Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF) is a precious metals developer with serious leverage to silver (“Ag“) as the [gold (“Au“): Ag ratio] of ~89:1 could move towards its 50-yr. average of ~60:1. In Feb. 2021 it hit 64:1, which would place Ag at $46.15/oz. (Spot Au = $2,988/oz.).

We’re in year #5 of fewer Ag ounces being mined than consumed. Above-ground inventories & recycling have picked up the slack, but how long before a major shortage? Supply takes years to unleash as most Ag production is a by-product of Au, lead, zinc, or copper.

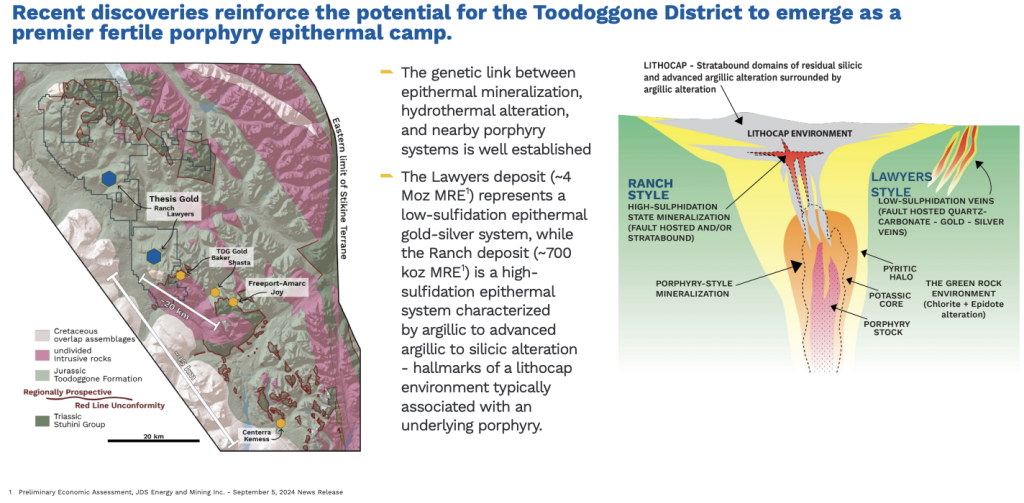

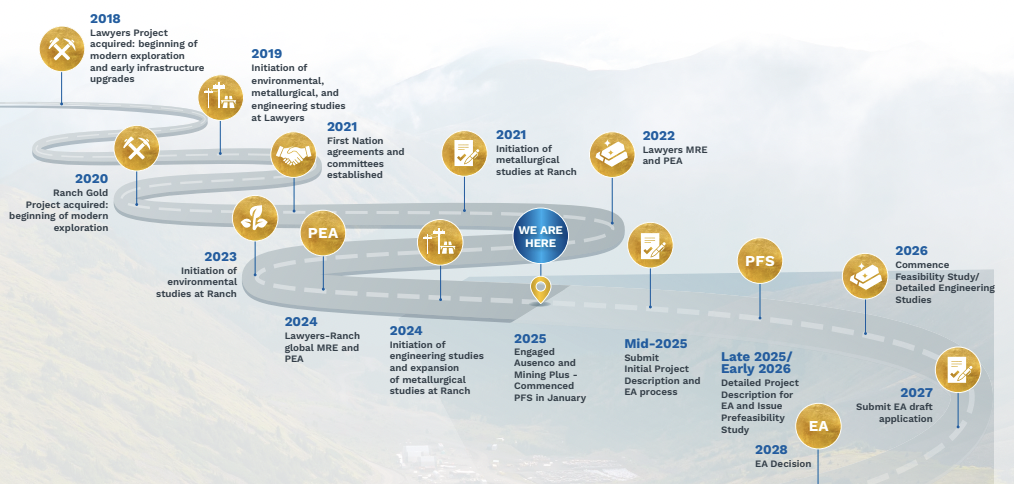

For Au & Ag, northern & central B.C., Canada are top destinations, world-famous for the Golden Triangle [“GT“] in NW B.C. and increasingly for the Toodoggone District in the northern part of central B.C.

South32 Ltd. recently invested in central B.C.’s American Eagle, (joining Teck Resources as a large shareholder). Freeport McMoRan is earning into Amarc Resources’ Toodoggone-based Joy project. Boliden AB is earning into the Duke project.

Boliden & South32 have the same US$10B market caps as better-known producer Alamos Gold. Interest is strong in Thesis Gold’s 4.7M oz., PEA-stage, Lawyers-Ranch [“L-R“] project in Toodoggone, which has a sizable 495 sq. km footprint.

Newly hired Chief Geologist Dr. Evan Orovan P.Geo is a highly experienced economic geologist with > 15 years experience in porphyry-epithermal systems globally. He’s recognized as an expert in his field.

Dr. Orovan, CEO Ewan Webster & the technical team are putting together a drill program. Webster says discoveries from step-outs and undrilled areas is the goal, plus a few deep holes in search of porphyries.

The team isn’t looking to add an incremental 500k or a million ounces from infill drilling, they want to demonstrate the potential for several million more ounces to entice a strategic partner or an acquirer.

In NW B.C.’s GT, BHP has a 19.9% stake in Brixton Metals with its flagship Thorn project, and McEwen Mining & its Founder Rob McEwen own a combined 11.3% of Goliath Resources. Newmont dominates the GT and is partnered with Teck on the large Galore Creek Cu/Au project.

Will the 2020s continue to be BIG for precious metals? Saudi Arabia, the UAE, and Qatar are expanding outside of fossil fuels & real estate into metals. For example, a State-owned group from Qatar announced an MOU with GT hopeful Doubleview Gold.

Sovereign Wealth Funds, such as Saudi Arabia’s & Norway’s US$1 & $2 trillion giants, are also diversifying. Pension funds, insurance companies & endowments across the globe are considering adding Au and/or Au equities to investment pools.

Wealth management firms with > $100 trillion of total assets under management have < 1.0-1.5% allocated to physical precious metals, yet 3.0%-5.0% is widely considered prudent.

Circling back to Au producers, they’re looking for meaningful projects to expand pipelines. Some are very interested in Thesis Gold’s Ag component (~25% of the Lawyer-Ranch resource).

It’s been two months since a BIG discovery at the Amarc/Freeport Joy deposit, where the high-grade, Au-rich AuRORA zone was identified. The best hole returned [162 m / 1.9% Cu Eq.] with a strong Au grade of 2.2 g/t.

Thesis Gold’s L-R is < 20 km west of AuRORA with TDG Gold sandwiched in between. In my last article, CEO Ewan Webster commented,

“Centerra Gold’s Kemess can’t be the only economic porphyry in the region. Toodoggone has been underfunded & overlooked, especially compared to the Golden Triangle. Thesis Gold demonstrated that large deposits exist. Amarc’s discovery brings much-needed attention to the area, positioning the district for consolidation.

I’ve maintained that the alteration system at our Ranch deposit isn’t possible without an underlying porphyry. Amarc’s AuRORA discovery increases the chances of Thesis finding a porphyry. Our high-sulphidation system is easily the largest in the district. A lot more drilling is coming to Toodoggone.“

Newmont, Freeport, Teck, BHP, Boliden, South32, Centerra, Hecla, Coeur Mining & New Gold have interests in northern or central B.C. Notably, six substantial Au players DO NOT have investments in B.C. –> Agnico, Barrick, AngloGold Ashanti, Kinross, Gold Fields & Alamos.

In November, Thesis announced the discovery of the Ring Zone, demonstrating the continuing success of the team’s exploration strategy integrating structural analysis, geochemistry, and geophysics to identify high-priority targets.

Initial drilling intersected near-surface mineralization, incl. some high-grade zones that could potentially boost economics. The best shallow intervals were [26.6 m / 1.75 g/t Au Eq.], incl. 7.0 m / 4.7 g/t, and [8.0 m / 11.4 g/t], incl. 2.0 m / 27.1 g/t Au Eq.

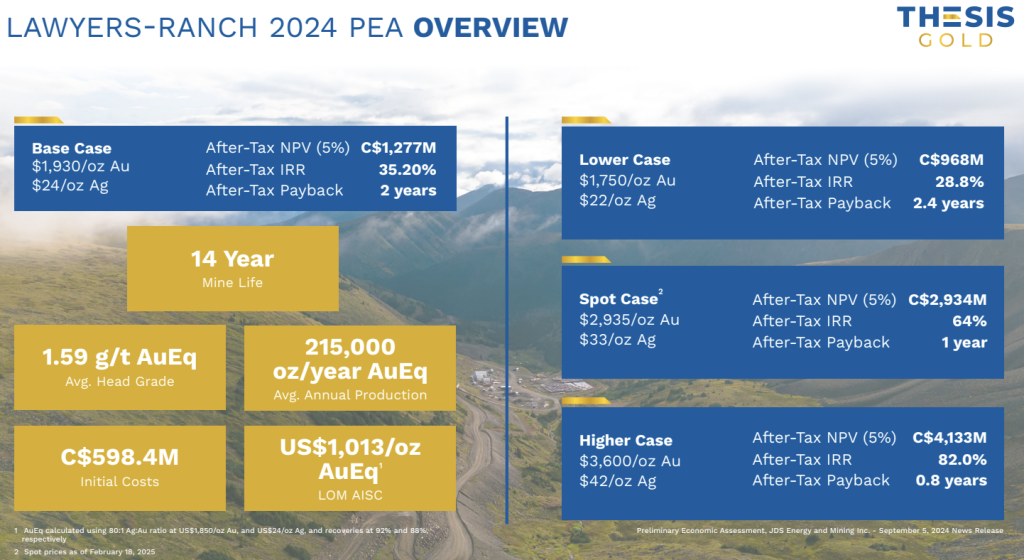

Assuming the PEA’s $1,930/oz. base case, post-tax NPV(5%) at L-R is C$1.28B & the IRR is +35.2%, due to a very low AISC of $1,013/oz. By contrast, the average trailing 12-month AISC among two dozen of the largest Au companies was $1,498/oz.

Even if L-R’s AISC increases 6%/yr. for five years to $1,356/oz. and the industry average rises by 3%/yr., L-R’s AISC would remain in the lowest quartile.

Therefore, properly funded & planned, annual cash flow at L-R *could be* [$2,988 – $1,356 = $1,628/oz.] x 300,000 ozs./yr. = ~C$705M. There’s meaningful execution & financing risk ahead, but that’s the math at spot pricing & spot FX rate.

At $2,988 Au [plus an assumed +10% increase in cap-ex & op-ex], and a +5% favorable move in the exchange rate, post-tax NPV(5%) is ~C$3.0B, and the IRR is ~65%. The ratio of NPV/cap-ex would be quite strong at ~5x, and the payback period would fall to ~1.0 year. These are stellar metrics.

At 14 years, L-R has room to extend its lifespan — and/or increase annual output. Importantly, 87% of the 4.7M Au Eq. ounces are in the Measured & Indicated categories. At 215,000 Au Eq. oz./yr., (273,000/yr. initial three years), this will be a meaningful Canadian mine.

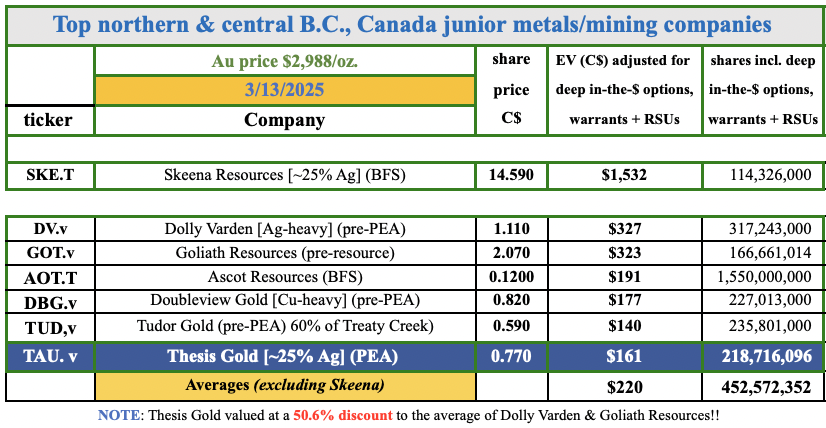

A key difference between Thesis Gold and its peers is that it’s years ahead of B.C. juniors like Amarc, TDG Gold, Goliath, Tudor Gold, Dolly Varden & Doubleview, plus dozens of other global juniors.

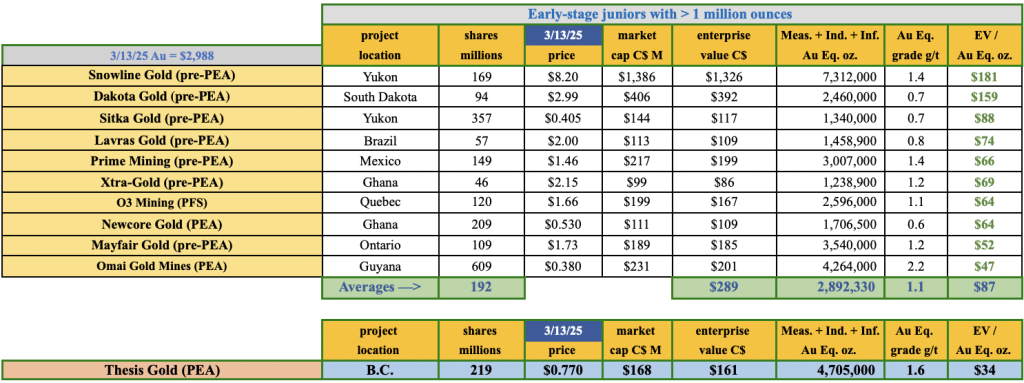

Thesis Gold appears undervalued at $34/oz. compared to peers averaging $87/oz. –> despite the peer average grade & resource size being 27% & 38% lower. Note that 7 of the 10 names above are earlier-stage. Readers are encouraged to review the Company’s latest corp. presentation.

At $0.77/shr. Thesis Gold is valued at ~12.5% of its after-tax NPV($1,930), or ~5.5% of its NPV($2,988). By contrast, PFS-stage O3 Mining is valued at ~14% of NPV, and Finland’s Rupert Resources (PFS-stage) at ~23%.

Imagine gaining control of the L-R project and ramping it up to 300,000 Au Eq. oz./yr. for 16-18-20 years. For that to happen the resource would need to grow above 6.0M from the current 4.7M Au Eq. ounces.

Several more years of drilling the highly prospective targets at Ranch could deliver line-of-sight to a lot more ounces. Thesis Gold offers compelling risk/reward — in an Au/Ag bull market — for an acquirer to bolster its production pipeline, diversify risk, lower portfolio AISC & gain operational flexibility.

Dozens of groups should be attracted to this magnitude of long-term cash flow coming from mining-friendly, green prolific B.C. Canada.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply