article updated: November 5, 2024.

Was this another head-fake? Just when investors thought it was safe to swim with lithium (“Li“) stocks again, the tide started rolling out. In September, most agreed that Li carbonate, hydroxide & spodumene concentrate prices had bottomed.

Investment banks like Citigroup & UBS said pricing would increase +25% by year-end upon promising news of supply curtailments in China & Africa. The price of battery-quality Li carbonate in China increased by 5 or 6% but gave it all back.

While I’m disappointed in the Li price stall, I believe levels will be much higher in 2025. The cure for low prices is… low prices. And, over the past year, dozens of Li juniors have died, even if they don’t know it yet. Today investors can buy top-decile companies at huge discounts.

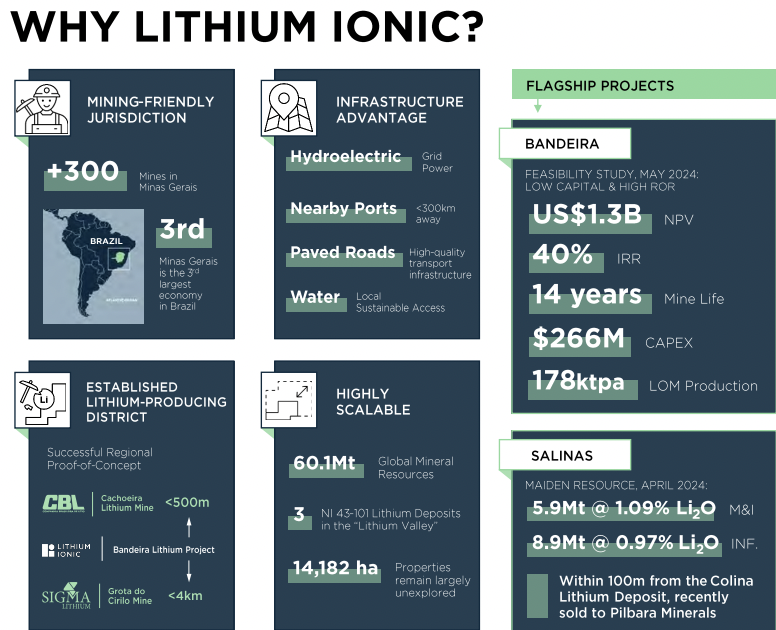

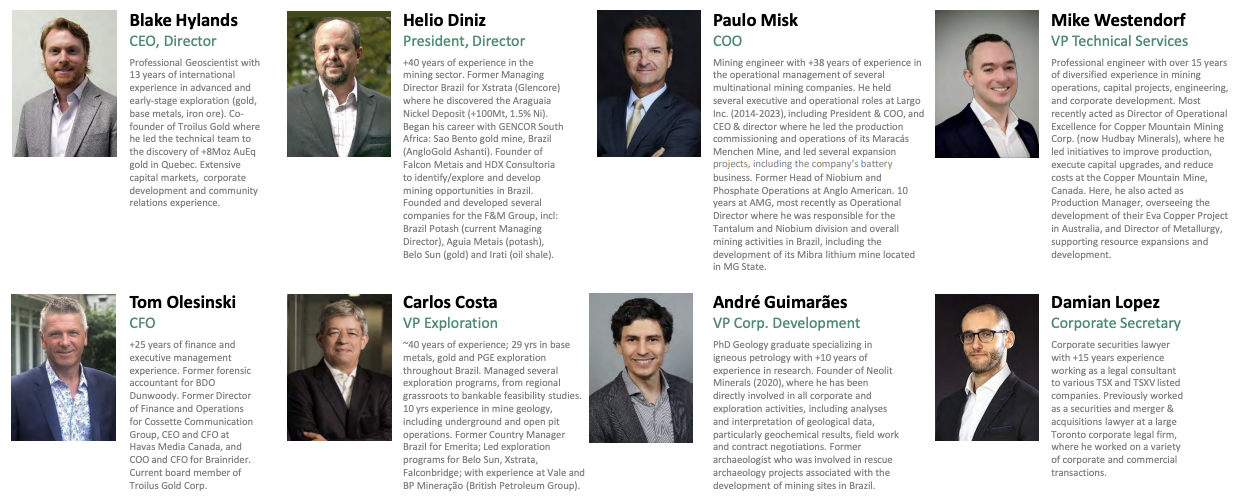

A company moving forward at a rapid yet prudent pace is Lithium Ionic (TSX-v: LTH) (OTC: LTHCF). On October 22nd it announced the start of Engineering, Procurement & Construction Management (“EPCM”) services for its flagship Bandeira project in NE Minas Gerais State, Brazil. This de-risking news is not SEXY, but is important.

Hatch Ltd. will play a leading role as an internationally recognized engineering firm with extensive global experience and a local presence in Brazil, including offices in the capital city of Minas Gerais.

Reta Engenharia, a leading Brazilian construction management company was selected for its extensive experience in greenfield mining projects. Blake Hylands, P.Geo., CEO of Lithium Ionic, commented,

“Our momentum towards production is stronger than ever as we kick off engineering & construction with our esteemed partners, Hatch & Reta. This significant milestone marks an important step towards our goal of becoming one of Brazil’s next major lithium producers. On the permitting front, we are in the final stages at both the national & state levels, putting us firmly on track to deliver on timelines.”

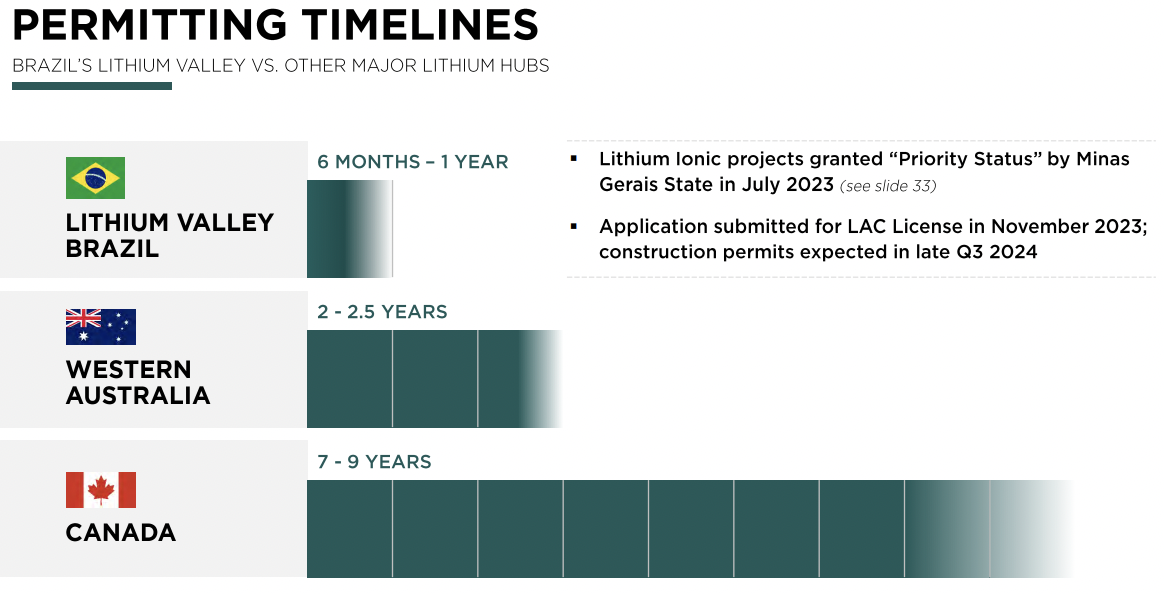

The review process is well underway for the granting of the Concomitant Environmental & Installation License, part of a fast-track permitting process. Following that, the final steps for full-scale production include the granting of the Mining Concession & Operating License, issued upon inspection of completed site facilities.

Lithium Ionic remains on track to begin operations at Bandeira in 2H/26. As Li market participants fret over EV penetration and the trajectory of home, commercial & grid-scale energy storage systems, monitoring supply cuts and trying to pick the bottom — a factor to consider is how much new supply is coming online.

I’m not referring to increased production from SQM, Ganfeng Lithium, Pilbara Minerals, Albemarle & Sigma Lithium, or low-quality spodumene in China & Africa that is not a long-term or reliable solution.

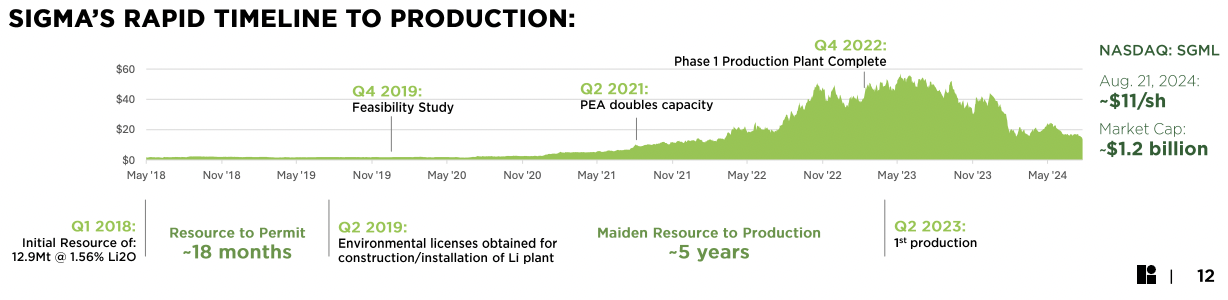

Lithium Americas, Critical Elements Corp, Patriot Battery Metals, Wildcat Resources, Rock Teck Lithium, Winsome Resources, Li-FT Power, and Q2 Metals, or the dozen+ DLE/brine hopefuls in Alberta, Saskatchewan –> NONE will be in production before 2028. By contrast, Lithium Ionic is following in the footsteps of Brazilian producer Sigma Lithium.

Sigma leaped from maiden resource to production in just five years — becoming a top-5 hard rock Li producer globally, making it high on the list of M&A targets. Its enterprise value {market cap + debt – cash} of $2.2B is low enough for numerous companies to acquire it.

In addition to Ganfeng Lithium, Zijin Mining, Rio Tinto, Pilbara, Tianqi Lithium, POSCO, SQM, Albemarle & MinRes — Sumitomo has made investments in the Li space, as has Mitsubishi. Glencore & Fortescue Metals are both rumored to be looking for more battery metals exposure.

Might Sigma be a natural fit for Brazilan giant Vale S.A. to enter the Li race? Notice that the list doesn’t include ~30 auto OEMs with valuations > $10B or eight Major battery makers.

As Lithium Ionic progresses, Pilbara will be advancing the Salinas project it’s acquiring from Latin Resources. With Pilbara in Brazil, and Sigma robustly growing, additional infrastructure will be built for their benefit, but also the benefit of companies like Lithium Ionic.

Rio Tinto recently made a big splash by announcing plans to acquire Arcadium Lithium for its attractive mix of existing operations + exciting development projects. Rio could easily afford to keep shopping…

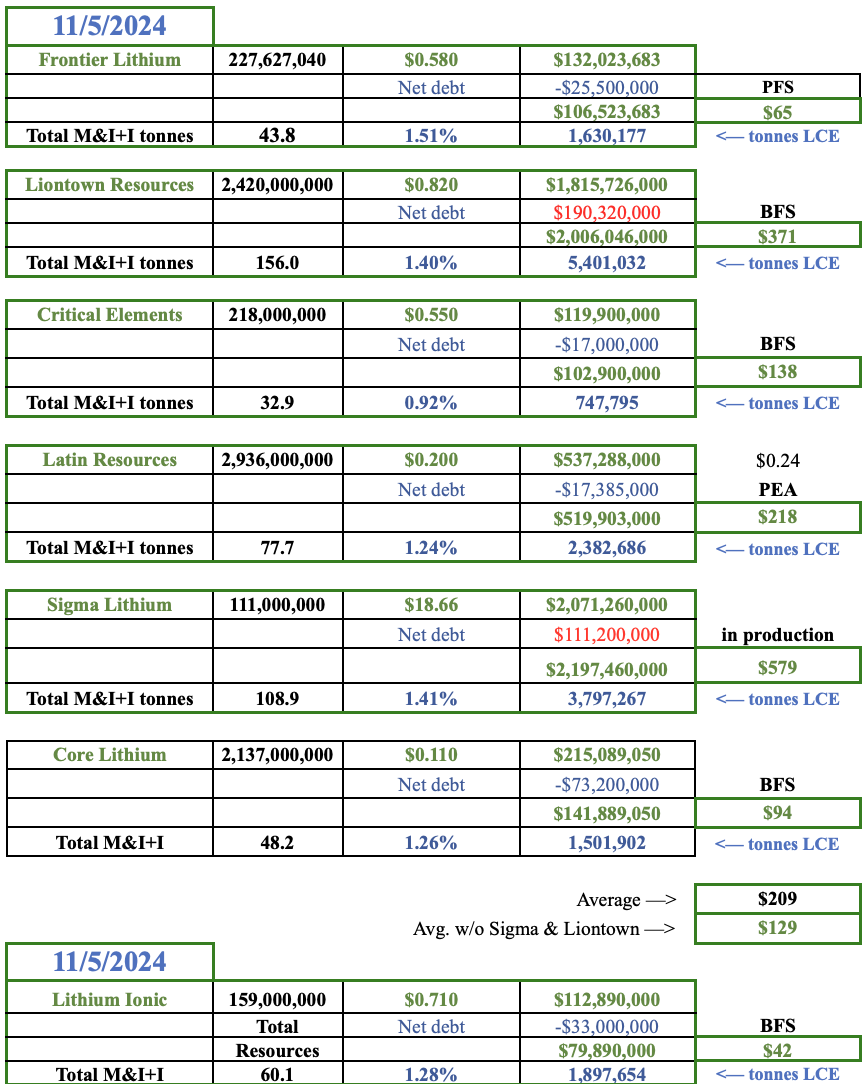

The readthrough valuation for Lithium Ionic if/when Sigma is acquired could make today’s enterprise value {market cap + debt – cash} of ~$80M look silly, trading at just 1/28 on an EV/tonne of lithium carbonate equiv. (“LCE“) basis. All else equal, if that valuation gap were to improve to 1/10th, Lithium Ionic’s share price would be $1.59 instead of $0.71.

I wouldn’t be surprised to see a 10 to 1 differential in 2H 2025 and a 6-8x gap in 2H/2026. Also supportive of a stronger valuation is Latin Resources’ enterprise value post-takeover bid from Pilbara.

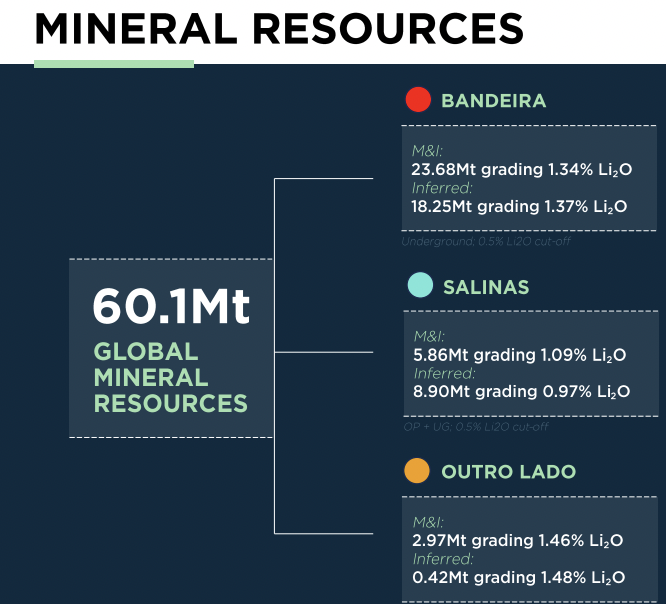

Latin is valued at ~$218/tonne of LCE for its PEA-stage project. By contrast, Lithium Ionic is valued at just $42/t. Latin has a great project, it’s larger than Bandeira, but it’s probably 18-24 months behind. Critical Elements‘ Rose project, is valued at $138/t.

SC 6% today is ~$750/t, Even if it rises +25% it would be < $1,000/t. Either there won’t be enough Li for the batteries needed to transition away from fossil fuels, or Li prices have to double.

That doesn’t mean Li prices will spike next month or next quarter, but within 1-2 years I envision a return to $17,500 – $22,500+/t LCE & $1,750 – $2,250/t SC 6%, with periodic spikes above $25,000/$2,500 per tonne.

To reiterate the bull case on Lithium Ionic, adjusted for its stage of development, it’s very cheaply valued, trading at a 68% discount to the average of Core Lithium, Latin, Critical Elements & Frontier Lithium, and just 1/28 that of Sigma.

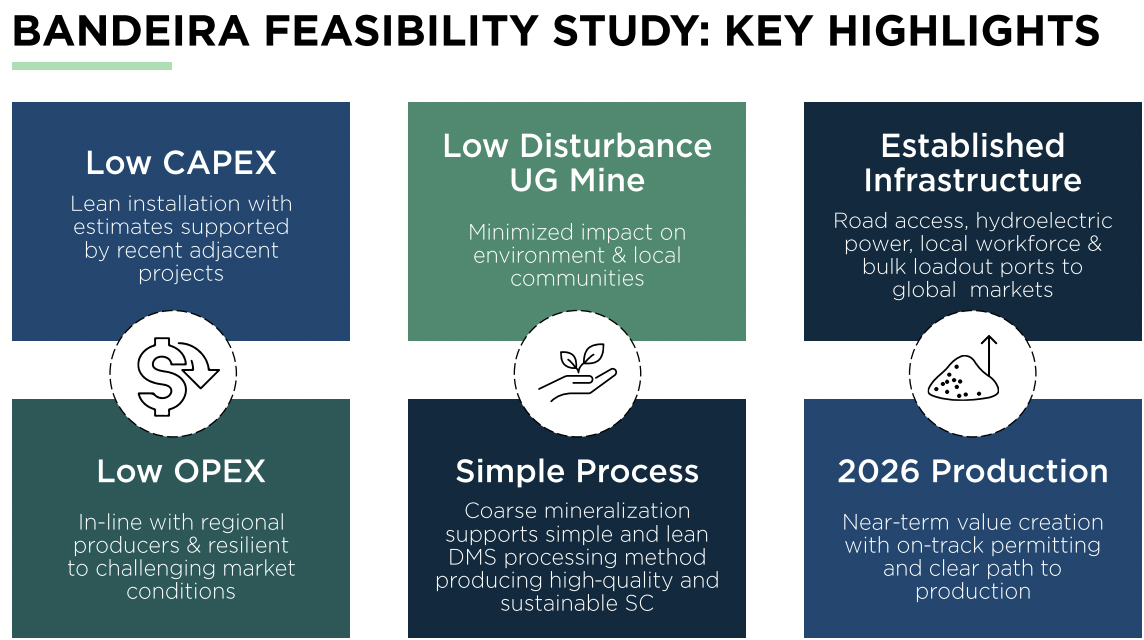

Like Latin Resources (acquired by Pilbara) Lithium Ionic is a prime takeover target, but in my view not anywhere near current levels. The Company should reach production before most peers. Bandeira is not in a far remote location dependent on gov’t to build 100s of km of roads, bridges, rail & power.

Not only is Lithium Ionic 1 of only 2 significant Brazilian Li plays not controlled by a Major, but it’s one of a handful of juniors that can be in production by 2026. Unlike S. American brine projects at 4,000+ meter elevations, in desert conditions where water is scarce, Bandeira has all the water it needs.

The Company is sitting on a strong cash balance of > C$30M to bridge it to a stronger Li market. Lithium Ionic is in the top (best) quartile of hard rock projects globally in operating costs/t & Li2O grade.

The metallurgy is well established by nearby Sigma’s operations as well as privately-held CBL, which has been in operation since 1991. Coarse mineralization supports simple DMS processing, producing high-quality & sustainable spodumene concentrate.

The Feasibility Study has one of the lowest spodumene concentrate price (SC5.5%) assumptions for years 1 to 6 at $1,559/t. Upfront cap-ex of US$266 is very low vs. peers and the post-tax NPV to cap-ex ratio of 4.9x is extremely attractive. For these reasons, the risk/reward proposition seems to be quite favorable.

Equity dilution over the next 2-3 years should be modest due to the low cap-ex hurdle, current cash balance, and the potential to obtain government / commercial / agency debt packages, partially pre-funded off-take agreements, royalty/streaming transactions, and equipment financing.

With established infrastructure in place and more being built, Lithium Ionic is ideally positioned for a Li rebound in 2025-26.

Readers are encouraged to review Lithium Ionic’s latest corporate presentation and press releases.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Ionic, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Lithium Ionic are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Lithium Ionic was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply