M&A is picking up in S. America to kickstart development efforts of long-dormant & slow-moving copper (“Cu“) projects. BHP & Lundin Mining announced the acquisition of one of the best projects on earth, Filo Mining’s Filo del Sol. Fun fact, this project was discovered in 1999.

McEwen Mining’s Los Azules in Argentina was discovered in 2007, and Regulus Resources’ AntaKori in Peru was discovered in 2012 but is pre-PEA a dozen years later. NGEX’s Los Helados/Chile– 2008, Lundin Mining’s Josemaria/Chile– 2006, Solaris’ Warintza/Ecuador– 2000…

On average, these six “generational assets” are 19 years old and still years from production! Not many companies have the patience or the balance sheet to start a mega-Cu project facing > 20 years before cash flow. There’s widespread agreement that the world needs more Cu, not just this decade, but for decades.

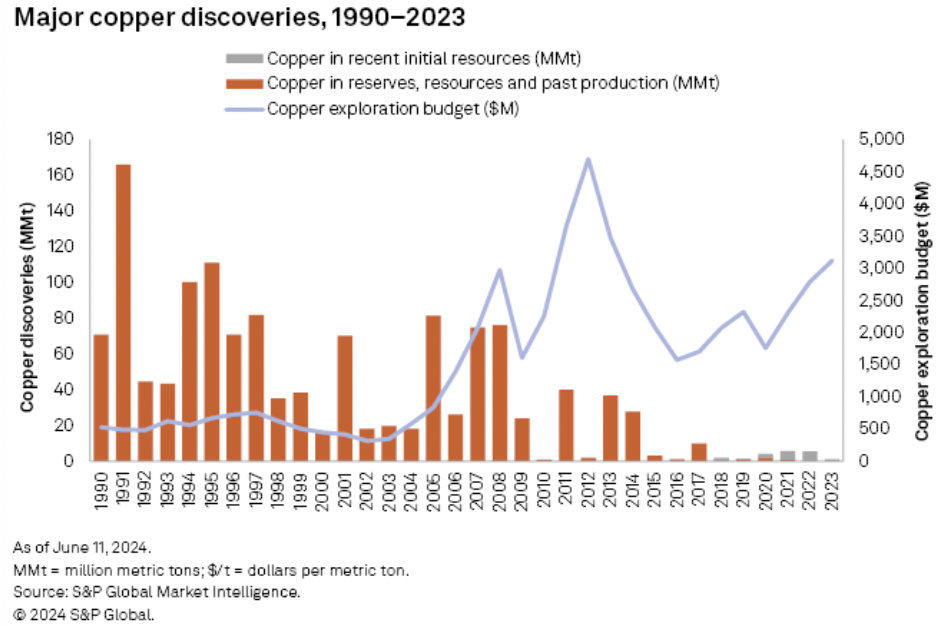

S&P Global Intelligence has a famous chart, see above –> Look at the absence of Major discoveries in the past decade! What does this mean for supply in the 2030s-40s? It’s truly alarming. In the 34-yr. period from 1990-2023 there was an average of 7 discoveries per year, and 9.4/yr. from 1990-2013, but just 1.4/yr. from 2014-2023.

This is a huge problem with no simple answers. In addition to new power plants & EVs, data centers are a surprisingly large user of Cu. Others include robotics, 5G/6G telecom, and “smart cities.” Global demand is growing at 3%/yr., which doesn’t seem so bad until one looks at long-term supply prospects.

Among the top Cu-producing countries are the DRC, China, Russia & Indonesia. Some of the world’s largest undeveloped Cu projects are in Pakistan, Mongolia, Indonesia, the Philippines, Zambia & Russia. What could possibly go wrong?

Top producing countries #1 & #2 are Chile & Peru, but reading my opening paragraphs tells the tale of S. America — projects take a long, long time to commercialize. And, even if major new assets come online reasonably on time, much of the output is headed to China and “the East.”

Western countries, most notably in N. America & western Europe, urgently need security of supply from friendly countries like Australia, the U.S. & Canada, where there’s a rush to develop smaller-scale projects sooner rather than later.

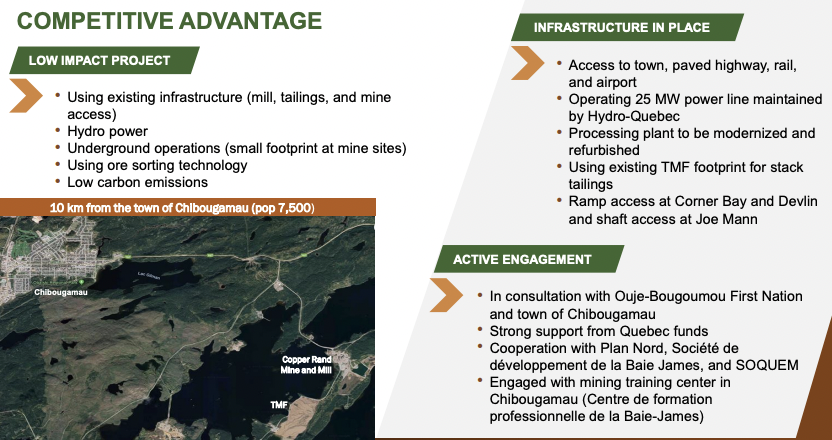

That means high-grade deposits in safe, secure jurisdictions, with evidence of local community support. It means green power like from a hydroelectric grid. It means projects that are not too remote and have water, power, roads, people, equipment, mining services, internet/phone, etc.

Finally, projects near major end markets, not oceans away. You know Cu is hot when an Au Major invests C$55M into a Chilean Cu-Au project like Agnico Eagle just did. Investing in Cu juniors offers compelling risk-reward. Lithium juniors are valued at about 1/100 the value of a tonne of lithium.

Gold (“Au“) & silver juniors at 1/50 & 1/30, respectively, the value of a troy ounce, and uranium juniors at ~1/5, the price of a lb. of U3O8. By contrast, Cu juniors fetch just 1/225 the price of a lb. of Cu (juniors at ~$0.02/lb. vs. price of ~$4.50/lb.).

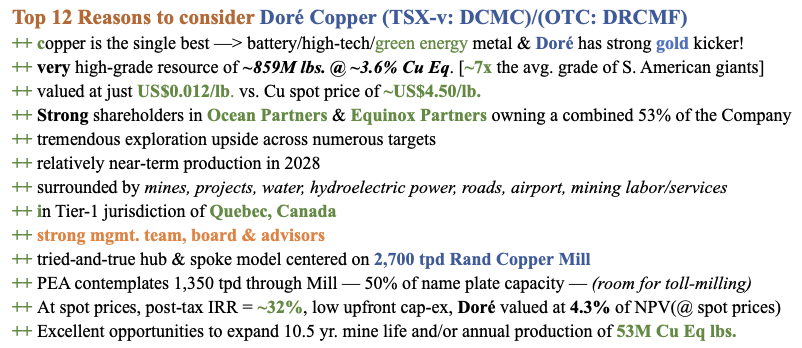

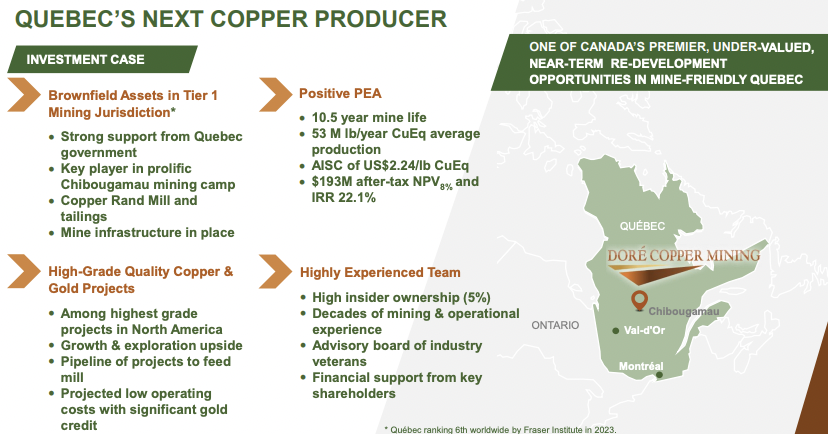

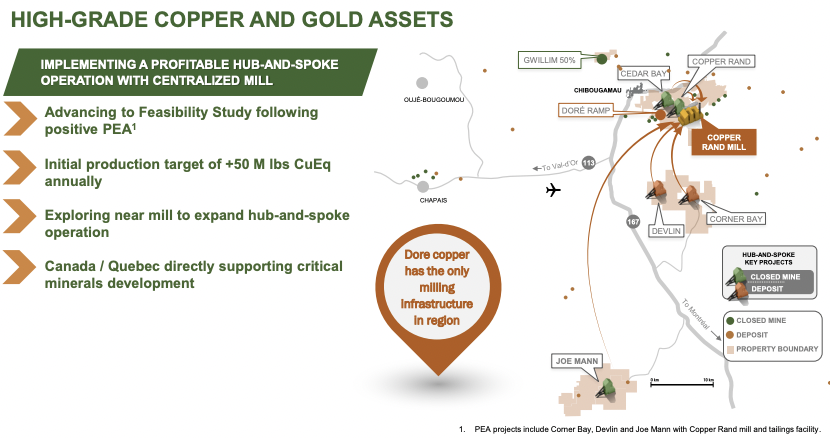

Canada & the U.S. check all the boxes for Cu plays. For example, Doré Copper (TSX-v: DCMC) / (OTC: DRCMF) has a very high-grade Cu/Au [brownfield] project in the prolific, low-risk Chibougamau mining camp in Quebec, surrounded by infrastructure incl.; roads, power, water, rail, an airport, labor, equipment & services.

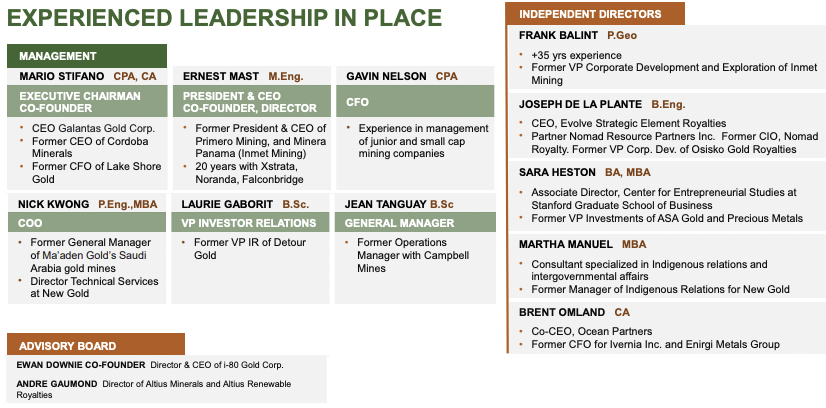

This is a company with an excellent management team, board & slate of advisors. see abbreviated bios above and a lot more detail on the projects and the team in the new October corporate presentation. Doré has a stellar shareholder base highlighted by Ocean Partners & Equinox Partners with a combined ownership of 53%.

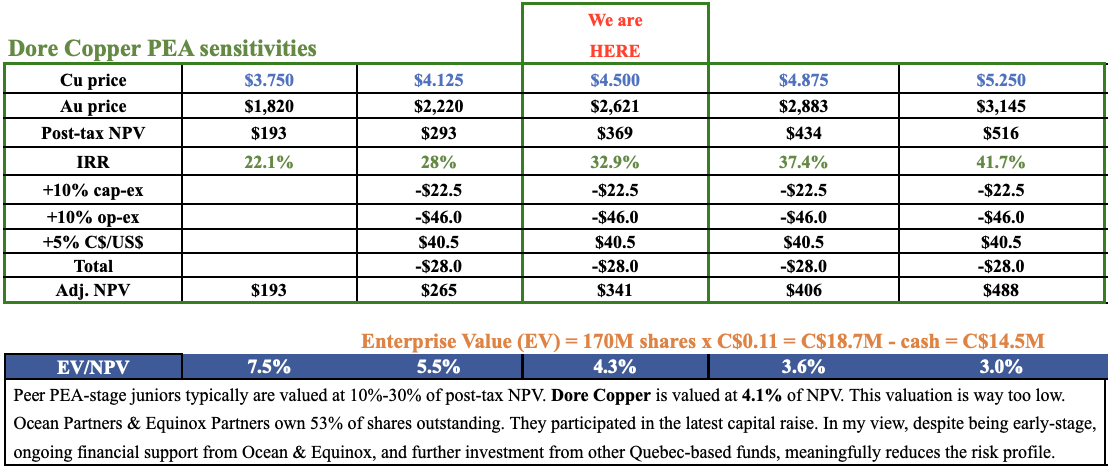

The Company is pursuing a hub-and-spoke development strategy upon which a PEA was done in May 2022, showing a robust project with a post-tax NPV & IRR of $193M & 22% [at $3.75/lb. Cu & $1,820/oz. Au], producing 53M lbs. Cu Eq./yr. over 10.5 years.

Upfront capital is reasonable at $181M and AISC is attractive at US$2.24/lb. Doré owns 100% of its assets, except for 50% of the promising GWILLEM Au target in a JV with Alamos Gold and a recently acquired 56% stake in a property tied to CB, with 44% owned by Pan American Silver.

Another multi-billion dollar producer with projects close by is IAMGOLD Corp. Any of those three companies could be interested in acquiring or partnering with Doré. In the following chart are ESTIMATES, based on the sensitivities data of the PEA, of post-tax NPV at higher Cu/Au prices, offset somewhat by an assumed +10% increase in op-ex & cap-ex.

At spot prices, the pro forma NPV is ~$341M vs. cap-ex of [$181M x 1.1 = $199M]. The NPV/cap-ex ratio at spot prices = 1.7x, which is quite good. I believe Doré is undervalued due in large part to fears of equity dilution. These metrics should improve over time as the mine life of 10.5 years has room to grow between now and initial production in 2028.

However, with assistance from gov’t in the form of grants, loans & tax breaks, and Quebec institutions, commercial lenders, equipment financing, off-take agreements & royalty/streaming opportunities, production could be achieved without excessive dilution. The Company currently has ~C$4M in cash.

An enhancement to PEA economics could come from detailed flotation test work on a composite CB sample that determined a clean 28% Cu concentrate can be delivered vs. the 24.7% concentrate grade assumption in the PEA.

Management believes the cost to design, permit, fund, build & commission a new 2,700 tpd mill & tailings facility would be ~$125M. High-grade projects have far less environmental impact — less waste & energy per pound of Cu produced, and lower capital intensity than giant, low-grade projects. These factors mean far less execution risk for Doré.

Although at the PEA stage, a BFS is expected in 2Q 2025. Depending largely on nearness to production, high-quality BFS-stage mining projects are valued at 25% to 50% of after-tax NPV.

For example, Skeena Resources is valued at ~45% of its BFS-stage project in B.C., Canada, and Montage Gold is trading at ~34% of its PFS-stage project in Côte d’Ivoire, Africa. By contrast, Doré Copper is valued at ~4.3% of post-tax NPV(at spot prices).

While the resource size is much smaller, Doré has 7x the average Cu Eq. grade of the largest S. American peers. And, it should reach production sooner than most of them. The land package hosts 13 former mines, deposits & target zones within 60 km of the 100%-owned, 2,700 tonne/day Copper Rand Mill.

The flagship Corner Bay [“CB”] project represents ~75% of a booked 859M pounds [Cu Eq. @ spot prices] [Au worth ~21% of total in-situ value]. Note, there’s also a historical non-43-101 compliant resource of ~94M Cu Eq. at the Copper Rand target. The resource size has ample room to grow given numerous exploration targets.

Most of the Au is found at the Joe Mann & Cedar Bay deposits host very high grades of 6.8 to 9.4 g/t Au. With Au doing so well, the Cu Eq. grade of the Company’s 859M lbs. is 3.6%. Doré is valued at just US$0.012/lb.

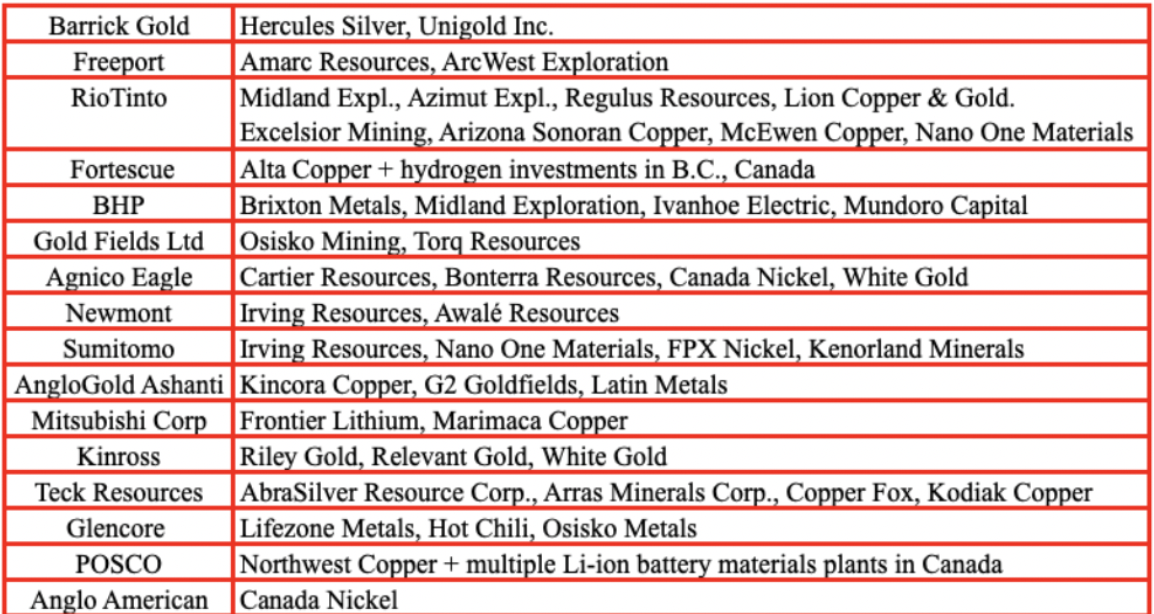

In the chart below are 13 large companies and the investments they’ve made in juniors. This is just the beginning, many listed above are swimming in cash. Although Cu at $4.50/lb. is not enough to incentivize companies to build mega-mines, existing producers are doing well and Au company profit margins are US$1,000-$1,500/oz.!

Notice I included two Au Majors as potential suitors of Cu-heavy assets. Both tout their credentials in Cu to complement primary Au portfolios. This year, Barrick & Newmont are guiding to production of 430M & 335M pounds of Cu.

The beauty of Doré Copper (TSX-v: DCMC) / (OTC: DRCMF) is that it can go it alone given its relatively low upfront cap-ex hurdle, or take on a strategic partner. If it does partner up, it can do so on favorable terms as it doesn’t need a great deal of financial assistance.

Perhaps CEO Ernest Mast could sell just 20-25% of the project, retaining 75-80% of the economics but getting a very meaningful chunk of cap-ex funded, with most of the remainder of cap-ex met with debt + other non-equity dilutive instruments.

News of funding, drilling updates, and progress towards a BFS in 2Q/25 should keep management busy and the news flowing. Please take 5-10 minutes to review the Company’s new October corporate presentation.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Dore Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dore Copper are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dore Copper was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply