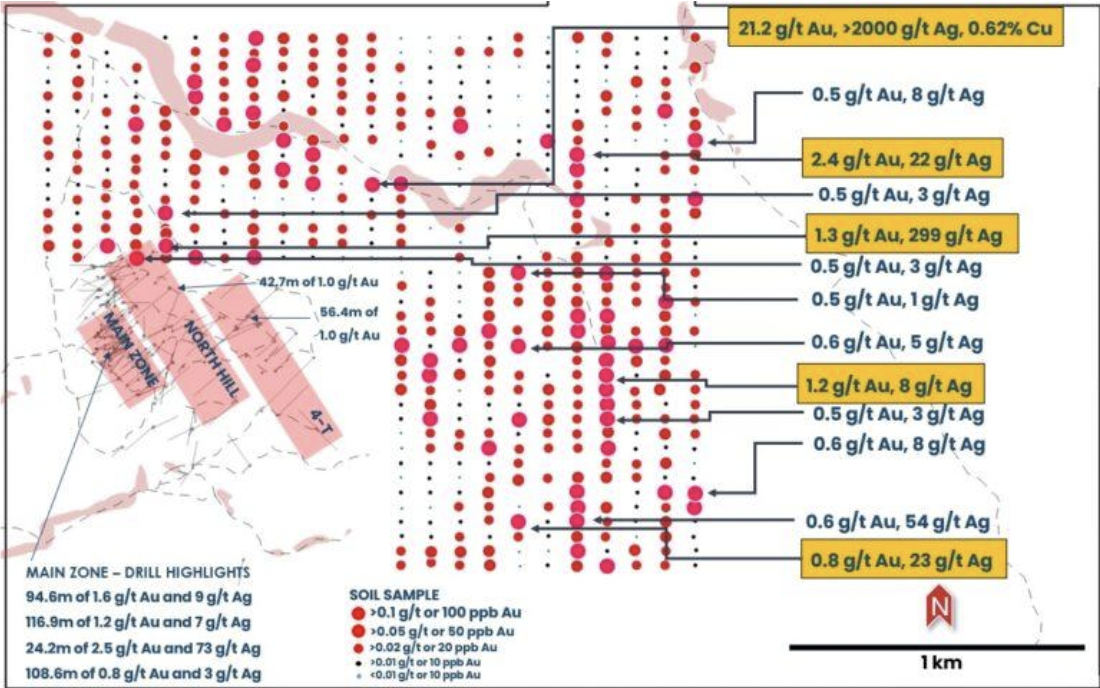

Investors eagerly awaited the results of 100s of soil samples in the southern portion of the 100%-owned Gran Pilar project in Sonora Mexico. It was worth the wait as 541 assays were reported on Nov. 12th, and 62 of 541 samples (11.5%) contained over 0.1 g/t Au. Samples > 0.02 g/t Au are thought to be anomalous and worthy of follow-up. Sixty-five % of samples were > 0.02 g/t Au.

Samples > 0.1 g/t Au (5x higher than the 0.2 g/t samples) are thought to be significant, warranting immediate follow-up as near-surface mineralization is likely. According to CEO Brodie Sutherland, the highlights below, “outlined the much larger potential for significant mineralization at Gran Pilar.”

These results coincide with early reconnaissance sampling that returned significant Au & Ag values earlier this year. CEO Sutherland added, “It is fantastic to see several values over 1 g/t in the soil results. As we take grab samples around the best clusters of soil samples, we find that values are directly related to mineralized structures tied to historic workings. This proves soil sampling is extremely effective in discovering new areas of interest.“

The best sample returned 21.2 g/t Au, [ > 2,000 g/t Ag], 0.62% Cu, 12.7% lead & 2.3% zinc. Follow-up has shown this highly anomalous sample coincides with a nearby historic working concealed in overgrown vegetation and is within a broader zone of anomalous values extending over 800 m long by 500 m wide.

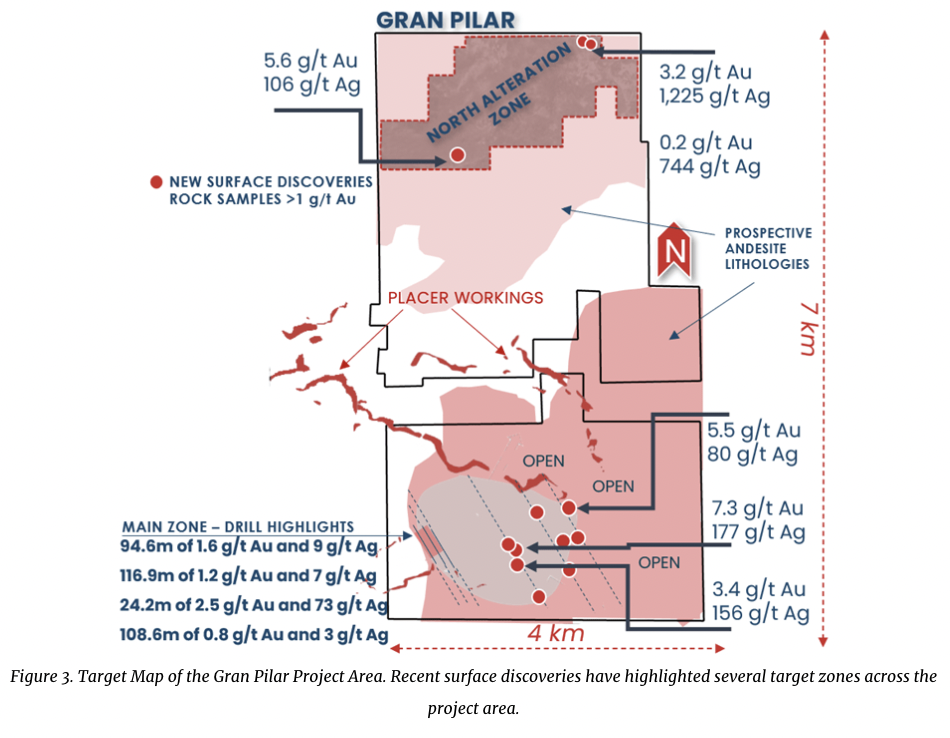

As a frame of reference, the highest historical soil sample across the Main Zone returned 8.1 g/t Au + 12 g/t Ag. Importantly, management believes that these soil samples triple the mineralized footprint to over 3 sq. km of the 22 sq. km Gran Pillar project. At spot prices, the best soil sample result equates to ~44.5 g/t Au Eq. (not incl. Cu, lead, or zinc).

The news is encouraging as the entire area had never seen systematic & modern exploration. Importantly, this is just a portion of the southern block, larger untested sections extend to the north. More results are pending, including over 180 rock samples (and counting).

In the soil sample grid above, the largest red dots are > 0.1 g/t (100 ppb), making up 11.5% of total samples. Areas where there are clusters of higher grades are being carefully considered, along with a lot of other exploration data, to determine optimal drill targets.

Management is very pleased with the results, CEO Sutherland told me that the 21.2 g/t Au + > 2,000 g/t Ag is the highest-grade soil sample he’s ever seen. It could be an outlier, it’s just one sample, but still impressive. The full press release can be found here.

Several other zones of significant & consistently high values were identified, showing several km of prospective trend that remains open to the east & south.

- Including 21.2 g/t Au and > 2,000 g/t Ag, 1,000 meters northeast of the Main Zone;

- 2.4 g/t Au and 21.9 g/t Ag, 1,700 meters east, northeast of the Main Zone;

- 1.3 g/t Au and 299 g/t Ag, 390 meters north, northeast of the Main Zone;

- 1.2 g/t Au and 8.2 g/t Ag, 1,700 meters east of the Main Zone;

- 0.8 g/t Au and 23.4 g/t Ag, 1,500 meters southeast of the Main Zone;

- 0.6 g/t Au and 7.7 g/t Ag, 2,000 meters southeast of the Main Zone.

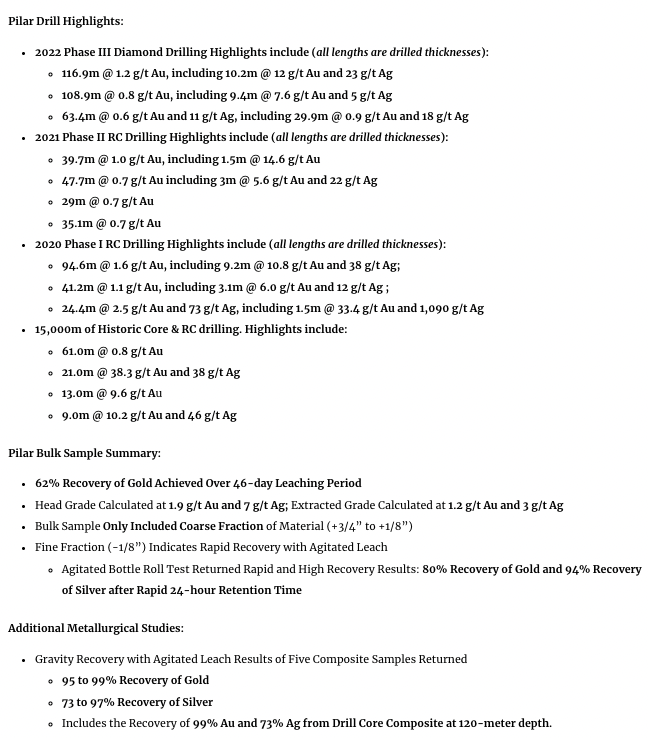

Based on management’s strong belief in the project’s potential, the Company is outlining a permitting & operations strategy for a pilot facility at Pilar underpinning a robust test mine scenario aiming to process up to 50,000 tonnes of material.

Timelines & budgets are being prepared to move forward with this initiative early next year. In 2023, the Company completed an offsite bulk sample that produced data showcasing the potential to recover Au & Ag through a variety of methods including heap leach, gravity, and agitated leach.

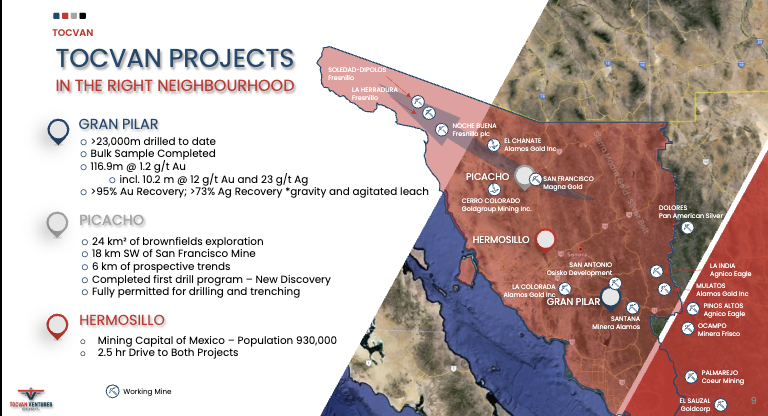

Gravity recovery with agitated leach on five composite samples returned 95 to 99% Au & 73 to 97% Ag. Although pre-maiden resource estimate, Tocvan has a substantial amount of drilling under its belt and has barely scratched the surface. With the help of a strong strategic partner, management believes Gran Pilar could be in production later this decade.

Producers including Grupo Mexico, Newmont, Industrias Penoles, BHP, Agnico Eagle, Fresnillo plc, Franco-Nevada, Alamos Gold, Equinox Gold, Coeur Mining, Fortuna Mining, Orla Mining, Minera Alamos & Minera Frisco have assets in Sonora or elsewhere in Mexico and could be interested in partnering with Tocvan as the Company truly has multi-million-ounce potential.

Given the many mines, projects, and past-producers surrounding Gran Pilar, and the fairly extensive historical work done to date, management is optimistic a sizable resource can be delineated. A large regional producer seemingly agrees.

It’s in discussions with management after six months of onsite + offsite due diligence. It will be interesting to learn (if possible) what the unnamed regional producer thinks of these soil samples.

A 4,000-meter drill program is planned for the near future, incorporating the new soil samples and other valuable data. A maiden resource estimate (“MRE“) in 1H 2025 for the initial Main Zone + adjacent trends will provide a good indication of blue-sky potential at Gran Pilar.

Timing of the MRE will depend on how well drilling is going. If well, the team might press on to get additional high-impact meters in. Please see my last article on Tocvan Ventures, done just a few weeks ago. Here’s a 2-minute video clip of Brodie talking about the soil sample results.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Tocvan Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Tocvan Ventures are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Tocvan Ventures was an advertiser on [ER] and Peter Epstein owned shares in the company, purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply