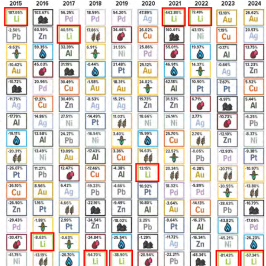

It’s amazing the runs that gold (“Au“) & silver (“Ag“) are having even before the U.S. FED has cut interest rates. Soaring prices signal a flight to safety on both geopolitical & inflationary/monetary grounds. As of May 21st, Au was up +50% over the prior 601 days from a low of $1,614/oz. in Sept. 2022.

That compares to an average gain of +122% over 973 days in three gold bull markets dating back to 2005. If today’s bull market were to play out like the last three, the price would hit $3,592/oz. around June 2025…

If one includes two major bull markets in the 1970s, (there weren’t any major ones in the 1980s or 1990s) the average of the past five becomes +259%, which would propel Au to $5,794/oz. I’m not making forecasts, I’m just pointing out there’s historical precedent for wild gains from here.

Two months ago, Bank of America started talking about $3,000/oz. Au for 2025, and some laughed. No one’s laughing now. Robust Central Bank buying is reportedly behind the spike in Au as China & Russia lead BRICS away from US$ assets.

Gold is soaring, yet a sample of a dozen viable producers, developers & explorers are trading 20% to 83% below their ATHs; Tudor Gold -83%, [New Found Gold, Skeena Resources & B2Gold (each -62%)], Newmont -47%, McEwen Mining -46%, Barrick Gold -42%, Seabride Gold -30% and [Torex Gold & Kinross Gold] (down 20% each).

Even if gold is range-bound for the next year, I believe 2Q-4Q/24 earnings from the Majors will be a strong catalyst, setting off a tsunami of M&A. Regarding Ag, the big story continues to be that physical demand is increasing robustly, most notably in solar panels.

China’s deployment of solar was up +148% in 2023 vs. 2022, on track to use one-seventh of the world’s mined Ag this year. Like Au, Ag has delivered several spectacular performances. For instance, from a low in 2003 to a high in 2011 it was up +1,014%.

We’re currently in year #4 of an Ag deficit. The setup in Ag is reminiscent of chronic undersupply in #uranium resulting in that price doubling over the past year. Readers are reminded that Ag averaged ~$85/oz. (in today’s dollars) for the entire year of 1980!

If one could choose the attributes of a mine development scenario, what would they be? Speed to market, high-grade, community support, access to capital, strong mgmt. team, low upfront cap-ex, lowest quartile op-ex, ample infrastructure, low technical & permitting risk & multi-million oz. potential.

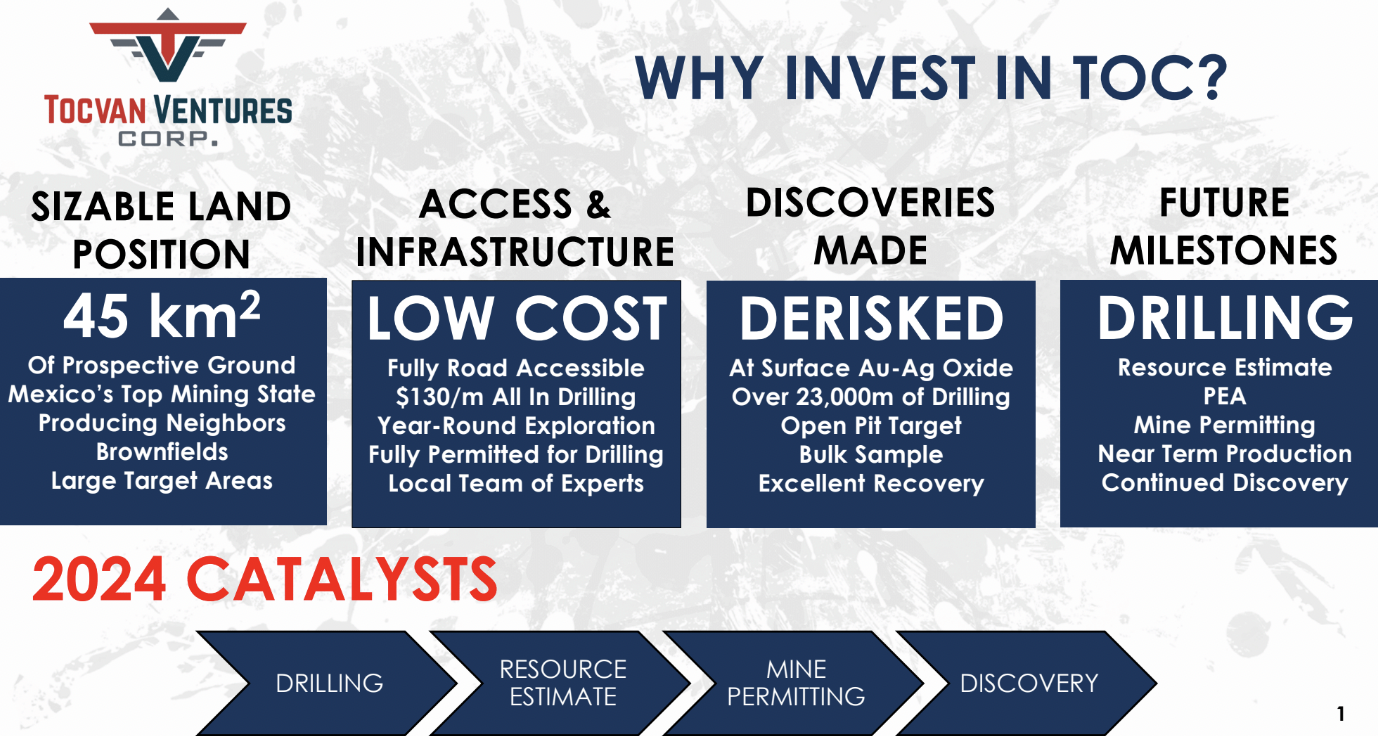

A company I like that’s attractively valued, and surprisingly low-risk, despite being early stage is Tocvan Ventures (CSE: TOC) / (OTC: TCVNF). My inaugural article on Tocvan was written in April.

Since then, two strong drill intervals have been announced, the valuation is +50% higher, and the Ag price jumped to US$32.5/oz. before pulling back to $30.5/oz.

Is it too late to get positioned? Of course not. Further gains in the 100s of percent will be enjoyed by many precious metal juniors this cycle. No one knows if Tocvan will be one of the bigger winners, but please continue reading.

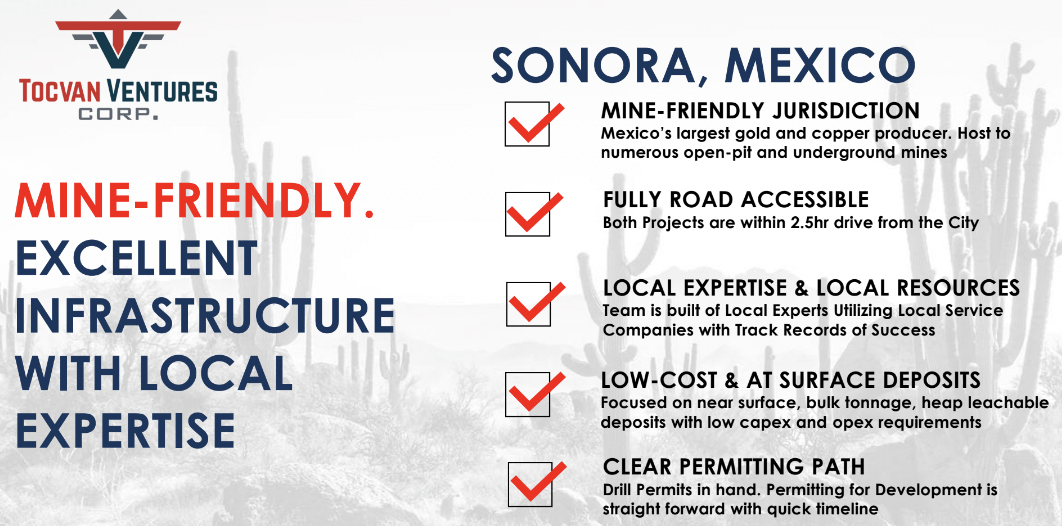

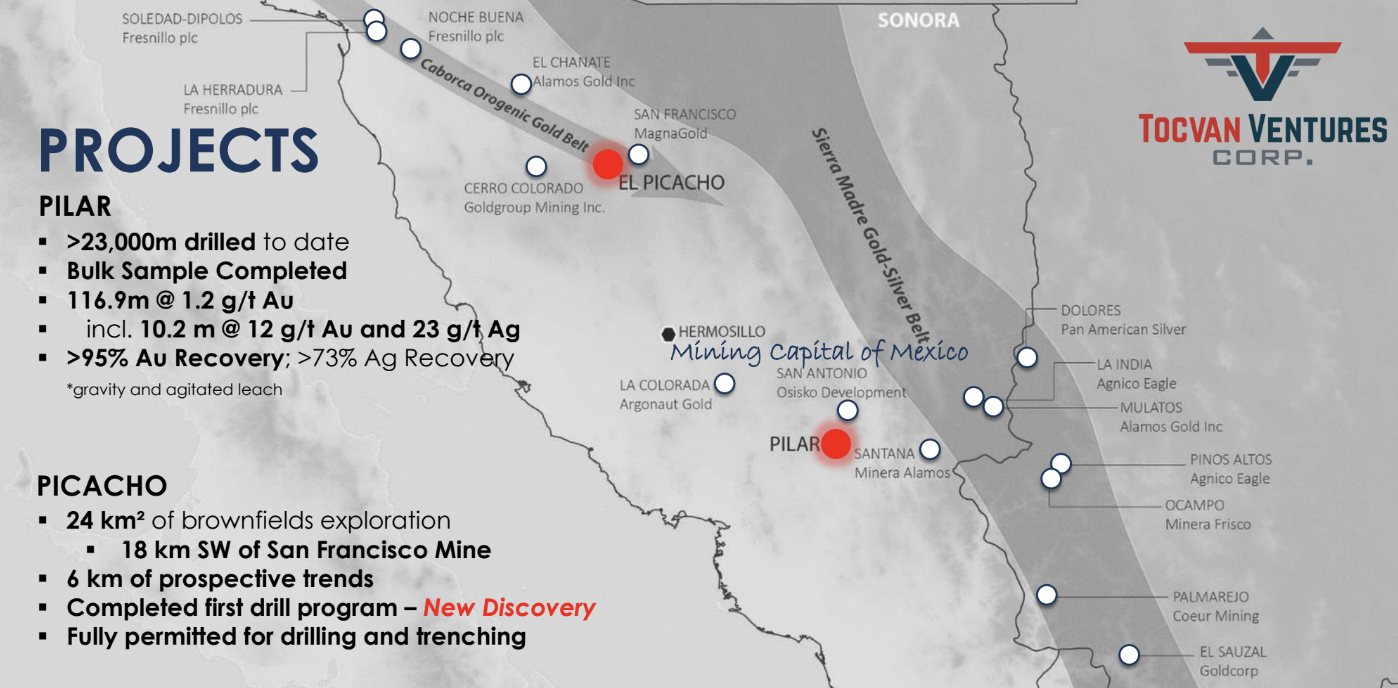

Tocvan enjoys nearly all the mine development attributes mentioned above at its Pilar Au/Ag project in Sonora, Mexico. Sonora has > 70 Au mines, many of which are heap leach operations.

Besides Nevada, there’s no better place on earth to develop a heap leach project. Pilar is road-accessible, ~130 km (a 2-hr. drive) SE of the capital of Sonora, Hermosillo.

Sonora is a mining-friendly State with excellent infrastructure (roads, power, water, skilled workforce, mining services & equipment). With an enterprise value {market cap + debt – cash} of just ~$24M, I think the risk/reward of Tocvan is quite compelling.

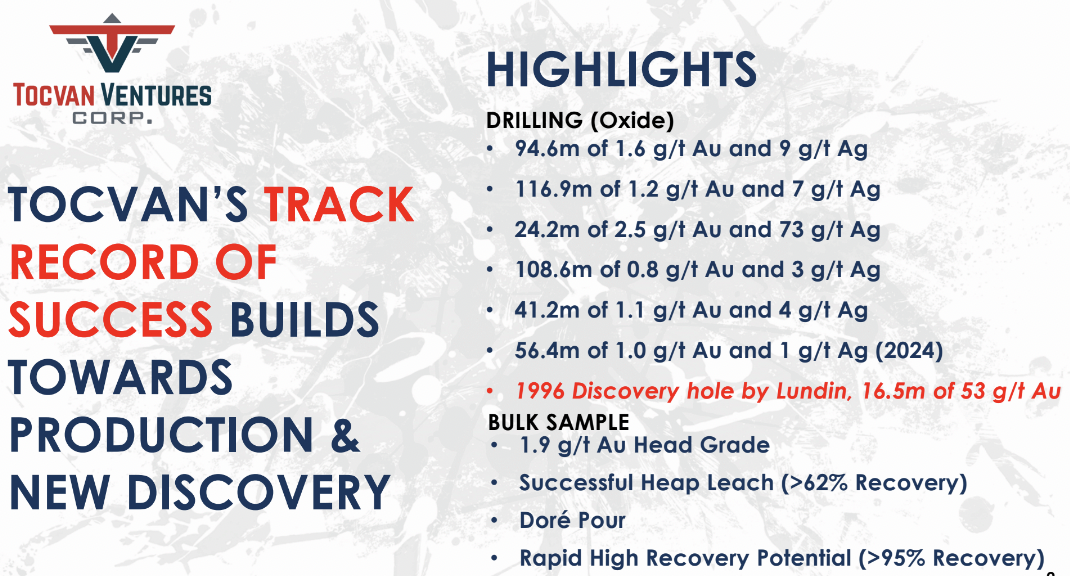

Earlier this month, management announced strong drill results from one of four holes. How strong? A near-surface (18 m vertical depth) interval of 56.4 m at 1.0 g/t Au is the headline, the best result ever outside of the main area — and the first time 10+ g/t has been hit {1.5 m of 26.8 g/t Au}.

On May 23rd, management announced another good intercept, 50.3 m of 0.8 g/t Au, starting at just 23 m depth.

CEO Brodie Sutherland commented,

“Today’s results hit one of the best holes ever off the North Hill Trend, providing added confidence in identifying additional high-grade mineralization. Much of the trend has yet to be tested… The proximity to parallel trends bodes well for tying together a large bulk tonnage target. Early results show great indications that a larger, robust mineralized system is present.”

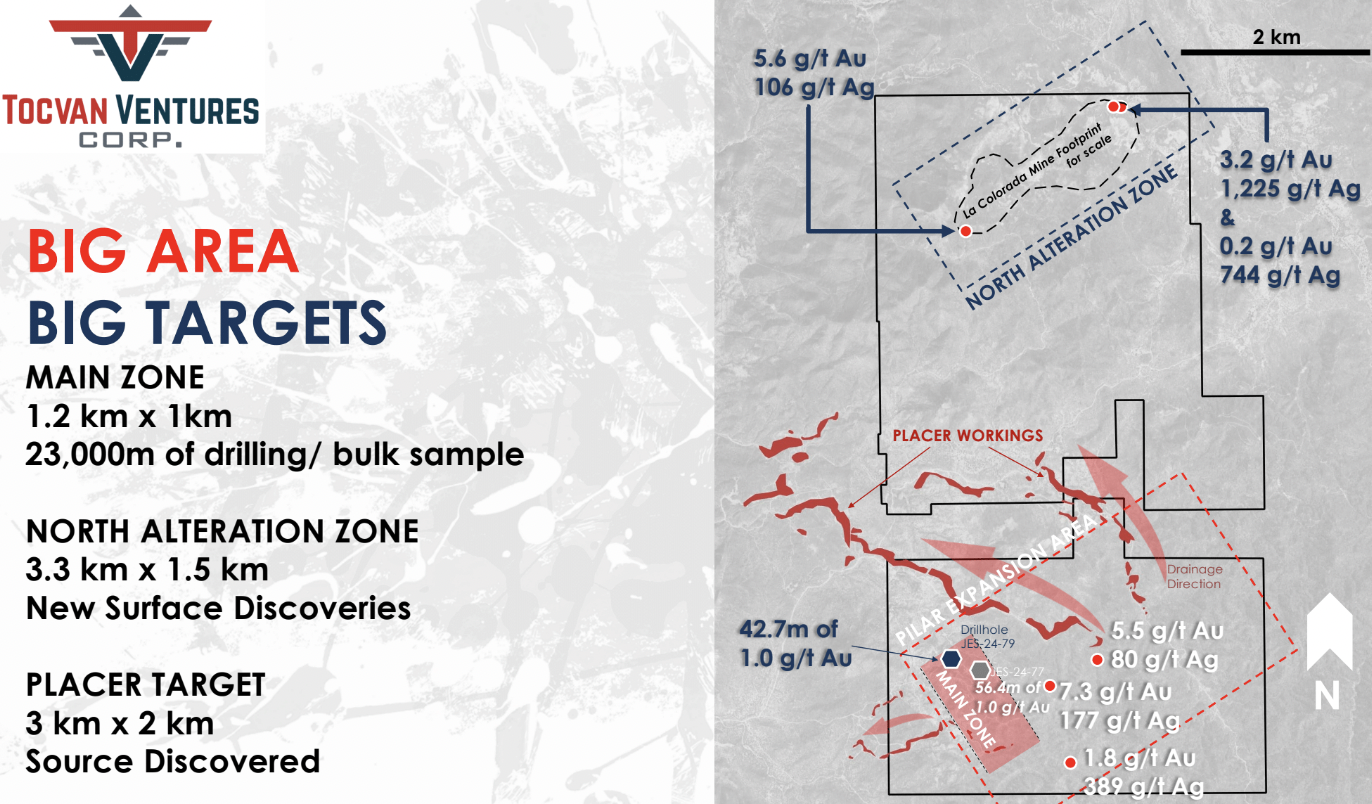

In the map below look at the red dots in the bottom half, showing rock samples of [5.5 g/t Au + 80 g/t Ag, AND 7.3 g/t Au + 177 g/t Ag]. That 56.4 g/t Au drill interval is 400 m east of the main zone, and those high-grade Au/Ag rock samples are ~1,000 meters further to the east.

If the technical team can establish continuity from the main zone across to those samples, it could be transformative. As exciting as the bottom half of the image is, look at the top half –> a 3.3 x 1.5 km alteration zone with more high-grade samples, incl. 3.2 g/t Au + 1,225 g/t Ag. That’s > 18 g/t Au Eq.

BIG AREA, BIG TARGETS… In total, 12.15 sq. km of prospective Au/Ag!

This new area, 400 m east of the primary zone, including the latest interval — which is 300 west-NW of the 56.4 m / 1.0 g/t Au intercept — opens the project up significantly. It’s why the team recently secured more ground around Pilar. A total of 1,825 meters have been completed across 15 holes.

Results in the new area & the main zone point to the potential for a low-strip ratio, which is critically important for heap leach mines. A high-grade center returned 5.3 g/t Au + 3 g/t Ag over 9.2 m, incl. –> 1.5 m of 26.8 g/t Au.

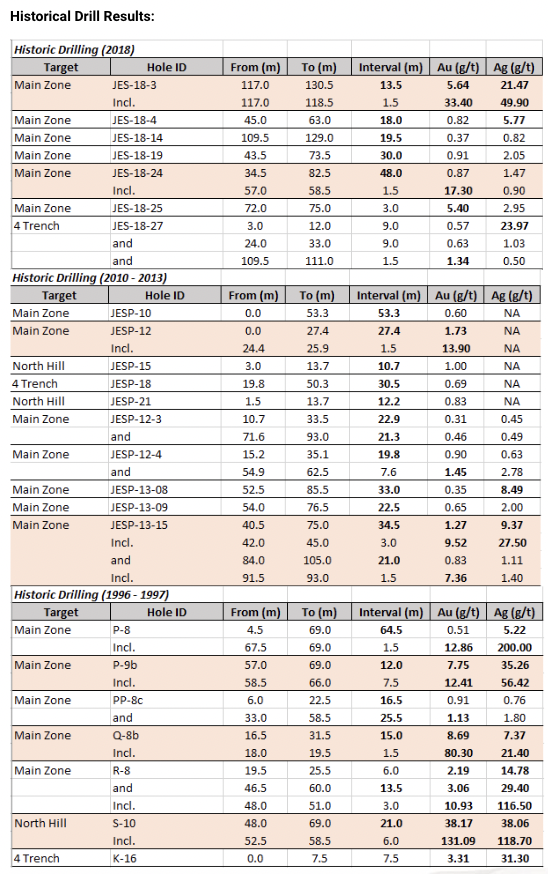

Management talks about drilling in 2020-24, but results dating back to the mid-1990s are noteworthy, including; 13.5 m at 5.6 g/t Au, 27.4 m at 1.7 g/t Au, 12 m at 7.8 g/t, 15 m at 8.7 g/t and 21 m of 38.2 g/t Au, {incl. 6.0 m at 131 g/t}. These are not heap leach grades! In the hands of a larger company, the exploration potential is immense.

That’s not to say Tocvan can’t go it alone for a few more years, it should continue advancing solo as long as possible. The longer management holds out, the greater the takeout value.

Pilar is surrounded by mines & projects owned by companies including; Argonaut Gold (being acquired by Alamos Gold), Osisko Development, Minera Alamos, Pan American Silver, Agnico Eagle & Coeur Mining. This is not merely a “close-ology” story. In major bull markets, high-quality projects like Pilar become very valuable.

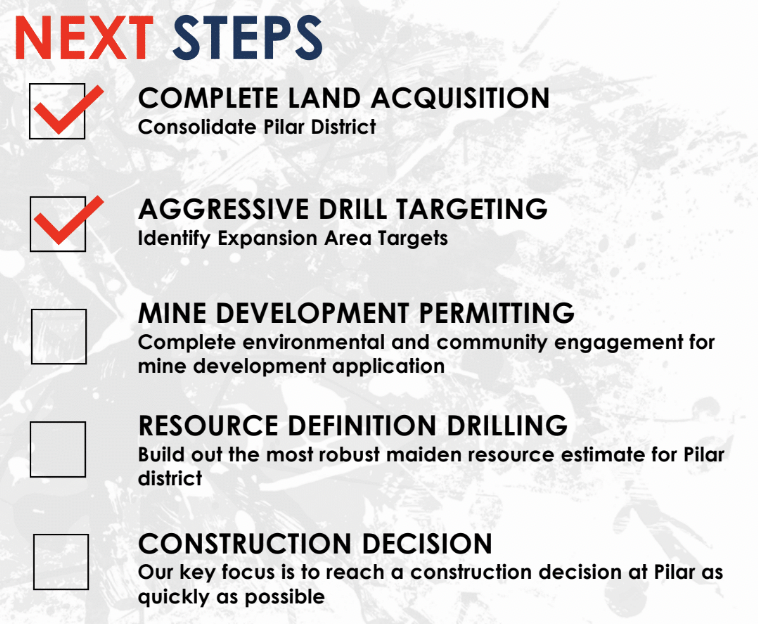

Low-risk, low-cost projects should be in high demand at $2,340+/oz. Au. The Company owns or controls two exciting opportunities in Sonora. It consolidated an attractive land position at its Pilar project, a 100% interest in ~22 sq. km of prospective area, + 51% in a one sq. km area shared with Colibri Resources.

The drill program will include (at least) 4,000 m of infill drilling + 3,000 m of step-out drilling, up to a combined 10,000 m. Results will go into a maiden resource estimate for the Pilar Main Zone.

Drilling is going well, the first hole followed up on one that returned 108.6 m of 0.8 g/t Au + 3 g/t Ag. Management believes the Pilar project has returned some of the region’s best results, including promising Au/Ag recoveries from preliminary metallurgical test work.

Three primary zones of mineralization were identified from historic surface work & drilling, referred to as the Main Zone, North Hill & 4-T. Each trend remains open to the SE and to the north. Parallel zones have also been discovered. Only half of a 1.2 km mineralized trend has been drill-tested.

The Company expanded its interest by consolidating ~22 sq. km of prospective ground. Majors & mid-tiers are interested in what Tocvan is up to, and management has begun talking with royalty & streaming companies.

Last month Franco-Nevada invested C$8.1M for a 2% royalty on a pre-maiden resource property package in B.C., Canada thought to contain ~2M ounces of Au (so far).

Management is studying the potential of a heap leach mine — ramping up to 50k ounces/yr. A great thing about heap leach operations is that upfront cap-ex can be < US$20M. With Au around $2,360/oz., an efficient, low-cost heap leach mine should be capable of delivering profits above US$1,000/oz.

Assuming a US$1,000/oz. profit margin on 50k ounces, that’s nearly $70M/yr. in cash flow vs. Tocvan’s enterprise value of ~$24M. On paper, few companies look this good. With such low cap-ex, Pilar could be in production as soon as 2026-27 and Tocvan will continue to own the vast majority, if not 100% of it.

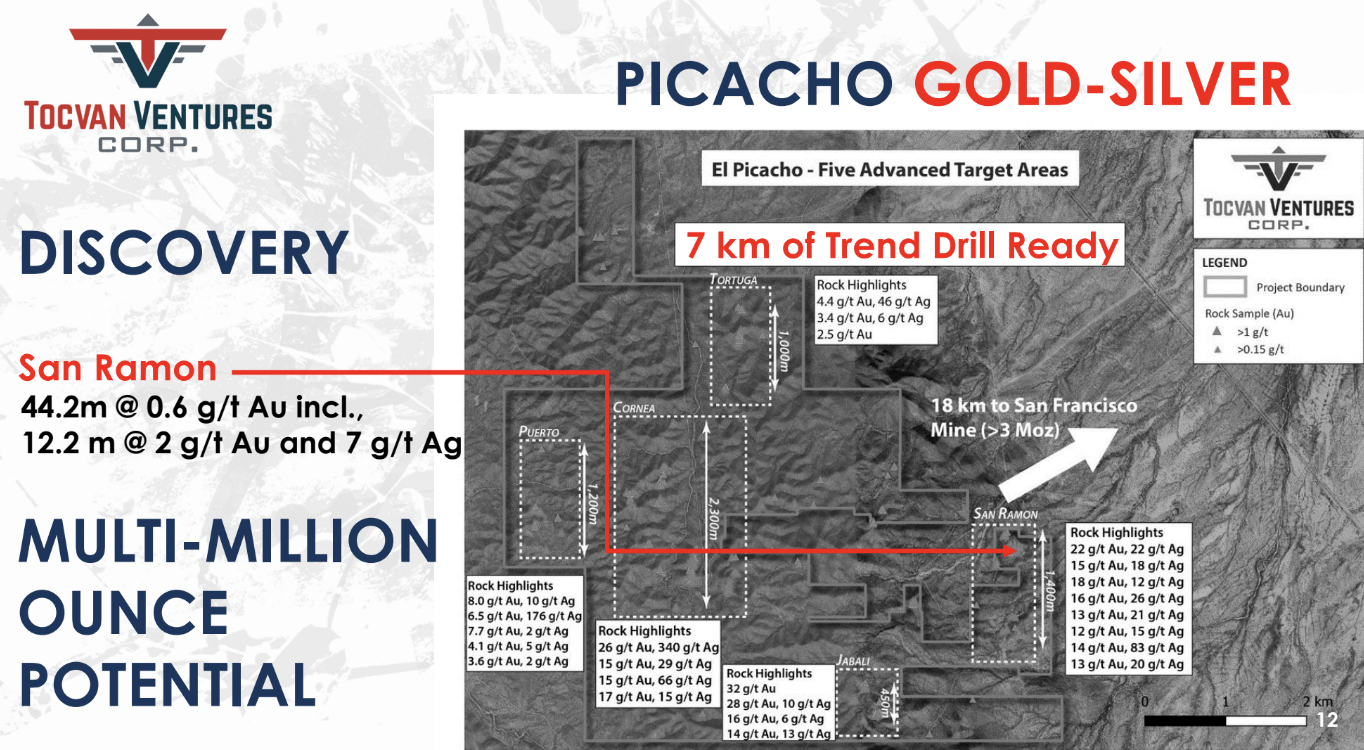

The Company has a second Au/Ag project in Sonora, but the overwhelming focus is on Pilar. The El Picacho project is in a region known for mines like Fresnilo’s [La Herradura, Soledad-Dipolos & Noche Buena], BHP’s Cerro Colorado, and Alamos Gold’s El Chanate.

Five primary zones of mineralization have been identified and there are over six km of prospective trends. Surface sampling & historic workings identified high-grade Au & Ag values. Management sees the potential for the discovery of a multi-million-ounce district.

Tocvan traded as high as $0.77 in April 2023 when the gold price was $1,995/oz. Gold is +19.5% since then, yet the share price is down -36%. In my view, Tocvan Ventures (CSE: TOC) / (OTCQB: TCVNF) offers a compelling risk/reward proposition.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Tocvan Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Tocvan Ventures are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Tocvan Ventures was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply