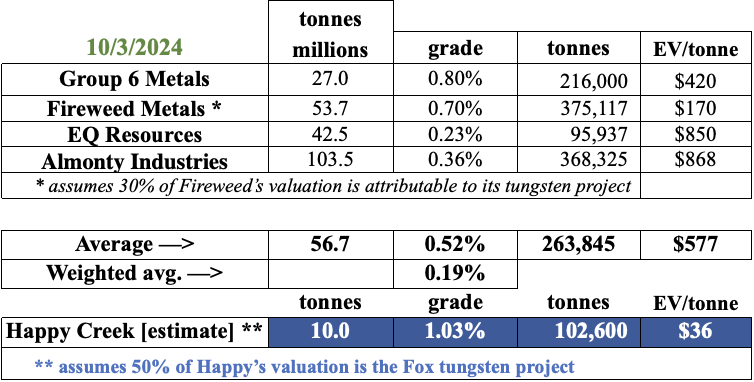

Happy Creek (TSX-v: HPY) has three Canadian assets — any one of which could be a company-maker. For example, its sizable Fox property hosts a Top-decile grade tungsten deposit. In the chart below, notice Happy’s grade compared to their peers.

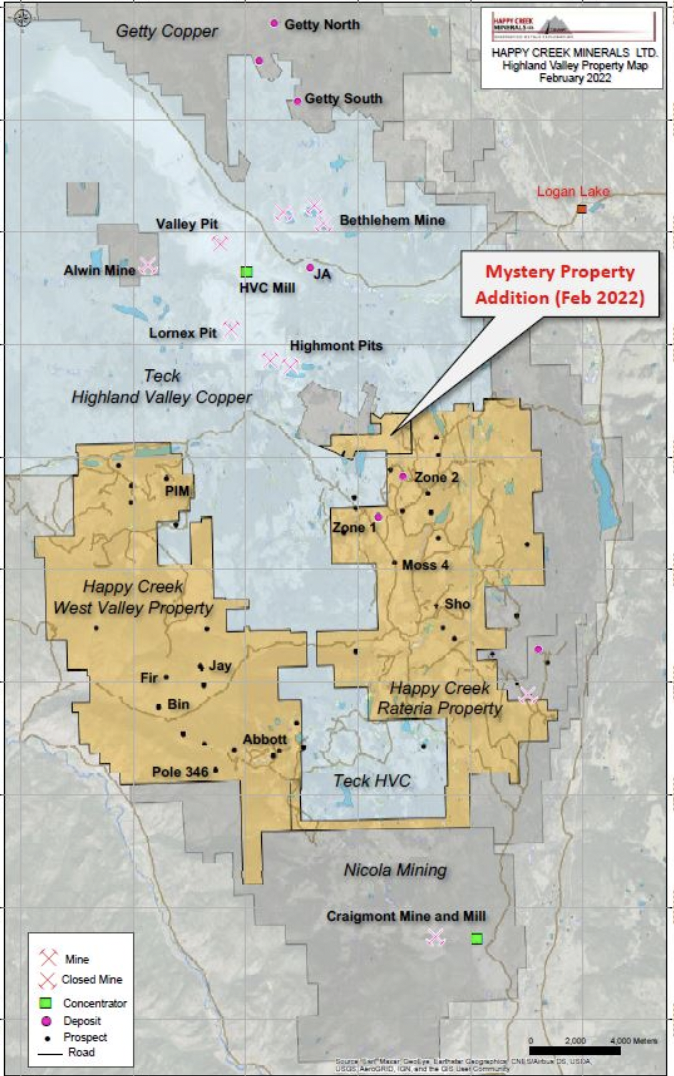

On October 4th, the Company announced a meaningful transaction, the sale of its Highland Valley project to Metal Energy Corp. for total cash & equity payments of ~C$6.4M over four years (all but $300k [at closing] in shares of Metal Energy), $250,000 in exploration expenditures is required by 12/31/24.

$1.0M, $1.0M, $1.5M & $2.5M worth of shares in Metal Energy will be issued on the 1st, 2nd, 3rd & 4th anniversaries, respectively, of the closing date. Importantly, Happy Creek will retain a 2.5% NSR on Highland Valley of which 1.5% can be repurchased by Metal Energy for $5M. Hopefully, this NSR will be valuable one day.

As per the agreement, if additional share issuances result in Happy Creek rising above a 19.9% ownership position in Metal Energy, then Metal Energy will have to pay cash instead of shares on the annual milestone payments. Metal Energy shares are up 100% on this news.

As part of the Ore Group, Metal Energy will leverage its extensive experience to harmonize & remodel historical data into a comprehensive, modern database. This process will enable the identification of opportunities & trends for future drilling & development.

The Highland Valley project is permitted to drill, boasting a history of > 55,000 metres of drilling across 402 holes. A systematic drill program will expand known high-potential zones and uncover new targets within the East & West Zone claims. The project was consolidated into a single land package over 17 years.

CEO Jason Bahnsen’s technical team thinks there’s a possibility of up to 50M tonnes of — 0.25 to 0.30% Cu — in Zones 1 & 2 {see map above}. However, if line-of-sight to 10s of millions of tonnes can be established, look at how much property remains to be explored/drilled.

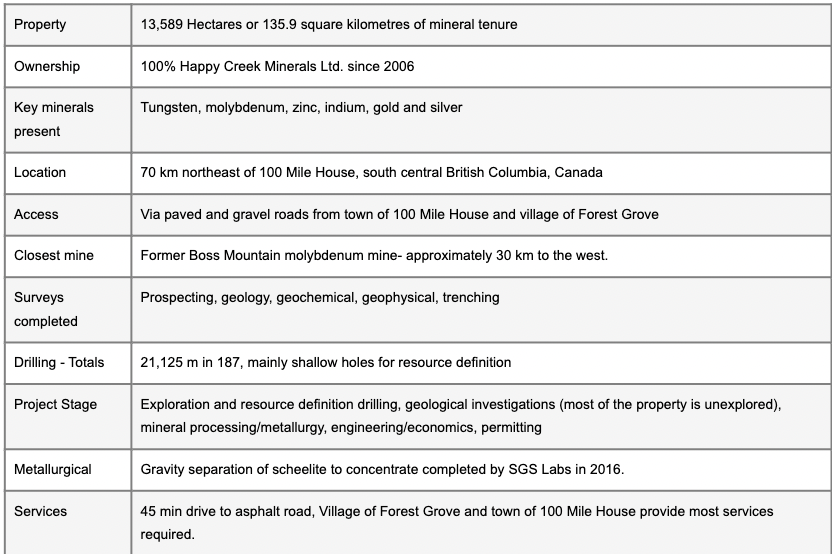

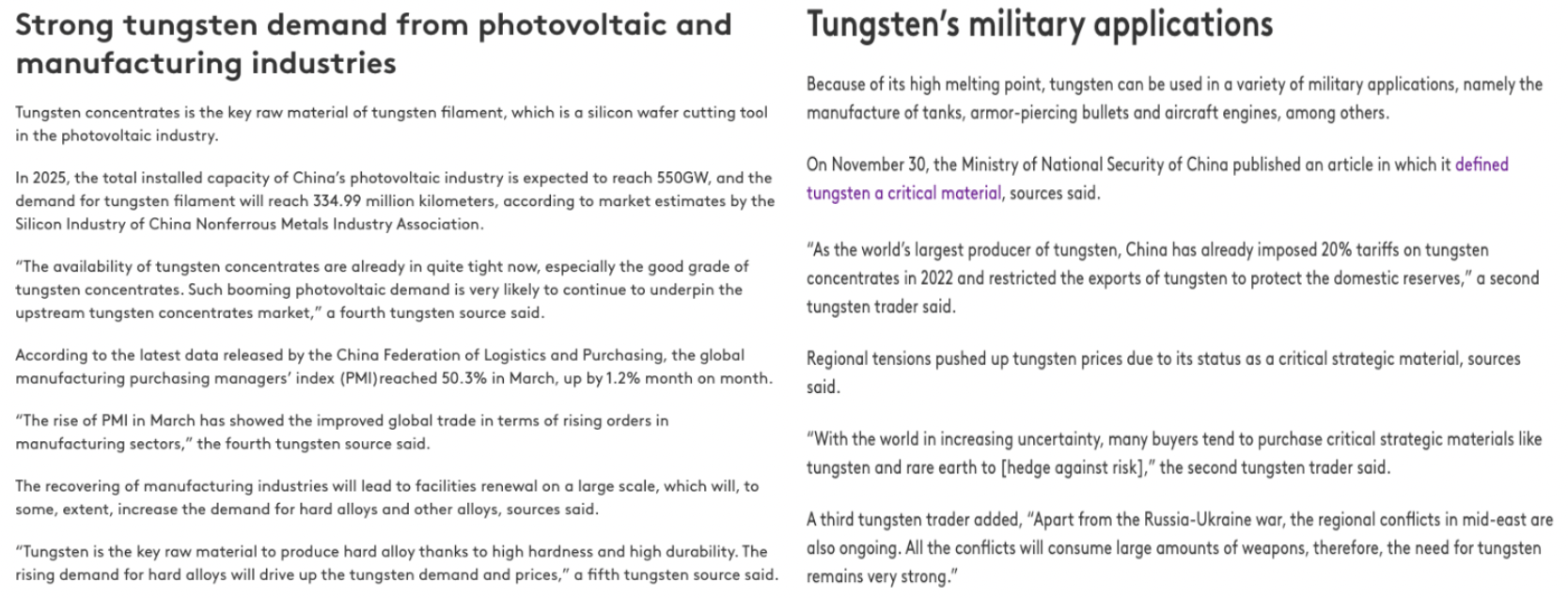

Happy Creek is now even more focused on its 100%-owned, 13,589 hectare Fox tungsten project in British Columbia. The global tungsten market was valued at ~US$4.8 billion in 2022 and expected to grow to $9.5 billion by 2031, which would be a CAGR of 8%.

The area of prospective mineralization at Fox is 12 x 5 km, but exploration to date has been limited to just a few small areas. Drilling has shown stacked sequences of tungsten mineralization averaging 10 meters thick from surface outcrops to ~150 m depth.

Interestingly, other metals such as zinc, indium, bismuth, gold & silver occur with the tungsten but are not included in the resource. Management believes there could be 10 to 40M tonnes of tungsten-bearing mineralization. Immediate plans are to continue mapping & sampling new zones to identify strong drill targets.

It would not require a large deposit for Fox to become an important asset. Given its stellar grade, 10M tonnes would be quite significant. And, Happy’s 100%-owned, 200 sq. km project could potentially host multiple tungsten deposits. {see chart above}.

The road-accessible Fox prospect is in the south Cariboo region of British Columbia. Due to its importance & supply risk, tungsten is deemed a strategic & critical element in Canada, the U.S., and the EU.

Preliminary metallurgical results indicate that Fox material can be recovered using gravity tables to produce a quality concentrate. There is excellent access & infrastructure; roads, power, rail & labor.

The U.S. government cares about tungsten for its uses in aerospace & defense, and tungsten is used in electrical contacts/switches, munitions, EVs, incandescent lighting, solar & wind farms & medical devices. Check out the latest on tungsten’s increasingly important role in the testing/development of nuclear fusion.

Tungsten is one of the hardest & densest industrial metals with the highest melting point. Tungsten currently trades at ~US$33,500/tonne, 3x that of battery-quality lithium carbonate. Over 85% of tungsten is sourced from China & Russia.

Although U.S. / Chinese geopolitical tensions are manageable at the moment, that could change if/when China invades Taiwan. Will China continue to allow critical materials like tungsten flow to support the West’s military complex?

Geopolitics & economic rivalry span far beyond military applications. Flashpoints could easily arise over semiconductors, solar panels, EVs, and/or Artificial Intelligence.

In the U.S., the Biden Administration recently announced a quadrupling of tariffs on Chinese EVs to 100%, a doubling on semiconductors & solar equipment to 50%, and an increase on Li-ion batteries to 25% from 7.5%. How heated might relations become? Canada recently introduced new tariffs as well.

Fireweed Metals bills itself as having one of the highest-grade tungsten resources. I attribute 30% (C$49M) of Fireweed’s valuation to its tungsten prospects or $131/tonne in the ground. Given Fox’s grade of 1.03%, (vs. Fireweed at 0.70%) each 10M tonnes could be worth ~C$11M = $27/tonne vs. Happy’s valuation of ~$7M.

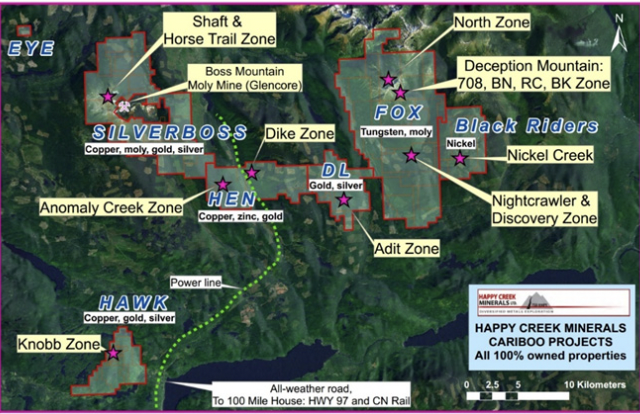

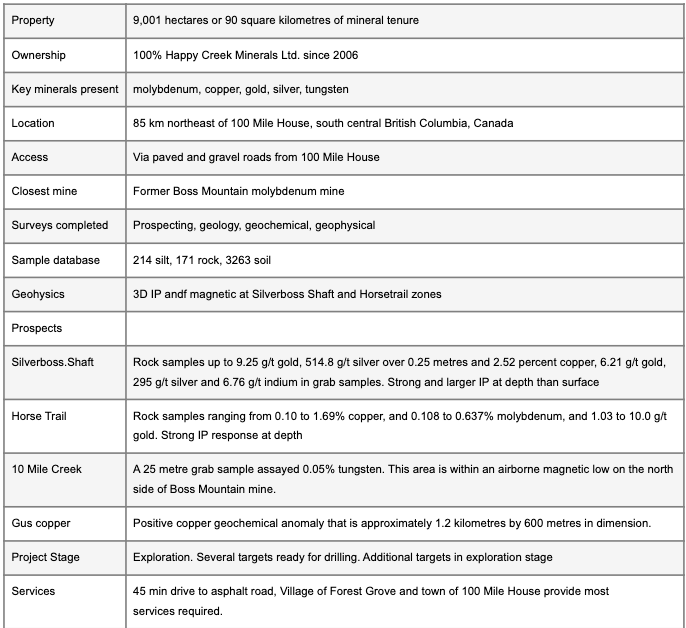

The 100%-owned, 155 sq. km, Silverboss property is ~85 km NE of 100 Mile House in S. central B.C. For the first time, a single Company has obtained this strategic land position around the former Boss Mountain mine.

This is the first time one Company has obtained a strategic land position around the former Boss Mountain molybdenum mine property, locally within 350 metres of one of the existing open pits. Silverboss is reasonably close to Imperial Metals‘ Mount Polly mine. 2024 guidance at Mount Polley is 30.0-33.0M lbs. Cu + 35-40,000 oz. Au.

Finally, the 6,266-hectare Hen & Art-DL property adjoins the Company’s Silverboss & Fox projects to the south & west, respectively. Exploration has developed easily accessible, low-cost Cu / Au / Zn / Ag targets. There has been sporadic trenching & drilling from 1993 to 2010.

Although the results were nothing to write home about, (a couple of meters here & there of 1-2 g/t Au) valuable insights on geology & structures are always gained by trenching & drilling. Readers should note that exploration techniques have improved substantially since the 1990s.

The DL prospect is centered on an adit (a tunnel with only one entrance), which dates back to the 1880’s. Rock samples returned up to 42.9 g/t Au, 34.7 g/t Ag over 1.0 m. Exploration to date has developed several easily accessible, low-cost copper, gold +/- silver drill targets.

The property shares similarities to other orogenic Au analogs like the Thunder Ridge & Spanish Mountain prospects 1.5 km to the south & 100 km to the north.

Silverboss + Hen & Art-DL could potentially be farmed-out or monetized if the right partner comes along. It’s hardly a stretch to think that Silverboss or Hen & Art-DL is worth C$5M+. In my view the Fox project is already worth C$10M+.

Happy Creek has three promising prospects in Canada. If one believes as I do that tungsten in the West will be in short supply, then Happy Creek (TSX-v: HPY) / (OTCQB: HPYCY) is a potential solution. Unlike Cu juniors, of which there are well over 300, there are fewer than 10 juniors with meaningful tungsten projects.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Happy Creek, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Happy Creek are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Happy Creek was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply