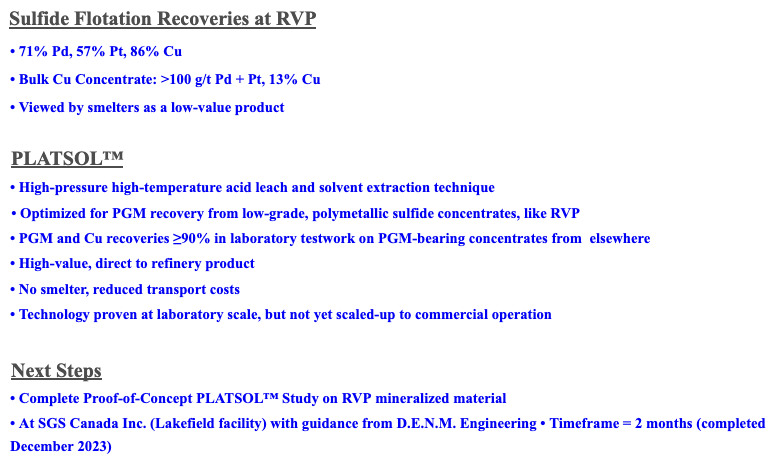

Importantly, management is currently testing PLATSOL technology, {see image below} in the hopes that recoveries can be increased well above the 71% Pd recovery in the latest PEA. An update on this topic is expected by the end of January.

I won’t delve into the palladium prospects because I’m more excited about the Li prospects, and so is Top-5 global producer MinRes. The fact that it chose New Age and the province of Manitoba is a vote of confidence in both.

Quebec & Ontario are not only Canadian Li-ion / battery metal hubs, they’re emerging as globally significant jurisdictions that will have a number of spodumene conversion facilities. SE Manitoba, (next to NW Ontario), host to the only active Li/cesium mine in Canada, is also developing into an important hub.

On January 7th it was reported that a Japanese firm is considering a $1.6 billion Li battery component facility to be built in four phases through 2030.

I continue to love Canada as one of the best places to explore/develop Li prospects due to its nearly 100% green, low-cost hydro-electric / nuclear power, close proximity to the U.S. EV market and dozens of high-quality, low technical risk conventional hard rock Li projects.

Of those 235 companies, only 17 have prospects in Manitoba, but none have meaningful deposits defined. If New Age has success in 2024’s 15,000 meter drill program, it and MinRes could dominate Manitoba.

If MinRes earns its 75% interest, it will have free-carried New Age for several years through delivery of a Definitive Feasibility Study (“DFS“). At that point, MinRes will have, (in my view) invested $25M+ in drilling, other exploration activities, reports, permitting and a feasibility studies.

Based on the advanced-stage Rose project owned by Critical Elements, I believe that 3-4 years from now a 25% stake in New Age’s SE Manitoba portfolio could be worth $40M.

In addition to the very promising SE Manitoba portfolio of 20,211 ha, management has secured 54,289 ha across three properties in northern Manitoba.

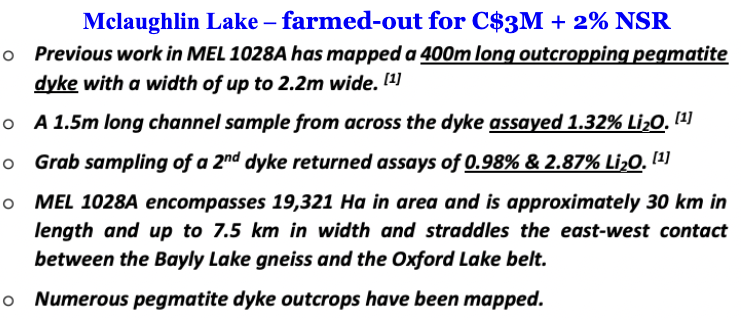

Four months ago, an Australian junior was selected to earn up to a 75% interest on the 19,321 ha McLaughlin Lake project by making cash & stock payments + exploration expenditures of $3M over five years. Importantly, New Age retains a 2% NSR.

Management recently secured another exciting prospect at Red Cross Lake, its 3rd property acquisition of 2023. Given that it obtained $3M with a 2% NSR to farm out the 19,321 ha McLaughlin Lake property, it might be able to secure an even better arrangement on the larger (30,688 ha) Northman Lithium property.

Northman has 28 km of strike length surrounding a LCT pegmatite swarm with historical sample assays up to 1.25% Li2O & 2.86% Cs2O from lepidolite pegmatite and up to 2.97% Li2O from spodumene pegmatite. Cesium in N. Manitoba could potentially be shipped alongside Li to the Tanco Mine.

For those wondering if N. Manitoba is too remote, it’s no more remote than parts of northern Ontario or Quebec, and less remote than parts of B.C., Saskatchewan, Yukon & the Northwest Territories (“NWT“).

The world’s largest Li companies, battery components & EV makers are all over Canada. Projects in SE Manitoba are supported by MinRes, and also giant Li-ion battery player LG Energy Solution in conjunction with Snow Lake Lithium.

New Age Metals (TSX: NAM) / (OTC: NMTLF) is valued at just $6M despite a fully-funded (by MinRes) $7M, 15,000 meter drill program starting this month. Initial drill results should be out in April/May.

Although early stage, the Company’s SE Manitoba properties are near the high-grade Li & cesium Tanco Mine, and not far from a major NW Ontario Li-ion battery components hub. Strong drill results and a recovering Li market could make today’s $0.04 share price a tremendous entry point.

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about New Age Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of New Age Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of funds. It’s assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, New Age Metals is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)