I’ve written several articles on Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF). I typically name ~20 mid-tier producers & Majors who could/should want to make a meaningful strategic investment into the Company or acquire it outright. I reference gold (“Au“) & silver (“Ag“) prices as well as they have had quite a run and the Company is ~25% leveraged to Ag.

Au & Ag are up +5.8% & +7.0% this month, and are up ~36% in the past year! Au, currently at $2,782/oz., is less than $10/oz. away from an ATH. Over the past ten years Au has a CAGR of +8%. If it were to rise 8% a year for the next decade, it would be ~$6,000/oz. Ag is not near an ATH, which, adjusted for inflation, is ~$200/oz. ($49.45/oz. nominal high in January 1980).

In November, South32 Ltd. made a significant strategic investment into B.C.’s American Eagle (a 19.9% stake, joining Teck Resources as a large shareholder). I found that interesting because South32 was not on my 20-name list.

Franco-Nevada invested in a pre-maiden resource company in B.C., Scottie Resources. Franco was not on the list either. Last year mid-tier producer Orla Mining made its first move into Canada by purchasing a mine in Ontario.

Franco, Wheaton Precious Metals, Royal Gold, Triple Flag & Osisko Gold Royalties have royalty/streaming interests in B.C. Therefore, interest in Thesis Gold’s 4.71M oz. PEA-stage Lawyers-Ranch [“L-R“] project should be high Au producers’ lists.

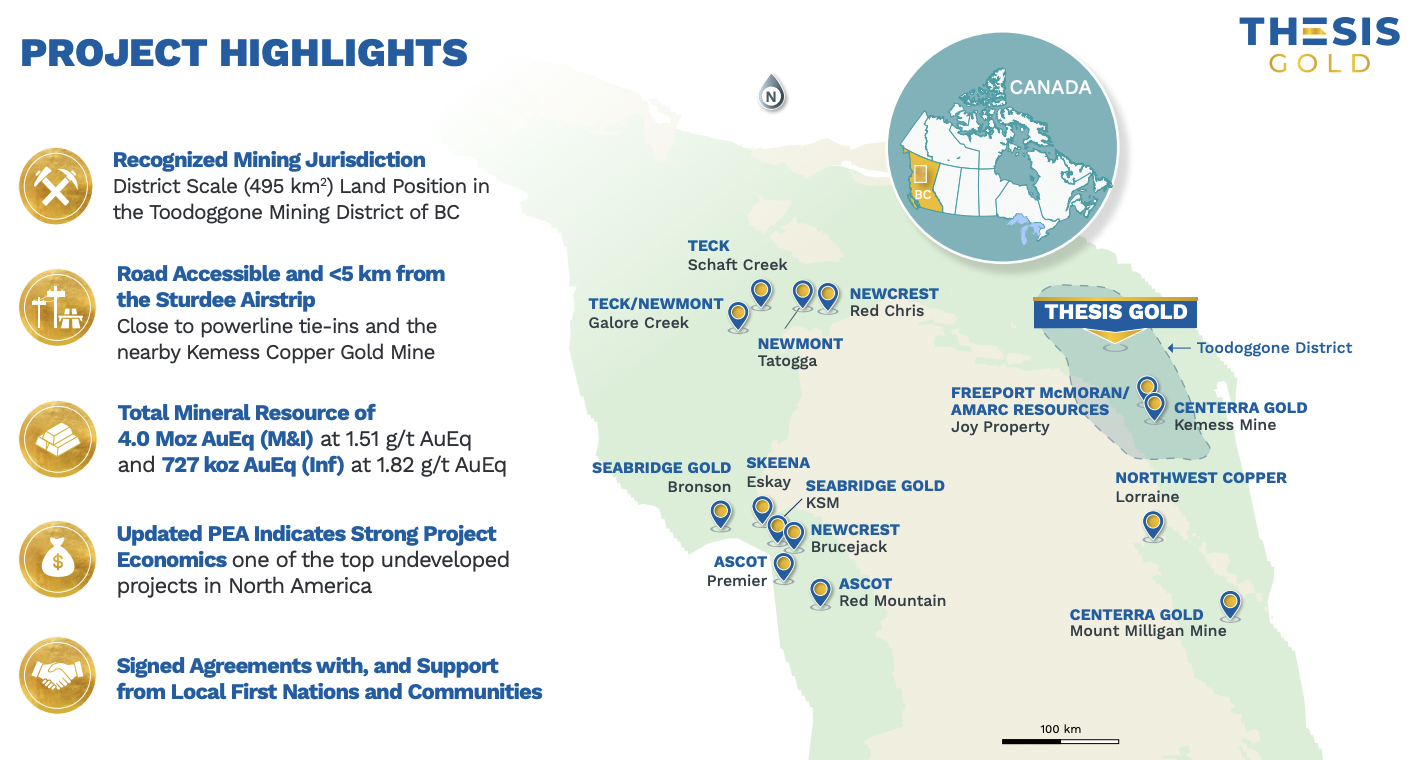

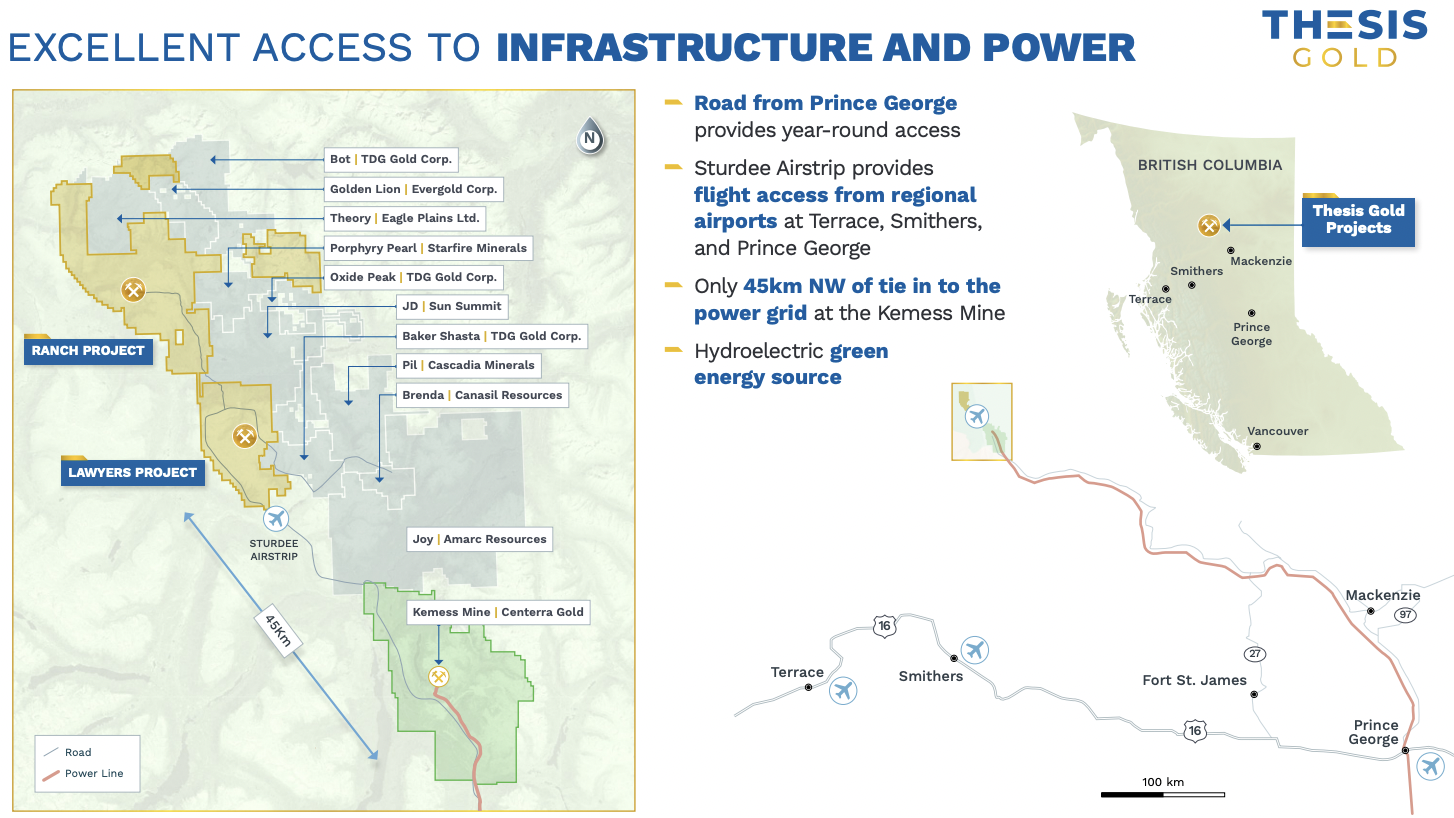

On January 17th all eyes were on north-center B.C.’s Toodoggone District, part of B.C.’s Golden Horseshoe — including the Golden Triangle to the W & NW. Thesis Gold has a district-scale (495 sq. km) land position in the region. Why the excitement? Freeport McMoRan is earning into the Joy project owned by Amarc Resources.

On the map below, note that Joy is < 40 km from L-R. Amarc announced a meaningful Cu/Au/Ag discovery sending its stock up 126%, and is now valued at > $140M. With a project next to Joy, TDG Gold is up even more, +246%. This is good news for Thesis Gold as it will attract investors, people & infrastructure to the area.

I asked CEO Ewan Webster for his thoughts on Amarc’s discovery,

“The discovery is excellent news for everyone in the Toodoggone district. I’ve been saying for years that Kemess can’t be the only economic porphyry. This district has been underfunded & overlooked, especially compared to coastal B.C. to the west. Thesis Gold demonstrated that large deposits exist in the Toodoggone. Amarc just reiterated it. This discovery brings much-needed attention, positioning the district for consolidation. Majors want control of districts, not just deposits. I’ve maintained that the alteration system at our Ranch deposit isn’t possible without an underlying porphyry. Amarc’s discovery should give people more confidence in our chances of finding one. Our high-sulphidation system is easily the largest in the district”

Freeport might step up drilling at Joy and look to grow its footprint in B.C., it could roll up Centerra Gold, Amarc & Thesis into an attractive regional play, {see map below}. Largely unknown to N. American investors, Boliden AB has roughly the same $12B market cap as Alamos Gold. Boliden is invested in a project in northern B.C.

Hecla Mining ($4.8B market cap) owns 11% of Cascadia Minerals, which is < 15 km from L-R. So, to recap, Newmont, Freeport, Teck, Boliden, Centerra Gold, Hecla & Coeur Mining (Silvertip project) and New Gold (in southern B.C.) have interests in B.C. nearby, or very nearby (< 40 km) the L-R project.

The Joy project & Centerra’s 7M ounce Kemess project are ~60 km south of L-R. Last year, Thesis Gold completed a 9,510-meter exploration season. Comprehensive fieldwork delivered geological, engineering & environmental data for permitting to support a Pre-Feasibility Study (“PFS“) expected in late-2025. Ausenco & Mining Plus have been engaged to complete the PFS.

In November, management announced a discovery at the Ring Zone (“RZ”), demonstrating the success of the team’s exploration strategy integrating structural analysis, geochemistry, and geophysics to identify high-priority targets.

Initial drilling intersected near-surface mineralization, incl. modest high-grade hits, that could potentially enhance project economics. Management has several drill seasons to find higher-grade ounces before operations commence.

According to the sensitivities section in the PEA, all else equal, if the Au Eq. grade increases +7.5% from 1.64 to 1.76 g/t, that would add C$230M to post-tax NPV. Shallow intervals included; 26.6 m of (1.75 g/t Au Eq.), incl. 7.0 m (4.7 g/t Au Eq.), 8.0 m of (11.4 g/t Au Eq.), incl. 2.0 m of (27.1 g/t Au Eq.), and 3.1 m of (9.05 g/t Au Eq.).

