A lot has to go right in the world for the conditions that have propelled gold higher to change. Gold (“Au“) is a safe-haven, one of the few asset classes large enough to absorb $100s of billions of inflows if/when China and/or Japan sell U.S. Treasuries more aggressively.

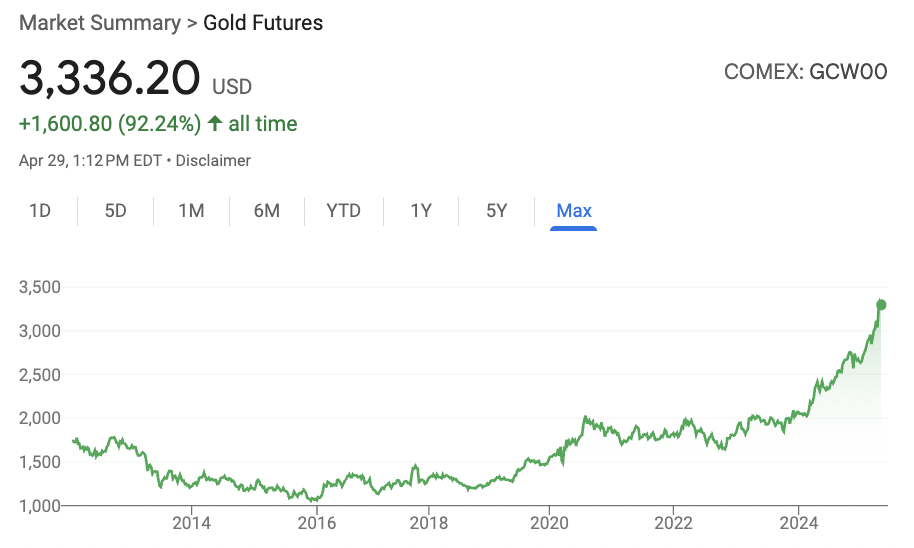

The past few weeks have been notable for the Au price bouncing back and rumors that the U.S. is quietly stacking Au alongside China and several other central banks. Au is currently at $3,336/oz., up +26% YTD & +45% in the past year.

Pundits like to point to the 11 years ending in 2012 when the price rose at a CAGR of +18%. Yet in the decade ending in 1980, the CAGR was +32.8%!

I’m not suggesting Au will rise by +18% to 32.8%/yr, but there seems to be ample room for a continued rally. Not that producers need higher prices, they’re doing fine at $3,336/oz.

Newmont Corp. just released its 1st quarter earnings, highlighted by US$1.2B in free cash flow. Given that its average realized price was $2,944/oz., the 2nd quarter FCF could be $1.5B, a run-rate of $6.0B/yr!

Switching to copper (“Cu“), [+22% YTD], long-term demand is growing at ~2.5%-3.0%, while supply is HIGHLY uncertain due to a lack of Major discoveries, aging operations (falling grades, rising costs), and the risky jurisdictions of existing & future mines.

Five of the top 10 Cu-producing countries are China, Russia, Indonesia (heavy Chinese influence), and Africa’s DRC (heavy Chinese influence). Up-and-coming hotspots include: Uzbekistan, Mongolia & Zambia (China influence!)… Can the West rely on these countries?

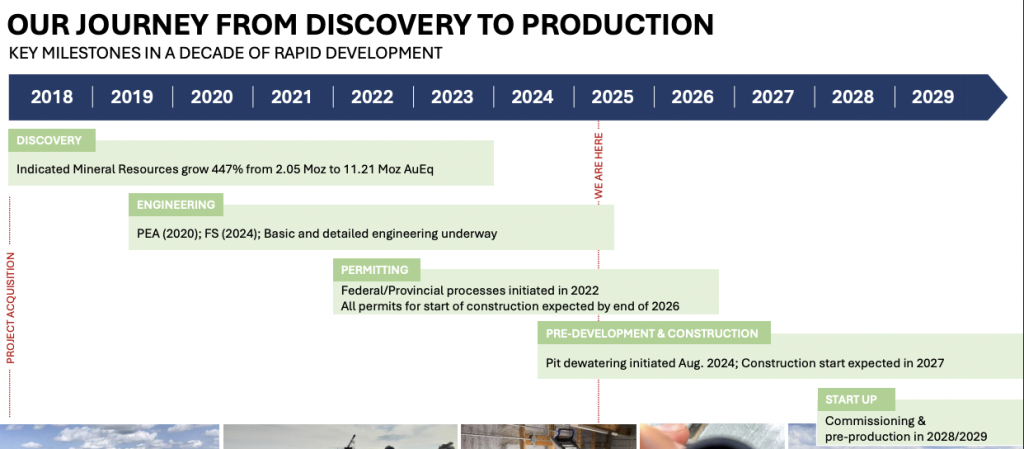

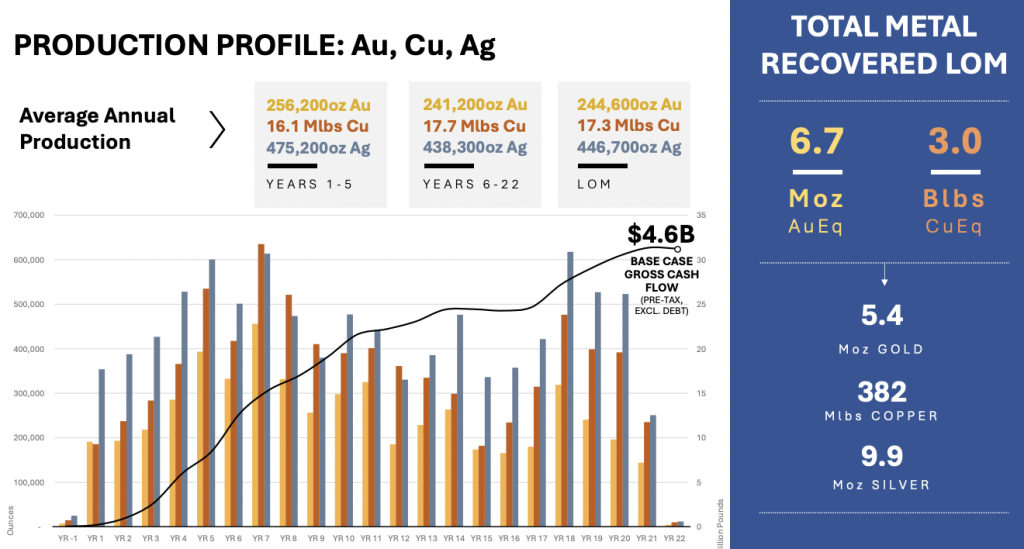

Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) has come a long way in 11 months. In May 2024, the market was unimpressed by a Bank Feasibility Study (“BFS“) with a post-tax IRR of +14% at $1,975/oz. Au. Today, gold’s at ~$3,336/oz, driving the IRR into the low-30s percent.

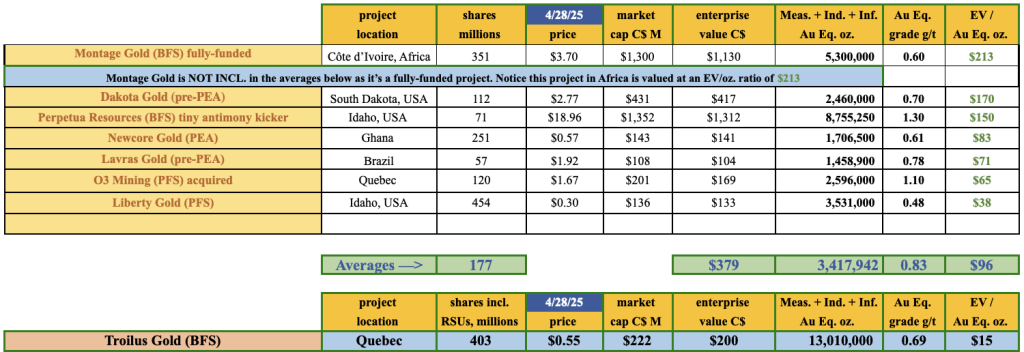

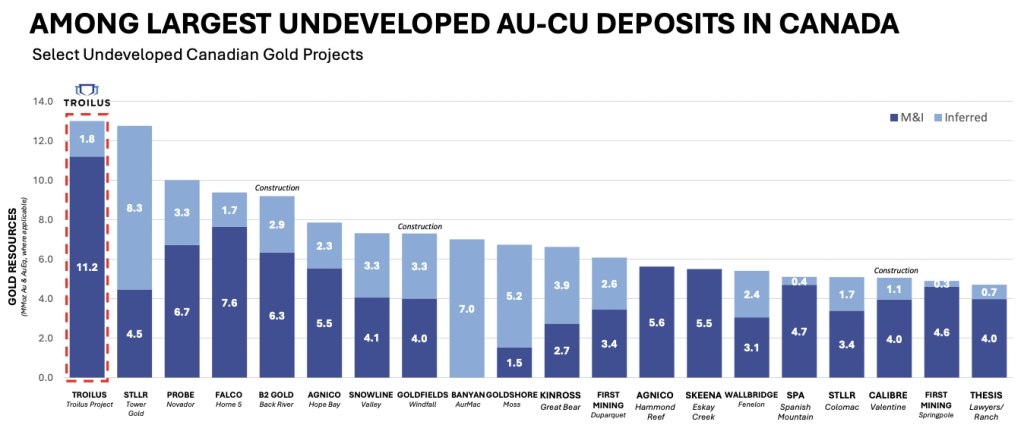

In the above chart, Troilus trades at a steep discount to select peers even though it is more advanced than most of them. At just $15/oz., there’s room for significant improvement upon favorable news in the coming months.

At spot pricing, the payback period is just over 3 years, and the average FCF is ~C$470M/yr. Compare that FCF figure to Troilus Gold’s enterprise value (market cap + debt – cash) of C$200M, and over US$500M of regional infrastructure is in place from prior operations.

On April 29th, the Company announced strong drill results, highlighted by hole SW-25-688 that delivered 56 m of 2.44 g/t Au Eq., incl. 3.28 g/t Au Eq. over 34 m, and 10 m of 5.07 g/t Au Eq. Shallow high-grade ounces are exciting as they could potentially be mined early on, enhancing Project economics.

In the following chart are four regional zones. Notice the high grades — a 110 g/t grab sample at Target #1, 34 m of 1.62 g/t at #2, and 7.6 m of 4.6 g/t at #3. Note also that Target #3, Testard/Bullseye, is a 50/50 JV with Alamos Gold.

Although Troilus Gold’s Project economics are dominated by Au, the Company’s Cu kicker is quite valuable to European & Asian smelters + a few Canadian groups, most notably Glencore. It’s the Cu that attracted the lion’s share of interest from lenders & export-import credit agencies.

The Troilus project has an impressive 13.0M Au Eq. ounces (Measured, Indicated + Inferred), and there remains serious exploration potential. Adding ounces might not seem necessary, but finding higher-grade ounces to exploit early in the mine plan would make a big difference.

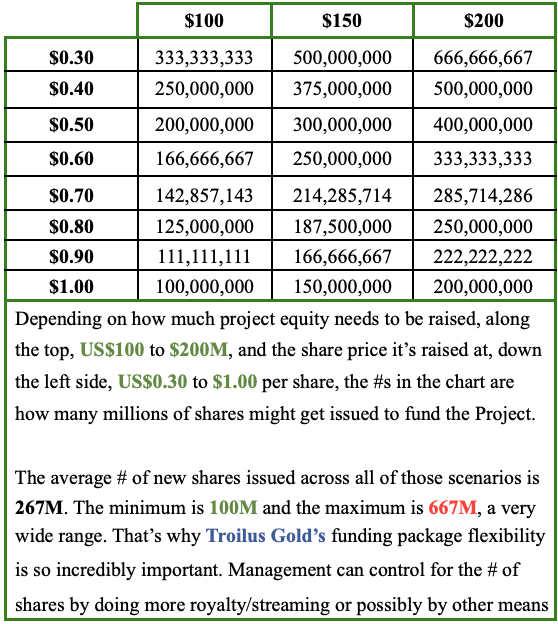

Management, led by Justin Reid, hopes to have a US$700M debt financing package lined up, and up to US$400M in royalty/streaming funds by year-end. After that news lands, the team will look to issue US$100M in Project equity.

A key risk is that the US$100M of Project equity turns out to be $150M or $200M, and/or the price of the private placement(s) is very low. In the following chart are scenarios for the number of Project equity shares issued at various US$ stock prices, assuming $100 to $200M is raised.

Given the current share price, some might scoff at the notion of private placements getting done at a share price of US$1.00. However, if the majority of equity issuance is not until 2027, and the Au price remains strong, shares could be a lot higher by then.

In the following timeline, notice that Troilus expects to reach pre-production (first pour) & commissioning in 2H/28 or 1H/29. That’s 3.5-4.0 years from now. At ~300,000 Au Eq. ounces, for 22 years, this will be a significant Canadian Au/Cu mine.

Importantly, if Troilus were to be acquired, its 100%-owned, 13.0M ounce project could be more aggressively drilled.

Instead of 303K Au Eq. ounces/yr, I believe 450K+/yr for 25+ years might be possible as peak production in the BFS is 536K ounces/yr, and the 4-year average of years 5 to 8 is 451K.

Without capital constraints, the Troilus complex could be a Top-6 or 7 Canadian mine in the 2030s-40s, along with mines owned by Agnico Eagle & Artemis Gold, and projects owned by Seabridge and Skeena Gold & Silver.

In addition to being large-scale, a year ago the Project had an estimated All-in-Sustaining-Cost (“AISC“) of US$1,109/oz. That’s the bottom quartile vs. an industry average of ~$1,500/oz. Newmont just reported 1Q/25 AISC of $1,651/oz.

Even though that $1,109/oz figure will climb between now and 2028-29, most producer AISCs are likely to keep rising as well. Therefore, Troilus has a good shot at remaining in the bottom quartile on costs.

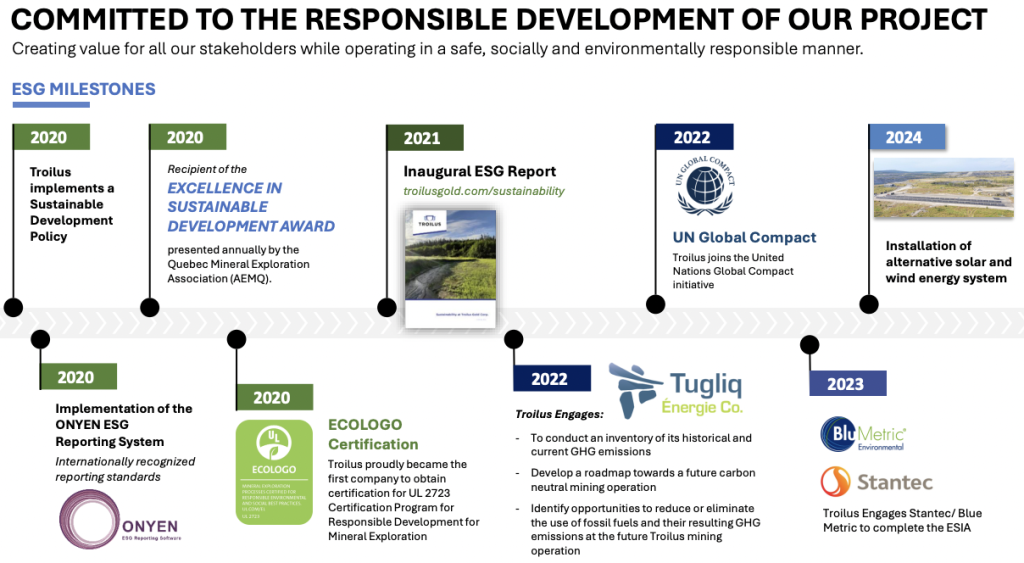

As seen in the following image, a great deal has been done on environmental & community/First Nation relations. Multiple ESG reports, certifications earned, awards won, wind/solar pursued, ESG groups joined, to develop the Project responsibly.

These accomplishments will pay dividends as conversations about fast-tracking the Project are held. It’s a lot easier for government bodies to fast-track advanced-stage projects vs. earlier-stage efforts with far fewer ESG boxes checked.

I see no reason why Troilus Gold (or an acquirer) will not have a multi-billion-dollar mine by 2030, like Agnico’s Detour Lake, IamGold’s Cote, and Artemis Gold’s Blackwater. Those three are worth an average of nearly C$5.5B.

As a rough estimate, assume the Troilus Gold mine has an enterprise value of C$3.0B in five years. Discounting that back at 10%/yr = $1.863B today. Assume the share count doubles to 806M in 2030.

That implies a value for Troilus of [$1.863B / 806M shares = C$2.31/pro forma share] vs. the current $0.54. Is C$3.0B in 2030 too aggressive? Not if the Company’s generating free cash flow of C$470M/yr. If shares outstanding rise by 50% to 605M, it would be C$3.08/pf share.

A lot has to go right, but nailing down US$700M in debt and securing up to US$400M in royalty/streaming cash, with Au above $3,200/oz., would be A LOT GOING RIGHT, and a long way towards de-risking the Project. The goal is for both of those funding events to happen this year.

That would give management time to drill, optimize the mine plan, explore renewable power options, get fully-permitted, and perhaps start construction, before having to raise the bulk of the Project equity. And, time for the valuation to increase, before potential takeover bids.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER], and Peter Epstein owned shares in the Company bought in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply