Wow, it finally happened! The spot gold (“Au“) price closed above US$2,500 on August 16th, currently at $2,530/oz. The significant move higher, +11% since early May, is attributed to lower U.S. inflation numbers paving the way for imminent interest rate cuts.

Major investment banks UBS, Citi, GS & BofA are calling for $2,700-$3,000/oz. next year. Interestingly, the midpoint of $2,850 is just +13% away…

A tsunami of M&A is rolling in. Recent deals in the Au space are highlighted by Gold Fields acquiring Osisko Mining for its 50% interest in the high-grade Windfall project in Quebec.

Gold Fields is paying roughly $400/oz. for the Bank Feasibility Study (“BFS“) stage project. That’s a very robust takeout metric that should reverberate across the sector.

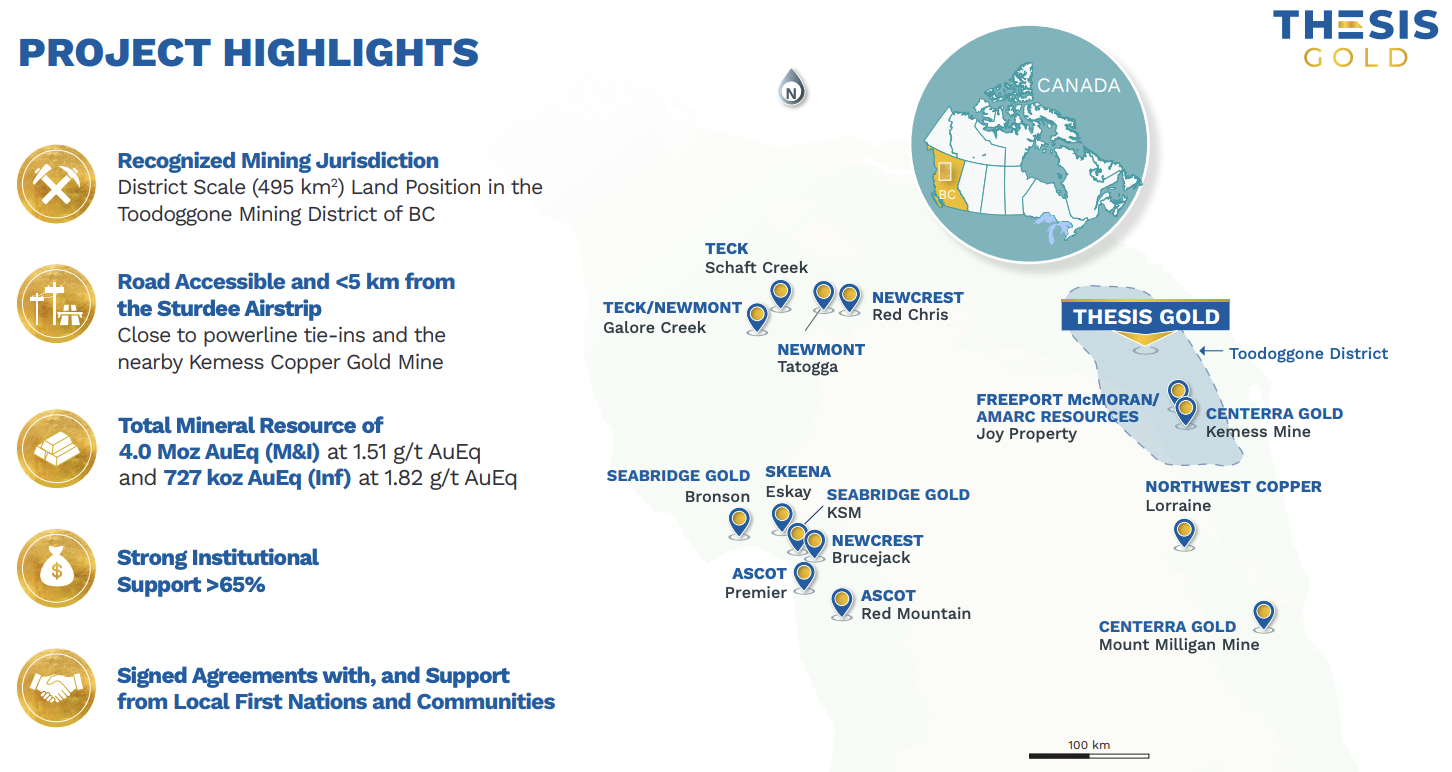

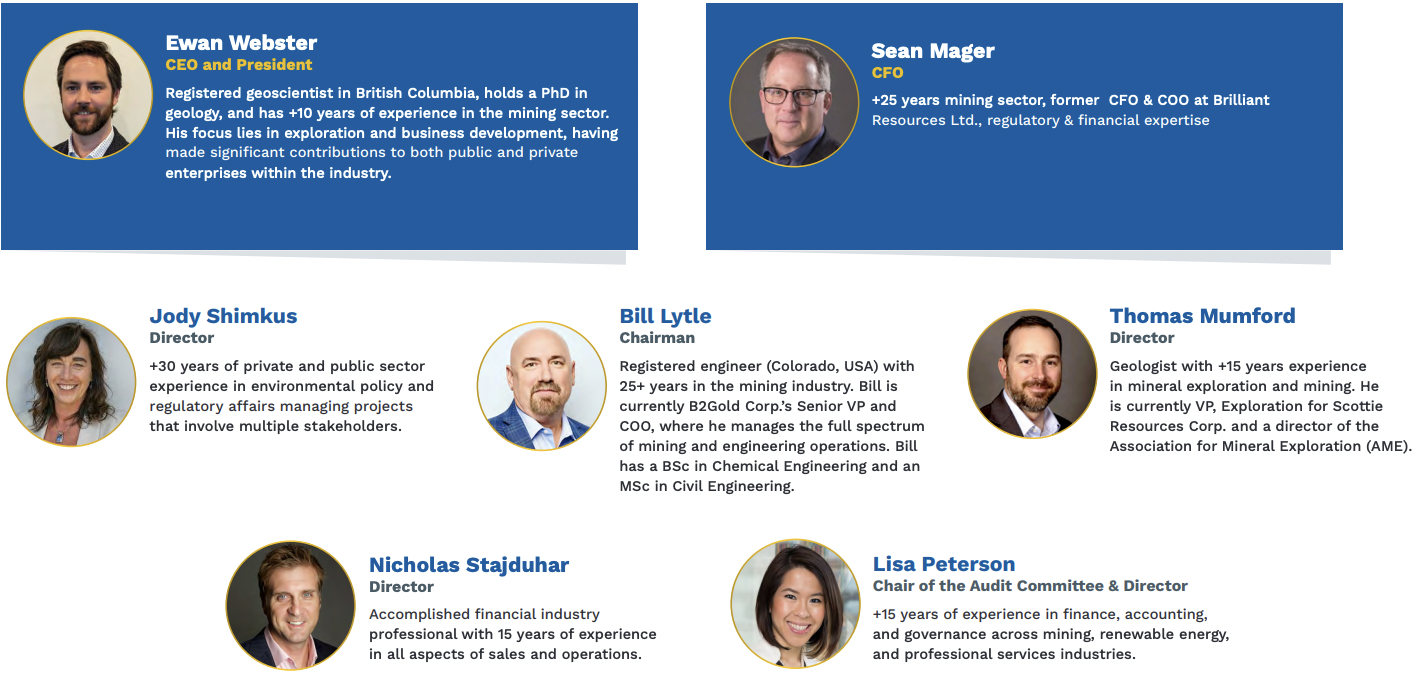

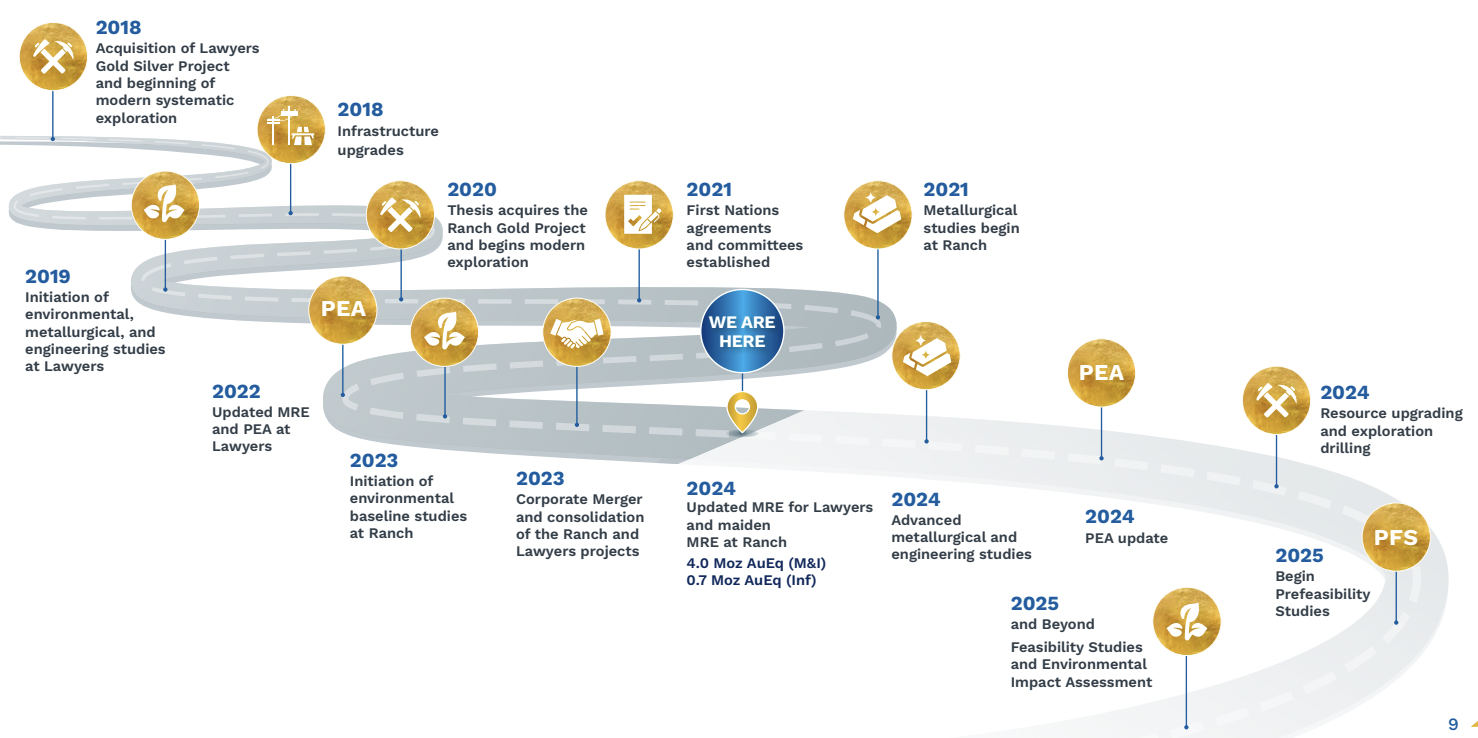

What might that transaction mean for PEA-stage Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF)? Thesis is in the right place, at the right time. The Company recently received an amended Mines Act permit at its 100%-owned Lawyers-Ranch project in north-central British Columbia. CEO Ewan Weber commented,

“This permit enables us to systematically advance our exploration & engineering efforts with the ability to conduct extensive drilling and continue our comprehensive geological & environmental studies. The upcoming release of our PEA will be a major catalyst, providing valuable perspective & insights into the project’s economic potential.”

Thesis has 4.71M Au Eq. ounces grading a solid 1.55 g/t. Importantly, 85% of those ounces are in the Measured & Indicated categories. At spot prices, silver (“Ag“) accounts for ~29% of in-situ metal value. An updated & enhanced PEA is expected shortly.

The impressive Ag endowment is perfect for those who believe Ag could outpace Au. Most people are learning that solar panels require Ag, that content per panel is rising, and that solar deployments are soaring (led by China). Perhaps less appreciated is Ag’s usage in Electric Vehicles.

New solid-state Li-ion batteries require more Ag than existing EVs and could add 100s of millions of ounces/yr. of incremental demand by the end of the decade. By contrast, mined Ag production stands at roughly a billion ounces/yr.

Silver’s high tick in 1980 of US$49.45/oz. equates to ~$202/oz. in today’s dollars! Compare that to the current spot price of just $29.82/oz. While I think that Au could hit $3,000/oz., if/when it does, Ag could be $50/oz.

So far, Thesis has booked 92.3M ounces of Ag, a larger resource than most Ag explorers. Nearly 100M ounces of Ag is a desirable asset for royalty/streaming companies to fight over.

Note: {all else equal, if Au were to rise to $3,000/oz., and Ag to $50/oz., total Au Eq. ounces at Lawyers-Ranch would increase to 5.175M}. As significant as 4.71M Au Eq. ounces is, that’s merely a stepping stone to potentially booking millions more in the coming years — mostly from Ranch — with > 20 undrilled targets.

Thesis’ resource estimate is underpinned by blockbuster intervals such as [4.1 m at 119.5 g/t Au], incl. 2.0 m at 231 g/t, a [gram x meter] figure of 484. And, in 2021 two intervals averaged a whopping 622 g-m! [34 m @ 19.6 g/t] AND [33.1 m @ 17.5 g/t]. Globally, those are Top-decile results.

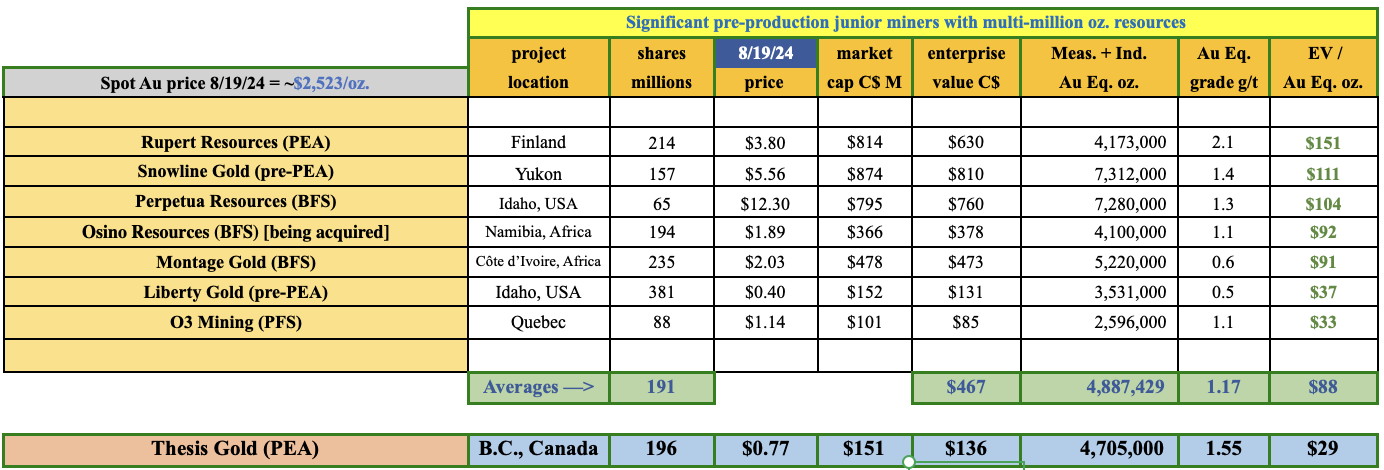

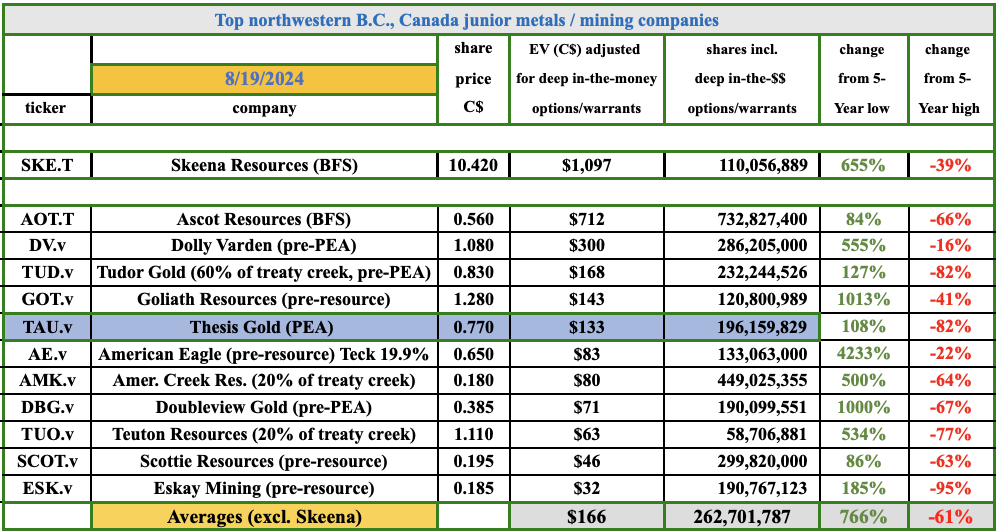

Notice that Thesis is valued at a 44% discount to the average of Dolly Varden & Tudor Gold. This, despite it potentially reaching production years sooner. Could it one day be valued more like higher-grade, BFS-stage, Skeena Resources? Even half of Skeena’s valuation would be roughly 4x the enterprise value {market cap + debt – cash} of Thesis.

Osisko’s high grade (10 g/t Au), and more advanced project make its ~$400/oz. takeout an apples-to-oranges comparison to Theisis. Still, Thesis is valued at just $29/oz. while peers are valued at an average of $88/oz.

Osino Resources is also more advanced than Thesis, but its grade is -29% lower and its flagship project is in Africa. Osino is being acquired for $92/oz. In my view, the universe of prospective suitors for Thesis is far larger than for others on the chart.

Among juniors with meaningful assets in B.C., Seabridge Gold, Artemis Gold, Centerra Gold, Skeena & Tudor have more resource ounces, attracting a lot of attention to the Province. Newmont, Teck, & Centerra are prime suspects, they should want to acquire Thesis.

In addition, Freeport McMoRan, BHP, Barrick Gold, Agnico Eagle, Boliden AB, Hecla Mining, Alamos Gold, Sumitomo, SSR Mining, Kinross, Evolution Mining, IAMGOLD, New Gold, Hudbay Mining, Eldorado Gold & Wesdome Gold have Au/Ag or copper (“Cu“) interests in Canada.

I recognize I sound like a broken record, always name-dropping potential suitors, but Au just topped $2,500/oz., M&A is picking up, and Ag could become a real winner for Thesis.

Industry-wide AISC (averaging ~US$1,360/oz. as of 6/30/24), plus relatively anemic production pipelines, also point to more M&A. Newmont’s 2nd qtr. AISC came in at $1,562/oz. and Barrick’s at $1,498/oz.

With Au > $2,500/oz., producers are printing money, they’re stacking so much cash they need to make acquisitions to justify soaring valuations. Majors currently have pristine balance sheets with net debt / EBITDA ratios well under 1x.

In my view, the Company’s growing 4.71M Au Eq. resource is worth more in a portfolio of projects/mines held by a mid-tier or Major benefiting from bullet-proof balance sheets, economies of scale, lower cost of capital & operating synergies.

Lower U.S. interest rates could propel precious metal prices higher while lowering companies’ cost of capital at the same time! Many of the companies shown below could be interested in acquiring companies like Thesis Gold with promising assets in Canada.

By my estimates, (not those of management), assuming a base case Au price of $1,900/oz., (~25% below spot) the after-tax NPV should be > C$1B, with a 25%+ IRR, and an AISC < $1,150/oz. Importantly, there should not be much equity dilution this year & next. I estimate the Company has ~$15M in cash.

Management has enough liquidity to continue drilling and deliver a PFS next year. After next year’s drill season, Thesis could have line-of-site to 6M Au Eq. ounces at Lawyers-Ranch. Six million ounces in a robust M&A environment could be worth $100/oz., yet the current enterprise value is $133M.

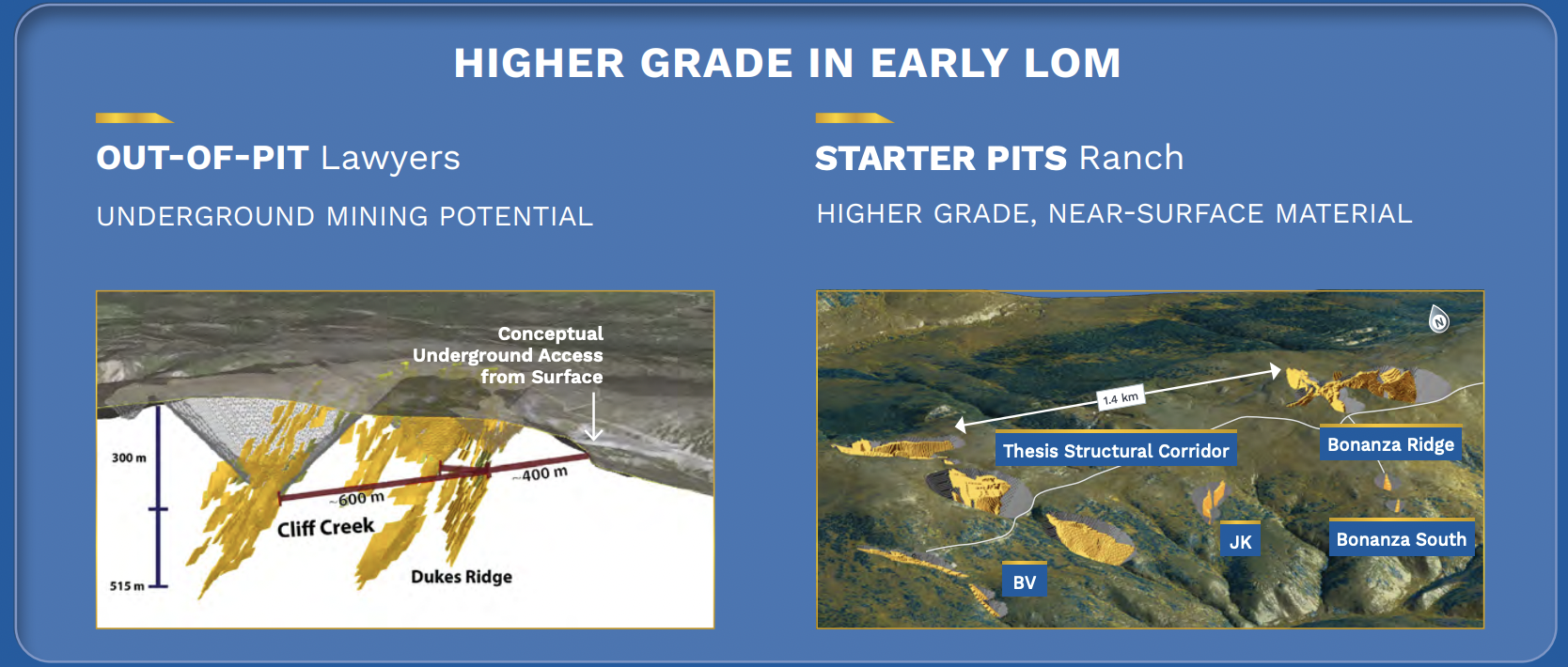

A 200k oz./yr. mine operating on clean, green (hydroelectric) power in B.C., Canada could be as good as it gets. A much improved NPV/IRR in the new PEA will come from a combination of increased production, higher Au/Ag prices, and higher-grade ounces mined earlier in the mine plan.

Readers should take a closer look at Thesis Gold (TSX-v: TAU) (OTCQX: THSGF), a stock that traded above $4/shr. in the Spring of 2021 when the Au price was in the $1,900s/oz. I believe Au juniors in NW B.C. could be poised for outsized gains. In the chart below, notice how far below 5-yr. highs these stocks are.

Earlier this month, a junior tabled a PEA with a base case Au price of $2,100/oz. Thesis doesn’t need > $2,000/oz. to thrive, but running after-tax NPV/IRR calculations at $2,500/oz. (as a valuation exercise) will show truly awesome economics. Please see the latest corporate presentation for a lot more info!

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply