No matter where one looks, there are supply-chain risks & uncertainties, some more serious than others, but few critical, precious, or base metal production sources are safe.

Barrick Gold is in arbitration with Mali and recently suspended its mine there (its 2nd largest mine!). Burkina Faso used to be a decent jurisdiction — until terrorist attacks targeted mining operations.

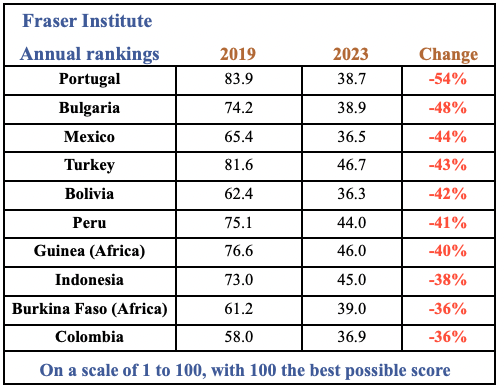

Remote projects that lack infrastructure, those without access to clean power/water, or those lacking local community support are more trouble than they’re worth. A few fallen angels below –> jurisdictions that have plunged in the Fraser Mining Survey from 2019 to 2023 — may surprise readers.

Risk analysis firm Verisk Maplecroft said 72 of the 198 countries it tracks have recorded a significant increase in interventionist policies & protectionism in the past five years. Gold (“Au“) producers are leery of operating in countries in the bottom quartile of mining jurisdictions as ranked by groups like the Fraser Institute.

Producers looking for safe ounces are flocking to Canada, the U.S. & Australia, home to the top 13 of the 86 ranked jurisdictions (Fraser). However, companies — like silver players in Mexico — can become overexposed to a single country. Therefore, investments in other mining-friendly places offer valuable diversification benefits without serious jurisdictional challenges.

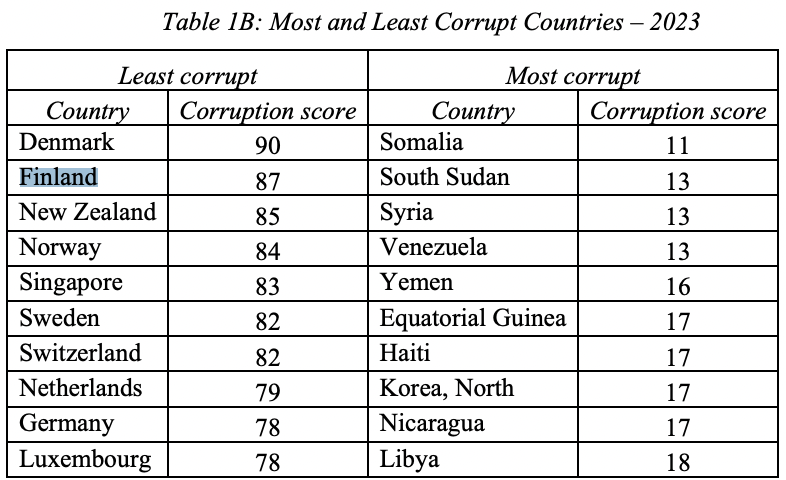

For example, Botswana, Sweden & Finland are in the top 20% of the latest Fraser Survey. Aswath Damodaran of NYU: Stern School of Business authors an excellent annual report –> Country Risk: Determinants, Measures & Implications, in which Finland is ranked in the top 6%.

Professor Damodaran uses Moody’s sovereign debt ratings, plus other sources, in his work. Finland also ranks #2 of 180! countries on corruption as per Transparency International.

A company I like a lot is Mawson Finland (TSX-v: MFL) which started trading on the TSX-v in mid-August 2024. It has just 19.1M shares outstanding, no warrants, and an enterprise value of ~C$34M. Do we even need to talk about the Au price? It’s up +37% in the past year and

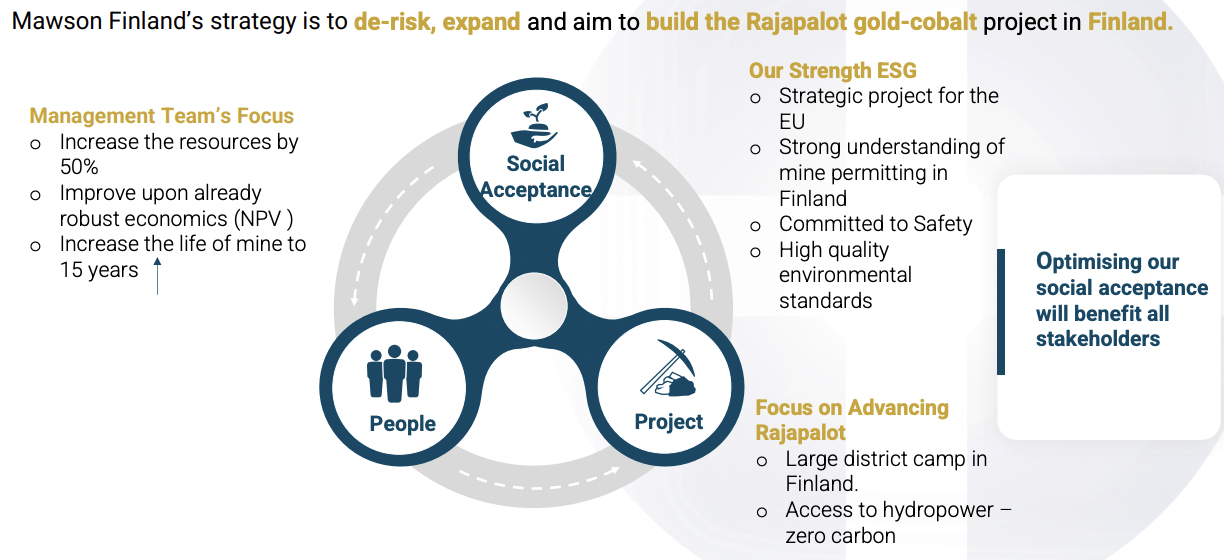

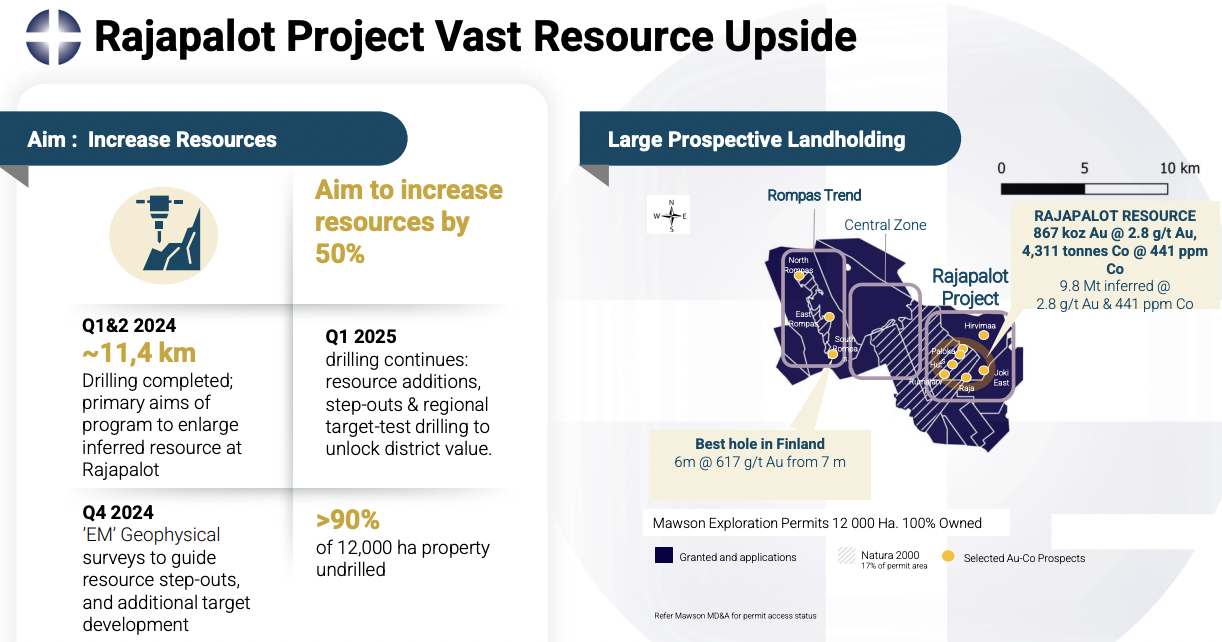

The first phase of an Environmental Impact Assessment for its 100%-owned, PEA-stage Rajapalot project hosting 9.8M tonnes of 2.8 g/t Au, + 441 ppm of cobalt (“Co“) was recently announced. That’s ~867k oz., (all in the Inferred category), or ~906k Au Eq. oz. at 2.9% Au Eq., with Co @ $24,000/t.

A year-old Preliminary Economic Assessment (“PEA“) delivered a post-tax NPV(5%) of US$211M & IRR of 26.5% at US$1,700/oz. Au. At today’s $2,755/oz. Au / $24,000/t Co, plus an assumed 5% increase in op-ex & cap-ex, the post-tax NPV would be ~C$875M and the IRR ~60%.

That means Mawson is valued at ~4% of its spot price, post-tax NPV. That’s way too cheap for a low-risk, high-quality project in a favorable location. But wait, it gets better. The goal is to increase the resource by +50% and extend mine life. That could result in ~1.35M Au Eq. ounces, enough for ~80k Au Eq. oz./yr. for 15 years.

Since drilling will presumably continue for years, I believe the mine plan could expand from 9 to –> 15-18 years at 125k+ Au Eq. oz./yr. {especially if a strategic partner comes in). Even if AISC increases +30% in a Feasibility Study to $1,071 from $824/oz., costs would be in the bottom quartile.

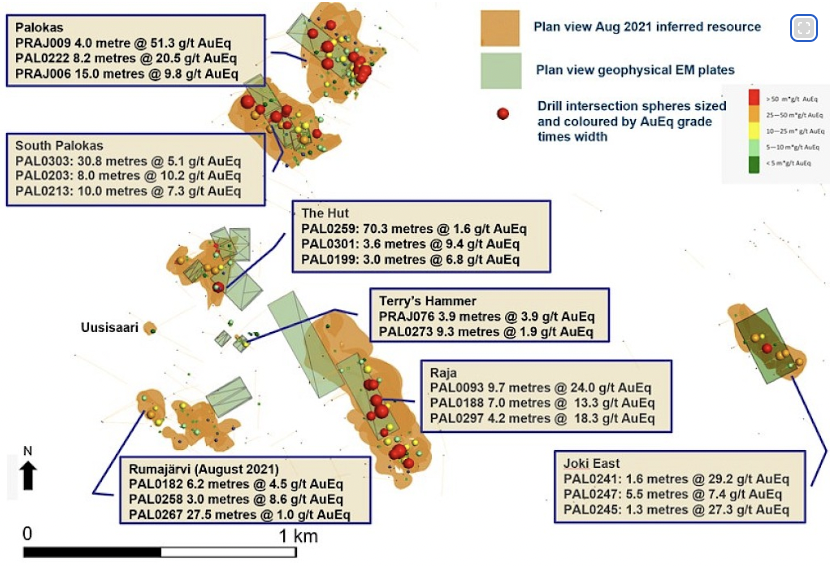

Mawson’s camp comprises eight distinct prospects with demonstrated continuity within deposits and expansion potential at depth and along strike. The Company has developed a strong geological & exploration model. In mid-January management commenced an extensive drill program.

Mawon now has four rigs turning and aims to achieve 12 to 15,000 meters of drilling by the end of April. Drill results will start coming back in February and keep flowing into June/July.

Growth potential is strong as drilling covers ~20% of the mineralization at the Rajapalot camp, and only 5% of the 100 sq. km Rompas-Rajapalot project area. Cobalt is not a big part of project economics but is an important part of the story.

Mawson Finland right below the label for Rupert Resources, center left on map…

Around the world, companies receive free money grants, low-cost loans, and/or tax breaks to develop critical metal projects. In Canada, Troilus Gold has received four LOIs from national export-import banks due to its copper endowment (~18% of the project).

As a thought experiment, cash flow on 125k Au Eq. oz./yr. with an operating margin of [$2,755-$1,071 (+30%) AISC = US$1,684/oz.] would be ~C302M/yr. Applying a 15% margin for error, call it C$257M for 15 years, and [C$525M in upfront cap-ex + working capital needs], + $C288M in sustaining capital.

That would generate a post-tax NPV(5%) of ~C$1.6B. Fifteen years at 125k/yr. is under 2.0M Au Eq. ounces. Assuming that 65% of cap-ex could be debt funded (incl. possible gov’t grants), and 35% of C$525M comes from issuing new shares at $2.00 each, $1.6B divided by ~111M pro forma shares is $14.41/shr.

Note, this is not a price target as it references spot Au & 100% of NPV. Share issuance will be spread over years, so the assumption of $2/shr. is not a stretch vs. today’s $1.90. Also, I believe up to 75%-80% of cap-ex could come from (non-equity), i.e. debt + grant(s), equipment financing & partially pre-funded offtake agreements.

Mawson’s 2.9 g/t Au Eq. is attractive. Several drill intervals were blockbusters, like –> [9.7 meters of 24.0 g/t Au Eq.], –> [4.0 m / 51.3 g/t Au Eq.], and –> [8.2 m / 20.5 g/t Au Eq.]. And, in 2012, the “best hole in Finland” [6.0 m / 617 g/t Au!] from 7 m, incl. 1.0 m of 3,540 g/t.

That blockbuster interval is ~8 km from the main deposit in an area called Rompas. Talk about blue-sky potential, Wow. Since 2013 just over 100k meters of drilling has been done by Mawson Finland and its predecessors. That’s a lot of de-risking for a PEA-stage project.

Over the past three summers, 2,407 samples have been analyzed using the ionic leach analytical method. This process successfully identified multiple areas of relative enrichment in Au + Co.

Note especially high-grade intervals at Palokas, S. Palokas & Raja…

Anomalous results are found in areas with high structural intensity. A high-resolution bottom-of-till [BOT] drill program is planned to obtain deeper subsurface samples.

Au/Co mineralization at Rajapalot has been drilled to 470 m below the surface at both the South Palokas & Raja prospects. Mineralization remains open at depth across the entire area. High-grade prospects occur across a 3 x 2 km area within a larger area of 16 sq. km.

Rupert Resources (13% owned by Agnico Eagle) is a major Finnish development success story with an enterprise value of ~C$870M. Its Ikkari project has 4.22 M ounces at 2.1 g/t Au. Attributing 90% of Rupert’s enterprise value to Ikkari values that project at $185/oz. Mawson’s pro forma 1.35M ounces trade at just $25/oz.

Rupert could increase its Au endowment by 23.5% and average grade by 7.5% by acquiring Mawson. That valuation differential ($25/oz. vs. $185/oz.) is noteworthy given both companies are at the PEA stage. Granted, Rupert’s Au resource size is 3x that of Mawson’s.

Outokumpu Oyj, owner of the Kemi mine south of Mawson is 26% owned by the Finnish government, which also owns stakes in Terrafame (nickel & cobalt) with Trafigura, Sibanye-Stillwater’s Keliber lithium project, and the Sokli phosphate + REEs project. Might the Finnish government invest in Mawson Finland?

In 2024, 38 holes totaling 11,376 m were drilled & reported at the Rajapalot Project. Four drill rigs will be mobilized at the Rajapalot project this quarter for 12-15,000 meters of diamond drilling. Mawson maintains an active presence with close ties to communities around Rajapalot, surrounding companies & government entities.

To learn more about Mawson Finland, I turned to CEO, Pres. & Dir. Noora Ahola. Few execs have her mine-friendly/ESG credentials! Last month she was recognized with the prestigious Female Director of the Year award, a testament to her exceptional leadership and the impact she continues to have in the Lapland region, and across Finland.

In addition, last month Mawson’s operations were classified by the Finnish Mining Association at the highest possible AAA level in the categories “Community relationships” and “The Environment”. Led by Noora & Exec. Chair Neil MacRae, the Company has a strong in-country team. See bios above & below.

In what ways is Finland a mining-friendly jurisdiction?

Finland is (#1 of 27 in the EU as per the latest Fraser Institute Survey, and #17 of 86 overall) as our bedrock contains numerous materials that are vastly underexplored. We are the EU’s largest producer of Au, platinum & palladium.

Finland has a well-developed & innovative mining ecosystem, especially in northern Finland where mining is a big part of our regional economy, culture & history. The country is politically, economically & socially stable, and ranked among the top jurisdictions for mining policy, regulation & legislation.

The Nordic region is routinely ranked one of the best places to live. Advanced transportation infrastructure, innovation & logistics are key strengths. Energy pricing is competitive and we enjoy a green power grid (~80% nuclear, hydro + wind).

We have leading education + R&D facilities developing sustainable mining & related tech, highlighted by a cluster of more than 200 mining, tech & service providers, and over 40 mines.

Agnico, Anglo American, Rio, Boliden, Kinross, B2 Gold & Rupert Resources have mines, projects, or project interests in Finland. Are there takeaways from those companies in developing Rajapalot?

Yes, there are important takeaways, and these companies also learn from us — for example, regarding environmental issues. In Finland, mining/exploration companies cooperate through networks like the Finnish Mining Association & the Finnish Minerals Group. If a company faces a challenge, others try to help. Regional events are important, we all support each other.

Anglo’s Sakatti project is partly on our Natura 2000 area, so naturally we discuss things with them. Agnico’s low-cost underground Kittila mine is producing ~230,000 oz./yr., but is scheduled to close in 2035. Others looking to diversify into highly attractive mining jurisdictions are interested in Finland.

Thank you, Noora, Mawson Finland has ESG credentials second to none. I look forward to hearing about ongoing progress in 2025.

Disclosures: Mr. Epstein of Epstein Research [ER] has no prior or existing relationship with any company mentioned. Readers are reminded that investments in small-cap metals & mining companies are highly speculative. Investors should consult with financial advisors before investing in high-risk stocks.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply