Game on! Centerra Gold Inc. was always a likely candidate to want a piece (or all) of Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF). On April 22nd, Thesis announced that Centerra will acquire a 9.9% equity stake at a 10% premium to market (WITH NO WARRANTS).

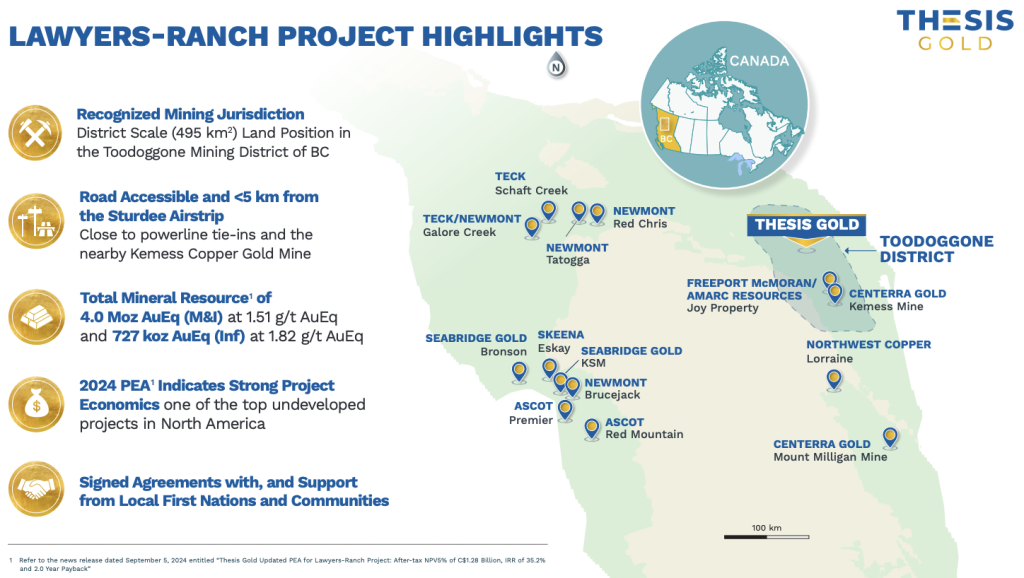

This is a huge vote of confidence in the 100%-owned Lawyers-Ranch project, the management team, board & advisors, and the jurisdiction –> the Toodoggone District in north-central B.C., Canada.

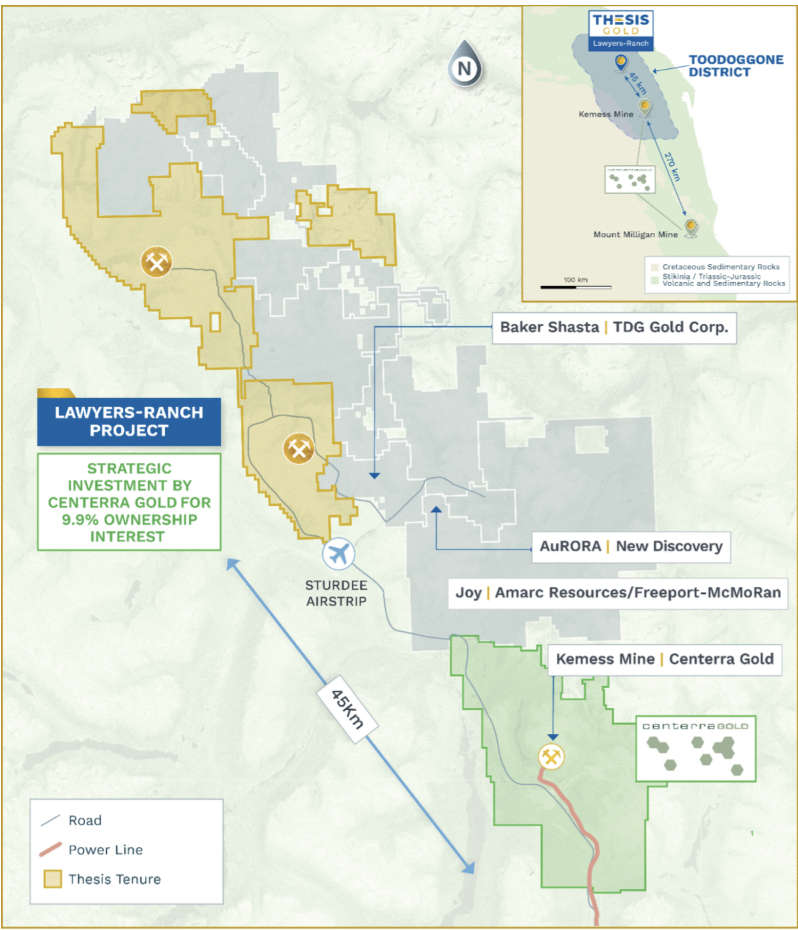

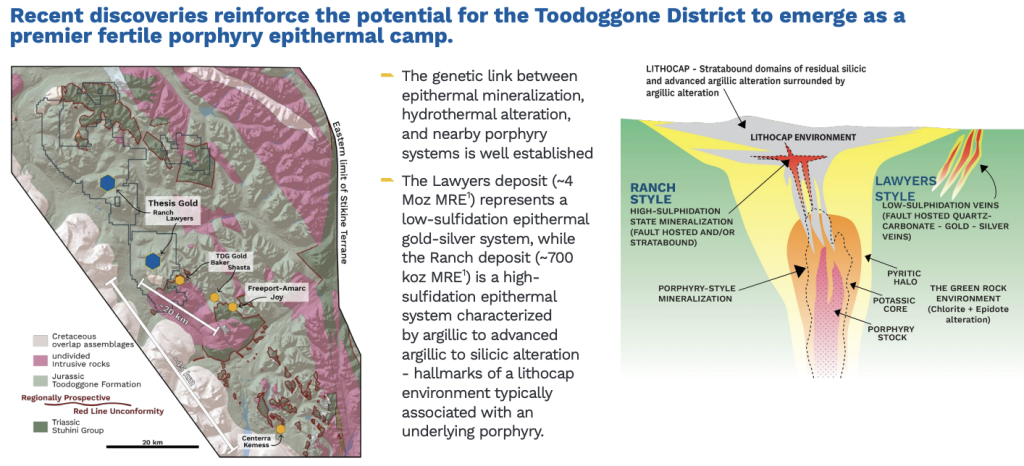

District-scale play –> Lawyers-Ranch/Kemess –> next to Freeport-McMoRan/Amarc

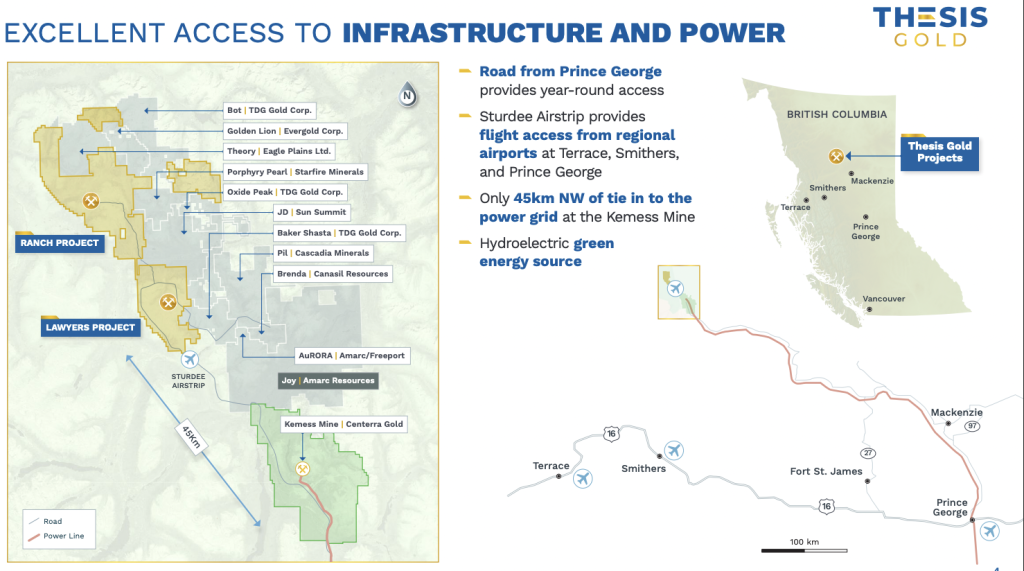

Centerra’s nearby, past-producing Kemess mine complex has a 230 kV power line, 50,000 tpd processing plant (needs refurbishment & new equipment), mine camp, administration facilities, truck shop, warehouse, and expandable tailings facility.

Centerra had ~$1B in net working capital on its balance sheet at year-end. This $24M cash injection tops up Thesis Gold’s treasury to ~$34M, enough to fund the Company into 2026. CEO Ewan Webster commented,

“…Centerra’s deep technical expertise, operational experience, and regional presence through the Kemess asset present a clear opportunity for collaboration and unlocking district-scale synergies.”

One of many reasons to be excited about this news is that Centerra will presumably be there next year to acquire another 10% (to go to 19.9% ownership), hopefully at a meaningfully higher valuation. {see NEW corp. presentation}

Centerra will benefit from district-wide operating synergies and economies of scale should it move forward on Lawyers-Ranch. Importantly, Thesis would enjoy those same benefits.

Lawyers-Ranch just got a lot more valuable. Several key synergies could be pursued, but one exciting one (subject to further studies) is sending Lawyers-Ranch ore 45-50 km to Centerra’s 50,000-tpd mill.

The mill is on care & maintenance, but it’s large enough & close enough, especially with Au at $3,346/oz. (spot touched $3,500 on April 22nd).

Lawyers-Ranch’s 1.55 g/t Au Eq. ore is US$167/tonne of rock. I don’t believe it would cost more than US$10-$11/tonne to ship to the Kemess mill.

Centerra might acquire Thesis Gold one day, and Freeport McMoran could easily afford to buy & develop the entire district, a district highlighted by Centerra/Thesis Gold & Amarc Resources. The key is that this camp will be actively developed.

Having Centerra backing Thesis helps with funding, First Nations & local communities, technical aspects/mine planning, and exploration programs. Centerra’s investment allows Thesis Gold to think bigger and work smarter.

Importantly, Lawyers-Ranch has signed agreements with, and has ongoing support from, First Nations & local communities. In reviewing prior articles, it’s notable that I consistently remark on the strength of the gold (“Au“) price.

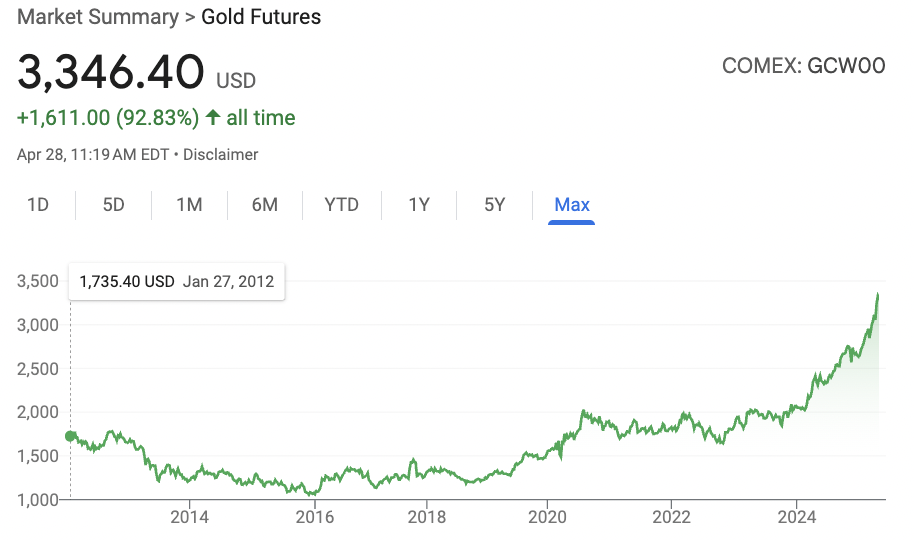

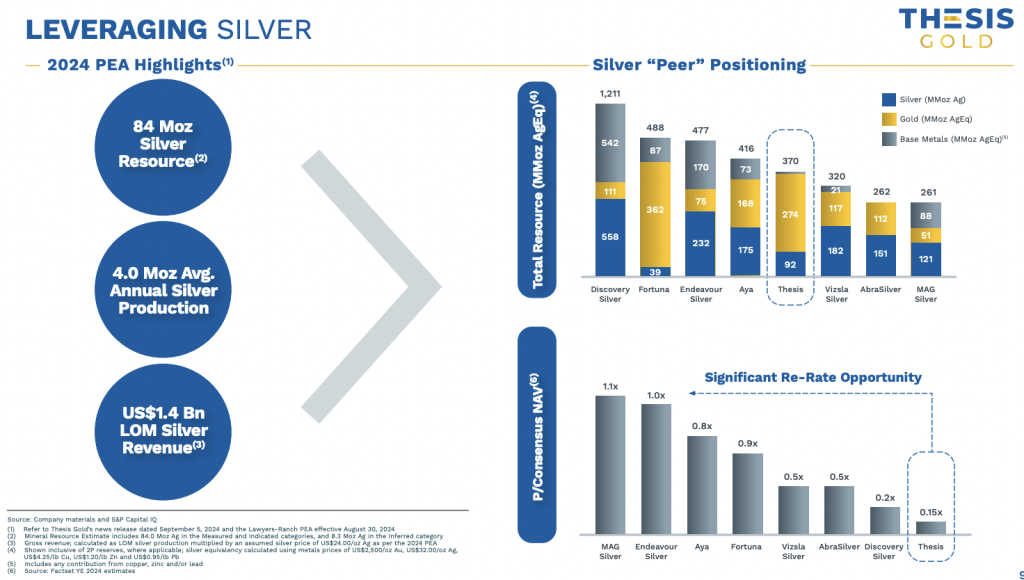

Yet, in my last article in March, the price was 13% lower than today’s $3,346/oz. Au is +27% YTD & +43% in the past year. I also always mention the silver (“Ag“) price as Thesis Gold’s 100%-owned, 495 sq. km Lawyers-Ranch project is roughly 21-22% Ag.

Although Ag has lagged behind Au, it always catches up. A way to track the Ag price relative to Au is via the Au: Ag ratio, currently at 102:1.

Over the long term, that ratio has averaged ~61:1. It was 73:1 in May 2024. The ratio has been = or > 102:1 less than 2% of the time. If it goes to 80:1, Ag would be $42/oz.

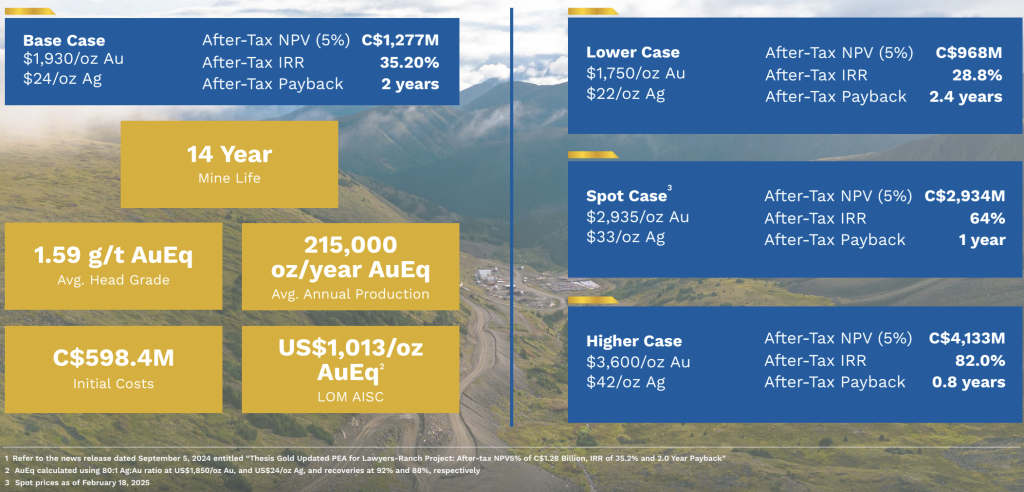

Averaging the “Spot Case” and the “Higher Case” shown above shows a post-tax NPV of $3.54B and an IRR of 73%. Post the BIG news, Thesis is valued at just 5% of that $3.54B figure.

Thesis Gold has no debt or streaming burdens, a 0.5% NSR at Lawyers with Royal Gold, and a 2.0% NSR on Ranch. Most booked ounces are on the Lawyers’ portion of the resource. I believe management could sell a new 1.0% NSR for $10s of millions.

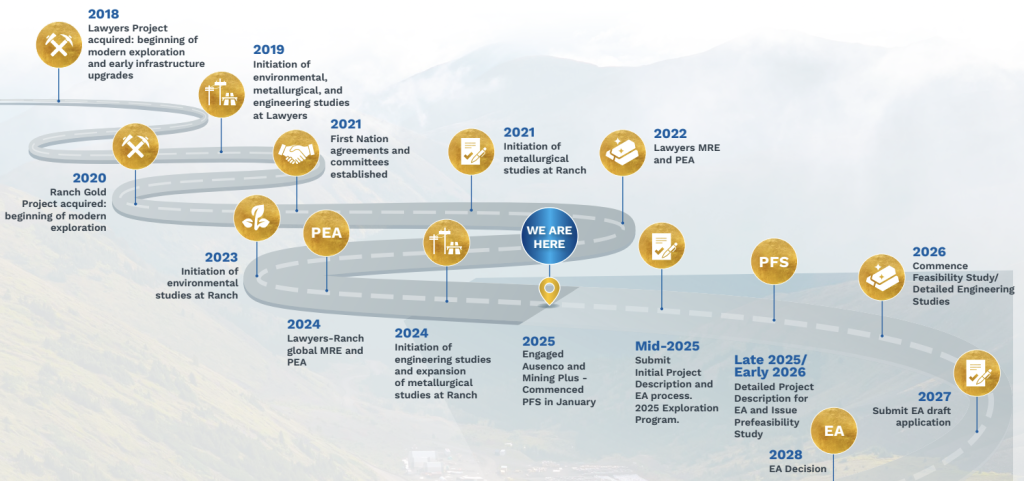

When the PFS comes out, this 4.71M (and growing) Au Eq. ounce project will attract considerable attention. If producing today, Lawyers-Ranch would be a Top-10 Canadian mine. {see NEW corp. presentation}

It would be the only mine not owned by a much larger producer like Agnico Eagle, Newmont Corp., or Alamos Gold. My view is that the existing mine plan of 215K Au Eq. ounces/yr could be expanded to 300K ounces/yr, and the 14-year mine life extended.

That scenario takes on new meaning with Centerra’s investment. I recognize I’m espousing very bullish commentary, but the Au price is +70% since Thesis Gold’s PEA! At 300K/yr, Lawyers-Ranch would be the 6th largest Au mine in Canada.

Since my last article, the U.S. President has continued to attack & belittle Canada and started major Trade Wars with the world (most notably China, Canada, Europe & Mexico).

As a result, B.C. Premier David Eby announced plans to fast-track 18 metals, mining, oil/gas & infrastructure/power projects. This is great news for the Toodoggone District, which already has considerable regional infrastructure.

Assuming more projects are fast-tracked, I believe Lawyers-Ranch will be as it advances through PFS in 4Q/25, and BFS 12-18 months later. This Project has year-round road access, and is < 5 km from an airstrip.

It’s 45 km from a powerline tie-in to (green, low-cost hydroelectric power) at the Kemess copper-Au mine complex (7.0M Au Eq. ounces at 0.6 g/t).

For Au & Ag, northern & central B.C., Canada are top destinations, world-famous for the Golden Triangle [“GT“] in NW B.C. and increasingly for Toodoggone in the northern part of central B.C.

South32 Ltd. recently invested in central B.C.’s American Eagle (joining Teck Resources as a shareholder). Freeport McMoran is earning into Amarc Resources’ Toodoggone-based Joy project. Sweden’s Boliden AB is invested in the Duke project.

From 4.71M Au Eq. ounces, there could be a line-of-sight to 6.0M+ ounces after next year’s drilling. In addition to chasing high-grade Au at surface, a few deeper holes will be drilled in search of one or more porphyry orebodies.

Promising deep porphyry results could attract Freeport, Barrick Mining, Teck, Boliden, South32, Coeur, and Hecla. Thesis Gold has graduated to developer status as it continues to de-risk Lawyers-Ranch.

To that end, newly hired Chief Geologist Dr. Evan Orovan, P.Geo, is a highly experienced economic geologist with > 15 years of experience in porphyry-epithermal systems globally.

In addition, Kettina Cordero was hired as VP Investor Relations. Kettina’s extensive experience and ability to foster strong relationships within the investment community will be instrumental in conveying the Company’s vision & milestones to stakeholders.

Dr. Orovan, CEO Webster & the technical team are putting together this year’s drill program. He says discoveries from step-outs and undrilled areas are the goal, plus a few deep holes in search of porphyries.

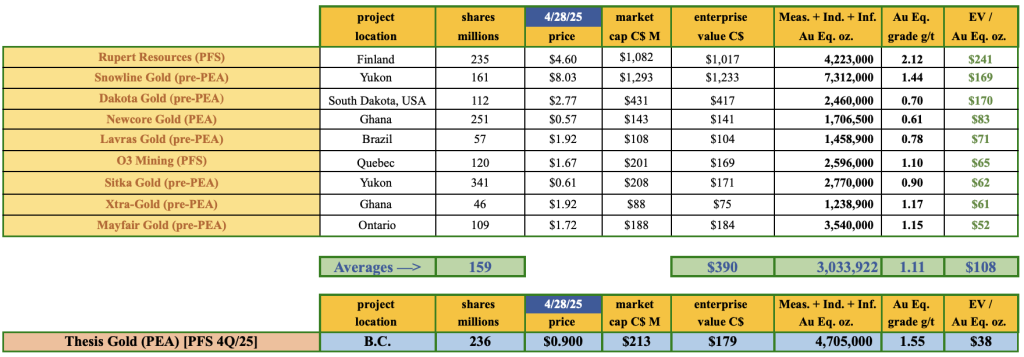

Thesis Gold’s valuation at C$179M is low on an EV/Au Eq. oz. basis vs. the peers shown below. Notice that several are pre-PEA, so probably 2-3 years behind Thesis. Compare Thesis at $38/oz. to the average of $108/oz., or an average of $93/oz. without Rupert Resources.

I believe the chances of Lawyers-Ranch becoming a mine are higher than the projects owned by most of those earlier-stage peers. All else equal, I would rather be invested in B.C. than in the Yukon, Brazil, or Ghana.

As M&A continues to pick up, takeouts at ever-higher premiums (well above $38/oz.) will be common. Producers are making so much cash, they won’t blink at paying an extra $25 or $50/oz. to secure high-quality, safe ounces like those held by Thesis Gold.

{see NEW corp. presentation}

Disclaimers/Disclosures:

While Thesis Gold is not a current advertiser on Epstein Research, it was in the recent past and could be again. Peter Epstein of Epstein Research should be considered biased in favor of the Company. Mr. Epstein owns shares of Thesis Gold bought in the open market. This is a high-risk, high-reward investment opportunity. Readers should consult with investment professionals before investing in small-cap stocks like this one.

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply