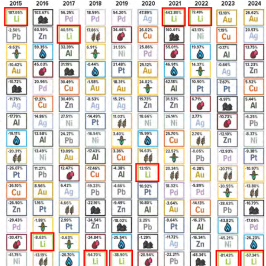

UBS recently raised its price target on #gold (“Au“) to US$2,800/oz., one of the more bullish announcements of the past month. Both Citi & Bank of America said it could reach $3,000/oz. next year.

High-grade, top-quality Au projects achieving production in the next several years in safe mining jurisdictions don’t need $2,800-$3,000/oz., $2,200 would be just fine. On May 20th Au hit $2,450, but has pulled back modestly to $2,370/oz.

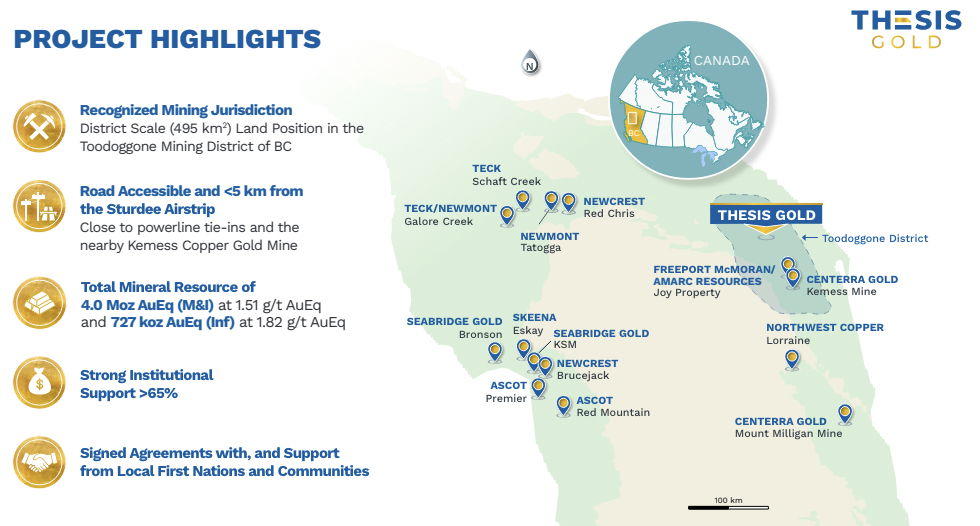

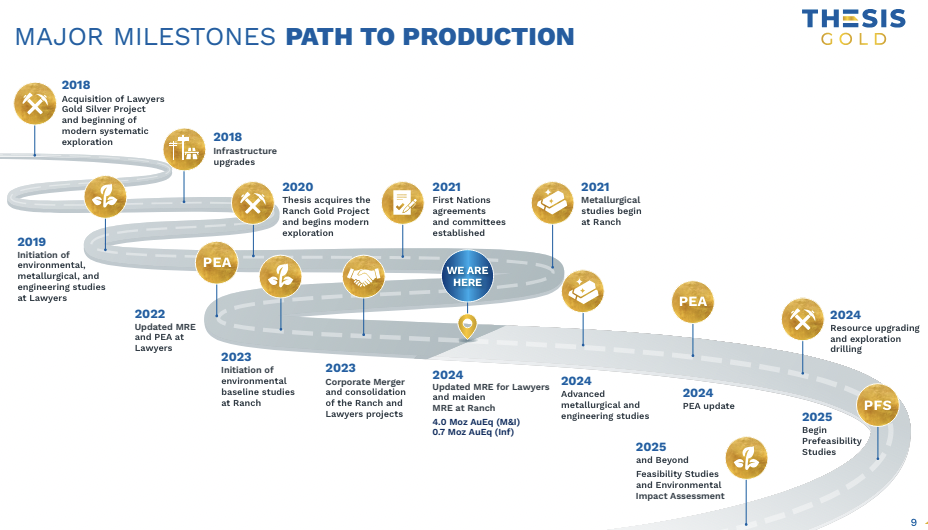

Readers may recall that Thesis Gold (TSX-v: TAU) / (OTC: THSGF) reported a new resource at its combined, 100%-owned, Ranch & Lawyers projects, now called “Lawyers-Ranch.” See new corp. presentation.

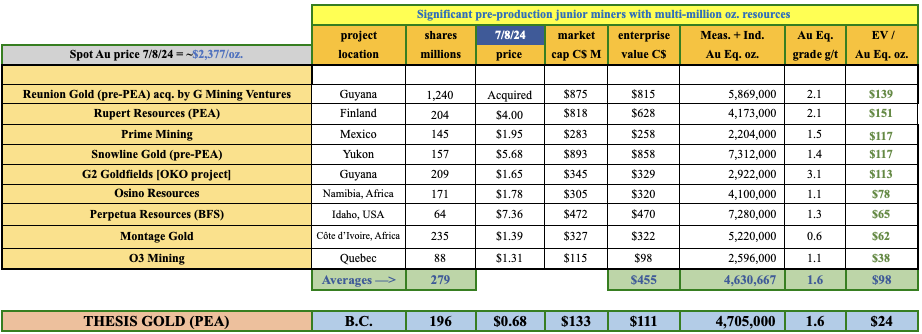

Total Au Eq. oz. is an impressive 4.705M, grading a solid 1.55 g/t. Importantly, 85% is in the Measured & Indicated categories. Silver (“Ag“) accounts for ~25% of in-situ metal value. Ag has outperformed Au this year, it currently sits at ~US$31.05/oz. — down from a recent 12-yr. high of $32.52/oz.

That’s good for those who believe Ag could outpace Au. While I think Au could hit $3,000/oz. in 2-3 years, if/when it does, Ag could be $50-$60/oz. Thesis has 92.3M ounces of Ag, a larger resource than most Ag explorers/developers. That endowment represents an attractive asset for royalty/streaming companies to fight over.

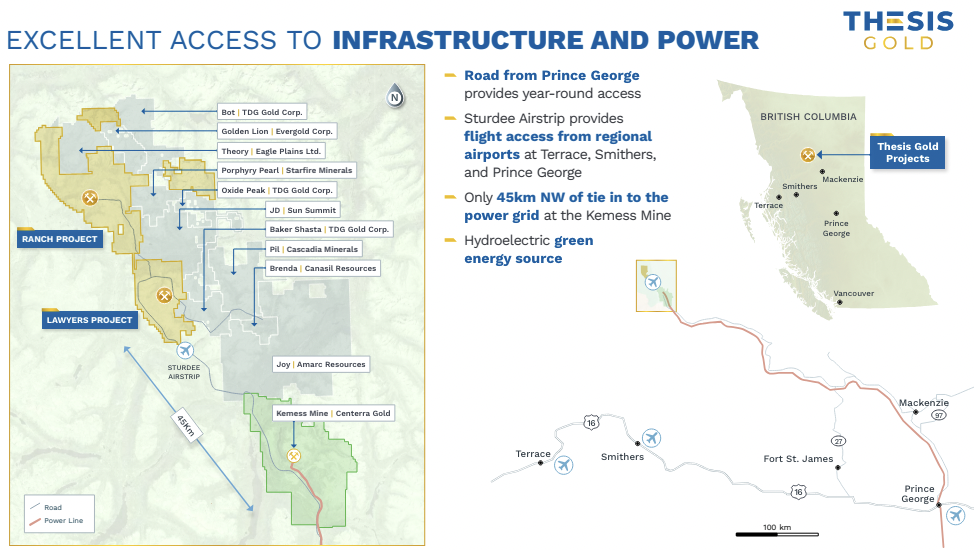

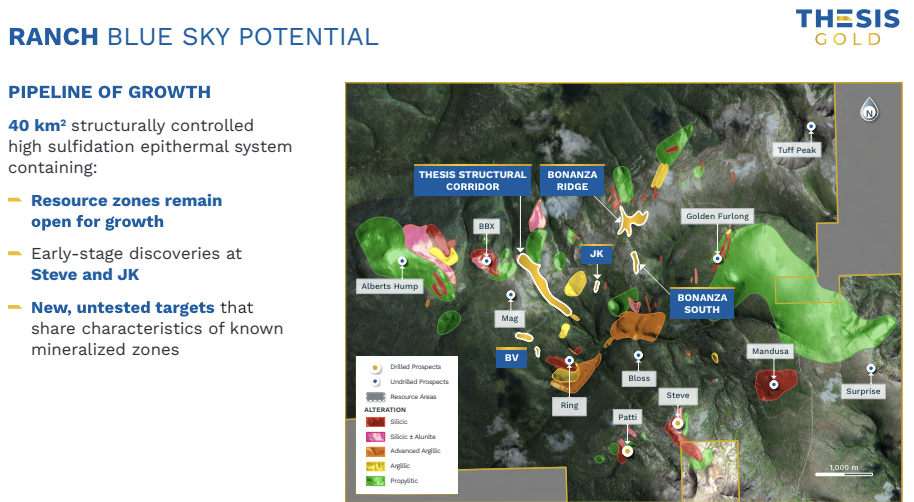

Thesis has mobilized for this year’s exploration of its Lawyers-Ranch project in the prolific Toodoggone mining district of Northern B.C. More than 10,000 m of drilling will be split between infill & expansion in both project areas, focusing on undrilled prospects at Ranch.

This Summer’s field program will focus on geological, engineering, and environmental baseline studies to further derisk the project and start preparing a Preliminary Feasibility Study (“PFS“). The required two years of baseline data collection at Lawyers is complete. Ranch is in year two of its study period.

Among players with assets in B.C., Teck Resources, Seabridge Gold, Artemis Gold, Centerra Gold, Skeena Resources & Tudor Gold have more ounces. Yet, Thesis’ MRE is underpinned by blockbuster intervals such as [4.1 m at 119.5 g/t Au], incl. 2.0 m at 231 g/t Au. That’s a [gram x meter] figure of 484.

2021’s best intervals averaged a whopping 622 g-m! [34 m @ 19.6 g/t] AND [33.1 m @ 17.5 g/t]. The Company is surrounded by; Newmont, Teck, Freeport McMoRan, BHP, Boliden AB, Hecla Mining, Skeena Resources & Ascot Resources.

Agnico, Alamos Gold, SSR Mining, Kinross, Evolution Mining, IAMGOLD, New Gold, HudBay Mining, Eldorado Gold, Victoria Gold & Wesdome Gold have Au/Ag or copper (“Cu“) interests in Canada. At 200k oz./yr., this is a Top-6, pre-construction Au-heavy project in N. America.

Many of the two dozen companies listed above could be interested in acquiring Thesis. In my view, the Company’s 4.71M Au Eq. ounce project is worth more as part of a portfolio of assets held by a mid-tier or Major that benefits from economies of scale, low cost of capital & operating synergies.

For example, Agnico has tremendous Au assets across eastern Canada, but none in the west. Or, consider Centerra with mines/projects very near Thesis, and sitting on ~$890M in cash. In the hands of a larger company, Thesis could be in production sooner than many other high-profile Canadian projects.

If the Au price keeps climbing there could be bidding wars for companies like Thesis. While I’m not counting on a bidding war, imagine if the Au price is $2,500+/oz. and Lawyers-Ranch has a robust PFS on it, with line-of-site to 6M+ Au Eq. ounces…

That sounds (my opinion only) like a $400M company vs. an enterprise value {market cap + debt – cash} of ~$111M today. Thesis has a strong team, led by CEO/President Ewan Webster & Chairman Bill Lytle. See bios here. Note: COO Ian Harris is transitioning to a consultant role.

I talk a lot about M&A because management has said a sale of the Company is the goal over the next few years. There should not be too much equity dilution this year & next, as Thesis is sitting on > $22M in cash.

Industry-wide AISC (averaging ~$1,370/oz. as of 3/31/24), and relatively anemic production pipelines at companies like Newmont & Barrick Gold (~4%/yr. through 2028 at Newmont, < 3%/yr. at Barrick) points to M&A.

Also pushing companies towards M&A are large cash balances, pristine balance sheets, extended timelines from discovery to production, and increased geopolitical risk.

A 200k oz./yr. mine operating on clean, green (hydroelectric) power in B.C., Canada is as good as it gets. Many of the two dozen names mentioned above could comfortably afford to acquire & fund multiple companies like Thesis.

As significant as 4.71M ounces is, that’s merely a stepping stone to potentially booking millions more ounces — mostly from Ranch — with > 20 high-quality targets that have never been drilled.

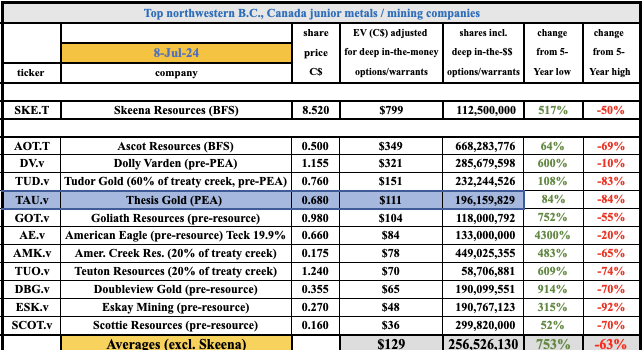

Ranch has 40 sq. km of resource zones, inc. early-stage discoveries at Steve & JK, and numerous untested targets. Thesis is more advanced than B.C’s Dolly Varden, Tudor Gold, Doubleview Gold, Teuton Resources, American Eagle, Goliath Resources, Eskay Mining, American Creek & Scottie Resources.

Last month, Thesis reported strong metallurgy at Lawyers-Ranch from, “gravity pretreatment, flotation & leaching of secondary concentrate, and float tails.” Overall recoveries ranged from 93.9% to 96.6% (avg. 95.6%) for Au & 86.4% to 96.4% (avg. 92.4%) for Ag.

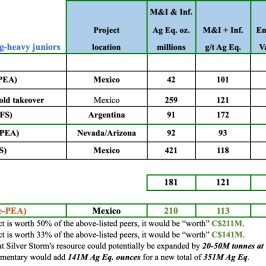

The Company is trading at just $24/Au Eq. oz. in the ground vs. $98/Au Eq. oz. among peers. In bull markets, M&A is often done at 3x-6x that level. In February, Thesis returned more blockbuster results from its Ranch project, including 60.0 m @ 4.5 g/t Au Eq. Ranch is road-accessible, connecting a contiguous 495 sq. km land package.

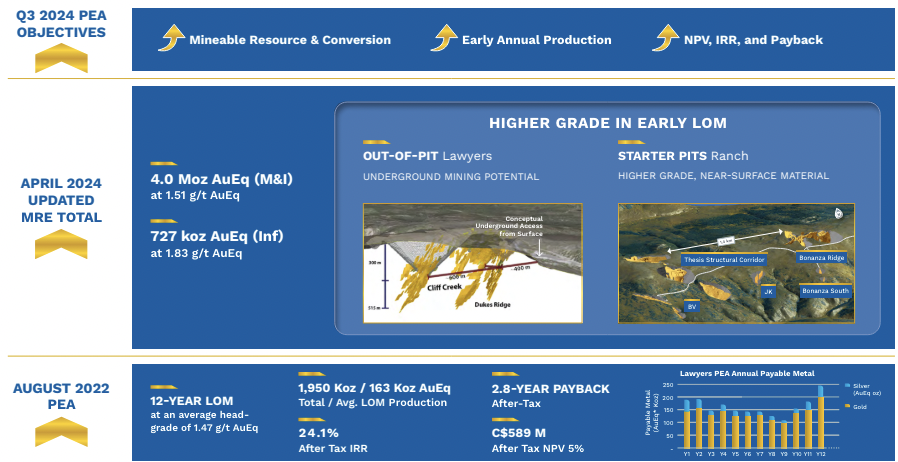

In 2022, a PEA on just the Lawyers project had an after-tax NPV(5%) of C$883M, using an Au price scenario of US$1,995/oz. (+15% on the sensitivities chart). A new PEA on Lawyers-Ranch is coming out this quarter, incorporating the combined resource. See new corp. presentation.

An improved NPV in the new PEA will come from a combination of an increase in annual production, a higher Au price assumption, and higher-grade ounces mined earlier in the mine plan.

By my estimates (not necessarily those of management), assuming a base case Au price of $1,900/oz., (20% below spot) the after-tax NPV should be > C$1B, with a 25%+ IRR, and an AISC < $1,150/oz.

In the above chart of B.C. Au peers, notice the far right column. On average these juniors are down -63% from 5-yr. highs! Part of that is due to equity dilution, but in my view, the market has not adjusted to the new world of prices at $2,200+/oz. Nor do these valuations reflect the coming tsunami of M&A activity.

Notice that Thesis is valued at a 53% discount to the average of Dolly Varden & Tudor Gold. This, despite it potentially reaching production years sooner. Could Thesis one day be valued like the higher-grade Skeena? Even half the valuation would be 3x the Company’s enterprise value.

How much longer will junior miners trade as if Au is at $2,000/oz., not $2,370/oz.? Before long, the best companies (with ample cash liquidity) will rise to the top. I think Thesis Gold (TSX-v: TAU) / (OTC: THSGF) could be among the top quartile or even the top decile of outperformers.

See new corp. presentation

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived or actual errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply