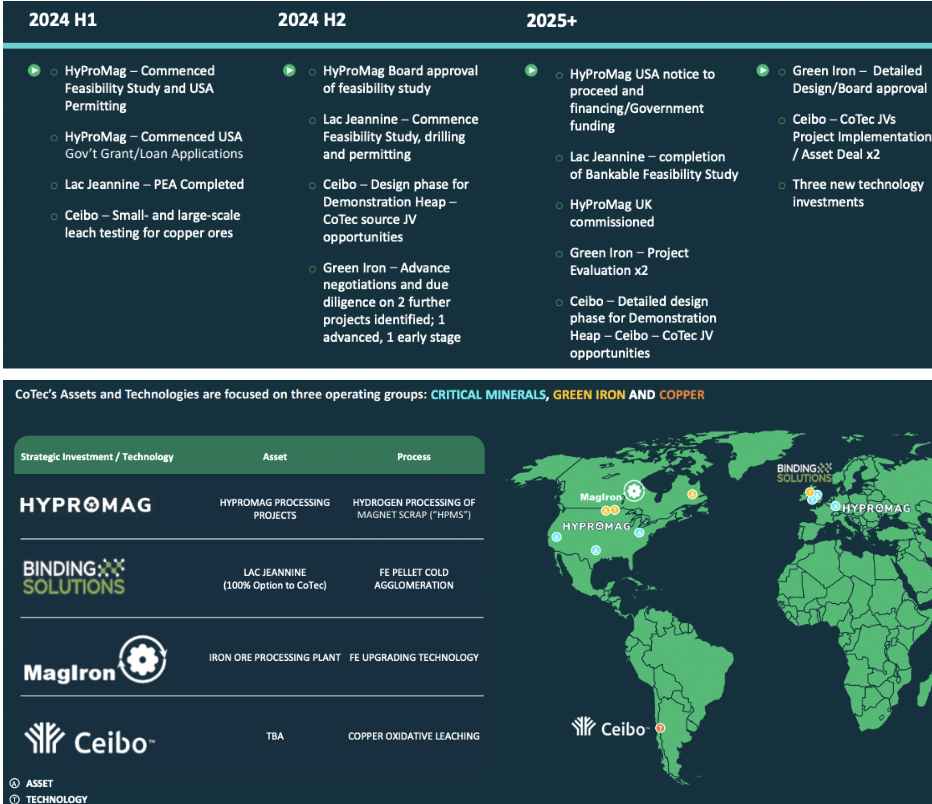

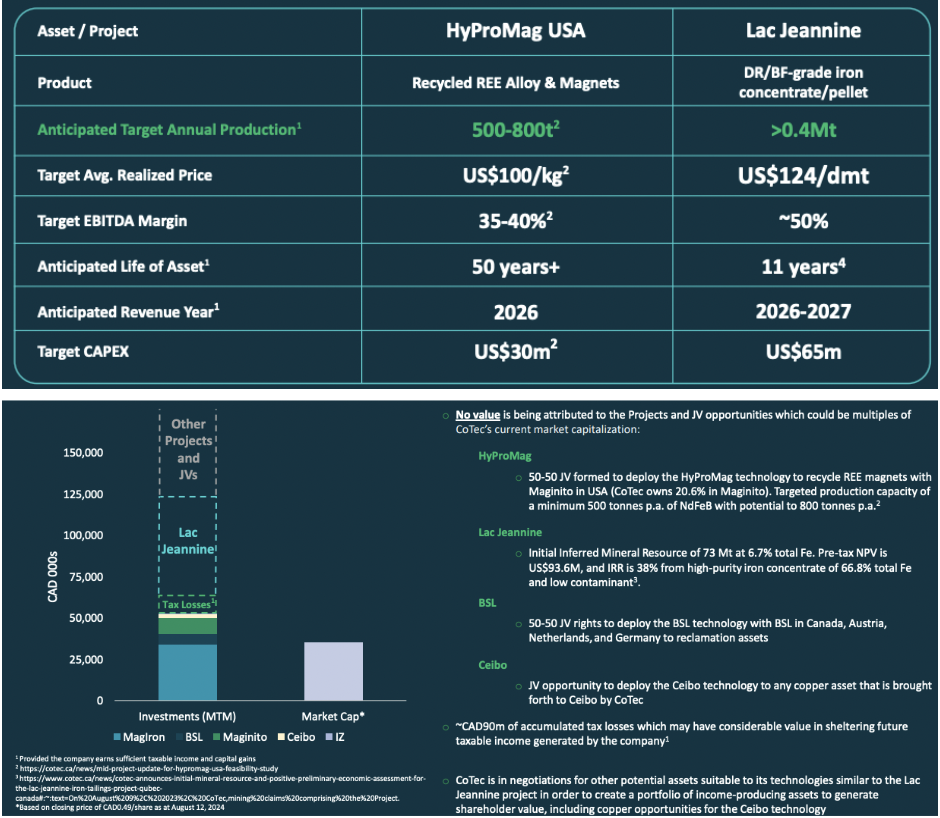

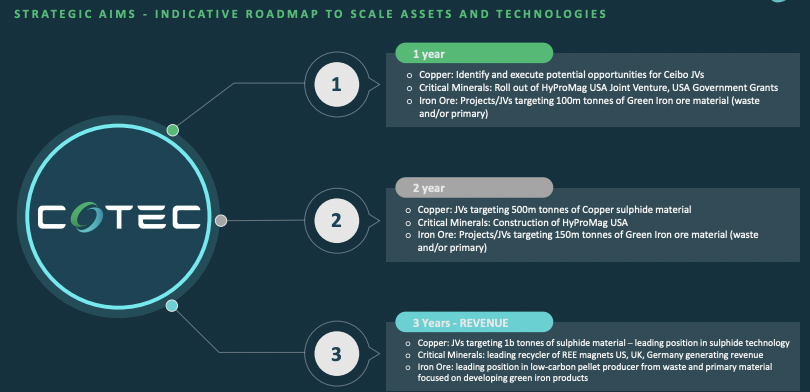

CoTec Holdings (CSE: CTH) / (OTC: CTHCF) has stakes in two assets + interests in four disruptive mine reclamation/recycling-related technologies. Its goal is to have stakes in 10 technologies + 30-40 assets. A near-term focus is its 50% interest in the HyProMag USA project in partnership with Maginito Ltd.

Disruptive means, significantly better in multiple ways; cheaper, faster, greener, simpler, scalable, repeatable & long-term sustainable. It’s not easy finding & deploying truly disruptive technologies, CoTec has reviewed over 300.

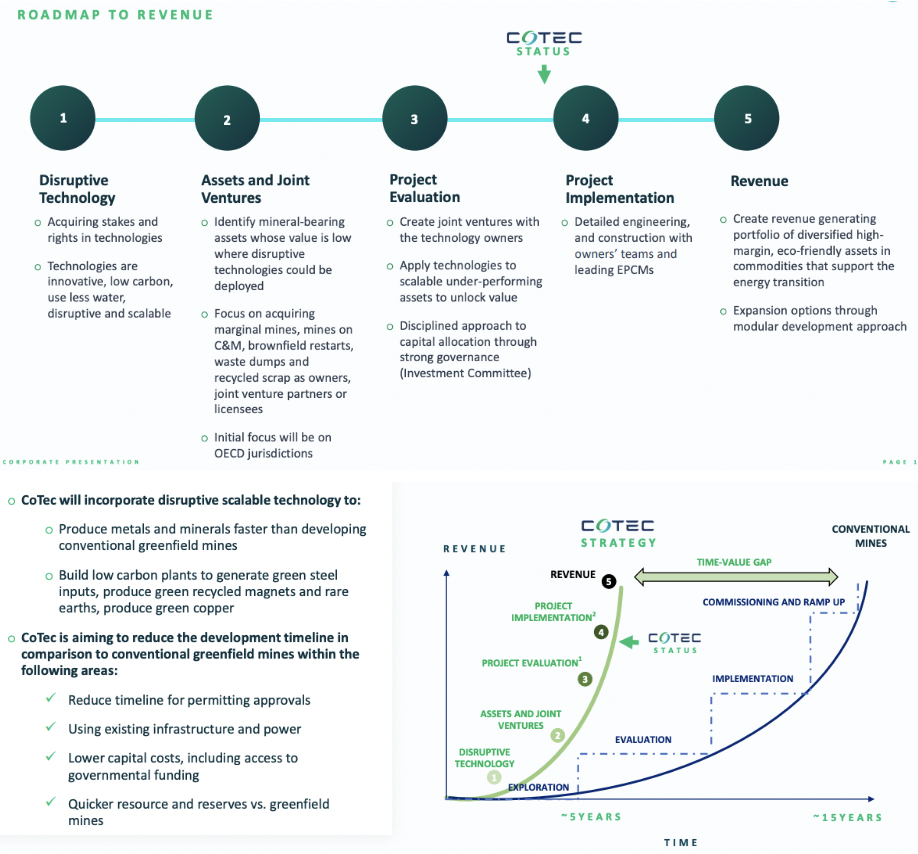

Readers are urged to read this article’s images, charts, graphs –> and especially the management bios. CoTec has one of the best corporate presentations I’ve seen for a junior miner.

HyProMag USA is working on securing federal government loans/free-money grants, U.S. State financial aid/tax incentives, and strategic partnerships for feed supply + recycled neodymium-iron-boron (“NdFeB”) magnet/alloy offtake agreements.

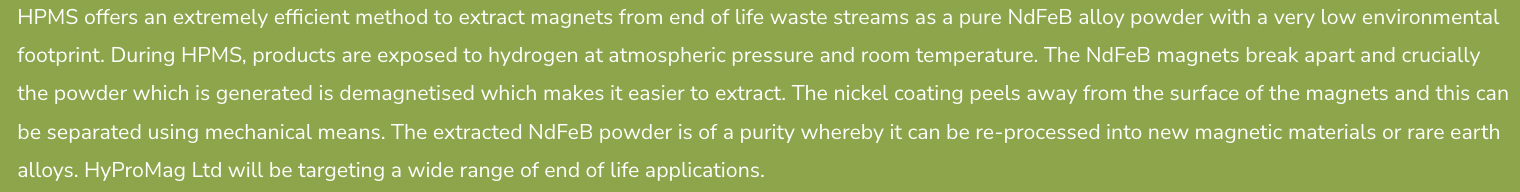

HyProMag is commercializing its core Hydrogen Processing of Magnet Scrap (“HPMS”) technology that enjoys competitive advantages vs. other REE magnet recycling approaches that have not solved the serious challenges of liberating magnets from end-of-life scrap streams.

A Bank Feasibility Study (“BFS”) on HyProMag USA is expected in the next 4 or 5 months. CoTec has transferred key tech & design elements + associated pilot plant operating data, from HyProMag’s ongoing commissioning of the Tyseley facility in the UK, and a facility in Germany.

The UK plant is slated to be fully operational in 1Q/25, while commercialization in Germany is scheduled for later that year. CoTec has a combined 60% economic interest in HyProMag USA plus 20.6% of projects outside the U.S.

The BFS for the U.S. is based on a hub-and-spoke model using three HPMS vessels (spokes) and one magnet manufacturing hub. See a description of HPMS in the green image below.

The targeted production capacity is 500 tonnes/yr. of NdFeB magnets, with an ability to expand to 800 tpy. That incremental +60% in throughput packs tremendous economic punch as considerably more free cash would flow with relatively small increases in op-ex & cap-ex.

On September 3rd, Maginito (Mkango 79.4% / CoTec 20.6%) & Inserma Anoia announced an exclusive agreement to collaborate on the optimization, commercialization, and roll-out of pre-processing technologies for HyProMag Limited’s operations in the UK, Germany, and the U.S.

CoTec’s HyProMag segment reduces end-of-life electronic scrap into new clean, green recycled REE magnets. It’s one of four low-cost, low-carbon, traceable, low-energy, highly sustainable business segments.

The Inserma unit for hard disc drives (“HDDs”) can be co-located at giant “hyperscale” data centers, shredding/recycling facilities, or HyProMag plants. The units rapidly remove motors containing REE magnets in an automated & scalable manner.

Over the past 15 years, more than US$100M has been invested into the technology by the Univ. of Birmingham & associated partners. Pre-processing, in combination with HyProMag’s innovative HPMS, does not require heat treatment or dismantling for magnet recovery, lowering the cost & carbon footprint of shredding the rest of the HDD.

Management believes combining the two technologies will meaningfully improve project economics. According to Adams Intelligence, from 2024 – 2040 global demand for NdFeB magnets will increase at a CAGR of 8.7%, more than twice the expected CAGR of copper, and 3x many other commodities.

Less than 5% of REE magnets are recycled as existing methods are not energy efficient, environmentally friendly, logistically simple, or low cost. China dominates, controlling up to 90% of the market. CoTec/Mkango is developing a closed-loop supply chain in key tech, energy & auto industries outside China.

A fully automated Inserma unit for commercial pre-processing of HDDs was successfully trialed on thousands of HDDs at HyProMag GmbH’s site in Germany, providing feed for the HPMS pilot plant at the Univ. of Birmingham.

The plan is to have hundreds of units providing pre-processing for end-of-life applications including HDDs, loudspeakers, wind turbine generators, EVs & other electric motors in the aerospace & defense sectors –> generating feed for HyProMag’s REE magnet recycling.

The U.S. urgently needs long-term security of supply of REE magnets for national security/homeland defense. Mkango, CoTec & HyProMag are engaging with major data center providers, shredders, recycling companies, and other groups showing interest.

The Agreement calls for the purchase of an initial three units to catalyze the roll-out of HMPS. Julian Treger, CEO of CoTec commented,

“Inserma has developed a key pre-processing technology that will enable HyProMag USA to secure its feed supply from rapidly expanding hyperscale data centers. As the U.S. BFS progresses, we are looking to provide a total, scalable solution to large technology & automotive companies, allowing for closed-loop, secure recycling within the U.S. at the lowest cost and lowest carbon footprint compared to traditional mining practices & alternative recycling technologies.”

The Inserma collaboration may not seem like a big deal, but it’s an excellent example of CoTec’s business model to deploy not just one disruptive technology, but also complementary technologies, to deliver the lowest cost, most sustainable, greenest, scalable operations.

By combining technologies such as Inserma’s with HyProMag (and possibly others) this segment’s profit margin should grow as costs get squeezed out, timelines are shortened, logistics are streamlined, operating synergies are realized & economies of scale kick in.

Readers are reminded that HyProMag is just one of several segments that CoTec is advancing. Unlike most junior miners, CoTec’s business model enjoys several de-risking features.

Most juniors have just one flagship asset, all its eggs in that one basket. If it falters, or worse, it’s typically game over! Assuming all goes reasonably as planned, a successful mine has a life of 10-25 years followed by years of reclamation. Operating improvements are possible, but overall flexibility is limited.

Mining by conventional methods starts with a bankable mine plan to raise many $100s of millions (or more). The highest-grade & easiest to reach ore will be exploited first, meaning margins don’t grow, they shrink.

S&P Global Market Intelligence recently reported that a major discovery in 2020-23 will take an average of 18 years to commercialize! Imagine investing a billion dollars over 18 years before knowing if an attractive profit margin will be earned.

Each of CoTec’s projects will have mine lives of 10-20+ years, but more important is the lifespan of the business segment itself. If successful, HyProMag should operate on dozens of sites, for a total of 50+ years, with each site requiring not 18 years to commercialize, just 3-5.

Eventually, fully integrated, highly efficient HyProMag systems comprising multiple technologies will be proven across project types & jurisdictions. This will lead to rapid, low-risk, low-cost permitting & deployment of new systems — reducing the 3-5 year timeline.

Cap-ex/site will be a small fraction of the amount required for large greenfield projects. Once CoTec has several sites up & running with Inserma and possibly other technologies, it will have growing long-term cash flows, with increasing margins, and the diversity of numerous sites will meaningfully de-risk the Company.

Over time, CoTec could become comparable to the high-margin, diversified, long-lived cash flows of precious metal royalty/streamers. Franco-Nevada & Wheaton Precious Metals trade at ~20x 2026e EBITDA. No, I’m not suggesting CoTec will enjoy a 20x EBITDA multiple anytime soon.

However, even if CoTec were to double its share count, (unlikely if strategic partners, partially pre-funded off-take agreements, commercial debt funding, free-money gov’t grants, infrastructure builds, R&D, and tax incentives play a meaningful role), it would still be valued at ~3x 2027e run-rate EBITDA.

By the end of the decade, annual EBITDA could be twice that of 2027’s expectations as projects in multiple business segments should be online. The current enterprise value {market cap + debt – cash} of ~$38M fails to reflect the exciting opportunities ahead.

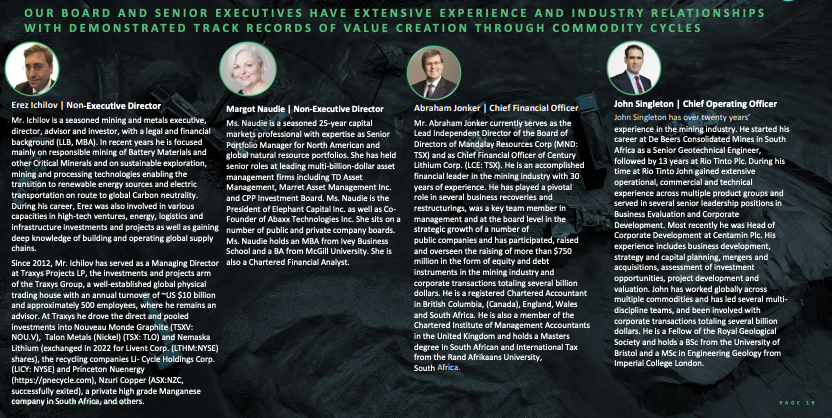

I would not be willing to give the Company the benefit of the doubt if not for its stellar team. How many juniors have not 1, but 2 MBAs from Harvard Business School?!? How many have the ex-CEO of a Major mining company (Rio Tinto, 2007-13)?

Which juniors have experience across the CIS region, the Middle East, Europe, S. Africa + S. & N. America? There are eight impressive/world-class technology/mining-focused execs, yet the valuation is under $40M!?! Please see the bios above & below.

Over a thousand words in and I’ve mentioned CoTec’s HyProMag segment, yet there are other promising segments, such as Binding Solutions Ltd. (“BSL”). BSL has a patented, commercialized, industry-leading, low-carbon, cold-binding (agglomeration) technology.

It converts fine materials from mines/waste dumps into iron ore pellets ready for direct reduction & hydrogen reduction furnace steelmaking processes to produce green steel with [up to 80% less energy, 70% less CO2 emissions, 100% less sulfur oxides (SOx) & 99% less nitrogen oxide (NOx)] compared to sintering & induration.

It’s not just CoTec that sees BSL as disruptive, Japan’s Mitsui & Co. and Australia’s Mineral Resources are invested. Decarbonization of the steel industry is an extraordinary undertaking taking decades to play out.

Ceibo, a technology backed by BHP, features a low-carbon, high-recovery methodology applied to primary or waste copper (“Cu”) via a groundbreaking sulfide heap-leaching process.

It can leach low-grade primary Cu sulfides such as chalcopyrite and Cu waste by high throughput inorganic leaching. Ceibo offers an alternative to the concentration process for leaching primary sulfides and utilizes existing infrastructure at mining sites.

MagIron will help decarbonize the U.S. steel industry. It has a patented process that converts waste into high-grade iron ore concentrate used as feedstock for the growing fleet of steel-making electric arc furnaces. MagIron is a brownfields restart of an iron ore processing plant (Plant #4) in the midwestern U.S.

In this article, I provided a lot of detail on how the Lac Jeannine tailings project alone could have a $100M+ after-tax NPV & 35%+ IRR in next year’s BFS, nearly 3x the Company’s entire valuation. Yet, this is just one of the long-term goal of 30-40 projects using 10 disruptive technologies.

Consider the potential for this Company’s margins to grow year after year from the above-mentioned operating synergies + economies of scale, delivered from multiple disruptive technologies, deployed collaboratively on many dozens of mine sites.

Eventually, there will be no need to build a better mousetrap to replace CoTec’s proven, integrated HyProMag systems, as they will be sufficiently streamlined, safe, low-cost, green, simple & profitable. CoTec is #ESG on steroids.

Now imagine that compelling scenario for HyProMag expanding to nine additional segments, including Bindling Solutions, Ceibo & MagIron. Management believes that CoTec Holdings (CSE: CTH) / (OTC: CTHCF) could become a billion-dollar company. Although I think that would take 5+ years, I agree.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CoTec Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CoTec Holdings are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, CoTec Holdings was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply