All dollar figures C$ unless indicated as US$… references to potential production & metal grades are silver (“Ag”) equivalent ounces.

Trump has ignited a fire under U.S. bureaucracies to move A LOT faster to permit mines (see his Executive Orders, incl. a Major one on March 20th for domestic production of critical materials). His actions also impact Mexican politicians & regulatory bodies.

If the U.S. starts fast-tracking metals & mining projects, Mexico will have no choice but to follow. Threatened by arbitrary tariffs, Mexico’s economy urgently needs the jobs and favorable economic impacts of responsible mining.

Silver Storm Mining’s (TSX-v: SVRS) / (OTC: SVRSF) shares are catching up to silver (“Ag”)-heavy producers, but remain undervalued. If management can restart the 100%-owned La Parrilla (“LP”) mine by year-end without excessive equity dilution, the share price should do quite well.

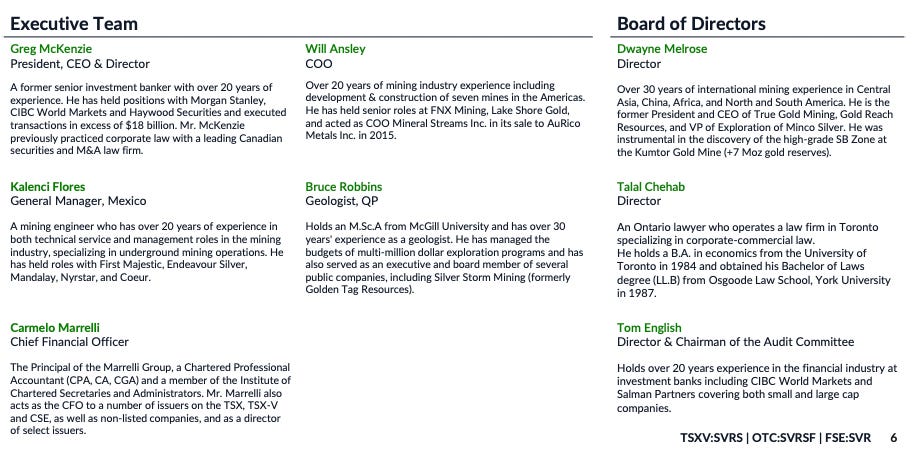

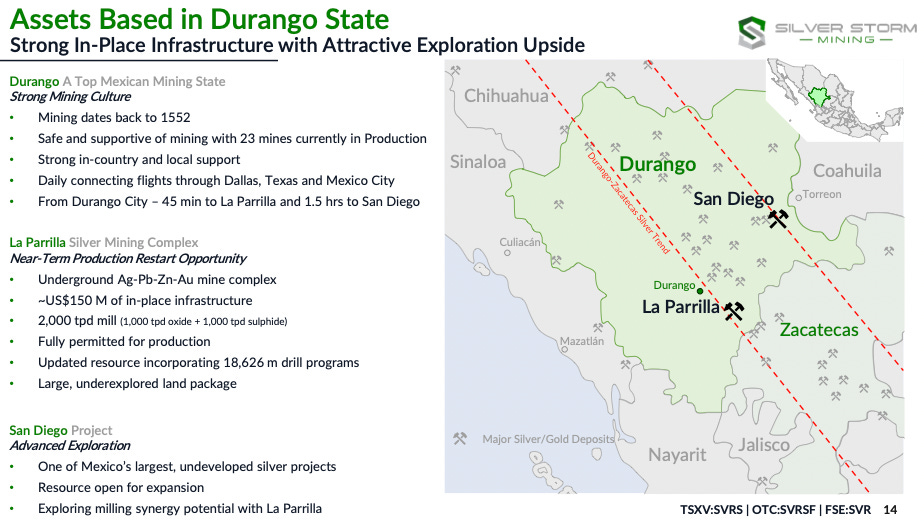

LP’s footprint of 38,128 contiguous hectares is situated just 76 km SE of the Capital of Durango in Durango State. As a reminder, LP was profitably operated by First Majestic from 2005 to Sept. 2019, but in the four years ending 9/30/19, the average Ag price was ~$16.6/oz., including periods below $15/oz. Ag is now double that.

Last year’s high points included meaningful drilling success & progress toward restarting LP. Not many junior miners can boast of having a top-18 (in the world) drill intercept in CY 2024, for two critical metals. Silver Storm did in Ag & Zinc.

The Company also experienced a six-week trading halt due to an audit of the LP acquisition taking way longer than anyone imagined. As far as we know, no meaningful problems were found…

Last month, management delivered an excellent resource upgrade to 27M Ag Eq. ounces at an average grade of 264 g/t Ag Eq. (~2.9 g/t Au Eq.). Two-thirds of the resource is Ag. This valuable endowment should support a robust 6 to 7 years of operations. CEO Greg McKenzie under-promised & over-delivered on the resource update!

The State of Durango hosts two dozen mines, it’s a very mining-friendly jurisdiction. LP was acquired in 2023 from First Majestic, which is Silver Storm’s largest shareholder at ~36%, (Eric Sprott owns ~15%).

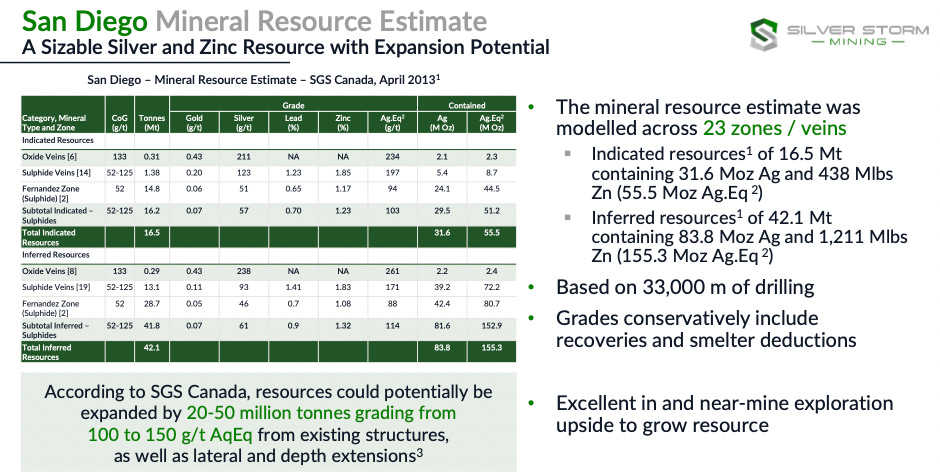

The Company also owns the large San Diego (“SD”) primary Ag project, valued at $110M at the end of 2020 when it was the sole asset of a predecessor company. Readers should note that Ag is ~25% higher since then. The plan is for cash flow from LP to help fund SD. More on SD below…

Management remains committed to a 4th quarter restart of operations at LP, but timing is subject to the closing of a debt/equity package — which requires a process of choosing a debt provider, negotiating terms, due diligence & documentation.

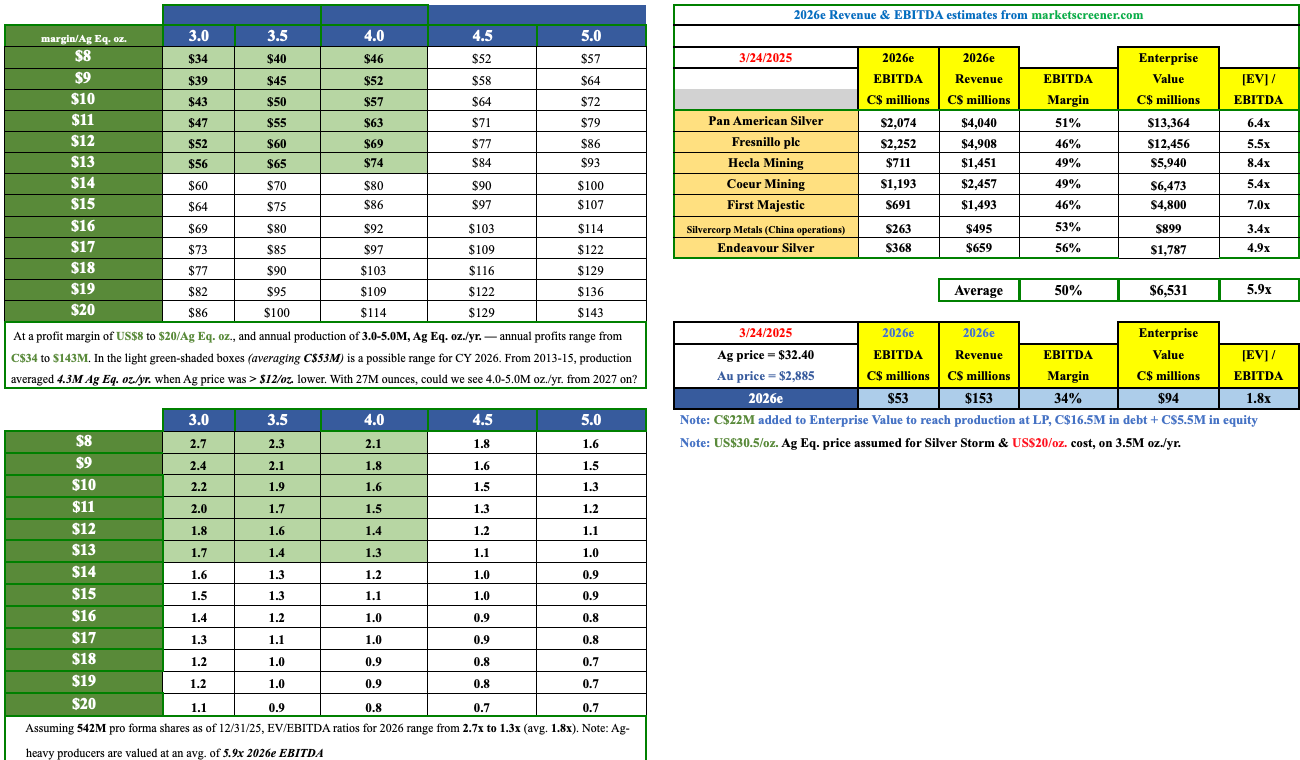

Readers may recall that ~$15M is thought to be needed, but in my view, more will be raised to provide a margin for error. Perhaps $22M of [debt $16.5M + equity $5.5M]. It doesn’t hurt that Ag & gold (“Au”) are +35% & +40% from a year ago!

And, in the past 10 months, the peso is ~20% weaker vs. the US$, great news for juniors like Silver Storm with costs in pesos, and upcoming revenue in dollars. In the following chart are operating scenarios for LP. The light green-shaded area is for 2026, and the remainder is for 2027 and beyond when the mine could potentially operate at 4.0-5.0M Ag Eq. oz./yr.

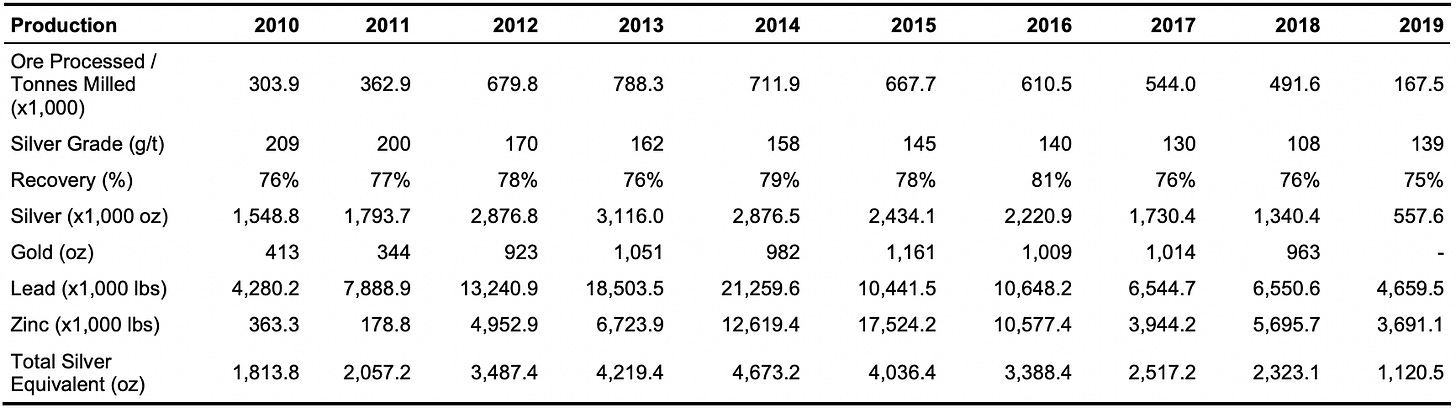

Note: there’s no guidance for a number > 3.0M annual ozs., but LP produced 4.67M in 2014. In the chart, the average cash flow at 3.0 to 4.0M oz./yr. with a range of margin scenarios from US$8-$13/oz. is $53M.

Silver Storm’s share price has improved to $0.145, but pro forma for upcoming debt/equity issuance to restart LP, and assuming a US$10.5/Ag Eq. oz. margin, LP is valued at ~1.8x 2026e EBITDA vs. peers at 5.9x. Granted, peers are in production and LP is not, so a significant discount is warranted.

However, I believe that LP’s valuation alone covers Silver Storm’s entire pro-forma enterprise value [EV] {market cap + debt – cash} of $94M, meaning investors get SD for free. LP enjoys US$150M (> 2x the Company’s EV) of in-place infrastructure, including a permitted 2,000 tpd mill + a partial mining fleet.

Readers are reminded of strong-to-very-strong drill results at LP. The best intervals to date (all grades Au Eq.) at LP are [1,810 g/t over 14.6 m], [911 g/t over 13.1 m] & [689 g/t over 9.4 m]. It would be very hard to overstate how crucial these bonanza grades of 10+ meters are.

1,810 g/t is a Top-5% result for intervals of at least 10 m, equating to ~20 g/t gold Eq. 2025 is off to a good start with [618 g/t over 18.0 m] –> [302 g/t over 15.0 m] –> and [565 g/t over 7.2 m].

In the following chart is LP’s operating history from 2010. The Mining complex ran continuously from 2005 to Sept. 2019. The best 3 & 5-year production periods averaged 4.3M & 4.1M Ag Eq. ounces, respectively.

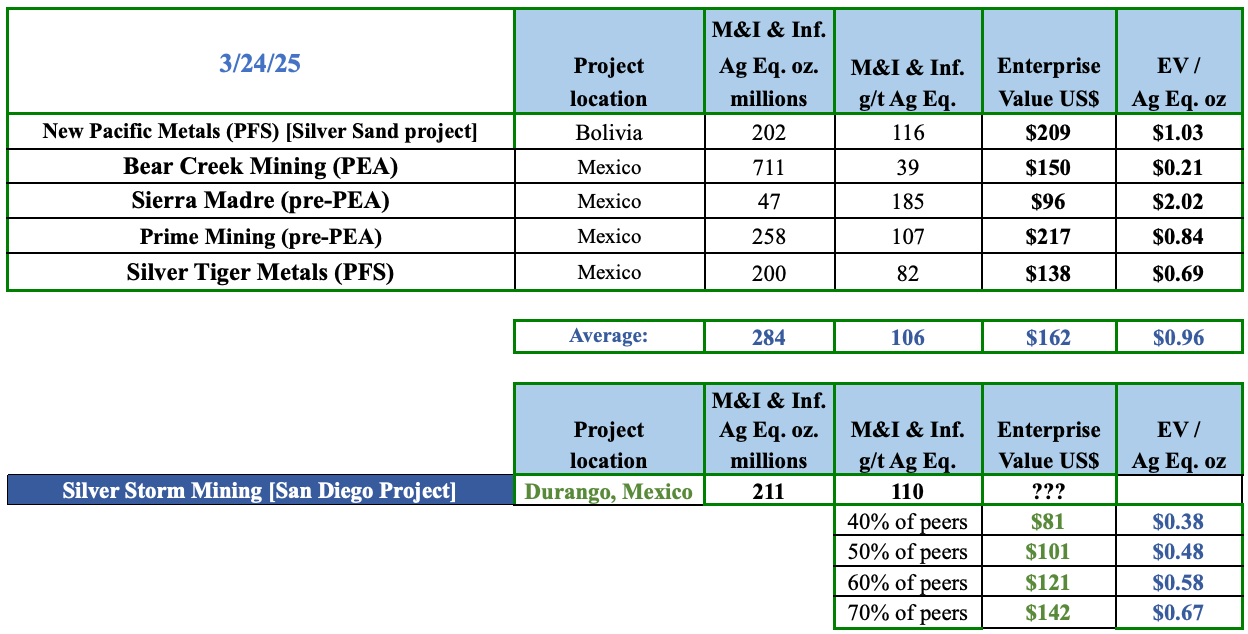

Switching gears, with Ag now above $30/oz. for two months running, and SD being one of Mexico’s largest undeveloped primary Ag projects, readers are reminded that this is a truly valuable & strategic asset. One of few primary Ag projects not owned by a producer.

SGS Canada reported that SD’s resources could (with more drilling & exploration) be expanded by 20-50 Mt at 100-150 g/t Aq Eq. (mid-point = 140.7M Ag Eq. ozs.) from, “existing structures + lateral & depth extensions.” For this article, I only include the 211M booked ounces.

I searched for juniors with Ag-heavy, bulk-tonnage projects. The following five are valued at an average of $0.96/oz. If SD’s 211M ozs. were worth that much, SD would be valued at $202M.

At $0.40/oz., less than half that of peers, SD is “worth” $81M, or $0.15/pro forma share (post equity raise for the LP restart). Roughly two dozen Ag-heavy names (producers & developers) are +200% to +390% above 52-wk lows vs. $SVRS +107%.

Although Silver Storm Mining (TSX-v: SVRS) / (OTC: SVRSF) is riskier than some of the high-flyers, it could have more upside than stocks that have already enjoyed big moves. The announcement of a debt/equity package to fund LP’s restart should be a meaningful de-risking event.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER] and Peter Epstein owned shares in the Company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply