Canada is a mining-friendly country sharing a border (the longest between any two countries on earth) with the U.S. Exports are accessible to Europe from the east coast, Asia from the west, and easily trucked/railed south.

Canada enjoys widespread, green hydroelectric, nuclear, wind & solar power. It has prolific deposits of silver, gold, cesium, chromite, cobalt, copper, iron, lead, lithium, nickel, palladium, platinum, REEs, tantalum, titanium, uranium, vanadium, and zinc.

That’s why Rio Tinto, BHP, Glencore, Vale (Canada), Teck Resources, Freeport McMoran, Anglo American, Fortescue Metals, Sumitomo Corp., First Quantum, Boliden AB, South32, Hudbay Minerals, Coeur Mining, KoBold Metals, Wyloo Metals, & Juno Corp. are active across Canada.

KoBold, Wyloo & Juno are private companies. That list does not include gold Majors like Newmont Corp., Barrick Gold, or Agnico Eagle, which are increasingly interested in copper (Barrick is changing its name to Barrick Mining).

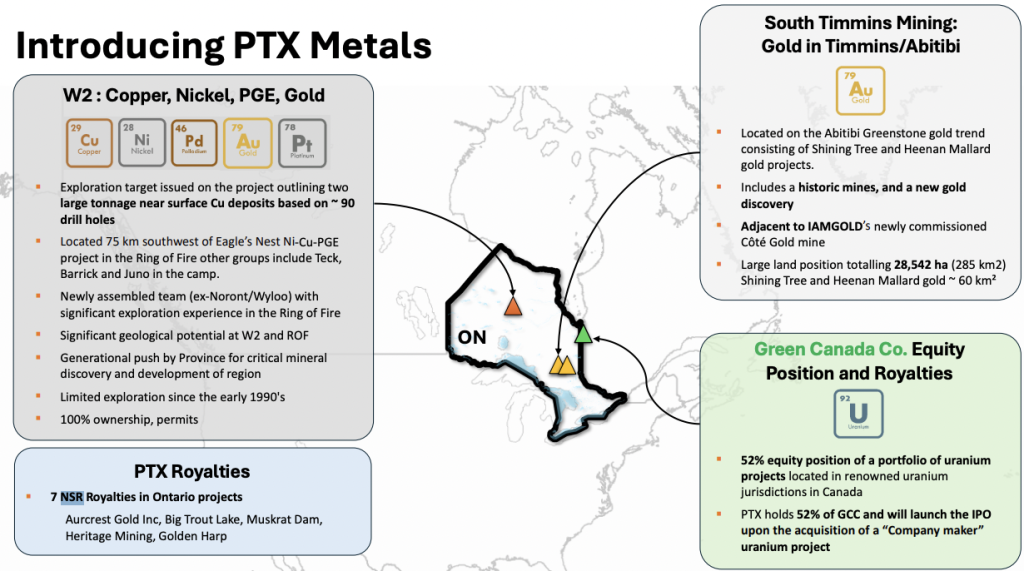

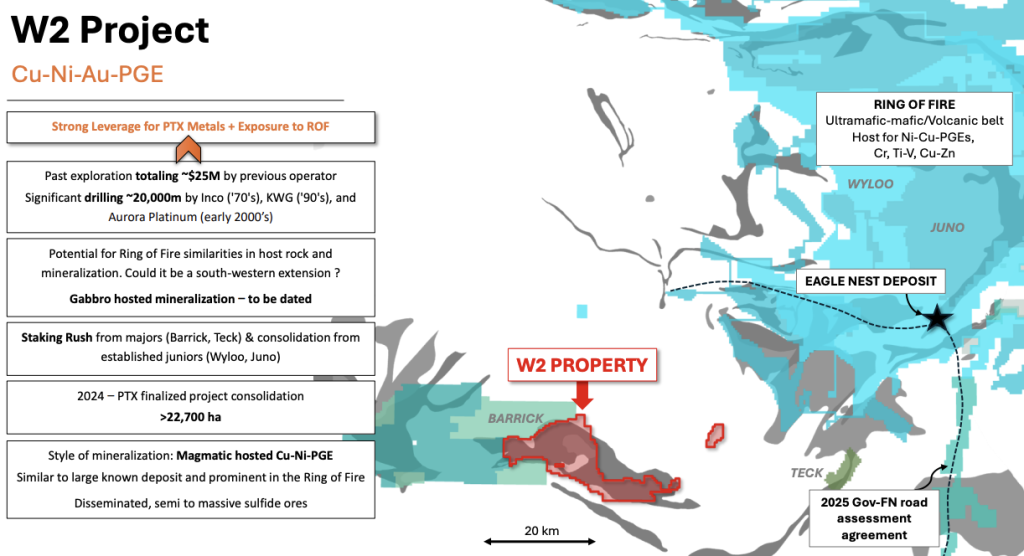

PTX Metals (TSX-v: PTX) / (OTC: PANXF) has properties, projects & royalties in Ontario, Canada. The flagship is the 100%-owned W2 Copper/Nickel/PGE + gold project, spanning 227.6 sq. km.

W2 is ~75 km SW of Wyloo’s high-grade Eagle’s Nest project –> ground zero of Northern Ontario’s world-famous Ring of Fire (“RoF“), a giant, remote, circular structure covering 5,000 sq. km.

Located ~520 km NE of Thunder Bay, it’s considered one of the planet’s last remaining, giant, underexplored, polymetallic geological structures. A new BFS at Eagle’s Nest this quarter should attract considerable attention.

W2’s largest component is copper, which has been strong YTD, +22%. Copper’s performance is impressive given the global turmoil since U.S. Pres. Trump started multiple Trade Wars this month.

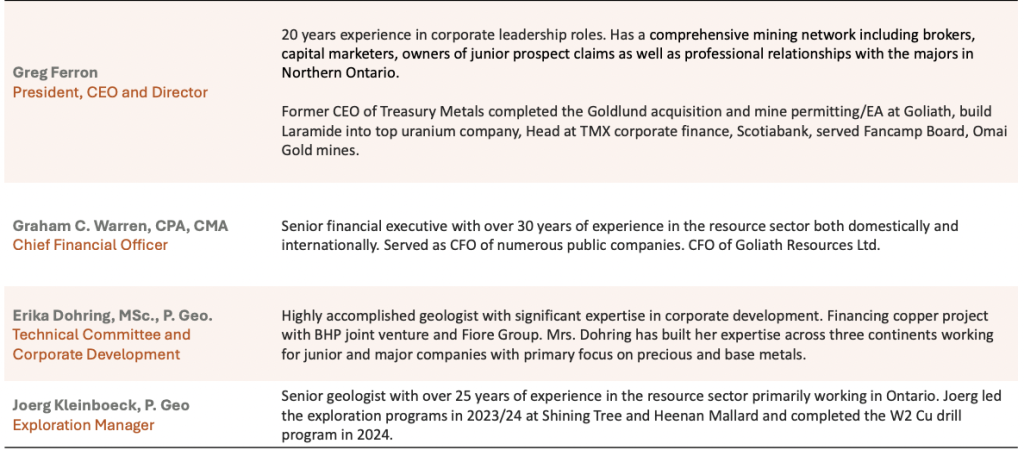

CEO Greg Ferron, former CEO of Treasury Metals, leads the Company. See management bios above & below. Insider buying at PTX has been impressive, especially by Mr. Ferron [2.48M shares owned] and Directors Jean-David Moore [4.712M shares] and Frederico Marques [3.115M shares].

In addition to strong fundamentals (multiple projects, properties & royalties) underpinning PTX, the geopolitical backdrop of tariffs & trade wars is bullish for Canadian projects.

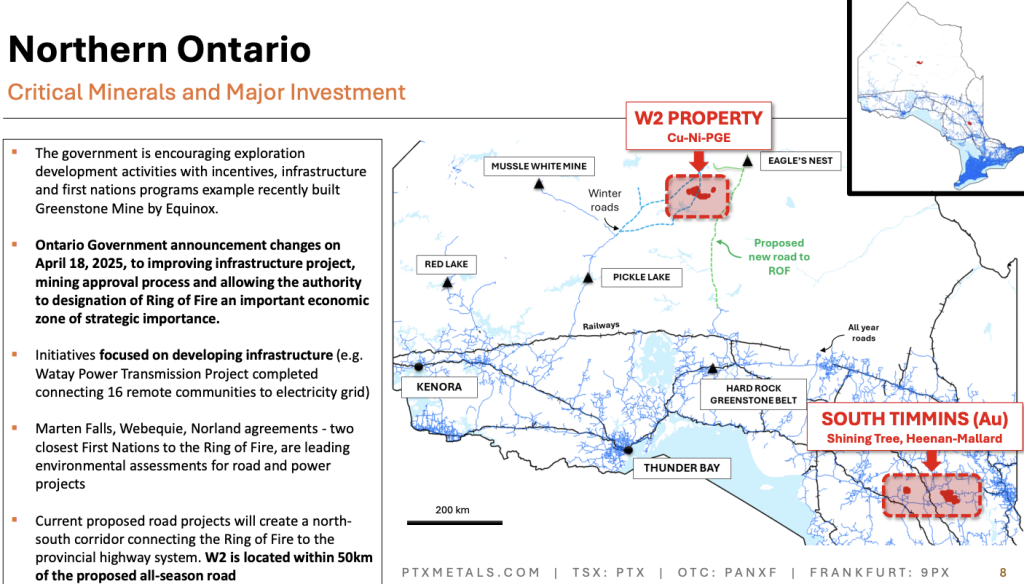

Ontario’s Premier Doug Ford has been talking up the RoF. Ford & PM Carney want a single environmental process instead of two to speed projects to market.

Ford stresses the urgency of building regional infrastructure, streamlining approval processes, and introduced a Bill that would give the Province the authority to designate special economic zones for strategically important projects.

PTX’s W2 could be deemed strategically important as it advances. Last year, management announced an independent exploration target (non-NI 43-101 compliant), based on historical drilling & exploration records dating back decades.

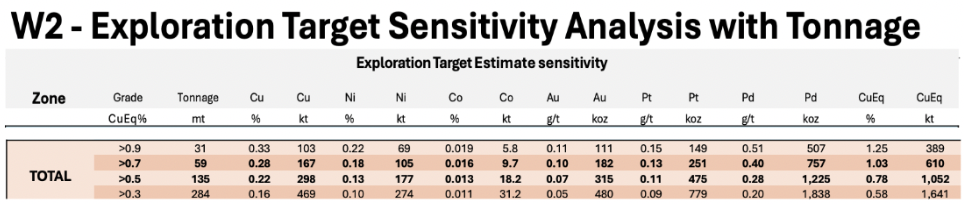

PTX’s 3D geological & grade shell modeling of historic & recent drill results shows a near-surface target of 31-284 million tonnes of 1.25% to 0.58% Cu Eq. Several larger-to-much-larger companies are watching W2 closely. Some think 500M+ tonnes is possible at W2.

Management believes stepping out and drilling at depth is a priority to expand and find new high-grade zones. The exploration target above is a reasonable estimate of what has been identified so far, supported by considerable historical drilling + exploration studies.

Readers can gain further comfort from the October 2024, third-party technical report on W2 that contains a detailed exploration history & commentary on geology, structure & mineralization styles.

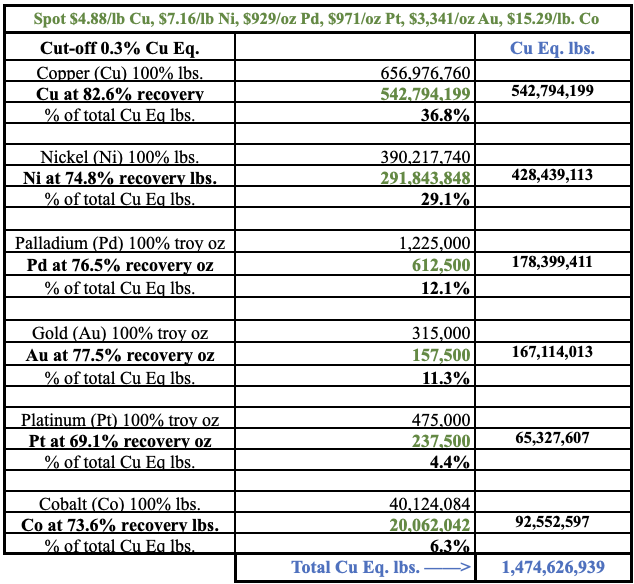

No modern metallurgical analysis is tied to the deposit, an important factor being worked on. CEO Ferron believes all six named metals should be exploitable. I use recovery rates at Eagle’s Nest for an approximation of W2.

Using spot prices and adjusting for recoveries, combined Cu + Ni represents 66% of total Cu Eq. pounds and [Pt + Pd + Au = 28%]. Compared to 1,052,000 tonnes = 2.32B lbs., at 100% recoveries, adjusting for prospective recoveries, results in 1.48 billion lbs.

This valuation exercise places PTX at less than a penny — at C$0.0064/Cu Eq. lb. (just for W2, not incl. the values of gold plays Heenan-Mallard, Shining Tree + seven royalties on Ontario properties).

Events that could turbocharge this story: 1) higher Cu/Ni prices, 2) more tonnage/higher grades, 3) a strategic investor, 4) streamlined permitting, 5) gov’t-funded infrastructure buildouts, and 6) discovery of (vanadium, titanium, or chromite).

More tonnage is likely as multiple areas are open at depth, and management has discovered significant Cu-Ni-PGE mineralization, expanding the central mineralized trend by > 3 km from the center of the AP Zone.

Interestingly, the deepest historical holes reached 185-235 m, but Eagle’s Nest’s mineralization runs to at least 1,600 m vertical depth. High grades, namely 2%+ Ni & 3%+ Pd, are found at Eagle’s Nest, which sits on strike with W2.

Northern Superior’s & OnGold Resources’ TPK project is an early-stage, very high-grade Au (25.9 m @ 13.5 g/t Au) deposit nearby. Bordering W2 to the west, Barrick has a similarly sized property. Juno & Wyloo also have large land packages in northern Ontario.

Wyloo is backed by Australian billionaire Andrew Forrest, founder of giant Fortescue Metals. In 2021-22, Wyloo outbid BHP to acquire Noront Resources for ~C$630M.

PTX is much earlier stage, but Wyloo paid (~C$0.21/Cu Eq. lb.) for Noront, vs. PTX’s valuation of ~C$0.0064/lb. for W2 alone. I imagine that Wyloo, Juno, and Teck are interested in W2. Juno is thought to be backed by Agnico Eagle.

Readers should note that although Wyloo, Juno & KoBold are private, each has ample cash and would make great partners. KoBold, (Bill Gates / Jeff Bezos are large shareholders), recently invested in promising lithium assets in Ontario.

One of the main risk factors is regional infrastructure. The RoF needs 100s of km of roads, bridges, powerlines, etc. Construction will be costly and take years.

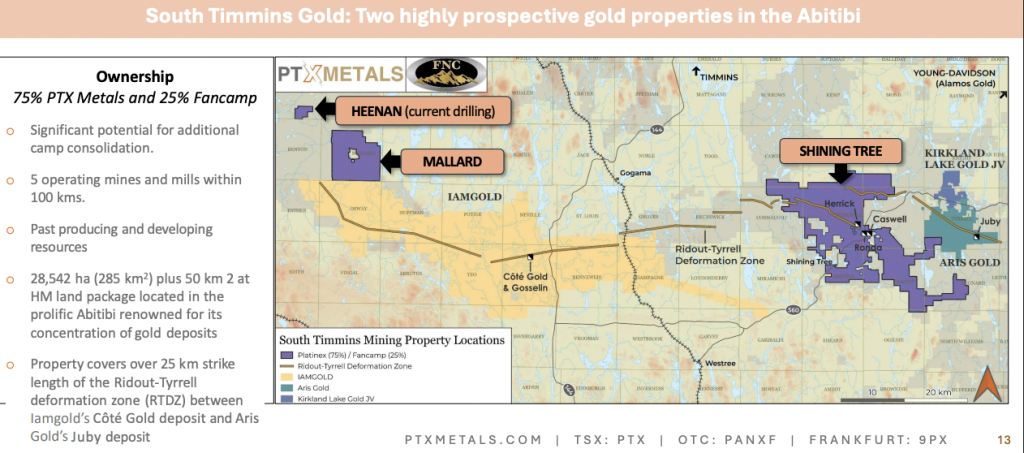

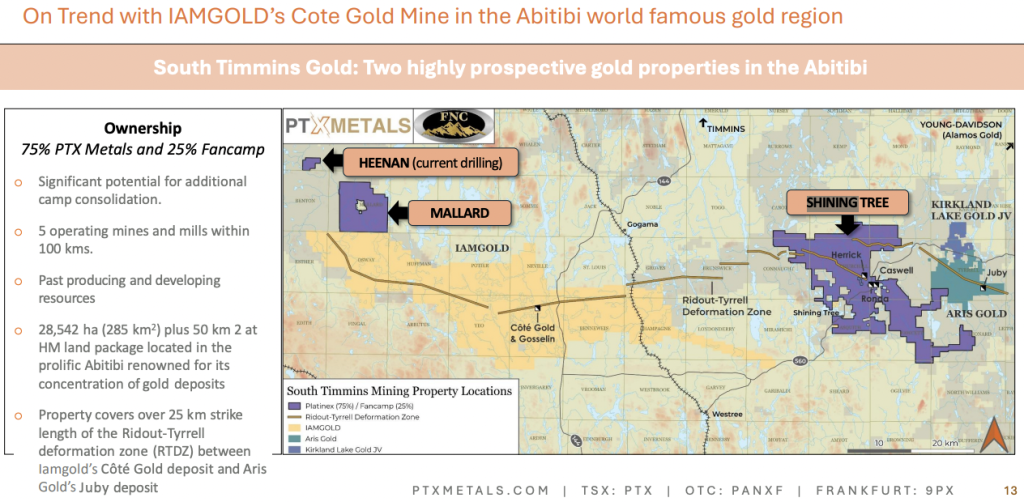

PTX has other properties, including the South Timmins JV (75% PTX / 25% Fancamp) with Au assets in the Abitibi Greenstone Belt and a 51% interest in Green Canada Corporation, which has uranium assets in Saskatchewan, Ontario & Quebec.

Finally, PTX Metals holds a portfolio of seven NSR royalties on Au, PGE, and base metal properties. All of PTX Metals’ properties (except the flagship W2) are open to being spun out or monetized. Those assets alone could potentially be worth the Company’s entire $9.5M valuation.

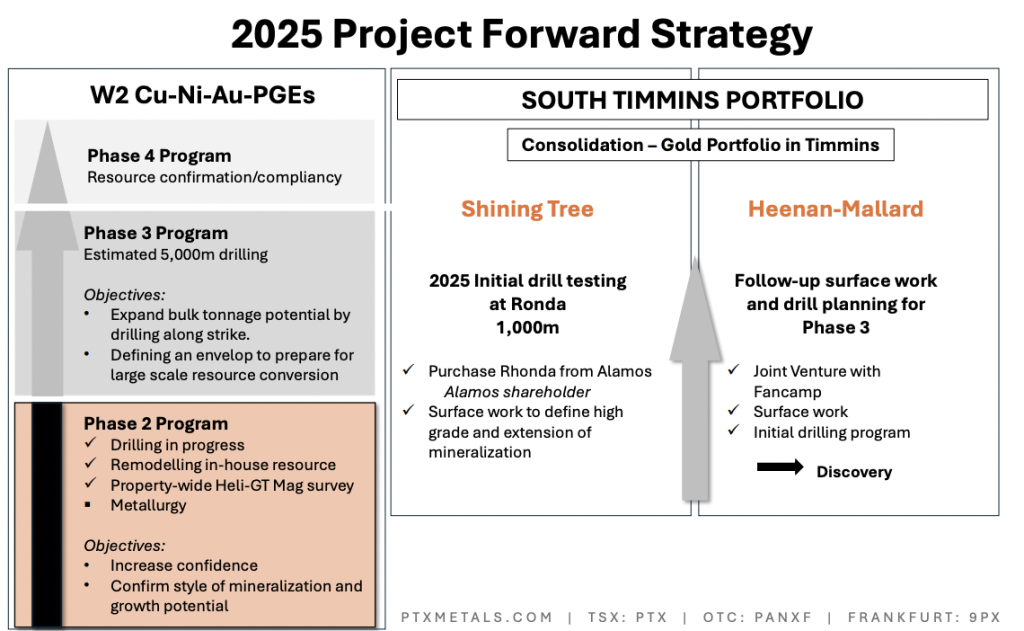

Results are in from the second phase drill program at the Heenan-Mallard Gold property, 45 km NW of IAMGOLD’s Cote Gold Mine.

As a follow-up to the initial four-hole drill program, PTX completed an additional five holes (693 meters –> 1,305 m incl. phase 1) testing continuity along strike and at depth.

All holes intersected near-surface Au, highlighted by 75.75 m at 0.5 g/t Au, incl. 5.00 m at 3.93 g/t Au. Recent drilling returned sizeable intercepts in most holes, confirming the expansion of a newly discovered system.

Eighteen months ago, 0.5 g/t Au was worth $31/t. Today it’s worth $54/t. Considering that there were multiple mineralized intervals above 70 m wide in core length in two of the holes, suggesting there’s potential for meaningful near-surface mineralization.

Drilling intercepted new gold mineralization, opening up the zone along strike and at depth. PTX has submitted exploration permits for its Shining Tree property, where a drill program is planned to test the high-grade Ribble Vein at Ronda.

In 1Q/24, mechanized stripping & channel sampling returned multiple channels of high-grade Au. The best channel sample was 16.1 m at 9.0 g/t Au.

Although most of the attention at PTX Metals has been on W2 (Cu, Ni, PGE, Au), the 75%-owned Heenan-Mallard & Shining Tree properties deserve a lot more respect, given the Au price is +45% in the past year!

The combined asset value at PTX — W2, Heenan-Mallard, Shining Tree + 7 royalties — appears to be worth far more than the Company’s C$9.5M valuation. PTX’s share price recently hit C$0.17, this sell-off could offer an attractive entry point.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about PTX Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of PTX Metals are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, PTX Metals was an advertiser on [ER], and Peter Epstein owned shares in the Company bought in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply