Readers are encouraged to always read disclosures/disclaimers at the bottom of every article.

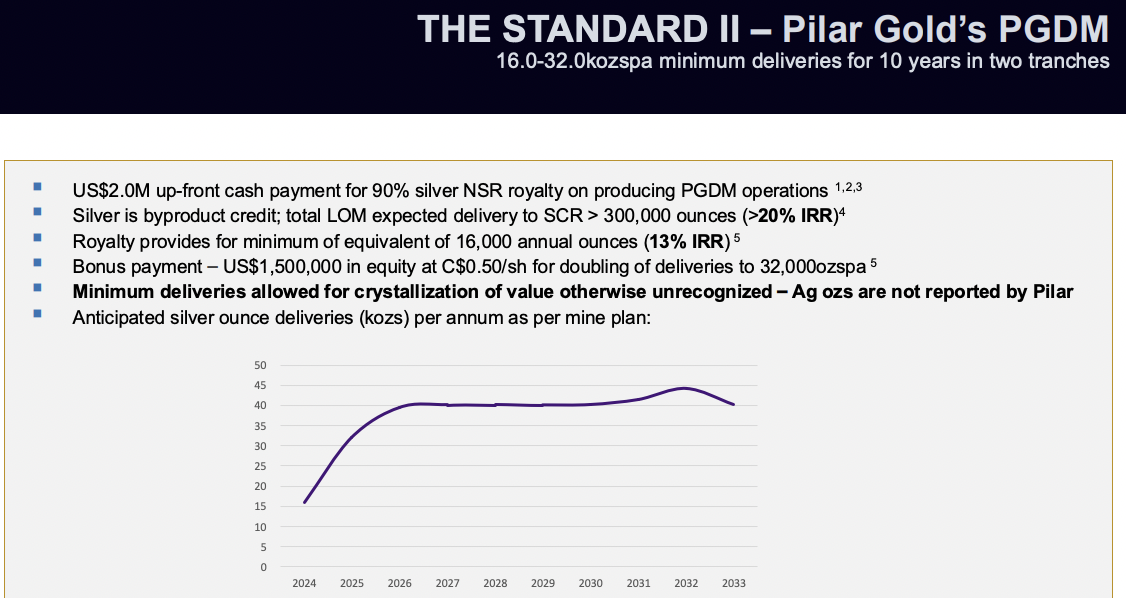

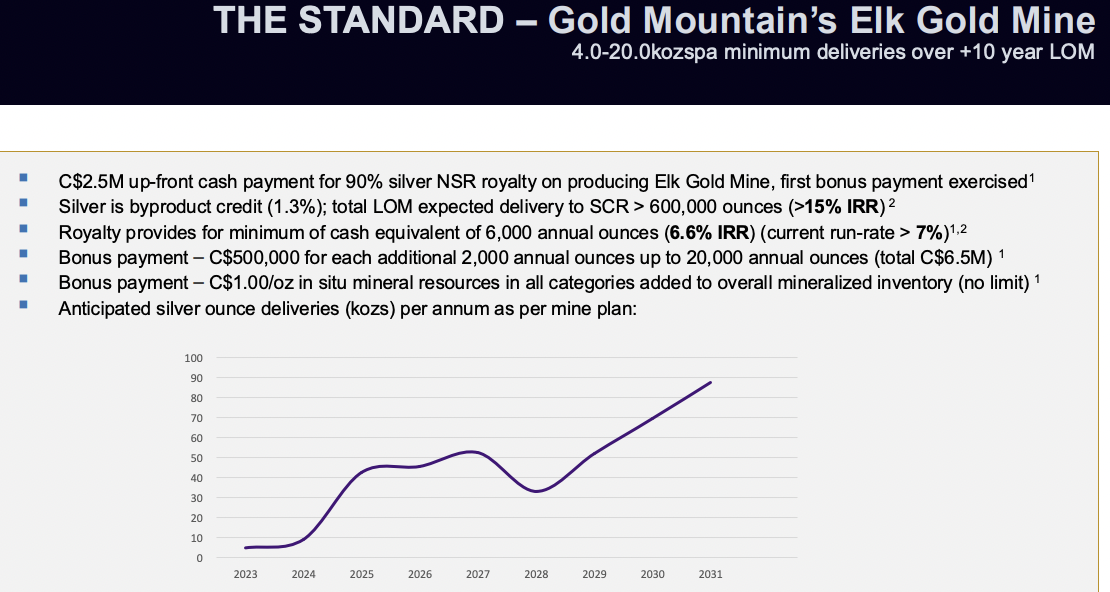

Silver Crown Royalties, (CBOE: SCRI) / (OTCQX: SLCRF) incorporated in August 2021, is a small, but revenue-generating silver (“Ag“)-only company focused on extracting value from Ag as by-product credits. It has four royalties, three of which are paying out cash.

This is a unique business model within the royalty space. Silver Crown has just 2.45M shares outstanding (incl. 67.5k restricted stock units). The enterprise value {market cap + debt – cash} is ~C$14.7M (at C$6.58/shr. on Jan. 6th).

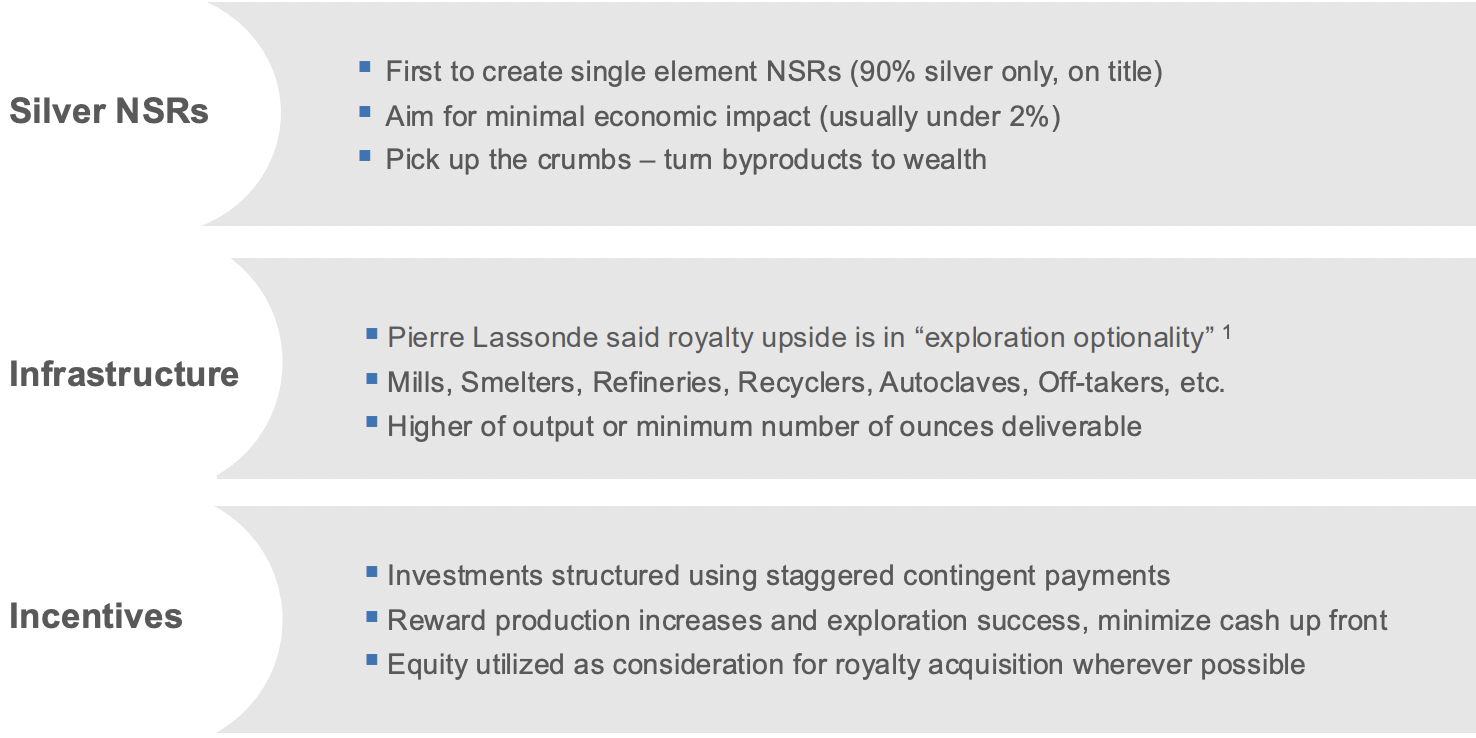

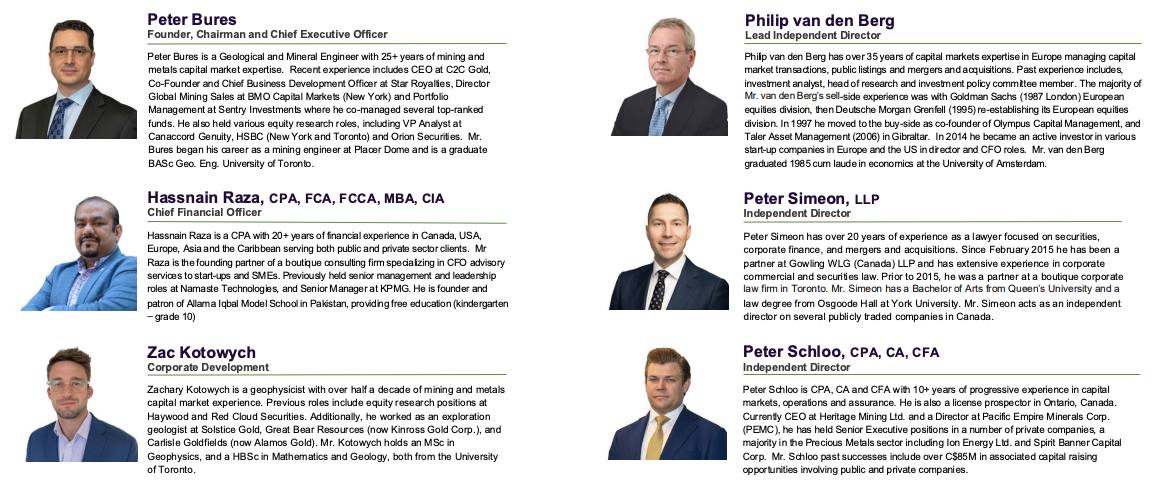

Founder, Chairman & CEO Peter Bures believes his team’s approach offers numerous competitive advantages, some of which are due to the Company’s innovative business model.

Silver Crown provides capital to mining entities earmarked for select aspects of operations — exploration, mine development, facility construction/expansion — in exchange for a percentage of revenue derived from that portfolio company’s Ag sales.

Mr. Bures is a geological & mineral engineer with 25+ years of expertise incl. as CEO at C2C Gold, co-founder & Chief Business Development Officer at Star Royalties, and Dir. of Global Mining Sales at BMO Capital Markets & Portfolio Management at Sentry Investments.

Peter has held various equity research roles after beginning his career as a mining engineer at Placer Dome. He is a BASc Geo. Eng. from the Univ. of Toronto. Although only three execs draw a salary, the team includes numerous experienced directors & advisors –> see bios below.

Once free cash flow is positive, probably by next year, SCRi will target 50% exposure to immediately cash-generating projects, 30% to near-term development assets, and 20% to exploration targets.

The Company’s focus on minimum cash-equivalent deliveries opens the playing field to opportunities otherwise inaccessible to competitors – projects that don’t report Ag production.

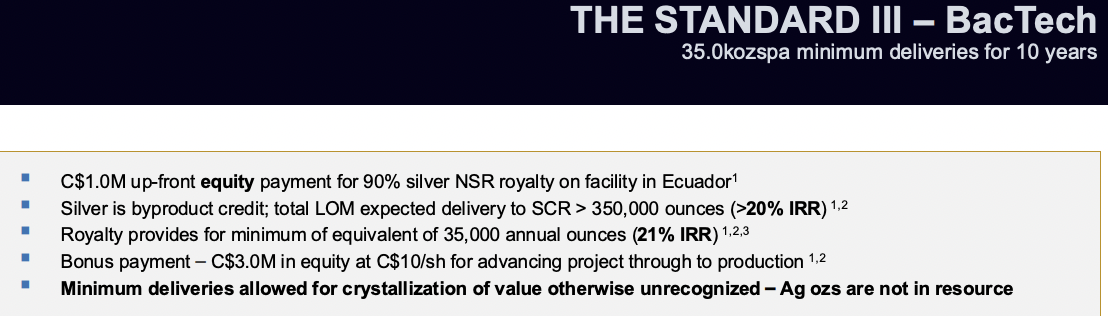

An example of Silver Crown’s business model is a transaction with Bactech Environmental Corp. whereby it was granted a royalty on a bioleaching facility being built in Ecuador to receive the cash equivalent of 90% of the Ag produced.

Silver Crown will receive a minimum of 35,000 ounces (paid in cash, not Ag) annually for at least 10 years following the commencement of regular processing operations. 35,000 ounces at US$30/oz. equals C$1.5M/yr.

The total purchase price consisted of (i) $1M in Silver Crown units at a deemed price of $10/unit, consisting of a common share and a 36-month warrant to acquire a new share for $16,

(ii) 100,000 special warrants, exercisable for 36 months into 100,000 shares upon Bactech successfully financing the project; and (iii) 200,000 special warrants, exercisable for 36 months into 200,000 shares upon Bactech achieving commercial production.

CEO Bures commented,

“This royalty has the potential to more than double our revenue for less than 25% equity dilution. We look forward to cultivating a positive relationship with Bactech as they continue to process environmentally sensitive mine waste…”

Ross Orr, Bactech’s Pres. & CEO added: “As shareholders in Silver Crown, it’s safe to assume they would be our first call should we obtain additional material for processing.”

Silver Crown is targeting operational Ag-producing projects, focused on generating consistent & growing income through an expanding portfolio of royalty interests. Management is searching worldwide for projects with Ag as a byproduct, often small production streams that are routinely overlooked.

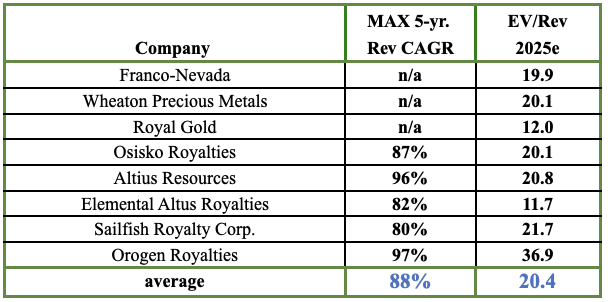

Franco Nevada & Wheaton Precious Metals trade at ~20x 2025e revenue and a group of eight royalty/streaming companies are valued at an average of 20.4x {see chart below}. If Silver Crown could earn a 10x multiple, its valuation could triple or quadruple (assuming revenue growth of 80%-100%/yr. for the next five years).

To learn more, I asked Mr. Bures the following questions…

How is Silver Crown Royalties different from much larger precious metals royalty/streaming companies like Wheaton Precious Metals?

Silver Crown is the ONLY pure-Ag company in the market. No royalty company gets over 50% of its revenue/cash flow from Ag. We’re 100% Ag, more than almost all primary Ag producers. As a smaller player, we can do deals no one else is interested in. With few competitors, we can earn strong economics.

We were the first to create Ag-only royalties and implement minimum delivery obligations (paying a minimum, no matter the actual production). So, we’re different, but we’re following in the footsteps of much larger companies, hoping to one day join their ranks.

How can tiny Silver Crown Royalties compete with giants like Franco-Nevada?

Ag is frequently present alongside gold, copper, lead, and zinc — but goes unreported roughly half the time — making it uninvestable to most royalty/streaming companies.

Reported Ag is a different story, but even then many projects are too small to move the needle for a Franco or a Wheaton. We pick up the Ag crumbs, letting the Majors feast on the main courses of Au/Cu/Pb/Zn.

We envision partnering with larger royalty companies on a case-by-case basis whereby we take the Ag exposure… and they take the rest. We have dozens of transactions under review at any given time and hope to close 3 to 5 in 2025, and again in 2026.

Silver Crown has been public for roughly six months. Despite a strong outlook for Ag, your share price is down nearly 30% from its high. What could turn things around?

More revenue would help as micro & nano-cap royalty companies often trade on revenue (if they have any). We hope to end 2025 with a minimum delivery obligation of 78,000 ozs (annualized) … That would be ~C$3.4M of run-rate revenue at US$30/oz. Ag.

As we continue to prove our business model with new transactions, our revenue should rapidly expand. Ag touched $34.90/oz. in 2024, and is currently $30/oz. Some think it will hit $40/oz. this year.

Your readers should note that the gold-to-silver ratio is ~90:1, vs. a long-term average of 60-65:1. Once Au hits $3,000, an Ag price of $40 would be an Au: Ag ratio of 75:1, and a ratio of 80:1 would be $37.50/oz. Ag.

How do you, your management team, board of directors & advisors stack up vs. peers?

Everyone says they have the best team. We have a strong team, but one way ours is different is in alignment – salaries are capped and the only upside to salary is from future quarterly dividends. We have three full-time execs and don’t expect to have more than 5 or 6 anytime soon.

I own ~10% of the Company. We plan to (eventually) distribute 80-90% of free cash flow. Given current shares outstanding of < 3M, it would not take much FCF to deliver an attractive dividend yield.

What are the biggest risks facing the Company?

Counterparty risks. Operational/geopolitical risks can be mitigated through diversification, and so can counterparty risk, however, if a miner simply refuses to pay or has no cash, that’s a meaningful risk at this early stage. We mitigate risk by investing in projects via success-based tranches over time.

Through diversification & planning for a 50% success rate, we hope to minimize the impact of these risks. We have a mandate to not put more than 10% of invested capital into any given royalty. And of course, we’re exposed to opportunity & risk from future Ag prices.

Please describe one of your most important assets and its risk vs. reward potential.

We don’t have a ‘most important’ asset. In mining, there are infinite risks to performance. We plan for a 50% success rate, meaning that if we can deploy capital at a 20-30% IRR, we should be able to generate a ROIC of 10-15%. Over time we expect that our success rate will improve.

We recently signed a definitive Ag agreement with PPX Mining Corp. for the acquisition of a royalty equal to 15% of (the cash equivalent) of Ag produced from PPX’s Igor 4 project in Peru. We will pay a total of US$2.5M in two tranches. A first tranche of $1.0M is due at closing, expected this quarter.

A second tranche of $1.5M is due six months after closing. Silver Crown will receive minimum quarterly payments equal to (the cash equivalent) of 14,062.5 ounces, (56,250 oz./yr.) up to 225,000 ounces. Royalty payments will commence immediately. If we receive minimum payments, it will take 16 quarters to reach 225,000 ounces.

At US$30/oz., the total undiscounted payback would be $6.75M on $2.5M invested. At US$33/oz., it would be $7.425M. The plan is to do many deals like this, larger over time, funded with reasonable amounts of equity.

Can you give readers an overview of what 2025 (and if possible) 2026 might look like?

2025 should see us exit at a minimum annual run rate of ~78,000 oz. worth of revenue, with upside to that figure. Assuming we close another four transactions in 2026, run-rate revenue could be tied to a minimum of 200,000+ oz./yr.

We are in active discussions on more than 10 transactions. The pace of closing new deals in 2025-26 and the underlying Ag price will dictate our valuation. We have the patience, experience & financial wherewithal to only make attractive investments, yet still enjoy robust growth.

Thank you Peter for your keen insights on Silver Crown Royalties. I look forward to announcements of new royalty transactions this year.

Disclosures: Peter Epstein & Epstein Research [ER] have no prior or existing relationship with Silver Crown Royalties or its management team/board. At the time this article/interview was published, Mr. Epstein owned no shares, warrants, or stock options in the Company. Silver Crown is a highly speculative, small-cap company with low trading volume. Readers are urged to consult with financial professionals before making investments in high-risk stocks. The content of this article/interview is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein, including but not limited to; commentary, opinions, assumptions, comparisons, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Inadvertent inaccuracies are possible. Readers are encouraged to conduct further due diligence.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply