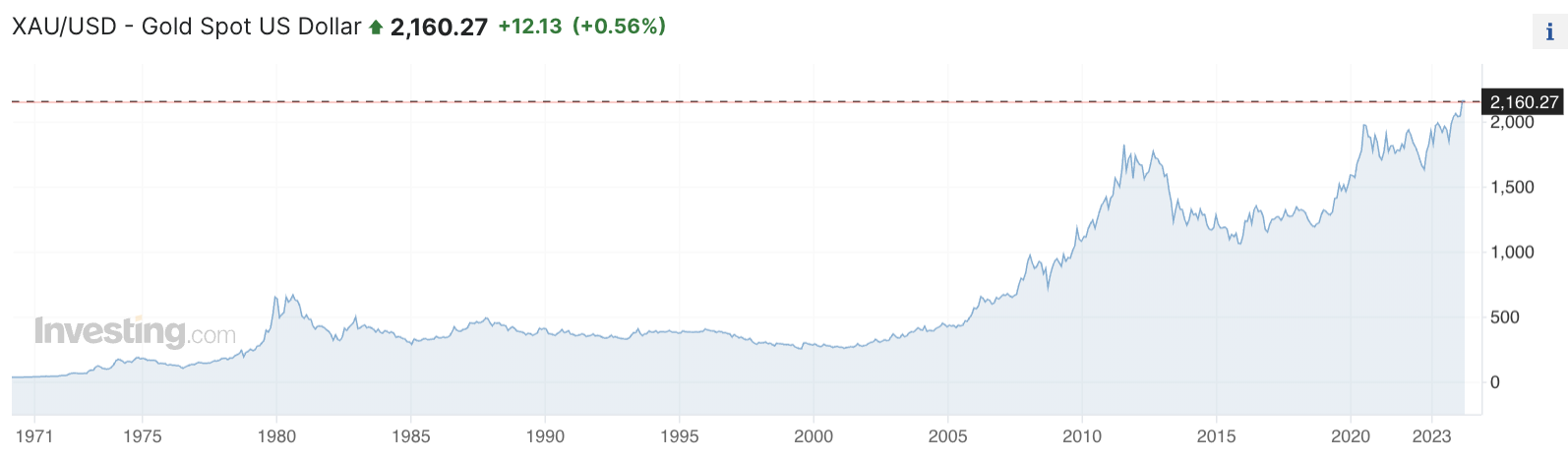

Wow. The spot price of gold is at US$2,160/oz., yet many juniors, even moderately advanced ones like Thesis Gold (TSX-v: TAU) / (OTC: THSGF) remain well below 52-wk highs. Who would have thought five months ago at $1,820/oz. that we would be sitting at $2,160 today?!?

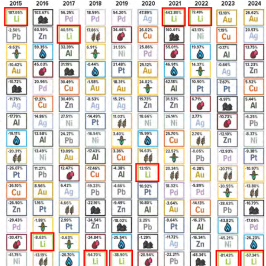

Imagine what long-term goldbugs are thinking now, $2,500? $3,000? $4,000/oz.? To be clear, gold (“Au“) juniors don’t need $2,500+ per ounce, but they sure would shine in that scenario.

Au is just +6.5% from $2,300/oz., a level only the most bullish investment banks predicted as highs for the entire year. What’s truly amazing about the current price action is that it’s happening before interest rate cuts have even begun.

Also amazing is how little gold China’s central bank holds relative to the U.S. On a per capita basis, the U.S. owns 15x as much Au as China. China & Russia are leading BRICS countries away from US$ assets. The move into Au seems likely to continue.

There are not that many safe, liquid asset classes large enough to absorb US$100s of billions of inflows from the sale of U.S. treasuries. Collectively, the world’s central banks hold > US$2 trillion in gold at spot prices.

On the supply side, output from mines is growing, but only modestly. Newmont & Barrick expect industry production growth of just 1%-2% over the next five years. Anemic growth, and costs have been rising at an alarming pace.

Newmont’s All-in-Sustaining-Cost (“AISC“) increased at a 4-yr. CAGR of +10.6%/yr. from 2020-2023.

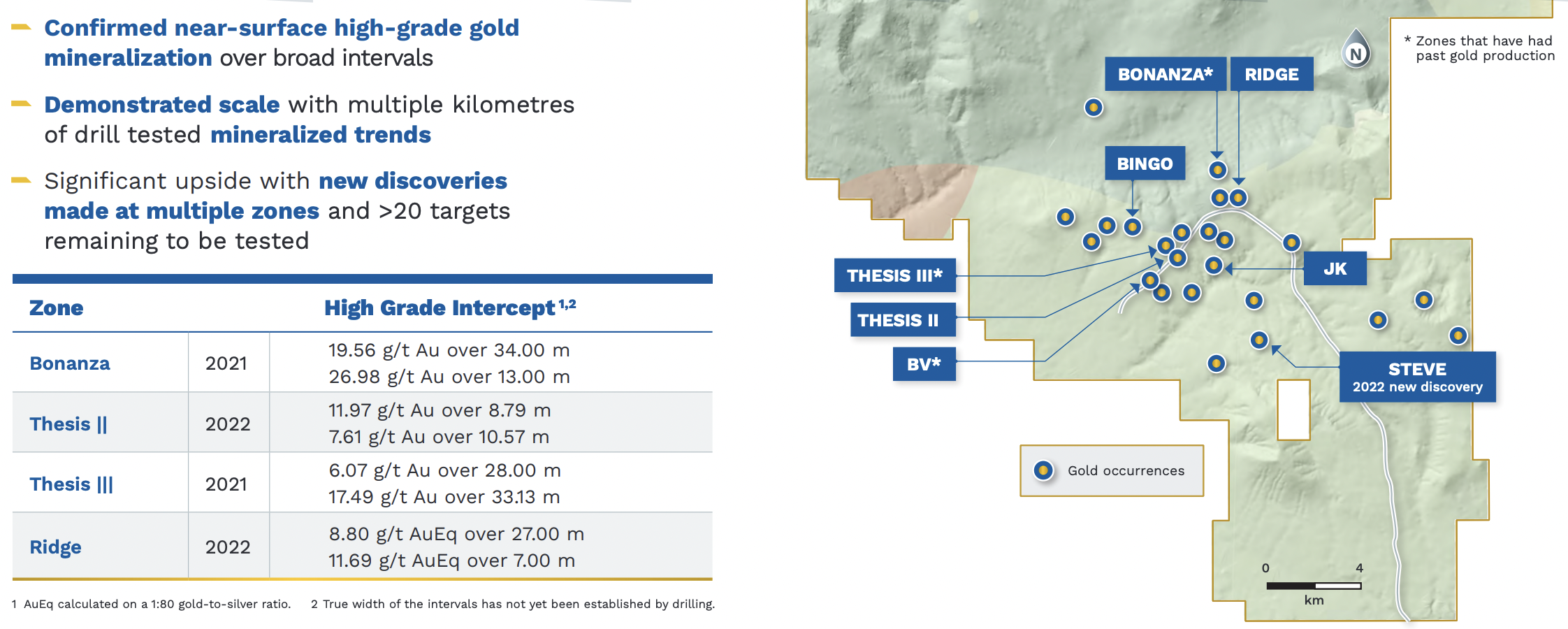

Gold producers are printing money at $2,150/oz. and have the ability and clear incentives (high AISC, low organic growth) to make acquisitions of attractive projects in prolific jurisdictions. Within a month, Thesis is expected to report a resource grading > the 1.5 g/t Au Eq. in the existing PEA.

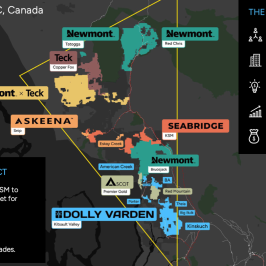

Regarding size (in my view only) it should be 5.0M +/- 250k Au Eq. ounces. That’s a lot of ounces, at a solid grade, especially for a prime jurisdiction like B.C. Canada, surrounded by companies including; Teck Resources, BHP, Freeport McMoRan, Boliden AB, Kinross, Centerra Gold, Seabridge & Hecla Mining.

Most gold juniors are still searching for discoveries, but Thesis has already booked blockbuster intervals such as last year’s [4.1 m at 119.5 g/t Au], incl. [2.0 m at 231 g/t]. That’s a [gram x meter] figure of 484 g-m. And, 2021’s best intervals averaged a whopping 622 g-m! [34 m @ 19.6 g/t] + [33.1 m @ 17.5 g/t].

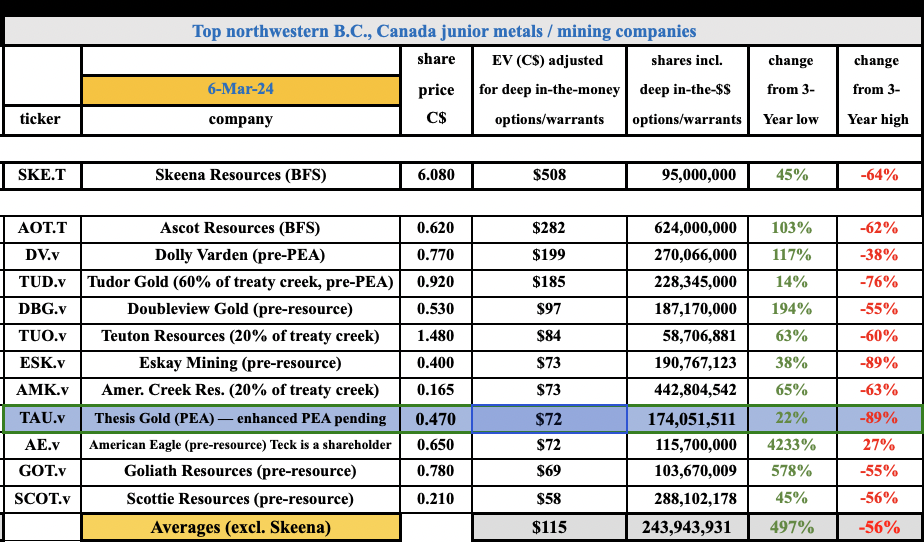

The Golden Triangle’s Ascot Resources is pouring first gold next month, which will attract attention. Thesis is more advanced than Dolly Varden, Tudor Gold, Doubleview Gold, Teuton Resources, American Eagle, Goliath Resources, Eskay Mining, American Creek Resources & Scottie Resources, none of whom have a PEA.

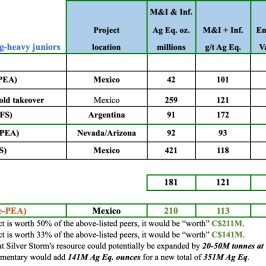

Yet, Thesis’ valuation at $0.47/shr., March 5th (enterprise value of ~$72M) is 55% below the average valuations of Tudor, Dolly & Doubleview. {see chart of peer B.C. juniors above}. The Company is trading at just C$14/Au Eq. oz. in the ground (assuming 5M Au Eq. ounces). M&A is often done at levels well above C$14/oz.

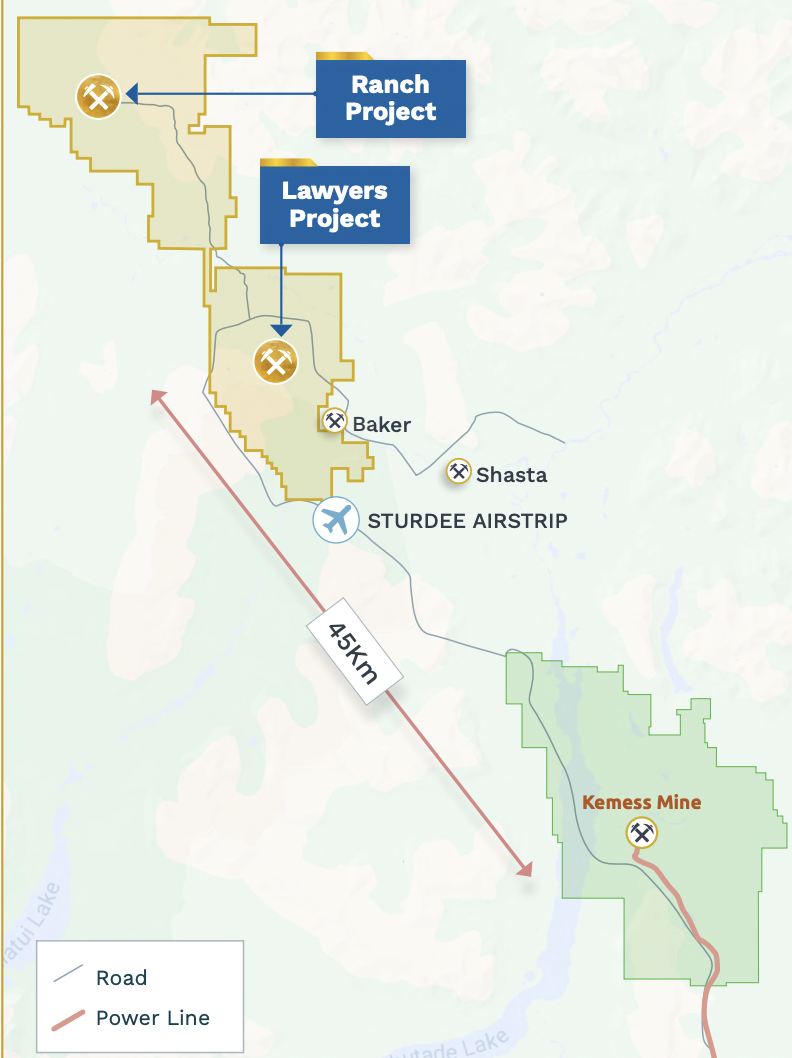

In the map above, one can see that Newmont (Newmont acquired Newcrest) & Teck have assets to the west, but Freeport (through an interest in Amarc Resources) & Centerra Gold are much closer. Interestingly, Centerra was sitting on a C$615M cash war chest on 12/31/23.

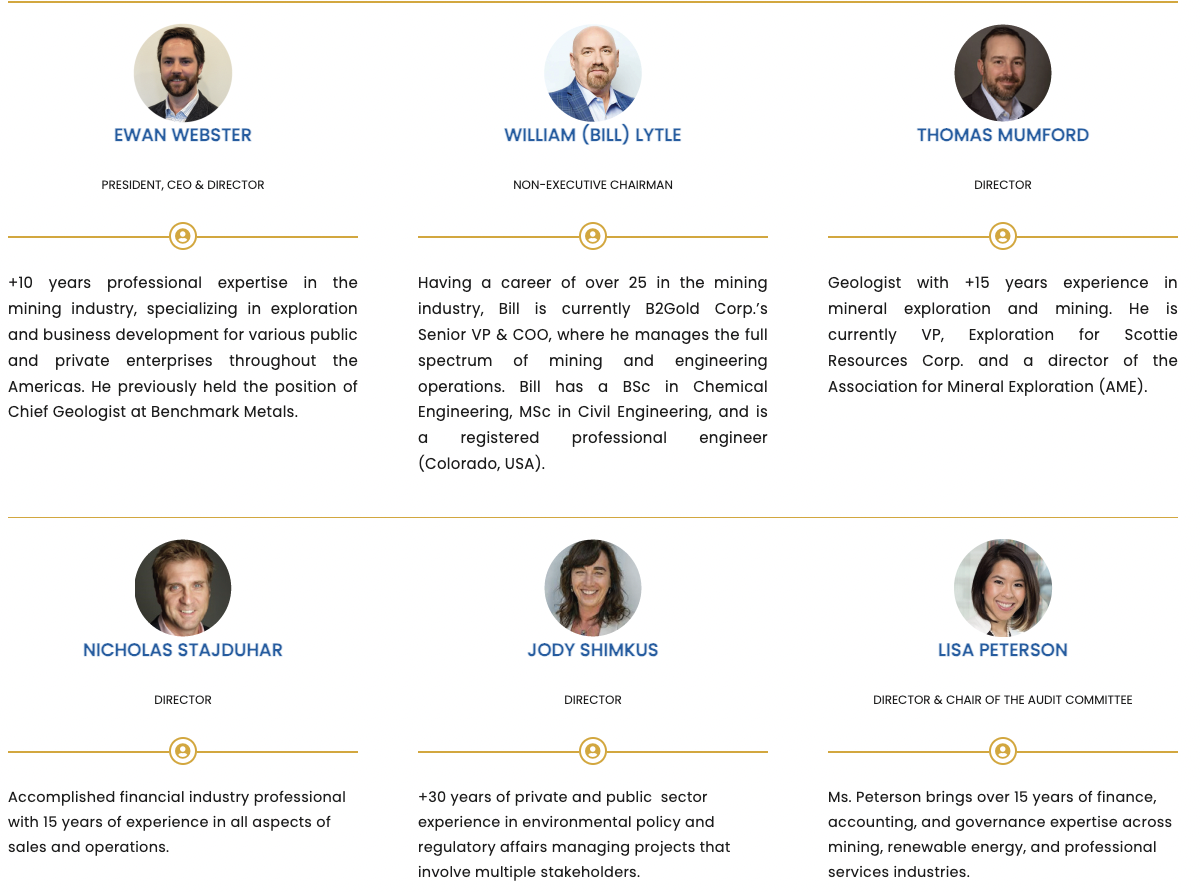

I believe Thesis would be a good fit for Agnico Eagle, who does not have operations in B.C., but has a major presence across Canada. Last year, B2Gold Corp. expanded its Canadian footprint by acquiring Sabina Gold.

Speaking of B2Gold, a few weeks ago Thesis announced the appointment of Bill Lytle as non-exec. Chairman. Mr. Lytle is currently SVP & COO of B2Gold where he manages all mining & engineering operating activities from acquisitions through to closure.

Last month’s results from the Thesis II & Thesis III zones at the 100%-owned Ranch Project included a strong interval of 60.0 m @ 4.53 g/t Au, but the market didn’t care. The Ranch Project is road-accessible by way of the Company’s Lawyers Au-Ag project, together forming a contiguous, 325 sq. km land package.

President & CEO Ewan Webster commented,

“2023 drilling results at Thesis II & Thesis III represent another step towards unlocking the full potential of the Ranch Project. Our targeted strategy for the program focused on furthering our understanding of the high-grade, near-surface potential at Ranch as we progress towards a maiden resource estimate.”

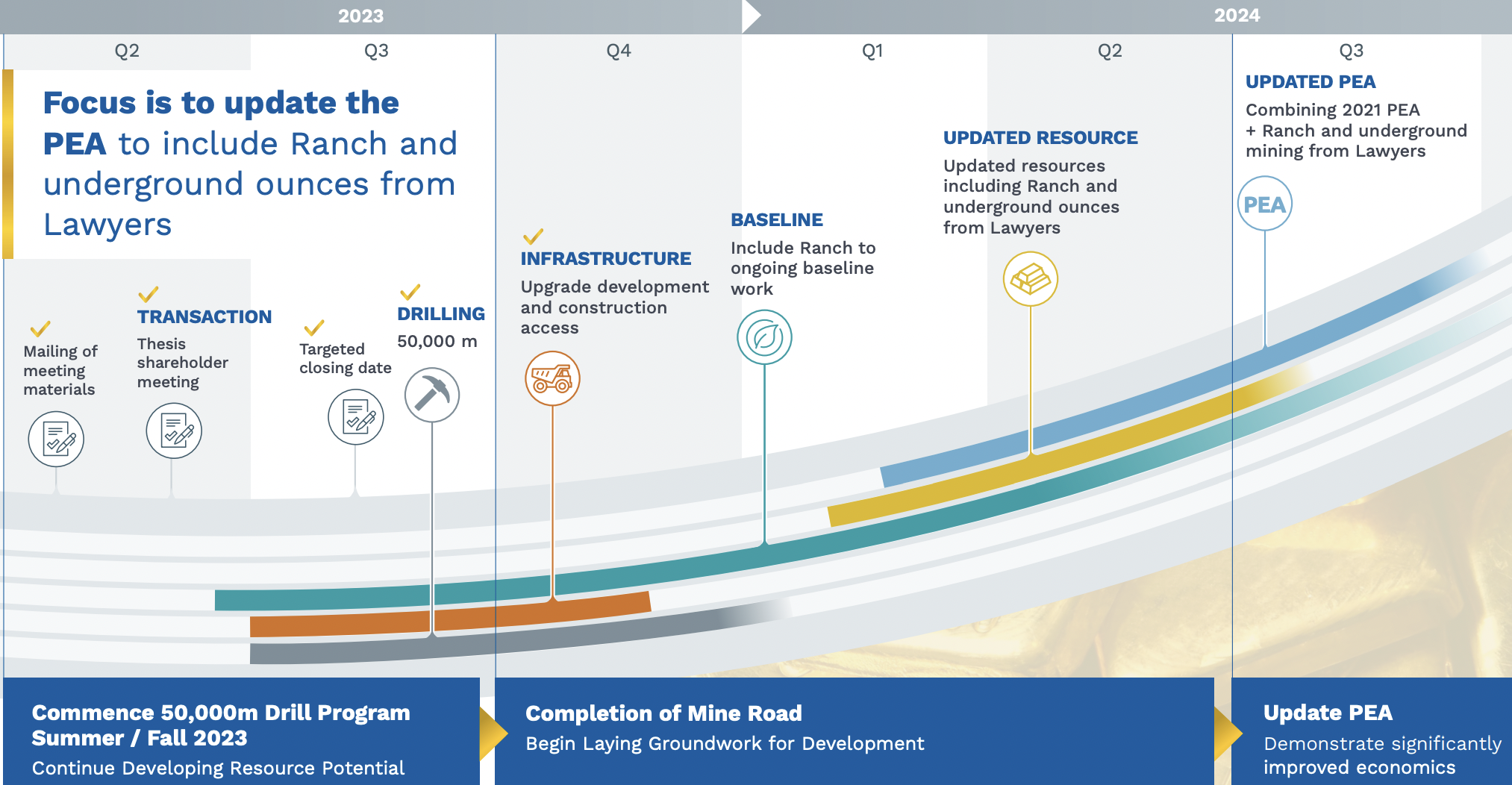

An optimized & enhanced PEA on the combined Lawyers & Ranch properties will be out later this year and it could turn a few heads. The 2022 PEA on just Lawyers had an after-tax NPV(5%) of C$883M, using a 15% upside (in the sensitivities section) gold price scenario of US$1,995/oz.

By my rough estimates, not those of management, assuming a Au price of US$1,950/oz., the after-tax NPV could be ~C$1.1B, with a mid-to-high 20%’s IRR, and an AISC < US$1,000/oz.

That AISC figure looms large as a key factor for companies like Newmont who reported an AISC of $1,444/oz. in the year 2023. The improved NPV will come from higher grade (> 2.0 g/t vs. ~1.5 g/t in the existing PEA) and an increase in annual production.

Others with elevated AISC levels include; OceanaGold Corp., IAMGOLD & AngloGold Ashanti who had CY 2023 costs of $1,587, $1,721 & $1,538/oz. respectively.

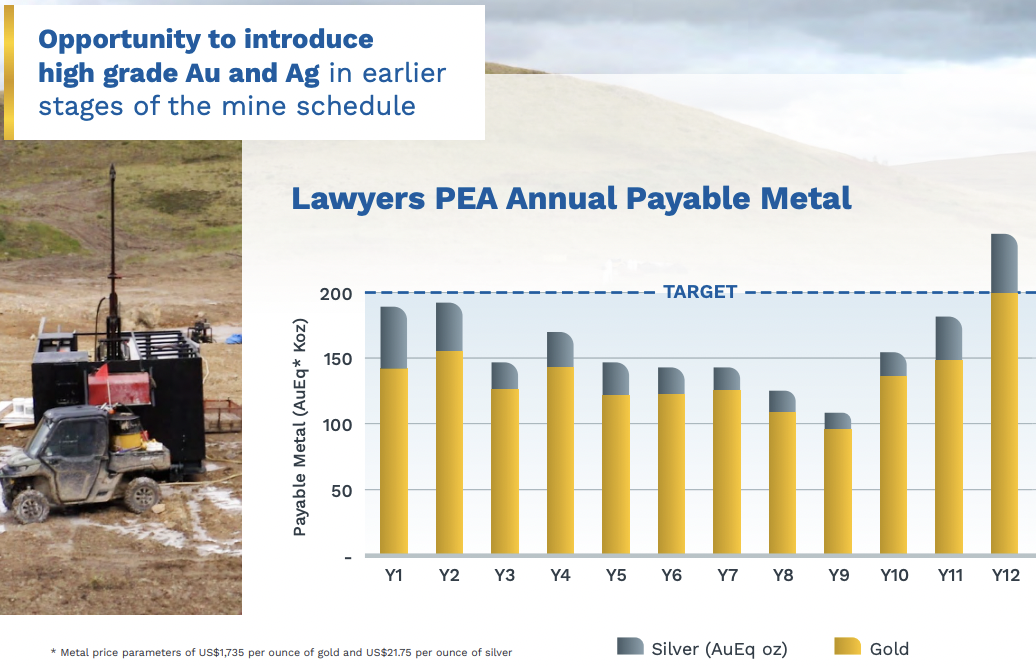

In the chart below from the Company’s corp. presentation, one can see that a goal of the new PEA will be to make production more consistent around 200k Au Eq. ounces/yr.

These attributes will more than offset higher cap-ex & op-ex. Regarding grade, an estimated 400-500k ounces of 4-5 g/t Au Eq. material sits beneath the Lawyers open pit.

Those ounces, plus near-surface, high-grade ounces at the Ranch project, are critically important to the economics in the new PEA as management plans to mine them early in the mine plan. At 200k Au Eq. ounces/yr., management believes this is a Top-4 pre-construction Au project in N. America.

As significant as five million Au Eq. ounces (+/- 250k oz.) is, that is just a stepping stone to potentially booking millions more in the coming years, mostly from Ranch, which has 20 high-quality targets that have never been drilled.

Let me end this article the same way I started it… WOW, gold is at $2,160/oz., just 6.5% below $2,300/oz. Thesis Gold (TSX-v: TAU) / (OTC: THSGF) has an existing PEA with a gold price assumption of $1,735/oz. Thesis is valued at just 7% of its upcoming after-tax NPV, [$72M / $1.1B = 7%].

While Thesis is years away from initial production, it’s also years ahead of most pre-PEA juniors, many of whom are pre-maiden resource estimate. Pundits agree that the pipeline of projects coming online at Majors is insufficient to meet increasing demand for Au from Western-friendly sources.

Many producers, like the ones mentioned above, will have strong balance sheets allowing them to pay a multiple of Thesis’ current C$72M enterprise value and fund cap-ex to build a 200k Au Eq. oz. per year mine.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Thesis Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply