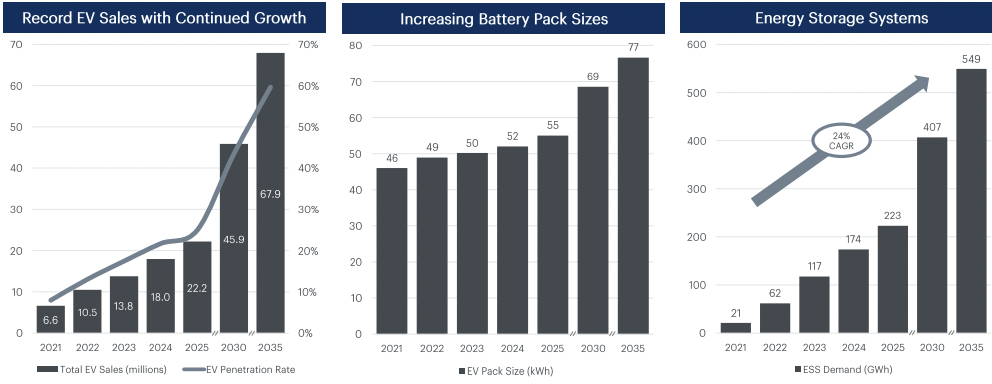

In these three charts from Benchmark Mineral Intelligence, the rate of EV sales growth is slowing, but units are forecast to climb a robust +18.7%/yr. from 2024-30. In addition, notice that the average Li-ion battery size is increasing (estimated +38% by 2030).

And, demand for Li in Energy Storage Systems (“ESS“) is scaling faster than in EVs. Rodney Hooper & Howard Klein of RK Equity believe ESS deployments could reach ~800 GWh in 2030, ~2x Benchmark’s figure. According to Benchmark’s estimates, Li use could increase +24%/yr.

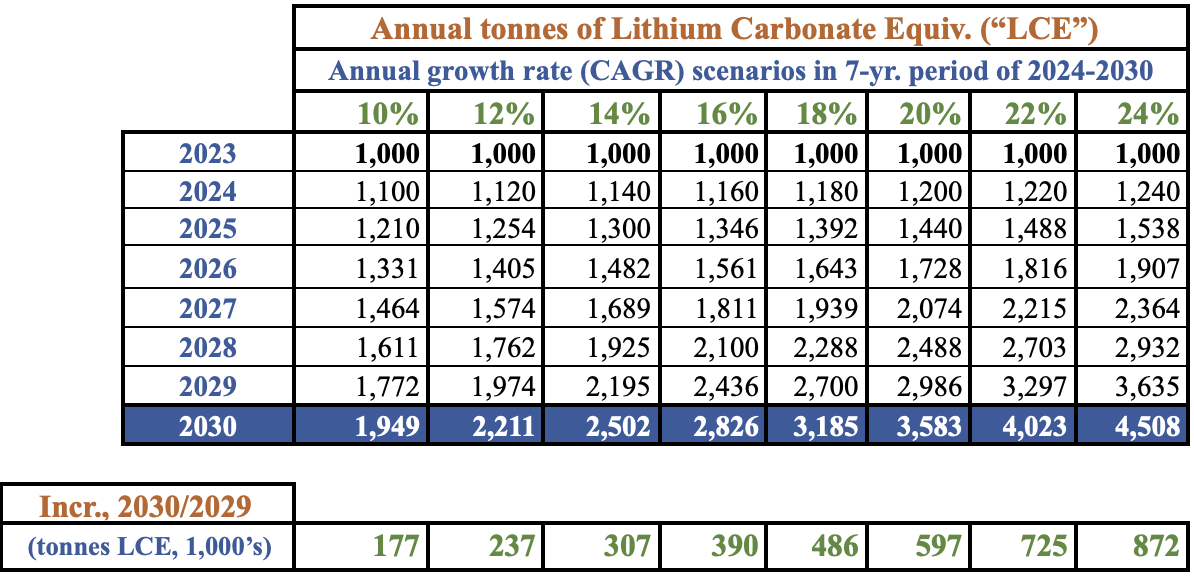

Even if EV sales rise 25% less (a CAGR of +14.0% vs. +18.7%), factoring in larger batteries shows Li demand up +19.5%/yr. And, assuming sodium-ion batteries take 10% market share, Li demand would still expand +17.7%/yr., meaning 471k incremental tonnes LCE in 2030 vs. 2029.

Ok, a lot of numbers being thrown around, the point is that Li consumption should remain very strong, especially if prices are low. On the supply side, some analysts might be placing too much faith in Li hopefuls reaching production, starting on time & ramping up to full capacity.

Can low-quality lepidolite in China & direct shipped ore from Africa continue to weigh on prices? It certainly could, but there is news of high marginal cost Chinese converters curtailing production. For example, top battery maker CATL is reportedly shutting down its Jianxiawo lepidolite operations.

In addition, producers Albemarle, Pilbara Minerals, IGO Ltd., Tianqi, Arcadium Lithium, Liontown Resources & Core Lithium, have announced production slowdowns for 2024.

Small companies face enormous challenges in funding, infrastructure, local community/First Nation relations, environmental approvals, permitting, construction, etc. With the China spot price collapse front page news for quite some time now, many Li projects have been set back 6-12 months.

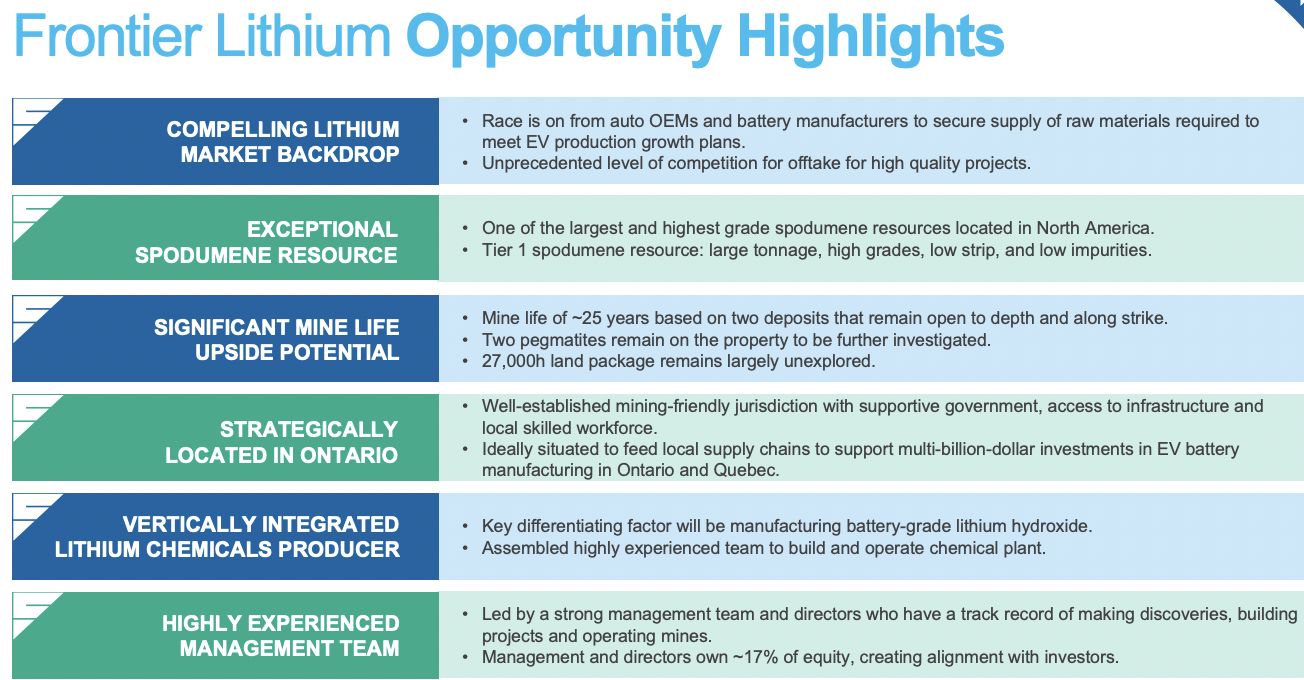

At $0.425/shr. (YahooFinance 2/23 close), Frontier Lithium (TSX-v: FL) / (OTCQX: LITOF) is down 89% from an all-time high of $3.89/shr. in May, 2022. Admittedly, this is an inauspicious way to start the bullish commentary that follows, but please continue reading. {see new corp. presentation}

Among dozens of promising lithium (“Li“) juniors that have been decimated, Frontier’s beatdown is, inexplicably, one of the worst. I see dozens of juniors surviving, but hundreds will disappear, be acquired, or transition to other pursuits.

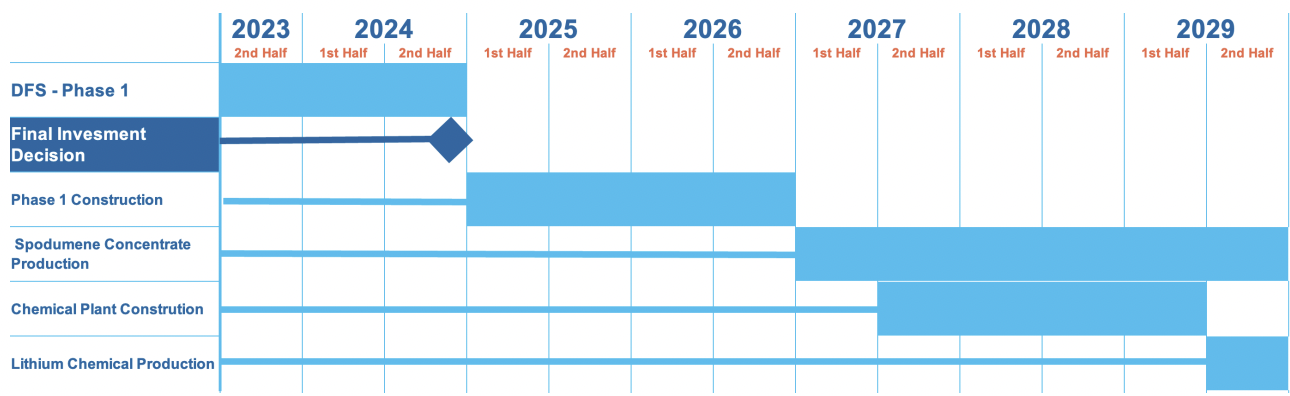

With a strong Pre-Feasibility Study (“PFS“) backing its 100%-owned PAK project, and a Bank Feasibility Study (“BFS“) in 2H 2024, Frontier remains one of the best positioned Li juniors in N. America. The stock would be a 5-bagger if it were to retrace half of what it lost — a return to $2.16/shr.

I’m not saying a 5-bagger is coming anytime soon, but if Li prices bounce back above US$25,000/tonne from ~$13,300k/t, management gets clarity on a road/bridge infrastructure project (more on that later), or there’s news of a strategic investor or off-take agreement, the share price could move a lot higher.

At $2.16/shr., Frontier would be valued the same as Patriot Battery Metals on an EV/tonne of Li Carbonate Equiv. (“LCE“) basis. Patriot’s shares have sold off — down 63% — so, I’m not just cherry-picking a highly-valued comp. While much larger in resource tonnage, pre-PEA Patriot is years behind Frontier’s development stage.

How likely is a return to $25,000/t? It’s hardly a stretch as the price soared past $80,000/t in 4th qtr. 2022. To be clear, Frontier does not need $25,000/t — $16,000-$20,000/t would be fine — given that all-in op-ex is $7,333/t. Frontier’s enterprise value {market cap + debt – cash} of ~$82M is just 3.4% of the $2.4B after-tax NPV(8%).

Trading below 10% of NPV is absurd for a low technical risk project in Canada nearing a BFS. Frontier is valued like an earlier-stage, higher risk, low-grade brine/DLE company. There are at least 10 brine/DLE projects in Canada, the U.S. & Argentina with Li concentrations < 125 ppm (< 0.027% Li2O).

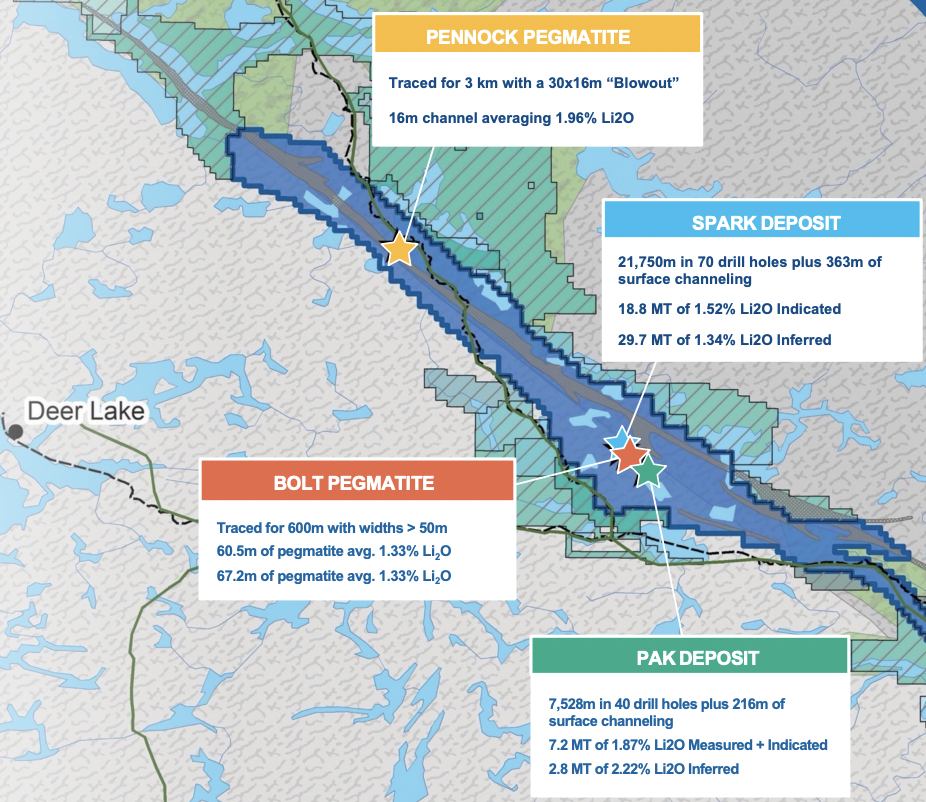

Frontier’s grade is excellent at 1.505% Li20, at least 56 times higher than those brine/DLE projects. The PAK project hosts 58.5M tonnes, so already a globally-significant hard rock resource at ~2.18M tonnes LCE. The goal is 100M tonnes. PAK is in the Tier-1 jurisdiction of Ontario, Canada.

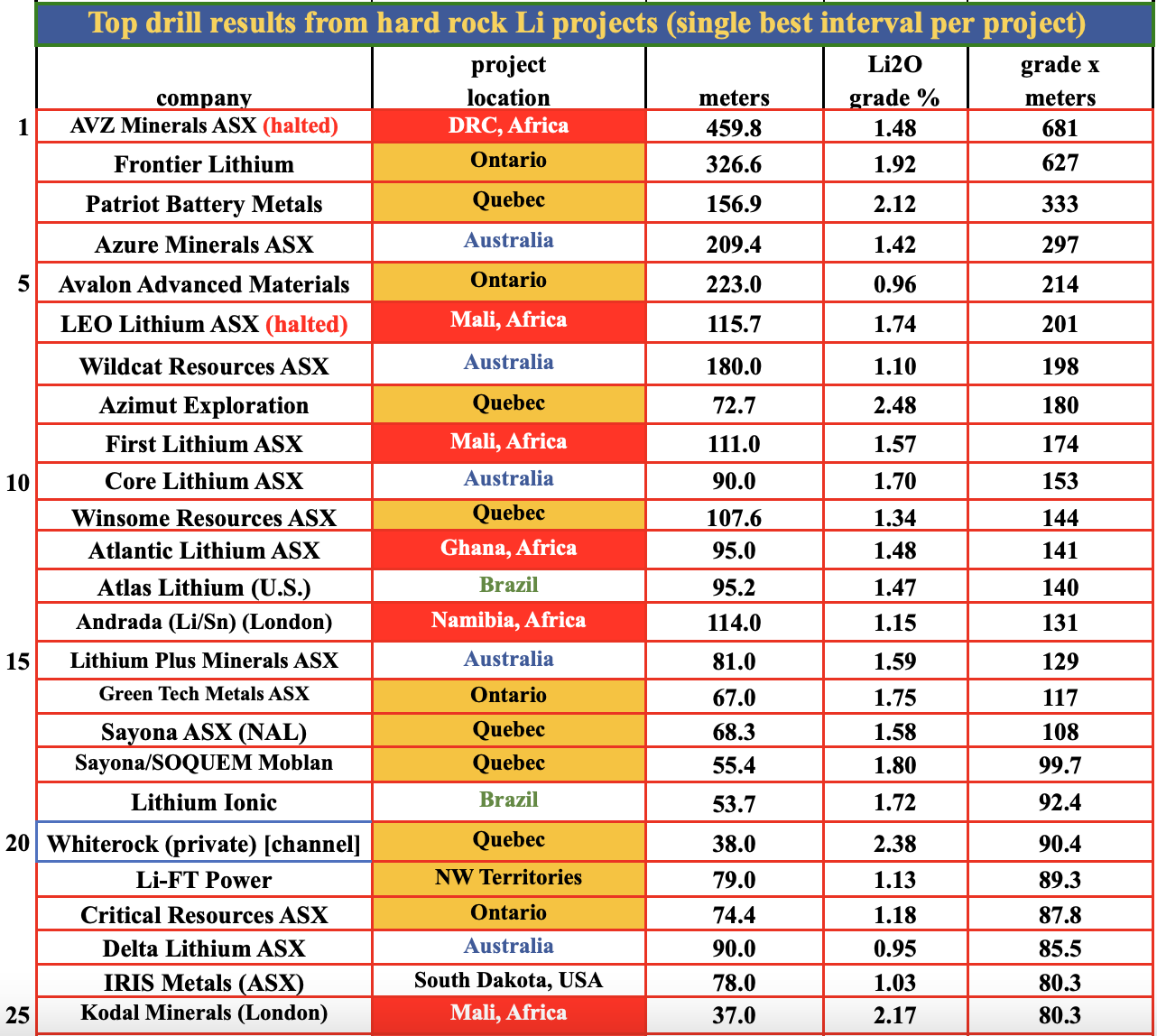

The following chart shows the world’s best Li drill intercepts as measured by [Li2O grade x core interval width in meters]. Frontier’s grade-meters figure of 627 is 4.3x larger than the average of the next 10 best Canadian drill hole intervals.

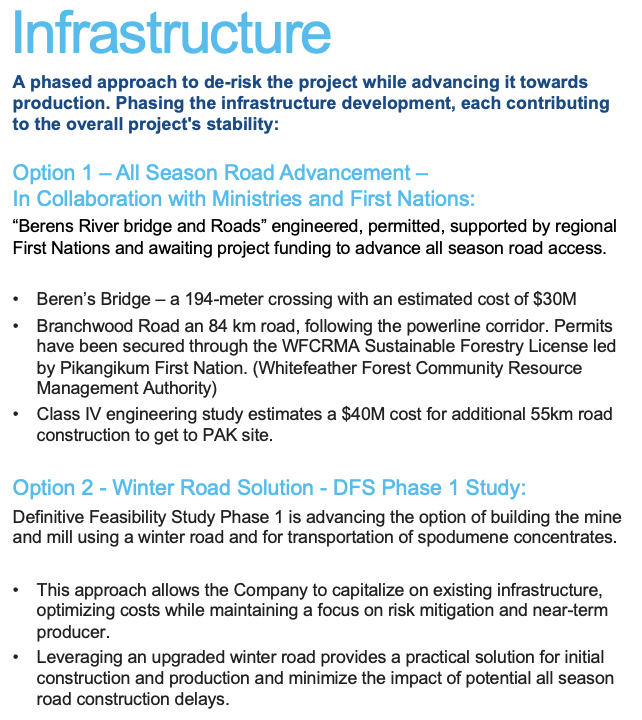

New projects in Africa, Brazil, Argentina & Chile require 100(s) of km of new rail, road, and power lines. Canada’s northern parts of Ontario, Quebec, Manitoba, Northwest Territories, etc. are no different. However, for some reason investors are fixated on a road/bridge project called Berens River.

About 60% of the Berens River project has been designed & permitted with support from First Nations. Funding has not been determined, but seeing as multiple stakeholders; (First Nations, other communities, peer project owners, tourists, etc.) will benefit, there’s little chance Frontier will have to fund it alone.

Water is not a constraint and a power line is under construction that’s expected to be energized within a year. In a worst case, I imagine Frontier could be responsible for perhaps $75M of Berens River outlays, but the majority of that would be spread over a few years with little if any due in 2024.

In the meantime, a winter road from Red Lake can be upgraded, (at low cost) for Phase 1 spodumene concentrate sales. Production of 100k tonnes/yr., (at up to 6.5% Li2O) from 2027-30, would help fund a larger operation of ~20k tonnes LCE/yr.

An additional $75M would add just 4% to the total remaining amount needed this decade. I believe Frontier’s share of funding for Berens will be less than $75M as the Ontario provincial & Canadian Federal governments will do the right thing and pick up most, (possibly all), of the cost.

Even if it’s $75M, readers are reminded that management is applying for multiple low-cost loans & free-money grants that, (if awarded), could total $100’s of millions.

Meaningful government assistance is probably not this year’s business, but loans/grants will remain open for years to come. In addition to uncertain infrastructure costs, there’s concern that an all-season road/bridge will not be in place soon enough for Frontier to thrive.

However, Stellantis, Ford, GM, Honda, Volkswagen, Hyundai, BMW, Toyota, Umicore, LG Energy Solution, SK On, POSCO, Northvolt & BASF have announced ambitious EV or Li-ion battery & component plans across Canada.

Canadian politicians & gov’t agencies have provided generous tax breaks plus other incentives to the above-mentioned companies, assuring them that ample supplies of high-quality, green, battery metals like Li will be available.

Government needs to step up and articulate its plans to build and/or fund critically important infrastructure between northern mines & southern manufacturing hubs. I believe it will, but I’m amazed they have yet to make their intentions clear.

Finally, there has been talk in Canada about streamlining environmental / permitting protocols to speed up approvals. Talk is cheap, Li juniors need the help now.

Make no mistake, even with loans/grants, upfront capital for PAK is significant. A funding alternative would be to sell a minority interest in the Project to a company like; Albemarle, Rio Tinto, Arcadium, SQM, IGO Ltd. Glencore, POSCO, Mineral Resources, Wesfarmers or Pilbara Minerals.

Other prospective non-equity sources of capital include; 1) the sale of a royalty or stream, 2) institutional loans / debt packages, 3) upfront cash payment for a portion of future production via an off-take agreement.

With no current drilling going on, Frontier Lithium (TSX-v: FL) / (OTCQX: LITOF) has cash liquidity to cover all expenditures into 2025. A lot of good things can happen for the Company and for the Li sector by then.

{see new corp. presentation}

Disclosures/disclaimers: As of February 26, 2024, Peter Epstein of Epstein Research had no prior or existing relationship with Frontier Lithium. Shares of Frontier have been extremely volatile and volatility is expected to continue. The Company is very speculative & risky. Readers are urged to consult with financial advisors before investing in small cap natural resource stocks.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply