After months of breathless commentary on bullish copper (“Cu“) fundamentals that drove the price to US$5.20/lb. in May, the price has since eased back ~23% to $4.04/lb.

Tepid growth in China, growing global Cu inventories, heightened tensions in the Middle East, and concerns over recessions in other major economies, including the U.S., have contributed to Cu’s pullback.

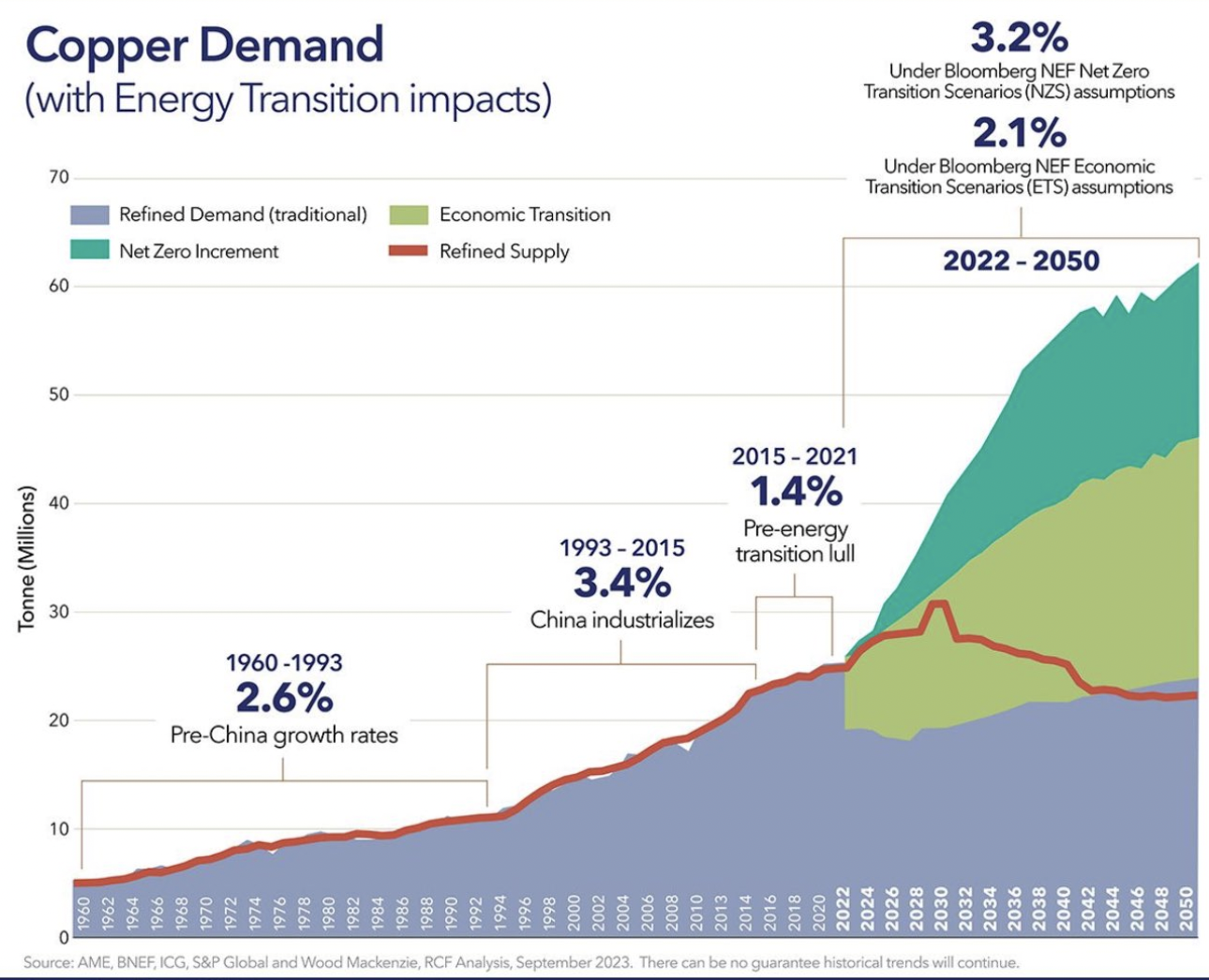

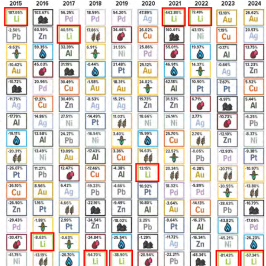

This chart is nearly 11 months old, +3%/yr. Cu demand growth through 2050 seems likely…

Many, including me, believe this move is temporary as longer-term fundamentals remain strong. For example, globally, mined supply is at risk. Annualizing the world’s largest producer CODELCO’s first half of 2024 Cu production to ~1.3M tonnes, it would be down -31% from 2015’s ~1.9M tonnes!

On August 13th, a strike at BHP’s/Rio Tinto’s Escondida — the world’s largest mine — started. And, > 50% of today’s Cu production, most notably in the High Andes of S. America, is in areas with elevated or severe water stress.

Desalination plants are being used to address water scarcity, but pumping treated seawater 50-150 km, often up 3,000+ meters, is cap-ex, op-ex & energy-intensive, and materials-intensive (steel, concrete). The incentive price to get most large greenfield projects built is > $5/lb.

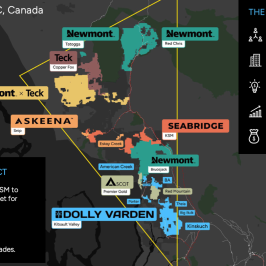

Notice that BHP & Lundin Mining used this pullback as an opportunity to acquire Filo Mining in a ~$4.5B transaction. Filo’s project has been well-known for years, why did BHP/Lundin pounce now? And, why did BHP try to acquire Anglo American? For the Cu! All roads lead to projects in Western-friendly countries near major markets.

Copper deficits are coming, it’s only a question of how soon & how large they will be. Canada is leading the charge to supply the world with iron ore, Cu, potash, uranium, coking coal & gold (“Au“), + REEs & lithium later this decade.

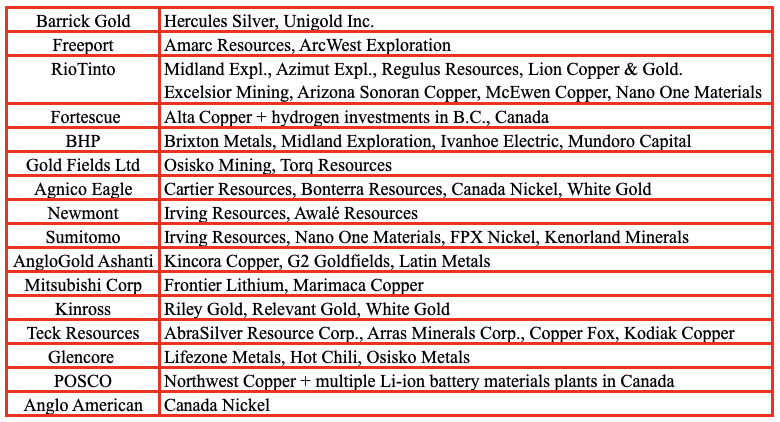

A lot More M&A is expected, most notably Teck Resources possibly acquired by; Rio Tinto, BHP, POSCO, Anglo American, Vale, Newmont, Barrick, Grupo México, Freeport McMoRan, Fortescue Metals, or Glencore.

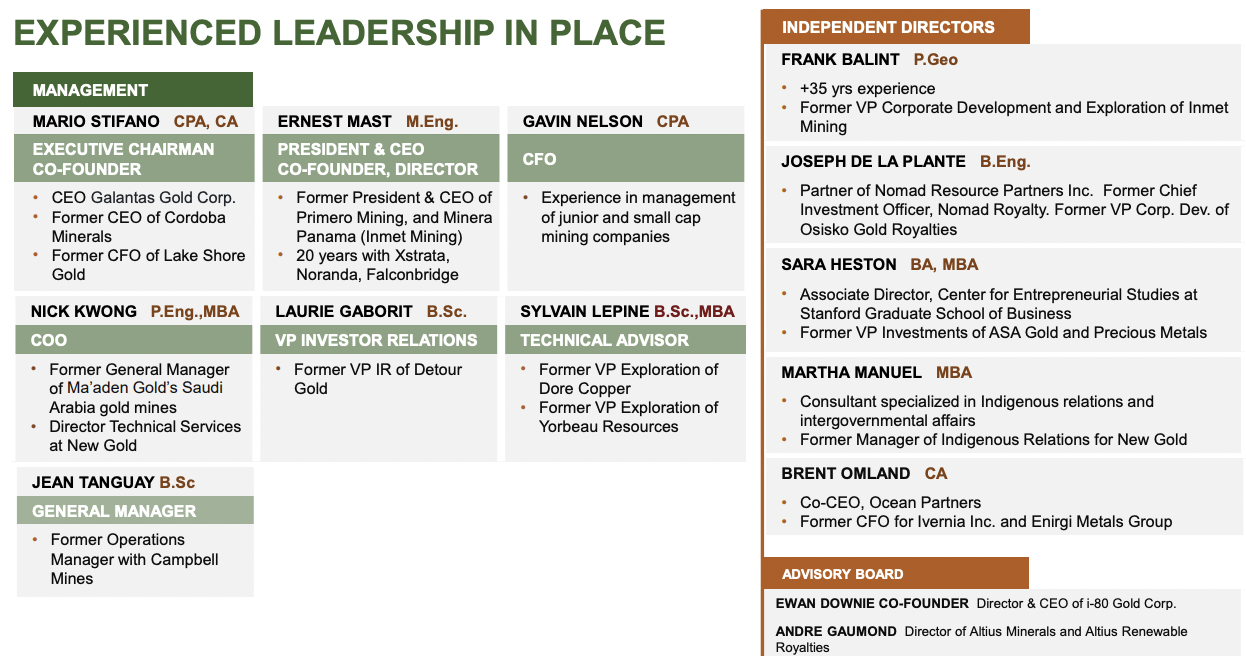

Of those dozen, all are invested in junior miners {see chart below}. Notice I listed two Au Majors as potential suitors of Cu-heavy assets. Both tout their credentials in Cu to complement primary Au portfolios. This year, Barrick & Newmont are guiding to production of 430M & 335M pounds of Cu.

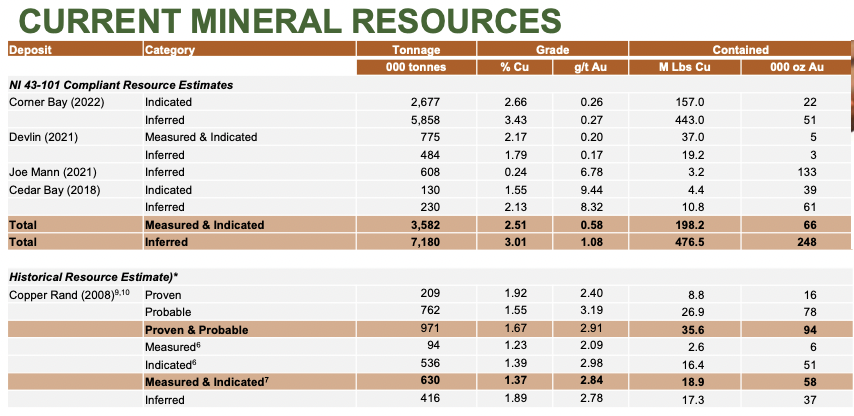

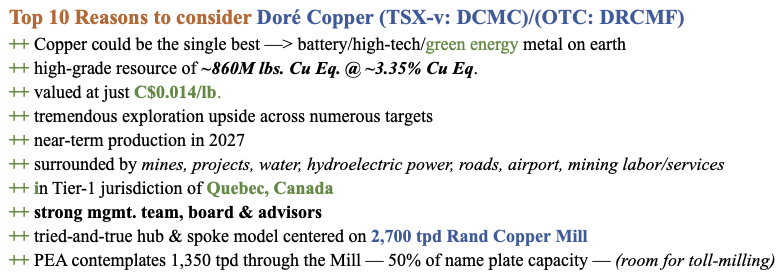

One of my favorite Cu plays is Doré Copper (TSX-v: DCMC) / (OTC: DRCMF), with very high-grade Cu/Au assets in Quebec. How high-grade? At spot prices, the combined resource is 3.35% Cu Eq. or 3.8 g/t Au Eq. due to the Joe Mann & Cedar Bay resource grades of 6.8-9.4 g/t Au (see chart below). Total Cu Eq. pounds is ~860M.

The Company is probably not going to be acquired by a Major anytime soon, but it could partner with one of the above-mentioned companies or with dozens of other producers. Under a billion pounds Cu Eq might not sound like much, but the potential for production in 2027 is a key selling point.

How much might near-term production of high-grade Cu/Au in a Tier-1 jurisdiction be worth? In my view, a lot more than the current C$0.014/lb. in the ground, especially as the Company has tremendous exploration upside. {see incredibly detailed corporate presentation}

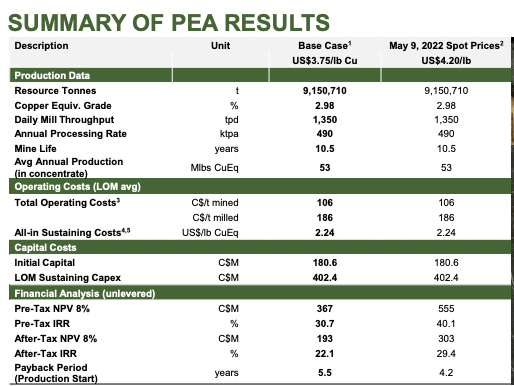

Looked at another way, at US$4.20/lb. Cu, Doré is valued at roughly 5% of its pro forma after-tax NPV (includes increases of 15% in cap-ex + 10% in op-ex, since mid-2022 PEA). That’s absurdly cheap.

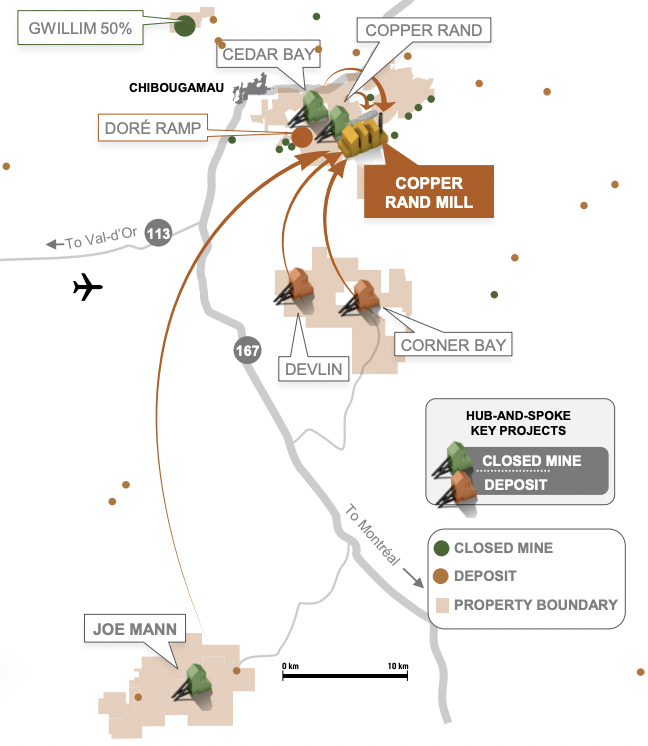

Doré is surrounded by crucial infrastructure including; roads, power, water, rail, an airport, labor, equipment & services. Its land package hosts 13 former mines, deposits & target zones within 60 km of the 100%-owned, 2,700 tonne/day Copper Rand Mill.

Doré recently completed two drill holes totaling 1,392 m and successfully extended the Southwest zone of the former Cedar Bay Cu-Au mine, which is roughly five km from its Copper Rand mill.

The Southwest zone is located 300 m SW of the Cedar Bay mine Main zone and was partially developed in the late-1960s on two levels (114 m & 200 m). The best results from historical drilling in the Southwest zone include; 5.2 m of 2.56% Cu, and [3.9 m of 2.22% Cu + 1.3 g/t Au].

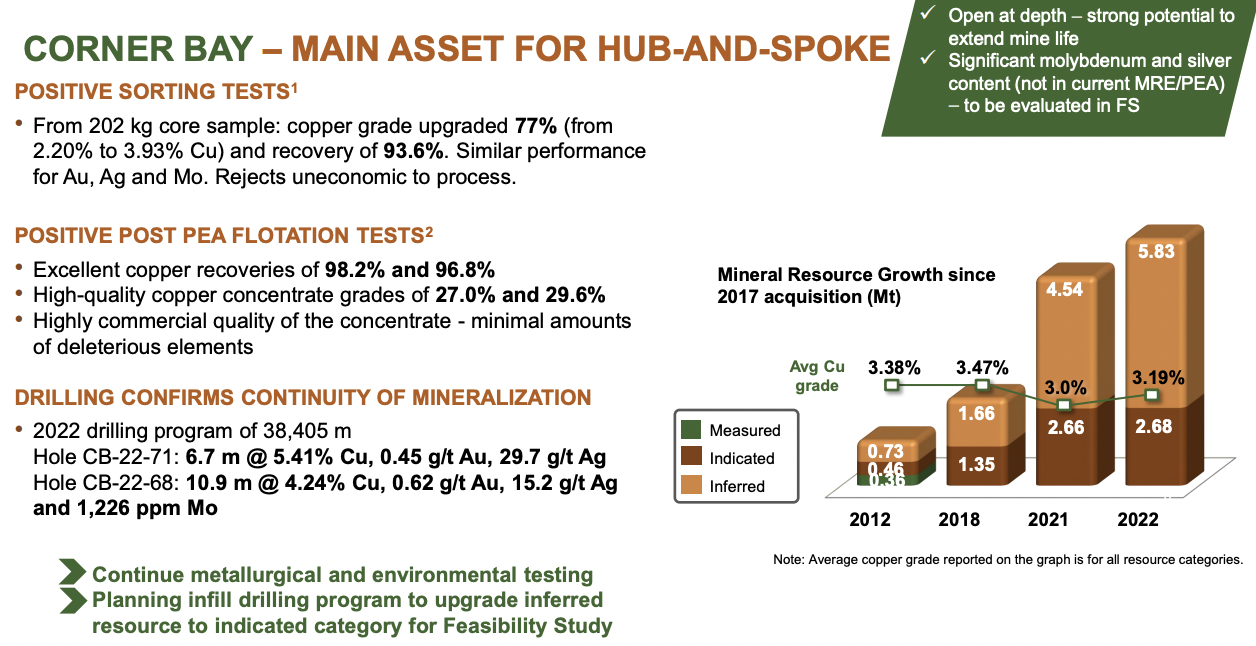

The flagship Corner Bay [“CB”] project represents ~82.5% of the ~860M lbs. [Cu Eq. at spot prices]. The Company is pursuing a tried-and-true hub & spoke development strategy upon which the PEA was done.

In total, ~1,080 m of a potential extension to the Cedar Bay Southwest zone along strike to the SE, had never been tested. These holes intersected two Cu zones. Hole CDR-24-09, 1.6 m of 1.06% Cu + 20.7 g/t silver (“Ag“), incl. [0.6 m of 2.82% Cu + 54.8 g/t Ag + 0.33 g/t Au] at a vertical depth of 414 m.

Doré Copper’s hub & spoke model centered on Copper Rand Mill…

Hole CDR-24-10 intersected a wide shear structure of 130+ m (true width). Cu mineralization was also intersected twice, including at a vertical depth of 541 m with 0.4 m of 1.70% Cu + 2.03 g/t Au. (~3.3% Cu Eq.).

The strong alteration footprint intersected in the second hole is promising as it indicates ~400 m of strike length that’s untested. Doré received a grant from the government of Quebec of ~$182k toward the drilling.

These most recent results are not blockbusters but demonstrate additional smoke as the technical team zeros in on the fire. Management plans down-hole geophysics to locate stronger conductors near & along the structure.

The northern strike extension of CB has never been tested on the new claim group. Access to the new claim group provides an additional 800 m along strike to test the possibility of a mineralized extension.

“The acquisition of SOQUEM’s claim group further consolidates the land position around our flagship Corner Bay deposit. High-grade Cu shear zones, with similar mineralization, have already been identified. There are also indications that the Corner Bay deposit could extend northwards into the newly acquired claims.”

An exciting target is the area of intersection between the N-S CB shear zone and the NW-SE shear zones of the new claim group. President & CEO Ernest Mast commented,

“We have confirmed the extension of the Cedar Bay Southwest structure towards the Lac Dore fault… We are very excited by the strong alteration in a wide shear zone characteristic of the large Cu-Au ore bodies in the camp, including our Copper Rand & Cedar Bay mines. The next step is to conduct a down-hole geophysical survey (pulse EM) to identify the potential for larger mineralized zones along the structure, followed by additional drilling.”

The Cedar Bay mine operated from 1958 to 1990, mining 3.9M tonnes grading 1.56% Cu + 3.22 g/t Au (~4.2% Cu Eq.) Ore from the mine was processed at the Copper Rand mill. The deposit was mined to a depth of 670.5 m. The existing shaft extends to a depth of 1,036 m.

In 2018 Doré completed four holes totaling 4,842 m and reported an Indicated resource of 130,000 tonnes at 9.44 g/t Au + 1.55% Cu, and an Inferred resource of 230,000 tonnes at 8.32 g/t Au + 2.13% Cu.

At spot prices that’s ~130k Au Eq. ounces just at Cedar Bay. In 2020 the Company completed 9,025 m of drilling, successfully extending several mineralized lenses. In other news, management is acquiring a 56.4% interest in a group of contiguous claims (446 hectares) immediately north & east of CB.

The new claim group had exploration during the 1970s with 36 diamond drill holes (7,610 m) and another 28 holes (5,327 m) in the 1990s. Several parallel shear zones were identified over a strike length of 1.4 km.

Mineralized zones have been tested to a vertical depth of 400 m. Significant intercepts include; 13.2% Cu over 0.6 m, 5.5% Cu / 2.4 m, incl. 13.9% Cu / 0.8 m, 8.9% Cu / 0.9 m, 12.5% Cu / 0.4 m, 15.3% Cu / 0.8 m, 9.8% Cu / 1.25 m and 12.4% Cu / 0.9 m.

As the Cu price bounces back above US$5/lb., — timing unknown — but I believe within six months, high-quality companies like Doré Copper (TSX-v: DCMC) / (OTC: DRCMF), with so many positive attributes, could see a nice bounce from C$0.10/shr. The share price touched $0.14 in May… {see Corp. Presentation}.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Dore Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dore Copper are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dore Copper was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply