All dollar figures are US$ unless indicated otherwise.

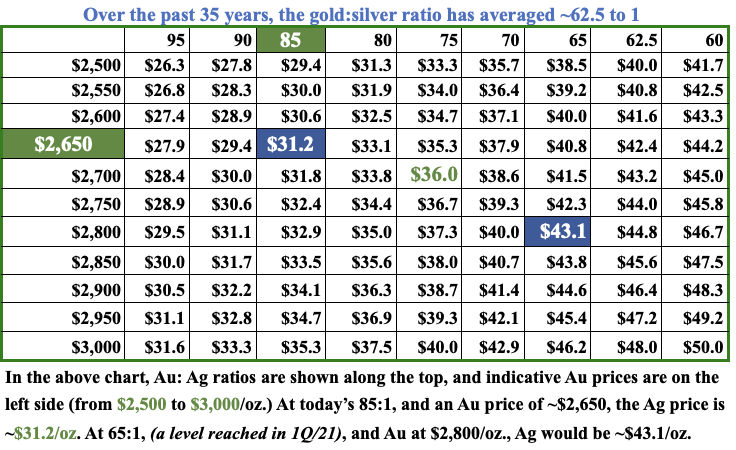

Precious metals are down since mid-October, gold [“Au“] -5% from a high of $2,790/oz., and silver [“Ag“] -10% from $34.90/oz. Yet, many precious metal companies are down a lot more. Newmont Mining has shed -27% since October 22nd, and Silvercorp Metals -34% since October 18th.

Now could be a good opportunity to invest in higher-risk precious metal names. Gold’s safe-haven appeal is on full display with Russia using the N-word, and the Middle East a powder keg. Well, at least China and the U.S. are getting along… no, wait, Trump said what about tariffs!?!?

Au is being stacked by central banks hand over fist as China & Russia lead BRIC countries away from the US$. Global debt levels are way too high, the U.S. just hit 36.1 TRILLION dollars. Meanwhile, Ag continues to gain ground as an industrial metal, not just a precious one.

Ag is used in solar panels and China is deploying 100s of millions of them, global deployments this year could soar ~50% to 600 gigawatts. New manufacturing technologies are increasing the amount of Ag per panel to achieve higher solar conversion rates, but the cost of Ag/panel remains quite low.

Likewise, Ag usage in EVs is higher than in conventional ICE cars, but a tiny component of vehicle cost. An Ag/Au junior I love is AbraSilver Resource Corp. (TSX-v: ABRA) / (OTCQX: ABBRF) with a truly world-class project in Salta province, Argentina hosting ~264M Measured & Indicated [“M&I“] Ag Eq. ounces.

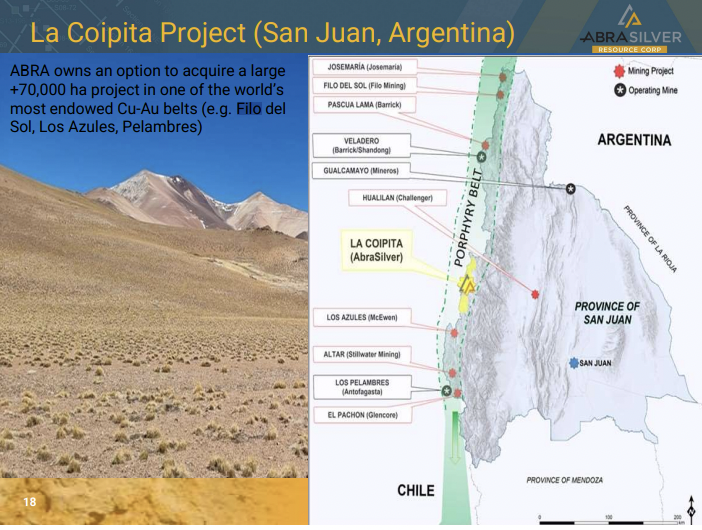

Note: AbraSilver has an attractive secondary project, partnered with Teck Resources who is earning up to 80% of the 70,000+ hectare La Coipita project by investing $20M over five years + cash payments of up to $9.3M. In my view, if Teck has success, 20% of this project could be worth north of $100M (otherwise Teck wouldn’t bother with it). AbraSilver is free-carried on La Coipita for several years.

Note: In addition to active drilling at Diablillos, management is drilling a very promising porphyry Cu/Au target located 3-4 km away from the main resource at Diablillos. Drilling at this new porphyry target is well underway and it appears that the technical team likes what it’s seeing, but until assays come back in Jan./Feb., there’s nothing to report.

Abrasilver’s enterprise value {market cap + debt – cash} is ~$190M. 100% of ounces are near-surface, in oxides, and entirely comprised of precious metals, with Ag accounting for ~57% & Au ~43%. Kinross is a strategic investor in AbraSilver with a 4% stake, it could grow its position size.

Canadian silver bug & billionaire Eric Sprott owns 10%. AbraSilver’s flagship opportunity is the 100%-owned Diablillos Ag-Au project.

I consider Diablillos a top-5, Ag-heavy, undeveloped project. Please see the brand-new corp. presentation.

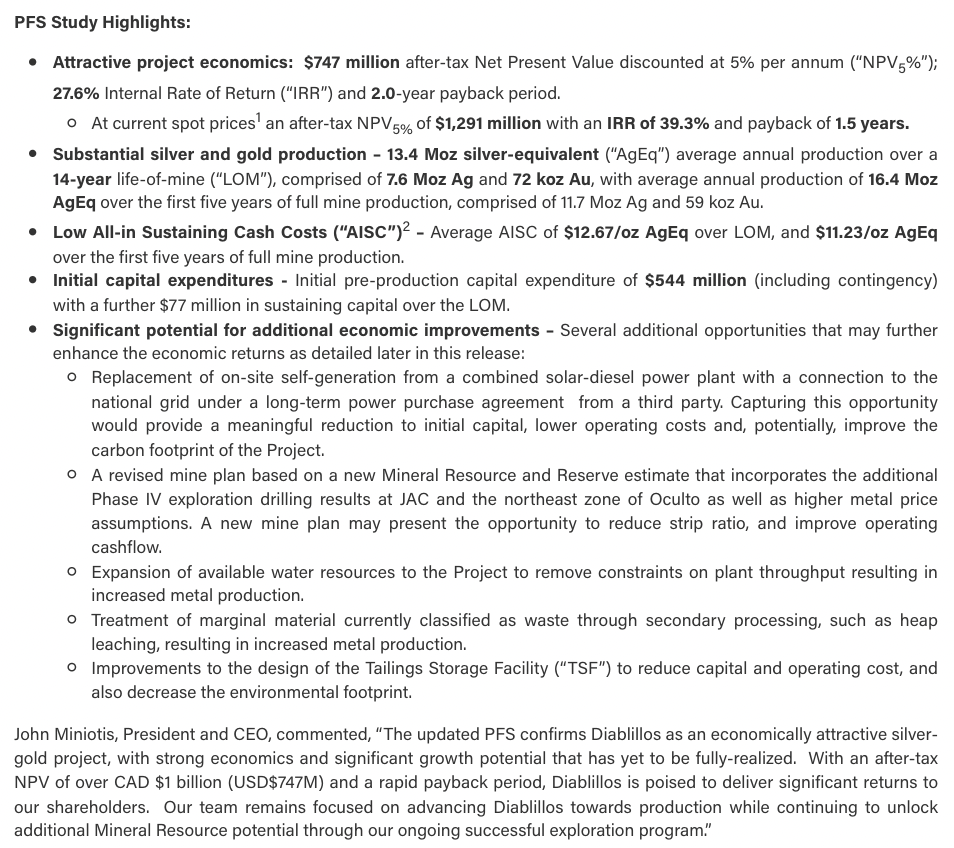

In March AbraSilver announced a strong Pre-Feasibility Study [“PFS“] based on $1,850/oz. Au & $23.50/oz. Ag. The post-tax NPV was $494M and the IRR was 25.6%. I won’t say more about this because a revised, enhanced PFS was released on December 3rd using $2,050/oz. Au & $25.50/oz. Ag.

The new post-tax NPV(5%) of US$747M is +51% higher, and the new IRR is 27.6%. This revised PFS was warranted as Argentina’s President Milei recently enacted a law slashing the corporate tax rate from 35% to 25%, eliminating onerous export duties, and allowing accelerated tax depreciation of plant & equipment.

Importantly, even this upgraded PFS has ample room for improvement. According to the press release, gains are possible in the area of power consumption, which could provide a “meaningful reduction to initial capital, lower operating costs and, potentially, improve the carbon footprint.”

The mine plan in the upcoming BFS will include additional drilling results at JAC + the NE zone of Oculto & *probably* higher metal prices. An expansion of water resources to the Project would remove constraints on throughput, resulting in the ability to increase annual production.

Treatment of low-grade material through heap leach processing would result in increased production, potentially cutting cap-ex in half, and helping to self-fund the Project. Improvements to the design of the Tailings Storage Facility could reduce capital & operating costs while decreasing the environmental footprint.

Updated cap-ex increased by $170M due to a stronger peso and an increase in indirect costs & manpower during construction. The higher figure includes capitalized waste stripping of $50M resulting from a change in the mining sequence. That $50M is not new spending, just a re-classification of some costs from operating to capital.

At spot prices of $30.70/oz. (currently $31.45) & $2,651/oz., post-tax NPV(5%) increases to ~$1.3 billion, with a strong IRR of 39.3% and a payback period of 1.5 years. Comparing the new NPV to AbraSilver’s enterprise value of ~$220M (at $2.54/shr.), the Company is valued at ~17% of the PFS spot price NPV.

At base case prices, the average post-tax free cash flow in years 1-3 is $220M, exactly the same as the enterprise value. Average production in years 1-5 is 16.4M (20.8M in year #2 at 246 g/t Ag Eq. or 2.9 g/t Au Eq.). That 20.8M Ag Eq. ounces in year #2 is music to the ears of mid-tier & Major producers.

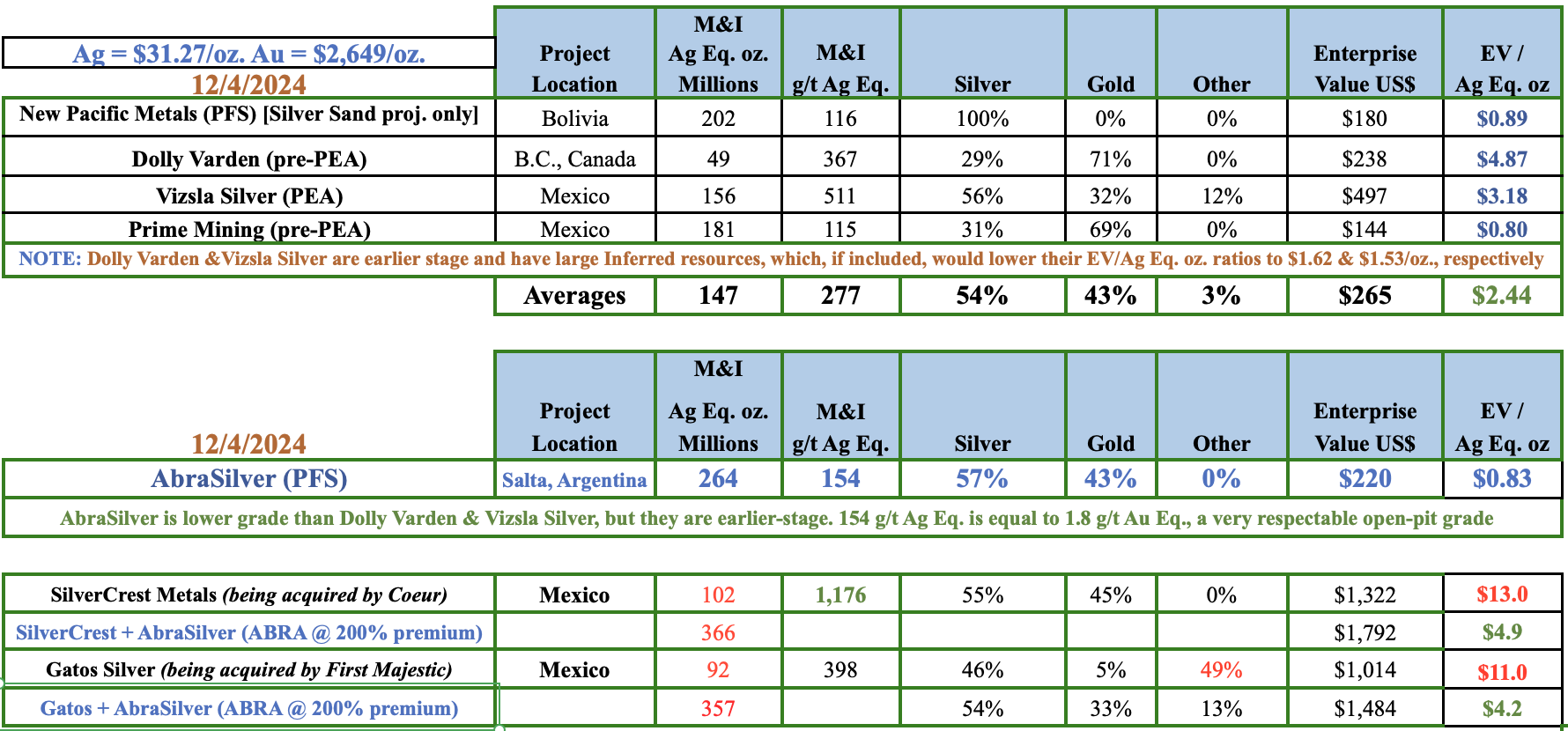

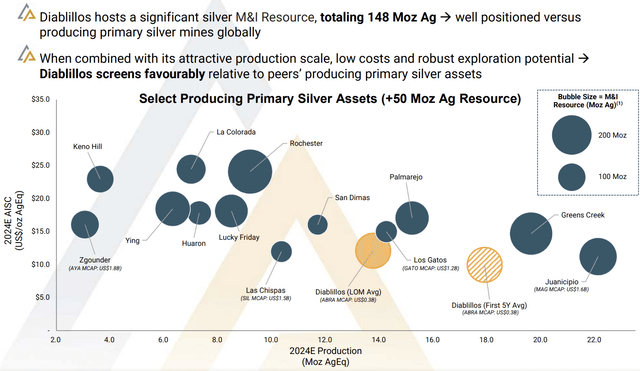

The AISC changed, but only by +2% to $12.67/Ag Eq. oz. life of mine, which is still a great number. Average production over the 14-year. mine life is 13.4M Ag Eq. ozs. In the following chart, AbraSilver compares favorably to New Pacific Metals, Dolly Varden, Vizsla Silver & Prime Mining with an average EV/ M&I Ag Eq. oz. ratio of $2.44 vs. $0.83 for AbraSilver.

Dolly & Vizsla have considerable Inferred resources which would lower their EV/oz. ratios, but they are earlier-stage than AbraSilver with Dolly pre-PEA. In my view, 17% of spot price NPV is too low for a company with a world-class project at the PFS stage with 264M M&I Ag Eq. ounces and counting.

Diablillos is a must-own asset. Consider the cases of two significant Ag producers that are being acquired, Gatos Silver by First Majestic & SilverCrest Metals by Coeur Mining.

Those two have 92M & 102M Ag Eq. M&I ounces, respectively (Gatos net for its 70% ownership). Granted, their resources are high to extremely high grade, generating strong margins {see chart below}. NOTE: {Gatos derives 49% of its Ag Eq. ozs from Zn, Pb & Cu}.

Gatos & SilverCrest are valued at an average EV/oz. ratio of ~$12/Ag Eq. oz. vs. just $0.83/oz. for AbraSilver. That means those companies could slash their EV/oz. ratios from ~$12/oz. to an average of ~$4.6/oz. by acquiring AbraSilver, even paying a 200% premium [$7.62, or C$10.72 per share].

M&I resources at SilverCrest would more than triple. The resource would nearly quadruple for Gatos — and its pro forma percentage of Ag/Au would increase from 51% to 87%. Another compelling reason for producers to acquire Diablillos is that it’s not in Mexico. Many Ag producers are overexposed to Mexico.

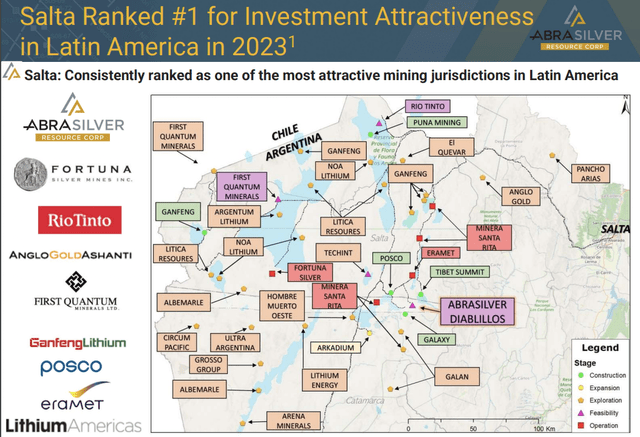

Salta province in Argentina is ranked meaningfully higher (top quartile) than Mexico in the latest Fraser Institute Annual Survey of Mining Companies.

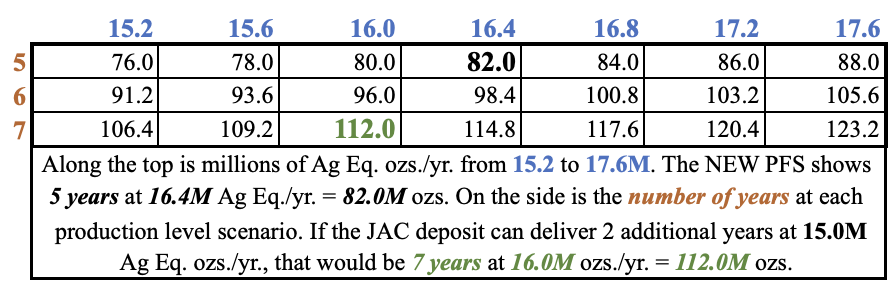

As exciting as this new PFS is, the BFS should be even better as drilling (20,000 meters in 2024-25) will be included. High-grade JAC mineralization could add 1-2 years of ~15M ounces/yr. to the first half of the mine plan. Therefore, instead of five years at 16.4M Ag Eq. ozs/yr., perhaps we get seven years at 16.0M ozs/yr.

These are higher-grade ounces, 200+ g/t Ag Eq., so 1-2 years could add roughly $75-$150M in NPV. Diablillos compares favorably on an Ag-only basis (M&I). It ranks in the lowest quartile on costs and around the top 36% on annual production (proposed) among Latin American primary Ag producers/developers.

Since 2020, management has grown the M&I resource at an average discovery cost of just $0.11/Ag Eq. oz., an industry-leading accomplishment. That means each oz. found for $0.11 is arguably worth ~21x more (compared to the average of the four peers above) the moment AbraSilver books it!

Diablillos has a large footprint with numerous high-priority exploration targets, several of which are currently being drilled. In Argentina, nine lithium projects owned by Lithium Americas (Argentina) Corp, Ganfeng Lithium, POSCO, Arcadium, Rio Tinto, EraMet, Tibet Summit, & Zijiin Mining are well underway.

The Country is experiencing a mining & economic renaissance (inflation tamed, peso steady) under the stewardship of President Milei.

Barrick, Newmont, BHP, Glencore, Freeport McMoRan, Teck Resources, Fortescue, First Quantum, Kinross, Grupo Mexico, Pan American Silver, AngloGold Ashanti, Lundin Mining, McEwen Copper, Silbanye-Stillwater, Hochschild Mining, Fortuna Mining & South32 also have mines and/or projects across Argentina.

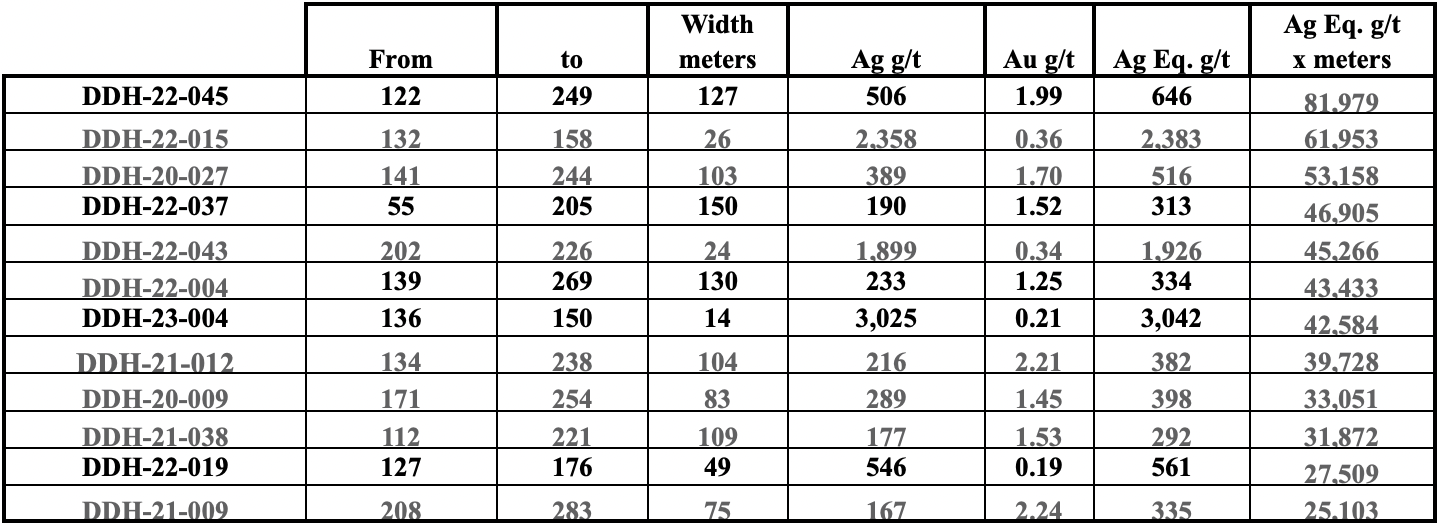

AbraSilver has enjoyed extraordinary drilling successes such as the above drill hole intervals from 2020-2023, among the best in the world this decade. The Company is in the midst of a 20,000-meter drill program which will end in February. Drill results are likely to continue being released about every three weeks into March/April.

Management is laser-focused on improving the grade in the first half of the mine plan, believing last year’s JAC discovery (drilled again his year) could be the answer with recent wide intercepts of 31.5 & 50 m of 277 & 250 g/t (Ag-only), and much higher grade intervals of 12 m at 1,042 g/t, incl. 6 m at 1,880 g/t, 3 m at 2,070 g/t, and 10 m at 520 g/t Ag.

To reiterate, many positive attributes will be in the BFS that were not captured in the new PFS. In my view, the cap-ex & op-ex numbers should not increase all that much if the optimizations mentioned above are realized. At the same time, annual production, recoveries & head grades could improve, especially as drilling is concentrated on high-grade zones.

Instead of 16.4M Ag Eq. ozs./yr. in years 1 to 5 –> 82.0M ounces, could JAC + other higher-grade zones possibly deliver 16.0M Ag Eq. ozs./yr. in years 1 to 7 –> 112.0M ounces? That would make a meaningful difference.

As a frame of reference, if the bull market in precious metals continues, 82M Ag Eq. ounces x $30/oz. = $2.46B, and 112M ounces x $40/oz. = $4.48B (+82%). As I said, Diablillos is a must-own, globally significant asset that is progressing quite nicely at a prudent pace.

Disclosures: Peter Epstein of Epstein Research [ER] has no prior or existing relationship with AbraSilver or its management team. Mr. Epstein owns shares of the Company purchased in the open market. AbraSilver is a high-risk, speculative company. Readers are urged to seek advice from investment professionals before buying high-risk stocks.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply