After hitting $5.20/lb. in May, copper pulled back 13% to $4.55/lb. Is it headed below $4.00/lb., or is this merely a pause that refreshes? On May 20th, copper (“Cu“) was up a remarkable +38.0% year-to-date and is still up a strong +20.6%.

Copper is indispensable for; decarbonization, EVs, renewable energy plants, grid expansions, the “Internet of Things,” data centers, Cloud/AI, supercomputing, robotics, crypto-currency mining, smart homes/cities, and more. Citi, Goldman & Robert Friedland say that $6.80/lb. is a reasonable possibility next year.

China, Russia, Kazakhstan & Zambia are among the world’s Top-10 Cu-producing countries. For geopolitical reasons, the West cannot continue to rely on countries like these.

Chile & Peru are #1 & #2 in Cu production, but high elevations, decades-old mines, falling ore grades, rising costs, water scarcity & local opposition plague S. American mining, with no end in sight.

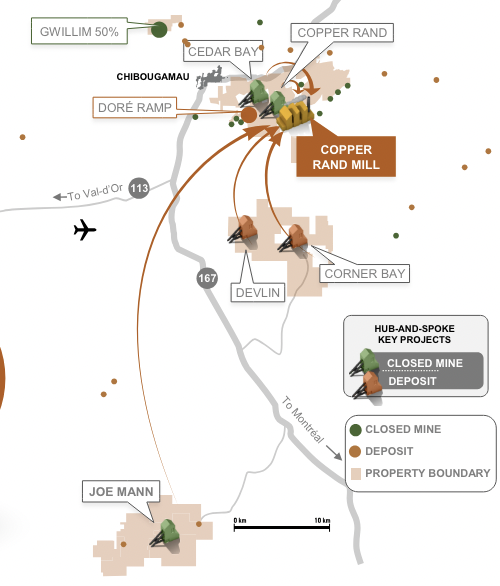

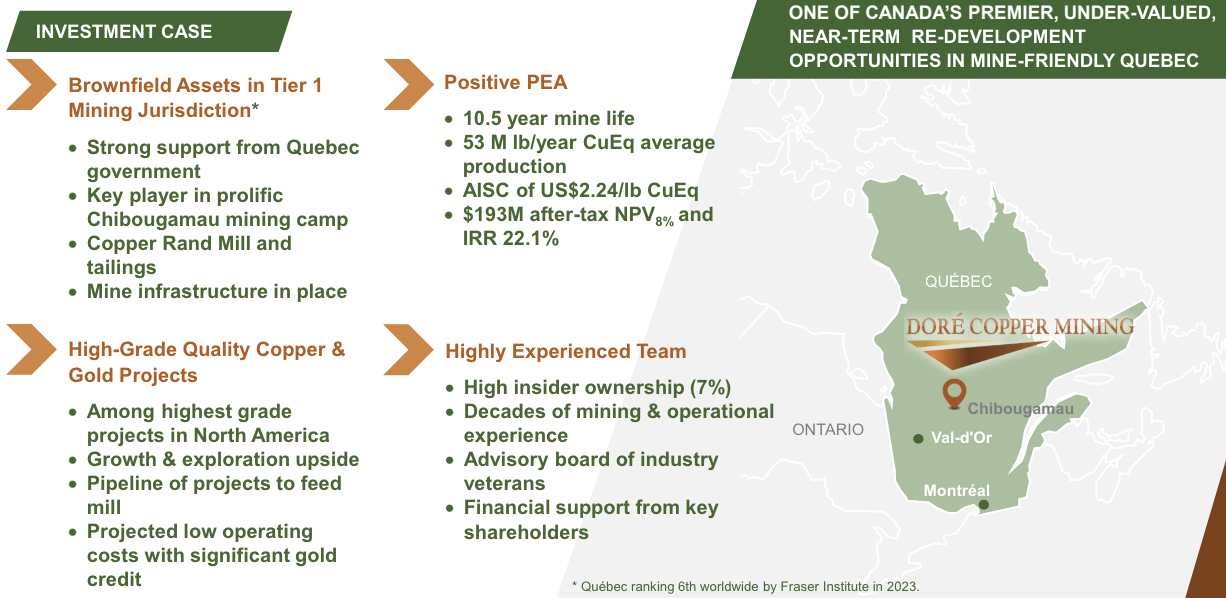

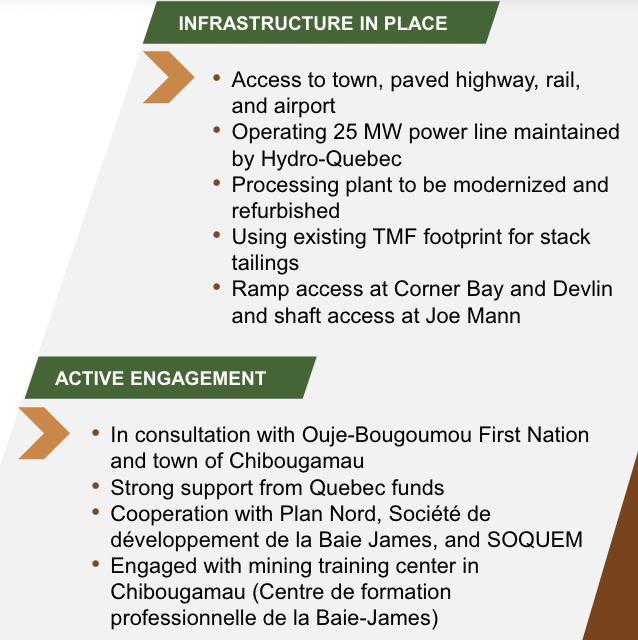

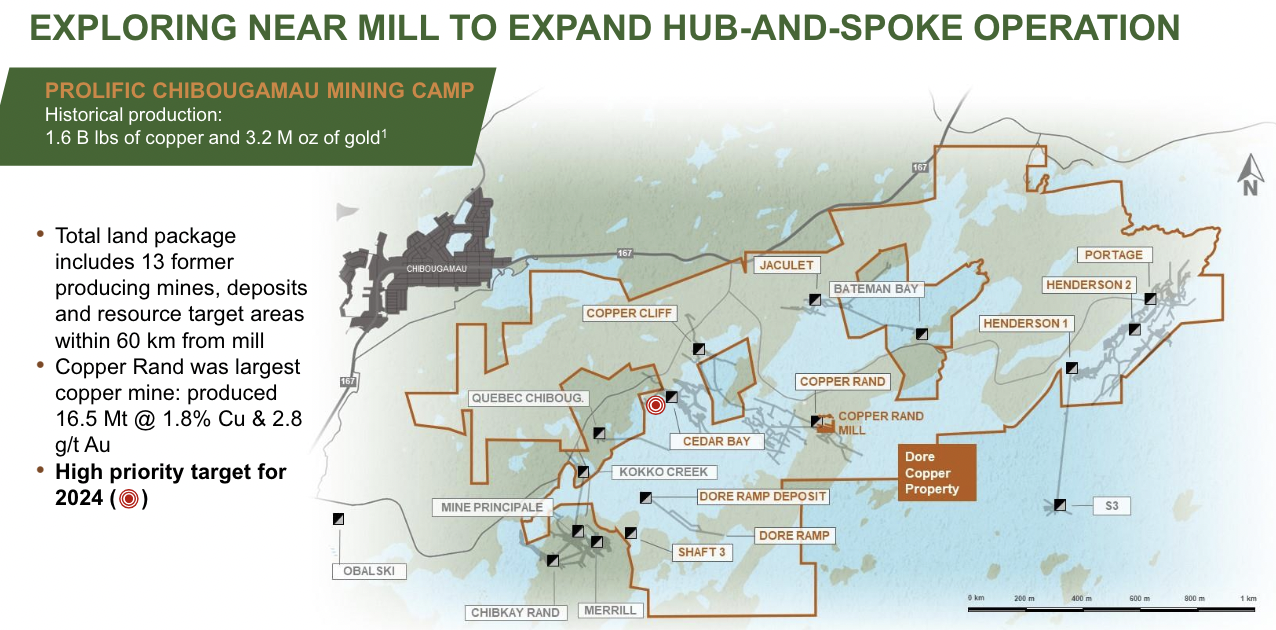

Doré Copper Mining Corp (TSX-v: DCMC) / (OTC: DRCMF) has a very high-grade Cu/Au (brownfield) project in the prolific Chibougamau region of Quebec. It’s surrounded by crucial infrastructure including; roads, power, water, rail, an airport, labor, equipment & services.

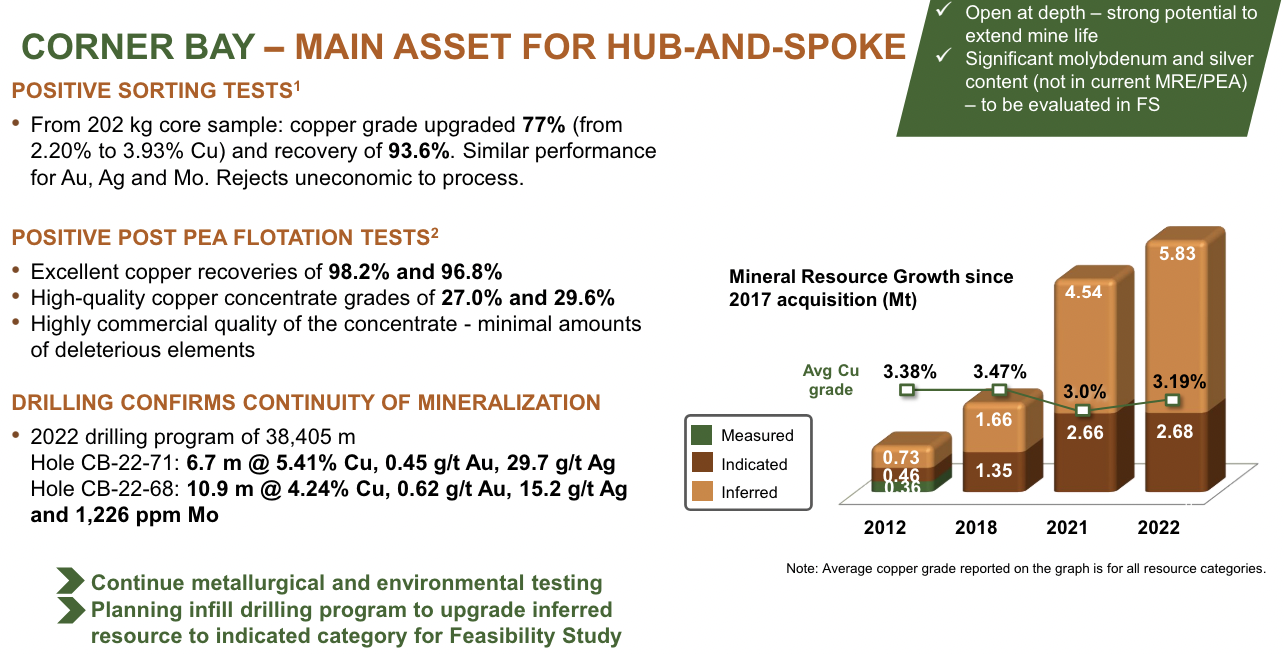

Doré’s land package hosts 13 former mines, deposits & targets within 60 km of the valuable 100%-owned Copper Rand mill. The Corner Bay project represents 82.5% of the already booked 800M+ Cu Eq. pounds.

The Company has a tried & true hub-and-spoke development strategy upon which a Preliminary Economic Assessment (“PEA“) was done in May/June 2022. The PEA is the tip of the iceberg of what a well-funded development effort could deliver. Doré has a strong shareholder base.

From gov’t grants & loans, Quebec institutions, commercial lenders, equipment financing, partially pre-funded off-take agreements & royalty/streaming opportunities, Doré could potentially reach production without excessive equity dilution.

The following interview of CEO Earnest Mast was conducted in the week ended June 7th. Readers are encouraged to view the Company’s new corporate presentation.

Please discuss the significance of Ocean Partners + Equinox Partners owning > 50% of Doré Copper. Might they box out strategic interest from companies like Teck Resources & Glencore?

Ocean Partners & Equinox Partners have been very supportive shareholders. Their ownership does not box out strategic parties. They would welcome a third large shareholder — a Cu company, or perhaps a mid-tier Au company looking to acquire an operation to lower its all-in-sustaining cost (“AISC“) via a valuable Cu byproduct.

While Ocean & Equinox are important shareholders, Doré owns 100% of the 800M+ pounds of Cu Eq. resource. We could sell a minority interest at the project level to help fund and further fast-track initial production.

Please describe the key findings of your 2022 Preliminary Economic Assessment (“PEA”). Why is your team skipping the Pre-Feasibility Study (“PFS”) stage?

The 2022 PEA demonstrated a robust project with a post-tax NPV & IRR of $193M & 22% for the production of > 50M pounds of Cu Eq./yr. over a 10.5-year mine life. Upfront capital is low at $181M and the AISC is competitive at US$2.24lb.

We feel we can skip a PFS because this is a brownfield site. A lot of the typical trade-offs, logistics & flow sheet decisions that make up a PFS are already accounted for, such as the location of the mill & tailings facility, and road access to sites. By skipping a PFS, we will save both time & money.

In what ways might the already strong economics in Doré‘s PEA improve in the upcoming Bank Feasibility Study (“BFS”)?

Great question. Of course, the main opportunity will be from a higher Cu price, as the PEA used US$3.75/lb. Also, we will include silver in upcoming resource models as recent test work indicates we have ~950,000 oz. of payable silver.

We have done detailed flotation test work on a composite Corner Bay sample and determined that we could produce a clean, 28% Cu concentrate vs. the 24.7% concentrate assumption in the PEA.

An increase in concentrate grade will lower smelter treatment terms, increase payment of Cu, and lower transportation costs. Regarding upfront capital costs, the PEA included $25M for an extension to the concentrator & installation of two new filter presses.

We have identified an existing part of the building that can be used (avoiding new construction), and it should be possible to operate with one filter. Readers are reminded that the PEA has a 10.5 yr. mine life and the 100%-owned Rand Copper mill has considerable excess capacity.

Extending mine life and/or mill throughput (including the possibility of toll-milling third-party ores) — could boost project economics.

In addition to operating on a brownfield site surrounded by roads, rail, power, water, people, equipment & services, and supported by strong shareholders & the Quebec government, we have tremendous upside potential in/around explored, underexplored & never explored areas.

Please discuss the most likely (non-equity capital) ways the PEA’s $181M in cap-ex could be funded.

Cap-ex of $181M is not a large hurdle compared to peer cap-ex figures around the world. As a critical metal project, we believe there will be debt funding available from both government & private entities.

Our main deposit at Corner Bay (82.5% of total resources) does not have a royalty or stream on it, making it highly attractive to royalty/streaming players. We also expect to be able to access equipment financing for a mining fleet.

Can you describe the replacement cost in today’s dollars of the exploration studies, permitting, sampling & drilling?

We have a vast land package with multiple past-producing mines. If one looks at just the exploration & studies in areas that have yet to be mined, the replacement cost of that work would be about $75M.

How much time & money would be required to design, deliver studies, permit, construct & commission a 2,700 tpd Mill & tailings facility?

Considerable time, probably 5 or 6 years would be required to select, study, permit, fund & construct an area for the tailings disposal. And the cost to build a new 2,700 tpd mill & tailings facility would be around $125M. The exact number is difficult to pin down. It’s rare to get a capital cost breakdown of a project after it has been built.

In what critical ways are high-grade Cu projects (2%+ Cu Eq.) preferable to low-grade, bulk tonnage Cu plays?

High-grade projects typically have much lower capital intensity than large, low-grade projects. More importantly, they are less prone to cost blowouts. Another advantage is that high-grade operations require less time to build.

High-grade projects have far less environmental impact — less waste & energy per pound of Cu produced. These factors should result in less project execution risk.

With very considerable assets, why is your enterprise value {market cap + debt – cash} just $15M?

Several single-asset juniors have gone bankrupt due to cost overruns and/or poor operational performance. Unfortunately, that negative sentiment has rubbed off on Doré Copper. However, we think that narrative should not apply to us as our project is fundamentally different in several critical ways.

Although at PEA-stage, we will have a BFS out later this year. Depending on nearness to production, BFS-stage projects are valued at 20% to 50% of after-tax NPV. Yet, assuming $4.20/lb. Cu, Doré is valued at just 5% of PEA-derived NPV (pro forma NPV includes a 15% increase in cap-ex).

Regarding capital costs, we’re in an area with established infrastructure and a competitive contractor environment surrounded by existing & past-producing mines. Components of our project can be managed as small independent initiatives.

On the operational side, we have a continuous Cu sulfide ore body that’s not at risk of significant resource calculation errors that have plagued other troubled peers. As we continue to derisk the project, our valuation should start reflecting the true value of our assets.

We see today’s valuation as an attractive opportunity to get positioned. I own ~3.3M shares of Doré Copper and have been buying in the open market for over four years, including at much higher prices.

Thank you for your time, trading at just 5% of after-tax NPV {assuming $4.20/lb. Cu) seems absurd in a bull market. I look forward to further developments at Doré Copper (TSX-v: DCMC) / (OTC: DRCMF) this year!

Readers are encouraged to view the Company’s new corporate presentation.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Dore Copper Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dore Copper Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Doré Copper Mining was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply