All ounces are gold (“Au”) equivalent [Au Eq.] ounces. Unless stated otherwise, all dollars are US$

Readers are encouraged to always read disclosures/disclaimers at the bottom of every article.

Executive summary –> Troilus Gold is undervalued due to fears of excessive equity dilution to fund a very large gold/Cu project in Quebec. Yet, there are levers to pull to raise a very substantial portion of cap-ex via non-equity capital. If positive news comes on funding, the share price could move meaningfully higher. The Project is valued at just 3% of post-tax NPV (at current Au/Cu prices).

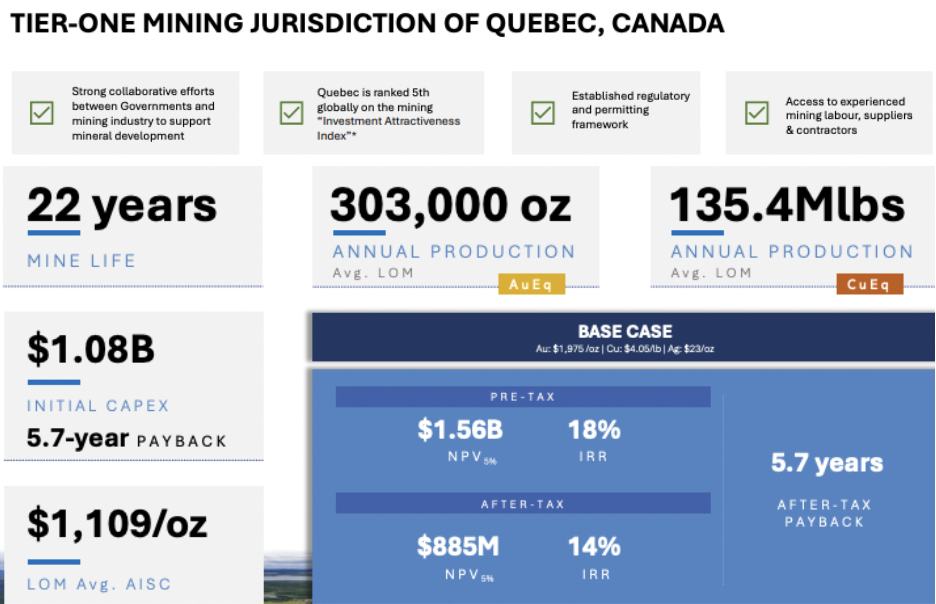

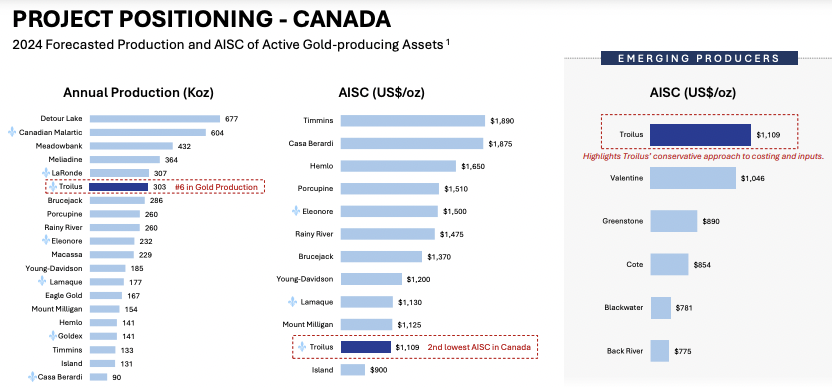

Troilus Gold (TSX: TLG) / (OTC: CHXMF) has one of the largest, advanced-stage, gold (“Au“) projects in N. America (303,000 Au Eq. oz/yr for 22 years). The brownfield Troilus Project hosts a past-producing mine on 495 sq. km in north-central Quebec and has a very significant copper (“Cu“) component.

The AISC at $1,109/oz is attractive compared to Newmont’s & Barrick’s most recent quarterly AISCs of $1,611 & $1,498/oz. A Bank Feasibility Study (“BFS“) in May showed a 22-yr mine life on just half of the 13M ounce measured, indicated & inferred resource.

Spot Au is now $705 (+36%) above the base case scenario in the BFS. Au at $2,680 & Cu at $4.40/lb. lifts post-tax NPV above $2.1 billion & IRR to ~24%. At current prices, free cash flow would be > $260M/yr.

The base case post-tax IRR of 14% at $1,975/oz Au is a sticking point for some. That IRR, and a payback period of over 5 years, caused the stock to plummet, and it remains near a 52-week low, –> -53% since mid-May. Meanwhile, Au is up nearly $300/oz.

Over the next 3-4 years, management will try to enhance Project economics with higher-grade ounces exploited earlier in the mine plan. Last month, drill results from a 1,866-meter, near-surface program on the newly discovered West Rim Zone (“WRZ“) showed 20 meters at 1.66 g/t Au Eq. incl. 3.1 g/t over 8.0 m.

From a recent press release, “Our primary objective is to identify & add higher-grade ounces that could be incorporated early in the mine plan. With the scale of this prospective trend (~4 km) remaining largely unexplored… we believe the West Rim Zone has the potential to enhance the mine model.”

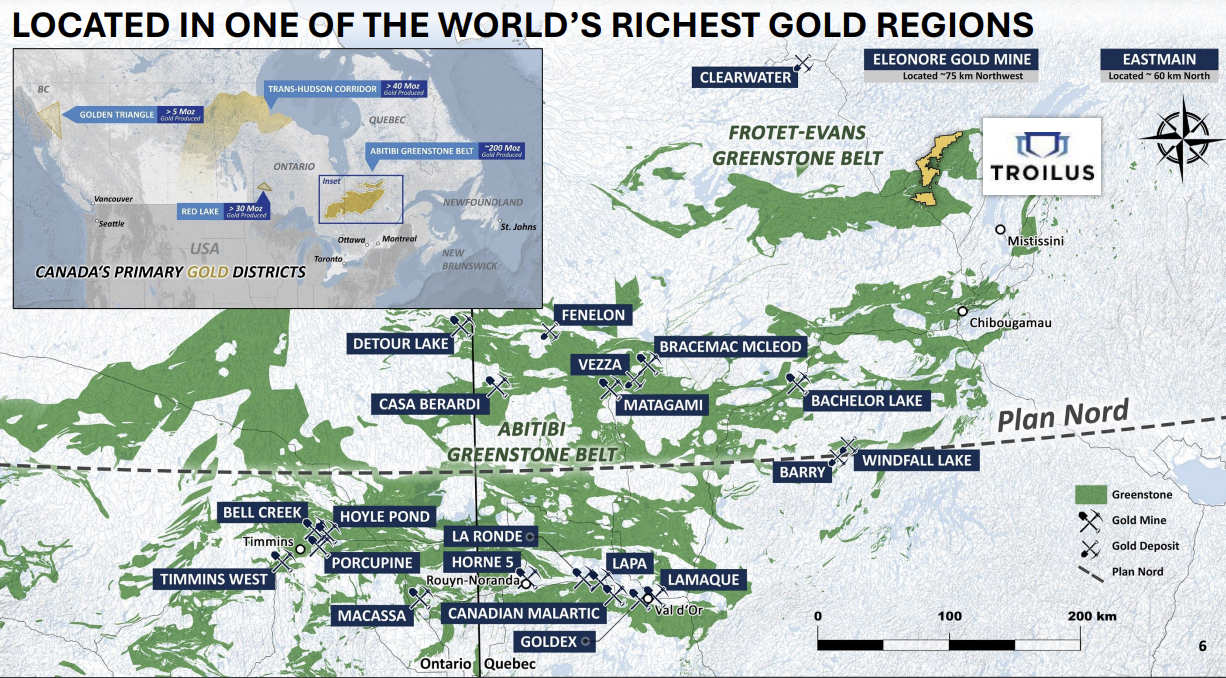

Troilus project in the Abitibi Greenstone Belt, just north of ~20 significant mines/deposits

Higher grades in years 1 to 5, could potentially add $100s of millions to post-tax NPV and boost IRR before accounting for stronger Au & Cu prices. However, there’s a problem. Some investors don’t believe Troilus will get funded, or if funded, equity dilution (well into the $100s of millions) is unavoidable.

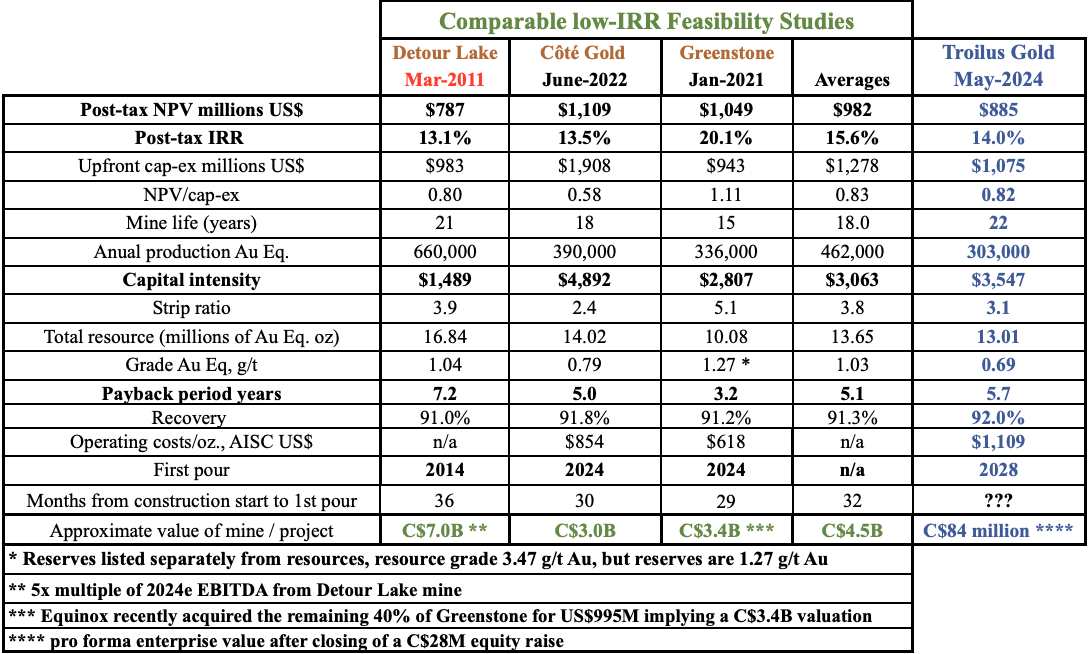

Readers are encouraged to compare Troilus to other low-grade, bulk tonnage mines in Canada. The following data is from each project’s respective Feasibility Study. Look at the comparisons to the Agnico Eagle Detour Lake, IAMGOLD/Sumitomo Côté Gold, and Equinox Gold Greenstone mines.

One would be hard-pressed to say Troilus stands out in an especially negative way. Yes, the grade is lower, but post-tax IRR of 13.1%, 13.5% & 20.1% averaging 15.2% is not much different than Troilus at 14.0%. And, payback periods of 7.2, 5.0 & 3.2, averaging 5.1 years not far from Troilus at 5.7 years.

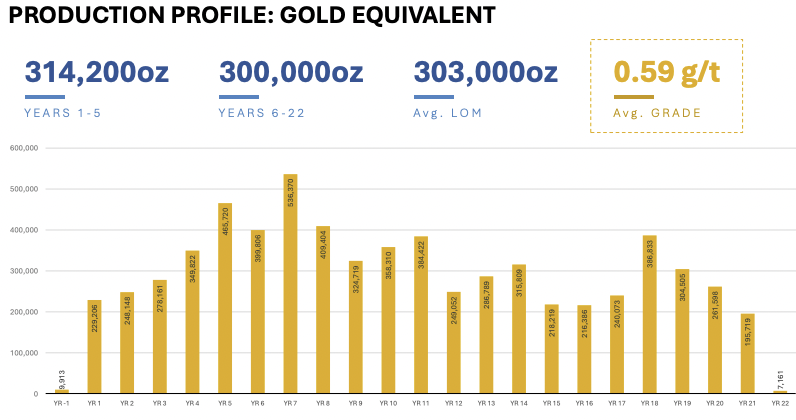

Although average peer production of 462,000 ounces is more than Troilus at 303,000 ounces, peak production in year #7 is 536,370 ounces, and years 5-8 clock in at 452,825 oz/yr. Therefore, Troilus with a strategic partner or an acquirer could presumably produce > 450k oz/yr for > 20 years.

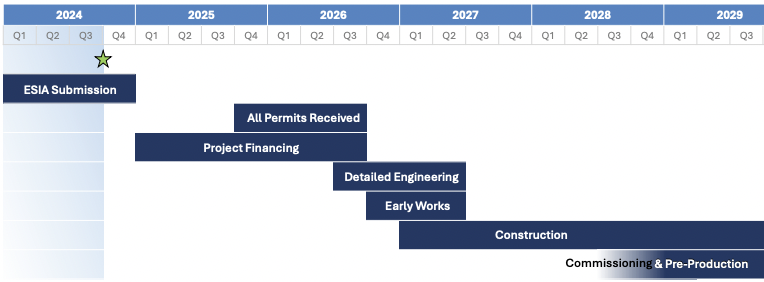

If development goes reasonably planned, Troilus is four years from where Côté & Greenstone are today, with their first Au pours in 2024. Notice the approximate valuations of each mine vs. the enterprise value {pro forma market cap incl. RSUs + debt – pro forma cash} of C$82M for Troilus at C$0.31/shr.

Côté & Greenstone are valued at roughly C$3.0 & C$3.4 billion, respectively. Amazingly, C$82M is just 3% of Troilus Gold’s post-tax NPV (at today’s Au/Cu prices). Troilus has solid economics at today’s metals prices to access debt, royalty/streaming, off-take agreements, and equipment financing.

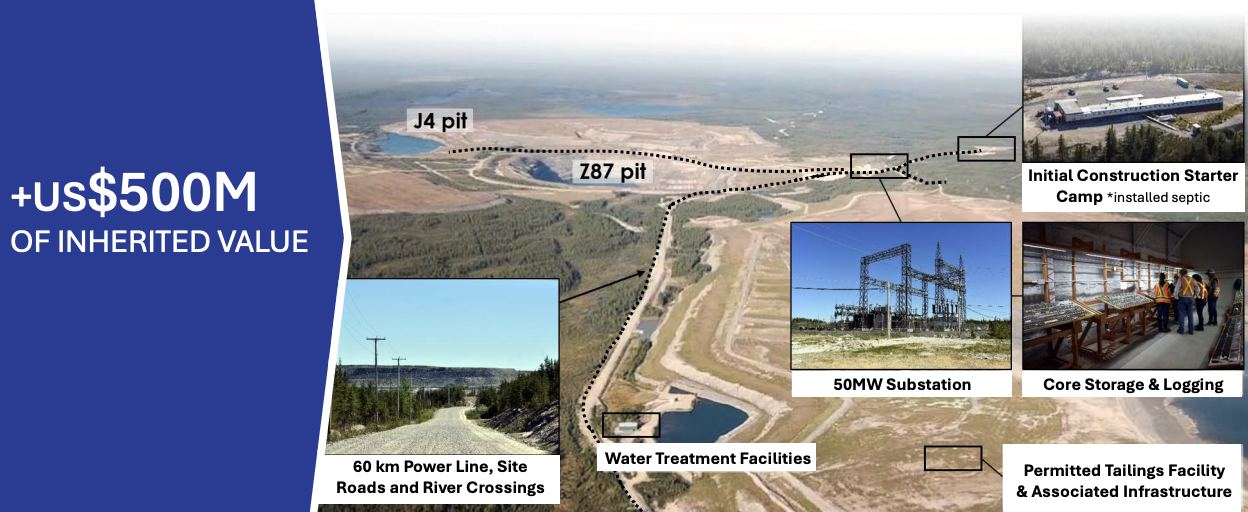

The same cannot be said of projects worldwide that have; complex flow sheets, difficult permitting requirements, local community opposition, dangerous jurisdictions, fossil fuel power, water challenges, or are very remote. Troilus has none of those problems. Technical risk is relatively low.

Last week a military junta in Burkina Faso said it plans to withdraw mining permits from foreign companies. Nothing like that happens in Quebec! Quebec is famous for its strong collaborative efforts between government & mining industry stakeholders in support of the development of provincial projects.

Of all the risks facing major Au projects, the biggest for Troilus is funding. However, gov’t assistance could come in the form of loans, grants, tax breaks, and R&D initiatives. And, royalties/streams on the Project’s Ag and/or Cu could deliver substantial sums.

Imagine if in a year Troilus is fully funded. How much would the Company be worth? Hard to say, but possibly considerably more than today’s level.

In addition to the potential for low-cost gov’t, or commercial debt, there are loans & loan guarantees available from Canada’s export credit agencies, funding from private equity groups & equipment financing from Komatsu Ltd, Caterpillar, or Liebherr.

Negative sentiment on Troilus is pinning the stock in the low $0.30s, but this negativity could dissipate upon updates on financing over US$1 billion in cap-ex + wcap. With numerous non-equity alternatives on the table, the downside might be pennies or a nickel, but the upside could be quarters.

Management believes it could (potentially) monetize its Ag in a royalty/stream for an upfront payment of ~US$50M, and possibly get ~10x as much for the Cu.

Therefore, with debt facilities + equipment financing + partially pre-paid off-take agreements with smelters, and royalty/streaming, up to 100% of [cap-ex + wcap] could be raised, or more likely, 75%-80% of total cap-ex raised without touching the Cu.

Even if equity raises are needed, nothing meaningful is needed anytime soon as the Company has ~C$35M in cash. I realize this sounds wildly optimistic given the current valuation & sentiment, but it comes down to the Cu royalty/stream (potentially) being worth US$500M.

That alone could satisfy up to 40% of [cap-ex + wcap]. Readers should note that the NPV would be lower after monetizing some or all of the Cu upfront.

Importantly, the Company does not want to monetize its valuable & strategic Cu endowment unless it has to. Even if non-equity sources come up short, management could sell a minority interest in the project.

Troilus would retain a majority stake with no meaningful equity funding required as the Company’s share of cap-ex would fall along with its ownership interest. Many multi-billion dollar Au producers should be interested.

Companies like; Agnico Eagle, Newmont, Barrick, Sumitomo Metal & Mining, Alamos Gold, Kinross, B2Gold, Gold Fields, Eldorado Gold, Hecla Mining, & Wesdome. The list does not include Cu-heavy producers like Teck Resources & Freeport McMoRan, but one can’t rule them out. Speaking of Au Major Agnico Eagle, this month it invested $40M into Cu-Au junior ATEX Resources.

Note: Alamos Gold (C$11 billion market cap) recently acquired Argonaut and is now a 50% JV partner on a sizable land package in the middle of Troilus Gold’s project area. See slide #7 of the new corporate presentation.

Investors who are pessimistic about valuation might be missing an important factor. The two biggest risks (funding & commercialization) are greatly diminished if Troilus is acquired or secures a strategic partner! And, the Project is arguably worth more as part of a portfolio of assets than as a standalone mine.

For example, if Agnico were to acquire Troilus to add to its eastern Canada Canadian Malartic, Detour Lake & LaRonde mines, it would enjoy diversification, economies of scale & operating synergies.

Troilus benefits from > US$500M in regional infrastructure. In addition to the significant dollar amount, the fact that considerable infrastructure is in place meaningfully de-risks the project.

With Au near an all-time high, and producers eager to bolster project pipelines, Troilus is looking to fund & build a mine in one of the best Au & Cu environments in a long time. Au companies are generating so much free cash flow they have little choice but to make acquisitions & strategic investments.

There are not many 300,000+ Au Eq. oz/yr projects in Canada (owned by juniors) that could start operations in 2028 or 2029, but dozens of mid-tiers & Majors urgently looking to grow.

The larger players will be willing & able to acquire & fund cap-ex on multiple projects like the one Troilus has, increasing competitive tension. As M&A picks up, there will be FOMO among producers, things could get very interesting!

Even if Troilus is not on top of M&A lists, it’s on all the lists! Valued at just 3% of NPV, there’s more room for upside than downside. With virtually no debt & ~C$37M in cash once its private placement closes, this is not a distressed scenario! I believe the cash will bridge Troilus to (some, not all) funding announcements in the next 3-4 months.

If I’m wrong and management can’t raise 70%-80% of cap-ex + wcap via non-equity sources, then an investment in shares at C$0.31 might not be a good one.

Readers can learn more about Troilus Gold (TSX: TLG) / (OTC: CHXMF) from its latest corp. presentation.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply