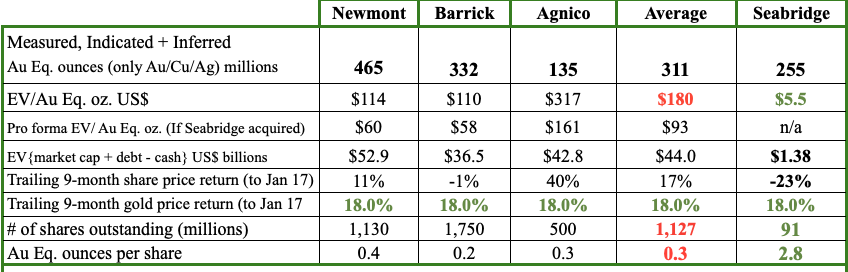

All dollar figures US$

This article concerns one of the most exciting gold/copper development stories on earth. No, it’s not in Africa, China, or Russia, it’s in B.C. Canada. Gold (“Au“) is in a bull market, up over 35% in the past year. It does well when geopolitical tensions are high, and geopolitical tensions are high.

“Eastern” nations, led by China, Russia & India are buying gold hand over fist, diversifying away from the USD. Aggressive buying could continue for years. China’s per capita holding of Au is 1/15 that of the U.S. India’s is 1/55.

Copper (“Cu“) is at the heart of EVs/energy storage systems, renewable power, AI/data centers, high-tech electronics/drones, aerospace/defense & 5G/6G telecom. Six of the top seven Cu-producing countries are Chile, Peru, the DRC, China, Russia & Indonesia.

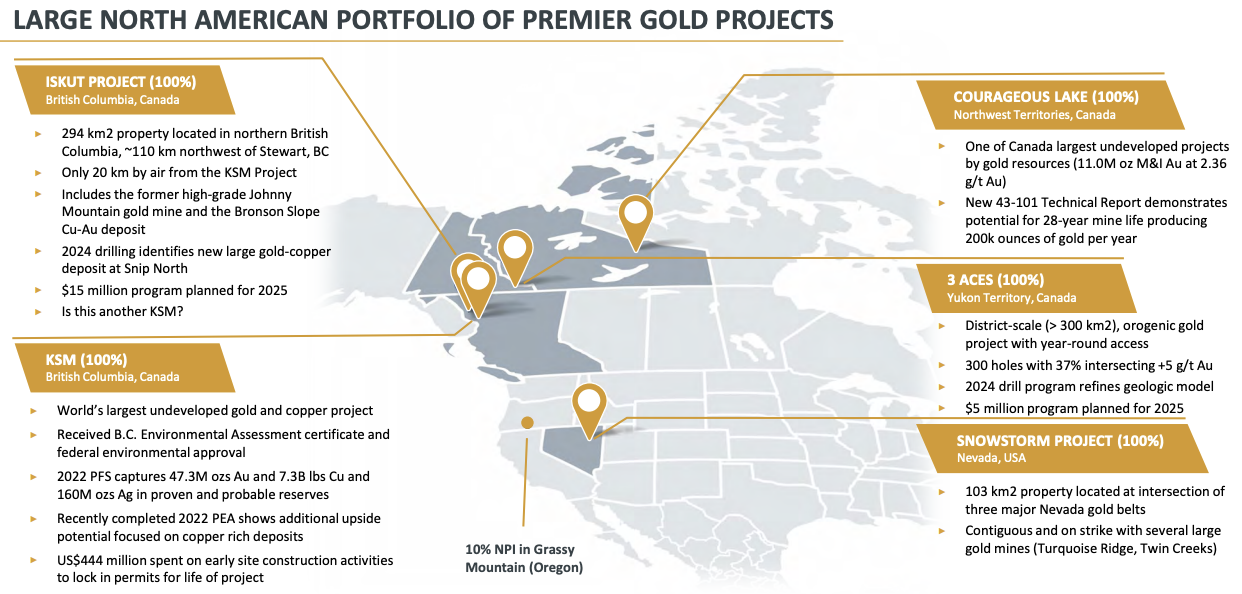

Chile & Peru have century-old mines with falling grades & rising costs. The other countries should not be relied on. If one wants BIG exposure to both Au & Cu in a safe, prolific jurisdiction, Seabridge Gold (TSX: SEA) / (NYSE: SA) is one of my favorite ideas. Its shares are down 43% from a high of $20.55 on October 22nd, while Au has been essentially unchanged since then.

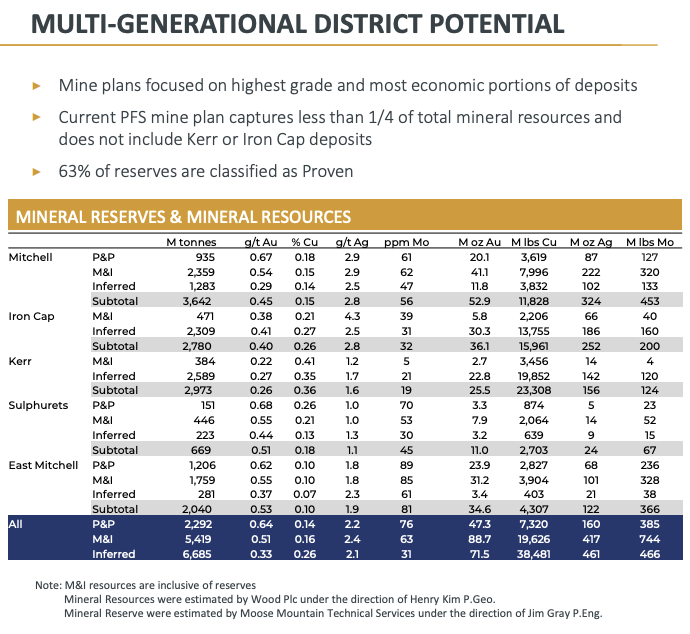

This is a company with ~255 million gold equiv. Measured, Indicated & Inferred ounces. Agnico Eagle has ~135 million, think about that for a moment… Some investors are worried about two challenges at the flagship KSM project, one by a First Nations community, and the other by an NGO.

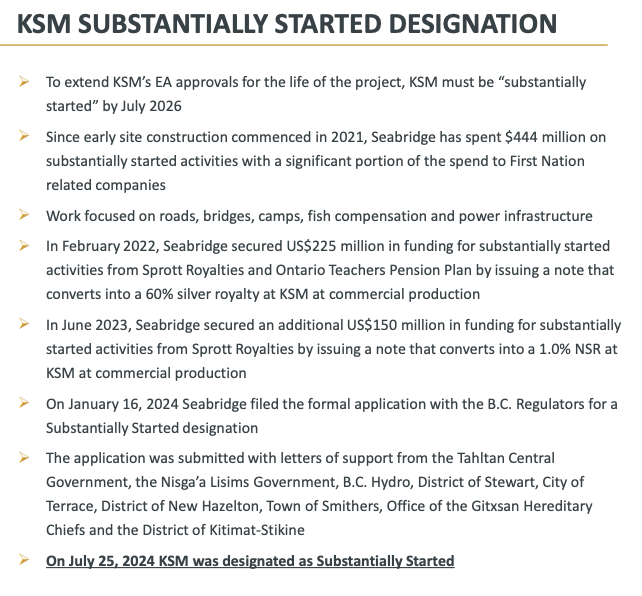

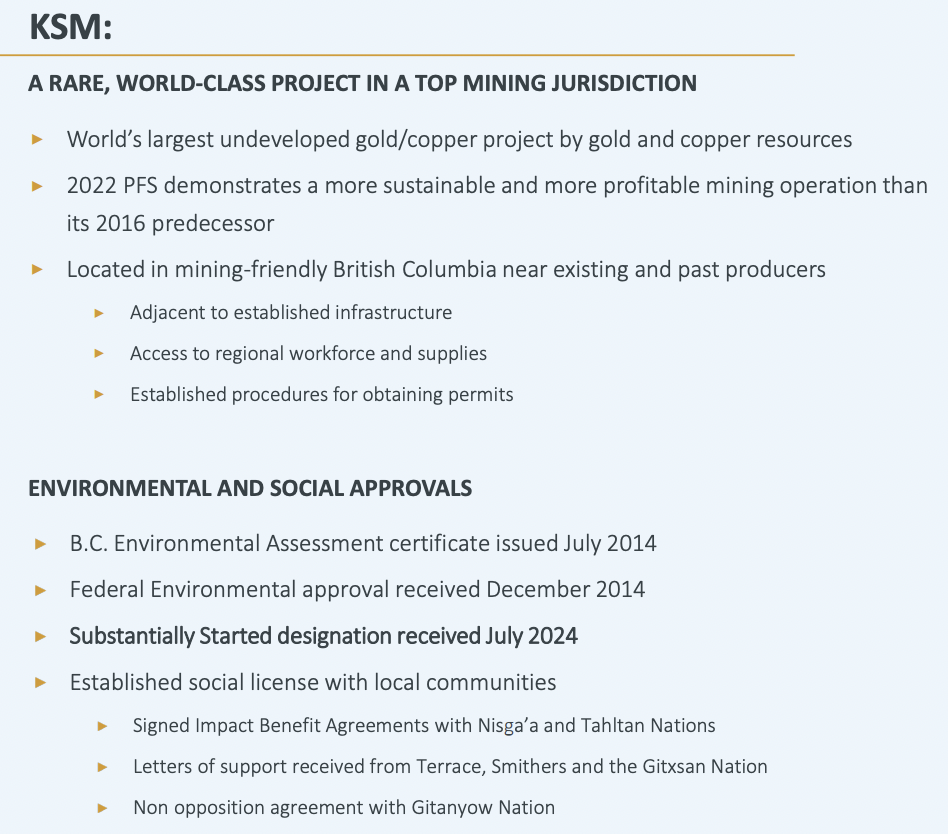

Seabridge was awarded a “Substantially Started Designation” by the B.C. government, having spent over $325M on construction activities between 2021-23, and ~$875M for all exploration & development activities since 2001. Eight slides in the latest corporate presentation describe the Company’s extensive infrastructure investments.

Yet, opponents are claiming the government was “unreasonable” in granting the designation even though it was overwhelmingly supported by most First Nations & local communities. The B.C. Minister of Environment & Climate Change Strategy has substantial leeway in deeming a project substantially started. Overturning it seems highly unlikely.

Management, lawyers & consultants are confident the objections have little chance of slowing the Company’s 100%-owned Kerr-Sulphurets-Mitchell [KSM] project in B.C. Canada, but longtime Chairman & CEO Rudi Fronk acknowledges that the challenges could take “a year or more” to resolve.

In my view, the major risk for Seabridge is funding a very large project. Upfront cap-ex could be 6x the current enterprise value. Twenty-four km of tunneling through a mountain to access deposits is not technically challenging, just expensive.

That cap-ex burden sounds daunting, but 100s of juniors have cap-ex vs. market cap hurdles above 6x — for example, some Cu juniors are valued at < $100M with upfront cap-ex over a billion dollars for giant projects in S. America.

I believe a dozen Western-friendly companies could comfortably afford to fund a substantial portion of Seabridge’s cap-ex for KSM. In addition to Newmont, Agnico & Barrick, the following could have interest.

Teck Resources, Freeport McMoRan, Rio Tinto, Glencore, BHP, Fortescue Ltd., Vale Canada, Mitsui & Co., Anglo American, and Sumitomo Corp. By far the leading contenders are Newmont, Teck, Agnico, Freeport, and Barrick.

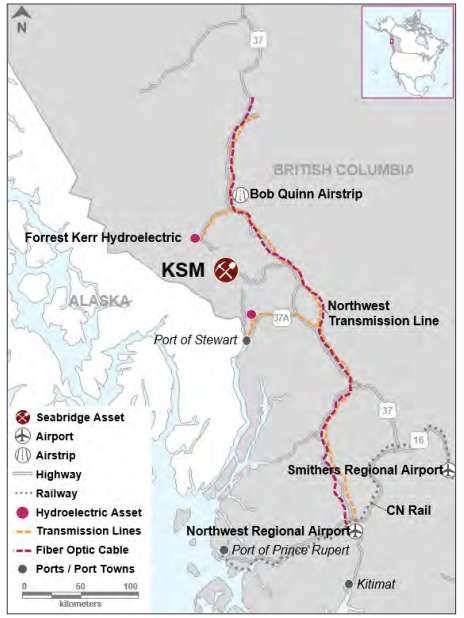

Spoiler alert, Newmont has a substantial presence in B.C. surrounding KSM with Brucejack to the south, Galore Creek & Tatogga to the north, and Red Chris to the NW, making it best positioned to gain operating synergies by acquiring/partnering with KSM/Seabridge.

Newmont & Barrick operate a globally significant JV in Nevada [Nevada Gold Mines]. Might they look to partner on KSM? Or, Barrick could go it alone. A significant advantage for Barrick is it has net debt of $500M, vs. about $6B at Newmont.

Barrick is experiencing very significant operating problems in Mali, Africa [causing it to shut its 2nd largest mine!]. Meanwhile, one of its largest development projects is in Pakistan. Barrick is headquartered in Toronto but only has one sizable mine (Hemlo) in Canada, and that one is 30+ years old.

Turning back to B.C. & KSM, Newmont & Teck are partners on Galore Creek & Schaft Creek. Might they partner on KSM? One should not count out Freeport. Last week Freeport’s partner Amarc Resources made a huge discovery in B.C. sending its share price up +163% in two days.

What about Agnico? Agnico has a major presence in eastern Canada. It has significantly outperformed Newmont & Barrick, giving it a strong share price to leverage in pursuit of KSM.

If that happens, it would be a powerful vote of confidence that ongoing opposition to KSM will not prevail. The amount of due diligence done by Majors over the years is staggering. With gold at $2,737/oz., now’s the time for suitors to pounce.

Three groups have been short-listed to conduct further due diligence and propose a JV structure at the project level. The strategic partner will be asked to fund 100% of cap-ex + working capital [~$200M] through the delivery of a Bank Feasibility Study in early/mid-2027, to earn an initial 10% stake in KSM.

From there the partner will have the option to continue funding all, or most, of cap-ex + working capital through commercialization to earn a majority interest of ~51% to ~70%. In my view, if management were to cede 70% ownership, it would be 100% free-carried through to production, thereby minimizing equity issuance.

Seabridge might issue far fewer shares than some fear. I assume 70% of upfront cap-ex can be funded with a consortium of commercial & government debt — plus export-import banks — and that cap-ex + working capital might total $8.5B. A strategic partner could help arrange debt.

Increases in gold & copper prices from Pre-Feasibility Study [PFS] levels well more than offset inflation. Post-tax NPV[5%] could be $14B, assuming; 1) $2,737/oz. Au [$1,742 in PFS], $4.30/lb. Cu [$3.53 in PFS], a +30% increase in both cap-ex & op-ex, and a 10% weaker Canadian dollar [1.44 vs. 1.30 in PFS].

I believe KSM is a must-own, generational asset. Once up & running in the early 2030s, Newmont or Barrick could increase their production levels > 25% and cash flow > 35% by acquiring KSM. Those calculations assume gold is $3,335/oz. in 2032 [an 8-yr. CAGR of +2.5% from the current price — although Au is up +10.8%/yr. over the past eight years!].

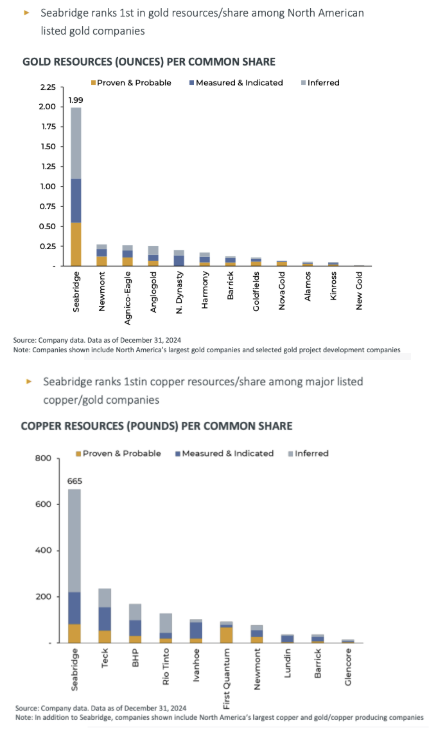

One of management’s favorite metrics, and for good reason, is Au Eq. ounces per share. In the chart below, notice that for Seabridge that figure is 2.8 ounces, but the Big-3 averages just 0.3 oz./shr. Amazingly, the Company also leads the pack in Cu terms, far better than Teck, BHP, Rio, Ivanhoe, etc.

KSM is the world’s largest undeveloped project. In total, Seabridge hosts ~255M Au equiv. [Au/Cu/Ag] ounces, [at spot prices, not including ~12.9M gold equiv. ounces worth of molybdeum], including Courageous Lake and two others.

Seabridge Gold’s prodigious metals endowment compares to Newmont’s resource of ~465 million Au Eq. ounces, Barrick’s at ~332 million, and Agnico’s at ~135 million. Although not apples to apples as Seabridge is years from production, Newmont is valued at ~$114/Au Eq. resource ounce, Barrick $110/oz. and Agnico $317/oz. By contrast, Seabridge trades at ~$5.5/oz.

KSM is cheap compared to producers due to the fear that it will be tied up in never-ending court cases. Of course, that COULD happen, but it’s not what pundits say is likely. In SW Alaska, two massive projects — Donlin and Pebble — have suffered major delays.

The EPA blocked Pebble in 2023 due to potential harm to salmon fisheries, followed by a 2024 permit denial by the U.S. Army Corps of Engineers. Appeals are underway… If KSM advances without meaningful delay, for example by securing a strategic partner, the valuation could move a lot higher.

Management states that the three prospective JV partners for KSM are not overly concerned about the two recent challenges, and [in my view] hopes to announce a strategic partner in 1H/25.

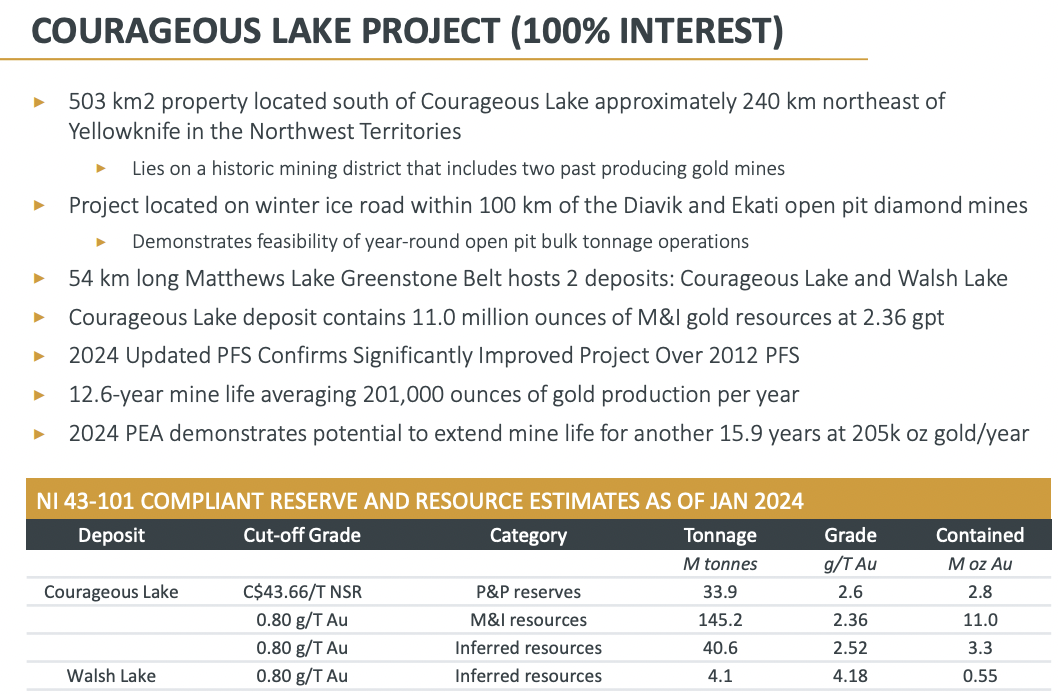

While little to no value is ascribed to Seabridge’s other assets, Courageous Lake [CL] and Iskut are very interesting. For instance, marking CL’s post-tax metrics from its PFS to market like I did with KSM’s, results in a post-tax NPV of ~$1.3B.

CL, in the Northwest Territories, is another one of Canada’s largest undeveloped Au projects. It has a Measured & indicated Resource of 11.0M oz. at 2.36 g/t. In periods of strong M&A, high-quality Au projects at the PFS or BFS stage can be taken out at $50-$200/oz. Eleven million ounces at the midpoint of $125/oz. = $1.375 billion.

I estimate that if management farms out CL, Seabridge’s residual stake could be worth $100s of millions. The 294-square km Iskut project could be another KSM as it has a large footprint with similar geology & grades, Iskut is 20 km away as the crow flies.

Management is considering unlocking the value of CL, Iskut, and others by spinning them off or farming them out. For now, all eyes are on KSM and its suiters. In the past nine months, Au is up +18% but Seabridge is down -23%. Newmont, Barrick & Agnico are up an average of +17%, led by Agnico up +40%.

Definitive news of a strong financial/technical partner will be doubly good as it will greatly de-risk KSM’s commercialization timeline, and demonstrate the conviction that recent opposition to the project is a normal course of business in the mining world, not a red flag.

Newmont, Agnico, Barrick, Teck & Freeport are bursting with free cash flow. In addition to paying down debt & buying back shares, the third leg of the excess FCF stool is enhancing production pipelines. Few, if any, projects in Western-friendly countries move the needle more than Seabridge’s KSM!

DISCLAIMERS — Peter Epstein of Epstein Research [ER] has no prior or existing relationship with Seabridge Gold or any other company mentioned in this article. Seabridge Gold is a fairly high-risk story but has considerable hard asset value in its 255 million gold equiv. ounces. Even still, the share price could be crushed upon news of a long delay in development.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply