Some on Twitter/X and YouTube are saying that even though prices may fall a bit more, the bottom is in for lithium (“Li“) stocks. It’s easy to say such a thing when companies like Albemarle traded down to $72/shr. a few weeks ago and is back at $91.5.

Top-5 producers Mineral Resources (MinRes) & Ganfeng announced the cessation of all (MinRes) & most (Ganfeng) growth initiatives. Zijin Mining slashed its 2025 production guidance for Li Carbonate Equiv. (“LCE“). Lower prices are slowing the ramp-up times on new projects.

Zijin is delayed in Argentina. What about POSCO’s, EraMet’s/Tsingshan‘s, Rio Tinto’s & Ganfeng’s Argentinian aspirations? All five have major brine projects that are behind schedule and will ramp up slower than expected. Only the producing JV between Ganfeng & Lithium Americas (Argentina) Corp. seems to be largely on track.

High-quality Li juniors offer a compelling risk/reward proposition. No longer is it necessary to dabble in the highest risk names, like pre-drilling or pre-maiden resource estimate companies. One can avoid difficult jurisdictions, and juniors with sub $0.10 share prices, or sub $10M market caps, and no cash to advance projects.

With far less risk one can get nearly as much upside potential with top-quartile Li juniors. Examples of companies that are almost certainly going to make it into production or be acquired are –> Patriot Battery Metals, Winsome Resources, Frontier Lithium, Liontown Resources & Standard Lithium.

Once Li prices rebound to US$16-$18k+/t, I think any of those stocks could double or triple by next year. Of course, if one thinks Li prices will remain below $11k/t through 2025, (current price ~$10.4k), it’s too early to try to catch a falling knife. In addition to the five Li players mentioned, an absurdly cheap company I love is Lithium Ionic (TSX-v: LTH) / (OTCQX: LTHCF).

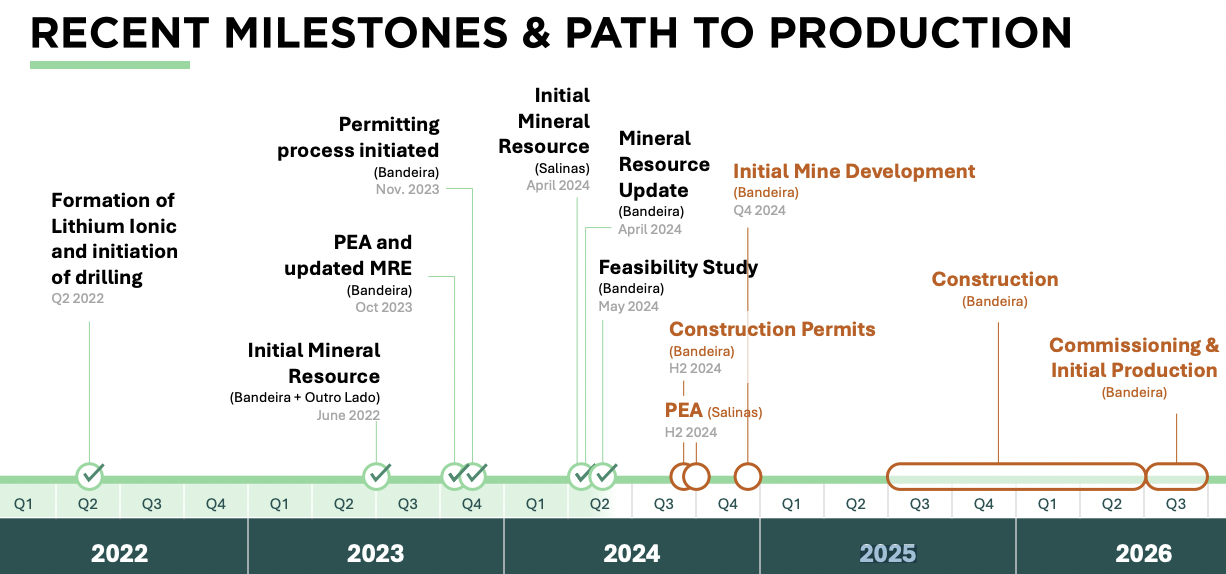

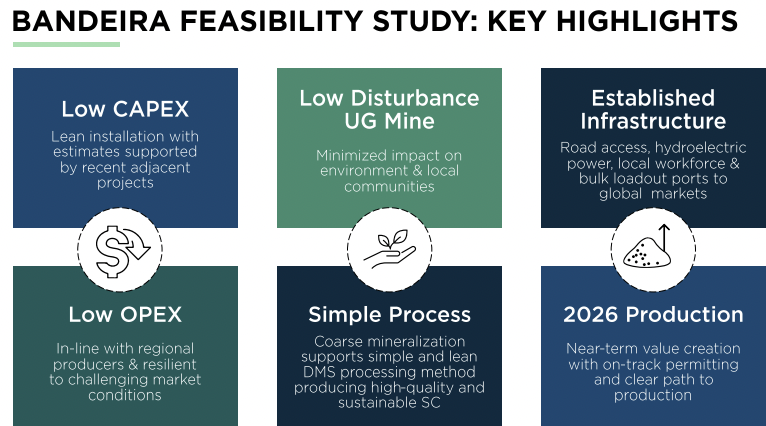

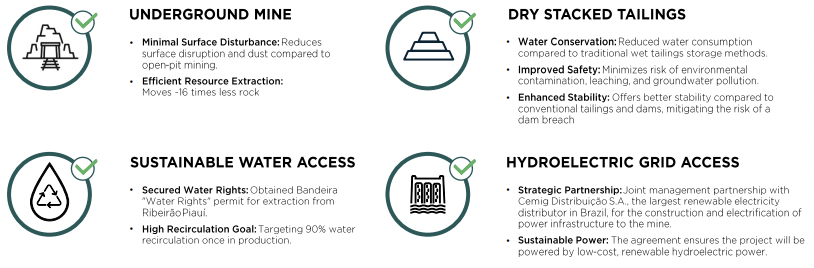

Its stock price has bounced off of the low, and it’s more than just a dead cat bounce. There has been very good news on the Company, plus great news for a nearby peer. On May 29th & 30th, Lithium Ionic announced results of a Bank Feasibility Study (“BFS“) and the signing of a term sheet for a US$20M royalty transaction.

The following week, management agreed to acquire the remaining 15% of select Salinas properties and announced (and later closed) a $15M private placement at a premium, with only a half warrant. These de-risking events highlight the strength of management, the balance sheet & the Bandeira project.

Fast forward to August, earlier stage neighbor Latin Resources agreed to be acquired by Australian bellwether Pilbara Minerals. Latin’s share price is up +71% on the news. It would be hard to overstate the significance of this transaction as it pertains to Lithium Ionic. First, it’s a robust vote of confidence in Brazil’s hard rock Li sector.

Make no mistake, Pilbara could have gone to Canada or Africa to acquire its first major asset outside of Australia. Having Pilbara next door will attract other multi-billion dollar companies to Minas Gerais. Second, Pilbara’s bold move signals that now’s a great time to pursue world-class Li projects.

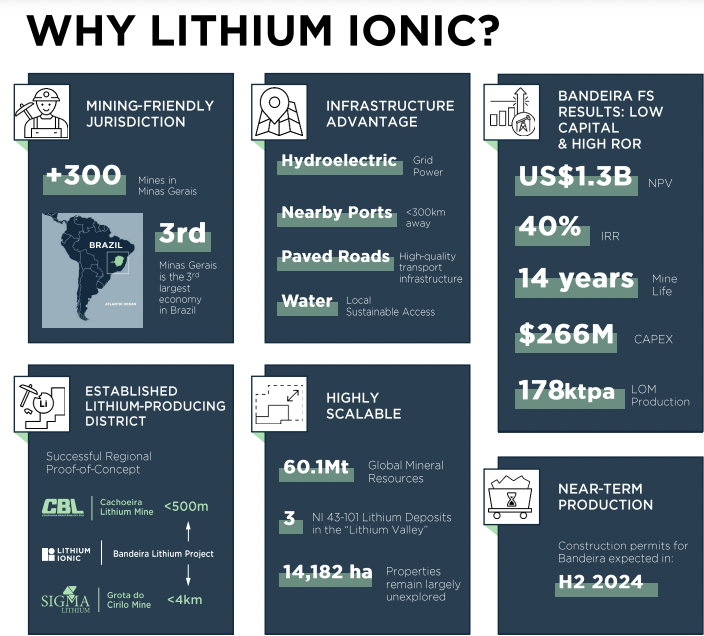

Third, Lithium Ionic has two much larger companies nearby, Pilbara & Sigma Lithium. Those companies’ projects/mine expansions will deliver very valuable regional infrastructure –> skilled mining labor, equipment & services, roads, housing, power, water, rail, high-speed internet, etc.

Readers are reminded that Sigma has been low-key (unofficially?) for sale for two years. Its management is thought to have been too aggressive in takeover discussions and missed the top of the cycle in 2H 2022.

Dozens of groups have kicked the tires. And, numerous groups looked at Latin Resources before Pilbara grabbed it. That means large Li producers, commodity traders like Glencore, Mitsui & Co., & Sumitomo, diversified miners like Rio Tinto & BHP, and giant EV & Li-ion Battery makers should have interest in Brazil’s next big Li story.

Unlike Canada or Australia, there are not a lot of large, high-grade, advanced-stage Li projects in Brazil! There’s Sigma, [Pilbara/Latin Resources], Lithium Ionic & Atlas Lithium. Atlas has a $150M valuation but is a pre-maiden resource play. A Rio Tinto could easily afford to acquire & fully develop Sigma, Lithium Ionic & Atlas.

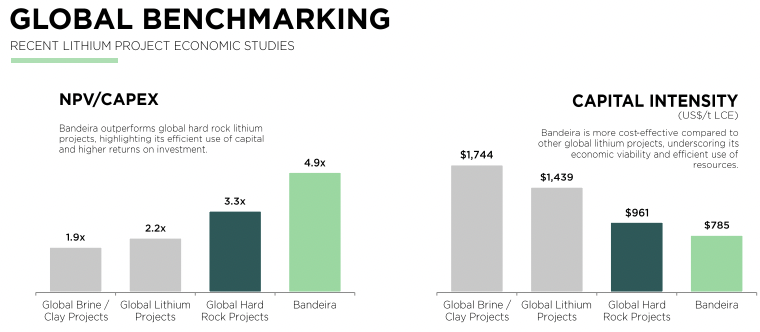

What’s so great about Lithium Ionic? It has a strong BFS with an industry-leading NPV/cap-ex ratio, Brazil is an up-and-coming jurisdiction with very few world-class projects, and its valuation is absurdly cheap compared to peers, especially Sigma & Latin Resources.

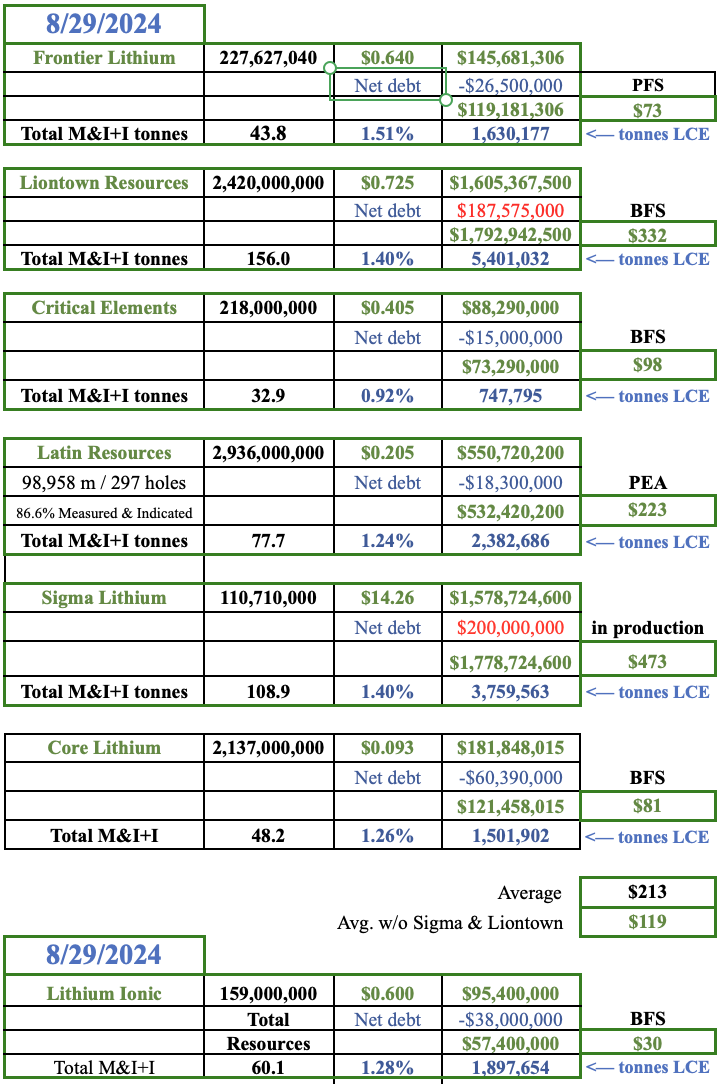

Sigma is currently in production, probably ~3.5 years ahead of Lithium Ionic, and is executing well on its growth plans. It deserves to trade at a meaningful premium. However, I don’t believe that Sigma should be valued 31x higher on an EV/LCE tonne basis.

And, I think Lithium Ionic should not trade at a whopping 74.5% discount to the average valuations of hard rock peers Frontier, Latin Resources, Core Lithium & Critical Elements. Over time, this extreme disconnect will revert to more reasonable levels.

Imagine if Sigma were to be acquired. Since that team is known to be holding out for a large premium, say it gets gobbled up at +75% above today’s share price. That would be $788/t vs. Lithium Ionic’s $30/t!

Admittedly, this is not an apples-to-apples comparison as Sigma’s been in production for over a year, but assuming (for argument’s sake) that Lithium Ionic doubles its share count before reaching production, it would still be valued at just $60/t. Once it reaches production, I think it should trade at a 4x or 6x discount to Sigma, not today’s 31x.

Think about it, with Sigma & Latin Resources acquired, that would leave only Lithium Ionic (TSX-v: LTH) / (OTCQX: LTHCF) in Brazil with an advanced-stage project that could be in production within ~2.5 years.

For those who think Sigma is not a fair comparison, consider the steep discount that Lithium Ionic trades at vs. PEA-stage Latin Resources. Latin has 26% more tonnes of LCE but is valued at $223/t vs. just $30/t for BFS-stage Lithium Ionic. Both have sizable high-grade projects in Brazil.

Since Latin is being acquired, it has effectively been marked to market. At a low point in the Li cycle, Latin is valued at [$223/$30] = ~7.4x that of Lithium Ionic. It seems reasonable to me that the Company could substantially outperform junior mining peers well into next year.

And, with ~$38M in pro foma cash, 39% of its market cap!, the downside from $0.60/shr. should be relatively modest vs. the vast potential upside. Pilbara & Sigma have blazed a path forward so that Lithium Ionic can thrive. Hopefully, it’s only a matter of time before investors recognize the alarming undervaluation of this story.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Ionic, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Lithium Ionic are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Lithium Ionic was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply