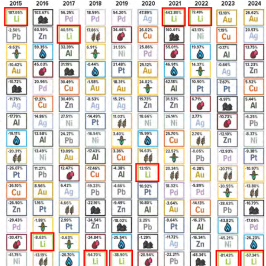

Will ongoing and possibly worsening economic woes in China sink the global economy? After months & months of bullish commentary by pundits (and me) about copper, (“Cu“), suddenly it’s out of favor? I feel the downside on the Cu price from today’s US$4.15/lb. is probably 15%, but the longer-term upside is 50%+.

And, in my view, -15% to 3.52/lb. would likely be short-lived, but +50% to over $6/lb. will (eventually) be forever. To be clear, I’m not suggesting that $6/lb. is coming soon, it might not be until 2026, but China’s troubles won’t last beyond next year.

Aside from China, demand/supply fundamentals point to higher prices. Cu is indispensable for decarbonization (clean energy power plants + EVs) + new & replacement electrical grid infrastructure + telecom/electronics + new & replacement construction + new wireless applications + military needs.

Commodities Research Unit (“CRU“) predicts that,

“…without new capital investments, global Cu mine production will drop to below 12M tonnes by 2034, leading to a supply shortfall of > 15M tonnes. Over 200 Cu mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.”

Some groups have lower deficit estimates. The follow-up question is, will this worrisome gap be shrinking in the 2030s or still growing? The world’s largest producer Chile continues to face challenges from aging mines, lower grades, drought conditions, and worker strikes/protests. Codelco’s production in CY23 marked a 25-yr. low.

Peru’s output thru July is -2.3%, but the world needs +3.5%! Until recently, analysts & industry leaders like Robert Friedland were saying that US$15,000/tonne = $6.80/lb. is needed to incentivize higher-cost Cu projects with cap-ex hurdles in the US$ billions, taking 18+ years (according to S&P Global Market Intelligence) to build a major mine.

Nothing has changed in that assessment, yet investment banks are lowering year-end & CY 2025 price forecasts on China concerns, making it more difficult for new Cu projects to get started, meaning less, or at least delayed, supply down the line.

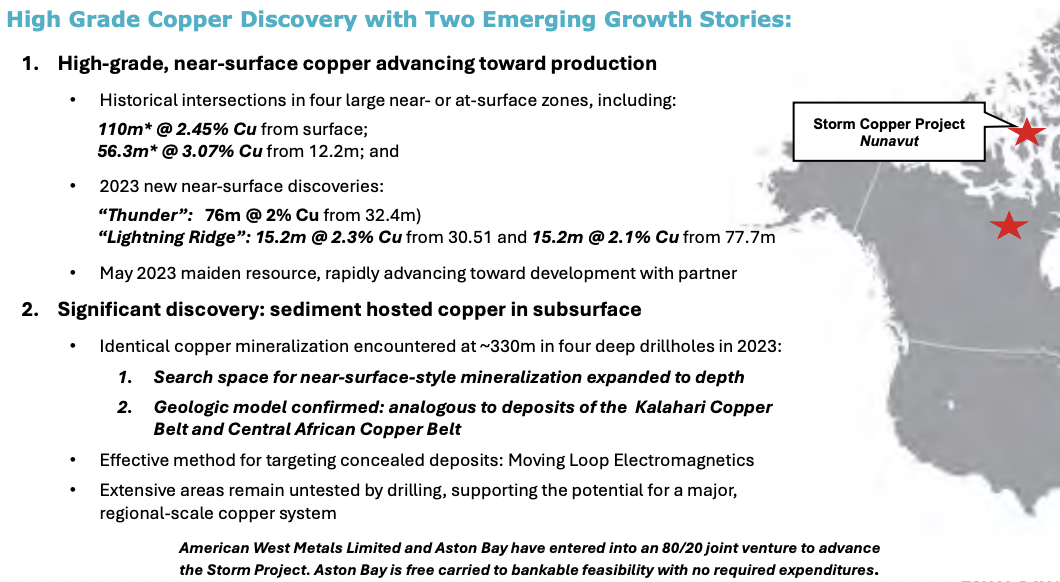

For juniors that can reach production in 3-4 years, without massive equity dilution, the near-term Cu price is not a problem. Aston Bay Holdings (TSX-v: BAY) / (OTC: ATBHF) is a company I continue to like. It hopes to be in production on a valuable JV project in 2027.

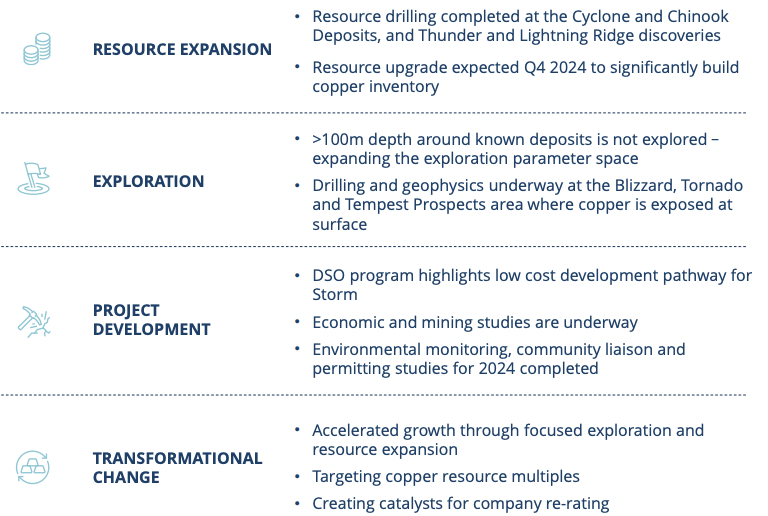

In last month’s article on Aston, I described detailed metallurgical work on representative Cyclone & Chinook deposit mineralization that generated potentially commercial-grade Direct Shipping ore products. This news is very important in assessing Aston Bay’s prospects as direct shipping puts both low-cost & speed to market on the table.

American West Metals, 80% owner & operator of the Storm Copper project, spearheaded this de-risking metallurgical work. Readers are reminded that Aston Bay’s 20% interest is free-carried until an investment decision, post the delivery of a Bank Feasibility Study (“BFS“).

Even after Aston is on the hook for 20% of cap-ex, the amount needed is likely to be relatively modest. I estimate Aston’s 20% share of total cap-ex for a Direct Shipping Ore operation might be ~$12-$15MM, spread over 12-18 months, starting no sooner than 4Q 2025.

The Company is sitting on ~$5M in [pro forma] cash after it receives the full 20% (in installments) of a royalty payment and having raised $4.1M in June.

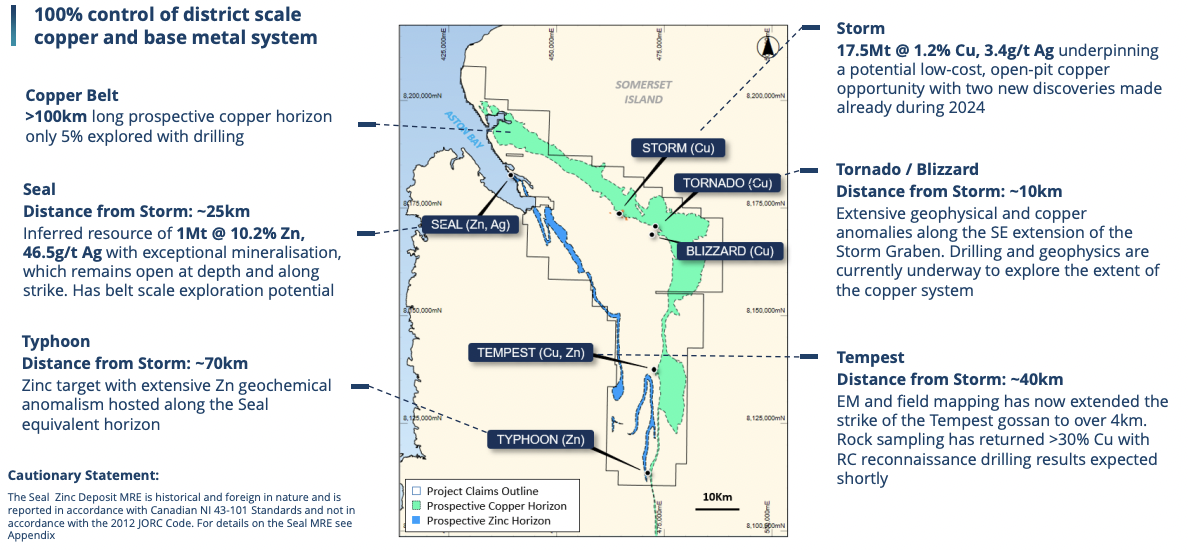

On September 2nd, drill results at the Storm project on Somerset Island, Nunavut, Canada were released, They continued to show a large, high-grade set of shallow deposits and a discovery named Squall. Over 20,000 meters have been drilled year-to-date at Storm & Tempest in 128 RC + 14 diamond drill holes.

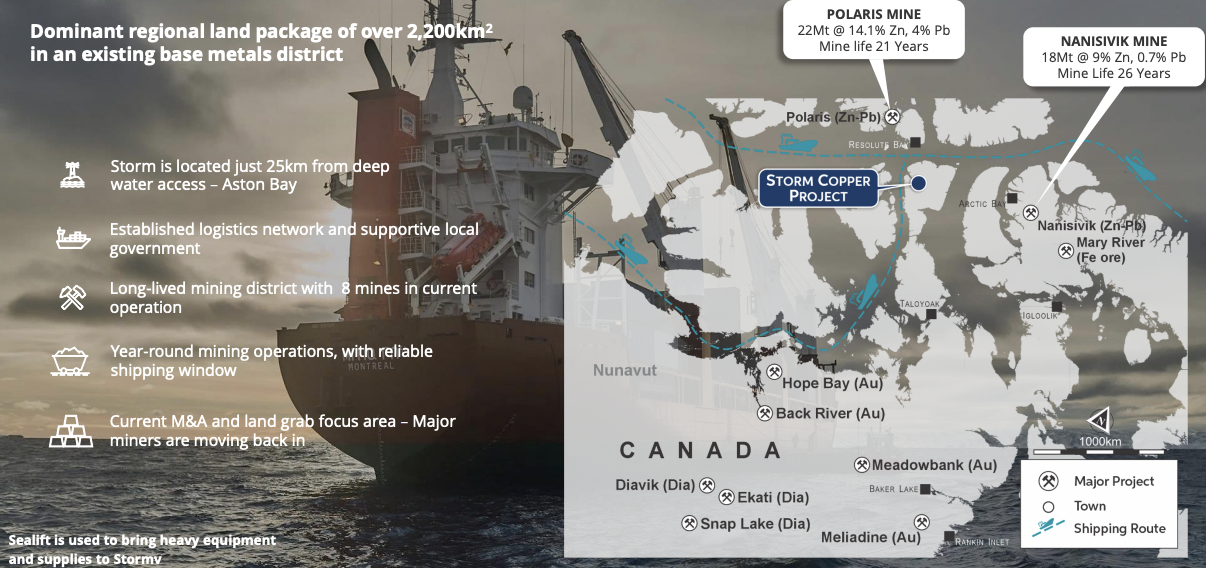

Nunavut is in a remote part of northern Canada, but in my opinion, is preferable to global Cu hotspots including; the DRC, Zambia, Russia, Indonesia, Mongolia & Pakistan.

Storm is just ~25 km over flat, barren terrain from a seasonal ice-free bay (Aston Bay) on the Northwest Passage, where concentrates from the world-class Polaris & Nanisivik zinc-lead mines were successfully shipped.

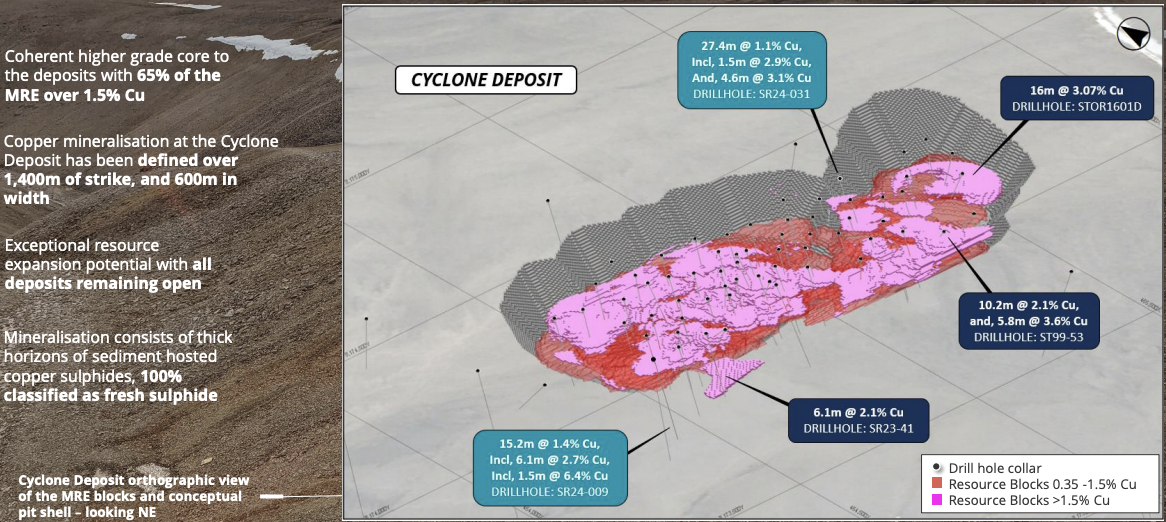

The resource upgrade potential on the Cyclone deposit has been advanced by strong high-grade intervals including; SR24-057 –> 1.5m @ 13.5% Cu + 23 g/t Ag from 55 m downhole, 3.1 m @ 2.0% Cu + 8.0 g/t Ag from 85 m and 1.5 m @ 1.8% Cu from 110 m.

SR24-035 –> 3.1 m @ 3.9% Cu + 10.5 g/t Ag from 58 m downhole, incl. 1.5 m @ 5.9% Cu + 16.0 g/t Ag (also) from 58 m, and 4.6 m @ 1.4% Cu from 72 m, incl. 1.5 m @ 3.1% Cu + 11.0 g/t Ag from 72 m. SR24-031 –> located outside the current resource intersected 27.4 m @ 1.1% Cu from 96 m incl. 4.6 m @ 3.1% Cu + 7.7 g/t Ag from 110 m.

Partner American Western Metals continues to do an excellent job on this year’s drill program. The goal was 20,000 meters, but that has been surpassed. It looks like American West will reach a total of 22,500 meters. Importantly, only 5% of 100 km in strike length has been drilled.

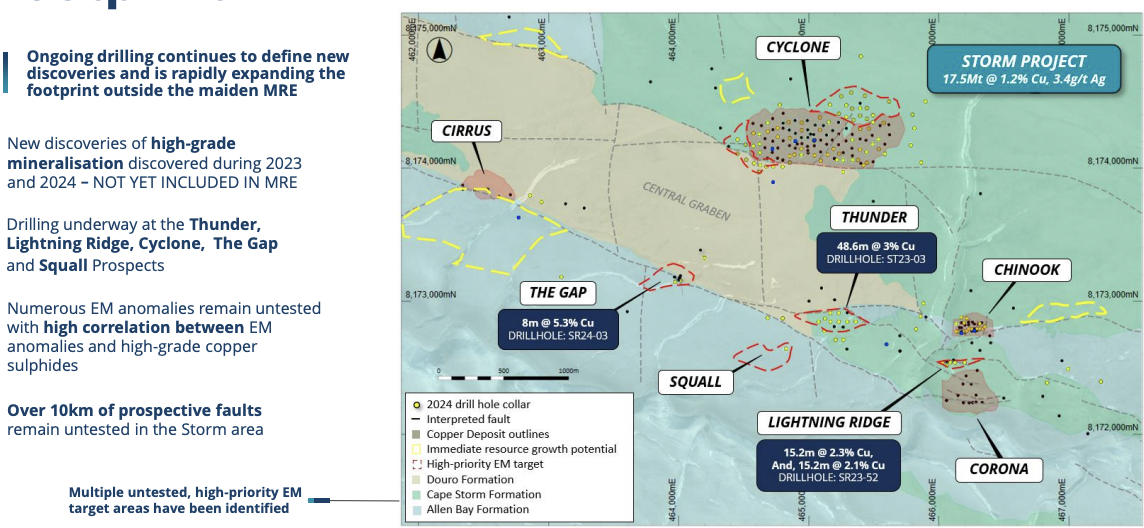

Readers are reminded that Moving Loop ElectroMagnetic (“MLEM“) anomalies have proven to be very good indicators of mineralized zones. Drilling a new MLEM anomaly south of the Thunder target intersected Cu sulfides from ~181 m downhole with strong visuals reported. This drill hole discovering Squall ended in mineralization.

It will be extended another 50 to 100 m, which should result in a wide, well-mineralized intercept. There’s real excitement about the extensive, ongoing drill program, especially the drilling of a 600 m hole testing a deep target beneath the Cirrus deposit. Success rates at drilling anomalies, like the one being chased there, have been high.

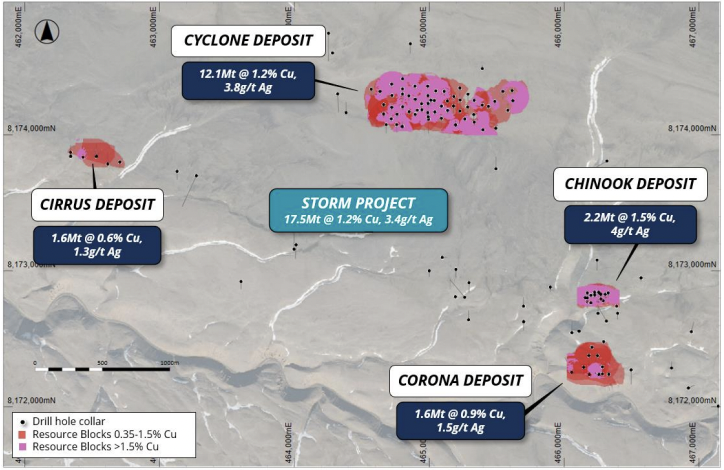

So far Storm has a maiden resource estimate of (JORC-compliant) 17.5M tonnes of 1.17% Cu {~204.5k tonnes} + 3.4 g/t silver {~1.9M troy ounces}. At spot prices, that’s ~464M Cu Eq. lbs. Importantly, 100% of the resource is amenable to low-cost processing & ore sorting in an open pit setting.

Dave O’Neill, MD of American West Metals commented,

“The latest assays continue to highlight the quality of known Cu deposits with exceptional intervals up to 13% Cu, including intervals of high-grade Cu outside the current resource envelope. This is an exciting time for the company with further assays due in the coming weeks and exploration activities ongoing at the Tempest & Blizzard/Tornado areas.”

Aston Bay CEO Thomas Ullrich added,

“…drilling, which has exceeded the planned 20,000 m, continues to expand known areas of Cu mineralization with more RC & diamond drill holes underway. We have made another significant discovery, named ‘Squall,’ the second from drilling MLEM anomalies this year. Both spotlight the growth potential of the resource at Storm and confirm the effectiveness of MLEM in pointing the way to discoveries. The diamond drill just started spinning on a new MLEM target below the Cirrus deposit. The configuration of this large 1,300 m x 500 m anomaly suggests a potentially mineralized horizon. With the positive hit rate drilling EM targets, we eagerly anticipate seeing this drill core.“

There will be ample news flow in the coming months on Storm from American West / Aston Bay. Drilling continues 24/7 with additional results earmarked for later this month.

The team at American West has a goal of doubling Storm’s mineralization to > 900M Cu Eq. lbs. this December. Yet, the new resource figure will not include 95% of Storm’s land package or close out the 5% being drilled.

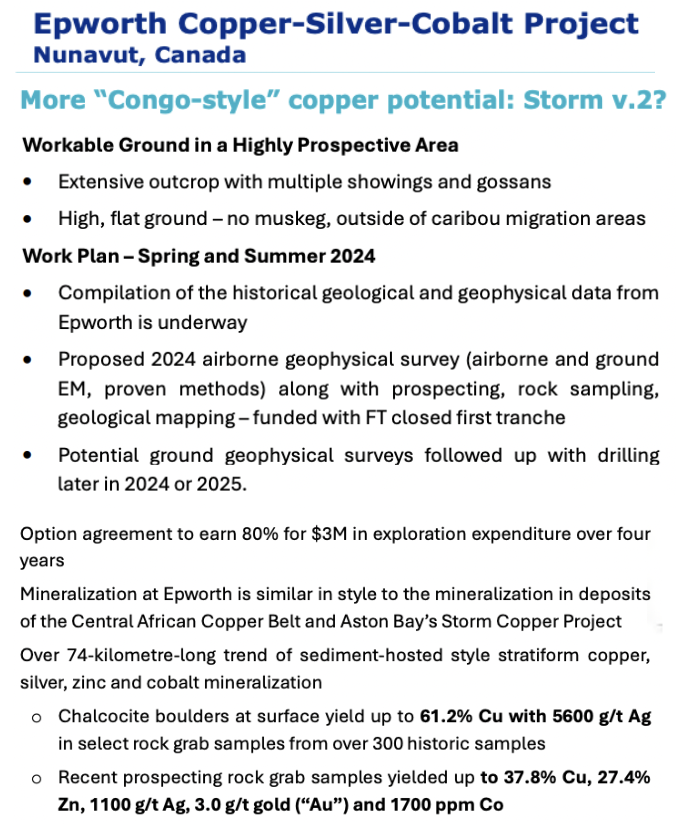

Aston’s 20% free-carried interest in Storm is arguably worth more than the Company’s entire enterprise value {market cap + debt -c cash} of $22M, meaning that shareholders get the Epworth project for free. Aston is earning up to an 80% interest in the 71,135-hectare Epworth project, for $3M over four years.

Also on Somerset Island, Nunavut, Epworth could be Storm Copper 2.0. It shares many of the same characteristics. Although earlier-stage, chalcocite boulders returned up to 61.2% Cu + 5,600 g/t silver! All else equal, if Epworth is half as good as Storm, it could be worth twice as much to shareholders.

Today, lithium juniors are on day #1 of a powerful rebound, many are up +10%-20%, as investors bet that Li prices have bottomed. Bullish sentiment could return to Cu juniors upon signs the Chinese economy is stabilizing, or supply disappointments from labor strikes/protests, water/power constraints & grade depletion, causing the Cu price to rise.

It wouldn’t take much (probably just +10%) to make a difference in market sentiment. And, +10% from $4.15/lb. would still be 12% below May’s high tick of $5.20/lb.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aston Bay are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply