In September there was much talk about China’s stimulus measures, called the most aggressive since 2019. What wasn’t said was that it was only the beginning. Well on Oct. 12th an even larger stimulus package was announced, and there’s reason to believe more is coming.

Millions of tonnes of new copper (“Cu“) supply is needed, and probably at a price like $12,000/t = $5.44/lb. to get bulk tonnage projects built. Eight of 16 major pre-production projects I’m tracking average 0.446% Cu Eq. ($44/t rock).

Mega-Cu projects in S. America take decades to commercialize. Filo Mining’s Filo del Sol was discovered in 1999, McEwen Mining’s Los Azules was discovered in 2007, Regulus Resources’ AntaKori in 2012, NGEX’s Los Helados – 2008, Lundin Mining’s Josemaria — 2006, Solaris’ Warintza — 2000…

On average, those six “generational assets” are 19+ years old and still years from production! Not many companies have the balance sheet to start a mega-Cu project facing > 20 years & billions in cap-ex before initial cash flow.

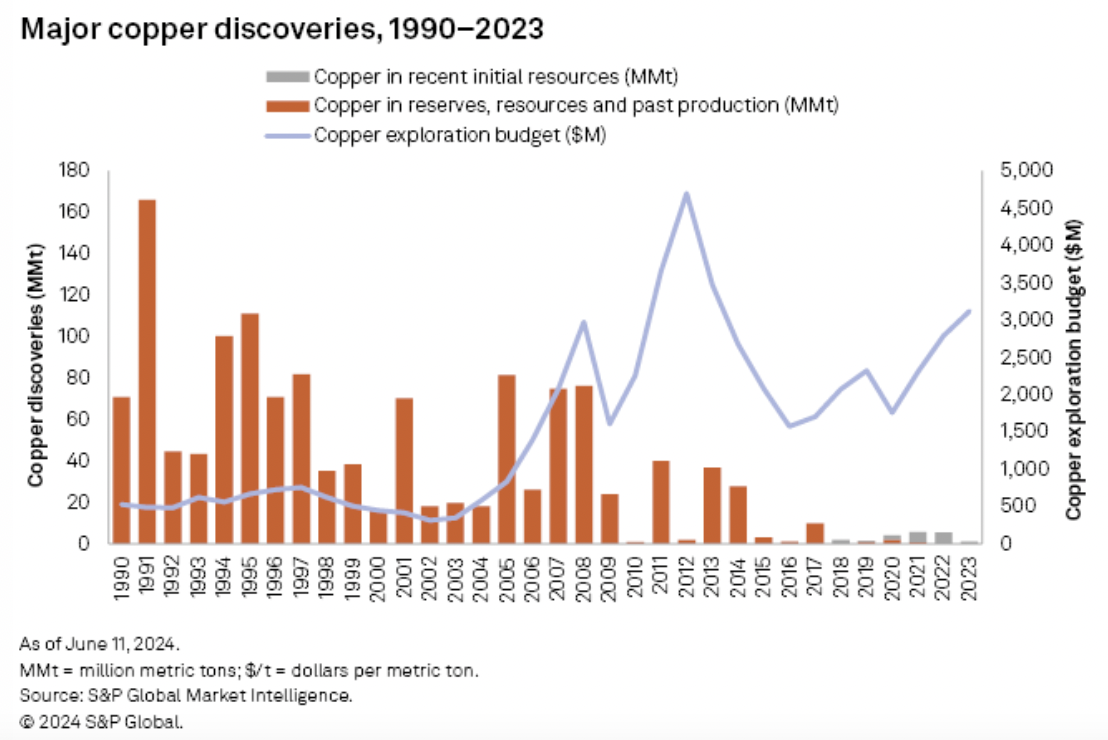

S&P Global Market Intelligence tracked “Major copper discoveries.” Look at the lack of discoveries in the past decade. From 1990-2013 there was an average of 9.4 discoveries/yr., but just 1.4/yr. from 2014-2023! What does this mean for mined output in the 2030s-40s?

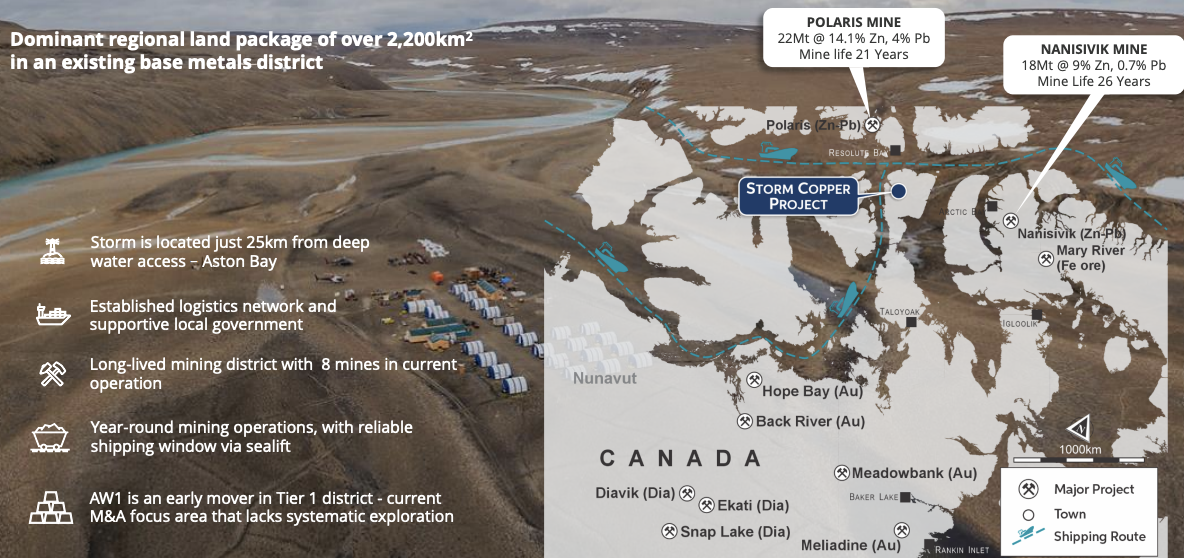

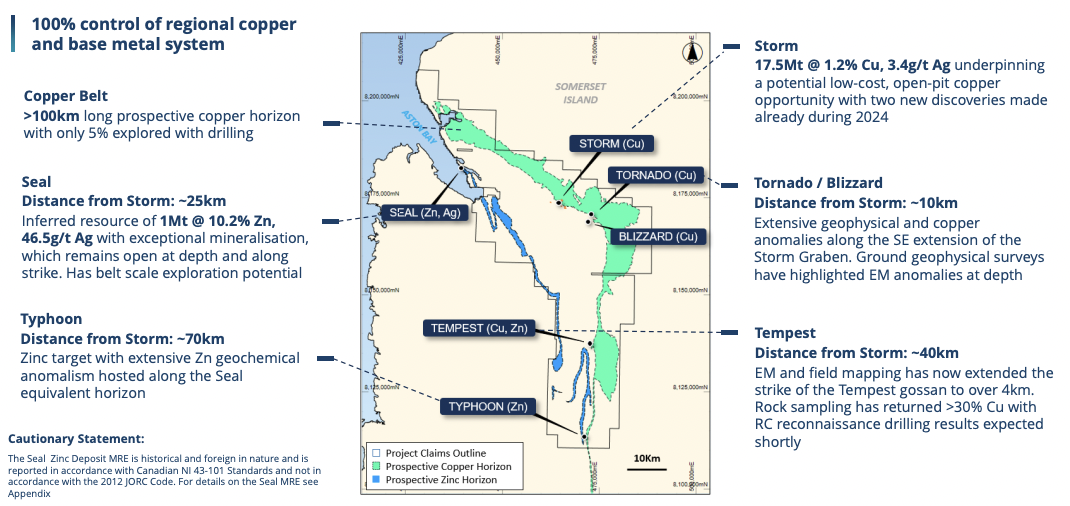

Countries in the West urgently need long-term security of supply from reliable countries like the U.S. & Canada. Aston Bay Holdings (TSX-v: BAY) / (OTCQB: ATBHF) has two exciting projects in Canada. Storm Copper has ~465M Cu Eq. lbs. Aston’s 20% ownership interest is free-carried through a Bank Feasibility Study.

Eighty (80%) percent owner, ASX-listed, American West Metals just raised C$6.3M, fully funding Storm for the next six months. The near-surface project comprises both Storm Copper & the Seal Zinc deposit (intervals incl. 14.4 m @ 10.6% Zn, & 22.3 m @ 23.0% Zn). Aston’s enterprise value {market cap + debt – cash} is ~$19M at $0.09/shr.

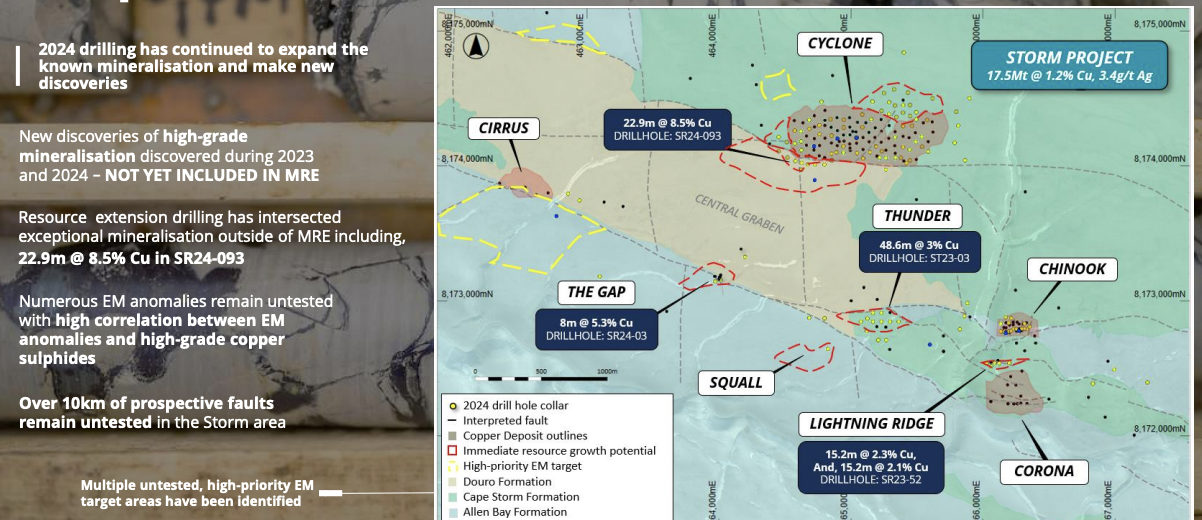

There are numerous underexplored & undrilled targets within the ~120 km strike length of the mineralized trend, see map below. Sixty-five percent of Storm’s maiden resource is 1.50%+ Cu ($148/t rock).

Storm Copper –> Cyclone, Cirrus, Chinook & Corona + The Gap, Squall, Lightening Ridge, Thunder, Tempest, Tornado, Blizzard & Typhoon

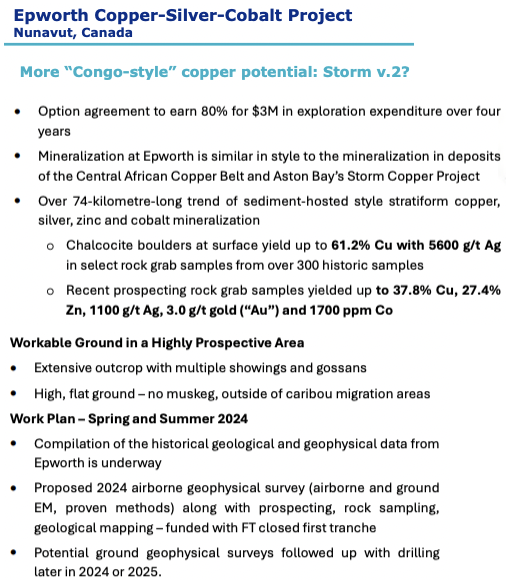

Storm consists of 173 contiguous mining claims covering an area of ~219,257 hectares on Somerset Island, Nunavut, Canada. The Company is also earning an 80% interest in the Epworth project which is at an earlier stage but has very high-grade samples, incl. a boulder sample of 61% Cu + 5,600 g/t silver!

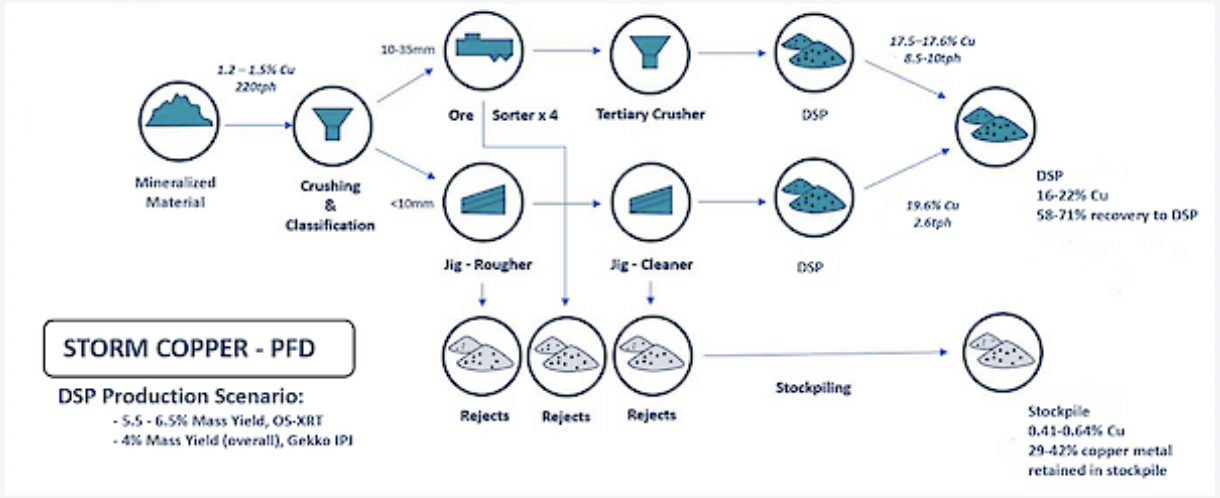

Aston has ~C$5M in cash (pro forma for 20% of a royalty deal on Storm). Its share of cap-ex, estimated at ~US$12-15M, to start a DSO operation should be manageable, especially as it will be spread over roughly 18 months. Regarding DSO, ore sorting using advanced sensors & algorithms separates potentially viable material from waste rock.

Ongoing test work is attempting to improve the process, including “continuing variability, comminution & optimization studies” on the Cyclone, Chinook & Thunder deposits.

Finally, in the U.S., on the east coast (Virginia), Aston has properties with high-grade, near-surface gold intervals incl.; 8 g/t Au over 6.3 m, 33.5 g/t Au / 1.3 m, 37.7 g/t / 1.5 m, 35.6 g/t / 2.0 m, 62.5 g/t / 1.4 m, [incl. 24.7 g/t / 3.6 m] & 15.6 g/t / 4.1 m.

For an update on Aston Bay, I spoke with CEO Thomas Ullrich.

Please give readers the latest snapshot of Aston Bay’s 20% (free-carried) interest in the Storm Copper project.

The 2,200 sq. km Storm Copper project is in northern Canada, on Somerset Island, in Nunavut. It’s 25 km from tide water at the deepwater Aston Bay, on the Northwest Passage — used for 10 historic & existing mining operations. We have a 20% free-carried interest, and American West Metals (“AWM“) owns 80%.

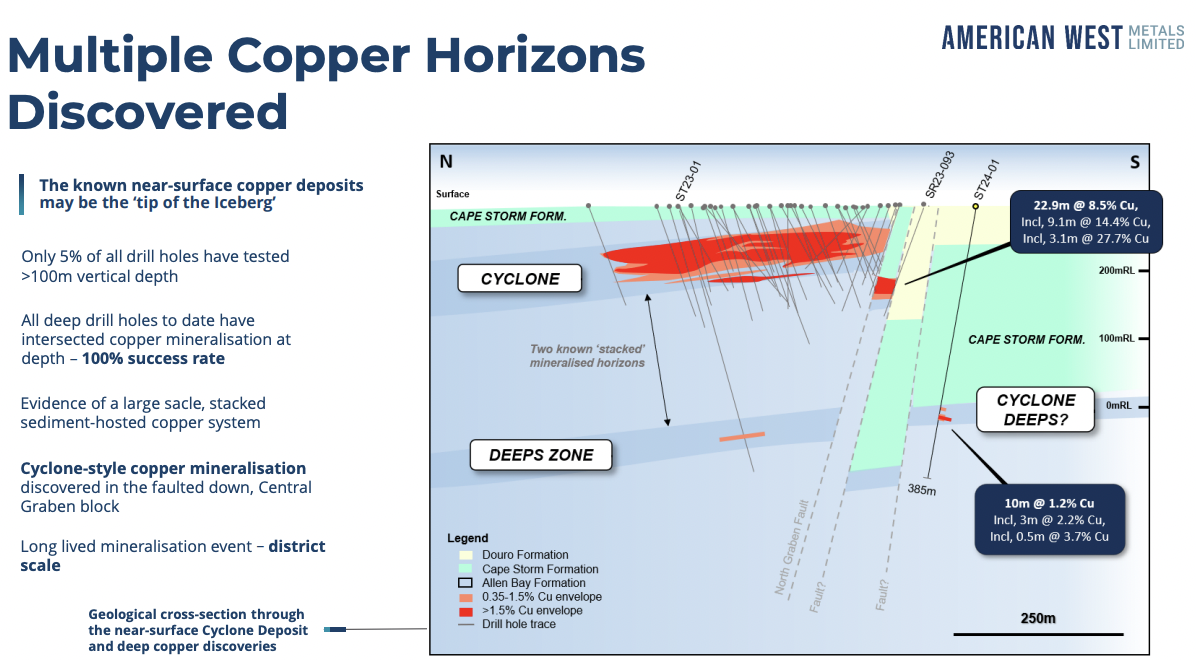

The geologic setting, mineralogy & zonation suggest similarities to giant sediment-hosted deposits in the Central African Copper Belt. So far, four near-surface zones have been identified.

Drill highlights, all at or near-surface, include 110 m of 2.45% Cu, 56 m of 3.1% Cu & 48.6 m of 3.0% Cu. Earlier this month 42.7 m of 3.1% Cu from surface was announced.

Importantly, zones are open laterally & vertically. AWM delivered a strong (Australian JORC-compliant) maiden resource estimate of 17.5Mt @ 1.2% Cu + 3.4 g/t Ag. AWM’s MD Dave O’Neill aims to double that resource with this year’s ~23,000 meters of drilling (100% funded by AWM). If we double, that would be 900M (JORC) Cu Eq. pounds.

Infill drilling continues to confirm excellent lateral continuity which will boost portions of the resource from the Inferred to the Indicated category. We should see a new resource from AWM before year-end.

American West Metals (“AWM”) drilled ~23,000 m at Storm Copper this year alone, please comment on the results.

We’re delighted with the number of meters drilled and the results. On September 27th AWM reported a strong interval from 87 m downhole –> 53.9 m of 3.9% Cu, incl. 22.9 m / 8.5% Cu & 3.0 m / 27.7% Cu! One would be hard-pressed to find a peer N. American intercept of > 2.0 m at > 20% Cu.

That hole is outside the existing resource estimate. The remaining assays will be reported this month. We’re excited that mineralized zones can be accurately mapped & modeled using electromagnetic techniques.

Aston Bay & American West Metals are pursuing a direct shipping ore (“DSO”) strategy, yet some question its viability in this setting. Can you explain the opportunity?

Yes, DSO would substantially reduce op-ex & cap-ex and allow operations to start much sooner. AWM’s team believes DSO could start in 2027. Detailed metallurgical testing on representative Storm mineralization generated potentially commercial-grade direct shipping products.

An ore sorting & gravity separation process allowed both coarse & fine fractions to be processed effectively. These circuits would eliminate the need for a conventional flotation plant & tailings facility.

Readers can review (in much more detail) the results of test work in our mid-August press release. The DSO concept has been vetted by engineering firms including Ausenco, who helped develop the Mary River iron ore mine on Baffin Island, Nunavut where ore is trucked 100 km to port.

By contrast, Storm Copper is only 25 km over flat, barren terrain to the deepwater Aston Bay. Metallurgy & ore-sorting specialist Nexus Bonum also contributed to the test work.

Last month, a bulk cargo ship delivered supplies to Storm. This shipment will significantly reduce the cost of drilling next year, proving that cargo can be economically transported to the project, and products delivered to market on the return journey.

What’s the latest on the Epworth project, also in Nunavut, in which Aston Bay is earning an 80% interest?

We believe Epworth could be Storm Copper 2.0. Since we’re earning 80% of it, it could be worth even more. When we negotiated the Epworth transaction in the first quarter, Cu was ~$3.80/lb. Today Cu is $4.42/lb. Note: UBS, Blackrock, and others are expecting $12,000/tonne or $5.44/lb. next year.

We have no work commitments, just a requirement to invest C$3M into the project over four years, making Epworth a valuable call option on Cu, with an Ag byproduct. We’re planning a 5,000 line-km airborne electromagnetic & magnetic survey to identify & delineate regional & property-scale structures.

Chalcocite boulders at Epworth yielded up to 61.2% Cu + 5,600 g/t Ag. We have permits for an initial phase of drilling. Recent prospecting grab samples yielded > 37.8% Cu, 27.4% zinc, 1,100 g/t Ag, and 3.0 g/t gold.

Storm & Epworth are classic examples of exploration starting with high grades found on the surface, chased up with geological mapping & geophysical surveys, leading to significant discoveries at depth. That’s how major deposits in Central Africa were discovered, and it’s our playbook for Storm & Epworth.

Why should readers consider buying shares of Aston Bay Holdings?

Good question… Unlike most Cu juniors, we have cash and a manageable burn rate due to being free-carried on Storm Copper. We think Storm could become a significant project, and American West thinks it could be operating within three years.

Our partner at Storm drilled 23,000 meters this year alone, will deliver an updated JORC resource estimate by next month, and a PFS in 1Q/25. Assuming drilling success, (not a sure thing) shareholders will own 80% of the earlier-stage Epworth, a project that could be as good or better than Storm Copper.

Thank you, Thomas, some believed your partner would not be able to drill 20,000 meters in a single season in Nunavut, but ~23,000 meters were done. Storm Copper is coming along nicely. The updated resource and PFS will be real eye-openers.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aston Bay are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply