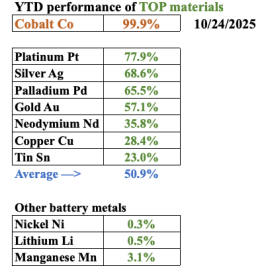

Tariffs, trade wars, and the negative impact on global stock markets, U.S. bonds & the US$ is BIG news in April. However, investors might not have noticed that gold (“Au“) fell just -7% at its worst last week, then rallied to an all-time high. By contrast, the Russell 2000 Index was down as much as -30%.

Many commodities will be star performers in 2025 vs. stocks. May COMEX copper (“Cu“) futures are down from their highs, but still up +14% YTD. Given the implications of Trump’s actions, metals & mining projects in N. America are now likely to be fast-tracked.

Cu can safely be included on the critical (albeit not rare) metals list. Of all projects that could be fast-tracked, REE & clean-tech projects (including reclamation of low-grade Cu tailings) in the U.S. & Canada are at the top of the list.

The trade war between the U.S. & China is NOT ending anytime soon… It’s just begun… Even if things calm down, the writing is on the wall. As I write this sentence, there are reports across social media that the U.S. will begin stockpiling REEs ASAP.

China dominates the REE market, responsible for 70% of global production, nearly 90% of processing, and up to 90% of REE magnet production.

Nothing short of military readiness for National Defense & Homeland Security is at stake — possibly within months, not years — plus negative consequences for other sectors including; EVs, aerospace, smartphones, computers, data centers, consumer electronics, robotics, and wind turbines.

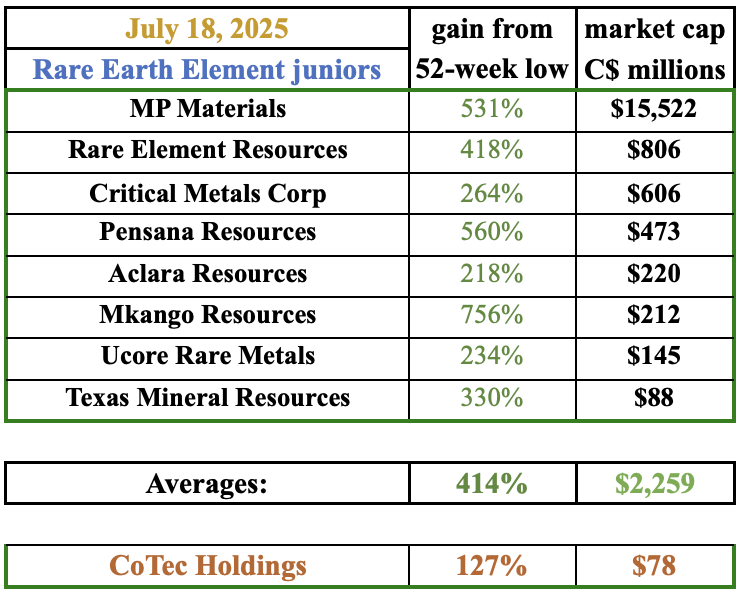

Restrictions/bans on REEs/magnets ratcheted up over the weekend of April 12-13, causing REE companies to soar, not tiny penny stocks, meaningful producers and developers (avg. market cap = C$2.26B) were up an average of +414% (updated to as of July 18th).

CoTec Holdings (TSXV: CTH; OTCQB: CTHCF) and JV partner Mkango Resources are building a prominent REE magnet recycling & permanent NdFeB magnet operation in the U.S. to extract & demagnetize NdFeB alloy powders for resale or for manufacturing new REE magnets. Corp. Presentation

In my opinion, CoTec should be up a lot more than it has been over the past year given its strong leverage to non-Chinese REEs, Cu, and to greensteel in the U.S. & Canada. Compared to the above average of +414%, CoTec is up an impressive +127%, and arguably has room to run.

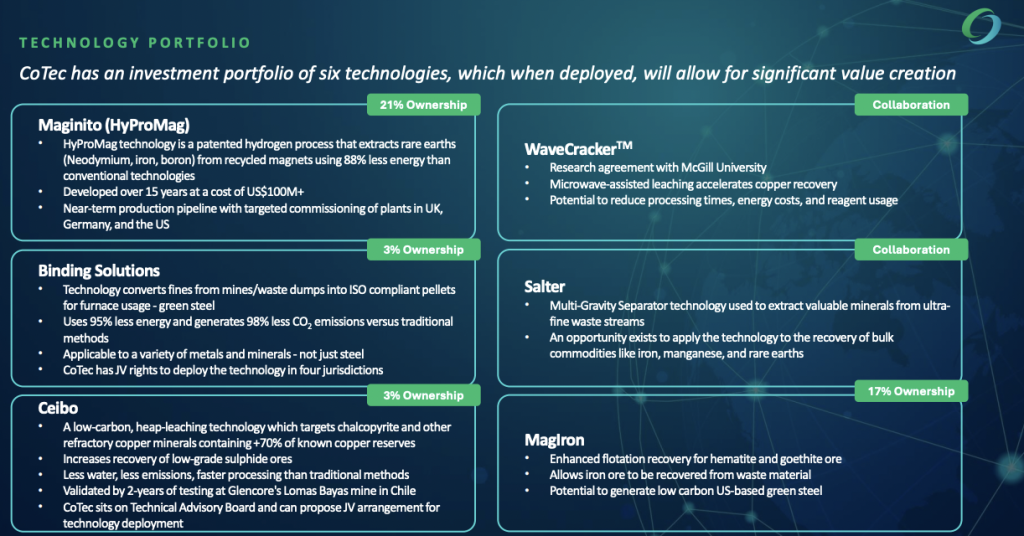

HyProMag uses HPMS technology to manufacture REE alloys & magnets with a significantly reduced carbon footprint, requiring ~88% less energy versus primary mining –> to separation –> to metal alloy –> to magnet production. That means far less emissions, less water use, and less cost.

NdFeB magnets are being produced & successfully tested by prospective customers. The magnets will be made with materials sourced domestically, enabling economical, traceable, U.S. production of recycled REE magnets.

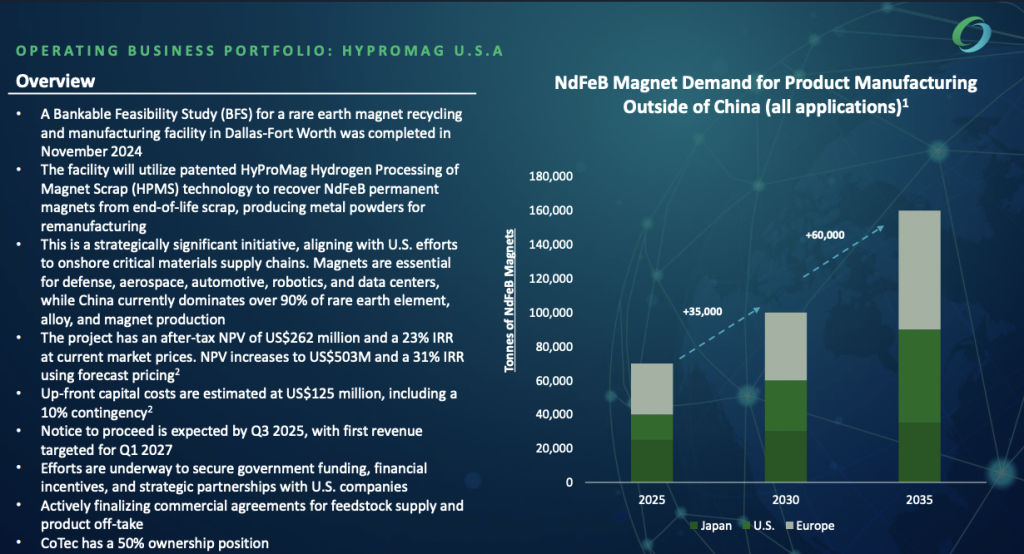

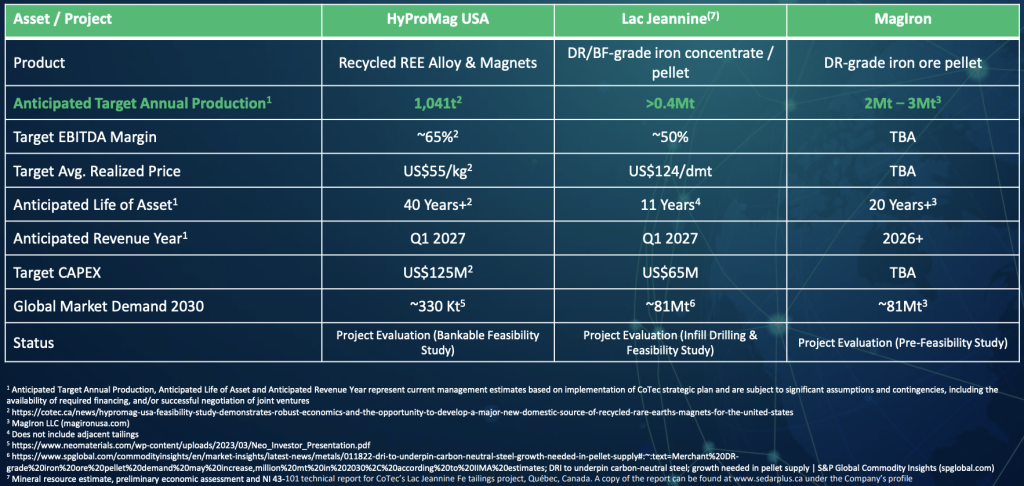

HyProMag USA is targeting up to 10% market share of NdFeB magnets in the U.S., hardly a stretch as 90% of the market is up for grabs absent China! In November, CoTec/Mkanga delivered a Feasibility Study (“FS”) for HyProMag USA.

Project economics are attractive with a post-tax NPV(7% real) of $262M and an IRR of 23%. CoTec owns 20.6% of the company that holds 100% of HyProMag Ltd. and a 60.3% direct + indirect interest in HyProMag USA, which is expected to be 3x larger than plants being commercialized in the UK & Germany.

The low all-in-sustaining cost (“AISC”) of ~$20/kg compares very favorably to current prices. Upfront cap-ex is manageable at $125M. For HyProMag USA, production of 750 tonnes/yr. of recycled NdFeB magnets, + 291 tonnes of NdFeB co-products, results in total payable production of 1,041 tonnes/yr. over 40 years.

The project in the U.S. — expected to be operational in 1H 2027 — will benefit by learning from the successes & challenges of the two HyProMag rollouts in the UK & Germany.

While not a sure thing, getting grant(s) totaling $10s of millions, plus financing 65%-75% of cap-ex with debt, and possible upfront payments for off-take agreements, would substantially reduce the equity component to the benefit of shareholders.

Significant grants/tax breaks could be a game-changer, and in my view, the likelihood of obtaining them has increased given recent events. The Dept. of Defense [“DoD“] awarded $45M to MP Materials and MP received a $60M tax credit through the Inflation Reduction Act [“IRA”] Section 48C.

The DoD granted $288M to Lynas USA and $94M to E-VAC Magnetics, which also received a $112M IRA tax credit. Ucore Rare Metals & Graphite One have also received U.S. State & Federal grants.

U.S.-listed junior USA Rare Earth, Inc. is pre-revenue but has a C$1.5B market cap due in part to REE magnet production plans in the U.S. state of Oklahoma (with feedstock, eventually, from owned U.S. mines).

USA Rare Earth is a much larger scale, integrated, proposition [~4.5x the production of CoTec’s initial 1,071 tonnes of NdFeB] but CoTec’s 60.3% interest in HyProMag USA + 20.6% stake in other HyProMag operations is valued at under C$30M.

In other news, CoTec signed a binding, long-term exclusivity & collaboration agreement with Salter Cyclones Ltd for its Multi-Gravity Separators (“MGS“) technology to recover iron ore & manganese from primary mining & tailings material.

This could be a step change in handling iron & manganese tailings, allowing it to produce high-grade iron & manganese concentrate from ultra-fine tailings otherwise sent to tailings.

A busy slide, but critically important! All this Blue-Sky potential is valued at just C$46M!

Manganese (“Mn“) use in Li-ion batteries is growing as lithium-iron phosphate (“LFP“) batteries have taken the world by storm. Mn added to LFP makes LMFP batteries that offer higher energy density + other attributes.

CoTec CEO Julian Treger commented,

“…initial due diligence of the MGS tech produced exciting results at our Lac Jeannine Project in Québec, supporting CoTec’s strategy of becoming a leading supplier of high-grade, low-carbon, iron concentrates and a supplier of high-grade manganese concentrates to the steel & high-purity manganese sulfate monohydrate (HPMSM) sectors.”

Lac Jeannine proposes to use Binding Solutions (“BSL“), one of six technologies that CoTec has minority interests in, or preferential access to. It’s not just CoTec that sees BSL as disruptive, both Japan’s Mitsui & Co. and Australia’s Mineral Resources are invested in BSL.

Each new tech & process innovation CoTec can deploy that increases recoveries by even 1% is quite impactful at the bulk tonnage scale. MGS has the potential to boost recoveries by several percent, which at Lac Jeannine (subject to further testing) could materially improve project economics.

Last year management reported robust PEA results on the Lac Jeannine, one of what will be tens of projects spanning several critical metals, technologies & jurisdictions, mostly in remediation/recycling settings. The after-tax NPV & IRR of US$59.5M & 30% are strong but they fail to tell the whole story.

The surveyed area has a total of 145M to 154M tonnes vs. the 73M tonnes included in the PEA. I estimate the NPV could grow to US$100M+ in this year’s Feasibility Study, especially if MGS technology can be deployed.

Also reported was a promising, earlier-stage collaboration with WaveCrackerTM, that could be deployed alongside CoTec’s use of Ceibo technology.

CEO Treger commented,

“… CoTec is focused on technologies to leach low-grade primary copper sulfides & waste using a proprietary high throughput inorganic leaching technology Ceibo. We see the potential for using microwaves [WaveCracker] to pre-condition the rock before leaching to potentially increase permeability & recoveries”.

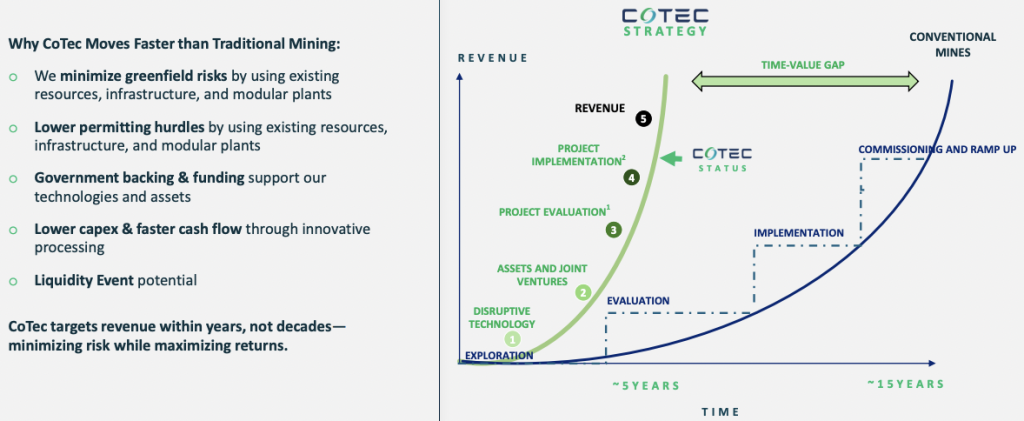

Readers are encouraged to look beyond just HyProMag USA & Lac Jeannine, which should be generating cash flow in 1H 2027. Most junior miners have one flagship asset where operating improvements are possible, but overall flexibility is low.

By contrast, CoTec will have multiple shots on goal by deploying technologies more cheaply, (lower capital intensity), faster, more sustainably (greener), and at a greater scale. Project after project, decade after decade.

As management adds low-cost iron ore tailings projects like Lac Jeannine to its portfolio, logistical/operational synergies, incl. leveraging BLS and possibly MGS, could make this segment a Company-maker alongside HyProMag USA + HyProMag (rest of the world).

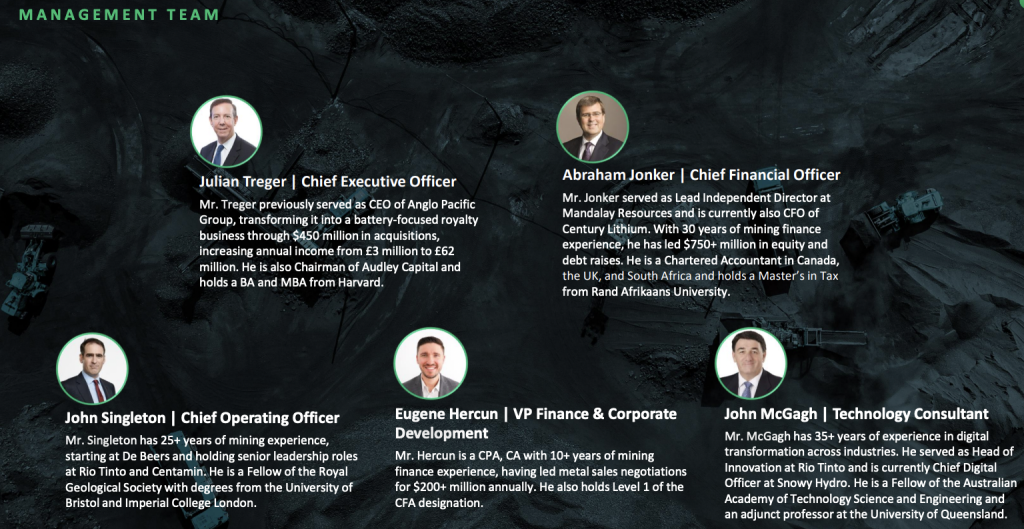

CoTec Holdings (TSXV: CTH; OTCQB: CTHCF) has considerable blue-sky potential due to investments in, and access to, truly disruptive technologies and a very talented management team, board & slate of advisors. {New Corp. Presentation}

The U.S. finally understands that China is a BIG problem that’s not going away. Fast-tracking of U.S. projects will gain considerable traction this year, especially for REE/cleantech projects.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about CoTec Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CoTec Holdings are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, CoTec Holdings was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply