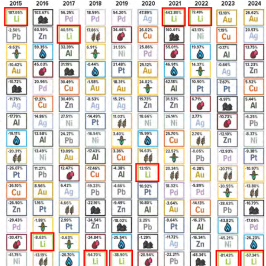

Despite huge moves in gold (“Au“) & silver (“Ag“), +39% & +48% in the past year — copper (“Cu“) & nickel (“Ni“) are indispensable, especially sources in N. America. I could write a book on the East, led by China vs. the West (U.S./Western Europe), but suffice it to say, relations are NOT good.

China/Russia + BRIC countries are decisively moving away from the US$, a prime reason Au is soaring. Over time, a weakening US$ is good for hard assets. Will the economic rivalry between East/West turn to military action?

Even if war seems unlikely today, can manufacturers of EVs & critical infrastructure bet on no wars in the next 20 years? Canada is especially well-positioned to thrive in the ongoing commodities boom as the hunt for security of supply intensifies.

It’s a haven next to the U.S. market and accessible to Europe from its east coast & Asia from the west. It enjoys nearly ubiquitous green hydroelectric power and has prolific deposits of Cu, Au, Ag, Ni, iron, zinc, lead, uranium & lithium, plus lesser concentrations of cobalt, REEs, platinum, palladium, chromite, titanium & vanadium.

That’s why Rio Tinto, Glencore, Teck Resources, BHP, Freeport McMoRan, Vale, Anglo American, Barrick Gold, Fortescue Metals, Sumitomo Corp., First Quantum, Boliden AB, South32, Hudbay Minerals, Ero Copper, Centerra Gold, Wyloo Metals, Taseko Mines, Imperial Metals & Juno Corp. are active across Canada.

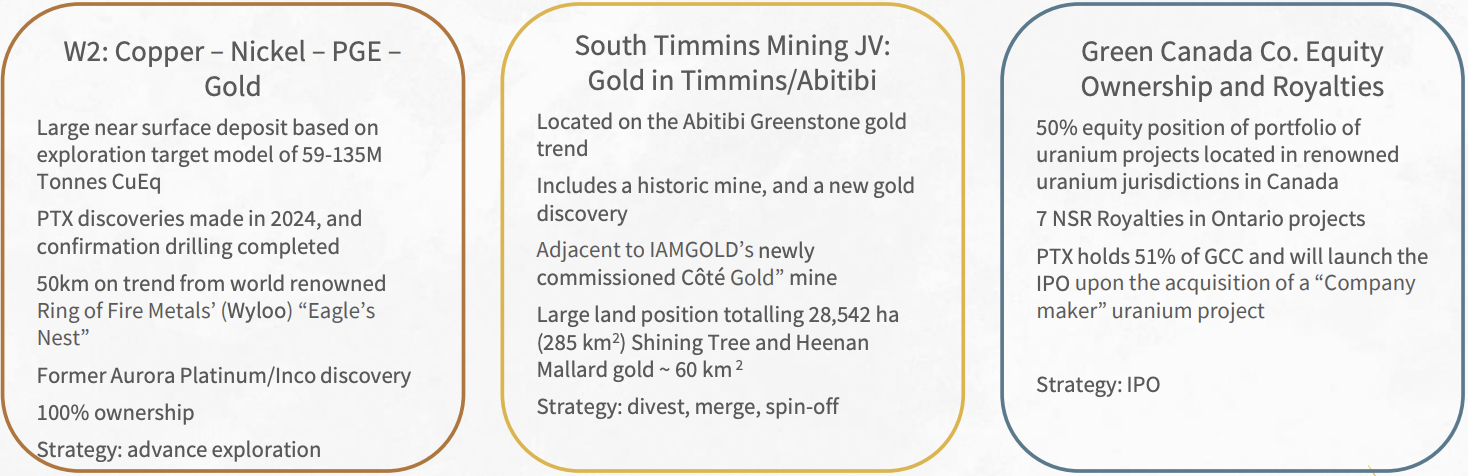

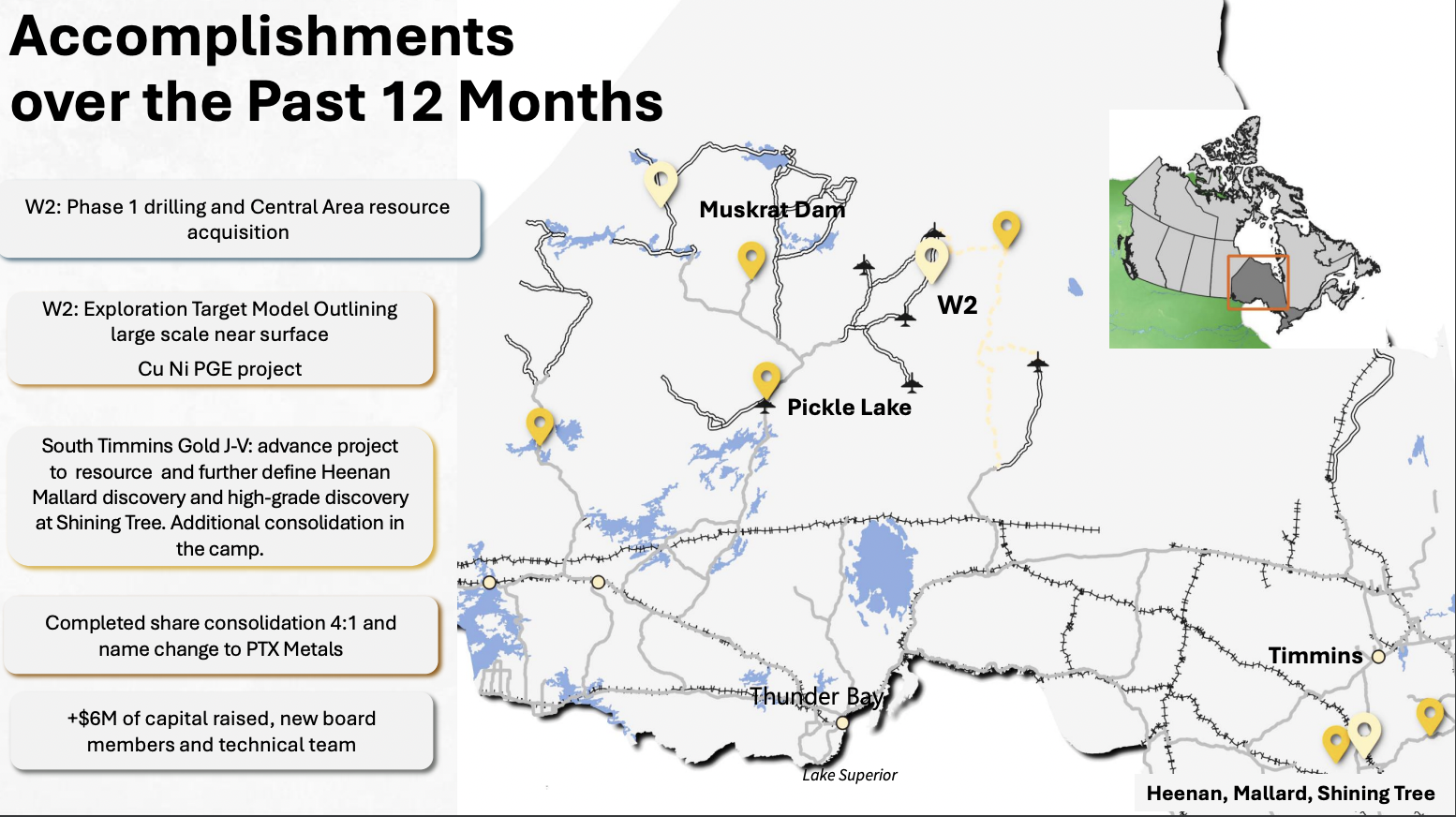

That list does not include Au companies, of which there are many. Juniors with attractive assets are well-positioned to entice one or more of those 21 players. For example, PTX Metals (CSE: PTX) / (OTC: PANXF) has two primary assets, the most important being its W2 Cu/Ni/PGE project, spanning 227.6 sq. km.

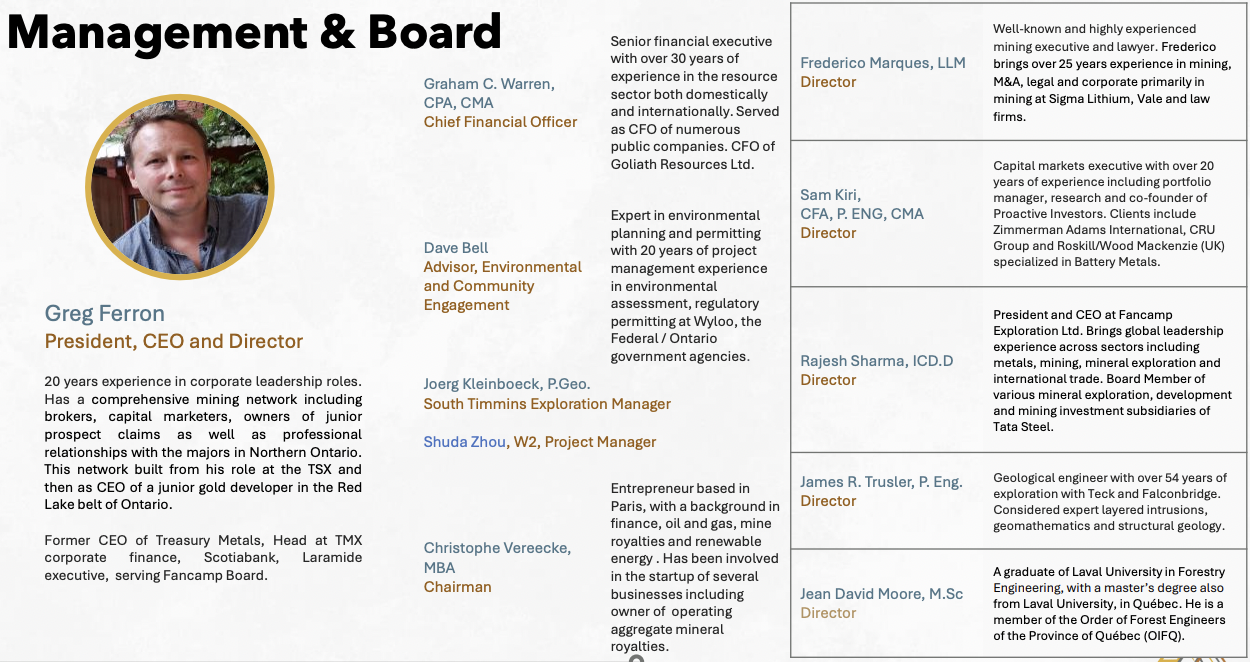

PTX is led by CEO Greg Ferron, former CEO of Treasury Metals. See mgmt. bios above. Dave Bell has extensive experience in environmental planning, permitting & community outreach, and he worked at Wyloo Metals.

Mr. Bell & CEO Ferron will be instrumental in continuing to build relationships with First Nations. Readers should note that Ferron & Dir. Jean-David Moore have been actively acquiring shares in the open market.

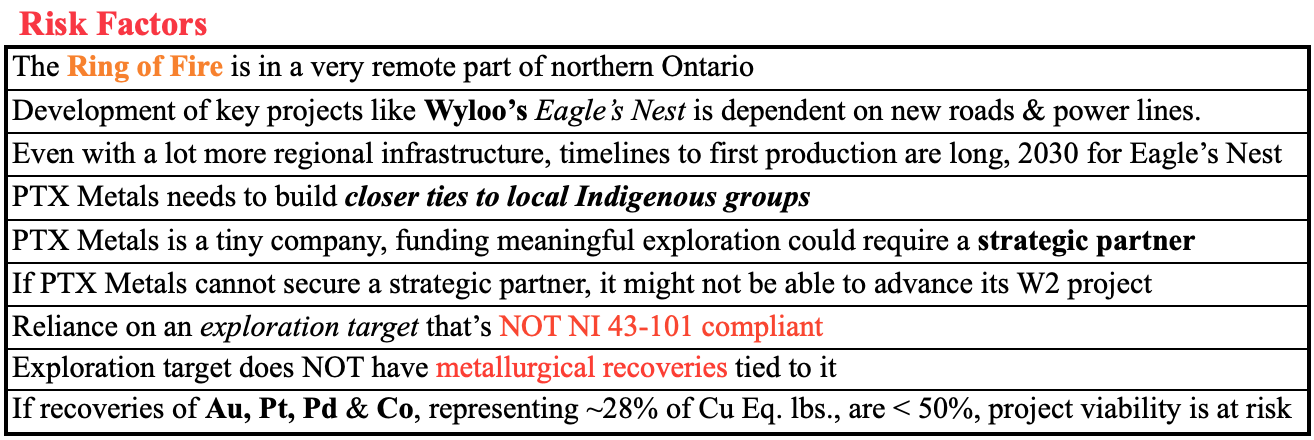

W2 is ~50 km SW of Wyloo Metals’ high-grade Eagle’s Nest project –> ground zero of Northern Ontario’s world-famous Ring of Fire (“RoF“). Readers are encouraged to read the risk factors below. PTX Metals is a very high-risk proposition, but it offers commensurate high return potential.

The RoF is a giant, remote, circular structure of ~5,000 sq. km. Geologists believe it experienced four “mineral emplacement events” associated with crustal breaks into the mantle, resulting in the deposition of very significant zones of mineralization.

The RoF is considered one of the last remaining, very large, underexplored, multi-commodity geological structures on Earth. Eagle’s Nest is the posterchild project, described as the largest high-grade Ni discovery since Inco’s Voisey’s Bay .

Privately-held Wyloo is backed by Australian billionaire Andrew Forrest, founder of Fortescue Metals. In 2021-22, Wyloo outbid BHP to acquire Noront Resources for ~C$616M. I estimate that 80% of Noront’s value was attributable to Eagle’s Nest and most of the remaining 20% was two large chromite deposits.

Therefore, that transaction was done at ~C$0.20/Cu Eq. lb. when the Cu price was ~$3.80/lb. vs. $4.40/lb. today. As per a 2012 Feasibility Study, Eagle’s Nest hosts 20M tonnes of 1.47% Ni, 1.05% Cu, 1.07 g/t Pt, 3.45 g/t Pd & 0.25 g/t Au. At spot prices, that’s a whopping 5.5% Cu Eq.

Metallurgical results from 2020 yielded impressive recoveries of 91.8% Cu, 83.1% Ni, 81.8% Co, 72.6% Ag, 86.1% Au, and 85.0% Pd. A new Feasibility Study in Q1/25 will attract a lot of eyeballs to the RoF.

Management of PTX recently announced an independent exploration target estimate [“ETE“] (non-NI 43-101 complaint) prepared by BAW Mining Inc., based on historical drilling & exploration records dating back decades. PTX is much earlier-stage, but Wyloo paid C$616M for Noront, vs. PTX’s valuation of C$8M at $0.10/shr.

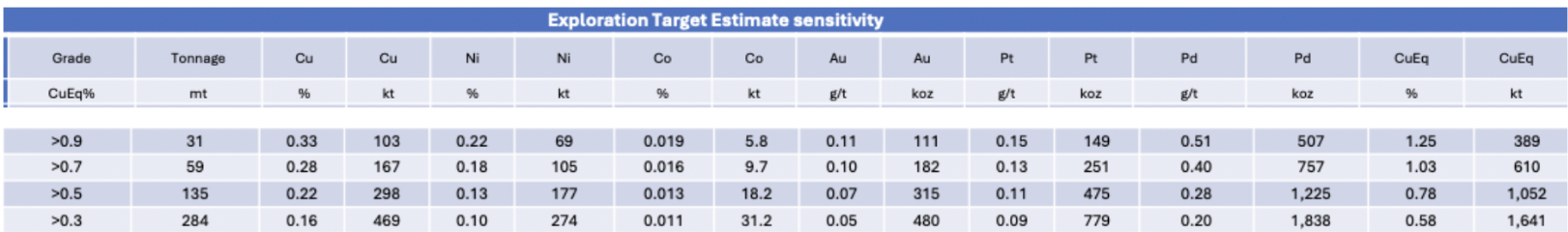

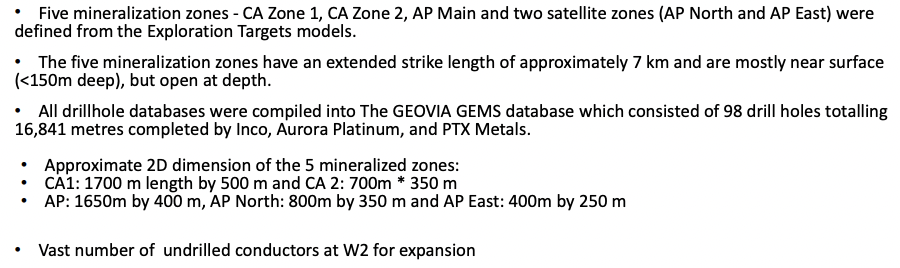

PTX’s 3D geological & grade shell modeling of historic & recent drill results indicates a near-surface ETE of 59-135 million tonnes of 0.78% to 1.03% Cu Eq. at a cut-off grade of 0.5 to 0.7%. Management believes another 12 to 15 infill holes should be enough to enable a third party to sign off on a NI 43-101 compliant resource next year.

However, it may take additional infill holes to convert all of the CA, AP, and satellite deposits. The company believes that stepping out and drilling at depth is a priority to expand the deposit and find new high-grade zones.

Readers are asked to believe (as I do) that the ETE shown above is a reasonable estimate of what has been identified so far. My belief stems from considerable historical drilling & numerous exploration studies, and expressions of interest in partnering on W2 (from unnamed parties).

Most helpful in my gaining comfort in the ETE is this third-party, October 2024 technical report on W2 that contains a detailed exploration history, and extensive commentary on geology, structure & mineralization styles. Importantly, the authors of the Report, from FGC Inc., agree with the reasonableness of the ETE.

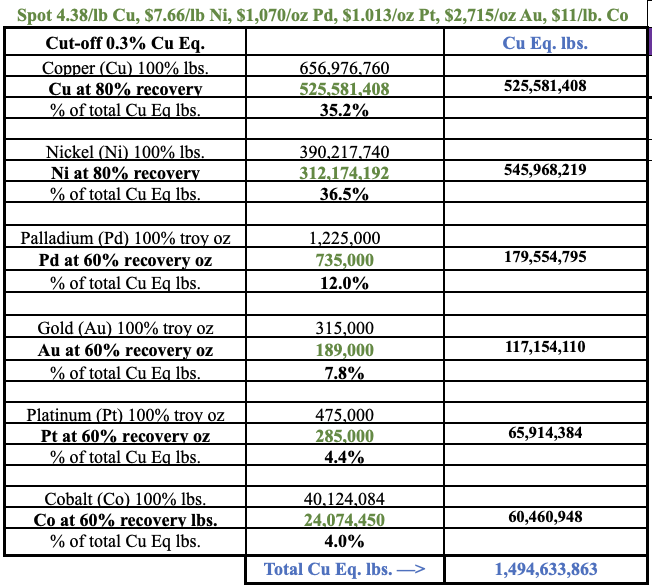

There’s no metallurgy tied to the ETE, which is a critical factor being worked on. CEO Greg Ferron believes all the metals will be exploitable. I assume an average 80% recovery of Cu & Ni, and 60% for Pt, Pd, Au & cobalt.

Using spot prices and adjusting for recoveries, Cu + Ni represents ~72% of total Cu Eq. lbs. In the chart below, instead of 1,052,000 tonnes = 2.3B lbs. Cu Eq. (at 0.5% cut-off) with 100% recoveries, using 80% & 60% results in ~1.5B Cu Eq. lbs. This valuation exercise values PTX at C$0.005/Cu Eq. lb.

In looking at the ETE above, one could argue that 135M tonnes (0.5% cut-off) — adjusted for recoveries — does not carry enough grade at 0.50% Cu Eq., while at a 0.9% cut-off (nice grade of 1.25% Cu Eq.) the deposit is not large enough at 31M tonnes.

Four things could turbo-charge this story in the coming year, 1) meaningfully higher Cu/Ni prices, 2) drill results pointing to more tonnage/higher grades, 3) a strategic investment from a company listed in paragraph #5 above, and/or 4) discoveries of potentially economic concentrations of (zinc, vanadium, titanium or chromite).

More tonnage is likely as deposit areas are open at depth and PTX’s recent drill hole W224-03 discovered significant Cu-Ni-PGE mineralization and expanded the central mineralized trend over 3 km from the center of the Aurora Platinum (“AP”) Zone.

In that hole, a 112.8 m intercept graded 0.16% Cu, 0.09% Ni, with anomalous Co, PGE & Au — (~0.41% Cu Eq), incl. 10.0 m at 0.49% Cu, 0.18% Ni (0.97% Cu Eq.) + 4.5 m at 0.87% Cu, 0.31% Ni (1.65% Cu Eq.). Interestingly, the deepest historical holes reached ~185-235 m, but Eagle’s Nest’s mineralization runs to at least 1,600 m vertical depth.

Surface dimensions of the five mineralized zones are; CA 1: 1,700 x 500 m, CA 2: 700 x 350 m, AP: 1,650 x 400 m, AP North: 800 x 350 m, & AP East: 400 x 250 m. That’s a total of 2,135,000 sq. meters. Assuming a specific gravity of 2.5 and a depth of 200 m, the combined volume would be 1.1 billion tonnes.

However, we don’t know how much of that ** potential ** 1.1B tonnes might be mineralized, and if mineralized, what the grades might be. Higher metal grades are found at Eagle’s Nest, which is on strike with W2, namely 2%+ Ni & 3%+ Pd.

Likewise, Newmont’s Musselwhite underground mine hosts high-grade Au directly to the west. OnGold’s TPK project also has a high-grade Au deposit. Bordering W2 to the west, Barrick has a similar-sized project as W2.

Privately-held Juno Corp. has a large landbank of properties. It claims to have the highest grades of vanadium & titanium in the RoF and showings of up to 6.5% zinc, 5.8% Cu, and a drill interval of 1.3 m of 23.5 g/t Au. Juno is reportedly backed by a large mining company.

Readers should note that although Wyloo & Juno are private, both are serious companies backed by BIG money. Either would make a great strategic partner for the W2 project.

To be clear, higher grades surrounding PTX in the RoF doesn’t necessarily mean new high-grade discoveries will be found at W2. It’s just that the RoF is known for its potential for large deposits & high grades.

One of the main risk factors is regional infrastructure. The RoF needs 100s of km of new roads & bridges. Construction is costly and will take years. However, both the Federal & provincial governments have earmarked large sums. Government bureaucracy & active First Nations involvement has slowed progress.

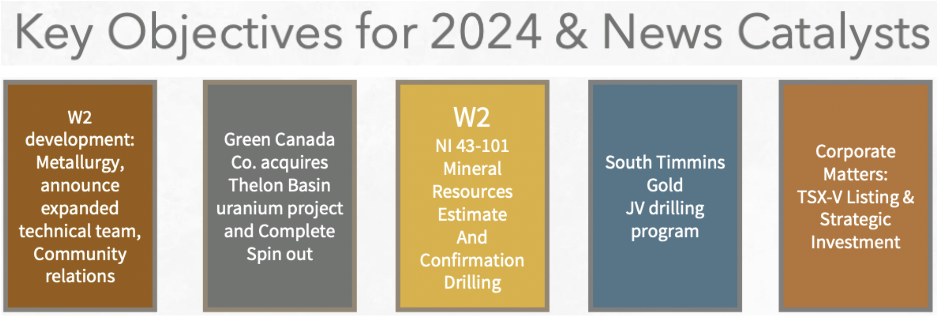

PTX has other properties incl. the South Timmins JV (75% PTX / 25% Fancamp) with Au assets in the Abitibi Greenstone Belt and a 51% interest in Green Canada Corporation, which has uranium assets in Saskatchewan, Ontario & Quebec, plus an option to earn 100% in the Muskrat Dam critical minerals project, also in NW Ontario.

Finally, PTX Metals holds a portfolio of NSR royalties on gold, PGE, and base metal properties. Readers should note that all of PTX Metals’ properties (except W2) are open to being spun out to shareholders, possibly via an IPO, or monetized. Those assets could potentially be worth as much as the Company’s entire $8M valuation.

Details of PTX’s assets can be found in the new October corporate presentation.

And, again here’s the October 2024 NI 43-101 Technical Report on the 100%-owned W2 project.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about PTX Metals Inc., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of PTX Metals Inc. are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, PTX Metals Inc. was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply