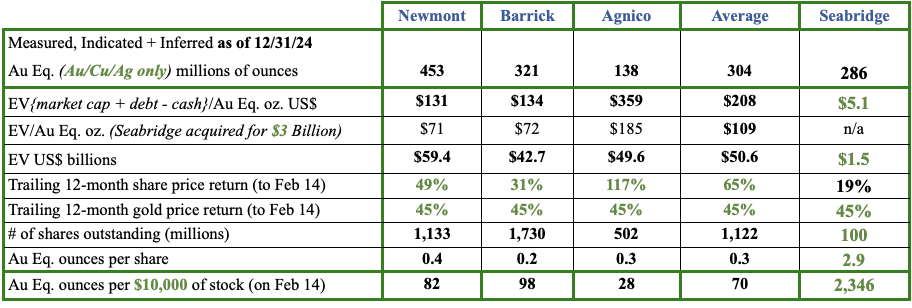

All dollar figures US$. All ounces are gold (“Au”) Equiv.

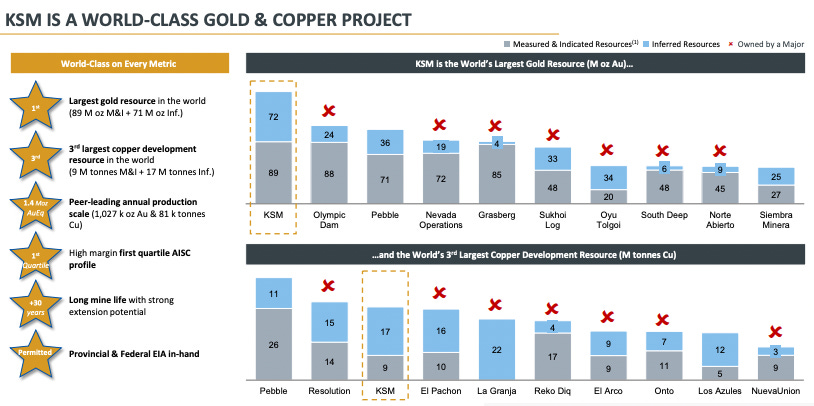

It’s astounding how many gold (“Au”) equiv. ounces a single company in B.C. Canada has, yet Seabridge Gold is valued at just $5.1 per ounce [on 286M Au Eq. ounces]. At $2,936/oz. Au & $4.56/lb. copper (“Cu”), this treasure chest is 63.5% Au / 33.0% Cu & 3.5% silver (“Ag”). Not including the Au Eq. of its molybdenum.

These ounces/pounds are years from seeing the light of day, making the $837B [C$1.2 Trillion!] in-situ value somewhat arbitrary… Except when comparing it to companies like Agnico Eagle, Barrick Gold, and Newmont Corp.

In the above chart, the average [Enterprise Value {“EV”} divided by Au Eq. oz.] ratio at $208/oz. is 41x that of pre-production Seabridge Gold (NYSE: SA) / (TSX: SEA) at $5.1/oz.

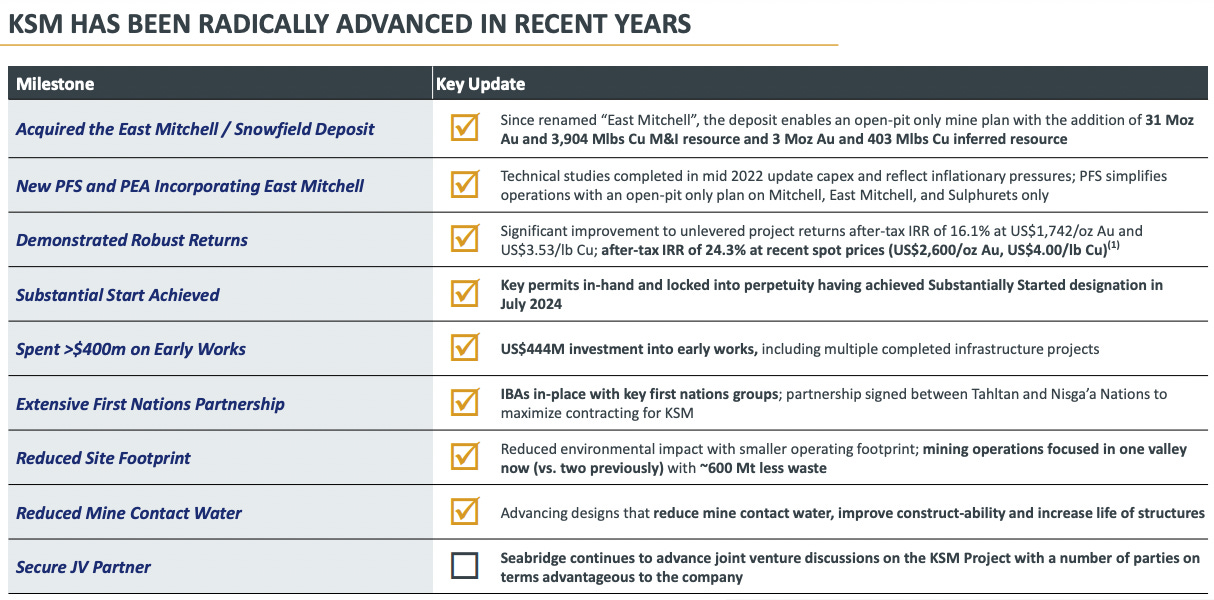

The Company’s share price is down -45% from its October 22nd high, while Au is +7% since then. This makes no sense. In last month’s article, I explained that there’s recent opposition to the 100%-owned, PFS-stage, flagship KSM project in northern B.C.’s Golden Triangle. Make no mistake, I believe, and most agree, that the opposition is entirely without merit.

On Feb. 14th Seabridge announced a $100M equity raise. Pro forma shares are now 100M and the EV is $1.38B, incl. ~$126M in pro forma cash + $375M of long-term debt. Included in the raise is $20M from an unnamed, “strategic investor.”

A very experienced & talented mgmt. team & board

Management has a short-list of three as it seeks, “a JV agreement with a major mining company” — so the mystery investor could be one of those three. Seabridge’s stock was down -15.5% on the private placement news, yet the cash comes with no warrants, so hardly the end of the world! It didn’t help that Au & Cu were down 1.6% & 2.3% on the day.

These de-risking events are significant!

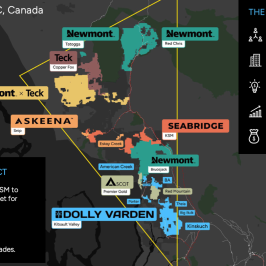

Newmont has a substantial presence in northern B.C., surrounding KSM, with Brucejack to the south, Galore Creek & Tatogga to the north, and Red Chris to the NW. At a recent investment conference, it touted B.C. as one of its most important operating regions.

On its year-end conf. call Newmont said Au production would average 6M ozs./yr. over the next decade. Barrick is experiencing significant problems in Mali [shutting its 2nd largest mine]. Despite being headquartered in Toronto, it has just one sizable mine in Canada, and Hemlo is 30+ years old.

Like Barrick & Agnico, top-5 global producer (not incl. China/Russia) AngloGold Ashanti has no investments in B.C. Notably, large Cu smelters in Asia & Europe need long-term, sustainable supplies of Cu. They could potentially provide upfront capital in exchange for off-take agreements.

One of my favorite investment metrics for precious metal companies is Au Eq. ounces per share. In the same chart above, for Seabridge that figure is 2.9 ounces.

Compare that to the Big-3 average of just 0.3 oz./shr. Amazingly, the Company leads the pack in Cu, far better than Teck Resources, BHP, Rio Tino, and Ivanhoe.

Don’t rule out Cu-heavy Freeport McMoRan. It could prudently diversify its nearly 30% exposure to Indonesia & 72% leverage to Cu, into more Canadian assets + much greater Au resources. Teck could diversify its 75% Cu / 25% zinc profile with KSM’s Au abundance.

I believe that Teck & AngloGold would need partners to mount a bid. Yet, Glencore could go it alone, its EV is nearly 4x that of Teck’s. Glencore is a globally significant commodities trading powerhouse.

It produces a lot of Cu through interests in numerous projects & companies, but very little Au. BHP has a 19.9% stake in northern B.C. Cu/Au junior Brixton Metals.

Notice that Newmont & Teck surround Seabridge’s KSM

Sovereign wealth funds, PE/hedge & pension funds, Japanese trading houses or Rio Tinto, and Vale Canada should care about KSM. Rio has been acquiring lithium assets in Quebec and is already big in diamonds, iron ore, and aluminum.

Vale plans to spend $10 billion in Canada to complement its considerable base metals footprint. No matter who gets in bed with Seabridge/KSM, it’s clear that Au & Cu fundamentals are robust.

Last week Chinese insurance companies were given the green light to stack Au. Reports indicate a wave of buying could amount to ~9.5M ounces from “a pilot program of 10 insurance companies investing 1% of their assets in bullion”

Some think this could be BIG, especially if countries like Japan follow and/or China’s insurance industry expands beyond the pilot stage. The world’s Top-100 wealth managers, with assets of ~$120 Trillion, report physical Au holdings of under 1.0%. When pressed, they acknowledge that the figure should be 3% or 4%. Adding 0.5% to the allocation would be an incremental 205M Au Eq. ounces.

As a thought experiment, if the past 10-year gain of 9.2%/yr. were to continue another 10 years, Au would reach $7,050/oz. And, if the industry’s All-in-Sustainable Cost (“AISC”) of ~$1,491/oz. {top 10 producers in 3Q/24} rose at the same rate, it would be $3,595/oz., resulting in a margin of $3,455/oz.!

Switching gears, Cu is indispensable in all things high-tech, [EVs + stationary energy storage systems + charging infrastructure], [AI / Quantum / Cloud computing], military applications/munitions, data centers, 5G/6G telecom, robotics/drones & renewable power. Even meeting 3%/yr. demand growth will be difficult.

The average age of the Top-15 Cu mines is 58 years. Cu grades are declining & costs are rising. Major discoveries as tracked by S&P Global have collapsed. From an average of 9.4/yr. in the 1990-2013 period, big to 1.4/yr. from 2014-2023. This has grave consequences for output in the 2030s-2040s.

Of these Top-20 Cu discoveries — 14 (70%) are 20+ years old!

Many experts like Robert Friedland & Gianni Kovacevic believe the incentive price to get most early-stage projects into production is $12,000/tonne = $5.44/lb., and perhaps $15,000/t = $6.80/lb. for the highest quartile cost assets — assets that are, nonetheless, needed,

Everyone knows that commercializing KSM will be expensive and is reliant on infrastructure builds like tunnels. I estimate upfront cap-ex of up to $8.5B (incl. working capital), but that number will be spread over several years.

Au is 107% above its avg. in 2019, Cu is +67% since 2020, Agnico’s & Newmont’s EVs are up +99% & +83% since 1/1/24. Majors are printing money… (Newmont’s consensus EBITDA estimate in 2025 is $9.3B)!

Imagine if Newmont were to acquire Seabridge for $3B, or $30/per shr. paid for entirely in its stock. For just 5.6% equity dilution, (or less if cash and/or debt were used) it would lock down one of the world’s greatest Au/Cu assets, with the added benefit of blocking competitors from doing so.

For Agnico all stock deals would be 6.2% dilution, Barrick 9.5%, Freeport 5.2%. Glencore 4.3%. All roads lead to KSM being built, including the road traveled by the Trump Administration in refocusing on domestic manufacturing, metals & mining, oil/gas & rolling back environmental protocols.

The U.S. & Canadian governments are doubling down on funding initiatives, fast-tracking & streamlining permitting.

KSM is a monster, at today’s $2,924 Au / $4.60 Cu, the post-tax NPV(5%) would be ~$16.6B (not incl. NPV gains from higher Ag & Mo prices, which are modest). That’s $16.6B after an assumed +30% increase in BOTH op-ex & cap-ex. I include a +9% favorable move in the exchange rate. Post-tax IRR would be in the mid-to-high 20s percent.

This means PFS-stage KSM is valued at just 8% of its post-tax NPV(5%), at {$2,924 Au, $4.60 Cu}. Seabridge is oversold due to fears it will be tied up in never-ending project challenges and be unable to secure a partner. Yet, management, lawyers & consultants are confident that recent objections have little chance of slowing the Company’s progress.

In my view, the biggest risk is funding such a tremendous project. Upfront cap-ex could be 6x the current enterprise value. Twenty-four km of tunneling through a mountain to access deposits is not too technically challenging but is time-consuming & expensive.

Further news of funding, the name(s) of the chosen JV partner(s) and deal terms, drill results, and the possible monetization of non-core assets will be important investment catalysts.

The remainder of this article describes four additional 100%-owned projects that Seabridge is given little-to-no credit for but could be monetized. Any could be compelling company-makers for junior miners in this ongoing bull market. Readers can review last month’s article for more information on KSM.

Courageous Lake (“CL”) is in the Northwest Territories and I believe is worth $100s of millions. It has 14.3M Measured, Indicated & Inferred [Au-only] ounces and a new PFS. The weighted average grade of 2.4 g/t (0.8 g/t cut-off) is attractive. As a frame of reference, at a 3.0 g/t cut-off there are 6.7M ounces at 5.3 g/t.

This scale & grade with a recent PFS should be worth $50-$100/oz. in a bull market. The PFS uses < 30% of the 14.3M ounces, so there’s room to expand mine life and/or annual production.

At spot pricing, CL’s post-tax NPV(5%) is ~$1.4B, and the NPV/upfront cap-ex is strong at 1.7x. In addition to KSM & Courageous Lake, there’s the Iskut project, in which a recent PR stated,

Iskut is ~30 km by air from KSM and was acquired in 2016 when Au was under $1,300/oz.! Iskut shares key features with KSM, allowing management to benefit from lessons learned. CEO Fronk’s team believes there could be a billion tonnes of mineralization.

The best intervals are —> 303 m/0.75 g/t Au, —> 478 m/0.49 g/t, and —> 532 m/0.48 g/t. Up to 0.2-0.3% Cu is found in some of the intervals. Moving on to the 3 Aces project…

According to Seabridge’s website, “The geological setting at 3 Aces is similar to some of the world’s largest & richest gold deposits. On surface high-grade Au has been found and the structures hosting the Au are laterally extensive.” 3 Aces is in the Yukon.

37% of 300 holes at 3 Aces hit +5 g/t Au or more, and 27% returned +8 g/t or more.

Finally, the Snowstorm project is in Humboldt & Elko counties, Nevada, contiguous & on strike with prominent existing & past-producing mines. It sits at the intersection of three Major Au belts — Getchell, Carlin, and the Northern Nevada Rift Zone — where > 300M ounces have been discovered.

Today is February 18th. On Feb. 14th Seabridge’s share price fell 15.5%. This week could present an interesting buying opportunity. This is a speculative situation but with ~$126M in cash, non-onerous debt, Au hitting new highs, and the Cu price outperforming Au YTD — owning 288M in-situ, Au Eq. ounces offers an attractive risk/reward proposition.

Disclosures: Seabridge Gold is a speculative company that is pre-revenue. The Company faces funding challenges that could be a problem if meaningful delays in permitting arise. While opposition to Seabridge’s flagship KSM project is considered a normal course of business, not a red flag, this is still a risk. Other challenges could pop up. Readers are urged to consult with investment advisors before investing in speculative stocks.

At the time this article was published, Mr. Epstein of Epstein Research owned shares in Seabridge purchased in the open market. Seabridge is not currently a paying advertiser on Epstein Research but is expected to become one in near the future. Mr. Epstein of [ER] should be considered biased in favor of Seabridge Gold.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply