In the last robust period of over-contracting (restocking) in 2005-07, the uranium spot price hit ~US138/lb., which adjusted for inflation is ~$211/lb.

And, 2005-07 was long before financial buyers like Yellow Cake Plc & the Sprott Physical Uranium Trust had appeared on the scene, not to mention the Global X Uranium & the Sprott Uranium Miners ETFs.

Interestingly, the long-term contract price was pinned at $95/lb., (~$145/lb. in today’s dollars) for 10 straight months from May 2007 to March 2008. So the current $91.25/lb. is not an outlier, not even close.

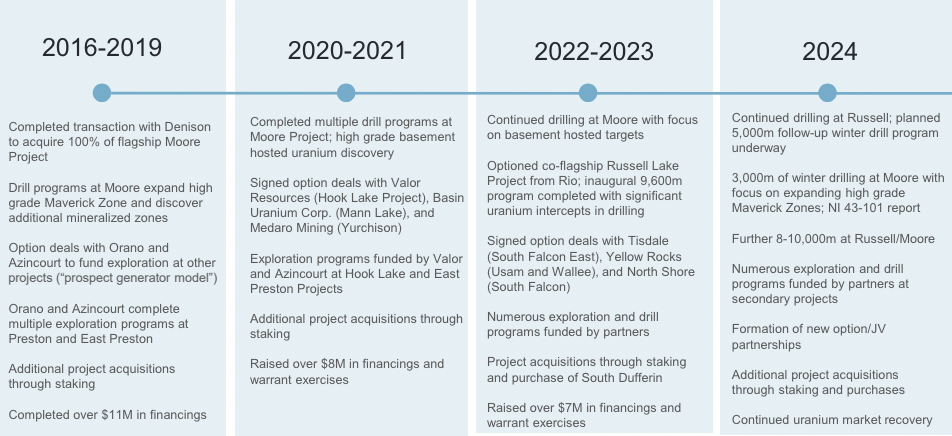

While many of the larger uranium companies have rallied 75%-200% from 52-week lows, smaller names like Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) have not increased nearly as much. It hit highs of $0.87 in 2021, and $0.84 in 2022, but only $0.64 since then, and closed at $0.415 on May 15th.

{See new Corp. Presentation}. This underperformance could change at any time as small caps often (eventually) outperform large caps in commodity bull marks.

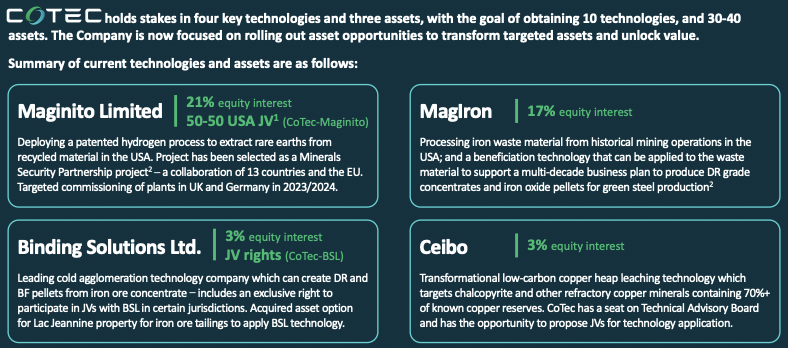

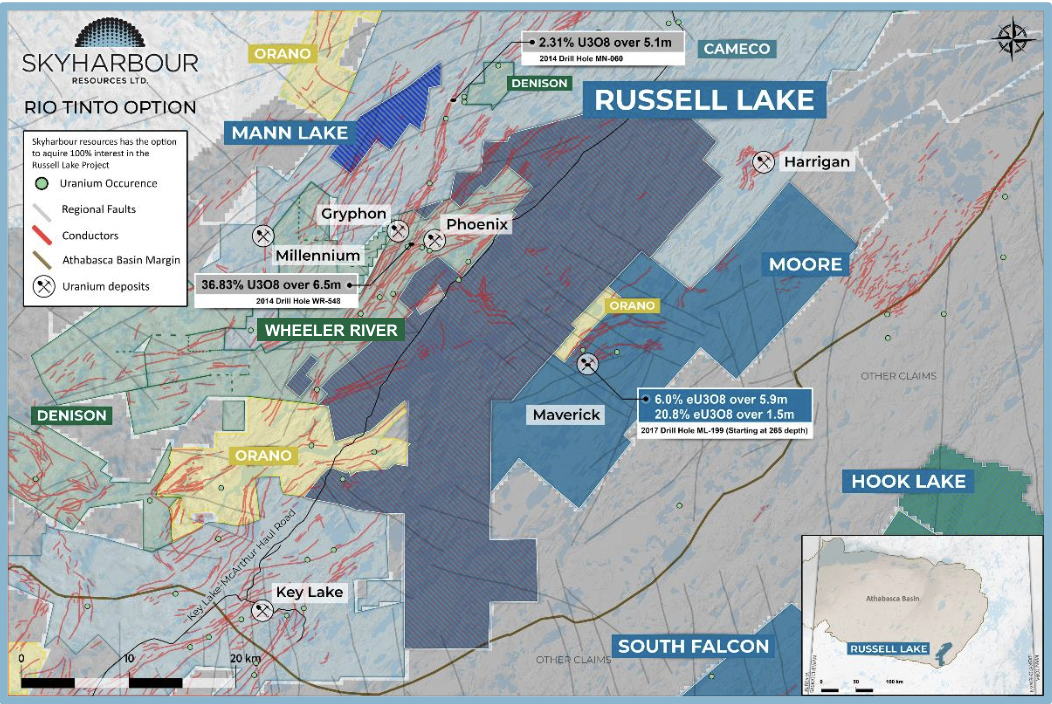

It’s important to note that virtually all of the portfolio was acquired when the uranium price was half (or less) of today’s level. The Company has the 3rd largest land position, at over 1.45M acres, in the Athabasca basin. Skyharbour is surrounded by Cameco, Denison, NexGen, UEC, Orano Canada, Fission Uranium & IsoEnergy.

The world’s two largest uranium producers, Canada’s Cameco & Kazatomprom (in Kazakhstan) are effectively sold out for years to come. In fact, from time to time, they may be forced to purchase U3O8 in the spot market to satisfy sales contracts.

CEO Jordan Trimble expects global demand this year to be ~197M pounds vs. primary mine supply of ~155M pounds. We are years away from a balanced market as the most important new mine, NexGen’s Rook I project (29M pounds/yr.), won’t be up and running before 2030.

France’s Orano, a Top-5 global producer, announced a long delay in a US$1.6B deal with Mongolia to mine uranium. This news came after the privately-held company reported a 5% decline in production in 2023. vs. 2022.

Supply of uranium to meet the growing needs of the nuclear power renaissance is highly uncertain, as sources from Russia, Kazakhstan, Uzbekistan, and certain African countries increasingly flow to China.

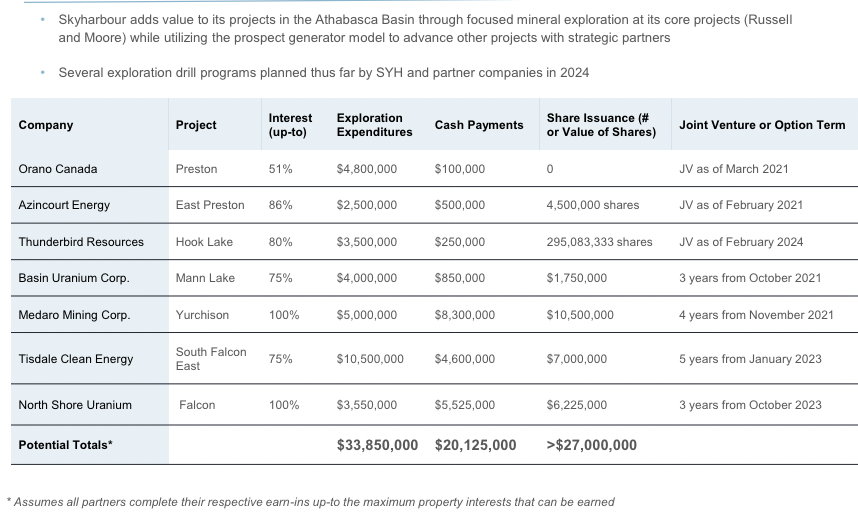

Orano Canada announced an extensive field program on a project in which it has in a JV with Skyharbour. This will be the first significant work done by Orano on the 49,635-hectare Preston project since 2020.

From the 2030s on, Small Modular Reactors (“SMRs“) powering islands & small cities will be a significant, (and under-appreciated), factor. Micro-reactors will be deployed to power desalination plants, AI/cloud/supercomputing, oil & chemical refineries, manufacturing hubs & data centers.

Amazon, Google, Meta, Tesla & Microsoft have already expressed interest in nuclear power. At a Dec. 2023 climate conference, dozens of countries agreed to triple nuclear power by 2050. This will be impossible without a substantial contribution from SMRs. China gets just 5%-6% of its power from nuclear, and India 3%-4%.

Those two countries could see a quadrupling of nuclear power generation by 2050, or growth of 5.0-5.5% per year, for decades. As mentioned, the supply side of the equation is a different story. I already discussed Kazatomprom, Cameco & Orano.

Even if Kazatomprom can avoid lowering next year’s guidance, eventually all of its output will be headed to China. The world’s largest uranium consumer is the U.S. In 2023, it produced ~0.1% of the uranium it consumed. With higher prices, production is increasing, albeit slowly with the typical ISR mine ramping up to 500k to 1.5M pounds/yr.

By 2030, production will almost certainly remain below 16M pounds vs. roughly 50M pounds consumed. Canada is extremely well-placed to pick up the slack as Russia & Kazakhstan inevitably divert production to China.

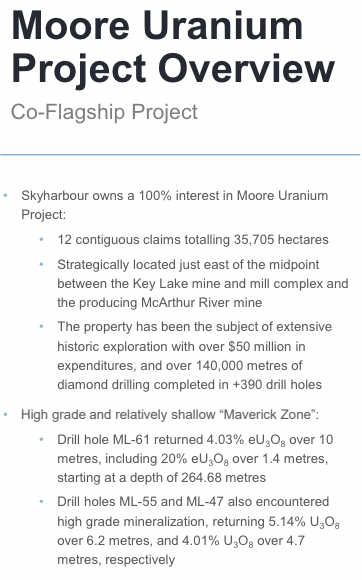

Canada is ideally situated in this uranium bull market, with no jurisdiction better positioned than the Athabasca basin. Turning back to Skyharbour, its technical team is very optimistic about this year’s drill program of 8k meters at co-flagship projects Russell Lake (“RL”) 5k + Moore Lake (“ML”) 3k meters.

These projects are contiguous and sit within 5-10 kms of Denison’s ($2.5B market cap) world-class Wheeler River project. Results are expected in June/July, and an additional 8-10K meters are planned after the results are assessed. Moore is 100%-owned, and management can earn up to 100% of Russell (it’s very close to 51% ownership now).

I don’t believe Skyharbour is getting proper credit for its assets being so close to Wheeler River, the value of which has more than tripled in the past few years. Please take a quick look at the map of ML & RL below. The combined land package is 3x larger than Nexgen’s Rook 1 and nearly 10x that of Wheeler River.

By no means does this vast scale ensure an economic resource will be found, but it can’t hurt. If a few 10s of millions of pounds can be booked, that might not be enough to host a standalone mine, but it would be plenty for Moore and/or Russell to become valuable satellite deposits.

In my view, if the uranium price remains strong, each pound at ML and/or RL could be worth several US$. Readers may notice that I don’t talk much about Skyharbour’s other 27 properties/projects. Too many for me to cover, but there’s excellent commentary on many projects besides jML & RL in the corporate presentation.

It would only take a few meaningful discoveries on Skyharbour’s 29 properties/projects to launch the share price higher. A promising update on partner company North Shore Uranium is out this morning. It announced anomalous uranium values of 300 ppm, up to 572 ppm U3O8 on two of the initial three drill holes at the 55,699-hectare Falcon property.

North Shore is on the right track, it has solid mgmt & technical teams. It has to invest $3.5M in exploration, make cash payments of $5.53M to Skyharbour, and issue $6.23M worth of shares by October 2026 to earn an 80% interest. The Falcon project is very important to North Shore’s future.

Readers are encouraged to review Skyharbour’s corporate presentation, one of the better ones in the uranium juniors space, to learn more about the Company’s 29 properties spanning > 587,000 hectares.

Skyharbour’s prospect generator business model has resulted in roughly $81M of exploration expenditures + cash payments + the value of shares in juniors (some of the $81M already realized). Management has another 20 properties available for farm-outs.

If one agrees that the uranium narrative will play out over years, not months, then investments into higher risk / higher return juniors like Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) make a lot of sense.

Readers should note that in major bull markets, many juniors eventually outperform blue-chip names, turbo-charging the performance of prospect generators like Skyharbour.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Skyharbour Resources are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Skyharbour Resources was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)