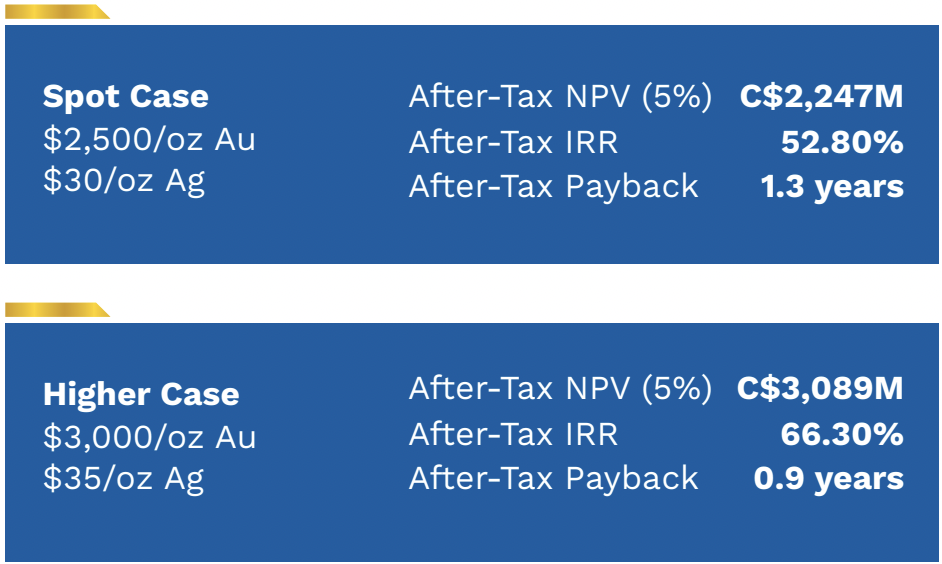

Deeper intervals support further expansion of underground resources, potentially extending the projected mine life. The sensitivity tables show levels up to $3,000 Au / $35 Ag. However, I believe Ag could be $40/oz. once Au hits $3,000/oz.

Mid-point of “spot” & “higher” cases = $2,750/$32.5 –> NPV = $2.7B, IRR = 59.6%

That extra $5/Ag oz. would add ~C$300M in post-tax NPV. Readers should note we’re just 7.5% from $3,000 Au. Assuming $1,930/oz. Au, post-tax NPV is C$1.28B & the IRR is +35.2%, with a low AISC of US$1,013/oz.

The payback period is 2.1 years. At $2,750/oz. & $32.5/oz. Ag [plus an assumed +10% increase in cap-ex & op-ex], and a 5% favorable move in the exchange rate, NPV is ~C$2.6B, and the IRR is ~56%. The ratio of NPV/cap-ex would be ~3.8x, and the payback period ~1.2 years.

The AISC stands out as producers have been reporting increases for years. For example, Newmont’s is $1,611/oz., Barrick’s $1,507/oz., and AngloGold Ashanti’s $1,616/oz. As strong as the PEA economics are, it’s still only a 14-year. mine life. There’s room to extend production further into the 2040s, and/or increase annual production.

Importantly, 87% of the 4.71M Au Eq. ounces are in the Measured & Indicated categories. At 215,000 Au Eq. oz./yr., (273,000/yr. in initial 3 years), this is a significant project. In my view, L-R could be expanded to 300,000 Au Eq. oz./yr. if acquired by a company with the ability to aggressively drill & develop it.

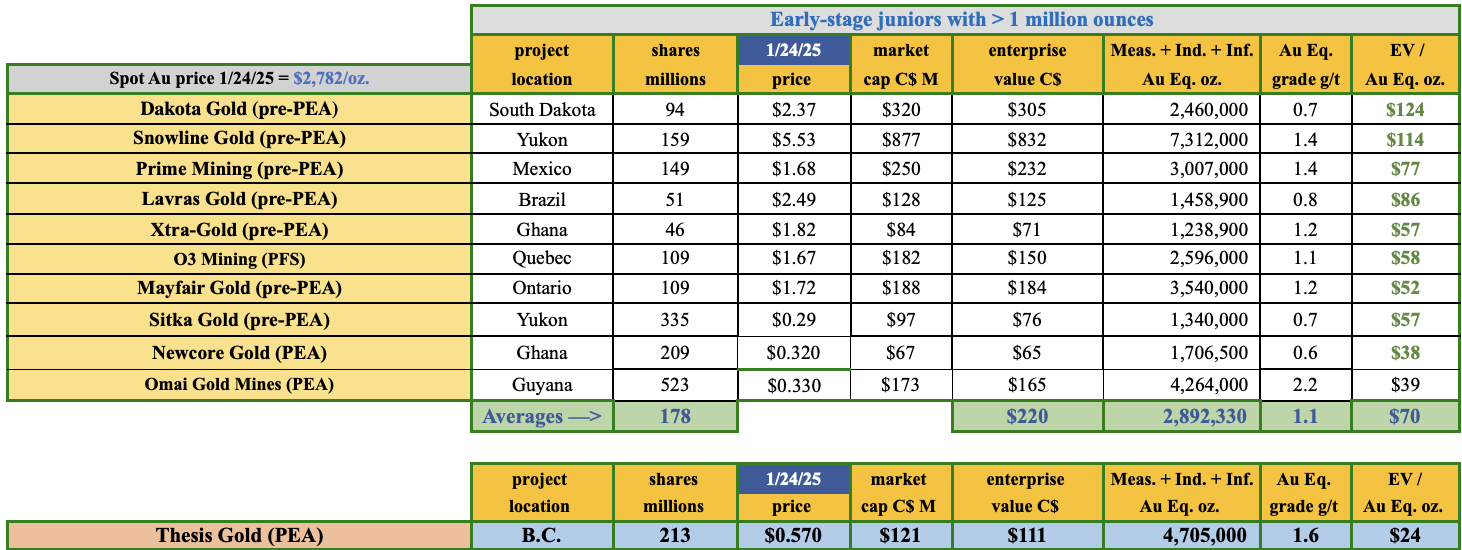

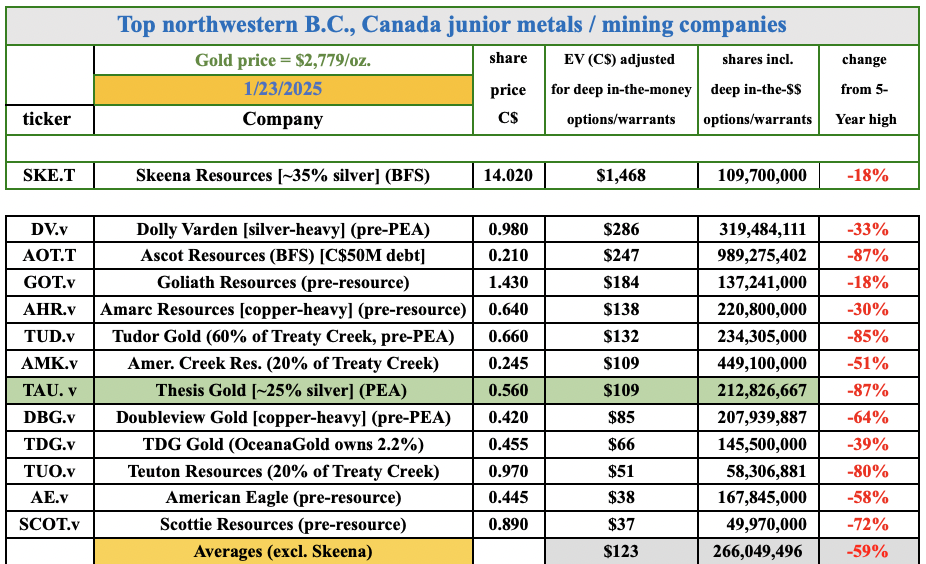

In the table above, Thesis Gold appears undervalued at $24/oz. compared to peers averaging $70/oz. –> despite the peer average. grade is 35% lower, and resource size 42% lower. Readers are encouraged to review the Company’s latest corporate presentation. Significant resource growth potential remains across L-R, especially at Ranch.

At $0.56, Thesis Gold is valued at ~8.5% of its after-tax NPV at $1,930/oz., and ~4.0% of NPV at $2,750/oz. By contrast at $2,750/oz., PFS stage O3 Mining is valued at ~12.5% of its NPV, Finland’s Rupert Resources (PEA stage) at ~18% of NPV, and Omai Gold’s PEA asset is at ~10% of NPV.

I believe the Company is meaningfully undervalued vs. B.C. peers like Dolly Varden, Goliath Resources & Amarc. The latter two are pre-maiden resource estimates. In the chart below, notice that Thesis Gold is valued at a 47% discount to the average of those three.

Imagine one of a few dozen producers gaining control of the L-R project and ramping it up to 300,000 Au Eq. oz./yr. for most of an 18-year mine life. Granted, the L-R resource would need to grow to ~6.00M Au Eq. from 4.71M, but that seems achievable with perhaps 3 or 4 additional drill seasons largely funded by a strategic partner or acquirer.

Even if the AISC comes in at $1,200 instead of $1,013/oz., it would remain in the best quartile. L-R’s operating margin could be US$1,550/oz. x 300,000 ozs./yr. = ~C$672M/yr. That’s hardly a stretch, it could easily happen. The Majors are only getting bigger, they need all the ounces they can get.

B.C. Canada remains a very mining-friendly jurisdiction, but not all places are. Barrick recently suspended a mine in Mali indefinitely (Barrick’s 2nd largest mine!). Burkina Faso used to be a good jurisdiction — until terrorist attacks targeted mining operations. First Quantum Minerals was forced out of Panama.

Do readers think Au will be a lot higher in 5 years, in 10 years? I do! Will 2025 be the year a strategic investor pounces on Thesis Gold, or are suitors waiting to see a PFS, which would push out a transaction until 2026? Either way, the Company is very attractively valued at C$0.56/shr.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply