In a world splintering into two factions, East vs. West, both need long-term sustainable supplies of critical materials like copper, REEs, silver & uranium. The East, mostly China, dominates the production and/or refining of many commodities, especially battery metals like nickel, lithium & cobalt (“Co”).

For clear geopolitical considerations, the West urgently needs to develop supply chains that bypass China. Yet, so far, it has failed to make meaningful progress. Not only are battery materials important economically, but they’re fast becoming critical in military applications, making them indispensable for national security.

Canadian domiciled Electra Battery Materials (TSX-v: ELBM) / (NASDAQ: ELBM) owns 100% of a fully permitted, very low-carbon (runs on hydroelectric power) refinery on 600 acres in Ontario, Canada that’s being expanded & refurbished to produce battery-quality Co in sulfate.

Importantly, the same property will house a lithium-ion battery recycling circuit, making it a Battery Materials Complex (“BMC“) producing or recycling Co + lithium, nickel, manganese & graphite.

This BMC is a sustainable, traceable, and IRA-compliant link in the midstream of the supply chain, producing the lowest-carbon materials in N. America, for N. America.

It would take at least five years to locate & acquire a greenfield site, design a facility, do environmental & operational studies, and permit, fund, construct/commission a new battery materials refinery & tailings facility. Electra’s BMC is the first of its kind in N. America. {see new corp. presentation}.

The Company has a strong technology-focused management team including the following four senior execs, two of whom are PhDs.

In 2023, Electra operated a plant-scale black mass demo plant that successfully recovered lithium, nickel, cobalt, and other minerals. The demo provided a lot of data for a recycling flow sheet, which will be revisited at a later time.

Management is contemplating another Co sulfate facility in Bécancour, Quebec, and a nickel sulfate plant, but these are longer-term aspirations.

For the initial five years, LG Energy Solution will purchase 60% to 80% of the Co sulfate produced. Several buyers are competing for the other 20-40% of output. Once fully funded with the remaining $54M in project cap-ex, management believes it will have a replacement value of US$250M = ~C$340M.

Electra was in the news last week for being awarded a US$20M = C$27M free-money grant from the U.S. Dept. of Defense (“DoD“) under the Defense Production Act. What prompted the DoD to fund tiny Electra Battery Materials, a non-U.S. company, with no stipulations or obligations?

Simple, according to Benchmark Mineral Intelligence, more than 90% of battery-quality Co sulfate is produced in China. CEO Trent Mell said in a recent interview that the DoD came to his team and invited them to apply for the grant! The U.S. needs regional options for battery metals from Western-friendly countries. Why is this such a big deal?

Li-ion batteries are increasingly used in military applications beyond just military transport. Batteries are essential for portable & wearable electronics (communications, night vision equipment, GPS/navigation systems, drones/UAVs), weapons systems & energy storage.

Another reason for excitement over a N. American supply of critical materials is that the U.S. Inflation Reduction Act (“IRA”) prohibits EVs from containing any minerals sourced from China & Russia to qualify for a US$7,500/vehicle credit.

As awesome as the $27M in free money is, investors should note the extensive due diligence done by the DoD, resulting in a robust vote of confidence in Electra’s team & project.

The DoD endorsement opens the door for new & existing discussions with interested parties including — giant EV & battery makers, commodity traders like Sumitomo, Mitsui & Co., Trafigura & Traxys — regarding off-take agreements, partially pre-paid forward sales, strategic investments + other non-equity initiatives.

Electra’s enterprise value [“EV“] {market cap + debt – cash} is ~$82M (incl. the recently announced $27M cash grant from the U.S. DoD). As mentioned, management believes an additional C$54M is required to complete refinery renovations.

The pro forma EV, post $54M investment is ~$136M, 40% of the $340M replacement value. An open question is how much of the remaining cap-ex will be funded with new shares vs. debt & other non-equity means. How much debt could this expanded, enhanced, retrofitted Co & battery material recycling complex support?

If one believes as I do that the BMC is strategically important to both the U.S. & Canadian federal governments, the provincial government of Ontario, and numerous EV & battery OEMs –> then a loan-to-value (“LTV“) [net debt divided by replacement value] of up to 50% seems reasonable. The current LTV is under 20%.

If the remaining cap-ex were obtained via additional debt, the LTV would rise to ~35%. There are only 57.2M shares outstanding. I don’t believe management intends to incur a lot more debt, but off-take agreements & royalty/streaming transactions can have debt-like features.

One can’t rule out some equity, but in talking with CEO Mell, his team has a lot of balls in the air, and they are optimistic about receiving grants/loans or tax incentives from Canadian and/or Ontario government entities, like those available through Canada’s Strategic Innovation Fund.

Strategic Innovation Fund criteria…

The pink elephant in the room is the collapse in battery metal prices over the past 18 months. The decline shows there’s real uncertainty about future demand keeping up with new supply. Regarding Electra, cost overruns have been painful, but I truly believe the Company has turned the corner.

The rate of EV sales growth is slowing, especially outside of China, but is expected to be up +20% globally this year. Meanwhile, the stationary energy storage market for residential units, large commercial, and giant grid-scale installations is growing faster than EVs, albeit from a much smaller base.

Li-ion battery chemistries are constantly changing. Some use less Co/Ni, and others like LFP configurations use none. However, for the foreseeable future, Co/Ni will be used in high-end EVs & products requiring higher energy density.

Given much lower battery metal prices since 2H/2022, new uses for Li-ion batteries are being developed. This is supportive of a rebound in prices next year. Importantly, Electra is different from the 1,000’s of juniors exploring for economic deposits.

A lithium explorer is tied to the price of lithium. By contrast, Electra plans to operate under a largely fixed-margin tolling business model. I estimate it will earn a 15%-20% EBITDA margin on its Co sulfate sales. Margins for recycling are yet to be determined.

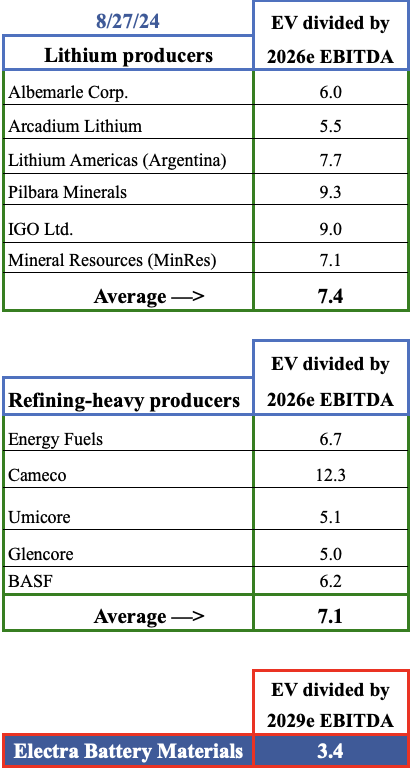

The Company’s corporate presentation shows an annual run-rate EBITDA of US$30.0M = C$40.8M is possible once Co sulfate production is ramped up to 6,500 tonnes/yr., which would support > 1M EVs annually. I estimate Electra is valued at 3.4x its fully-ramped up EBITDA (not including any EBITDA from recycling).

Compare that to the comps shown below averaging over 7x 2026e EBITDA. Electra’s BMC is ideally situated to serve well over a dozen battery material / Auto plants being built.

Future EV/EBITDA ratios for peers vs. Electra (once ramped up, cobalt-only)

In the coming years, companies like GM, Umicore, Ford, Stellantis, Samsung SDI, Glencore, LG Energy Solution, BMW, Toyota & Panasonic — with valuations in the $10s of billions — will easily be able to acquire Electra’s refinery (if Electra wants to monetize it).

The alternative to sourcing Co & battery metals from Electra will be relying more heavily on China & Africa. For the next decade, N. American battery/EV makers have little choice but to get most of what they need from those two places.

Obtaining materials via train in a day or two is environmentally & logistically superior and less costly than receiving them by ocean vessel + train in weeks. If there’s a major trade war, or a more serious geopolitical development, EV production in N. America could be severely impacted.

If a protracted disruption, military readiness could be impaired. The companies shown below will secure as many feedstocks as possible — not just from Electra — but from any player outside China & Africa. Some will build dedicated battery facilities themselves, but those will come online years after Electra’s.

In CEO Trent Mell’s latest video interview, he invites investors to watch closely or upcoming news. {see new corp. presentation}. If management can announce more non-equity dilutive funding in Sept./Oct., I think the share price could enjoy another leg up.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Electra Battery Materials, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Electra Battery Materials are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Electra Battery Materials was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)