It’s hard to believe the gold (“Au“) price has soared past $2,100, $2,200, $2,300, $2,400/oz., now sitting at ~$2,320/oz. Gold stock investors don’t quite believe it either. Newmont‘s & Barrick’s share prices remain 50%-55% below all-time highs.

Imagine what long-term gold bugs must be thinking –> $5,000/oz.? $10,000/oz.? Yet, there’s no reason to rely on them when Bank of America & Citigroup have straightforward bull case scenarios of $3,000/oz. and UBS says $4,000/oz. is possible in 2026 or 2027.

Sounds crazy, $3,000/oz., right? But is it? That’s only +25% above $2,400/oz. Wait, hold on, take a step back — anything above $2,100/oz. is icing on the junior mining cake.

For the first time in history, it’s reasonable to say that if the Au were to fall $200/oz., Au companies would still be in good shape. That’s a nice cushion and one that doesn’t seem like it will be tested with Chinese, Indian, and other Central Banks (“CBs“) buying hand-over-fist.

Will China slow its pace of accumulation? Doubtful. On a per capita basis, the U.S. FED owns ~15x as much Au as China’s CB. China, Russia, and other countries fear owning US$ assets for geopolitical & U.S. balance sheet reasons.

On the supply side, output from mines is growing, but modestly. Newmont & Barrick expect production growth of just 1%-2%/yr. through 2028. So, anemic growth and costs have been soaring. Newmont’s AISC was up at a 4-yr. +10.6% CAGR from 2020-2023.

Au producers are printing money and have the ability and clear incentives (elevated AISCs, low organic growth) to make acquisitions of attractive projects in safe jurisdictions.

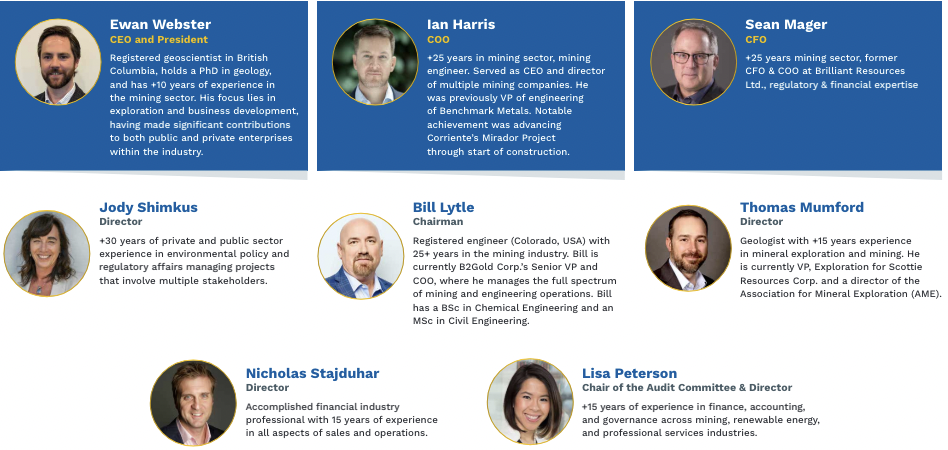

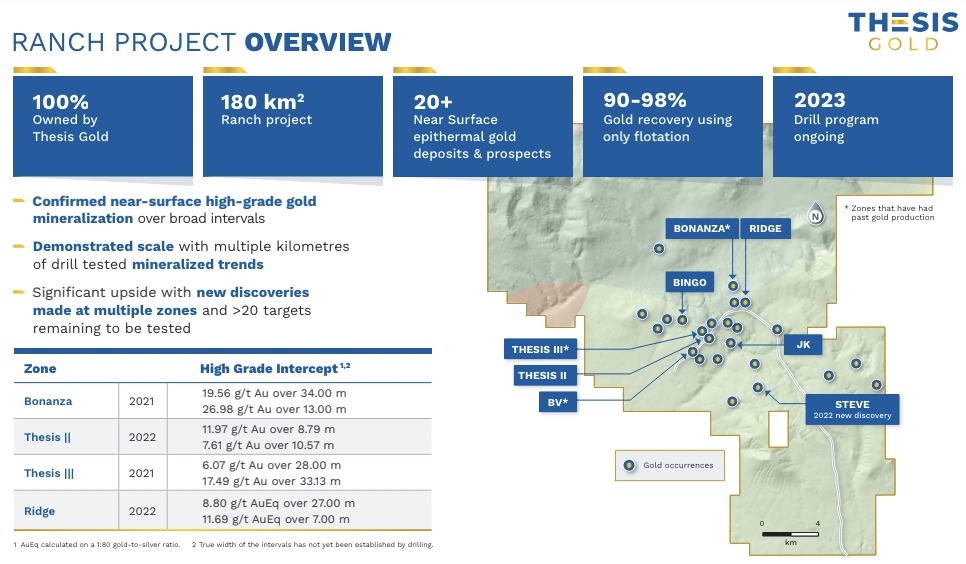

Thesis Gold (TSX-v: TAU) / (OTC: THSGF) just reported a new resource at its combined, 100%-owned, Ranch & Lawyers projects, now called “Lawyers-Ranch.” Total Au Eq. ounces came in at 4.7M, grading 1.55 g/t. Importantly, 85% of those ounces are in the Measured & Indicated categories. See the new Corp. presentation.

At spot prices, silver (“Ag“) accounts for ~30% of the total in-situ metal value. That’s great news for those who believe that Ag could outpace Au in the coming years. Make no mistake, I think Au could go to $3,000/oz., but if/when it does, Ag could easily be $50+/oz. CEO Ewan Webster commented,

“We foresee this materializing in a significant underground potentially mineable Mineral Resource and secondly as you can see in the sensitivity table for Ranch, there is the opportunity to develop much higher-grade starter pits to jump-start production and reduce the pay-back period.“

Thesis has 92.3M ounces of Ag, already a larger resource than the majority of Ag explorers. Depending on recoveries, that impressive endowment could represent an attractive asset to one of over a dozen Royalty/Streaming companies.

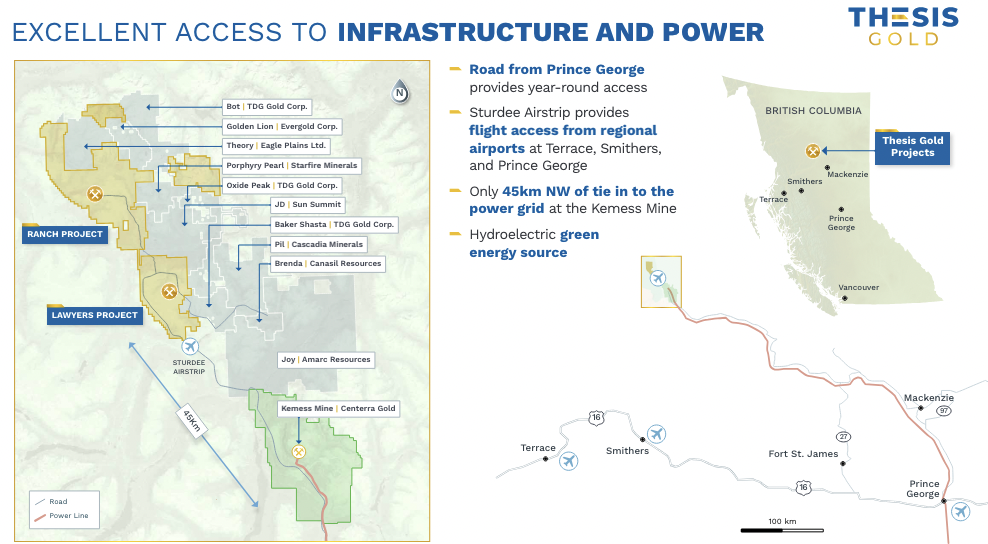

Yes, 4.7M Au Eq. ounces is a lot, and at a solid grade, especially for a prime jurisdiction like B.C. Canada. Thesis is surrounded by; Teck Resources, BHP, Freeport McMoRan, Boliden AB, Kinross, Centerra Gold, Seabridge & Hecla Mining.

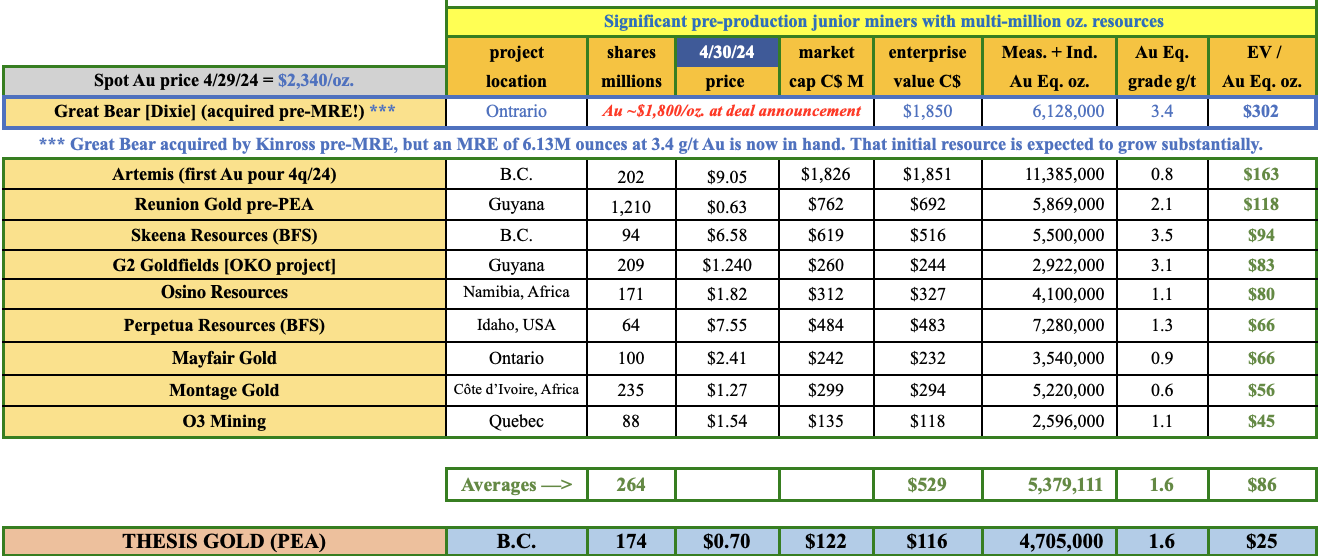

Among juniors in B.C., only Artemis Gold (0.8 g/t Au Eq.), Skeena Resources (3.5 g/t Au Eq.) & Tudor Gold (1.25 g/t Au Eq.) have more ounces. The MRE is underpinned by blockbuster intervals such as [4.1 m at 119.5 g/t Au], incl. 2.0 m at 231 g/t Au.

That’s a [gram x meter] figure of 484. Yet, 2021’s best intervals averaged a whopping 622 g-m! [34 m @ 19.6 g/t] AND [33.1 m @ 17.5 g/t].

Thesis is more advanced than peer Golden Triangle hopefuls; Dolly Varden, Tudor Gold, Doubleview Gold, Teuton Resources, American Eagle, Goliath Resources, Eskay Mining, American Creek Resources & Scottie Resources, none of whom have a PEA.

The Company is trading at just $25/Au Eq. oz. in the ground. In bull markets, M&A often gets done at 3x-6x that level (albeit for more advanced-stage projects). However, by the end of next year Thesis will be more advanced, and the Company will have completed a Pre-Feasibility Study on a larger resource.

In the comparison chart above I show Great Bear’s acquisition by Kinross, but I don’t include that $302/oz. valuation in the average of $86/oz. While Lawyers-Ranch might not be the next Great Bear, it should still be worth a lot more than $25/oz. in a bull market.

The map above shows that Newmont & Teck have assets west of Thesis, but Freeport (through an interest in Amarc Resources) & Centerra are much closer. Centerra was sitting on a massive C$842M cash war chest as of 12/31/23.

Might Thesis be a good fit for Agnico Eagle? Agnico does not have operations in B.C., but is a major Canadian Au producer. In February, Thesis returned blockbuster results from its Ranch Project, including 60.0 m @ 4.5 g/t Au Eq. Ranch is road-accessible, connecting a contiguous 495 sq. km land package.

A new PEA is coming out later this year incorporating the newly-combined resource. In 2022, a PEA on just Lawyers had an after-tax NPV(5%) of C$883M, using an Au price scenario of US$1,995/oz. (+15% above the base case assumption). See the new Corp. presentation.

An improved NPV will come from an increase in annual production, a higher Au price assumption, and higher-grade ounces mined earlier in the mine plan.

By my estimates, (not those of management), assuming an Au price of US$1,900/oz., the after-tax NPV could be C$1B, with a 25%+ IRR, and an AISC under US$1,100/oz. That AISC figure looms large for companies like Newmont, which reported an AISC of $1,485/oz. in the 4th qtr.

Others with elevated AISC levels include; OceanaGold Corp., IAMGOLD, AngloGold Ashanti & Argonaut Gold who reported 4th qtr. 2023 levels of $1,658, $1,735, $1,538, & $1,804/oz., respectively.

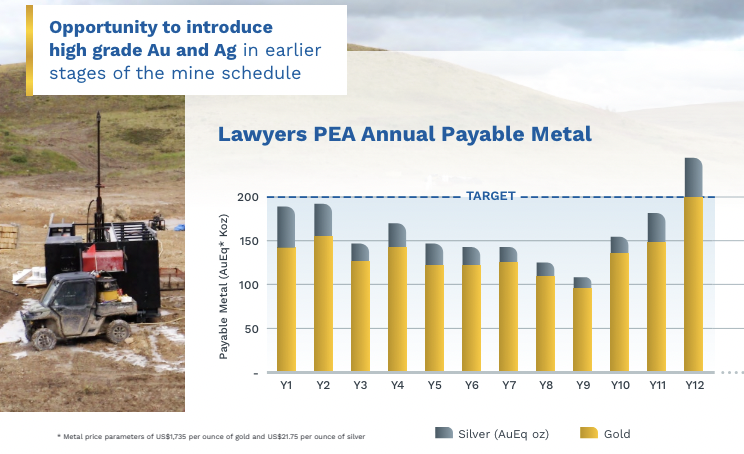

The addition of a low-risk, sizable, sub-$1,100/oz. AISC mine to those companies’ portfolios would move the needle. In the chart below from the Company’s Corp. Presentation, one can see that a goal of the new PEA will be to make production more consistent around 200k Au Eq. ounces/yr.

At 200k Au Eq. ounces/yr., I believe this is a Top-5 pre-construction Au project in N. America. As significant as 4.7M ounces is, that is just a stepping stone to potentially booking millions more ounces in the coming years — mostly from Ranch — which has > 20 high-quality targets that have never been drilled.

Thesis Gold (TSX-v: TAU) / (OTC: THSGF) has an existing PEA with an Au price assumption of $1,735/oz. By my estimate, Thesis is valued at just ~12% of its upcoming after-tax NPV, [$116M / $1B = ~12%]. While Thesis is years from production, it’s years ahead of pre-PEA juniors, many of whom are pre-MRE.

Existing producers, like the ones mentioned above, have very strong balance sheets, allowing them to pay a multiple of Thesis’ current $116M enterprise value and fund cap-ex to build a 200k Au Eq. oz./yr. mine. See the new Corp. presentation.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Thesis Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply