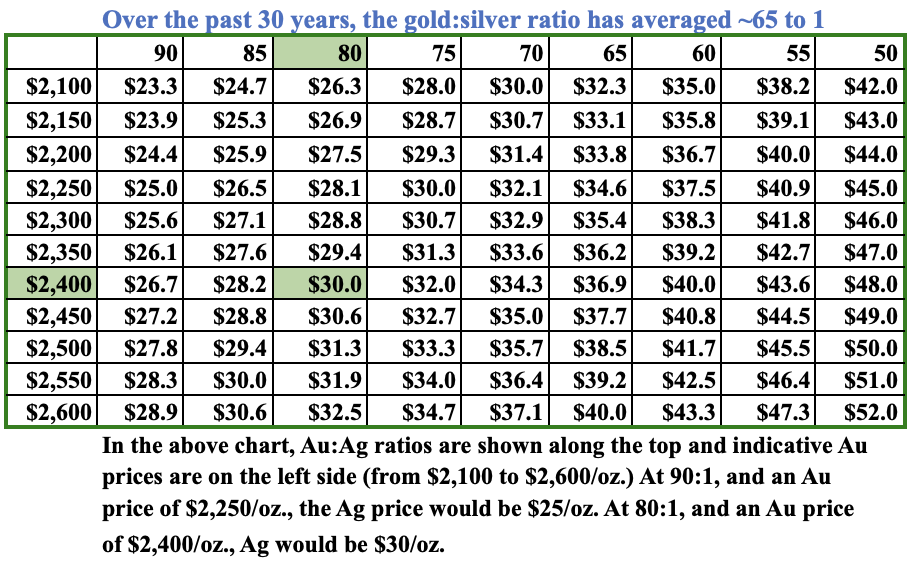

Precious metals have moved decisively higher in the past month. Gold (“Au“) is at an all-time (nominal) high. Yet, silver (“Ag“) has lagged behind Au’s impressive move. The Au: Ag ratio is ~87:1 vs. after a spike in Ag on April 2nd. The 30-year average ratio is ~65:1.

With strong industrial demand and year 4 of a mined Ag deficit, it would not be surprising for the ratio to revert to say 75:1. In 2011, the ratio hit 32:1.Regarding the Au: Ag ratio, I’m not talking about Ag’s technicals, I’m referring to real-world physical demand.

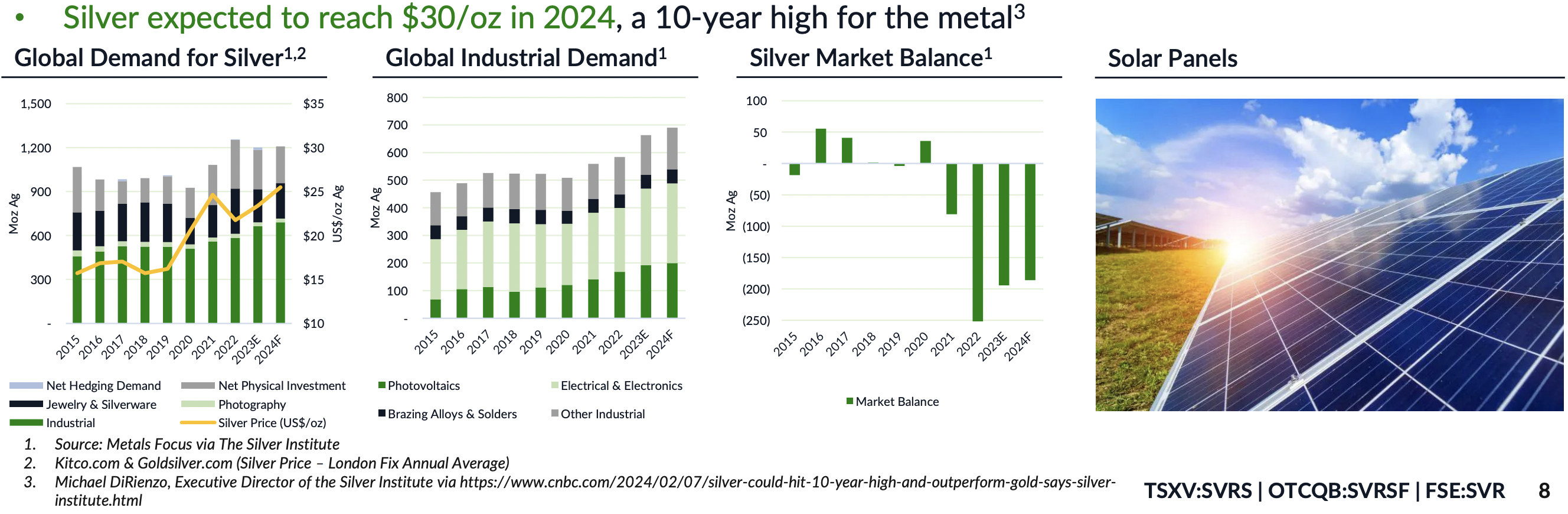

Last year, China added more solar capacity [217 gigawatts, +148% over 2022] than any other country’s total installed capacity. Globally, renewable power increased by +50%, [95% solar + wind]. And, three-quarters of that 95% figure came from solar.

Each gigawatt of solar requires ~600k ounces of Ag. If China’s solar capacity increases +30% this year, an additional 282 gigawatts vs. 217 in 2023, it would consume ~170M ounces, ~14% of the world’s Ag demand.

Since the supply of Ag is highly inelastic, primary Ag projects benefit most from an increase in the Ag price. Today’s spot price of ~$26.3/oz. is still astonishingly cheap vs. the inflation-adjusted price of $84/oz. for the entire year of 1980. This makes no sense, especially as all-in-sustaining costs have been rising 10%+/yr. since 2020.

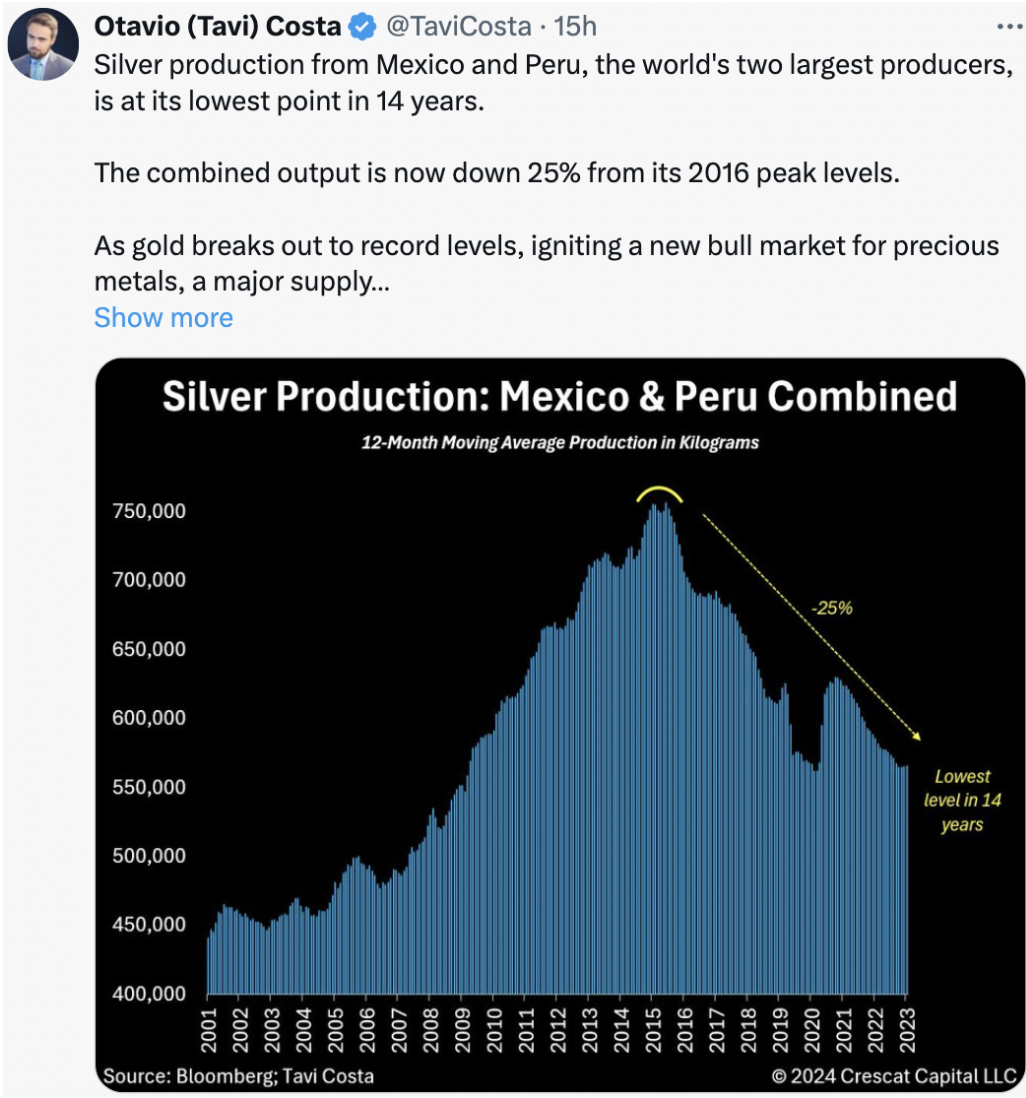

The post below on X/Twitter shows that for Mexico & Peru (combined), the two largest Ag producers on Earth, the 12-month rolling average of Ag production is down 25% from its 2016 peak. It’s no wonder we are in year 4 of a mined Ag deficit. This is why the Ag price has been so strong lately, it’s at a 3-yr. high.

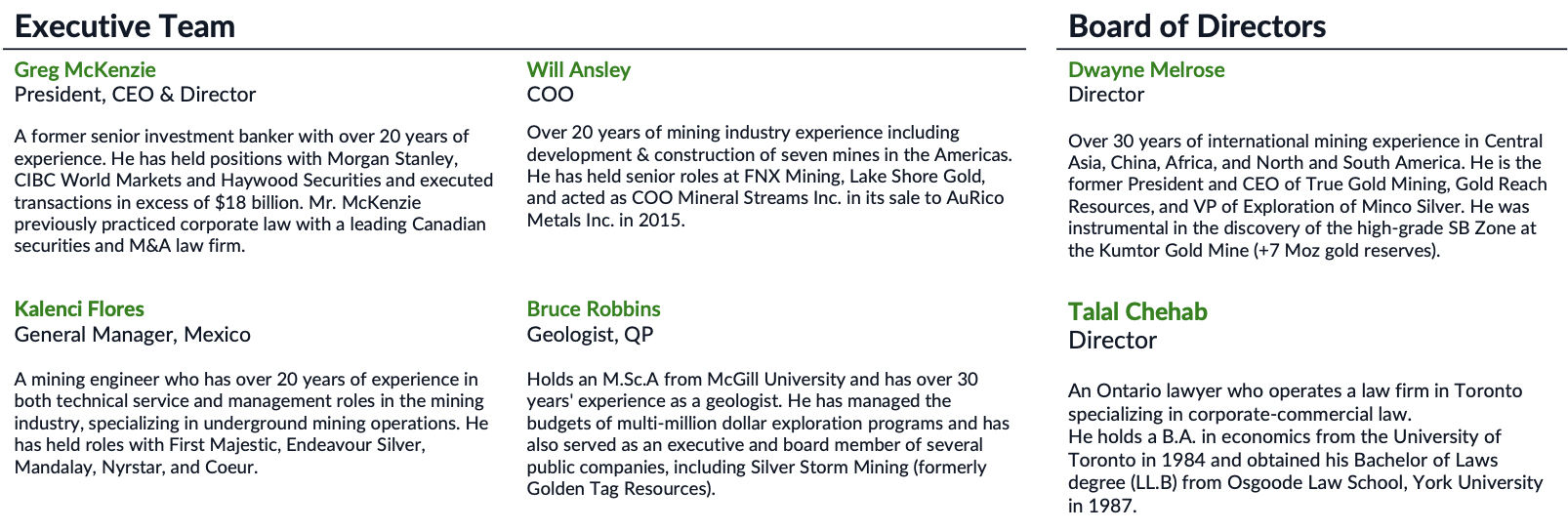

How often have readers heard a story about a past-producing mine being rehabilitated for “near-term” production, only to have it repeatedly delayed & hit with material cost overruns? Silver Storm Mining’s (TSX-v: SVRS) / (OTCQX: SVRSF) management team, led by CEO/Pres./Dir. Greg McKenzie has seen & heard it all before.

The company has forged strategic partnerships with key stakeholders in the mining industry, enabling access to capital, technology, and expertise necessary for sustainable growth. Please see corporate videos here. At C$0.13/shr., Silver Storm could be on the verge of a big move higher along with the underlying Ag price.

His team has pervasive experience in mine development & operations. They’re taking a methodical approach to re-start the La Parrilla (“LP”) primary Ag mine & mill (around mid–2025), acquired from First Majestic Silver (“FM”) [FM is a 41% shareholder in Silver Storm & Eric Sprott 10.5%]. McKenzie has executed M&A transactions valued at > $18 billion.

General Manager, Mexico Kalenci Flores has > 20 years’ experience, specializing in underground operations having worked with First Majestic, Endeavor Silver & others. COO Will Ansley also has > 20 years’ experience in the mine development & construction of seven mines in the Americas. Director Dwayne Melrose has 30+ years under his belt.

Mr. Melrose has worked across the globe and was President & CEO of True Gold Mining, acquired by Endeavour Silver. He was instrumental in the discovery of the 7M+ oz. Kumtor Gold mine. Geologist, QP Bruce Robbins has over 30 years’ experience as a geologist and has managed many exploration programs.

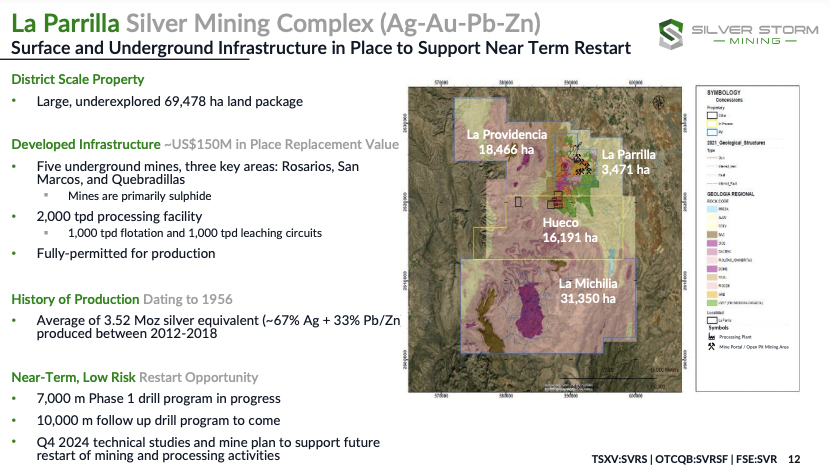

The 100%-owned LP project hosts five underground mines; Rosarios, La Rosa, San Jose, Quebradillas & San Marcos, and the Quebradillas open pit, all surrounding the 2,000 tpd fully-permitted mill consisting of parallel 1,000-tonne per day (“tpd”) flotation & 1,000 tpd cyanidation leach circuits to treat both oxide & sulfide ores using a conventional flowsheet.

Mineral resource estimates have been completed for 22 veins in the Rosarios, San Marcos & Quebradillas zones, both oxide & sulfide. The estimate includes 2,025 core samples (1,271 meters) from 392 boreholes and 9,676 chip samples (5,148 meters) from 3,190 underground channels. LP has ~15.5M Ag Eq. ounces grading ~258 g/t Ag Eq.

LP was a highly profitable mine during its entire lifetime, but at an average of 3.5M Ag Eq. ounces/yr. it was too small for FM, (enterprise value [market cap + debt – cash] of $2.6B). By contrast, Silver Storm is valued at just $50M. As the largest shareholder, and an investor in the most recent capital raise, FM remains a valuable strategic partner.

Compared to the Company’s $50M valuation, LP alone has ~US$150M (replacement cost) of above & below-ground infrastructure in place, including a fully permitted 2,000-tonne-per-day mill. In addition to $150M, replicating the infrastructure would take 4-5 years of studies, permitting, funding & construction.

Transferring ownership of LP to Silver Storm, was a win-win for both companies as FM maintained significant upside to LPs success and gained a free option on Silver Storm’s 100%-owned crown jewel San Diego project.

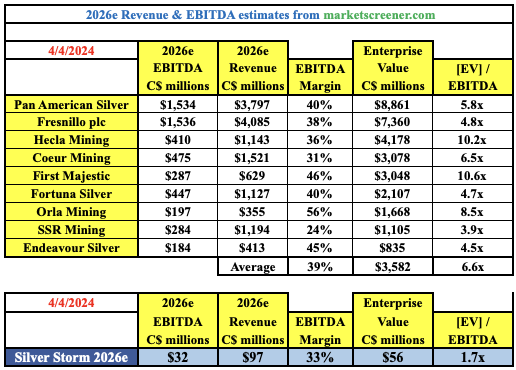

Assuming things go reasonably as planned, Silver Storm gets a profitable operation at a run-rate of 3.0M oz. Ag Eq. by the end of next year. In the chart below are nine much larger Ag-heavy producers that trade at an average 2026e EV/EBITDA multiple of 6.1x. By contrast, Silver Storm is valued at 1.5x 2026e EBITDA.

McKenzie stated that annual cash flow could be C$32M/yr., on 3M Ag Eq. ounces, assuming US$25/oz. Ag Eq & AISC of US$17/oz. Some of that cash flow could be reinvested into the even more exciting San Diego (“SD”) project. SD has > 210M Ag Eq. ounces, making it one of Mexico’s larger undeveloped Ag projects.

The replacement cost of the drilling & exploration done at SD is ~$30M. Before Silver Storm acquired LP, SD was the only major asset. In 2021, the Company (named Golden Tag) was briefly valued at over $100M.

SD is envisioned as a bulk tonnage operation, possibly 10M to 15M Ag Eq. ounces/yr. Management believes SD has potential as a low operating cost, long-lived mine.

Mckenzie & team reviewed dozens of prospects and did extensive due diligence on LP before locking it down. This is an exciting project consisting of 41 contiguous mining concessions totaling 69,478 hectares in Durango State, Mexico. There’s tremendous blue-sky exploration potential.

An ongoing 7,000-meter drill program is almost done at LP is delivering very strong results, including a few blockbusters. The best interval to date is 1,810 g/t Ag Eq. over 14.6 meters. That’s 58.2 troy ounces per metric tonne, or US$1,520/t rock at spot prices. A 10,000-meter drill program will soon follow.

It would be nearly impossible to overstate how incredibly important these bonanza grades are. CEO Mckenzie has been saying for a year that he expects 3M Ag Eq. ounces of production, but if the ultra-high grade runs deeper and/or wider, all bets are off. While the team won’t say that greater than 3.0M Ag Eq./yr. is coming, it seems quite possible.

LP hosts a past-producing mine complex in continuous production from 2005 to 2019 that produced 34.3M Ag Equiv. ounces. This is a primary Ag mine — 67% of the output is Ag — and 33% lead//zinc. Durango State has 23 operating mines, it’s a mining-friendly jurisdiction.

Management plans to process oxide ore by cyanide leaching to produce doré bars onsite. Sulfide ore will be processed by differential flotation to produce Ag-rich lead & zinc concentrates.

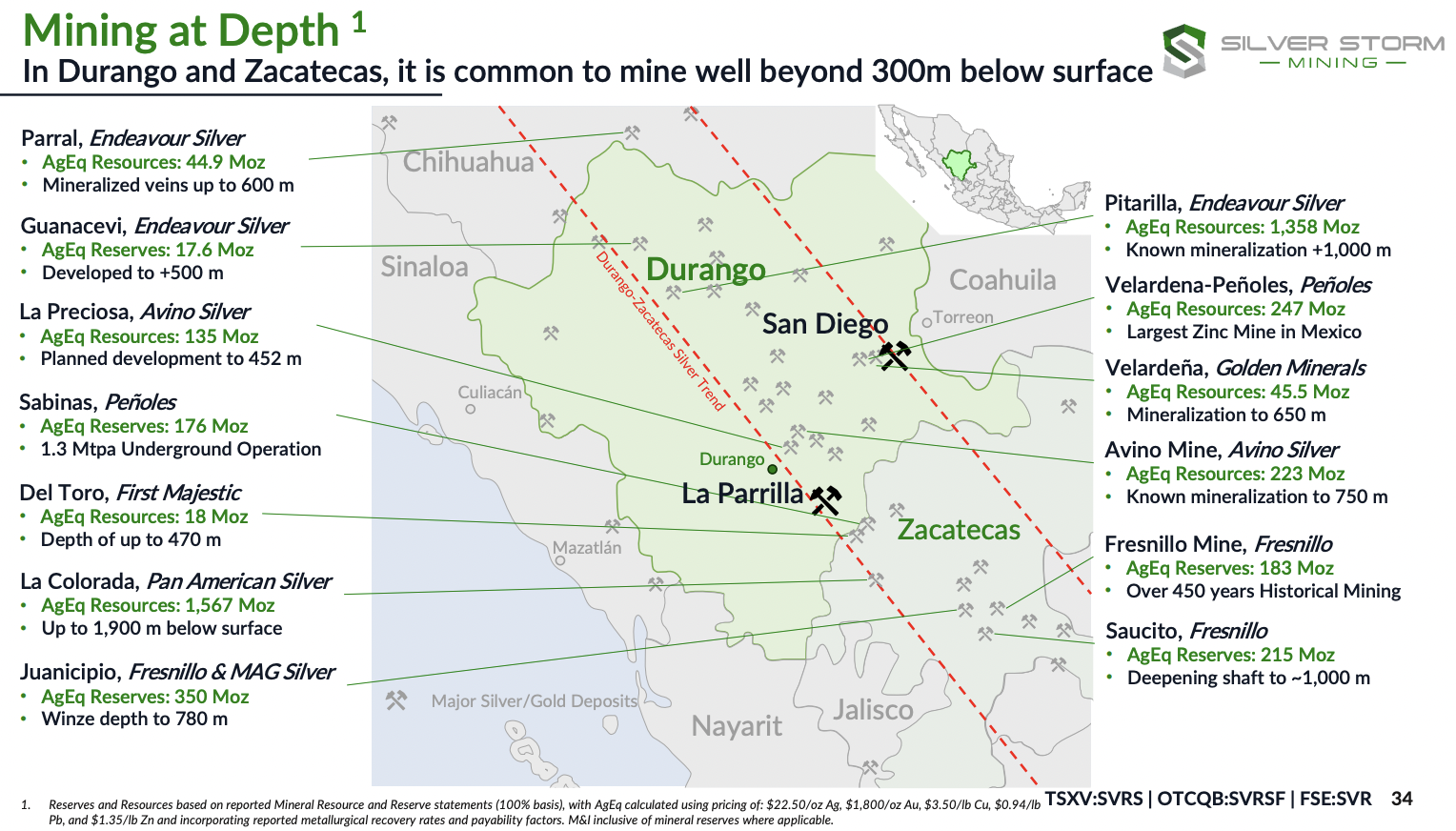

The following slide, “Mining at Depth” is one of my favorites in the new corp. presentation. The average depth of the mines on the slide is 810 meters, and some are still open.

By contrast, the resource estimate at LP extends to a depth of ~450 meters, and is open. In addition, many high-grade veins mapped at the surface have not been followed underground. In other words, there’s very substantial blue-sky exploration potential at LP.

With the Ag price seemingly breaking out, readers should take a closer look at Silver Storm Mining (TSX-v: SVRS) / (OTCQX: SVRSF). This is a Company with near-term production in 2H 2025, trading at just 1.5x 2026e EBITDA vs. peers at 6.1x. In my view, investors are essentially getting the crown jewel 210M+ Ag Eq. oz. San Diego project for free.

Please see corporate videos here.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply