Unless stated otherwise, dollars are US$ & production #s are gold (“Au”) Equiv. ounces

On March 20th spot gold (“Au“) sits at $3,044/oz., near an all-time high, (futures hit $3,065/oz.), and investment firms are raising targets. Australia’s Macquarie Group is forecasting $3,500 within 6 months & Bank of America also mentions $3,500 for 2025 (as a bull-case).

Morgan Stanley’s bull case is $3,400. Goldman Sachs & BNP Paribas raised targets, but only to $3,100. Those are the highest estimates, the consensus is ~$3,150/oz., just +2.8% above the high tick on futures, even though Au is up +40% in the past year.

I’m a long-time follower of bonds/interest rates/currencies guru Jeffrey Gundlach of DoubleLine Capital. He’s now expecting US$4,000/oz. next year.

Investment firms seemingly believe geopolitical turmoil will subside, inflation is under control, interest rates will fall & central banks will stop stacking gold. Will Trump cool it with tariffs and stop threatening to takeover Greenland, Canada, and the Panama Canal?

A lot has to go right for the conditions that have propelled Au higher to change. Au is a safe haven, one of the few asset classes large enough to absorb $100s of billions of inflows if/when China and/or Japan sell U.S. Treasuries.

And then there’s copper (“Cu“), a critical metal that has handily outperformed Au YTD. The U.S. economy is weakening, and China’s has been slow for three years running, yet the Cu price is rising… Why?

Long-term Cu demand is growing at a robust 3.0%-3.5%/yr., while supply is HIGHLY uncertain due to a lack of Major discoveries, aging operations (falling grades, rising costs) and the risky jurisdictions of existing & future mines.

Five of the top 10 Cu-producing countries are China, Russia, Indonesia, Kazakhstan & Africa’s DRC. Up-and-coming hotspots include Uzbekistan, Mongolia & Zambia… Can the West rely on these countries?

S&P Global reports that commercializing greenfield projects takes 18 years and that 1.4 Major Cu discoveries were made annually from 2014-2023. Yet, in the preceding period of 1990-2013, that average was 9.4/year.

BHP, Teck & Freeport McMoRan say the world needs five massive new Cu mines per year. That’s not possible at today’s ~$5.10/lb. It might not even be possible at $6.00/lb., at least not for higher-cost projects.

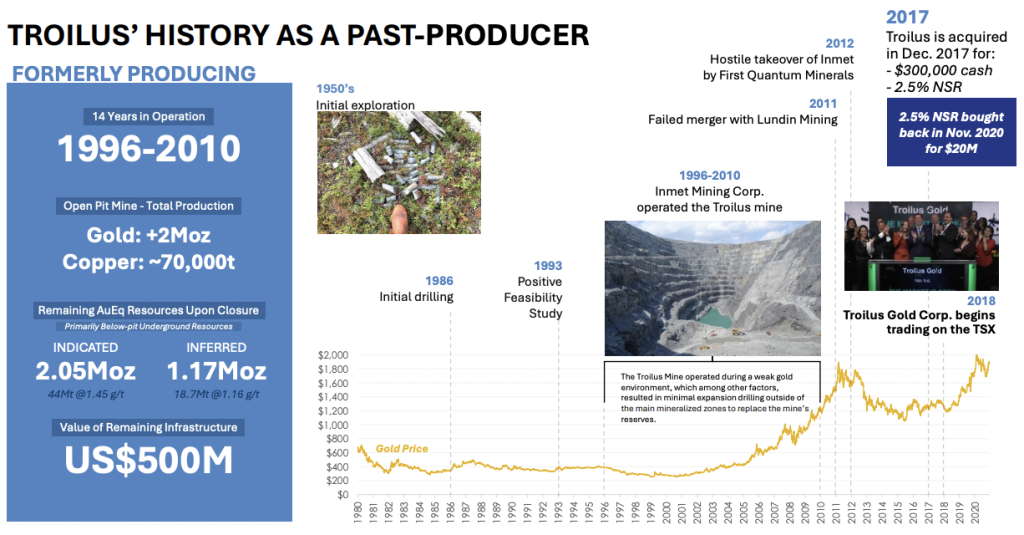

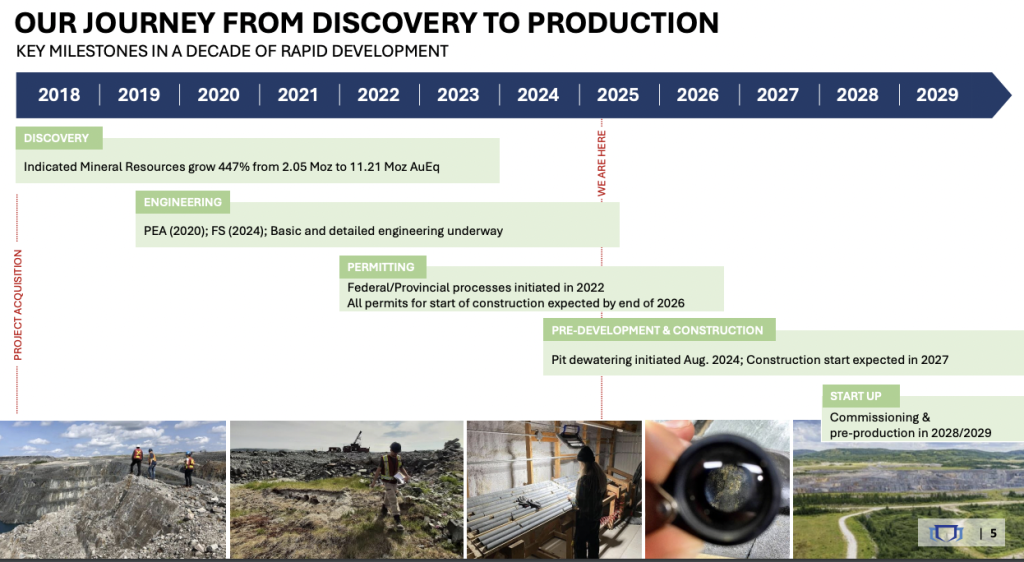

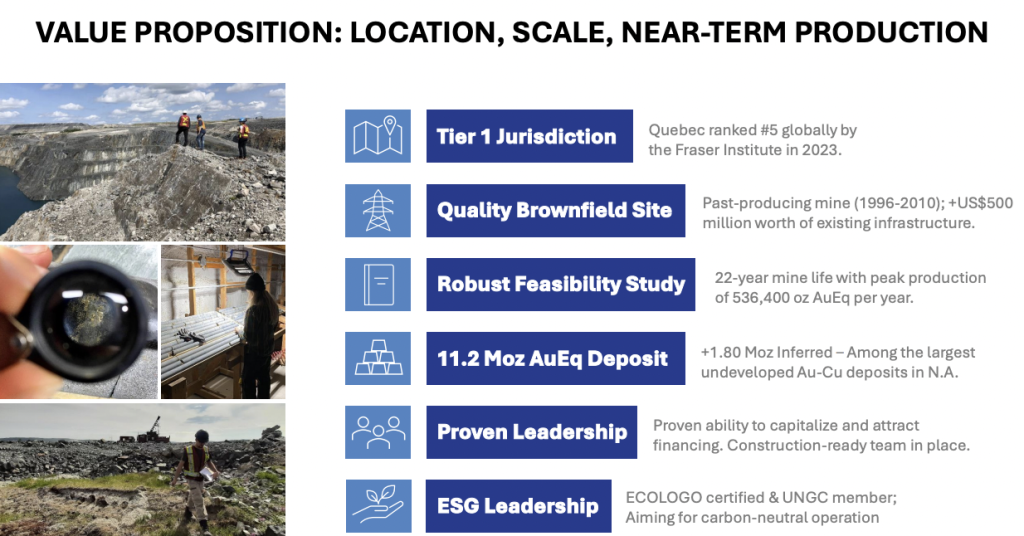

If things go reasonably as planned, Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) has a huge 13M Au equiv. ounce, BFS-stage project in Quebec Canada entering production in 2H/28 or 1H/29.

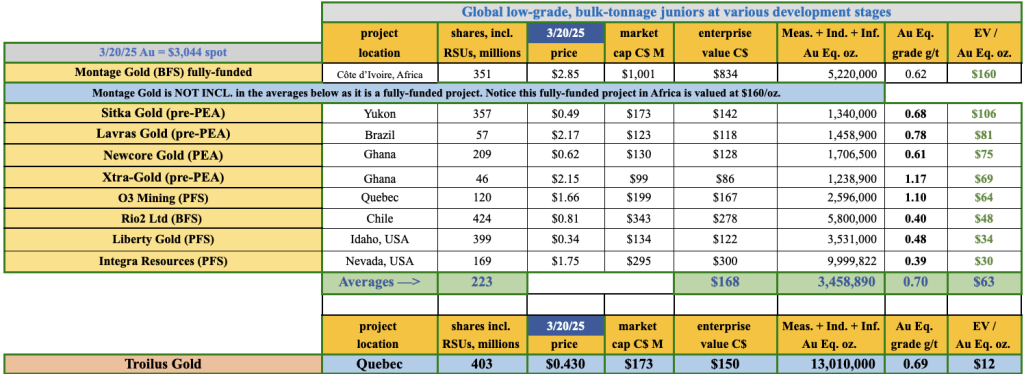

I believe Troilus is meaningfully undervalued at C$12/oz. vs. peers at C$62/oz. (see above) and trading at 5% of its post-tax NPV($3,044 Au/$5.10 Cu). Most BFS-stage projects, even in riskier places, (not yet funded) are valued at 10%-25% of NPV.

Some of the higher-valued companies above are earlier stage, with far fewer ounces, and in riskier jurisdictions. For instance, Montage Gold in Africa is fully funded and valued at C$160/oz. How much might Troilus be worth fully funded (assuming ~US$200M equity dilution)?

C$12/oz. is absurdly cheap for a project at BFS-stage in Quebec backed by FTQ Solidarity Fund, the Caisse de dépôt et placement du Québec, & Investissement Québec!

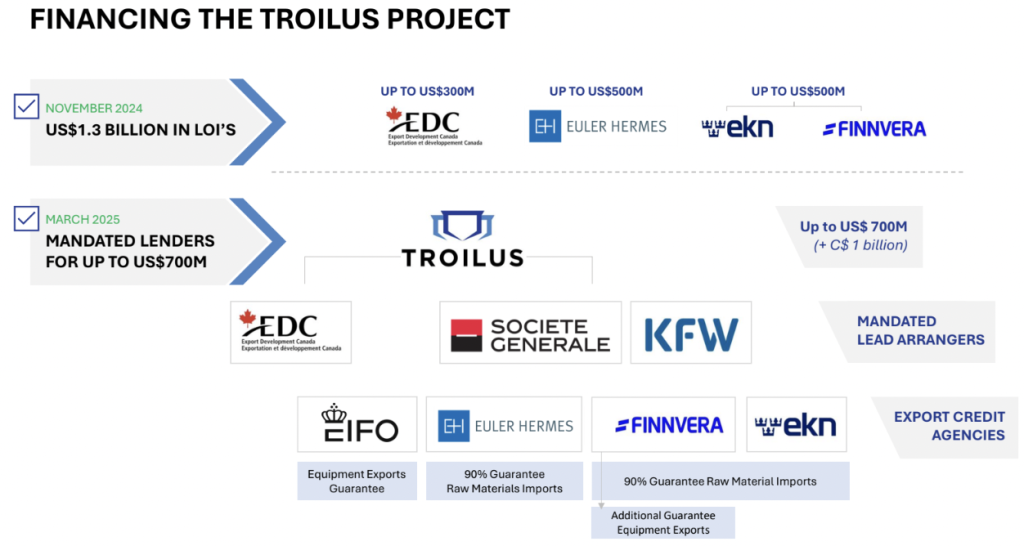

Late last week management executed a non-binding term sheet with an investment syndicate including Societe Generale, KfW IPEX-Bank, and Export Development Canada (EDC), for a debt package of $700M.

Although roughly 80% Au / 17% Cu / 3% Ag, the Company’s Cu endowment has grabbed the attention of refiners across Europe & Canada.

A final debt package is expected by year-end. Significant due diligence has been ongoing since last Summer. Permits are expected in 2026, and production in 2H/28 or 1H/29.

It’s been 10 months since the effective date of the Feasibility Study. That study used Au & Cu prices of $1,975/oz. & $4.05/lb. vs. today’s $3,044/oz. (+54%) & $5.10/lb. (+26%). Troilus Gold’s IRR of 14.0% was not much different than several other bulk tonnage Canadian mines.

Some thought Au/Cu price assumptions were too high and complained about a “cap-ex blowout” vs. the PFS. Yet, Agnico Eagle’s Detour Lake, IAMGOLD’s/Sumitomo’s Côté, and Equinox Gold’s Greenstone mines had an average IRR of 15.6% in their Feasibility Studies.

Today, Troilus Gold’s post-tax IRR is ~30%. I recognize that at spot pricing some projects have IRRs in the 40%’s or 50%’s, but are they large-scale, brownfield opportunities at BFS-stage in Tier-1 jurisdictions?

Can peers deliver 400K+ oz./yr. for 20+ years in the best quartile of AISC? Of the large projects in safe locations that can reach production within four years –> are they valued as cheaply as Troilus?

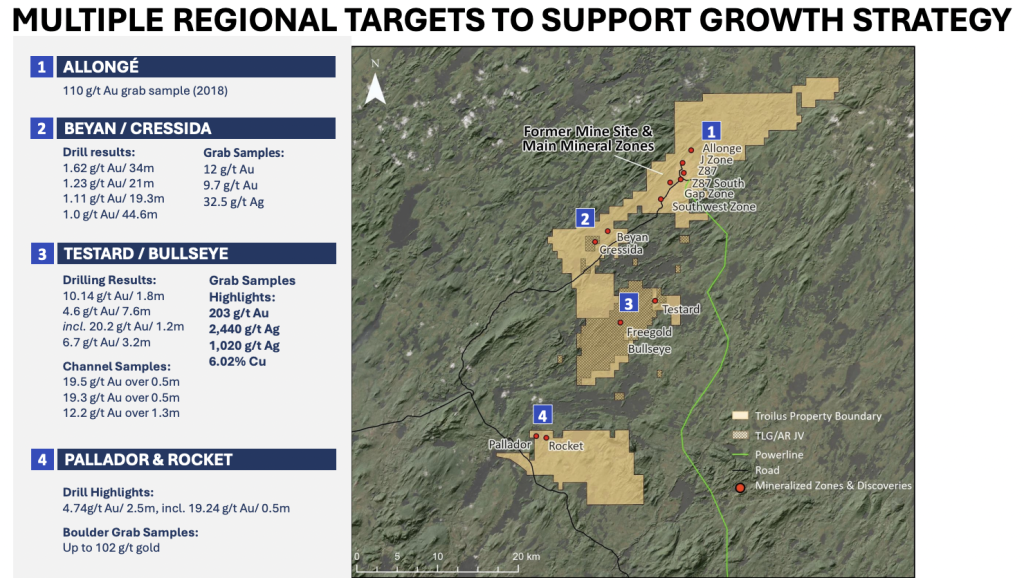

Why do I say 400K+ ounces when the BFS shows 303K oz./yr.? Peak annual production is 536K oz. and years 5 to 8 average 452K oz. Therefore, I believe a larger company could turn this into a larger mine. As it stands, only half of the Company’s 13M ounces are being exploited.

Two significant new hires were announced last month, EVP Projects Rivard, and VP Sharpe, bolstering the Company’s technical expertise & project execution credentials. These high-profile additions come on the heels of December’s hiring of Andy Fortin as VP Ops & General Mgr.

In my view, these seasoned execs, combined with the existing team, show that Troilus is ready, willing & able to build a major mine in northern Quebec without a strategic partner. A mine that could employ 1,400 construction workers as soon as late next year!

Andy Fortin has over 28 years of experience in mineral processing & project management, including a notable tenure at the Troilus mine during its 14-year operation by Inmet Mining where he led a mill expansion from 10-20k tpd.

His familiarity with the Troilus site, construction, operational optimization & metallurgical processes will be instrumental as the project advances toward development.

Beyond Troilus, Mr. Fortin served as the process & surface operation manager at Goldcorp’s Eleonore mine and as process plant manager at Agnico Eagle’s Meadowbank mine, where he was recognized with awards for operational excellence and sustainability initiatives.

Denis Rivard, PEng, (35 years experience) will lead the development of the Project, overseeing the assembly of a team to execute detailed engineering, procurement & construction, and directing all pre construction activities. Mr. Rivard held senior roles at Freeport-McMoRan, Ausenco, SNC-Lavalin & WorleyParsons.

Chris Sharpe, PEng (20+ years) will oversee all technical & engineering aspects, liaising closely with operations & project teams to ensure optimal performance, compliance, safety & cost-efficiency. With > 20 years of experience in mine planning, technical studies & project management, he held leadership roles at Centerra Gold and Minera Alamos.

I’m increasingly confident that a very significant Au/Cu operation will be built, given soaring Au/Cu prices and the above, and future, team members. Still, some fear excessive equity dilution is unavoidable. I disagree. Troilus is actively pursuing non-equity funding solutions.

Debt will be the lion’s share, likely 55%-65% of [cap-ex + working capital totaling $1.25 billion]. Troilus could also benefit from Quebec/Federal government [loans, and/or tax breaks].

Government free-money grants are possible (but not a sure thing). Pre-payments on off-take and royalty/streaming transactions are likely. CEO Justin Reid has said that $100M could come from monetizing the Project’s silver.

I believe another $200-$300M in royalty/streaming funding could come from monetizing a small portion of the Company’s Cu and/or a tiny portion of the Au. Troilus has numerous options that, taken together, should not require massive dilution.

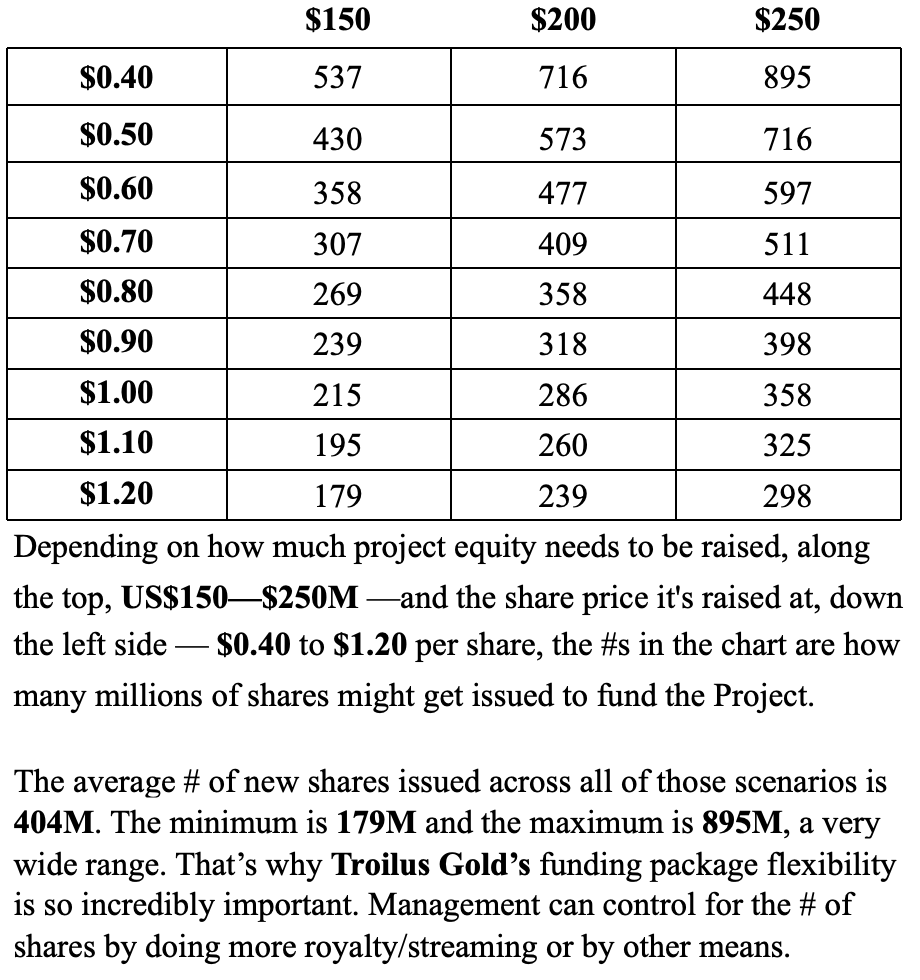

The following chart shows equity dilution scenarios in millions of shares. If the share price remains too low, management will keep issuance under control by pulling other funding levers, but the range of possibilities remains wide.

Bottom line, $700-750M of debt + $300-400M of royalty/streaming + $150–250M of equity = ~$1.275B. Pre-payments for off-take, convertible debt & grant money could reduce the equity component closer to the $150M end of the range.

Debt could come in above $700M as lenders get comfortable with $3,000+ Au, +30% higher than when due diligence efforts commenced!

Mr. Reid recently said plain vanilla secured debt terms are agreed on with interest rates said to be sub-10% (based on European sovereign debt yields, interest rates could be sub-8.5% for 10-year maturities) and no onerous covenants.

Multiple financing sources allow management to optimize a package that provides flexibility to ramp up production and withstand bumps in the road. The goal is for the vast majority of equity to come in after the debt & royalty/streaming transaction(s) are finalized.

While a $15-$20M equity raise later this year can’t be ruled out if royalty/streaming funds take longer than expected, all hands are on deck to avoid it.

This remains a speculative investment, but as funding falls into place investors can compare Troilus Gold’s prospects to the success stories of Detour Lake, Côté, and Greenstone. Artemis Gold’s B.C. Canada Blackwater mine (1st pour in January) is yet another Canadian winner. It’s valued at ~C$4.4B.

Those four de-risked Canadian assets are valued at an average of ~C$5.0B vs. Troilus Gold at ~C$150M ($0.43/shr.)! Granted, in addition to higher execution risk + equity dilution fears, Troilus is four years from production.

However, readers are reminded that the other mines were built by juniors — (except for Artemis, later sold to producers) — when Au was $1,000-$1,500+/oz. lower!

Greater funding certainty for Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) should provide line-of-sight to a multi-billion dollar mine, causing the valuation gap to decline. That gap should shrink, perhaps by a lot, possibly faster than some expect.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply