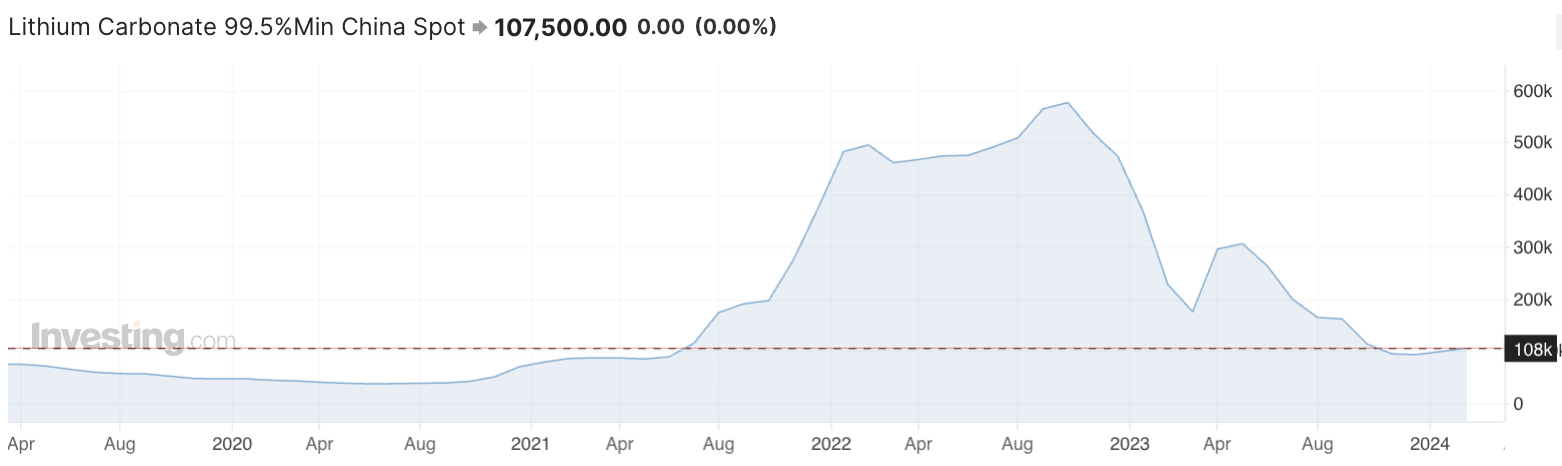

It seems like the battery-quality lithium (“Li“) carbonate spot price in China bottomed at 95.5k yuan/tonne. The price subsequently rallied ~22% to 116.5k/t, but has drifted lower to 107.5k/t = US$14.9k. While sentiment in the Li space remains weak, there has been more balanced reporting on Li fundamentals.

This closely watched spot soared above $84k/t in 4Q/22. A better way to think about Li prices is through SQM’s quarterly contract prices, averaging $32.5k, $31.0k, $22.1k, & $20.0k over the trailing 1, 3, 5 & 7-yr. periods.

The spot price has fallen further than many thought it would. Producers of low-grade sources of spodumene from Africa + low-quality lepidolite in China were considered swing producers that would largely disappear at prices below $20-$25k/t.

That did not happen, many Chinese converters are operating at a loss to fulfill contracts (keep customers) & retain employees. As analysts better understand what’s going on in China, last week Macquarie released a positive industry report. And, two other global banks lowered their oversupply forecasts.

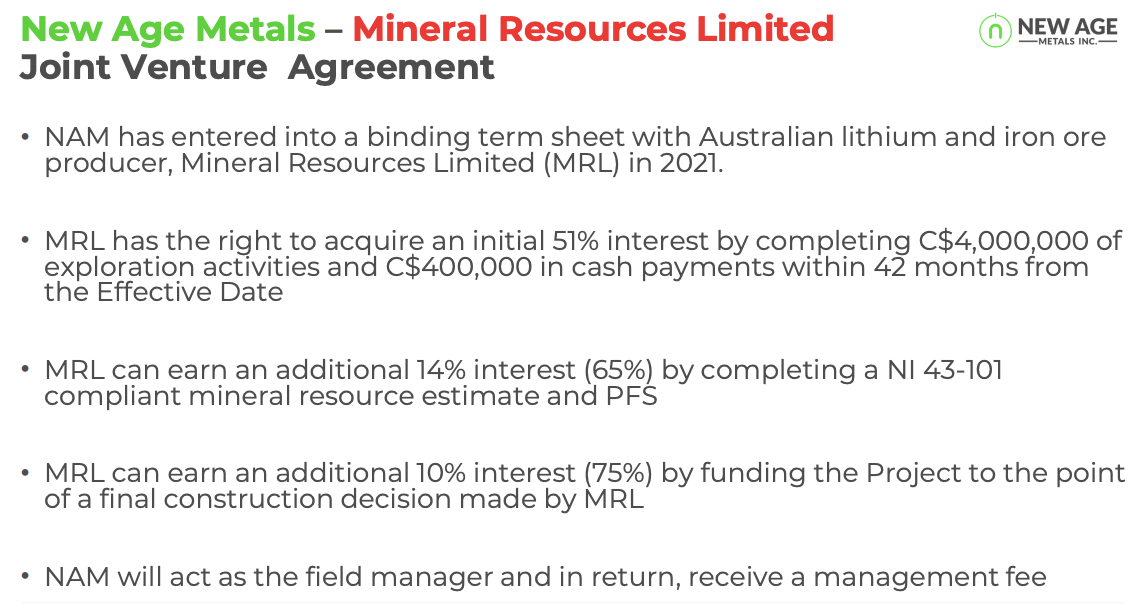

New Age Metals (TSX-v: NAM) / (OTCQB: NMTLF) has promising Li prospects in SE Manitoba, just north of the high-grade Tanco Li/cesium mine. Importantly, management has an ace-in-the-hole in a 75% farm-out arrangement with Australian Li Major Mineral Resources [“MinRes”].

For those believing that SQM’s contract price will fall below $15k/t for an extended period… Li stocks may not be for you. I think a long-term average of $20k+ is more likely. In a $20k+/t environment, I estimate each tonne of Li carbonate equiv. (“LCE“) in a Feasibility study could be worth $200.

If true, a prospective 20M tonne resource with a Feasibility study on it — (5M [25%] tonnes net to New Age) — at 1.15% Li20 could be worth $28.5M vs. the Company’s current valuation of $5M. Between now and a potential $28.5M valuation, there should be little or no equity issuance.

Why do I use a 1.15% Li20 value? Just speculation based on one of New Age’s properties that hosts a small [historic] (non NI 43-101 compliant) resource that graded 1.40% Li2O. That, and the Company’s proximity to the high-grade Tanco mine, points to attractive grade potential in SE Manitoba.

New Age is free-carried for the next several years as MinRes invests serious cash (compared to New Age’s enterprise value). In the 12 months ending 6/30/24, MinRes has committed to spending $7M, enough for up to a 15,000-meter drill program (12,500 m was completed).

As of March 1st,

“…54 of 57 diamond drill holes for ~12,500 total meters are done, targeting high-priority geophysical & geochemical targets identified from an extensive summer fieldwork campaign. Drill hole LT24-032, targeting the FD5 pegmatite on the Lithium Two property, intersected 21.75 meters core length of spodumene-bearing pegmatite. Drill hole LT24-044 intersected, 66.60 meters core length of pegmatite with localized spodumene zones.”

The Lithman West property is a high-priority target with numerous trends analogous to those on the Tanco mine three km to the east along strike. A drill program on this project is slated for 1Q 2025.

Results are beginning to come in from this year’s drilling. The New Age/MinRes properties are near the high-grade Tanco mine, the only active Li/cesium operation in Canada. Tanco is the world’s largest producing cesium mine.

According to Wikipedia, “Globally, there are three major occurrences for cesium that have been commercially mined — the Tanco mine in Manitoba, Bikita in Zimbabwe & Sinclair in Australia. The Tanco underground mine has been in operation since the late 1960’s.”

If MinRes earns its 75% interest, it will have carried New Age through the delivery of a Definitive Feasibility Study (“DFS“), all the way to a construction decision. At that point, MinRes will have, (in my view) invested $25M+ in drilling, other exploration, permitting & Feasibility studies.

Of 245 Canadian & Australian-listed juniors I’m tracking with at least one Li prospect in Canada, how many will see 12,500 meters of drilling this year? As far as I know, besides Patriot Battery Metals, Winsome Resources, Li-FT Power, Brunswick Exploration, Sayona Mining & Power Metals, none have as much drilling planned.

Are readers aware of any other junior miner with a third-party, 100%-funded exploration budget that’s larger than the company’s entire valuation!?! Talk about a free option on Li, wow. New Age is sitting on ~C$3M in cash as it awaits drill results.

New Age also has a call option on the price of palladium via its PEA-stage River Valley project, which it gets zero credit for, but is worth millions of dollars.

Importantly, management is currently testing Platsol technology, {see image below} in the hopes that recoveries can be increased well above the 71% Pd in the latest PEA. See the latest highlights from Platsol testing.

I won’t delve into the palladium prospects as I’m more excited about the Li prospects, and so is the Top-5 global producer MinRes. The fact that it chose New Age and the province of Manitoba to explore for Li is a strong vote of confidence in both.

Quebec & Ontario are not only Canadian Li-ion / battery metal hubs, they’re emerging as globally significant jurisdictions that will have multiple spodumene conversion facilities. SE Manitoba, (next to NW Ontario), host to the only active Li/cesium mine in Canada, is also developing into a hub.

I continue to love Canada as one of the best places to explore/develop Li prospects due to its nearly 100% green, low-cost hydroelectric / nuclear power, close proximity to the U.S. EV market, and dozens of high-quality, low-technical risk conventional hard rock Li projects.

Of those 245 companies, under 20 have prospects in Manitoba, and none have meaningful deposits defined. If New Age has success in its drill program, it & MinRes could dominate Manitoba.

Based on the advanced-stage Rose project owned by Critical Elements, I believe that 3-4 years from now a 25% stake in New Age’s SE Manitoba Li portfolio could be worth $30M vs. the current Company valuation of $5M.

In addition to the very promising SE Manitoba portfolio of 20,211 ha, management has secured 54,289 ha across three properties in northern Manitoba.

Six months ago, an Australian junior was selected to earn up to a 75% interest on the 19,321 ha Mclaughlin Lake project by making cash & stock payments + exploration expenditures of $3M over five years. Importantly, New Age retains a 2% NSR.

Management secured another exciting prospect at Red Cross Lake, its 3rd property acquisition in the area. Given that it obtained $3M + a 2% NSR to farm out the 19,321 ha McLaughlin Lake property, it might be able to secure a better arrangement on the larger (30,688 ha) Northman Lithium property.

Northman has 28 km of strike length surrounding a LCT pegmatite swarm with historical sample assays up to 1.25% Li2O & 2.86% Cs2O from lepidolite pegmatite and up to 2.97% Li2O from spodumene pegmatite. Cesium in N. Manitoba could potentially be shipped alongside Li to the Tanco Mine.

The world’s largest Li companies, battery components & EV makers are all over Canada. Projects in SE Manitoba are supported by MinRes, and also giant Li-ion battery player LG Energy Solution in conjunction with Snow Lake Lithium.

New Age Metals (TSX: NAM) / (OTC: NMTLF) is valued at just $5M despite a fully-funded (by MinRes) $7M, 12,500-meter drill program that ended in March. Initial drill results should be out in late April, and visual inspection of cores seems promising. Strong drill results and a recovering Li market could make today’s $0.03 share price a tremendous entry point.

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about New Age Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of New Age Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of funds. It’s assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, New Age Metals was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)