Over the past several months, there has been a frenzy of headlines about the U.S. experiencing substantial shortfalls in electric power as soon as next year due to a massive buildout of data centers that serve Artificial Intelligence, supercomputing, the Cloud & cryptocurrency mining.

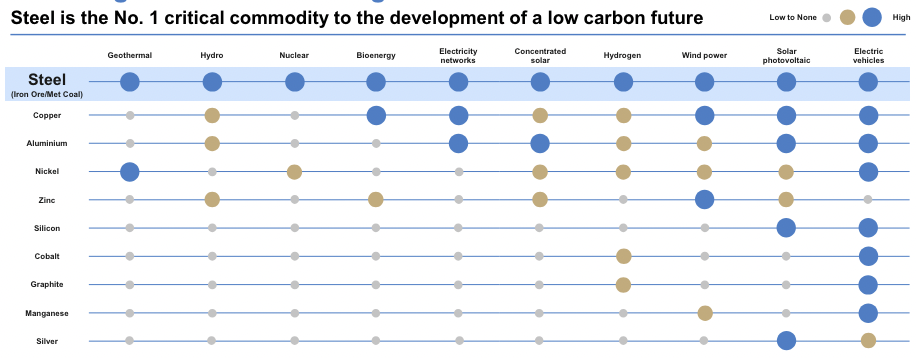

These reports highlight the need for a lot more copper (“Cu“). However, equally important is green steel. Renewable energy plants are BOTH Cu & steel-intensive. The global flat steel industry reached US$558B in 2023. Future Market Insights sees it rising 5.9%/yr. through 2034.

According to consulting group McKinsey...

Also supporting robust steel demand is new construction, especially the emergence of megacities across Africa, and the reconstruction of war-torn cities. Experts forecast that by the year 2075, 4 or 5 of the world’s largest cities will be in Africa. Iron ore is the primary feedstock in steelmaking.

More importantly, clean, high-grade ore, ~68% iron (“Fe”) content, is in high demand for ESG reasons. Pelletizing high-grade, low-carbon iron ore is even better.

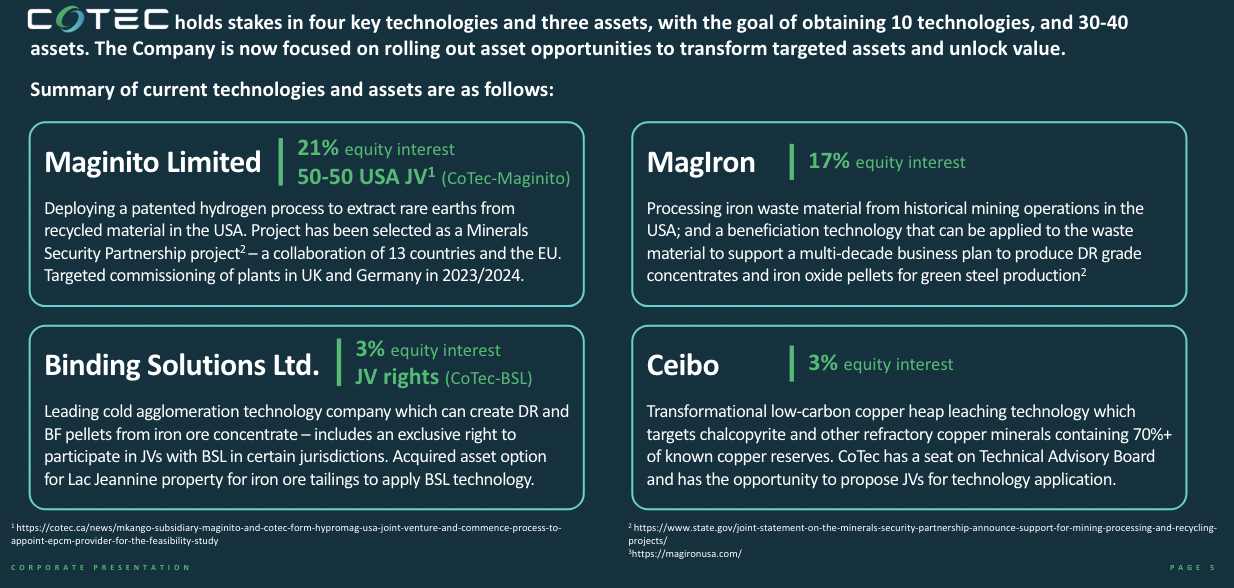

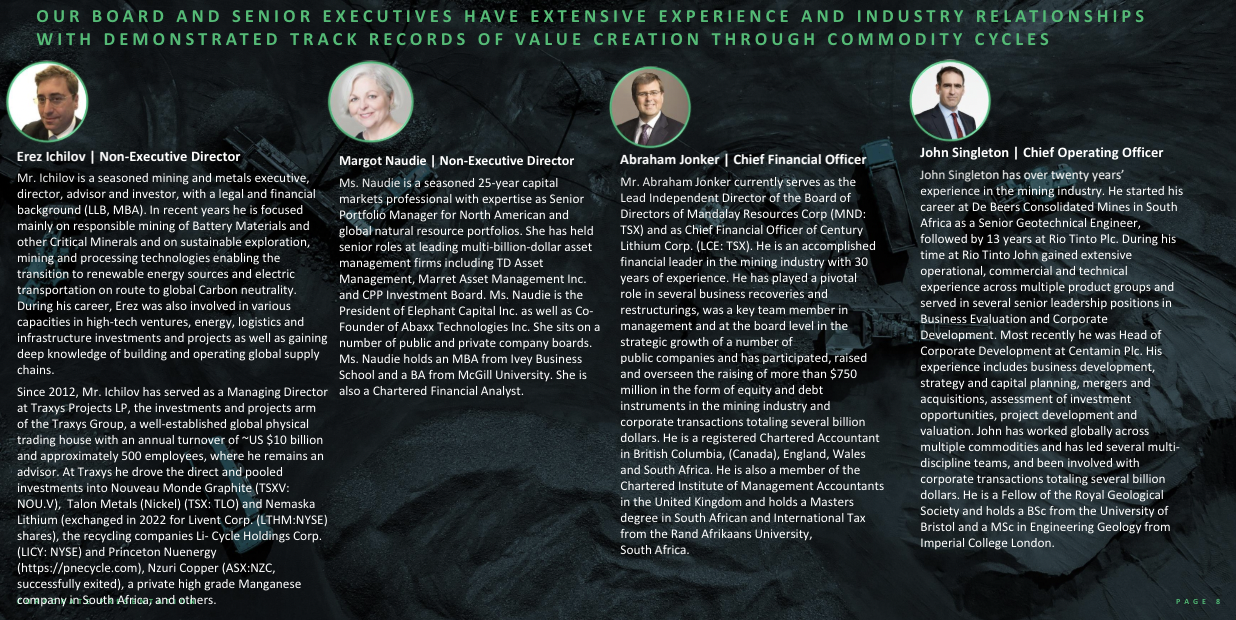

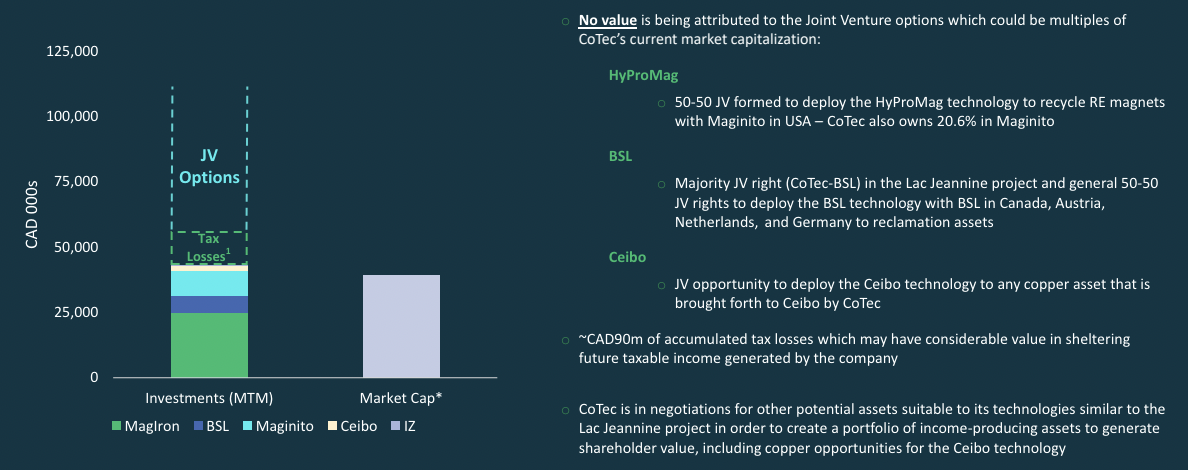

CoTec Holdings (TSX-v: CTH; OTCQB: CTHCF) is an ESG-focused company with minority interests in several disruptive technologies, any one of which could be leveraged into a major Company-maker. The technologies are at advanced stages and well-funded by third parties.

It has a 17% interest in the MagIron iron ore concentrator, with more than 2 decades of feedstock, a 100% interest in the Lac Jeannine Iron Tailings Project in Quebec, a 60% [direct + indirect] interest in the rollout of HyProMag technology in the U.S., and a 3% interest in Ceibo, a low-carbon copper (“Cu“) heap leaching technology.

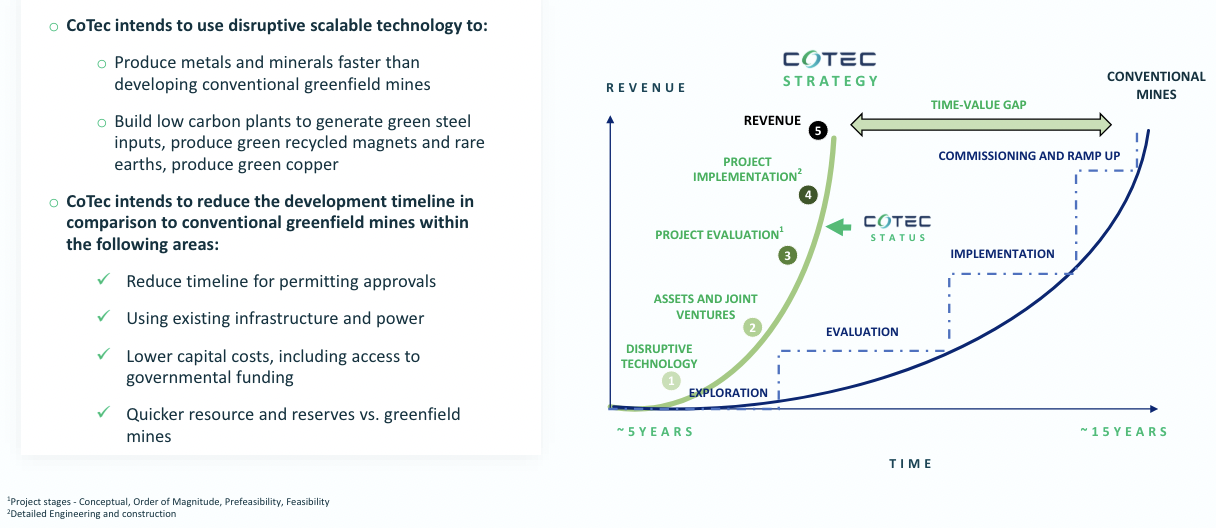

S&P Global recently reported that on average, a major project discovered in 2020-23 will take 18 years to reach production. A sobering finding, and a non-trivial percentage of those projects will NEVER make it. By contrast, CoTec expects its projects to reach production in 3 to 5 years.

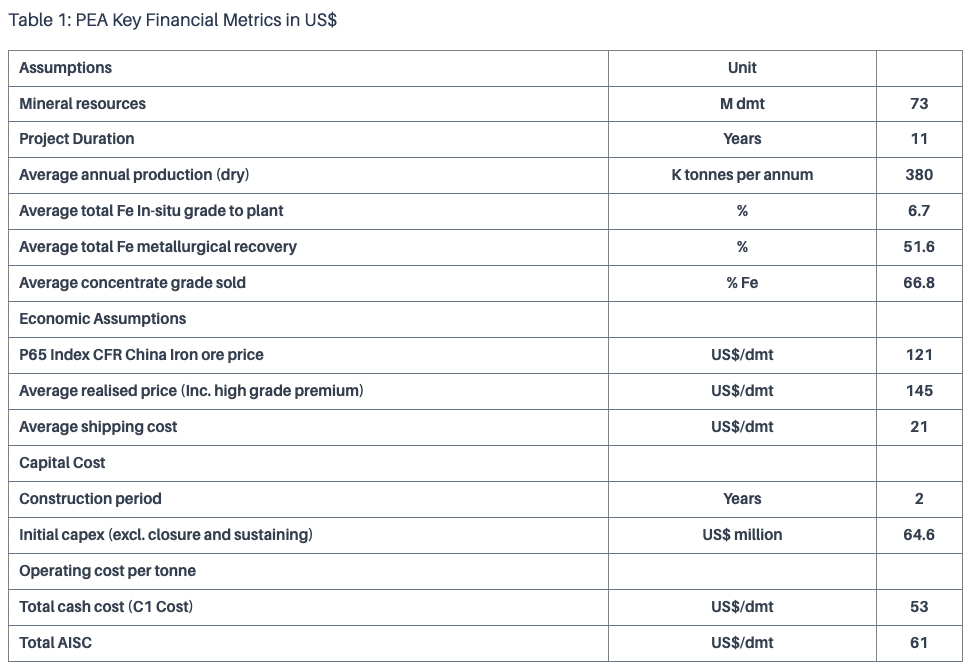

Readers are encouraged to read the images, charts, graphs –> and especially the management bios, in this article. CoTec has tremendous blue-sky potential. Last week the Company reported strong PEA results on Lac Jeannine, one of what will be many projects spanning multiple metals, technologies & jurisdictions.

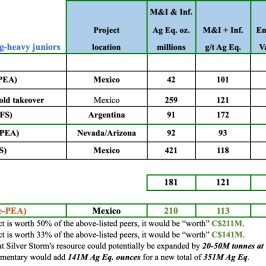

The after-tax NPV & IRR of US$59.5M & 30% are good but fail to tell the whole story. In the PR, the following quote from CEO Julian Treger is important,

“The inclusion of the Adjacent Tailings has the potential to almost double the life of mine [resource size] with no additional cap-ex. We will focus on this strategy as well as several other optimization opportunities to further enhance the exciting results of the PEA.

The surveyed area of tailings has a total estimated tonnage of 145M to 154M tonnes vs. the 73M tonnes included in the PEA. I estimate the NPV could grow to US$100M+ [4x CoTec’s current valuation] in next year’s Bankable Feasibility Study.

A high-grade Fe concentrate of 66.8% is contemplated, but management hopes to get 67.0%+. The PEA is a snapshot in time, it does not include operational & Fe improvements still on the drawing board that could be deployed between now and project commissioning.

Nor does it contemplate the potential to add other disruptive technologies. And, the PEA does not include the potential benefit of low-cost loans, free money grants, government-funded infrastructure / R&D, and tax incentives.

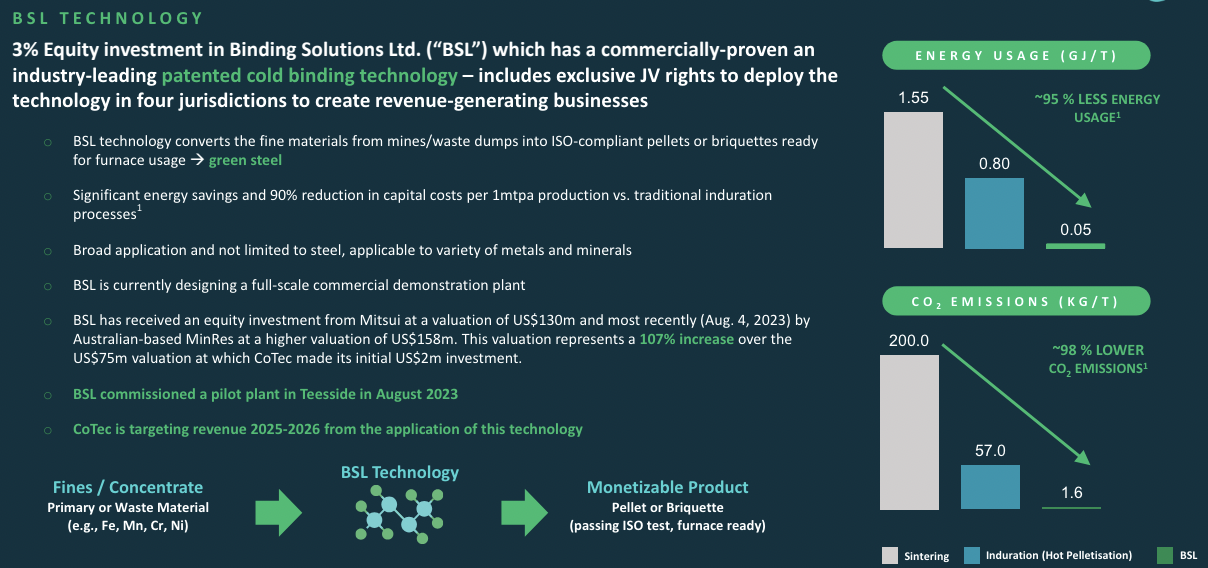

In total, those avenues of funding & assistance could be substantial. And, government support will likely be available, in various forms, for other projects as well. For example, management is studying the use of its licensed Binding Solutions (“BSL“) technology to enhance project economics.

With BSL, fine materials from waste/tailings are converted into iron pellets or briquettes for use in the production of green steel (~70% less carbon dioxide emissions). Energy savings of up to 90% drive capital costs much lower than traditional processes.

It’s not just CoTec that sees BSL as disruptive, both Japan’s Mitsui & Australia’s MinRes are invested. Even if one’s not excited by the caveats presented in the PR pointing to a higher NPV/IRR (subject to drilling & engineering), readers are encouraged to look beyond this single project.

For most mining juniors, there’s typically one flagship asset. Operating improvements are possible, but overall flexibility is low. By contrast, CoTec will get multiple shots on goal by deploying technologies more cheaply, (lower capital intensity), faster, more sustainably (greener), and at a greater scale across multiple sites.

Optimization of equipment & materials and economies of scale will drive margins higher over time. Lac Jeannine alone is not a Company-maker, but that’s kind of the point. No single project will make, OR BREAK, this company.

As management adds several low-cost iron ore tailings projects like Lac Jeannine to its portfolio, economies of scale + logistical/operational synergies, including leveraging BLS, could make this segment a Company-maker.

Numerous projects running concurrently over decades will provide strong revenue growth & diversification (risk reduction) with the expectation of rising margins along the way.

Meaningful cash flows could start in 2026 with the rollout of an entirely different technology in the U.S. HyProMag U.S.A. has been in development for over a decade in the UK with ~US$100M invested to date through the UK & EU governments.

Less than 5% of REE magnets are recycled as existing methods are not that efficient, environmentally friendly, logistically simple, or low cost. CoTec is developing a closed-loop supply chain for Rare Earth Element (“REE“) magnets in key industries.

The size of the opportunity is enormous. REE magnets are required for electrical motors in EVs, wind turbines, and Aerospace & Defense applications.

The U.S. Departments of Energy & Defense could be interested. HyProMag U.S.A. recently appointed DoD Washington insider Linda Lourie as a board advisor to support their efforts to secure Federal funding and roll out the technology in the U.S.

China dominates this critically important supply chain, controlling up to 90% of the market. HyProMag will not only bypass China, it will do so with lower costs, energy consumption & emissions.

It’s quickly scalable through a Hub & Spoke model, enabling long-term security of supply compared to conventional mining practices. HyProMag uses a hydrogen process to reduce electronic scrap into an oxide powder that can be used by CoTec to manufacture new recycled REE magnets.

A core pillar of the future of CoTec is Cu, a key metal for the energy transition. Cu is increasingly being secured as a critical & strategic mineral for Western governments. CoTec has an interest in sulfide Cu heap leaching technology Ceibo in which BHP & Energy Impact Partners are invested.

Ceibo is a low-carbon, non-bio, oxidative leaching technology. Work is based in Chile, where a demonstration facility is planned. CoTec has significant industry experience on its Board (Glencore & Rio Tinto) to assist in finding asset opportunities. Management is collaborating with Ceibo through its Technical Review Board.

Ramping up to a company-wide $100M+/yr. in income won’t happen overnight. Yet, once CoTec’s business model has been proven with successful projects in multiple segments, investors will be able to assess the earnings trajectory. The share price could move well before then.

Companies that enjoy high-quality, growing, long-term, sustainable cash flows trade at premium multiples. For example, gold/silver royalty companies like Franco Nevada & Wheaton Precious Metals trade at an average EV multiple of ~21.5x 2026e EBITDA.

If CoTec can earn US$30M in EBITDA in 2027, it’s valued at < 1x 2027e EBITDA. Assuming 100% equity dilution (hopefully not necessary as gov’t grants/loans, other debt providers & strategic partners kick in), CoTec would still be valued at < 2x 2027e EBITDA. NOTE: That indicative US$30M figure is from HyProMag U.S.A alone.

Will CoTec ever trade like Franco Nevada? Even a half or a third of Franco’s EV/EBITDA multiple would propel CoTec’s valuation into the $100s of millions vs. ~C$32M today. Is it too aggressive to compare tiny CoTec to giant royalty/streaming companies? Consider much smaller companies like Metalla Royalty & Streaming [$344M market cap].

Metalla has a promising portfolio of precious metals projects, at earlier stages, valued at > 20x 2026e annual revenue. The market has line-of-sight on Metalla’s late-2020s & early-2030s revenue/EBITDA and is paying a premium for it.

In some ways, CoTec’s prospects are even better than royalty/streaming companies that endure greater project execution risks (longer timelines, more tenuous local community support, funding hurdles, less direct government assistance, etc.).

If the technologies it has access to are successfully deployed, CoTec will fundamentally change the way metals & minerals are extracted & processed. With projects in Canada, Europe & the U.S., the Company will provide long-term security of supply of clean, green, high-grade iron ore, critical REE magnets & Cu, free & clear of China.

In my view, bypassing China is becoming an ever more important national defense imperative for the U.S. CoTec is well on its way to producing meaningful quantities of critical materials for decades to come. As the market figures this out, CoTec could outperform higher-risk, lower-growth junior miners.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CoTec Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CoTec Holdings are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, CoTec Holdings was an advertiser on [ER], and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply