Readers are encouraged to always read disclosures/disclaimers at the bottom of every article.

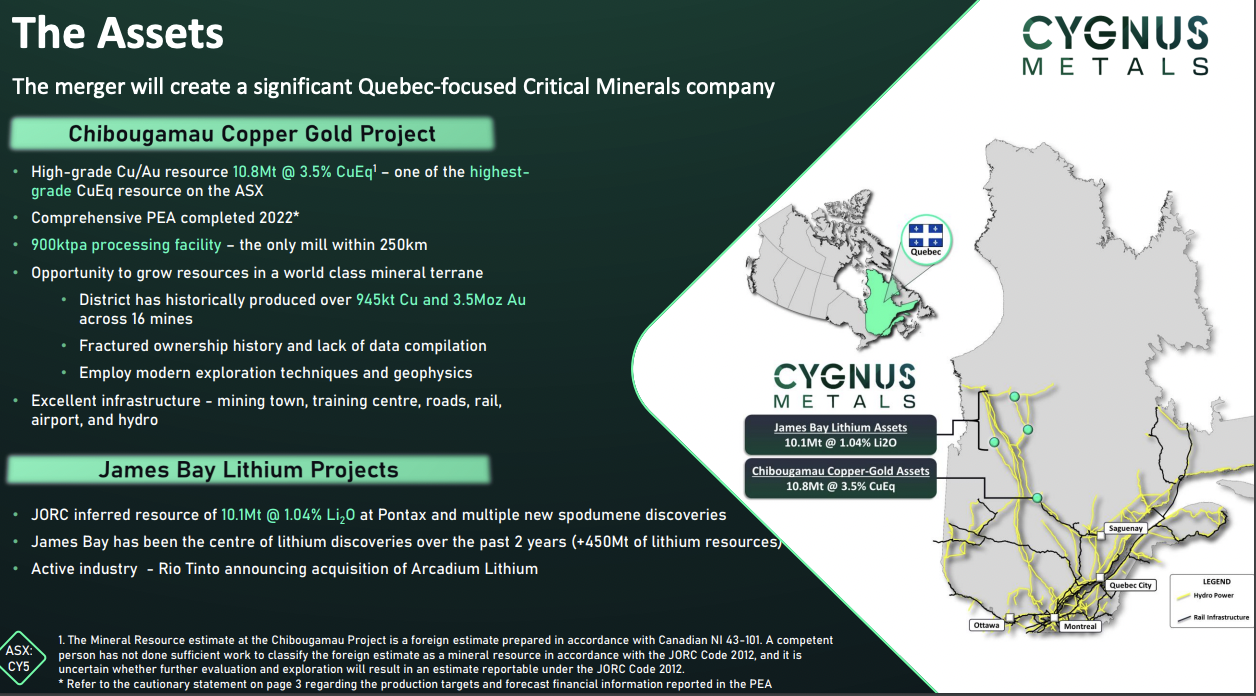

On October 15th, Doré Copper announced a merger of equals with, and into, Australian-listed #lithium (“Li“) junior Cygnus Metals. The new tickers for Doré –> Cygnus are (TSX-v: CYG) / (OTCQB: CYGGF).

The Li sector is in a world of pain but is likely at, or very near, a bottom. I believe Li prices will significantly improve this year. Please see this article for more details on Cygnus’ promising prospects in Quebec.

Shareholders received 1.83 shares of Cygnus per Doré share held. From now on I refer to the combined entity as Cygnus. The NEW Cygnus is listed in both Australia & Canada and has ~C$12.5M in cash. Note: Management is cautiously optimistic about being awarded a modest free-money grant this quarter.

The primary focus this year will be on the Cu/Au assets. S&P Global makes it easy to see why Cu supply will almost certainly be a challenge by the 2030s, likely sooner. Look at the 20 largest Cu discoveries from 1990-2023. A dozen (60%) are from the 1990s!

On January 9th, management announced it increased its Cu/Au land position in Quebec by +50% — via staking new ground — to 282 sq. km. Two diamond drill rigs start this week, targeting resource growth + brownfield exploration targets. Drill results are expected imminently from a program completed before Cygnus’ merger with Doré Copper.

Cygnus’ small, but much higher-grade Cu resources could be very valuable once operations restart around 2027 or 2028 — not in the DRC, Mongolia, Indonesia, Pakistan, Serbia, Russia, Zambia, Panama, or the Philippines — but in safe, prolific, mining-friendly Quebec, Canada.

Western countries urgently need security of supply from the U.S. & Canada. That means high-grade deposits in safe, secure jurisdictions, with solid local community support. It means green power and projects that are not too remote, projects with ample water, power, roads, people, equipment, services, internet, etc.

Finally, projects near major key end markets, not oceans away. Signs of Cu being in high demand include BHP’s & Lundin’s blockbuster acquisition of Filo Mining, and Agnico Eagle investing C$55M into a pre-construction Chilean Cu/Au project. Troilus Gold received four LOIs from export-import banks in November due to its Cu by-product.

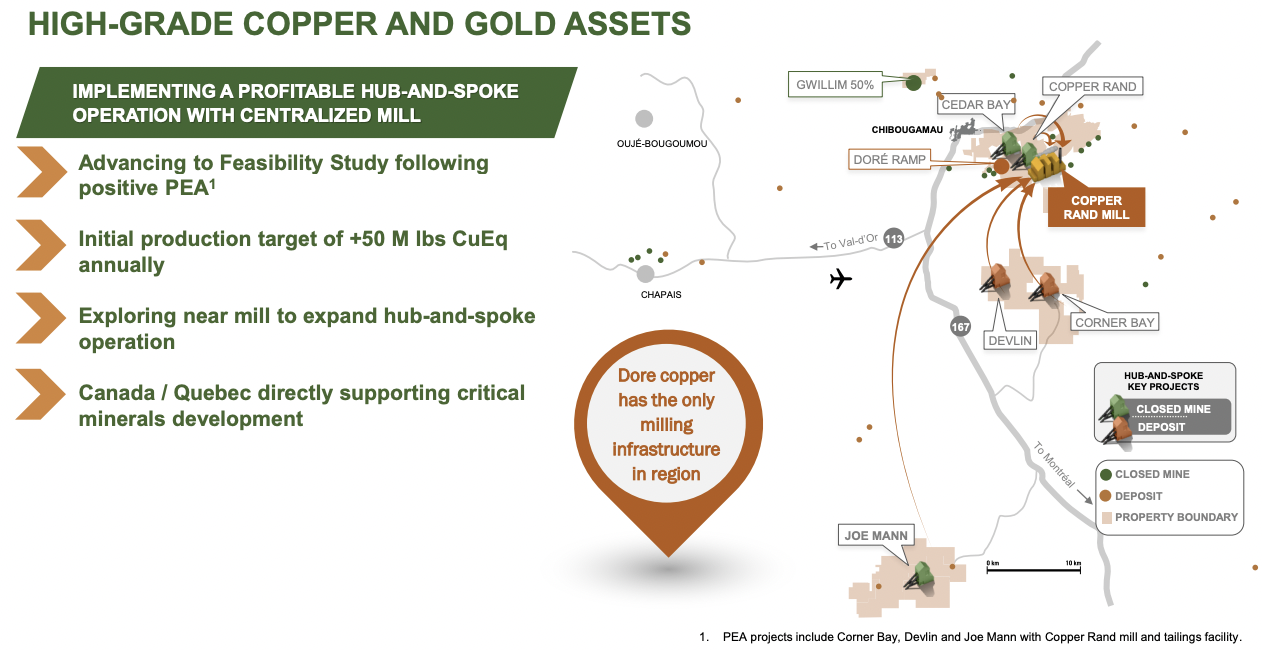

Readers are reminded that Cygnus’ plans call for producing 53M pounds Cu Eq./yr—over 10.5 years as outlined in its May 2022 PEA. The Compay is pursuing a hub & spoke model with multiple high-grade Cu-Au assets feeding its centralized Copper Rand mill. Management is proceeding with a feasibility study, which is expected in 1H/26.

Between now & then the goal is to find one or more new deposits near the Copper Rand mill and continue drilling to expand known areas. Management has consolidated a large land package in the prolific Lac Doré/Chibougamau & Joe Mann mining camps that historically produced 1.6 billion pounds Cu + 4.4M ounces Au.

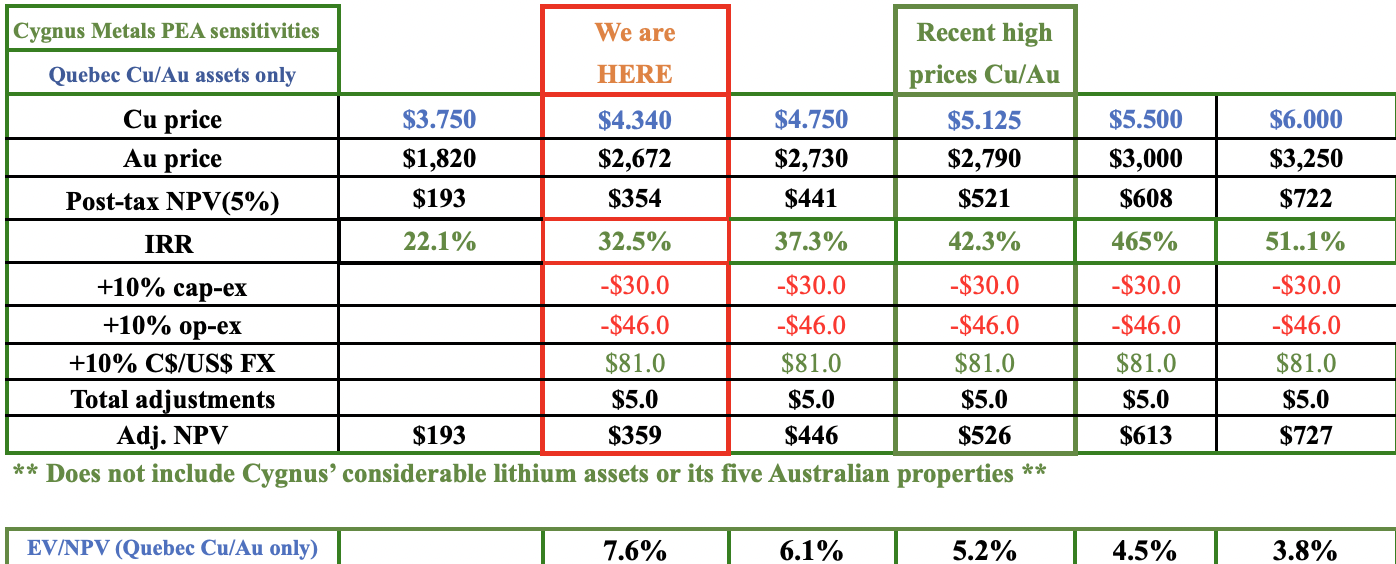

The PEA depicts a robust project with a post-tax NPV & IRR of $193M & 22% [at $3.75/lb. Cu & $1,820/oz. Au]. Upfront capital is reasonable at $181M and the AISC is attractive at $2.24/Cu Eq. lb.

At spot Cu/Au & FX levels, NPV jumps to $359M with an IRR of ~32.5%, incl. an assumed 10% increase in op-ex & cap-ex, offset by a favorable move in the exchange rate. At these levels, the Quebec Cu/Au assets are valued at ~7.6% of NPV and the NPV/Cap-ex ratio would be attractive at 1.8x.

At last year’s high prices of $5.125/lb. & $2,790/oz., the adjusted NPV would be ~$526M with a ~42% IRR, and Cygnus’ Quebec project only would be valued at ~5.2% of NPV, and the NPV/Cap-ex ratio would be very attractive at 2.6x. I added the higher Cu/Au prices, up to $6.00/lb. / $3,250/oz. into the chart because I think we could see those levels by 2026 or 2927.

The Quebec footprint includes 16 past producers, deposits, and resource target areas within a 60-km radius of Copper Rand. Molybdenum & silver content is not in the MRE/PEA but will be evaluated for inclusion in the upcoming Feasibility Study. The highest grade Moly interval is 3.3 meters of 1,877 ppm, equal to ~1.3% Cu Eq.

With government assistance in the form of grants, loans & tax breaks, and Quebec institutions, commercial lenders, equipment financing, off-take agreements & royalty/streaming opportunities, production could be achieved without excessive equity dilution.

A meaningful enhancement to PEA economics comes from detailed flotation test work on a composite CB sample that determined a clean 28.0% Cu concentrate can be delivered vs. the 24.7% concentrate grade assumption in the PEA.

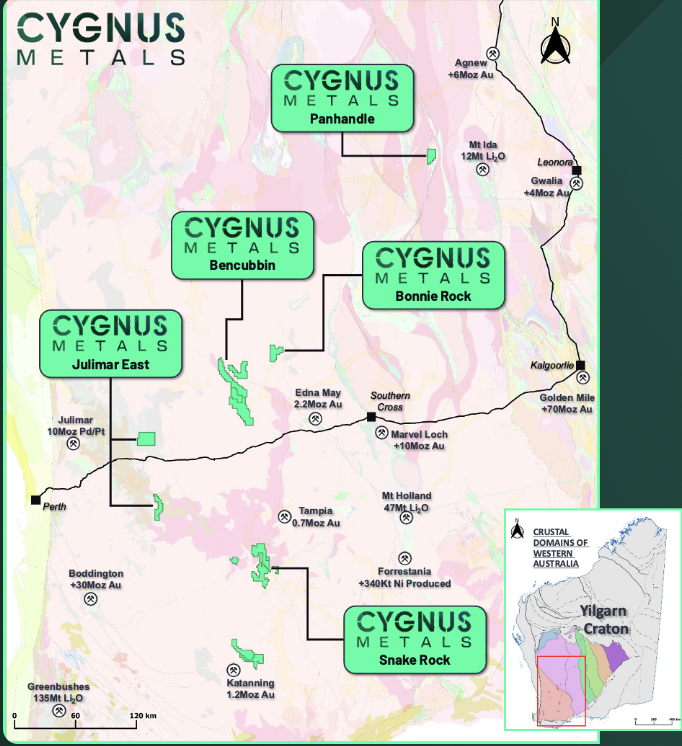

At spot prices, the resource estimate contains 841M Cu Eq. pounds at a strong 3.53% Cu Eq. grade. Backing out the value of the Company’s lithium assets in Canada + five Australian properties prospective for lithium, REEs, nickel, gold, Cu, silver, lead, and zinc — the remaining Quebec assets are valued at C$0.047/Cu Eq. lb.

That’s roughly 2x the per lb. valuation of pre-production S. American Cu giants, but at 3.53% Cu Eq., Cygnus has 6-7x the grade. Cygnus owns 100% of its assets, except for 50% of the promising Gwillim Au target in a JV with Alamos Gold, a recently acquired 56% stake in a property tied to Corner Bay, and 44% owned by Pan American Silver.

Another multi-billion dollar producer with projects close by is IAMGOLD. Any of those three would benefit from partnering with Cygnus.

Five prospective, potentially valuable properties across Australia, near producing mines

Low Li, nickel & cobalt prices have slashed the cost of Li-ion batteries. New end uses for batteries are proliferating. In addition to EVs, Li is needed in batteries for retail, commercial & grid-scale stationary storage systems.

On Albemarle’s recent conference call, its CEO said the stationary storage market is up +36% year-to-date, and EV industry expert Rho Motion reported that global EV sales are up +25% YTD through November, led by China, +40%.

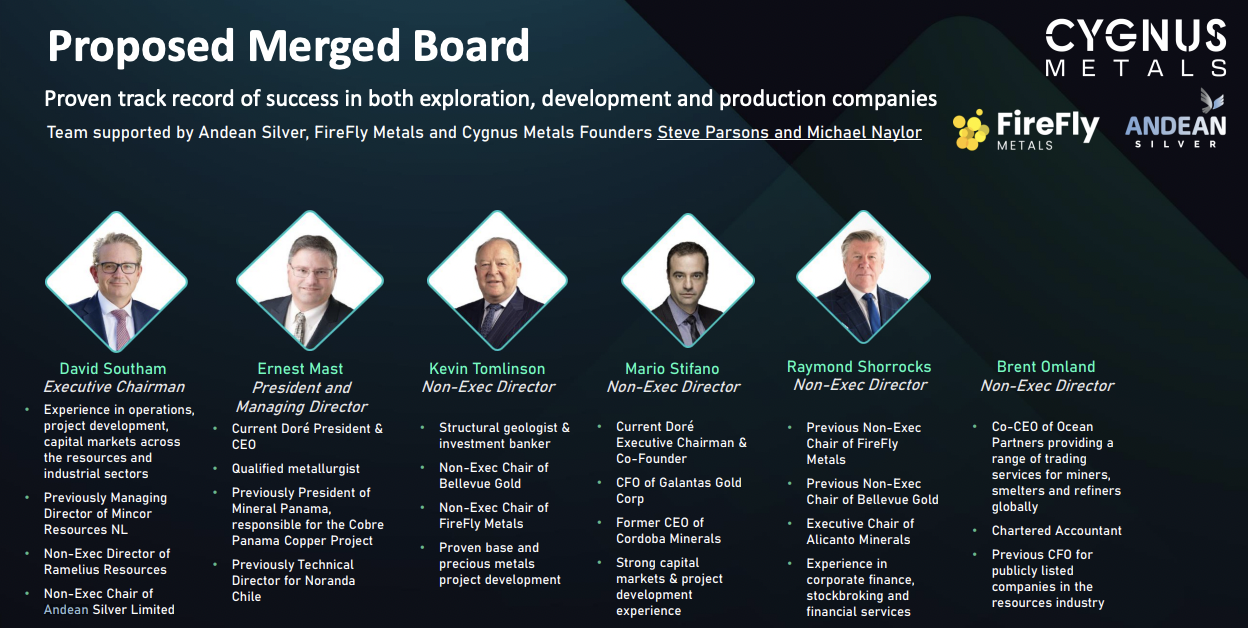

In addition to Li, Cygnus Metals’ management team & board have extensive experience in base & precious metals and a track record of success. Several have significant histories at well-known producers Bellevue Gold, Andean Silver, and development company Firefly Metals.

Bellevue is valued at ~C$1.8 billion with 3.2M ounces of high-grade Au (9.05 g/t), and C$600M FireFly Metals is advancing its Green Bay Cu-Au Ming project in Newfoundland, and exploring Pickle Crow in Ontario.

The combined Cygnus & Doré management team, board & advisors is a force to be reckoned with. Next year could be BIG, especially if the Li sector bounces back, which I expect it will.

In the meantime, the Company’s Cu-Au assets will be prudently advanced with ample cash liquidity at a time when many junior miners are running out of funds and having great difficulty raising more.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cygnus Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Cygnus Metals are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Cygnus Metals was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply