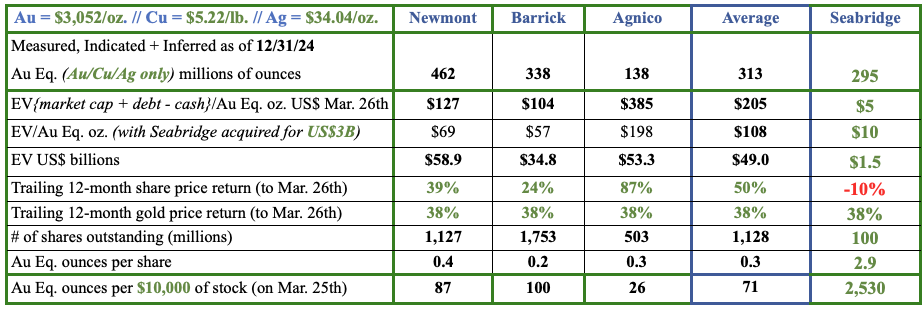

all $ figures are US$ unless indicated C$

Trump has been President for 66 days. He & sidekick Elon Musk are taking a wrecking ball to U.S. government institutions, foreign alliances & global trading regimes. A focus has been on the aggressive use of tariffs, and threats to use more of them!

However, wrecking balls are not precision instruments. There will be several upheavals in the U.S. and worldwide besides just economic ones. Geopolitical and economic uncertainty, including numerous countries on war footing, is high with no end in sight.

Therefore, factors that launched gold (“Au“) above $3,000/oz. could continue for an extended period. I believe Au will continue rising. Producers are printing money.

From 2015-2018, Newmont’s EBITDA averaged ~$2.5B/yr. Going forward, it could be 4x higher at $10B/yr. Barrick Gold’s EBITDA will likely be 3x higher, Agnico Eagle’s 7x! These companies will need ever-larger acquisitions to move the needle.

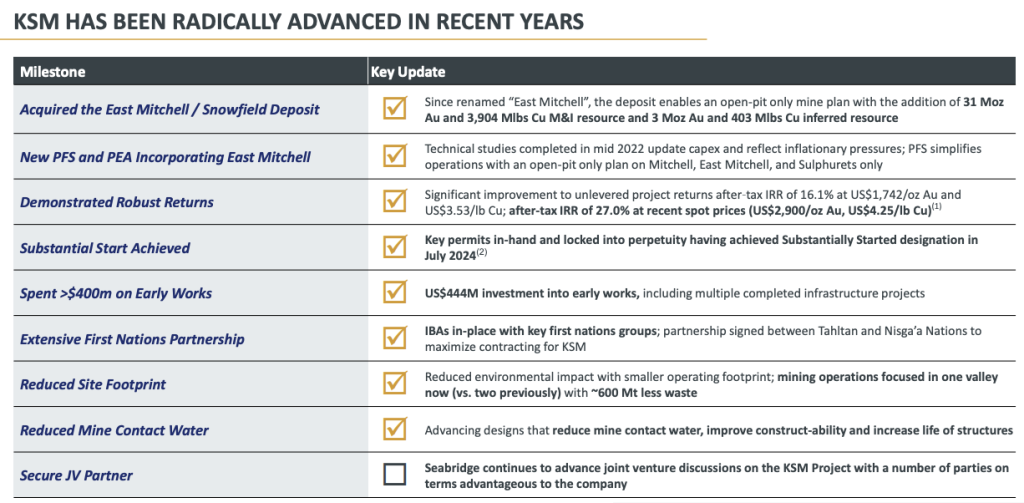

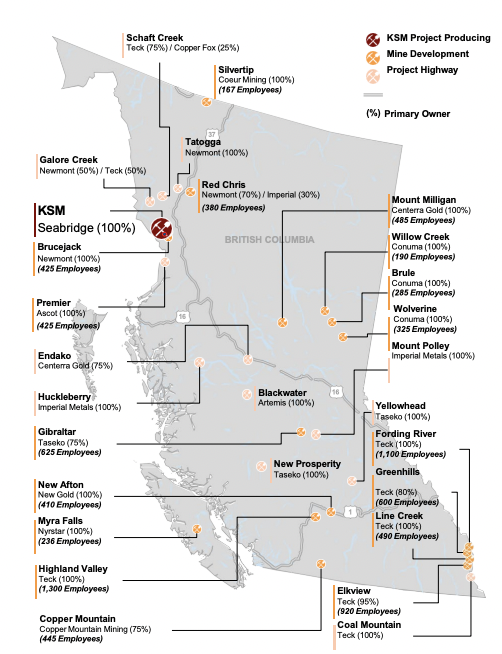

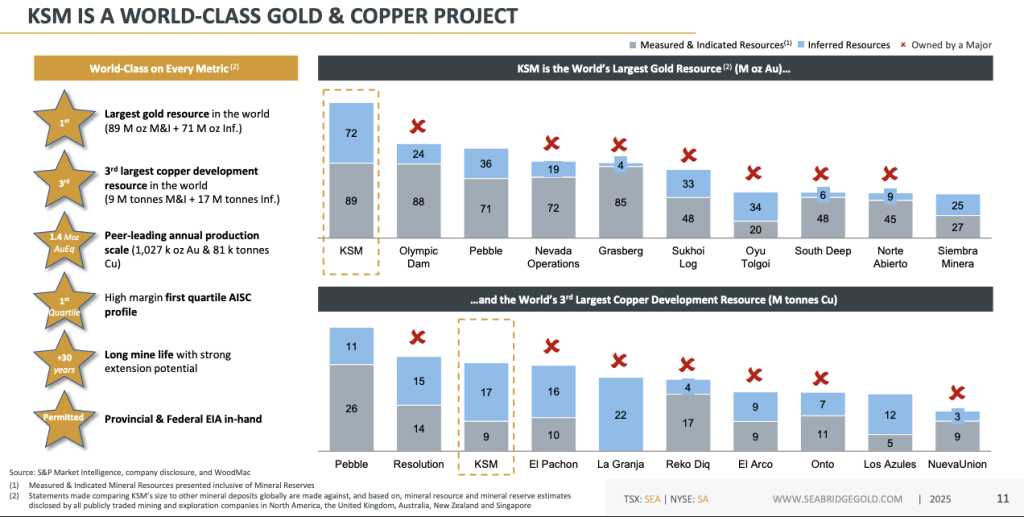

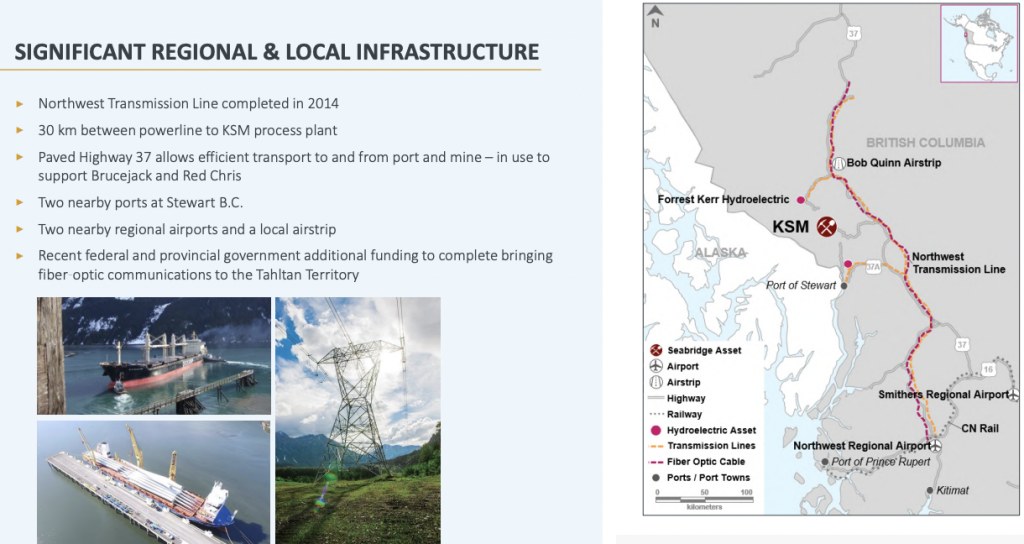

One can’t get any bigger than Seabridge Gold’s (TSX: SEA) / (NYSE: SA) 100%-owned KSM project in northern B.C., Canada. A knock against KSM has been that it’s TOO big. {See NEW Corp. Presentation}

Even if that notion was true in the past, it isn’t true at $3,052/oz. Au + $5.22/lb. copper (“Cu“) (+75% & +48% from the 2022 PFS prices of $1,742 & $3.53). Au futures hit an ATH of $3,102/oz. this morning…

Seabridge is incredibly cheap compared to producers, due in part to fears it will be tied up in project challenges. Yet, that’s simply not what lawyers, consultants, analysts, pundits & the management team think will happen.

News of a strong financial/technical partner coming on board will be doubly good. It will meaningfully de-risk the Project’s commercialization timeline & funding, and demonstrate that current opposition to mining KSM is a routine risk factor, not a red flag.

NOTE: Northern Dynasty Minerals’ share price has more than quadrupled (+345%) from its 52-week low due to optimism about getting the Pebble Cu-Au project in SW Alaska back on track. Pebble is currently blocked by the U.S. EPA, citing potential harm to the local salmon industry.

Admittedly, cap-ex for KSM at possibly $7.7B [$6.4B in PFS + 20% inflation adjustment] is daunting, but it will be spread over 5-6 years with no BIG outlays before 2H 2027. Newmont & Barrick are generating $3-$4B/yr. in free cash flow after taxes & cap-ex.

Freeport McMoran, Teck Resources & Glencore, not to mention BHP, Rio Tinto, Vale & Anglo American could also deliver KSM into production on their own. {See NEW Corp. Presentation}

Au companies that could team up with each other or with a Major include AngloGold Ashanti, Kinross, Gold Fields, Northern Star Resources & Alamos Gold.

Importantly, it’s not just the massive Au resource of 183.0M troy ounces, it’s also the 59.2B pounds of Cu. That’s why I include non-Au companies as potential strategic partners or acquirers.

With Canada’s economy increasingly threatened by arbitrary tariffs and hostile intentions from its southern neighbor, Canada would be prudent to fast-track metals/mining projects (like the U.S. now says it will) to maximize the economics of things it can control.

At spot Au & Cu prices + the current US$/C$ exchange rate, and assuming a +20% increase in both cap-ex & op-ex, post-tax NPV(5%) is ~US$20B and the IRR is ~27%. KSM will generate a very substantial amount of economic activity (jobs, taxes, royalties, consumer spending, infrastructure builds, etc.).

Few metals/mining projects in N. America are as economically impactful to its host country as KSM. If one assumes 65-70% of upfront cap-ex could be funded with debt, Project equity could be $2.5-$3.0B, of which ~$1.0B would be attributable to Seabridge if management were to farm out 2/3’s of KSM.

Three groups have been short-listed to conduct further due diligence & propose a JV structure at the project level. Roughly speaking, prospective partners are asked to fund 100% of cap-ex [estimated at $200M through the delivery of a Bank Feasibility Study (“BFS“) to earn an initial 10% stake in KSM.

From there, the partner will have the option to continue funding cap-ex through commercialization to earn a majority interest. If management were to give up control of KSM, I believe Seabridge could negotiate to be 100% free-carried through production, thereby minimizing equity issuance.

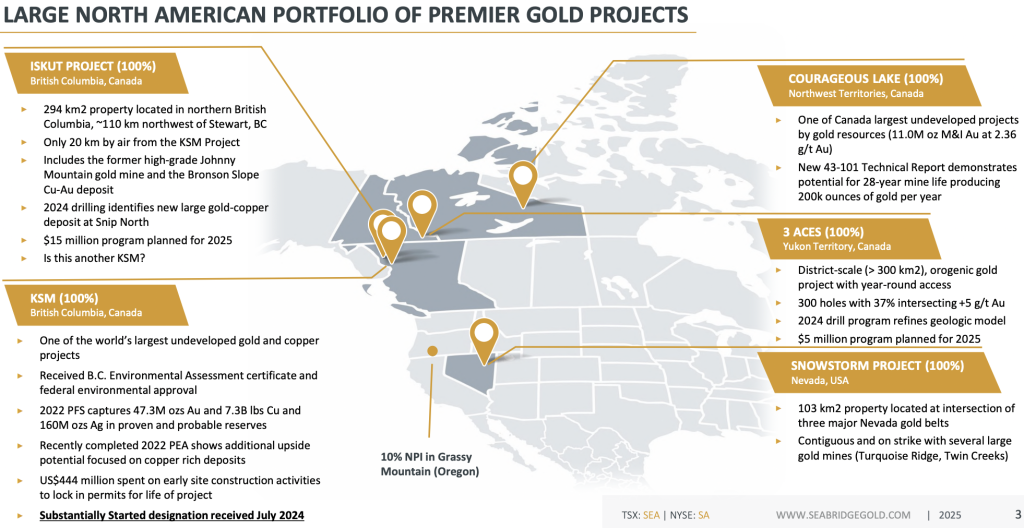

KSM is the world’s largest undeveloped metals/mining project. In total, Seabridge hosts ~295M Au equiv. [Au/Cu/Ag] ounces, at spot prices, [not including molybdenum], including Courageous Lake (“CL“) and four other projects.

Seabridge’s prodigious metals endowment compares to Newmont’s resource of ~462 million Au Eq. ounces, Barrick’s at ~338 million, and Agnico’s at ~138 million. That’s right, Seabridge has more than twice the Au Eq. [Au/Cu/Ag] ounces as Agnico, {all figures at spot pricing}.

Although not apples to apples with Seabridge years from production, the Big 3 are valued at an average of $205/Au Eq. resource ounce. By contrast, Seabridge trades at $5/oz.

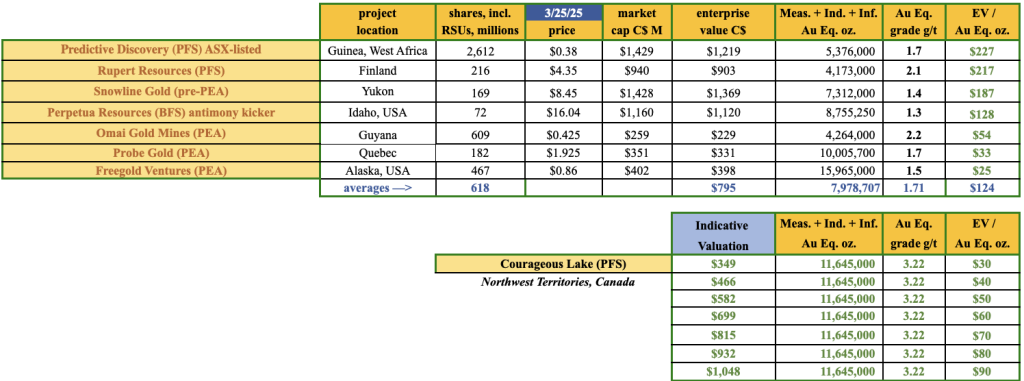

Little to no value is ascribed to Seabridge’s other assets, yet Courageous Lake & Iskut are significant. In the chart below are other multi-million-ounce resources, at various stages, around the world.

Newmont, Barrick & Agnico are up +51%, Seabridge -10%

CL is in the Northwest Territories and is one of Canada’s larger undeveloped Au projects. It has a Measured, Indicated & Inferred Resource of 11.645M oz. at 3.2 g/t. If management were to farm it out, Seabridge’s residual free-carried stake could be quite valuable.

The following chart shows seven juniors with at least 4M Measured, Indicated & Inferred ounces. While I can find examples of valuations under $25/oz., I can also find others at > $100/oz. CL’s grade & resource size are 88% & 46% better than the average.

Management believes the 294-sq. km Iskut project “could be another KSM.” It has similar geology & grades. As the crow flies, it’s 20 km from KSM. Last year’s best drill interval was 303 meters of 0.90 g/t Au Eq. (0.75 g/t Au).

Even if Iskut could show line-of-sight to becoming 5% the size of KSM, it would be a valuable satellite deposit or a company-making asset for a third-party junior. {See NEW Corp. Presentation}

Seabridge’s 3 Aces project in Yukon has seen 300 drill holes with 37% intersecting 5+ g/t Au & 27% 8+ g/t Au. The geological setting is similar to some of the world’s largest & richest Au deposits. High-grade, laterally extensive Au has been found at the surface.

Snowstorm is a 103 sq. km project at the intersection of three major Nevada gold belts and is contiguous and on strike with several large past-producing & existing Au mines & projects.

Nevada will be a leader in terms of project fast-tracking in the U.S. Monetizing CL, Iskut, 3 Aces, and/or Snowstorm to help fund KSM would help keep equity dilution as low as possible.

This year should be a game-changer for Seabridge Gold (TSX: SEA) / (NYSE: SA), North America is fast-tracking projects, both Au & Cu hit all-time highs this month, producers are refocusing on Western-friendly jurisdictions, and prospective strategic partners are generating massive cash flows.

{See NEW Corp. Presentation}

Disclosures: Seabridge Gold is a speculative company that is pre-revenue. Although first production is expected in the early 2030s, delays could unfold. Readers are urged to consult with investment advisors before investing in speculative stocks.

At the time this article was published, Mr. Epstein of Epstein Research owned shares in Seabridge purchased in the open market. Seabridge is not currently a paying advertiser on Epstein Research but is expected to pay for three (and possibly more) articles in the future. Mr. Epstein should be considered biased in favor of Seabridge Gold.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply