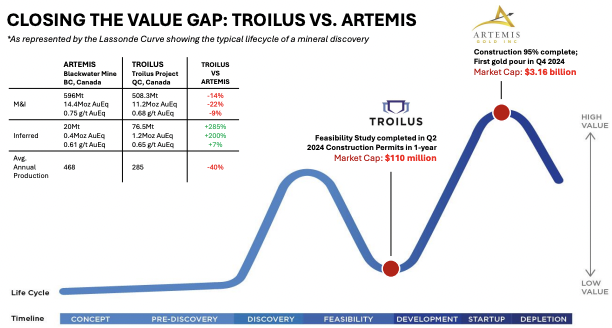

In my opinion, Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) is meaningfully undervalued due to fears of huge equity dilution needed to fund its very large, 100%-owned Troilus gold/copper project in Quebec. A new slide from the Company’s January Corp. presentation is compelling in showing Artemis Gold’s market cap vs. that of Troilus.

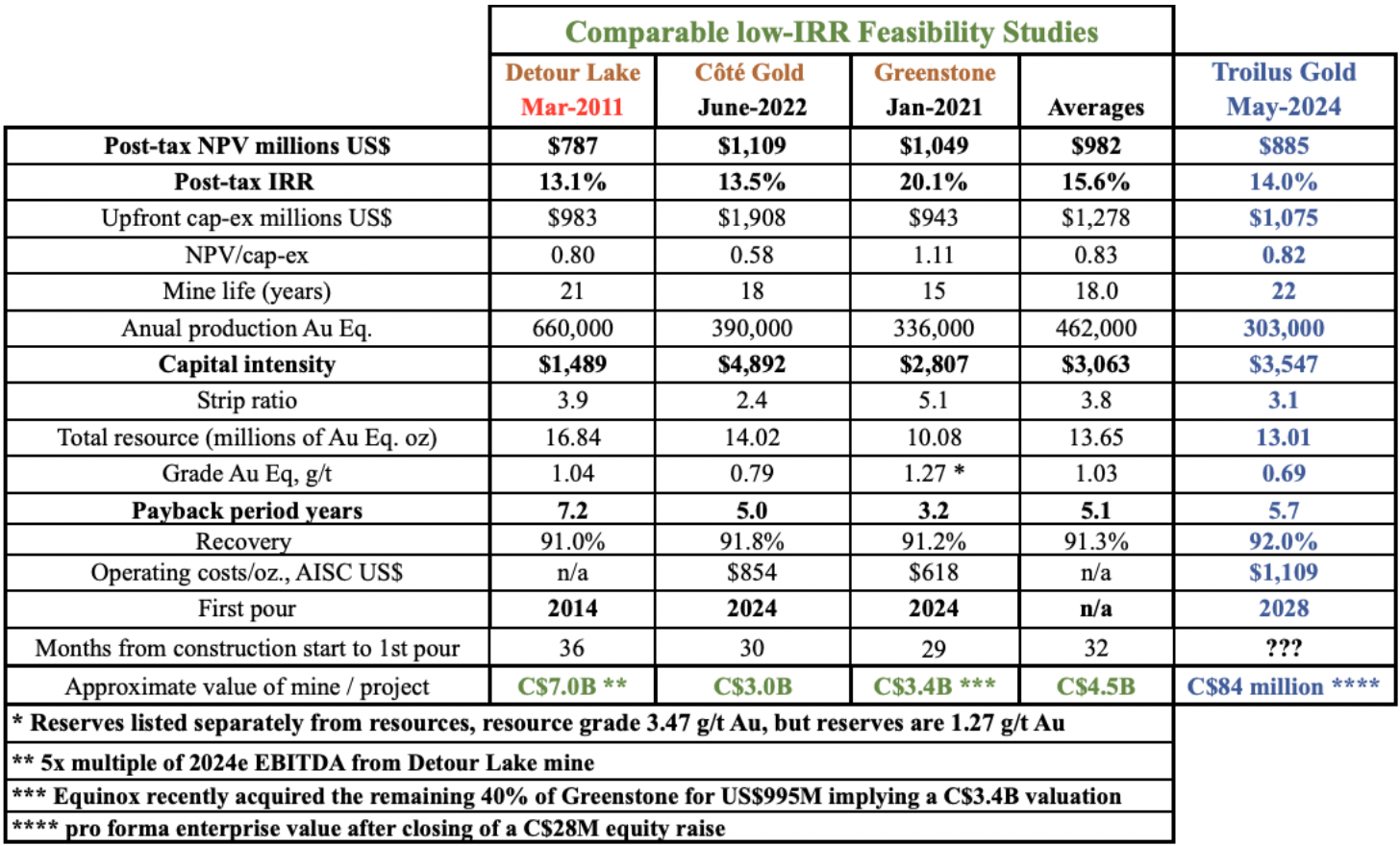

On Jan. 15th, the enterprise values {market cap + debt – cash} of the companies were $88M vs. $3.8B. In a prior article, I compared Troilus to low-grade, bulk tonnage Canadian assets — Agnico Eagle’s Detour Lake, IAMGOLD’s/Sumitomo’s Côté, and Equinox Gold’s Greenstone mines, with average valuations over $4B.

If Troilus can avoid issuing too many shares over the next 4-5 years, its $88M valuation is absurdly cheap. Equity dilution can be mitigated with debt of up to 75% of [cap-ex + working capital + a provision for cost overruns], Ag and/or Cu royalty/streaming, selling a minority interest in the project, and equipment financing.

Importantly, on Nov. 13th, 19th & 21st management announced not one or two, but four indicative Letters of Intent (“LOIs”) totaling US$1.3B from export-import credit agencies in Germany, Finland, Sweden & Canada. This de-risking news has been largely ignored.

These commitments (subject to further due diligence), would fund a large majority of cap-ex, potential cost overruns + working capital. However, if/when the LOIs are approved, not all of the headline-grabbing $1.3B will be utilized.

Still, the stamps of approval from these agencies will help Troilus obtain a robust, multifaceted financing package of debt, equity, equipment financing, and possibly a royalty/streaming deal.

The LOIs deliver considerable debt capacity before accounting for potential investments from commercial banks & corporations in Europe & Canada and Quebec institutions.

Funding for the German component is tied to a commercial off-take agreement with Aurubis AG, Germany’s largest smelter, on a meaningful portion of the project’s Cu for up to 15 years. Funding from the Finnish component is contingent on strategic partnerships with a Finnish equipment provider & Boliden.

Notice that the Cu portion of the Troilus project is significant to the credit agencies. Several months of due diligence have already been completed and this process is expected to continue well into 2025 to arrive at definitive agreements. Interest rates on the loans should be attractive, and maturities could be ten years.

Major & mid-tier producers urgently want to expand production pipelines & resource bases in this precious metals bull market. Few projects are better positioned than Troilus to quench their thirst.

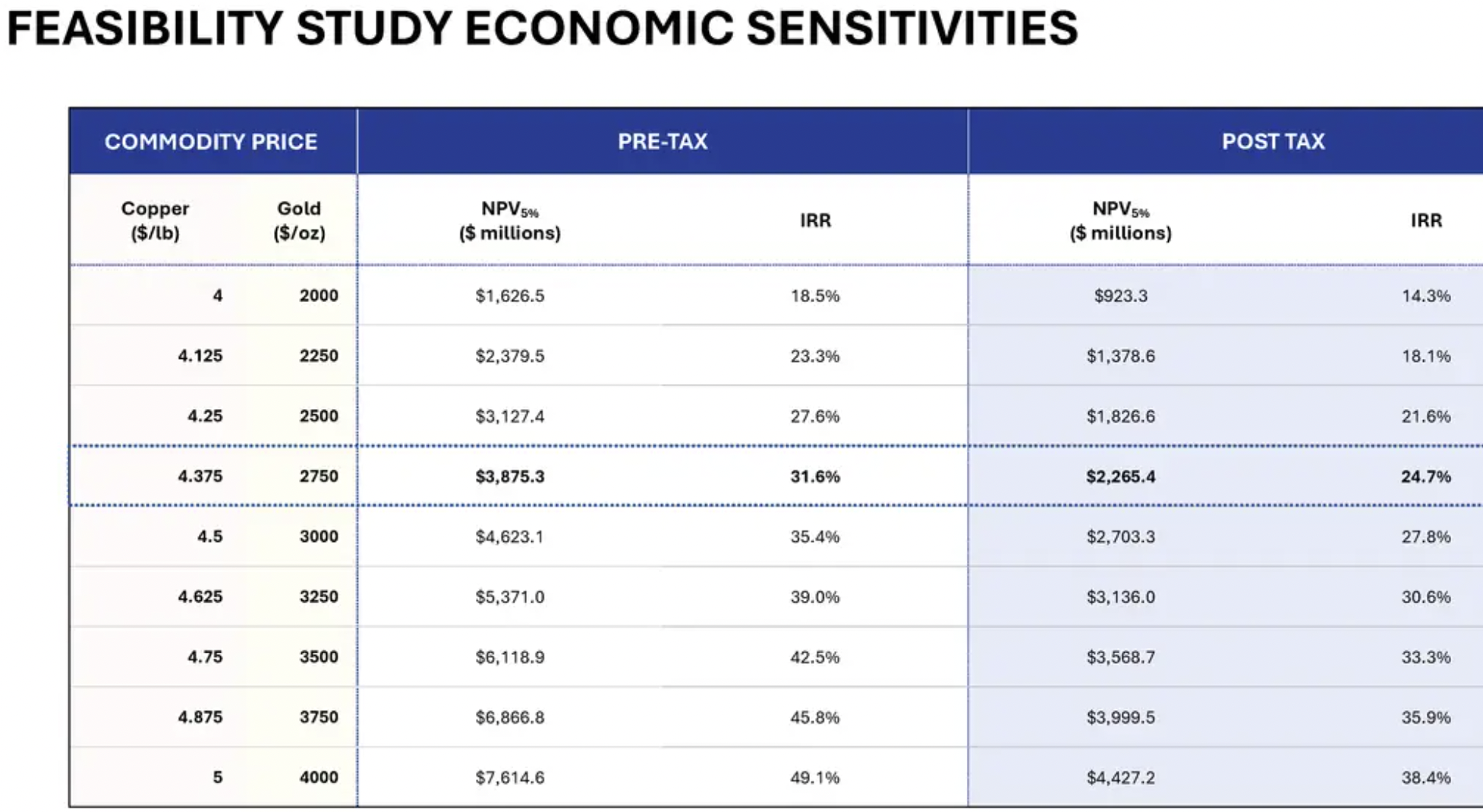

Troilus has an enterprise value {market cap + debt – cash} of ~$88M at $0.30/shr. That means its flagship project is valued at just 3% of post-tax NPV assuming gold (“Au“) at today’s $2,695/oz. & Cu at $4.40/lb. 2024 was a BIG year for the 13.0M Au Eq. oz. Troilus project, yet the Company’s share price was down -37.5% from $0.48 to $0.30.

This is despite Au being up +27%. At spot prices and noting a favorable move in the US$/C$ exchange rate, the pro forma post-tax NPV & IRR are roughly C$3.1B & 24%. In mid-May, a Feasibility Study (“FS“) de-risked the logistics & operations of the Troilus project, but investors focused on a 14% post-tax IRR.

Eight months later, Au is up another 14% (+36% above the $1,975/oz. base case), and a junior recently announced a PFS with a base case of $2,200/oz. Au, closely followed by another company using $2,330/oz.!

Free cash flow at base case Au/Cu prices was estimated at ~C$202M/yr. At the spot price, it would average ~C$380M/yr. Readers are reminded that the AISC came in at an attractive $1,109/oz.

Companies like; Agnico Eagle, Newmont, Barrick Gold, Sumitomo Metal & Mining, Alamos Gold, Kinross, and Eldorado Gold are watching developments at Troilus closely, and Cu-heavy producers like Teck Resources & Freeport McMoRan should not be ruled out as potential strategic partners.

Last year Troilus strengthened its team with key appointments such as Andy Fortin as VP of operations & general manager plus two board members, Chantal Lavoie, newly appointed Chairperson, and Francois Biron, Chairman of the tech committee. Mr. Lavoie is a P.Eng with > 35 years of experience in operations, permitting, and construction.

Chantal brings extensive experience in managing large-scale projects from permitting to operations. He held senior roles incl. Mgr. of the U/G Division at Barrick’s Goldstrike project, COO of De Beers’ Canadian operations, CEO of Crocodile Gold Corp., COO of Dominion Diamond Corp., and most recently was COO of Iron Ore Co. of Canada.

Troilus Gold’s FS calls for a 22-year open-pit operation of 303k Au Eq. ounces/yr., but peaking in year 7 at 536.4k ounces demonstrates a mine plan that could be greatly expanded, making it of serious interest to Majors. The Corp. Presentation [page #14] depicts the Troilus Project as the 6th largest in Canada (if operating today).

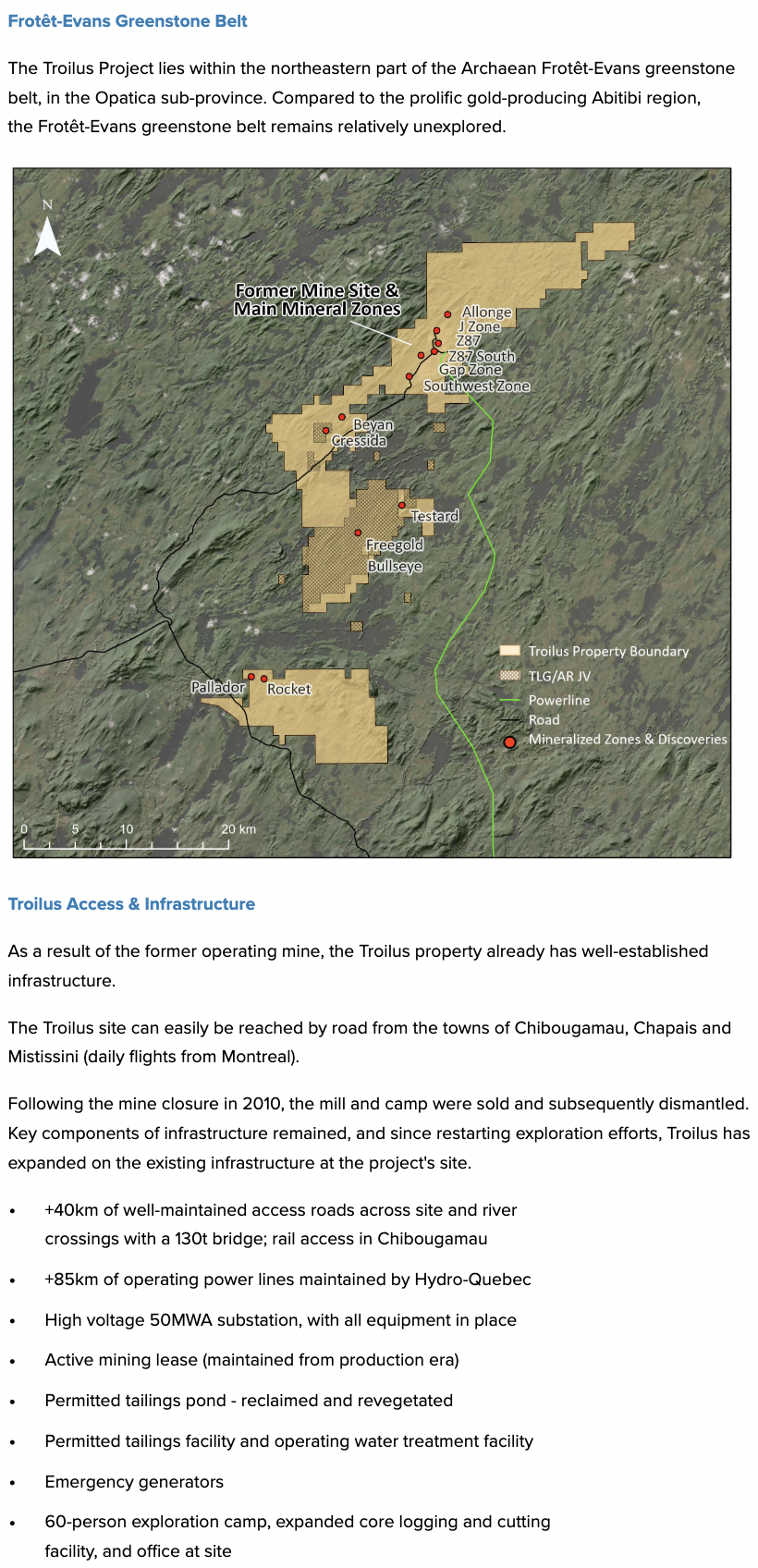

CEO Justin Reid likes to remind investors that ~US500M of existing & upgraded infrastructure is in place as Troilus is a pre-existing mine, having produced ~2M ounces of Au + ~70,000 tonnes of Cu from 1996-2010.

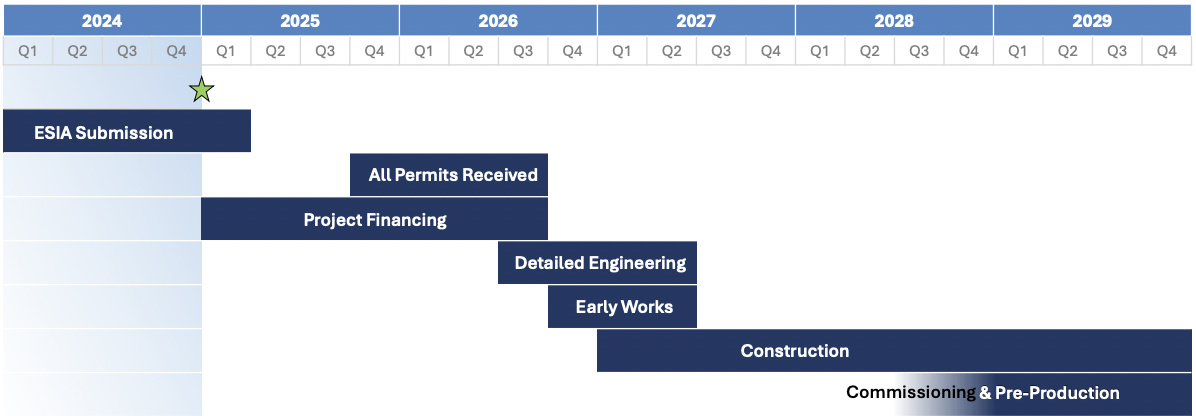

Regarding permitting, public consultations with local communities have, and continue, to provide valuable insights. These efforts have been pivotal in advancing the environmental & social impact assessment (“ESIA“), expected to be submitted this quarter. All permits should be in hand next year & first Au pour is planned for 2028 or 2029.

Last August dewatering of the J4 pit commenced and is expected to be done by next quarter. J4 is one of two formerly mined open pits. This year management will start dewatering Z87 with plans to finish that pit in 2026. These activities will open up new access for drilling, laying the groundwork for the next phase of development.

Drilling slowed in 2024 as management focused on the main ore bodies, pursuing both, “strategic resource expansion & conceptual exploration opportunities.” Efforts were rewarded by the West Rim discovery in September, highlighted by 20 m of 1.66 g/t Au Eq., located 150 m from the planned reserve pit.

The technical team is optimistic it can expand upon its initial success at West Rim and potentially find additional higher-grade zones to enhance economics in the opening years of the mine plan. Higher grades in years 1 to 6, could add $100s of millions to post-tax NPV.

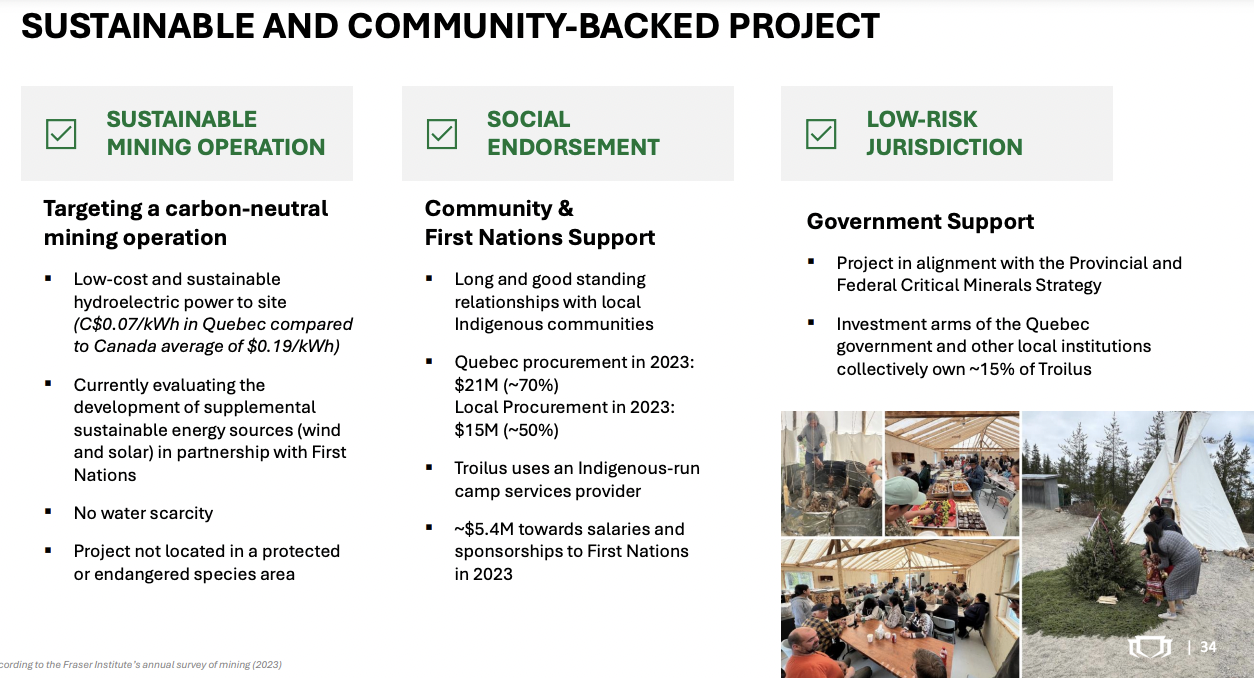

In September, 500 solar panels and a wind turbine were installed on site, marking a critical step toward supplementary & backup power. The project is reportedly in one of the windiest parts of James Bay.

This renewable power initiative is important as it will eventually make dirty, diesel generators obsolete and should be cheaper than diesel in the long run. Over the next 12 months, management will monitor these assets to assess the optimal locations & feasibility of larger-scale installations.

A recent study with Coalia, the National Research Council of Canada, Lamont, and Minesite Drainage Assessment Group determined that the Troilus rock is not acid-generating and will not require additional treatment, minimizing the environmental footprint. This means waste rock can be repurposed for things like road construction.

Management believes its Project is both environmentally friendly, (sustainable hydroelectric power + solar & wind, tailings-friendly, with a plan for carbon-neutral operations), and as a past producer has low-technical risk –> (86% of the 13M ounce resource in the Measured & Indicated categories).

This year’s goals include; advancing basic & detailed engineering, securing long-lead time orders, negotiating contracts with equipment suppliers, extensive collaboration on due diligence with export credit agencies, and launching early-works projects onsite.

In addition, more drilling at West Rim to further define its potential while also exploring other near mine opportunities and along the mineralized corridor will be done. Notice that I haven’t mentioned a strategic investor.

The LOIs bought management time to continue de-risking, exploring, optimizing the operating flow sheet, and improving the share price. With ~C$25M in cash, there’s no immediate need to raise capital. This year management could announce a royalty transaction on its Ag production, something thought to be in the works last year.

If one is bullish on Au & Cu, one would be hard-pressed to pick a better location than Quebec. A Major Canadian mine expected to be in production this decade should be of keen interest to large Au and possibly Cu producers. 2025 is poised to be a transformative year for Troilus Gold (TSX: TLG) / (OTCQB: CHXMF).

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER], and Peter Epstein owned shares in the company, purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived or actual errors, including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply