Investors in junior miners in N. America or “penny dreadfuls” in Australia know these highly speculative investments can be horribly oversold. And, when a company has multiple projects, the sum of the parts often comes up well short of the whole.

This is especially true during downturns, but some commodities are in bull markets –> most notably gold & silver (“Ag“). A compelling company that no one knows because management has been quiet for quite some time is Nubian Resources (TSX-v: NBR) / (OTCQB: NBRFF).

Nubian has both a hidden and a forgotten asset, two assets that could be Company-makers. Regarding the hidden asset, Nubian owns 55 million shares of Athena Gold. That position alone at $0.07/shr. is worth $3.85M, about the same as Nubian’s entire enterprise value {market cap + debt – cash} of ~$4M!

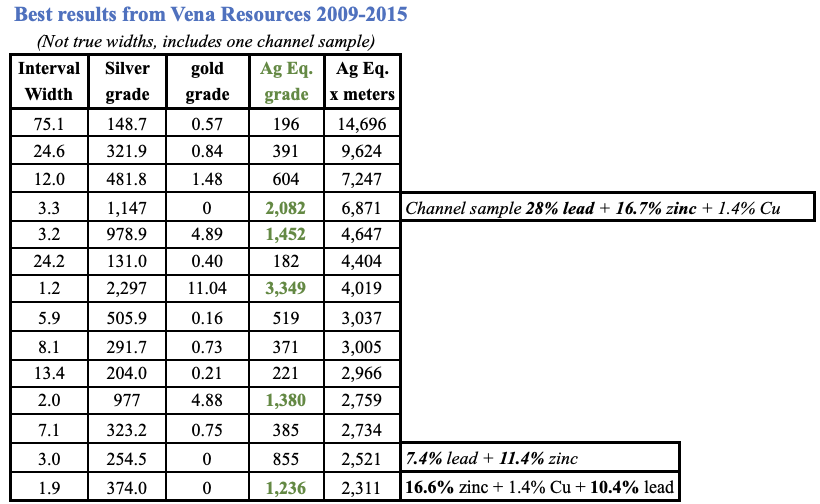

That means investors in Nubian at $0.06 get the forgotten asset for free. Nubian’s forgotten asset is an excellent primary Ag project named Esquilache in southern Peru. Look at these high-grade intercepts, they compare well to the best that S. America has to offer.

These pockets of ultra-high grade should interest prospective strategic partners who could drill more aggressively than tiny Nubian. Strong grades and a management team that was instrumental in selling Aquiline Resources to Pan American Silver for > $620M in 2010.

When Ag languished for most of the last decade, US$10-$20/oz. lower than the current US$31.41/oz., many Ag-heavy projects in S. America went dormant. Now, there’s an Ag renaissance underway.

In addition to producers Coeur Mining, Endeavour Silver & Aya Gold & Silver up an average of +200% from 52-wk lows, smaller companies like Pantera Silver, GR Silver Mining, Andean Precious Metals, and Gatos Silver, are up an average of +361%.

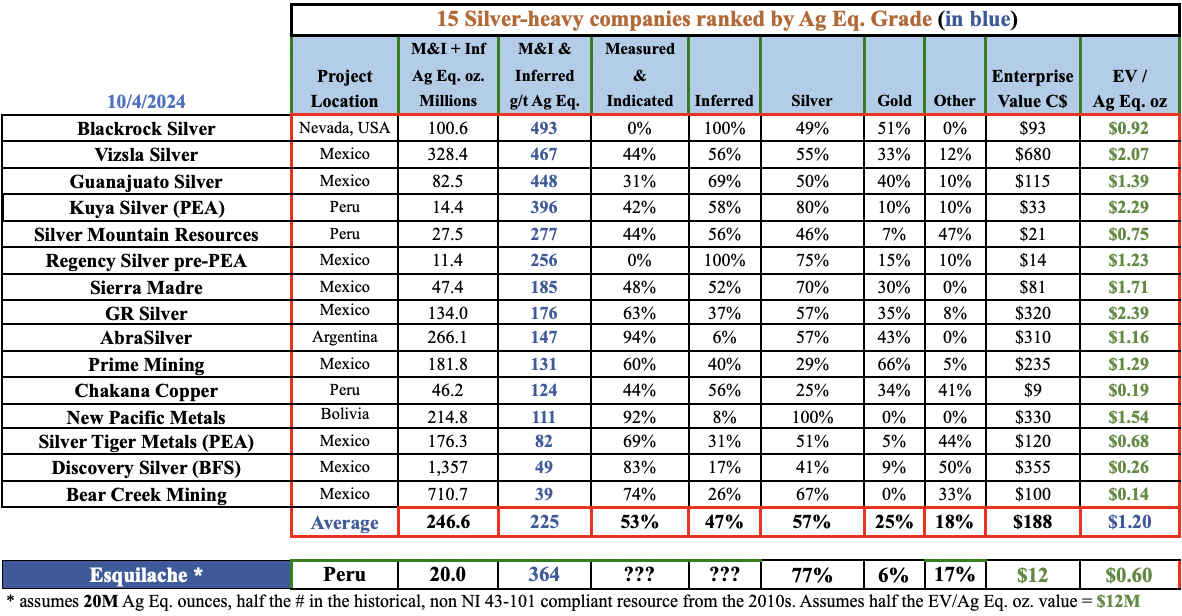

A non-NI 43-101 compliant resource showed ~3.39M tonnes of 281.5 g/t Ag + 0.25 g/t Au + 0.22% Cu + 0.56% lead + 0.95% zinc. At spot prices, this would be a strong primary Ag (77%) resource with an Ag Eq. grade of 364 g/t. A new NI 43-101 compliant resource estimate is coming next year.

It’s been a decade since Nubian’s Esquilache project saw meaningful work. Yet, it had a [non NI 43-101 compliant], (in-house), Pre-Feasibility Study (“PFS“) done by Vena Resources. The project was interesting in 2013, it’s a lot more interesting today… The Ag price has doubled!

The PFS findings cannot be relied upon, but much of the work will be utilized in this bull market. The first step is a surface sampling & mapping field trip. Community agreements are being finalized, followed by permitting for a drill program.

Three phases of drilling are planned for a total of 12,554 meters. Additional funding is required to spearhead these exploration activities. Management will refresh existing engineering, metallurgy & costings, leading to a new mineral resource estimate & Preliminary Economic Assessment (“PEA“).

Vena Resources claimed to have nearly 40M Ag Eq. ounces (non-NI 43-101 compliant). In the chart below are peer valuations ranging from $0.14 to $2.29/Ag Eq. oz. Discovery Silver & Bear Creek are valued at an average of $0.20/.oz. because they have an average grade of just 44 g/t Ag Eq. (US$44/t rock). Nubian’s indicative grade of ~364 g/t Ag Eq. would be (US$368/t rock).

Could Esquilache alone be worth $12M? In my view, YES. I get that $12M figure from a prospective 20M Ag Eq. oz. resource valued at $0.60/oz. (half the average of peers in the above chart).

Companies like Hecla Mining, Coeur Mining, First Majestic, HudBay Mining, Fortuna Mining, Orla Mining, SSR Mining Endeavour Silver, SilverCorp Metals & Aya Gold & Silver would greatly benefit from partnering to develop a project like Esquilache.

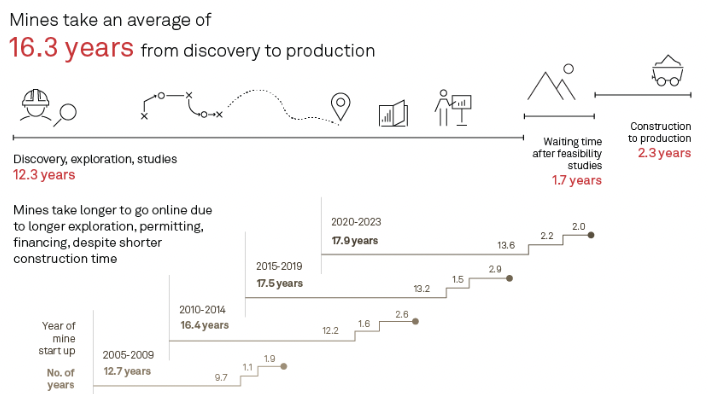

Earlier this year, S&P Global Market Intelligence released a study that showed the average time for a Major discovery in 2015-23 to reach production of 17.5+ years! With Ag/Au prices soaring, every producer on earth is urgently trying to bolster production pipelines.

Esquilache could reach initial production in 2026, and remember, investors in Nubian at $0.06/shr. get Esquilache for free due to the 55M shares of Athena Gold.

Vena Resources planned to develop a small-scale operation of 350 tpd. Management, led by CEO & Director Martin Walter & Chairman Marc Henderson is pursuing an initial 350 tpd operation, which would be ~2,950 Ag Eq. oz./day (assuming 72% recoveries).

This proof-of-concept mining stage is a low-cost, prudent way to fast-track production.

Nubian owns 55 million shares of Athena Gold, worth more than Nubian’s market cap…

Nubian owns 55M shares of Athena Gold, a company with two exciting projects. A new team led by Chairman David Goodman & CEO Koby Kushner, P.Eng., CFA, is taking the reigns. The Excelsior Springs project is in Nevada’s Walker Lane trend. 84 RC holes defining the near-surface Buster Mine gold zone have been drilled.

In 2022-23, 29 holes led to the discovery of significant high-grade mineralization. The best results were 33.5 m at 5.4 g/t Au Eq. & 27.4 m at 6.6 g/t Au Eq. Athena is re-envisioning what was once a narrow-vein underground target into a large-scale open pittable target.

AngloGold Ashanti, Kinross (nearest to Excelsior), Centerra Gold & Augusta Gold are active in the area. Athena’s other focus is in Ontario, at the Laird Lake project in the world-famous Red Lake Gold camp.

According to CEO Kushner, > 90% of the Au in Red Lake occurs within 300 m of the contact between Balmer & Confederation rock types. Everywhere this contact exists has been extensively explored, except for a 10-km stretch that Athena controls.

There’s a lot of enthusiasm around Laird Lake. Given its unexplored and the importance of the Balmer-Confederation contact zone, this could be the most prospective property in Red Lake.

Athena Gold’s stock is up +40% in the past month due to the new management team coming in to revitalize the Au projects, but it’s still valued at < $10M.

Both the 100% interest in Esquilache that investors get for free AND the 55 million shares in Athena Gold, have substantial blue-sky potential. Either one could be a Company-maker. Nubian Resources (TSX-v: NBR) / (OTCQB: NBRFF) is an excellent opportunity to play the bull market in Ag.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Nubian Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Nubian Resources are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Nubian Resources was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply